Dont Leave Out Traditional Lenders

Because credit union products, policies and pricing can be all over the place, you should not completely abandon regular mortgage lenders when you shop for a home loan.

Competition is a healthy thing and keeps prices down. Get at least four mortgage quotes from a variety of sources banks, mortgage companies, credit unions and brokers and compare them all.

Then call a couple of the most competitive lenders and see if their guidelines will work for you, and if their lending agents are professional and respectful.

This way, you ensure that you get a good experience and pay a fair price.

Alternatives To Penfed Credit Union

- Navy Federal Credit Union mortgage review Also specializes in loans to military members, veterans and spouses, plus no mortgage insurance required on conventional loans with down payments less than 20 percent

- USAA mortgage review Another lender focused on serving members of the armed forces and their families, with lots of praise from customers

- Carrington Mortgage Services review Considers non-traditional credit data, accepts much lower credit scores and offers non-QM loans but also charges fees

Bank Vs Credit Union Terms

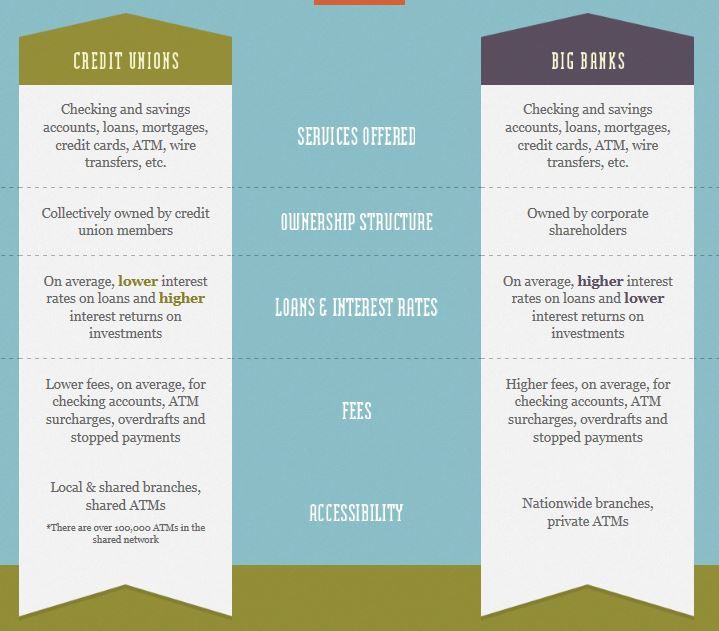

The fees charged by banks are typically higher than those charged by credit unions for the same type and size of loan. Since credit unions are designed only to earn as much as is needed to exist and not to make a profit, they return the extra funds they earn to members in the form of increased interest or reduced fees.

All this means that your credit union home loan will likely come with lower closing costs and origination fees. Credit union mortgage rates also tend to be lower than traditional banks although the difference may not be as drastic as you might like. A few tenths of a percent may not seem like much but it can amount to a large savings over the life of the loan.

Modified date: Oct. 19, 2020

It often seems as if you can get a mortgage just about anywhere. There are mortgage banks, mortgage brokers, and online mortgage sources. Even many insurance companies and investment brokers offer mortgages, either to their clients or to the general public.

But is there any advantage to get a mortgage through a credit union or local bank?

There are actually a few:

Whats Ahead:

Recommended Reading: What Is A Good Fixed Mortgage Rate

When And Why Should You Do It

- Reducing the monthly loan payment.If there are lower interest rates available than what you currently have on your loan, theres an easy way to cut down the monthly payment. Some opt to shave a portion off by extending their 15-year to a 30-year term. Although the monthly payment is significantly less expensive, the major drawback is that you will then be paying back more interest over time.

- Access the equity in your home.If you choose to refinance and borrow more than you currently owe on the loan, you get a check back for the difference. This cash-out refinance measure usually means that people will not only have received a lower interest rate, but also a chunk of change that can be used for bigger purchases or reinvested into the home for the sake of renovations or maintenance.

- Pay down the loan more quickly.If you refinance and go from a 30-year term to a 15-year term, you can pay off the loan in half the time. This also means that you will pay less interest over the course of time. The only caveat here is that the monthly payment will go up.

- Go from an adjustable- to a fixed-rate loan.If you have an adjustable interest rate on your first mortgage and would like to lock in a fixed rate, you can do so when you refinance. Transitioning from an adjustable rate to a fixed one can be an additional way to provide stability when you would prefer consistent and non-fluctuating payments.

Can I Take Out A Heloc Or Second Mortgage Through A Credit Union

Many credit unions offer a HELOC or second mortgage, just like youd find at your bank. Before taking out either, make sure you understand how they work. A HELOC is a line of credit you borrow against your homes equity. You can draw from the balance you need and make interest-only payments for the first 10 years. After 10 years, the loan goes into repayment mode. You cannot draw from the line any longer and will owe principal and interest payments.

A second mortgage provides access to your homes equity in one lump sum. You make principal and interest payments right away and dont have a line to draw on. However, your interest rate is fixed, whereas a HELOC has a variable interest rate that can change monthly.

Don’t Miss: What Is The Best Refinance Mortgage Company

Lets Compare Bank Vs Credit Union

Products of a Bank vs Credit Union

A similar suite of basic products is offered by banks and credit unions. For eg, almost all banks or credit unions offer basic checking and savings accounts, and in regards to some products they differ.

A wider range of saving accounts is more likely being offered by credit unions. Credit unions also commonly offer savings accounts for kids and teens.

On the other hand, Banks are more likely to offer more specialized high-end products like wealth management, investments, or business accounts.

Getting Mortgage from Bank vs Credit Union

A credit union guarantees lower fees and interest rates be it mortgages, credit cards, personal loans, or other financial products Credit unions often offer lower interest rates and compared to the average bank.

These rates do not hinder your financial flexibility.The same applies to fees, which are comparatively reasonable because they dont charge you with appraisal, origination, processing, tax service, and underwriting fees.

As per the National Credit Union Administration, the median credit score to secure a mortgage with a credit union was 753, which is lower than the score for banks.

This means that you dont need the perfect credit score to secure a mortgage from the credit union.

Interest Rates of Bank vs Credit Union

Because this will generate more profits for its owners banks often have poor interest rates. This is not necessarily always the case.

Safety with Bank vs Credit Union

How Do Bank Mortgages Work

Getting a mortgage from your bank or credit union is a simpler process. You complete a loan application, meet with a loan officer and review your available choices. Your bank or credit union may have excellent options for you, and getting a home loan through your own financial institution may qualify you for relationship perks like free checking.

On the downside, working with one bank limits your choices. The bank next door might offer a better deal, but you wont know about it if you only talk to your bank. That could be important if your for a better rate at one financial institution over another. Even a small difference in your interest rate can cost you tens of thousands of dollars over the life of a 30-year mortgage.

Again, doing your homework is key. Learn more about qualifying for a mortgage and consider which factors might affect your loan approval, rates and fees. Familiarize yourself with going interest rates and see how your banks rates line up. Armed with this knowledge, youll have some idea whether or not youre getting a good offer from a bank. Do you have doubts? You can always shop around with other lendersand a mortgage brokerto see what they have to offer before you sign.

Read Also: Rocket Mortgage Payment Options

Read Also: What Is The Average Time To Pay Off A Mortgage

What Does A Mortgage Broker Do

A mortgage broker is basically the middleman between you and a mortgage lender. They look over your loan application and say, Hey buddy, it looks like you can afford this much mortgage. Ill find you a good lender.

You shake hands and they go to a group of lenders and say, Hey folks, look here. My buddy can take out this much mortgage. Whos got the best deal?

A lender raises their hand, and the broker brings them to you, takes your money, and says, Hey, look! Its a perfect fit!

And thats about it.

How Navy Federal Credit Union Works

You can get a mortgage through Navy Federal if you are an active military member, veteran, family member of someone affiliated with the military, or Department of Defense civilian. You may also qualify if you live with a Navy Federal member.

The credit union has over 200 branches around the US, plus nine overseas branches and locations on US military bases. It provides mortgages for residents all around the US.

Navy Federal specializes in mortgages for people affiliated with the military. You can get a regular VA loan. If youve already used up all your VA loan benefits, you may qualify for a Military Choice Loan, a 30-year mortgage with no minimum down payment.

Its possible to qualify to become a Navy Federal member without having all the requirements for a VA loan, so you can also get a conventional mortgage . You may qualify for a Homeowners Choice Loan, which is similar to Military Choice, but for people who arent eligible for VA loans.

You can also refinance your VA, conventional, Military Choice, Or Homeowners Choice mortgage.

Navy Federal doesnt offer FHA or USDA mortgages, or home equity loans or HELOCs. It also doesnt have construction loans or reverse mortgages.

The credit unions website has an intuitive interface with an online preapproval application. The site says that you may even get preapproved immediately. Or you can apply in person at a branch.

Also Check: What Does Gmfs Mortgage Stand For

You May Like: How To Get Mortgage Statement Online

What Are The Disadvantages Of Credit Unions

Most credit unions cannot compete with banks when it comes to convenience and technology like mobile banking. Many credit unions cannot compete with online banks in terms of technology. Credit unions may offer lower interest rates on loans, but the array of financial products may be limited in scope compared to big banks.

Consider A Credit Union When You Shop For A Mortgage

If youre looking for a home loan, it makes sense to contact different kinds of lenders. That includes banks, mortgage companies, mortgage brokers and credit unions.

A credit union may offer benefits that the other lenders dont, because its a non-profit and owned by its members.

Or, it may not. Not all credit unions are created equal, and many mortgage companies and banks do a stellar job at a low cost. Thats why you need to compare them all.

Recommended Reading: Can I Get A Mortgage With A 660 Credit Score

Pros Of Getting A Bank Mortgage

The benefits of using a bank for your mortgage are:

- More branch locations: Banks tend to have more brick-and-mortar locations which makes branch locations easier to find.

- Better technology: Large banks can generally invest a lot of money in online banking platforms and apps. You can easily access your account when youre traveling. And you can get to the root of any problems without having to call or visit a branch.

How To Join A Credit Union

While some credit unions are limited to certain employers, types of workers or geographic areas, in general, quite a few credit unions are open to any members and will be happy to have you join. Some credit unions are digital-first and have a nationwide membership base. No matter where you live or work, you may be able to join a national credit union and get access to their rates on loans, CDs and savings accounts.

As part of the process of joining a credit union, you may need to pay a fee or make a donation, typically in the range of $5 to $25, which is the cost of purchasing one share of ownership in the credit union cooperative. You can join a credit union by going to a branch in person or opening a new account online.

Also Check: What Is My Mortgage Payment Going To Be

Cons Of Getting A Credit Union Mortgage

The benefits of credit unions arent as apparent when searching for mortgage rates, because credit unions dont have the marketing scale banks have, which is why they generally dont appear in searches for low rates, says Rich Arzaga, founder and CEO of Cornerstone Wealth Management in San Ramon, California.

The cons of getting a mortgage through a credit union include:

Reasons To Consider A Credit Union Mortgage

Shopping for a mortgage loan is a great way to save on interest with a better loan rate. In addition to banks and mortgage brokers, home buyers may also want to look to mortgage lenders that may be in their neighborhood but can be overlooked: Credit unions.

Along with sometimes offering better mortgage interest rates, credit unions offer other benefits that other lenders may not do so well, such as having low or fewer fees, knowing the local market better and being able to make loans on unique properties.

Read Also: What Does Buying Points On Mortgage Mean

Cons Of Bank Mortgages

Some of the downfalls of choosing a bank for your mortgage lender are:

- Customer service: A large bank may not provide the same level of customer service and attention youd find at a local credit union.

- Higher rates and fees: Banks tend to charge higher interest rates and have more fees.

- Harder to qualify: Banks can be more stringent about loan approvals. That makes it harder for home buyers with lower credit scores or smaller down payments to qualify for a mortgage.

Greater Texas Credit Union Mortgage Loans

Greater Texas Credit Union offers six different types of mortgages, including conventional, FHA, and VA loans. Moreover, we offer loan terms in a variety of increments: 10 years, 15 years, 20 years, and 30 years.

The best part is you dont have to navigate these options on your own. Our loan officers will guide you through the process, answering all of your questions.

Additionally, you can visit our online mortgage center to find all the resources to equip you for the homebuying process. There you can check out the following:

- Find out how much home you can afford and calculate how much you would qualify for as well as your mortgage payment.

- Our mortgage checklist gives you a comprehensive list of everything you need to apply and qualify for a home loan.

- Get the home buying basics from our learning center, which includes a mortgage glossary, how to get a loan, and types of loans.

If buying a home is on your bucket list, but you are still working on improving your credit, Greater Texas Credit Union offers its members a , a four-step program that helps you gradually repair your credit.

More questions about credit union mortgage loans? Weve got you covered!

You May Like: Can Mortgage Rates Go Lower

What Is A Direct Lender

A direct lenders job is to make and fund mortgages. Unlike mortgage brokers, direct lenders approve your mortgage applications and loan you money directly because they are the lender.

One of the biggest advantages to going with a direct lender is that they take care of the whole mortgage process. They do everything from processing your loan application to giving you a mortgage preapproval to underwriting your mortgage.

What does that mean for you? The faster a lender works, the quicker you get your mortgage. And when youre trying to close on a house, getting your mortgage faster gives you an advantage over slower borrowers.

While You Cant Plan For Every Extra Expense Anticipate Paying:

Recommended Reading: Who Is The Mortgage Holder

Best Credit Union Mortgage Lenders Of 2022

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

You may have heard good things about credit union mortgages. are member-owned nonprofit organizations that use their profits to reduce costs and fees, and to offer higher savings rates.

These credit unions rise to the top of the heap for first-time home buyers, VA and FHA loans, digital convenience and other factors.

You may have heard good things about credit union mortgages. are member-owned nonprofit organizations that use their profits to reduce costs and fees, and to offer higher savings rates.

These credit unions rise to the top of the heap for first-time home buyers, VA and FHA loans, digital convenience and other factors.

Access To A Home Equity Loan Or Home Equity Line Of Credit

The need for this type of loan could happen at any point in the home ownership process. For example, if youre buying a home, you may decide you want a home equity loan or HELOC as part of the down payment. This is a common strategy for buyers who are looking to avoid private mortgage insurance, which is very expensive.

Banks and credit unions are natural sources of home equity loans and HELOCs. If you already have a relationship with one, itll be easier to get either type of loan. Many banks and credit unions also routinely provide home equity loans and HELOCs along with new first mortgages.

But even after youve been in your home a while, you may still decide you need secondary financing. It could be to renovate or expand the home, or even to borrow money for other purposes, like debt consolidation or investment.

Whatever the reason, it will be much easier to get secondary financing if you already have a well-established relationship with the institution. You may even find that your bank or credit union regularly offer you opportunities for home equity loans and HELOCs.

And once again, since they already have much of your financial informationincluding your first mortgagethe application process will be both quicker and less complicated.

Recommended Reading: How Much Is Mortgage Insurance Monthly