How Much House Can I Afford With A Va Loan

Veterans and active military may qualify for a VA loan, if certain criteria is met. While VA loans require a single upfront funding fee as part of the closing costs, the loan program offers attractive and flexibleloan benefits, such as noprivate mortgage insurance premiums and no down payment requirements. VA loan benefits are what make house affordability possible for those who might otherwise not be able to afford a mortgage.

With VA loans, your monthly mortgage payment and recurring monthly debt combined should not exceed 41%. So if you make $3,000 a month , you can afford a house with monthly payments around $1,230 .

Use ourVA home loan calculatorto estimate how expensive of a house you can afford.

Types Of Home Construction Loans

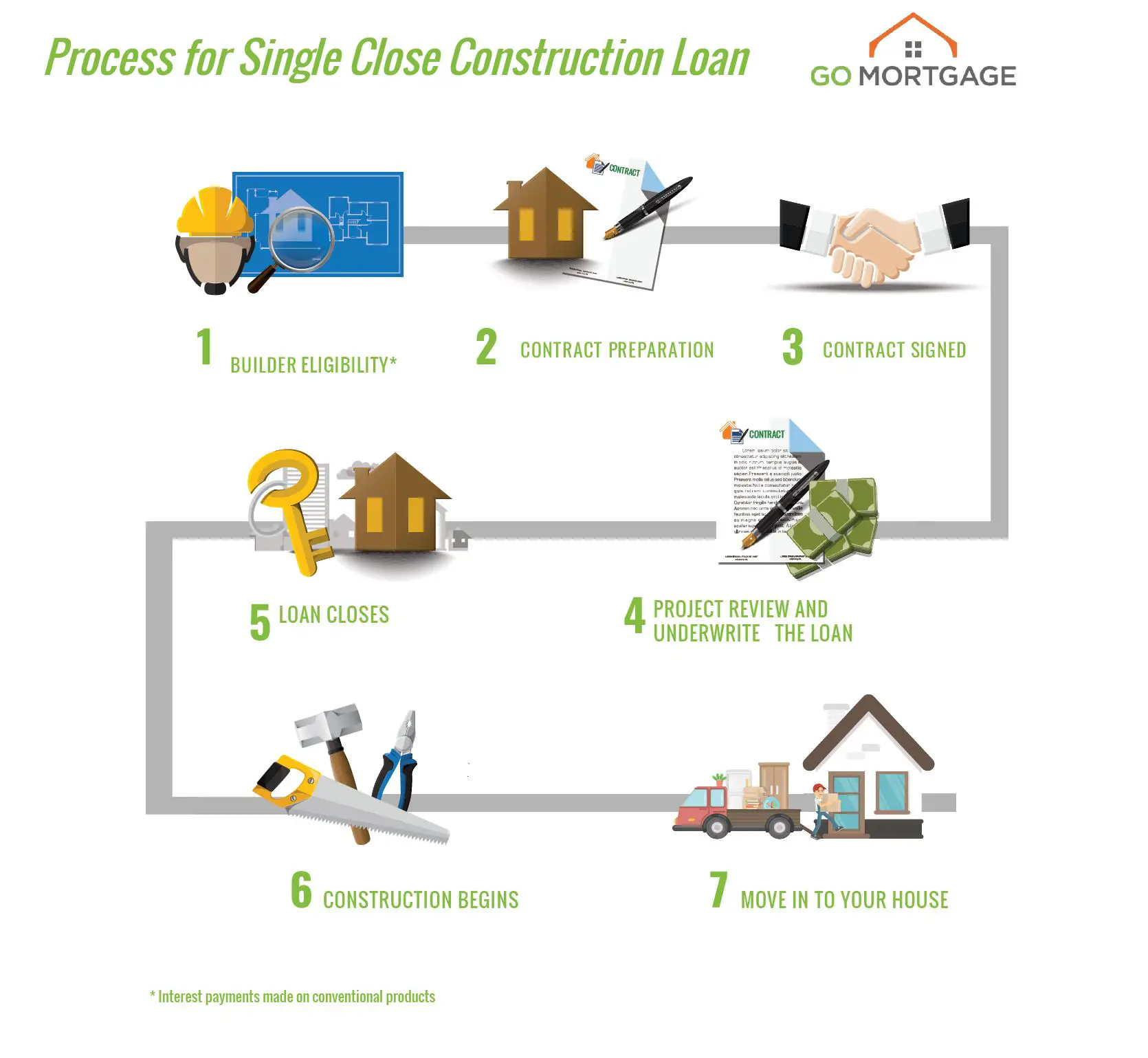

Generally, lenders offer two types of financing to build a house construction-only loans and construction-to-permanent loans.

If you take out a construction-only loan, the short-term financing only covers the expenses of building the house. To move into the home, youll also need a traditional mortgage.

With a construction-to-permanent loan , this is not necessary. The lender will provide funds for the costs of building, then the loan will be converted to a permanent mortgage once the project is complete.

Prepare The Blue Book

A”blue book” is a comprehensive document detailing the project timeline, floor plans, and even profit projections. Your blue book should also include a list of the materials and suppliers needed, as well as all the subcontractors you’ll work with. In essence, the blue book “pitches” your case to lenders, assuring them that you have a feasible plan.

Recommended Reading: How Are Mortgage Rates Determined

How To Get The Upper Hand In Home Buying

HomeScout is more than just a listing search toolits your home buying dashboard.

With HomeScout, you can access unfiltered MLS listings, unique photos, and updates, helping you book viewings fast when you find a home you are interested in.

HomeScout also helps you keep up-to-date on communications with your lender and real estate agentyoull never miss another email or important message again.

HomeScout is free and gives you access to a home buying support team that streamlines communication while protecting your personal information.

How Do Construction Loans Work

Construction loans usually have variable rates that move up and down with the prime rate. Construction loan rates are typically higher than traditional mortgage loan rates. With a traditional mortgage, your home acts as collateral if you default on your payments, the lender can seize your home. With a home construction loan, the lender doesnt have that option, so they tend to view these loans as bigger risks.

Because construction loans are on such a short timetable and theyre dependent on the completion of the project, you need to provide the lender with a construction timeline, detailed plans and a realistic budget.

Once approved, the borrower will be put on a draft or draw schedule that follows the projects construction stages, and will typically be expected to make only interest payments during the construction stage. Unlike personal loans that make a lump-sum payment, the lender pays out the money in stages as work on the new home progresses.

These draws tend to happen when major milestones are completed for example, when the foundation is laid or the framing of the house begins. Borrowers are typically only obligated to repay interest on any funds drawn to date until construction is completed.

You May Like: How Much Is A 280k Mortgage

Lower Equity Adds Risk

Additional monthly debt repayments lower your cushion against surprises like unexpected repairs or a sudden job loss. Since you typically need at least 20% equity in your home to be approved for a home equity line of credit, you may have fewer options if you canât cover your costs with savings. If house prices fall, you could also find that you owe more money for your house than what itâs worth.

You May Like: Does Rocket Mortgage Sell Their Loans

Work With A Qualified Builder

To gain approval for a construction loan, youll need to prove you have a qualified builder involved in the project. A qualified builder is usually defined as a licensed general contractor with an established home-building reputation.

If you intend to act as your own general contractor or build the home yourself, this presents a unique challenge and you likely will not be approved for a standard construction loan. In this scenario, you may want to turn your search to owner-builder construction loans. In todays housing market, it can be tough to qualify for these types of loans but it is possible if you provide a well-researched construction plan that demonstrates your home-building knowledge and abilities. Dont forget a contingency fund for unexpected surprises.

Read Also: Can You Get A Reverse Mortgage On A Manufactured Home

Can You Airbnb Your House If You Have A Mortgage

Yes! You CAN list your house on Airbnb if you have a mortgage. I have three different homes listed on Airbnb right now and all three have mortgages. And weve leveraged these investments to replace my wife Kates full time income.

However, your mortgage may have wording that requires you to inform or obtain permission before you do. Heres everything you need to know to make sure youre in the clear to list your home.

Is It Possible To Get A Construction Loan With No Money Down

Traditionally financed construction loans will require a 20% down payment, but there are government agency programs that lenders can use for lower down payments. Lenders that offer U.S. Department of Veterans Affairs loans and U.S. Department of Agriculture loans are able to qualify borrowers for 0% down.

You May Like: When Is It Worth To Refinance A Mortgage

Most Affordable Markets For Homebuyers

According to 2020 data fromZillow Research, record low mortgage rates have helped to boost affordability for potential homeowners. The table below shows the top 10 most affordable markets to live in for December 2020 and is based on a typical home value of no more than $300,000 . The market and share of income spent on a mortgage may fluctuate based on the current mortgage rate, the typical local homeowner’s income and the typical local home value.

How Much Does It Cost To Remodel

According to Home Advisor, in the U.S. the average renovation costs $46,788. The typical range is $18,372 $77,016.

Youll want to carefully price out the following, getting multiple quotes and bids, and doing careful research on the costs of remodeling such as:

- Permits: $60 $500. Although every local municipality is different, yours will probably require a permit for remodeling projects such as window installation, plumbing work, structural changes, fencing installation, and electrical work.

- Architectural planning: $2,000 $8,500. If you have a larger, more complex remodel, its wise to hire an architect who can plan it out for you.

- Labor: $20 $150 per hour. If you dont have the skill, time, or desire to DIY your remodel, youll have to contract it out.

- Materials: Material cost varies so widely that we cant put a price on this.

Tip: Experts suggest that you add 20% onto your initial budget to account for unforeseen problems and costs.

Recommended Reading: How Much Mortgage Do You Pay A Month

How To Get A Land Loan: Everything A Buyer Needs To Know

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been previewed, commissioned or otherwise endorsed by any of our network partners.

Traditional mortgage choices are plentiful, but what if you need to buy an empty lot, either to build your dream home or an office for your business? Land loans are significantly different than home or commercial mortgages in terms of financing options, costs and even finding a lender.

There are many ways to get land loans, but it can be difficult to figure out which one is the right fit. Thats why we developed this guide.

Skip AheadSet Yourself Up for Success

When shopping for a new home, visions of gorgeous kitchens, sumptuous master baths and closet space galore may dance in your head, but you cant forget the important step of financing.

As you shop for your dream home, key questions to ask yourself very early in your search include:

- Are my credit reports up-to-date and accurate?

- What information will I need to gather to apply to finance my new home?

- What can I afford in the way of a mortgage?

- What are my loan options?

- Where do I learn more about, and ultimately shop for, a mortgage?

In addition to builder financing, there are some unique tools that apply to new homes that include bridge loans and new-construction financing. These can be used to fund the purchase and construction of a new home before the sale of your current home.

What If I Want A Bridging Loan Instead Of A Self Build Mortgage

If you own your existing home or have enough equity in it, you may be able to remortgage or take out a bridging loan to pay for your new plot, fund the build costs, or even both. You would then sell your old house once you had completed the new one and pay off the loan.

Bridging loans are a more expensive way to borrow money for a building project ranging from 0.59% to 1.5% per month and the arrangement fees can be quite high between 1% and 2% of the total borrowing facility. This can be with or without incurring exit fees.

Rachel Pyne of Buildstore adds: Its important to note that a regulated bridging loan secured on your main residence has a maximum term of 12 months. This means you must complete your new home and sell your old one in this time to repay the loan.

You May Like: Is A Reverse Mortgage Good Or Bad

Don’t Miss: How To Qualify For Mortgage Refinance

You Made Your Land Purchase Now What

Once youve bought the land, you can now start to plan for what youd like to build on it. There are several different options you can choose to finance construction, whether its a residential home or a commercial building.

Here are a few of the more common ways to pay for a construction project on your new piece of land:

Construction-to-permanent loan. Many banks and credit unions offer these types of loans, specifically designed for building a home. Money is paid out as construction progresses, and the loan converts to a traditional mortgage when you move in.

Construction-only loan. Much like a construction-to-permanent loan, these loans pay for construction of the home as it happens. However, it will not convert to a traditional mortgage. Youll need to pay the balance in full at the end of construction, or refinance to a new loan that pays off the construction loan. This type is also known as a two-time close construction loan.

FHA construction loan. These loans are backed by the Federal Housing Administration and offer a one-time close construction-to-permanent loan. You can qualify with a credit score as low as 500.

VA construction loan. The Veterans Administration allows qualified military service members or veterans to finance a home construction using a VA loan. This is also a one-time close loan.

How Do I Apply For A Construction To Permanent Loan

The approval process for getting a construction loan is similar to applying for an existing home purchase. We will review documentation for your loan provided by you, and we will also review the sales contract, plans and specifications, and other items to approve the builder.

When youre ready to get started, a can help guide you through the process.

Don’t Miss: How Much Mortgage 200k Salary

How Construction Loans Work

If you plan to self-build, youll need to explore the specialized finance available to you. A construction loan, also known as a construction-to-permanent loan, a self-build loan, or a construction mortgage, is one of these.

A construction loan is typically a short-term loan used to cover the cost of building your home. During the construction phase, the loan is released gradually as the work progresses. Typically, you will only pay interest on the loan during this time. This keeps payments low but doesnt reduce the principal loan balance.

Construction loans generally have variable rates that are higher than traditional mortgage loan rates. Once construction on your house is completed, you can either refinance the construction loan into a permanent mortgage or get a new loan to pay off the construction loan

How Much Money Can I Borrow With A Self Build Mortgage

The amount you can borrow will depend on your unique financial circumstances your income and outgoings will be used to establish how much you can borrow.

“Unlike a mortgage for a house purchase, self build borrowing isn’t limited by your plot or property’s current value,” comments Emma Lunn. “You can typically borrow up to 75% of your project costs, or more if you already own the plot of land.

“Every self build mortgage lender will have its own maximum loan amount. Some lenders also have separate limits on how much you can borrow for buying the land, the build costs ad the gross development value .”

Banks and building societies apply an affordability calculation to assess your borrowing limits. This will take the costs of any debts such as loans, credit cards, childcare costs.

A mortgage will not be granted if it is deemed not to be affordable.

Mortgages of this type are regulated by the Financial Conduct Authority .

Don’t Miss: How Much Interest Did I Pay On My Mortgage

Construction Loans Offer Flexibility

Building â or fixing up â your suburban castle can be a seriously stressful exercise. You need a firm project plan , backed by a well-organised team. A project manager can also be useful. A kindly tyrant with a stick can also be useful.

Youâll also need money, though you wonât want it all in a lump sum at the start. Specifically, youâll need a home loan with special construction conditions.

Our construction loans let you draw down your loan in chunks or instalments. Most banks offer this facility and may refer to these instalments as âprogressive drawdownsâ or âprogress paymentsâ. We use both, but they mean the same thing â individual payments, drawn at various stages of the project, from a pre-agreed loan amount.

The obvious advantage of this loan is that you only pay interest on the money you use. To further lighten the load, our construction loans have interest-only repayment options during the build period.

Weâll talk about progressive drawdowns in more detail in How construction loans work . But first a word about the most crucial element in any construction project. Your team.

How This Site Works

We think its important you understand the strengths and limitations of the site. Were a journalistic website and aim to provide the best MoneySaving guides, tips, tools and techniques, but cant guarantee to be perfect, so do note you use the information at your own risk and we cant accept liability if things go wrong.

- This info does not constitute financial advice, always do your own research on top to ensure its right for your specific circumstances and remember we focus on rates not service.

- We dont as a general policy investigate the solvency of companies mentioned , but there is a risk any company can struggle and its rarely made public until its too late .

- Do note, while we always aim to give you accurate product info at the point of publication, unfortunately price and terms of products and deals can always be changed by the provider afterwards, so double check first.

- We often link to other websites, but we cant be responsible for their content.

- Always remember anyone can post on the MSE forums, so it can be very different from our opinion.

MoneySavingExpert.com is part of the MoneySuperMarket Group, but is entirely editorially independent. Its stance of putting consumers first is protected and enshrined in the legally-binding MSE Editorial Code.

You May Like: Can You Get A Reverse Mortgage On A Manufactured Home

Also Check: What Documents Do I Need For A Mortgage

The Construction Mortgage Process

The mortgage process for the construction of a new home is more complicated and often more expensive than that of a conventional mortgage on an existing home. Not only does building the home take time and effort, but most lenders require more assurances before theyll start lending you money. For the most part, a high credit score and decent income wont be enough. Potential homeowners need to provide their lender with proof that the construction of their home will be completed within a certain timeframe. Banks, in particular, will also want to verify that the contractor or home builder in question is certified and has a history of well-built housing projects. If you yourself are planning to act as the contractor, it might make the lender skeptical until you can give them a reason to believe you are adequately qualified to take on a project of this magnitude. This is especially true for progress draw mortgages. Because the house isnt already built, there is a lot more risk on the part of the lender. If anything should go wrong during construction, they could potentially lose a lot of money. In the event that the borrower defaults on their loan, the lender might have to repossess the property, then try to sell a plot of land with a partially finished house on it.

Trying to pay off your mortgage early? Find out how by .

Rating of 5/5 based on 107 votes.