Other Mortgage Fees Or Costs

There may be other fees or charges associated with mortgage products such as an application fee or product fee.

- These fees are usually either paid up front or added to the mortgage. Keep in mind, if fees are added to the mortgage this could ultimately cost more due to interest being charged.

- When comparing mortgage deals, it may be a good idea to consider both those with and without product fees. You will be able to compare both APRC and your potential monthly repayments, to make an informed decision about the best option for you.

Why Are There So Many Different Interest Rates

The number of different interest rates available when you borrow or save can be confusing.

The interest rates high street banks set depend on more than just Bank Rate.

For loans, other factors are considered, including the risk of the loan not being paid back.

The greater the lender thinks that risk is, the higher the rate the bank will charge. It can also depend on how long you want to take out a loan or mortgage for.

You can use our interactive chart to see how interest rates of different financial products have changed over time. Choose a product from the drop down menu in the enter the series box.

By loading the chart you agree to Tableau cookie policy. This use will include analytics.

Bank of England’s explainer to why do interest rates matter.

Mortgage Fees And Charges

Mortgage lenders don’t just make their money from the interest they charge on the loan most products come with an application or product fee too.

These are often around £1,000, and can be paid either up-front or added to your mortgage balance, though doing the latter will cost you more as you’ll pay interest on it.

Lenders may also offer fee-free deals – but you’ll usually pay for this through a higher interest rate.

For example, a mortgage deal might have a 5.39% interest rate and come with a £999 product fee. However, there may also a fee-free version available at 5.49%.

In this particular example, the version with the fee would be cheaper over the long term. But that won’t always be the case.

It will all depend on the size of the fee, and the difference between the two interest rates.

You can calculate the difference between fee-free and fee-paying mortgage deals yourself with our mortgage repayment calculator.

Recommended Reading: Does Pre Approval For Mortgage Affect Credit

Impact Of High Versus Low

High-interest rates make loans more expensive. When interest rates are high, fewer people and businesses can afford to borrow. That lowers the amount of credit available to fund purchases, slowing consumer demand. At the same time, it encourages more people to save because they receive more on their savings rate. High-interest rates also reduce the capital available to expand businesses, strangling supply. This reduction in liquidity slows the economy.

Low-interest rates have the opposite effect on the economy. Low mortgage rates have the same effect as lower housing prices, stimulating demand for real estate. Savings rates fall. When savers find they get less interest on their deposits, they might decide to spend more. They might also put their money into slightly riskier but more profitable investments, which drives up stock prices.

Why Are Mortgage Interest Rates Important

Your mortgage interest rate determines how much the balance of your loan will grow each month. The higher the interest rate, the higher your monthly repayments.

Interest rates are always calculated as a percentage of your mortgage’s balance.

If you have a repayment mortgage – which most people do – you’ll pay a set amount of your balance back each month plus interest on top of that. Those with interest-only mortgages pay interest but none of the -capital.

Don’t Miss: What Is Escrow Means Mortgage

Choosing The Right Loan Type

Each loan type is designed for different situations. Sometimes, only one loan type will fit your situation. If multiple options fit your situation, try out scenarios and ask lenders to provide several quotes so you can see which type offers the best deal overall.

Conventional

- VA: For veterans, servicemembers, or surviving spouses

- USDA: For low- to middle-income borrowers in rural areas

- Local: For low- to middle-income borrowers, first-time homebuyers, or public service employees

Loans are subject to basic government regulation.

Generally, your lender must document and verify your income, employment, assets, debts, and credit history to determine whether you can afford to repay the loan.

Ask lenders if the loan they are offering you meets the governments Qualified Mortgage standard.

Qualified Mortgages are those that are safest for you, the borrower.

Interest On A Home Equity Loan

-

You have to use the money from the home equity loan to buy, build or substantially improve your home.

-

If you use the money to buy a car, pay down credit card debt, or pay for something else not home-related, the interest isnt deductible .

» MORE:Learn how to deduct property taxes on your tax return, too

Don’t Miss: How To Buy A House At Auction With A Mortgage

How To Get A Lower Mortgage Rate

Your mortgage rate is an important part of your home loan. Getting a lower mortgage rate starts when you make the decision to become a homeowner. Building a good credit history and making responsible financial decisions will show lenders youâre a responsible borrower. When you begin searching for a mortgage loan, shop around to see which lenders are offering the best terms. As you work with a lender to determine the details of your loan, consider these options to help get a lower rate.

- Save up for a large down payment. A bigger down payment means you’re financing less of the total cost of your home and can help you avoid paying private mortgage insurance.

- Purchase mortgage discount points. This is a way you can prepay interest on your mortgage loan. By paying a percentage of the cost of your loan with mortgage points, your interest drops slightly.

- Talk to a Home Lending Advisor. Talk about your financial situation and the ways your loan type and term can help you get a lower mortgage rate.

How Do I Find The Best Mortgage Rate

Finding the best home mortgage rate is a matter of knowing your goals and picking the right tool to get the job done. The best mortgage for you may not always be the one with the lowest interest rate. Factors like how long you keep your home loan will impact your decision.

If you plan on keeping your home loan long-term, then a fixed-rate mortgage is ideal. Mortgage rates today are very reasonable for fixed-rate 10-, 15-, or 30-year mortgages. Locking in a low rate is a smart choice. But you can get lower mortgage rates with some adjustable-rate loans too. If you plan on only keeping your home for a short period of time, then you may be able to pay less interest with an ARM.

Also Check: How Much Does An Average Mortgage Cost

What You Can Do To Protect Yourself If Interest Rates Rise

If the interest rate rises, your payments increase. Make sure that you can adjust your budget in case your payments increase.

Ask your lender if they offer:

- an interest rate cap: a maximum interest rate your lender can charge on a mortgage. You never have to pay more in interest than the maximum cap, even if the interest rates rise

- a convertibility feature: where, at any time during your term, you can convert or change your mortgage to a fixed interest rate

Note that if you choose a convertibility feature and change your mortgage to a fixed interest rate:

- you usually have to pay a fee

- certain conditions may apply

Interest Rate And The Apr

Whenever you see a mortgage interest rate, you are likely also to see an APR, which is almost always a little higher than the rate. The APR is the mortgage interest rate adjusted to include all the other loan charges cited in the paragraph above. The calculation assumes that the other charges are spread evenly over the life of the mortgage, which imparts a downward bias to the APR on any loan that will be fully repaid before term which is most of them.

Recommended Reading: How To Lower My Mortgage Interest Rate Without Refinancing

Mortgage Rates In The 2000s

At the start of the 2000s, mortgage rates averaged around 8% and then gradually fell to a range of 5% to 6% for most of the decade.

This was also a significant decade for mortgage rates because of the 2008 financial crisis, causing the Federal Reserve to slash its federal funds rate to near 0 to make borrowing more affordable. By the end of 2009, the average rate on a 30-year fixed mortgage was around 5.14%.

Read Also: 18 Month No Interest Credit Card

Is There Still Time To Refinance

Americans watch mortgage rates closely, and any time rates pull back even the slightest amount, more people apply for mortgages. With rates still substantially higher than a year ago, however, applications remain stuck near the lowest level in more than two decades, according to MBA data.

While refinancing options can lead to a lower monthly payment, not all of the options yield less interest over the life of the loan. For example, refinancing from a 5% mortgage with 26 years left on it to a 4% rate, but for 30 years, will cause you to pay more than $13,000 in additional interest.

Before you start shopping around for a lender, you can find out how much you could save by using a mortgage refinancing calculator.

Youll also want to consider how long you plan on staying in your home as the closing costs can eat up your savings if you sell shortly after refinancing. The closing costs to refinance run between 2% to 5% of the loan amount, depending on the lender. So you should plan on keeping your home long enough to cover those costs and realize the savings from refinancing at a lower rate.

Keep in mind that the rate you qualify for also depends on other factors such as your credit score, debt-to-income ratio, loan-to-value ratio and proof of steady income.

Don’t Miss: What Qualifies As A Jumbo Mortgage

Mortgage Rates In The 1980s

The 1980s was the most expensive decade for mortgage borrowing largely due to consistently high inflation. By late 1981, mortgage rates averaged more than 18%, an astronomical price compared to todayâs standards.

Paul Volcker, the chairman of the Federal Reserve Board from 1979 to 1987, had the uphill task of rescuing the economy from âstagflation,â a term used to describe stagnant growth and high inflation.

Volckerâs monetary policy of focusing on bank reserves and limiting the money supply pushed the country toward a recession that lasted from 1980 until 1983. Inflation fell to 3.2% in 1983, from an all-time high of 13.5% in 1980, and the economy rebounded. Mortgage rates began falling in 1982, ultimately dropping to 9.78% by the end of the decade.

How Do Different Mortgage Loan Options Compare

The figures above represent a conventional home loan. A conventional mortgage is one you get from a bank. The bank will look at your income to decide how much to lend you. Conventional loans usually require a big down payment. If you cannot afford a significant down payment, you might be required to purchase expensive mortgage insurance.

Lets look at two alternative mortgage options and see how they stack up.

FHA Mortgage

The FHA is the Federal Housing Administration. When you take out an FHA mortgage, you dont receive money directly from the FHA. Instead, you get a loan from a lender that follows special FHA rules. These rules are meant to make buying a home more accessible for low- and moderate-income homebuyers.

An FHA loan requires a 3.5% down payment, which is often lower than what is required on non-FHA mortgages.

FHA loan interest rates for the past few years have been between 2.9% and 3.4%:

- At 2.9%, a $345,000 home would cost $516,957

- At 3.1%, a $345,000 home would cost $530,354

- At 3.4%, a $345,000 home would cost $550,803

TruePath Mortgage

The TruePath Mortgage is available only through TCHFH Lending, Inc., a nonprofit mortgage lending subsidiary of Twin Cities Habitat for Humanity. TCHFH Lending, Inc. provides this mortgage for low- and moderate-income households across the Twin Cities metro area. The TruePath Mortgage can require no down payment from the homebuyer with a 2.0% fixed interest rate.*

- At 2.0%, a $345,000 home would cost $459,067.

Also Check: Can I Refinance My Mortgage With The Same Bank

How Does Mortgage Interest Work

One of the biggest hurdles for prospective homeowners is finding the right mortgage. And one of the things that can make or break an affordable mortgage is the interest rate. Home loan interest rates can severely impact your long-term costs, so most buyers look for the lowest rates possible. But not every lender or loan is the same.

It would help if you explored the question, How does mortgage interest work? before agreeing to any financing. Heres what you should know so you can get the best mortgage rate and choose the loan type that suits your needs.

Get approved to buy a home.

Rocket Mortgage® lets you get to house hunting sooner.

Don’t Forget Taxes Insurance And Other Costs

If you’re buying a home, you’ll also need to consider some other items that can significantly add to your monthly mortgage payment, even if you manage to get a great interest rate on the loan itself. For example, your lender may require that you pay for your real estate taxes and insurance as part of your mortgage payment. The money will go into an escrow account, and your lender will pay the bills as they come due. These costs are not fixed and can rise over time. Your lender will itemize any additional costs as part of your mortgage agreement and recalculate them periodically.

Don’t Miss: Can You Finance A Pool Into Your Mortgage

How To Get A Lower Mortgage Interest Rate

Even though mortgage interest rates are posted at every financial institution, there are many ways to lower your rate.

- Ask for a discounted rate. Every lender can provide a discount. You just need to ask and negotiate.

- Shop around. Youll want to contact a few different lenders to see what rates theyre offering.

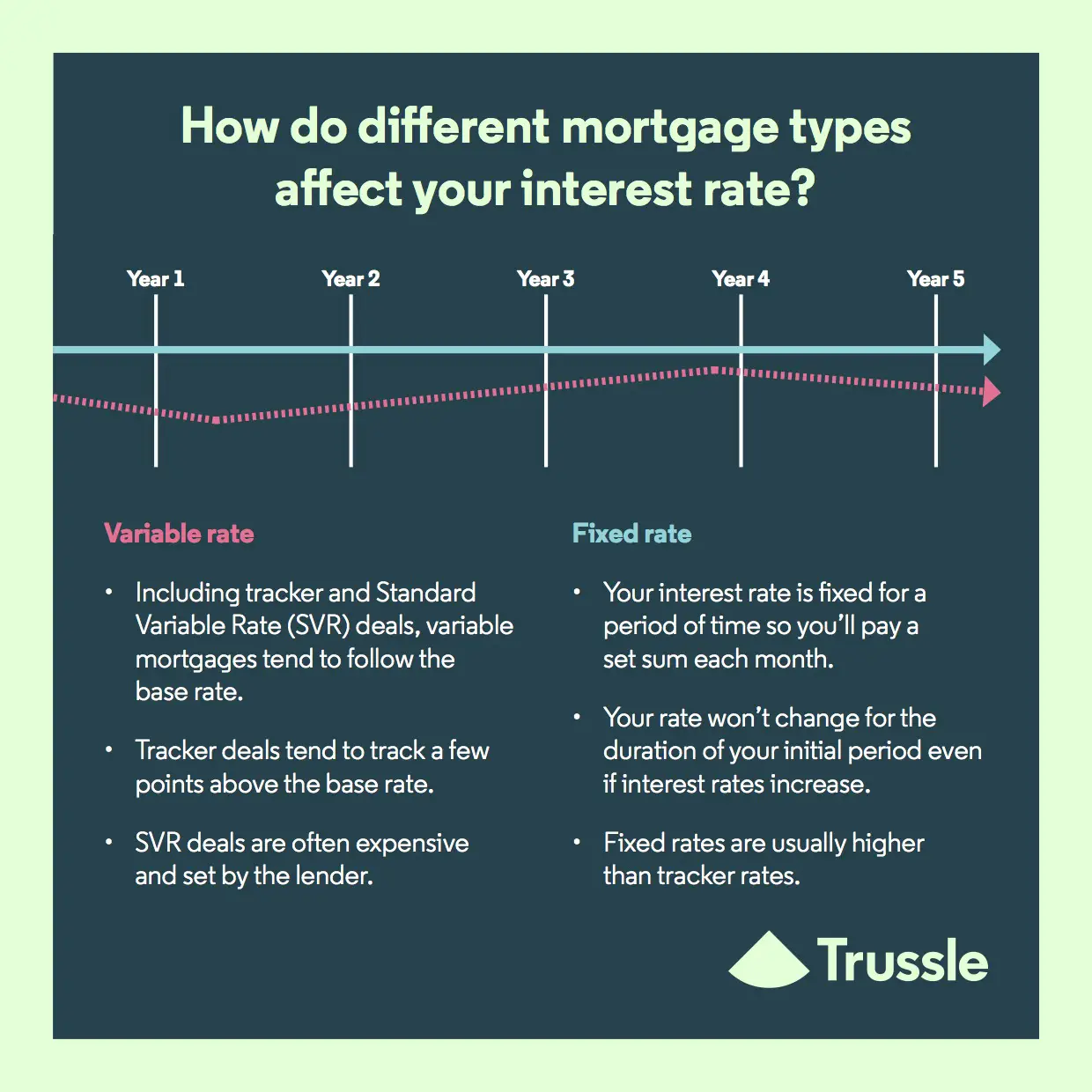

- Choose a variable rate. Variable-rate mortgages are usually lower than fixed-rate mortgages, but they could go up during your term.

- Use a mortgage broker. Working with a broker can be beneficial since they can shop around and find you the lowest rate.Refinance. If you already have a mortgage, you could see if your lender allows you to blend and extend your mortgage.

When getting a mortgage, many people focus on getting the lowest interest rate possible, but that shouldnt be your only priority. Be sure to check all the terms, including any prepayment options, before you commit.

How Your Credit Rating Affects Your Interest Rate

Lenders look at your credit report and credit score to decide if they will lend you money. They also use them to determine how much interest they will charge you to borrow money.

If you have no credit history or a poor credit history, it could be harder for you to get a mortgage. If you have good credit history, you may be able to get a lower interest rate on your mortgage. This can save you a lot of money over time.

Also Check: How To Find Mortgage Payment

What Is The Break

The break-even point is when the interest you saved is equal to the amount you paid for mortgage points. They sort of cancel each other out.

Alright, its time to go back to math class again. Lets calculate the break-even point from our example we used before. To do this, just divide the cost of the mortgage point by the amount youd be saving per month . And there you have it, that answer is the break-even point.

$2,400 / $36 = 67 months

In other words, in 67 months, youd have saved over $2,400 in interestthe same amount you paid for the mortgage point. After reaching the break-even point, youll pocket that $36 each month, which will be the money you save on interest because of the mortgage point you bought.

Also Check: Can My Parents Cosign On A Mortgage Loan

Fixed Interest Rate Mortgage

Fixed interest rates stay the same for your entire term. They are usually higher than variable interest rates.

A fixed interest rate mortgage may be better for you if you want to:

- keep your payments the same over the term of your mortgage

- know in advance how much principal youll pay by the end of your term

- keep your interest rate the same because you think market interest rates will go up

Also Check: Can You Get A Mortgage With No Job

Dont Forget Taxes Insurance And Other Costs

If youre purchasing a house, you also need to remember several additional factors that may substantially increase your monthly mortgage payment, even if you receive a fantastic interest rate on the loan itself. For example, your lender may ask you to include real-estate taxes and insurance in your mortgage payment. The funds will be placed in an escrow account, and your lender will pay your payments when they become due. These expenses are not set and can increase over time. As part of your mortgage agreement, your lender will list any extra expenses and recalculate them regularly.

If you need home financing or have any questions about the lending process, please visit our website and contact us today for more information.