Should You Increase Your Credit Limit

If you know you’re likely to spend up to your credit limit no matter how high it is, carrying the higher debt burden will probably outweigh any benefits from increasing your credit limit. Otherwise, consider requesting an increase. Before doing so, make sure that you have an established credit history in good standing.

The Bottom Line: Will A Mortgage Help My Credit

When you initially purchase your home, it may be disheartening to watch your credit score fluctuate. Once you begin making payments and the initial hard credit inquiries disappear, youll start to see your credit rise. With the added diversity to your credit mix and the always aging lines youve established, your score could reach new heights. Learn more about your home loan options and apply for a mortgage.

Helps You Earn More Rewards

If you consistently pay off your credit card balance in full and on time, but you’re not putting all of your expenses on your credit card, it might be time to start. Having a higher credit limit can help you do that and increase the rewards you earn, such as cash back, points, or travel miles. The conventional wisdom says that you shouldn’t charge everyday expenses like groceries and gas to your credit card, but that advice only applies if you’re carrying a balanceit’s designed to help you avoid making a bad problem worse.

On the other hand, if you never carry a , paying for recurring expenses on your credit cards won’t cost you anything and can help you earn more rewards. Those rewards can actually reduce your spending in other areas by helping you pay for vacations, gifts, clothes, and nights out.

Don’t Miss: Recast Mortgage Chase

Mortgage Payments Vs Rent

Paying a mortgage on time can make a big difference in your credit score and paying the same amount in rent on time typically does not.

Rent payments are considered in some scoring models if they are reported .

But mortgage payments are typically reported without any special effort on your part and are routinely factored into credit scores.

About the authors:Teddy Nykiel is a former personal finance and student loans writer for NerdWallet. Her work has been featured by The Associated Press, USA Today and Reuters.Read more

Bev O’Shea writes about credit for NerdWallet. Her work has appeared in the New York Times, Washington Post, MarketWatch and elsewhere.Read more

How A Mortgage Affects Your Credit

Know the fundamentals. Your measures your ability to pay back debts. You only earn so much money so keeping your amount of debt in good proportion to your income is essential. This is called your debt-to-income ratio.

Keeping it no higher than 36% is considered optimum with no more than 28% going to your mortgage. If you know you will purchase a home in the near future, dont take on other debt obligations. Keep your debt-to-income ratio low.

However, do continue to build your . A little credit is better than no credit as far as your credit score is concerned. And of course, paying your mortgage on time is good for your credit history.

Also Check: 10 Year Treasury Vs Mortgage Rates

Does Refinancing Your Mortgage Impact Your Credit Scores

Refinancing your mortgage can be a great way to lower your interest rate and reduce your monthly mortgage payment, but it can also impact your credit scores.

Reading time: 4 minutes

Refinancing a mortgage is the process of taking out a new home loan and using that loan to pay down the balance on your original mortgage. Refinancing can be a great opportunity to change the terms of your loan: You might refinance to shorten the duration of your loan or, more commonly, to secure a lower interest rate. If interest rates have dropped significantly since you first took out your mortgage, your long-term savings could be substantial.

However, keep in mind that, despite the benefits of an adjusted loan, a mortgage refinance could have a negative impact on your credit scores. Here are three things to know about your credit reports before you begin the refinancing process:

Dispute Any Errors You See On Your Credit Report

Mistakes on your credit report can bring your score down, so get a copy of your report and scan it for errors. Common mistakes include duplicate credit accounts, which makes it look like you have more debt than you really do, and identity errors like a misspelling of your name. If you find inaccurate information, dispute it by contacting the credit bureau in writing and letting them know whats wrong with your report.

You May Like: Can You Get A Reverse Mortgage On A Condo

How Does Applying With A Co

When applying with a co-borrower, credit checks will be done for each mortgage applicant. If one co-borrower has a lower credit score, lenders typically use the lower score of the borrowers to determine mortgage eligibility and what rates and terms to offer. For that reason, we often recommend that only the borrower with the higher credit score apply to get the best terms possible. If you decide to apply with a single borrower, youll still be able to put both names on the homes title. If youre unsure on whether or not youd like to add a co-borrower,we can help you figure that out.

Take a master class in mortgaging with our free guide.

How Credit Scores Are Determined

Before getting into specifics, it’s important to understand how credit scores are determined. The reality is that your score with each of the credit bureaus is based on a mix of factors that each account for a different percentage of the number you’re given.

Payment history : Whether or not you have a history of making your payments on time has the greatest impact on your overall score. To that end, it’s crucial to make sure that you pay your credit card bill on time, every time.

Your credit utilization ratio looks at what percentage of your total available credit you’ve used. For the best results, you should try to keep this ratio under 30% whenever possible.

Length of credit history : While you can’t really do much to speed this one up, the longer your accounts have been open and you have a history of making timely payments, the higher your score will be.

Credit scores take into account the total amount of outstanding debt that you have, as well as the different types of credit that you use. Your FICO score tends to favor having a variety of loan types on your credit report, including installment loans and revolving credit.

Recommended Reading: Chase Recast

Lowers Your Credit Utilization

The FICO credit-scoring model will ding your credit score if the amount of credit you’ve used is close to the total amount of the credit available to you. That’s because lenders consider you to be at risk of taking on too much debt, making it more difficult for you to make future payments. Even if these risks don’t actually apply to you, that’s how the scoring model works, and your credit score can suffer as increase.

For example, if you have a $2,000 credit limit and you regularly end up with a monthly balance of around $1,800, you’re using 90% of your available credit. Raising your credit limit will reduce the percentage of funds being used, lower the credit utilization ratio, and should improve your credit score.

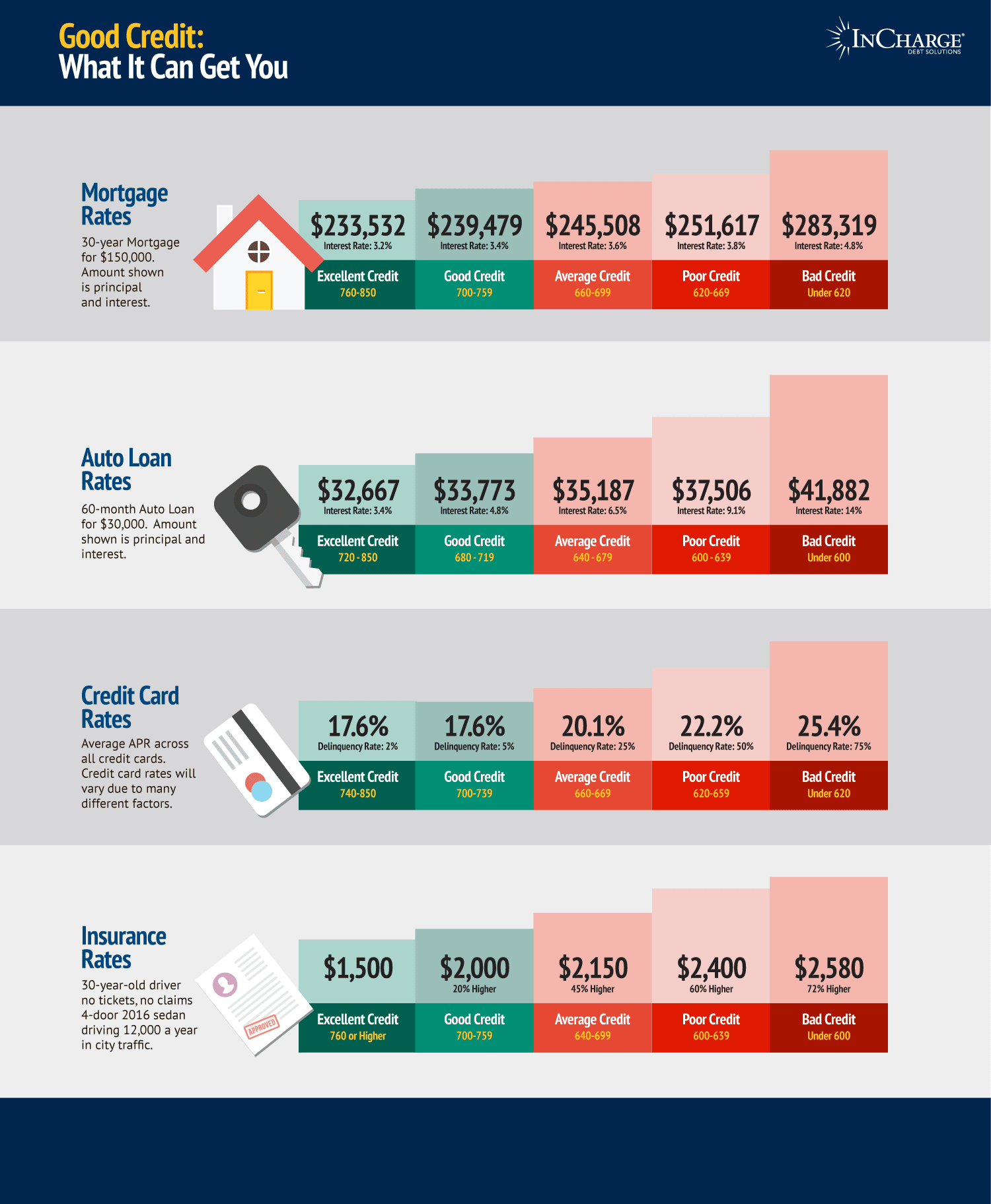

How Your Credit Impacts Your Mortgage Approval

Good credit is key to buying a home. Thats because lenders see your credit score as an indication of how well you handle financial responsibility. That three-digit number gives them an idea of how risky it is to lend to you after all, they want to make sure you pay back what you borrow, especially for a large purchase like a house. Your score could be the difference between getting an approval for a mortgage and getting turned down.

Your credit also impacts your mortgage approval another way: it might be used to help determine the rate and terms of your mortgage. If you have a higher credit score, you might get a lower interest rate or more flexible payment terms.

Recommended Reading: How To Repair Your Credit Report Yourself

Read Also: 10 Year Treasury Vs 30 Year Mortgage

Cheaper And Easier To Get Loans And Additional Credit

If your credit score is higher, you will have a better chance in the future of getting approved for a credit card, car loan, or mortgage. You’ll also have a better chance of getting a lower interest rate since your credit score determines whether you’ll be offered the best available rate or a higher, risk-adjusted rate.

Soft Credit Checks Hard Credit Checks And Your Mortgage

Soft credit checks are checks on your credit that have zero impact on your score. These checks can happen fairly often. For example, every time you go online to check your credit score through a site like CreditKarma or your credit card they conduct a soft check. This way you can monitor your score without damaging it.

The Better Mortgage pre-approval can show you how much money you can borrow as well as the rates you qualify for with just a soft credit pull. If youre in the early stages of home research, you can get a rough estimate of whats available to you without placing any hard checks on your credit.

Benefits of the Better Mortgage pre-approval and soft credit check:

- Doesnt affect your credit score

- Shows you your score, so you know what we know

- Allows us to run a monthly debt calculation

- Helps us calculate a more precise number for what you can borrow

- Allows us to quickly run different financing options with you over the phone

Recommended Reading: Reverse Mortgage Manufactured Home

How A Mortgage Can Hurt Your Credit

There is, of course, the other side to the story. If you have trouble repaying your mortgage on time, your credit score will almost certainly suffer. Although its always a good idea to make your mortgage payment on or before the due date, the real trouble for your credit begins about a month after you miss a payment. Most mortgage lenders extend a grace period of 15 days before theyll penalize you with a late fee. If a payment is 30 days or more past due, they will report it as late to the credit reporting agencies.

Even one 30-day late payment can have a lasting effect on your credit. Payment history accounts for 35% of your credit score and is the biggest factor in its calculation. A late payment will appear on your credit report for seven years, though its effect diminishes over time. An isolated 30-day late payment is less damaging than multiple late payments or one that extends to 60 or 90 days past due.

An unpaid mortgage that goes into foreclosure creates its own set of problems. In a foreclosure, multiple missed payments cause your mortgage to go into default. As part of your loan agreement, your lender has the right to seize your property and sell it to recover their money. The missed payments that lead up to foreclosure120 days or four successive missed payments is typicalwill seriously damage your credit. The foreclosure itself also becomes a negative item on your credit report. Worst of all, you lose your home and any financial stake you have in it.

A New Mortgage May Temporarily Lower Your Credit Score

When a lender pulls your credit score and report as part of a loan application, the inquiry can cause a minor drop in your credit score . This shouldn’t be a concern, though, as the effect is small and temporary, and on its own shouldn’t cause significant damage to your credit score or affect a lender’s decision. In addition, credit scoring models recognize rate shopping for a loan as a positive financial move, and typically regard multiple inquiries in a limited time period as just one event.

That said, this is not the time to apply for credit you don’t strictly need, such as new credit cards or a student loan refinance. Save those applications for later, after the mortgage loan has closed and the house is yours.

If you aren’t submitting a formal loan application yet but want to get prequalified so you’ll know how much house you can afford, your lender will likely base its prequalification on a “soft” inquiry. This type of inquiry does not affect your credit scores.

Once you’ve been approved for a mortgage and your loan closes, your credit score may dip again. Good news: Since you’ve already been approved for your home loan, this temporary drop may not matter much.

You May Like: How Does Rocket Mortgage Work

Tips For Increasing Your Credit Score After Buying A House

There are a lot of companies that claim they can raise your credit score quickly but remember that developing a good credit score is a process that takes time. Paying your mortgage and other bills on time is the first step to good credit. Keeping your credit card utilization low is another way to reflect your credit worthiness to lenders. Maintaining a good standing with creditors and lenders helps develop a long credit history.

How Does My Credit Score Affect My Mortgage

Your credit score directly affects the interest rate on your mortgage. Basically, high credit scores lower your interest rates, while low scores cause them to rise. If I already have a high credit score, what else can I do to lower my mortgage rates? If you can afford higher monthly payments, then opting for a shorter loana 15-year instead of a 30-year loancan help reduce your interest rate. Short-term loans cost banks less money. In appreciation, your bank might reward you with an interest rate as much as one percent lower than that of a long-term loan.

Recommended Reading: Chase Recast Mortgage

Your Score Could Drop But Will Rebound With Timely Payments

Becoming a homeowner is a huge milestone. It often takes years to build up your credit and finances enough to get approved for a mortgage. But how does a mortgage affect your credit score during and after the homebuying process? While you may see your score drop, dont panicits usually temporary. Heres what you should know.

Transcript: The Role Of Your Credit History

Your lender wants you to be a successful borrower, and so before making a loan, they will examine your current debts, payment habits, credit history and credit score.

Your credit report is important because it is a record of your credit activities. It lists any credit card accounts or loans you have, the date you opened each account, your credit limit or loan amount, the balances, and your payment history.

It’s a good idea to keep track of your credit history and monitor it regularly, especially before you start the loan application process. You can request a free credit report from each of the three main credit bureaus annually at www.AnnualCreditReport.com.

Your credit score is a number based on your credit history. Credit scores range from 300 to 850, the higher the better.

Lenders consider your credit history and credit score when making decisions about loan approval, interest rate, loan amount, and the type of loan you can get. If you apply for a loan with one or more co-borrowers, lenders evaluate the credit of all applicants.

Approximately 35% is your payment track record. So the most important thing you can do is pay your bills on time. About 30% is what you owe. Owing money on many accounts suggests to lenders you may be overextended.

Approximately 15% is the length of credit history. Lenders want to see you can responsibly manage credit accounts over time.

About 10% is new credit accumulated in the previous

Related articles

Also Check: Chase Mortgage Recast

Your Credit Score Could Decrease

As crazy as it seems, paying off what is likely your largest installment debt might not, in fact, send your FICO score through the roof.

Philpot explains that if you dont have a balanced mix of revolving to installment debt and a good length of time that credit has been establishedand is still openyour score may dip slightly.

While minor, there could be a negative impact if your mortgage was the only loan in the installment category, as the overall credit mix of your credit picture accounts for 10% of your score, says David Bakke at MoneyCrashers.

And isnt the only category that could negatively affect your score.

Your score may also see a modest drop when the loan is paid off, because it takes the mortgage off of the length of credit portion of your score, which accounts for 15% of your score, Bakke says.

Doesn’t Checking My Credit Hurt My Score

When you request your own credit report, those requests will not hurt your score.

How to get your credit score

There are several ways to get a credit score, some of which are free. When choosing how to get a score, pay attention to the fine print about how the score is calculated. Some companies that offer credit scores use different scoring models than lenders use. Here are 4 ways to get a score:

If you have a low credit score

Also Check: Chase Mortgage Recast Fee