Pass The Safe Mortgage Loan Officer Test

The SAFE MLO Test can be scheduled by visiting the NMLS website. Applicants use their existing account number to schedule the exam. The exam has 115 scored questions, and test takers must answer at least 75% correctly. It costs $110 to take, and students are given 3 hours and 10 minutes to complete the test. You can learn more by visiting the MLO Testing Handbook.

Secure Your Employer Sponsorship

Your Florida Loan Officer License will remain in pending status until your employing sponsorship is verified with NMLS. This verification is completed inside of the NMLS portal. Users will visit the Form Filing Home screen, then click Company Access. Theyre then prompted to add their employer sponsorship by submitting employment details. Once the sponsoring employer receives notice of the verification request, they can approve the sponsorship. Upon approval, applicants are officially licensed

Pass The Safe Mortgage Loan Officer Test In Mississippi

The Mississippi SAFE MLO Test can be scheduled by visiting the NMLS website. Applicants use their existing account number to schedule the exam. The exam has 115 scored questions, and test takers must answer at least 75% correctly. It costs $110 to take, and students are given 3 hours and 10 minutes to complete the test. You can learn more by reviewing the MLO Testing Handbook.

Read Also: How Much Will My Monthly Mortgage Payment Be

Do Mortgage Processors Have To Be Licensed

You must have a loan originator license if you work as an independent contractor Loan Processor for a loan processing company. You must have a mortgage broker license if you own a processing company that independently contracts with licensed mortgage brokers to process loans.

Read Also: How To Determine What You Qualify For A Mortgage

Is It Worth Becoming A Mortgage Broker

If you enjoy working in a client-facing environment and helping people, mortgage broking may be a career for you to consider. Flexibility: Throughout your career, youll have the flexibility to be self-employed or work for a brokerage. Both options have great benefits and either may suit you at different life stages.

Read Also: Can You Get A Mortgage To Cover Renovations

What Fees Do I Have To Pay For My Florida Loan Officer License

The NMLS collects 6 fees as a part of the application process:

Total application fees: $329.25

Keep in mind that this does not include fees for reporting course hours to the NMLS. Mortgage Educators includes all course reporting fees in its prices to help make that process easier. You will, however, be responsible for paying the NMLS testing fee .

Why Should You Become A Mortgage Broker

Mortgage brokers can hire individuals to work for them. Instead of having to produce clients on your own to get a paycheck, you can have others pounding the pavement to bring in new business for you.

Once youre licensed, you can choose to continue pursuing your own borrowers, or you can focus on growing your team. Either way, the opportunity for growth will increase exponentially once you become a mortgage broker.

You May Like: What Type Of Interest Is A Mortgage

Mortgage Broker And Branches

MB & MBB: Mortgage Broker and Branches â Chapter 494, Florida Statutes: The license is required for an entity conducting loan originator activities through one or more licensed loan originators employed by the mortgage broker or as independent contractors to the mortgage broker.

Mortgage Broker Branch: This license is required for mortgage broker licensees who conduct business at locations other than their principal place of business:

Prepare With Diehl Education

If youre ready to obtain an MLO license in multiple states, Diehl Education can help. Withstate-specific PE courses, our content is designed to provide you with the knowledge necessary to originate loans successfully and ensure legal compliance. We can also assist you to secure your licenses in U.S. territories, such as Guam, Puerto Rico, and the Virgin Islands.

You can also take our NMLS CE courses to satisfy the annual CE requirement to keep your MLO license current in multiple states. Our comprehensive CE courses are updated regularly, tailor-made to fit the requirements of individual states, and specially curated by industry professionals that care about your success.

Dont wait to add a state MLO license. Get started today with Diehl and see how an additional license can enhance your career.

Scott Weghorst

Also Check: What Is A Teaser Rate Mortgage

How To Get A Mortgage Broker License In Florida

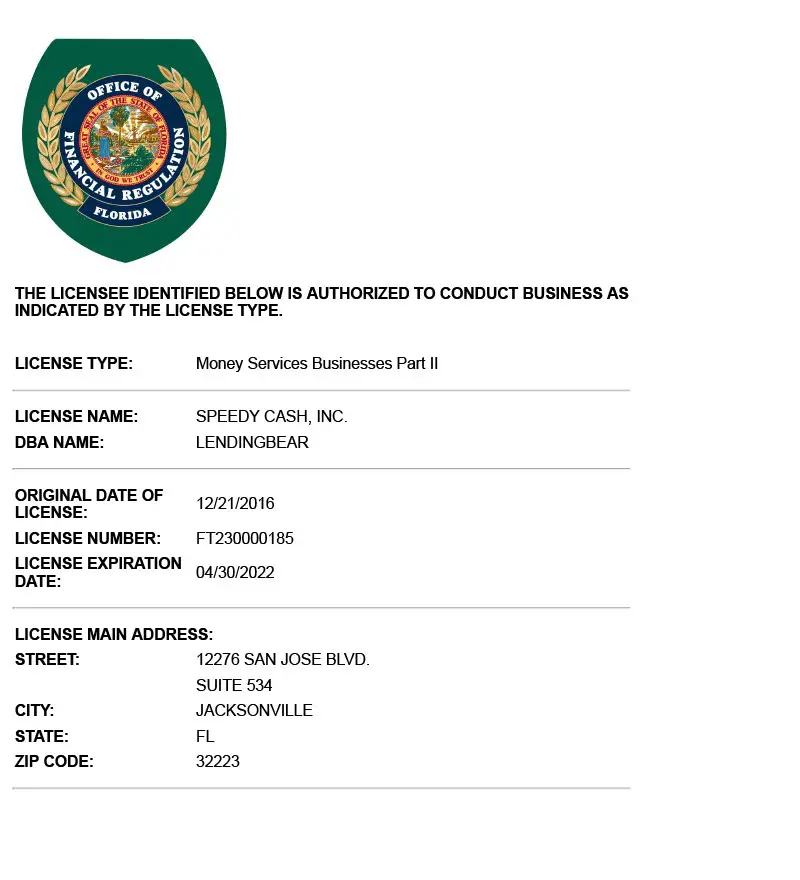

If you want to start a mortgage broker business in the State of Florida, you must first get a mortgage broker license. The Florida Office of Financial Regulation sets the licensing requirements and the registration process is handled by the Nationwide Mortgage Licensing System and Registry .

There are several criteria that you will need to fulfill before you can get your license. In this post, we will walk you through all the steps needed to get your mortgage broker license in Florida.

Your Trusted Source For Mortgage Education

For over 40 years, OnCourse Learning has provided a best-in-class learning experience no matter where you are at in your journey.

Premium Content

Our interactive courses offer real-world examples designed to fit various types of learning styles.

Promise of Compliance

Whether your journey begins or ends with fulfilling a state or federal training regulation, we can help you stay compliant.

Quick Support

Our friendly and knowledgeable support teams are on standby to provide guidance and find solutions.

The value, the course coverage of needed information and the ease of online study makes this course and others provided by OnCourse Learning winners in my book!

You May Like: What Documents Are Needed To Get Pre Approved For Mortgage

Also Check: How Much Income For A 250k Mortgage

Application Requirements And License Maintenance

All mortgage license applications, amendments and renewal filings must now be filed through Nationwide Mortgage Licensing System and Registry .

All mortgage license applications, amendments and renewal filings must now be filed through Nationwide Mortgage Licensing System and Registry .

To apply, renew or manage a license, please visit: Nationwide Mortgage Licensing System

Where Do I Take The Test Can I Take It At Home

The NMLS test must be scheduled and taken at a Prometric testing center. Testing centers are placed throughout the country and chances are that there is one very close to you.

There are three ways to schedule your test at one of these testing centers. You can:

- Login to your NMLS account and navigate to the Manage Test Appointments page

- Go to www.prometric.com/nmls

Read Also: How Much Should You Spend On Your Mortgage

Choose A Mortgage Broker License Types

Chapter 494 of the Florida Statutes sets the different license types and the requirements you need to meet to obtain them.

The license types for mortgage brokers include:

- Mortgage Broker License conducting loan originator activities through one or more licensed loan originators who act as independent contractors or are employed by you

- Mortgage Loan Originator License soliciting a mortgage loan, accepting an application for a mortgage loan, negotiating the terms or conditions of a new or existing mortgage loan, processing a mortgage loan application, or negotiating the sale of an existing mortgage loan to a non-institutional investor

You can find the full list of license types on the NMLS website.

Benefits Of Having Multiple Nmls State Licenses

There are several benefits to having multiple NMLS state licenses that not only help you increase your monthly income but can make you a more well-rounded mortgage loan officer. Take a look at the following advantages to see how having extra NMLS state licenses can support you and your career:

- Increase your business and accommodate a wider pool of clients

- Ensure you can continue to make a profit despite unfavorable geographic-specific market conditions

- Boosts your credibility as an MLO

- Ability to compete with interstate banks

- Can work from home in a different state

Don’t Miss: How To Pay Off Home Mortgage

Request An Nmls Account

Before beginning the educational component of licensing, prospective Loan Officers must create an NMLS account on the State Mortgage Registry website. NMLS is a national database in which all Florida MLOs must register. After creating their account, applicants receive a personal NMLS number that will be maintained for the duration of their time working as a Loan Officer.

Are You Ready For Fingerprinting

If you have everything you need for your fingerprinting visit, click the button below. If you are not sure, please expand the drop down list above and read the checklist.

The State of Florida requires that all individuals looking to obtain a license from the Florida Nationwide Mortgage Licensing System must undergo a live scan Level 2 background check before they can apply. Visit the NMLS Resource Center for more information:

You May Like: What Mortgage Terms Are Available

Renew Your Mortgage License

Continuing Education Requirement:

In the state of Florida, MLOs are required to complete their continuing education requirements ANNUALLY before December 31st. This does not mean you can complete your continuing education on December 30th and be guaranteed renewal.

NMLS renewal guideline dates are as follows:

- You will be ON TARGET for renewal if you complete your continuing education BEFORE November 30th.

- You will be AT RISK for renewal if you complete your continuing education AFTER December 17th.

Dont procrastinate because there is no grace period and failing to complete your continuing education on time will result in the loss of your license.

Choose from either classroom, LiveStream, or online continuing education to renew your MLO license with ease. Our staff handles all the necessary reporting for you and is standing by to answer any questions that you may have.

Course formats include:

Your Success Is Our #1 Priority

OnCourse Learning empowers aspiring mortgage loan originators and seasoned mortgage loan officers to take their learning experience to the next level. Get and maintain your NMLS license with:

- NMLS-approved mortgage pre-licensing, continuing education and late CE courses

- Exam prep tools to help you pass your NMLS license exam

- Over 50 years of mortgage education experience

- Weve helped over 300,000 mortgage brokers begin and advance their careers.

“This was well organized, wonderfully set up to give you ample opportunities to practice the information given through exams, quizzes, discussion scenarios, and message board.”

Read Also: How To Read A Mortgage Loan Estimate

How Do I Get My Florida Mortgage Broker License In Florida

*Please note, that this is a general overview of requirements and that they may not reflect the most recent information. Your specific circumstances may require a different process as well. Please always verify requirements with the appropriate agencies.

Recommended Reading: How Much Should You Pay For Mortgage

Fingerprints And Criminal Background Check:

You are required to have your fingerprints scanned electronically at an NMLS-authorized fingerprint vendor for an FBI Criminal Background Check with the submission of your MU4 Application. The cost of the CBC is $36.25.

If you are obtaining your MLO License in Florida, you must also have your fingerprints scanned electronically at a Florida Department of Law Enforcement location. We recommend using PearsonVUE. The cost of the FDLE fingerprint is $33.

You may make an FDLE fingerprint reservation by calling PearsonVUE at 1-877-238-8232.

Don’t Miss: What’s The Best Type Of Mortgage

How Many Mlo Licenses From Different States Can You Have

You can have as many MLO licenses from different states as you wantas long as youve met the required guidelines outlined by the NMLS and state.

So, if you wanted to originate loans in all 50 states, plus U.S. territories, you could. The only catch is that you would have to hold a valid license in all of these locations and make sure to complete the annual NMLS Continuing Education requirements. If youre employed by a mortgage company, that company must also be able to conduct business in those states as well.

You can find more information on that matter on the NMLS B2B Access: Frequently Asked Questions page.

How Much Commission Does An Mlo Make

Loan officers are the main point of contact for borrowers throughout the mortgage application process at almost every mortgage lender. Thats an important job, right? In return for this service, the typical loan officer is paid 1% of the loan amount in commission. On a $500,000 loan, thats a commission of $5,000.

You May Like: How To Get Approved For Mortgage With Low Income

Also Check: Is Closing Cost Part Of Mortgage

Create Your Nmls Account

You can get started with this step right now! By starting an NMLS account, you will be assigned an NMLS Unique Identifier which will be your license number for the rest of your mortgage career. You will need this number before you take any education or do business. Coordinate your account creation with your future employer.

How To Get A Florida Mortgage Loan Originator License

Step 1: Obtain your Unique Identification Number with NMLS

Creating an account with NMLS only takes a few minutes. After creating your account, NMLS will notify you by email with your Unique Identification Number. Click below to do this now. Please bring this number with you to class so we can provide you with completion credit.

Step 2: Complete the 20 Hour Florida SAFE Comprehensive Course

Pre-Licensure Education: Completion of 20 hours of NMLS approved pre-licensure education course, of which a minimum of 2 hours shall cover the provisions of Florida Law and Rules.

Step 3. Pass the SAFE Act Test

You are required to take and pass the SAFE Act National Test with Uniform State Test . Our recommendation is to take the test within 10 after youve completed the 20 hour pre-licensing course. A score of 75% or better is required to pass the SAFE Act test.

- TEST ENROLLMENT: First you must create a TEST ENROLLMENT on the NMLS website. You will pay $110 for the National Test with Uniform State Test upon the enrollment. Creating the enrollment is what will give you permission to schedule the test.

How To Submit Criminal Background Check

If you are obtaining your MLO License in Florida, you must also have your fingerprints scanned electronically at a Florida Department of Law Enforcement location. We recommend using PearsonVUE. The cost of the FDLE fingerprint is approximately $33 .

Step 5: View your Application Status

Criminal Background Check Status

Also Check: Should I Get 15 Year Mortgage

Florida Mortgage Broker License Requirements

Business is booming in the Florida real estate market. Homes continue to sell as buyers are snatching up everything from condos to single-family homes. Real estate professionals in the state are reaping the benefits of the markets success.

If youre looking for an excellent way to take advantage of Floridas favorable real estate market, you should look into mortgage broker licensing.

Fingerprinting For Nmls Mortgage Broker Licensing

FDLE Approved Live Scan Vendor

Accurate Biometrics offers fast, easy live scan fingerprinting for Level 1 background checks for licensing under the Florida Nationwide Mortgage Licensing System . You can get your fingerprints taken by a trained technician at one of over 50 live scan fingerprinting Kiosks located in The UPS Store® locations throughout the state.

If you have questions about what to bring, please take a look at the checklist below. If youre ready to get started, click the GET FINGERPRINTING button. Questions? Call or use the chat feature on this page.

Don’t Miss: How Do I Calculate My Mortgage Payoff Amount

The Repealed Surety Bond Requirement

Previously, one of the main criteria you had to meet to get licensed was to post a Florida mortgage broker bond and prove a certain level of net worth, but these rules have been repealed.

When you get bonded, you pay a fraction of the bond amount that is required of you. This is the bond premium. Its between 0.5% and 5% of the bond amount for applicants with a solid financial profile.

Need a mortgage broker bond for another state? Fill in the short form below to get a quote!

About The Mortgage Broker License Requirements In Florida

How To Become A Mortgage Broker In FloridaTo Comply With Common Mortgage Regulations

- Our “Loan Officer Boot Camp” training program provides excellent training for new and experienced Loan Officers – and even includes sales pitches and advanced calculations!

To Get A Mortgage License In Florida

- Applying for an NMLS account and ID number

- Completing your pre-licensing course requirements

- Passing the SAFE licensing exam

- Applying for your license with the NMLS

Don’t Miss: How To Check My Mortgage Balance