Negotiate A Seller Concession Instead

Everything in life is negotiable. As you negotiate a better real estate deal, consider negotiating for a seller concession to cover your closing costs.

They agree to chip in a certain amount at the settlement table toward your costs, out of their proceeds. Often, this proves better than a lower purchase price, since it means coming up with far less cash at the table. Rather than asking for a lower price, and therefore a lower total loan amount, you can potentially eliminate your closing costs entirely.

Why You Shouldn’t Roll Closing Costs Into Your Mortgage

by Christy Bieber |Updated July 19, 2021 – First published on April 13, 2021

Image source: Getty Images

There’s a host of downsides to rolling closing costs into your mortgage.

When you get a new mortgage or a refinance loan, you’ll usually need to pay closing costs. These are usually around 2% to 5% of your home’s value, and they can add up to several thousand dollars.

Typically, when you’re getting a new mortgage, you have to pay these costs out of pocket up front. However, when you refinance a mortgage, some lenders let you roll these costs into your new loan. That means if you were going to borrow $200,000 and pay $6,000 in closing costs, you’d instead borrow $206,000 and pay no closing costs up front.

This may sound like an attractive option since you don’t need to come up with several thousand dollars to close on a refinance loan. But, in many cases, it’s actually a far better idea to pay the closing costs up front and be done with them rather than dragging out repayment over time. Here’s why.

They Are Numerous And Can Easily Mount Up

Lea Uradu, J.D. is graduate of the University of Maryland School of Law, a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, Tax Writer, and Founder of L.A.W. Tax Resolution Services. Lea has worked with hundreds of federal individual and expat tax clients.

Getting a mortgage isnt free. Before you get those house keys, youll go to the closing table to sign loan documents and paperwork that transfer homeownership from the seller to you.

Throughout your home purchase, third partiessuch as your real estate attorney and your mortgage lenderhave performed services. Closing costs include the fees these professionals charge for these services to finalize the real estate transaction and your home loan.

Read Also: Is Mortgage Insurance The Same As Pmi

How Else Can I Avoid Paying Closing Costs

As we mentioned above, you can usually roll closing costs into your mortgage only when you refinance.

But there are other ways to reduce your closing costs when buying a home.

The first is asking your mortgage lender to waive some or all of your upfront fees. They might agree, but theyll charge you a higher interest rate in return. This is known as a lender credit.

You might also ask your seller to cover some of your closing costs. Known as a seller concession, this is more likely in a buyers market than a sellers market.

USDA borrowers can roll closing costs into their USDA loan if the appraised value is higher than the purchase price. More on that here.

How Much Will I Pay

This depends on the amount of your loan and other factors.

For all loans, well base your VA funding fee on:

- The type of loan you get, and

- The total amount of your loan. Well calculate your funding fee as a percentage of your total loan amount.

Depending on your loan type, we may also base your fee on:

- Whether its your first time, or a subsequent time, using a VA-backed or VA direct home loan, and

- Your down payment amount

Note: Your lender will also charge interest on the loan in addition to closing fees. Please be sure to talk to your lender about any loan costs that may be added to your loan amount.

You May Like: How Do You Get A Cosigner Off A Mortgage

Can You Waive Closing Costs On A Home

Some closing costs must be paid, no matter what. But you can try to negotiate origination and application fees with your lender. You may even be able to get your lender to waive certain fees entirely.

SoFi Loan ProductsSoFi loans are originated by SoFi Bank, N.A., NMLS #696891 . For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.SoFi MortgagesTerms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility for more information.Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

- Mon-Thu 5:00 AM – 7:00 PM PT

- Fri-Sun 5:00 AM – 5:00 PM PT

Home Loans General Support:

- Mon-Fri 6:00 AM 6:00 PM PT

- Closed Saturday & Sunday

- Mon-Thu 8:00 AM 8:00 PM EST

- Fri 8:00 AM – 7:00 PM EST

- Closed Saturday & Sunday

- Mon-Thu 5:00 AM – 7:00 PM PT

- Fri-Sun 5:00 AM – 5:00 PM PT

Should You Roll Closing Costs In A Mortgage

Well, it depends.

It is important to understand the consequences when you are including your closing costs into the mortgage.

If you choose to roll it in the loan amount, then you are paying interest on the closing cost for the entire loan period.

Lets say you are buying a $300,000 home that requires you to put down $12,000 as closing costs during settlement. If you choose to roll this additional amount into your mortgage, you will end up paying $21,378 over the 30-year period considering a 4.3% rate.

Also, when you are taking a higher loan amount, your LTV increases. This will, in turn, reduce your stake in the property. When you look to sell your property in the future, you will end up making a lower profit.

Here are my two cents If you are short on cash, and not able to pay the closing costs out of pocket, it is fine to include it in your mortgage otherwise, paying it upfront is always the better alternative.

Don’t Miss: What Is The Best Mortgage Company To Refinance With

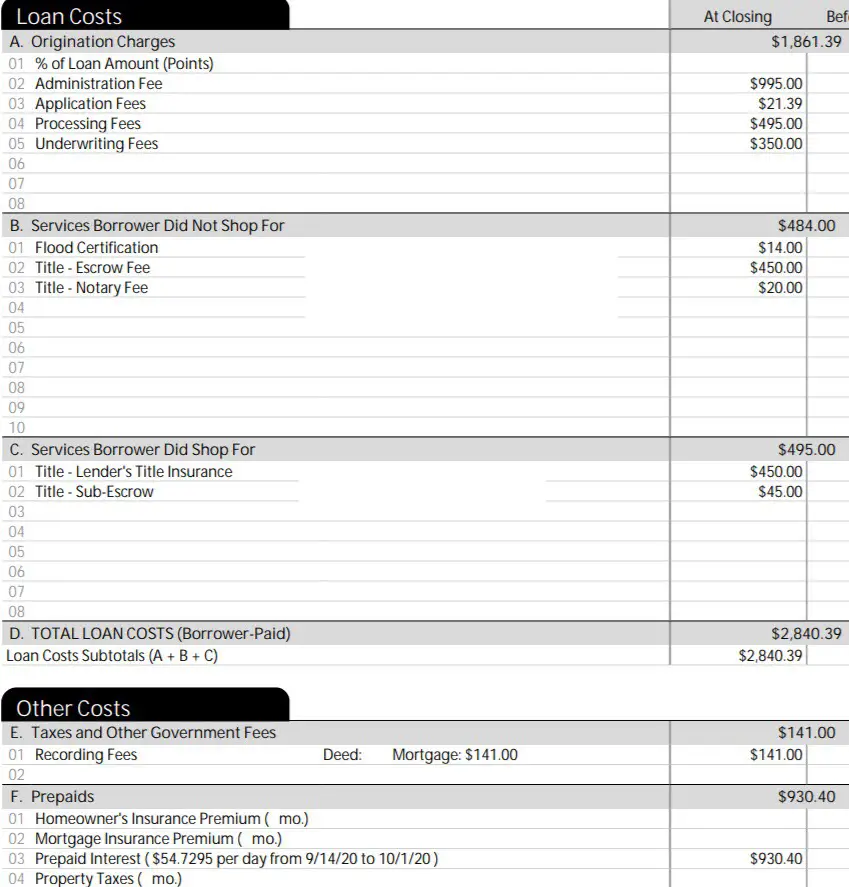

How To Calculate Closing Costs

When it comes to calculating closing costs, the most important thing to be aware of is everything that could go into those costs. With that in mind, well walk you through an example based on a $200,000 loan amount. Well get into more detail on what each of these are later on, but for now there will be a short explanation and a focus on the math.

Before we get there, it should be noted that your loan estimate will list the things you can and cannot shop for. You can typically look around for different providers of title insurance, survey services, homeowners insurance, etc.

Under the first box on the closing cost page are the fees the lender charges to give you the loan, including an origination fee, which is typically around 1% of the loan amount. On our $200,000 loan, this is about $2,000. Some lenders list an origination fee as two separate fees for processing and underwriting. Add them together.

Mortgage points are prepaid interest payments you can make at closing in exchange for a lower rate. One point is equivalent to 1% of the loan amount, but you can get them in increments of as little as 0.125%. The origination fee and any points you pay for will be listed under Origination Charges on your Loan Estimate. You may also see these referred to as discount points.

Youll have a credit monitoring fee that could be around $10. This is something set up so that your lender gets alerts if you have major changes to your credit when youre going through the mortgage process.

Can Your Closing Costs Be Included In The Loan Balance

Youve probably heard the saying, Life isnt fair. Thats especially true when youre buying a home.

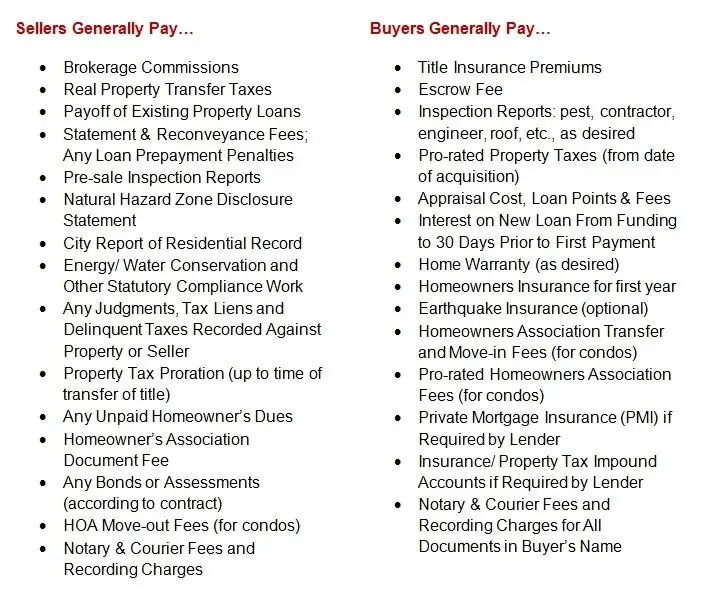

While the seller usually pays the real estate commission and a few other fees, the bulk of the costs of buying a home are the responsibility of the buyer and those fees can easily add up to thousands of dollars or more.

In this article, well discuss how investors can keep more cash on hand by including closing costs in the total loan amount.

Also Check: Stilt Interest Rates

Read Also: How Does Making Extra Payments On Mortgage Work

How Much Do You Pay For Closing Costs

Your lender is required to give you two documents outlining the closing costs for your loan. Within three days of applying for a mortgage, you’ll receive a Loan Estimate that approximates your closing costs. Within three days of finalizing your mortgage, you’ll receive a Closing Disclosure that confirms your costs.

What’s Included In Closing Costs

Closing costs are a significant expense, requiring careful consideration when you shop for a mortgage. Closing costs include things like your lender’s loan processing fees, fees to make sure there is a clear title, fees from the property surveyor, and deed recording fees from your local government offices. Then there are “points,” which are upfront interest costs you pay to qualify for a lower interest rate. Each point is 1 percent of your loan’s total amount.

Closing costs vary from region to region, anywhere from 1 to 8 percent of the price of the home. Typically they represent 2 percent of the home price, so closing costs for a $250,000 home could range from $5,000 to $7,500 not small change when you’ve already had to come up with cash for the down payment.

Recommended Reading: Can You Sue A Mortgage Lender

Recording Fees And Transfer Taxes

Local or county governments charge fees whenever a property changes hands. The seller is usually responsible for covering transfer taxes and recording fees. Sellers may have to pay fees to the county government, state government, both or neither it all depends on your state.

Transfer taxes are usually expressed as a set number of dollars per $100,000 of the homes appraised value.

Dont Miss: Can You Get A Reverse Mortgage On A Mobile Home

Should You Roll Them Over

There might be times, especially when your down payment is the barest minimum, that attempting to include closing costs in the actual mortgage could put you outside of the approval window. When this happens, the ratio of debt to the homeâs market value is too low. In a tight economic climate, lenders closely watch this ratio to be sure that you can actually handle the mortgage.

But if you have an adequate cushion between your mortgage amount and your homeâs appraised value, wrapping closing costs into your mortgage can give you breathing room to recarpet the house or put in the much-needed driveway. Just remember that if you do roll closing costs into your mortgage, youâll want to plan to stay in the house a while as it takes a few years to recover the cost.

Read Also: Nerdwallet Loans

Don’t Miss: Who Is The Best Company To Get A Mortgage From

Pros And Cons Of Rolling Closing Costs Into Your Mortgage

Borrowers who roll closing costs into a mortgage spend less money out of pocket and keep more cash in hand. Thats a big argument in favor of rolling in closing costs.

However, you are also paying interest on those costs over the life of the loan.

For example, lets assume:

- The closing costs on your new mortgage total $5,000

- You have an interest rate of 3.5% on a 30-year term

If you roll the closing costs into your loan balance:

- Your monthly mortgage payment would increase by $22.50 per month

- And you would pay an extra $3,000 over the 30-year loan term, meaning your $5,000 in closing costs would actually cost $8,000

Heres another con: By adding the closing costs to your new mortgage balance you are increasing the loan-to-value ratio. Increasing the LTV lowers the amount of equity in your home.

Less equity means less profit when you sell your home because youd have a bigger lien to pay off after the sale. You would also have less equity if you wanted to take a home equity loan.

The cons losing equity and paying more interest may be OK with you if youre still saving more from your lower refinance rate than youre losing by financing the costs.

Closing Costs: What You Can Control

Closing costs are a necessary part of your home purchase. Transferring a property and obtaining a loan are complicated processes, and they require help from numerous different sources. Unfortunately, the people doing that work wont do it for free.

Still, its wise to educate yourself on closing costs and learn how to keep charges to a minimum.

Read Also: How To Calculate Va Loan Amount

Also Check: What Is A Good Mortgage Interest Rate

Can You Roll Closing Costs Into The Mortgage

In simple terms, yes you can roll closing costs into your mortgage, but not all lenders allow you to and the rules can vary depending on the type of mortgage youre getting. If you choose to roll your closing costs into your mortgage, youll have to pay interest on those costs over the life of your loan. This essentially means that youll be paying much more for these costs than you would paying for them upfront.

Pros And Cons Of Financing Your Closing Costs

When youre buying a home, one of the things you have to factor into your budget are closing costs. Typically, homebuyers spend between 2% and 5% of the purchase price on these expenses. If you agree to finance your closing costs, youll pay less money up front. Before making that move, however, its best to weigh the advantages and disadvantages of taking that route. If you want additional expert guidance, use SmartAssets financial advisor matching tool to pair up with a financial professional who can help you with your real estate needs.

Check out our closing costs calculator.

Also Check: What Questions Should I Ask Mortgage Lender

Do Realtor Fees Come Out Of Pocket

Realtor fees also known as commission are part of almost every real estate transaction. Even though buyers dont have to pay realtor fees, theyre still on the hook for some major out-of-pocket expenses the down payment and in some cases, earnest money. Theyll also usually have closing costs they have to cover.

Also Check: Rocket Mortgage Conventional Loan

Are Closing Costs Negotiable

While there is no way for you to outright dodge paying closing costs, there are ways that you can pay considerably less.

According to HUD, the Real Estate Settlement Procedures Act seeks to reduce unnecessary high closing costs by requiring lenders to give you a good faith estimate for the itemized list of fees. One thing to note here is that these are still estimates.

Some closing costs are negotiable such as title and attorney fees, commission rates, and recording fees. Also, watch out for miscellaneous fees like delivery and funding fees. If the fees seem vague, you may be able to lower or eliminate them.

As different lenders may have different requirements, the closing costs can vary widely. So before you finalize your mortgage, make sure to shop around.

Most people dont realize that buying a home is going to be one of their most expensive purchases. Also, mortgage is one of the longest term loans that is out there. If you are considering a 30-year fixed mortgage, youll most likely be in touch with your lender for 30 years.

The lenders understand this, and they will try their best to get your business. This is your only opportunity to set the numbers, so give it your best to bring it down as much as you can.

Stay ahead in your financial journey by taking advantage of our most recommended tools and resources

You May Like: How To Work For A Mortgage Company

Do Refi Closing Costs Get Rolled Into The New Mortgage

Closing costs are fees charged by the lender, title company, appraiser and other entities involved in processing a loan. Whether you are obtaining a new mortgage or refinancing an existing one, these costs will apply. In most cases, you can choose to pay closing costs upfront, or you often can roll them into the new loan.

How Do I Pay Closing Costs

Now that we know what closing costs are, lets cover how best to pay them. Generally speaking, there are two ways to pay closing costs. The most common way is to pull out your wallet and just write a check to whichever institution is in charge of closing. But who wants to pay out-of-pocket? Not many of us. Thats why theres a second option. The other way you can pay your closing costs is by rolling them into your loan. This is easier to do with VA loans than other loan types, and will carry different ramifications depending on whether youre purchasing or refinancing.

You May Like: A Mortgage Loan Originator Is Defined As

What’s Your Cash Flow Situation

How much cash you have not to mention how much you need should also play a role in your decision. Do you have the funds to cover the closing costs upfront? Would doing so deplete your emergency savings or leave you lacking in funds needed for repairs? If so, rolling those costs in might be your only option.

On the other hand, if you have plenty saved up or some equity you can pull on from another property, paying closing costs upfront is likely your best bet. It might mean a bigger chunk of change now, but it will reduce your monthly payment and interest costs, ultimately freeing up more cash flow in the future.