Breaking Even: Should You Buy Points

Buying points is betting that you are going to stay in your home without altering the loan for many years.

Points are an upfront fee which enables the buyer to obtain a lower rate for the duration of the loan. This means the fee is paid upfront & then savings associated with the points accrue over time. The buyer spends thousands of Dollars upfront & then saves some amount like $25, $50 or $100 per month. After some number of years owning the home, the buyer ends up benefiting from the points purchase.

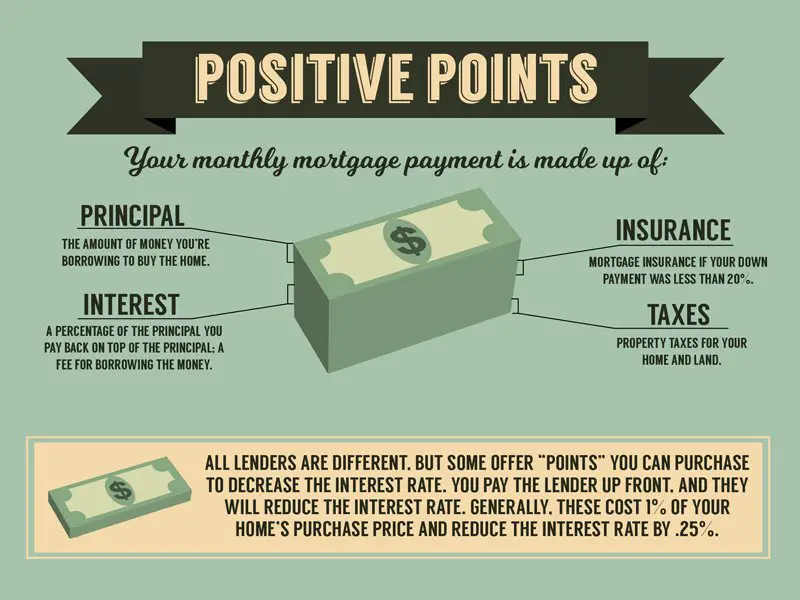

What Does It Mean To Buy Mortgage Points

One of the lesser-known items youll need to address in your mortgage process is the option to buy points. Mortgage points are fees that you pay to the lender in exchange for a lower interest rate. But how do you know if buying points is a good idea for your situation? Here are a few things to think about.

Comparing Mortgage Loan Offers

Understanding how points work is just one important factor in your decision. Its also important to know how they work when comparing loan rates. Thats because if two lenders offer you the same interest rate but one is charging a point and the other isnt, the lender that isnt charging the point is offering a better deal.

While youre loan shopping, if two lenders offer you a fixed-rate loan of $200,000 at 4.25%, but one is charging a point for that rate, youd be paying an extra $2,000 upfront with that lender to get the same rate from the other lender for free. Thats why its so important to comparison shop carefully and understand loan terms before you decide on a lenders offer.

Recommended Reading: What Is The Mortgage Rate For Bank Of America

What Are Mortgage Points

Mortgage points are fees you pay a lender to reduce the interest rate on a mortgage. Paying for discount points is often called buying down the rate and is totally optional for the borrower.

As you search for the lender with the best offer, be careful when looking at mortgage rates advertised online. When you read the fine print, you may find that one, two or even three or more discount points have been factored into the rates.

Discount points are totally optional. You’ll want to find out what a lender’s rate is without adding a bunch of upfront fees.

Does Buying Points Pay Off

The Should I buy mortgage points calculator determines if buying points pays off by calculating your break-even point. Thats the point when youve paid off the cost of buying the points. From then on, youll enjoy the savings from your lower interest rate.

To find the break-even point, the calculator determines your monthly savings from buying points and divides that amount into the total cost of the points. For example:

On a $200,000 loan, purchasing one point brings the mortgage rate from 4.1% to 3.85%, dropping the monthly payment from $957 to $938 a monthly saving of $19. The cost: $2,000. The calculator divides the cost by the monthly savings amount to find the break-even point.

$2,000/$19 = 105 months

Back to the question: Is buying points worth it? The answer depends on how long youll keep the mortgage.

» MORE:Calculate your closing costs

Don’t Miss: How To Shop Around For Best Mortgage Rates

Do Mortgage Points Affect Taxes

Mortgage points may be tax deductible as home mortgage interestbut that still doesnt make them worth buying. In order to qualify, the loan must meet a slew of qualifications on a lengthy list of bullet points, all of which are determined by the IRS.

If youve already bought mortgage points, check with a tax advisor to make sure you qualify to receive those tax benefits.

Will Applying For Different Mortgages Hurt My Credit

The generally consider credit checks from multiple mortgage lenders as one credit check because they assume youâre searching for the best deal. But you have to limit your applications to a short window of time. Some credit-scoring models consider multiple mortgage inquiries within 14 days as just one inquiry, while others treat several inquiries as a single one if you made them within 45 days. Because you probably wonât know what scoring model a particular lender will use now or if you apply for credit in the future, submit each of your mortgage applications within a 14-day period to be on the safe side.

You May Like: What Is Prime Rate For 30 Year Mortgage

Is It Worth Buying Mortgage Points

Once you answer the question, what are mortgage points, that’s just the start. You need to do some math to see when you would break even from the purchase. For example, say you were taking out a $250,000 loan. You have a choice between not buying points and getting an interest rate of 3.00% or buying one point and reducing your rate to 2.75%. If you take a 30-year mortgage and remain in your home the entire time, you’d obviously end up better off for having paid points.

- If you don’t buy points: Your monthly payment would be $1,054 and total repayment costs would be $379,444.

- If you buy a point: Your monthly payment would be $1,021 and your total loan repayment costs would be $367,417.

You’d pay $2,500 for a point and would save $12,027 over time. But if you plan to sell or refinance, you may not be in your home long enough for your monthly savings to make up for the $2,500 you spend.

You can calculate roughly how long it will take you to break even for paying points. Simply divide the cost of the point by the monthly savings. For example, if you divide $2,500 by $33, you’d see it would take around 75 months for the savings to cover the upfront cost of buying mortgage points.

- You’d owe $244,780.50 on the loan with the 3.00% interest rate

- You’d owe $244,559.53 on the loan with the 2.75% interest rate

What Are Points And Lender Credits And How Do They Work

Generally, points and lender credits let you make tradeoffs in how you pay for your mortgage and closing costs. Points, also known as discount points, lower your interest rate in exchange paying for an upfront fee. Lender credits lower your closing costs in exchange for accepting a higher interest rate.

These terms can sometimes be used to mean other things. Points is a term that mortgage lenders have used for many years. Some lenders may use the word points to refer to any upfront fee that is calculated as a percentage of your loan amount, whether or not you receive a lower interest rate. Some lenders may also offer lender credits that are unconnected to the interest rate you pay for example, as a temporary offer, or to compensate for a problem.

The information below refers to points and lender credits that are connected to your interest rate. If youre considering paying points or receiving lender credits, always ask lenders to clarify what the impact on your interest rate will be.

Points

Points let you make a tradeoff between your upfront costs and your monthly payment. By paying points, you pay more upfront, but you receive a lower interest rate and therefore pay less over time. Points can be a good choice for someone who knows they will keep the loan for a long time.

Lender credits

See an example

When comparing offers from different lenders, ask for the same amount of points or credits from each lender.

Donât Miss: Bofa Home Loan Navigator

Read Also: How To Become A Mortgage Loan Officer In Michigan

Build Your Perfect Mortgage With Total Mortgage

Mortgage points can potentially save you money on your mortgage loan, but the monthly savings will depend on the interest rate, the amount you borrow, and the term of the loan. However, mortgage points may not be the best financial move for your situation.

The right mortgage can save you thousands. Get a free rate quote from Total Mortgage for a home purchase, refinance, or home equity loan.

Those Who Dont Plan On Owning The Home Longer Than The Recovery Period

The takeaway from the example above is that if you expect to be in the home less than 9.5 years, paying discount points to lower the rate wont make financial sense.

At least thats the case if you will need to pay the discount points yourself. If theyll be paid by the seller or by a gift from a family member, taking the discount will absolutely be worth doing.

Otherwise, it will only make sense if you expect to be in the home for longer than the recovery period.

You May Like: What Salary Is Required For A Mortgage

Using Apr To Compare Loans

Comparing different loans with varying interest rates, lender fees, origination fees, discount points, and origination points can be very difficult. The annual percentage rate figure on each loan estimate helps make it easier for borrowers to compare loans, which is why lenders are required by law to include it on all loans.

The APR on each loan adjusts the advertised interest rate on the loan to include all discount points, fees, origination points, and any other closing costs for the loan. This metric exists to make comparison easier between loans with wildly different discount points, interest rates, and origination fees.

How Points And Credits Are Calculated

Points are calculated as a percentage of the total loan amount, with 1 point equal to 1%.

Every lender has a specific pricing structure, which is why different lenders offer the same rates at different prices.

At Better Mortgage, transparency is key to us, which is why points and credits are displayed in actual dollar values when you view your personalized rate options in your Better Mortgage account. Positive numbers in your points/credits column represent points , and negative numbers represent lender credits .

Read Also: When Does It Make Sense To Refinance Mortgage

Calculating Points On Arm Loans

While a point typically lowers the rate on FRMs by 0.25% it typically lowers the rate on ARMs by 0.375%, however the rate discount on ARMs is only applied to the introductory period of the loan.

ARM loans eventually shift from charging the initial teaser rate to a referenced indexed rate at some margin above it. When that shift happens, points are no longer applied for the duration of the loan.

When using the above calculator for ARM loans, keep in mind that if the break even point on your points purchase exceeds the initial duration of the fixed-period of the loan then you will lose money buying points.

| Loan Type |

|---|

| 120 months, or whenever you think you would likely refinance |

Are Mortgage Discount Points Worth It

In the above example, the mortgage applicant saves $14 per month for every $1,000 spent on mortgage points. To reclaim the full $1,000 cost of the points, the homebuyer would need to make 71 regular monthly payments. That would take almost six years.

Home finance experts call the time it takes to recover your upfront cost the breakeven point.

Every mortgage loan will have its own breakeven point for buying points.

If you plan to stay in your home beyond the breakeven point and this is key! if you dontthink youll refinance before the breakeven hits, paying points may be a good idea.

The longer you stay in the home beyond the breakeven point, the more youll save because the interest rate reduction continues generating monthly savings as long as you have the loan.

Selling your home or refinancing the mortgage before its breakeven point can make discount points a waste of money. In this case, youd do better to put the money toward your down payment to increase your home equity.

According to Freddie Mac, the typical 30year fixedrate mortgage loan carries between 0.5 and 0.7 discount points.

Adjustablerate mortgages tend to carry fewer points because ARM homebuyers intend to sell or refinance sooner. Points pay off only if you keep the loan long enough to realize savings from the interest rate reduction.

How mortgage points affect APR

But APR also assumes youll hold your loan for 30 years. Very often, you will not, which nullifies the APR math.

Read Also: Which Bank Is Best To Get A Mortgage

Scenarios Where Buying Mortgage Points May Make Sense

Understanding how much points cost, the impact on your monthly payments and your break-even point is a good place to start. From there, you can consider your specific situation to determine if buying points is a smart idea.

Generally, buying mortgage points could make sense when:

- You plan on living in the home beyond the break-even point.

- You likely won’t benefit from refinancing your mortgage before the break-even point.

- Buying points won’t strain your finances.

However, if you need the cash for other expensessuch as moving, remodeling or monthly billsyou want to make sure buying points won’t leave you in a bind. Additionally, if you plan on selling the home soon, or you think you might refinance, the savings from buying a lower interest rate will be limited.

In fact, if you suspect you might not stick with the same mortgage for long, it could make more sense to ask for lender credits rather than buying mortgage points. Lender credits could basically be seen as selling points rather than buying them, because the lender pays you to accept a higher interest rate. It can make sense if you’re having trouble affording a down payment or the closing costs. Or if you suspect you may move or refinance soon.

You Pay The Points Out Of Your Own Funds

This is a common outcome in strong real estate markets and among higher-priced properties. Sellers rarely pay any closing costs under either condition. If so, youll need to budget additional funds for closing.

Lenders will generally accept funds coming from any source, with the lone exception of borrowing. For example, lenders generally wont permit you to take an advance on your credit card to pay the points.

Also Check: Can You Reverse Mortgage A Condo

Paying Mortgage Points For A Lower Interest Rate

- Its important to consider both the loan type your expected tenure

- To determine if paying points upfront is a good deal

- Generally worth looking into if you plan to stick with your mortgage/property for a long time

- And if you want an even lower fixed rate youll actually benefit from for years to come

It would probably make more sense to pay mortgage points on a 30-year fixed as opposed to an adjustable-rate mortgage, seeing that you could benefit for many more months, though both situations could make sense depending on the price and associated discount.

Same goes for the homeowner who plans to stay in the property for years to come. Seeing that youd save money each month via a lower housing payment, the more you stay the more you save.

Want a fast, free rate quote? Quickly get matched with a top mortgage lender today!

Another plus is that these types of points are tax deductible, seeing that they are straight-up interest. And that tax benefit should be factored into the equation

*The loan origination fee may also be tax deductible if its expressed as a percentage of the loan amount and certain other IRS conditions are met.

If you arent being charged mortgage points directly , it doesnt necessarily mean youre getting a better deal.

All it means is that the mortgage broker or lender is charging you on the back-end of the deal. There is no free lunch.

Additional Ways To Lower Interest Rates Or Costs On Your Loan

Buying mortgage points isn’t the only way to lower your mortgage’s interest rate or how much you pay in interest overall. Here are some additional options you’ll want to look into:

- Shop lenders and loan types. It can pay to get offers from multiple mortgage lenders, as each lender may have its own method for determining the interest rate it will offer you. Additionally, your rate could depend on the type of mortgage you get and whether it has a fixed or adjustable rate. Shop around to see which ones you’ll qualify for and which will be best.

- Increase your down payment. While you’ll need to come up with extra cash for a large down payment, doing so could lead to a smaller loan amount and lower interest rate. Putting at least 20% down can also help you avoid paying for mortgage insurance, which can lower your monthly payment.

- If you can’t afford a higher upfront cost but could take on a larger monthly payment, a shorter repayment term can lead to a lower interest rate.

- Find a less expensive home. Buying a cheaper house is another way to reduce your monthly payment and down payment amount.

Once you have a mortgage, you may be able to refinance to get a lower interest rate. Or, if your lender allows it, you could make bimonthly payments to decrease how much interest accrues overall.

Don’t Miss: How Much Income To Qualify For 200 000 Mortgage

Lets Look At Some Examples Of Mortgage Points In Action:

Say youve got a $100,000 loan amount and youre using a broker. If the broker is being paid two mortgage points from the lender at par to the borrower, it will show up as a $2,000 origination charge and a $2,000 credit on the HUD-1 settlement statement.

It is awash because you dont pay the points, the lender does. However, a higher mortgage rate is built in as a result of that compensation to the broker.

Now lets assume youre just paying two points out of your own pocket to compensate the broker. It would simply show up as a $2,000 origination charge, with no credit or charge for points, since the rate itself doesnt involve any points.

You may also see nothing in the way of points and instead an administration fee or similar vaguely named charge.

This could be the lenders commission bundled up into one charge that covers things like underwriting, processing, and so on.

It could represent a certain percentage of the loan amount, but have nothing to do with raising or lowering your rate.

Regardless of the number of mortgage points youre ultimately charged, youll be able to see all the figures by reviewing the HUD-1 , which details both loan origination fees and discount points and the total cost combined.

*These fees will now show up on the Loan Estimate and Closing Disclosure under the Loan Costs section.