Overview: Paying Off Your Mortgage Early

Every time you make a mortgage payment, its split between your principal and your interest. Most of your payment goes toward interest during the first few years of your loan. You owe less in interest as you pay down your principal, which is the amount of money you originally borrowed. At the end of your loan, a much larger percentage of your payment goes toward principal.

You can apply extra payments directly to the principal balance of your mortgage. Making additional principal payments reduces the amount of money youll pay interest on before it can accrue. This can knock years off your mortgage term and save you thousands of dollars.

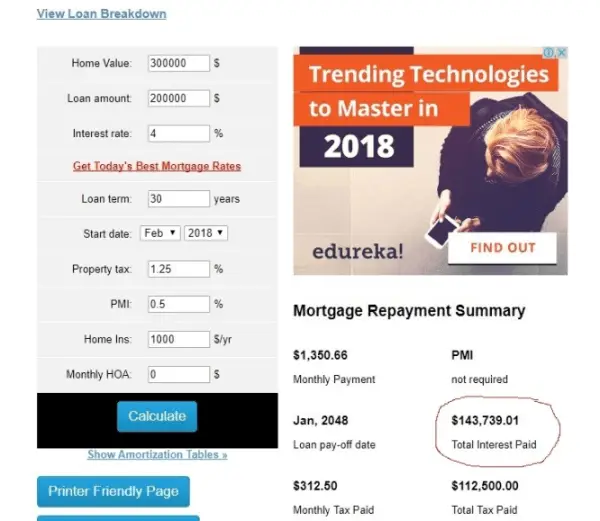

Lets say you borrow $150,000 to buy a home at 4% interest with a 30-year term. By the time you pay off your loan, youll have paid a whopping $107,804.26 in interest. This is in addition to the $150,000 you initially borrowed.

Now, lets say that you pay an extra $100 every month toward a loan with the exact same term, principal and interest rate. At the end of the term, youll have paid $82,598.49 total in interest. Thats $25,205.77 less than you would have paid if you didnt make any extra payments. Youll also pay your loan off 74 months earlier than you would if you only paid your premium each month.

The decision to pay off your mortgage early is a personal one that depends heavily upon your individual circumstances.

Do You Have Any Other More Expensive Debts

Expensive debts are those that cost a lot to pay off over time.

Other expensive debts could include unsecured loans, where the interest rate is much higher than the cost of your mortgage borrowing.

Always pay off more expensive debts before thinking about reducing your mortgage but be careful not to rack them up again.

Good Debt Vs Bad Debt

Some people think of all debt as bad, but thats not really the case. Experts refer to both good debt and bad debt. A mortgage lands squarely in the good debt column.

How a loan is secured determines whether its good or bad, says Stanley Poorman, a financial professional with Principal®. A mortgage is secured by an assetyour housewhich gives it an advantage. Personal loans and credit cards are not.

Think of good debt this way: Every payment you make increases your ownership in that asset, in this case your home, a little bit more. But bad debt like credit card payments? That debt is for things youve already paid for and are probably using. Youre not going to own any more of a pair of jeans, for example.

Theres another key difference between purchasing a home and buying most goods and services. Very often, people can pay cash for things like clothes or electronics. The vast majority of people couldnt pay cash for a home, Poorman says. That makes a mortgage all but necessary to buy a house.

Also Check: Can I Change Mortgage Companies

Make Extra Mortgage Payments

Another way you may be able to save money on interest, while reducing the term of your loan is to make extra mortgage payments. If your lender doesnt charge a penalty for paying off your mortgage early, consider the following early mortgage payoff strategies.

Just remember to inform your lender that your extra payments should be applied to principal, not interest. Otherwise, your lender might apply the payments toward future scheduled monthly payments, which wont save you any money.

Also, try to prepay in the beginning of the loan when interest is the highest. You may not realize it, but the majority of your monthly payment for the first few years goes toward interest, not principal. And interest is compounded, which means that each months interest is determined by the total amount owed .

What Age Should You Be Debt Free

Kevin O’Leary, an investor on Shark Tank and personal finance author, said in 2018 that the ideal age to be debt-free is 45. It’s at this age, said O’Leary, that you enter the last half of your career and should therefore ramp up your retirement savings in order to ensure a comfortable life in your elderly years.

Don’t Miss: What Is Veterans Mortgage Relief Program

Should I Pay Off My Mortgage

Just because you can pay off your mortgage early doesnât necessarily mean that you should. Of course, it would feel great to rid yourself of a huge financial burden like a mortgage. But if you really want to know if itâs a good decision, you have to look at the math.

There are pros and cons to paying off your mortgage early. Whether the pros outweigh the cons will depend on your overall financial situation.

Pay A Lump Sum Toward The Principal Balance

If you receive some sort of windfall, such as an inheritance or a large tax refund, you can also consider making a lump sum payment toward your mortgage. Doing so would immediately reduce the principal balance you owe, which would help you save money on interest and shorten your repayment timeline in one fell swoop.

Using the same example above, lets say you inherited $10,000 and decided to throw it on your mortgage right after you purchased your home. In this case, you would save more than $14,000 in interest over the term of your mortgage, and you would also pay off your home loan over a year and a half earlier than originally planned.

You May Like: What Is The Average 15 Year Fixed Mortgage Rate

Is It Worth Paying Your Mortgage Off Early

The biggest reason to pay off your mortgage early is that often it will leave you better off in the long run. Standard financial advice is that if you have debts , the best thing to do with your savings is pay off those debts. … Generally, a smaller mortgage gives you greater freedom and security.

Disadvantages Of Paying Off Mortgage Early

- Less money for higher-interest debt. If you have credit card or student loan debt, funneling your extra cash toward paying off your mortgage early can actually cost you in the long run. This is because these other types of debt likely have higher interest rates.

- Less money for savings. Putting all of your money toward your mortgage can also cut into what you can set aside in savings. If youâre going to focus on paying off your home loan early, itâs a good idea to make sure you have an adequate emergency fund first. Itâs usually recommended to save up enough to cover three to six monthsâ worth of expenses so you can manage any unexpected costs without having to go into debt.

- Could miss out on higher returns from investing. If you have the opportunity to invest your money for returns that are significantly higher than your mortgage rate, youâd be better served doing that than missing out on compounding earnings to get rid of your mortgage faster. For example, if your mortgage rate is 3.5% and your portfolio earns an average of 6% per year, youâd lose money by using extra funds to pay off the loan early.

Read Also: How Much Do Mortgage Loan Originators Make

Make Extra Repayments Where Possible

Every penny counts as they say. Look to see where you can make some potential savings which can then be used to pay off your home loan faster. For example, instead of eating out often, eat at home instead and use the extra saving to put towards your monthly repayments.

Paying an extra $100 on your monthly repayments could enable you to save a lot on interest whilst also allowing you to own your home much sooner. Before considering this option check with your lender to see if making additional payments are allowed.

Will You Be Charged For Overpaying Your Mortgage

Check your mortgage deal to get an accurate picture of how charges can cut into any savings that result from overpaying your mortgage.

You could be charged for paying your mortgage off early or making a monthly payment, which goes over your agreed monthly limit.

Many lenders will let you overpay up to 10% a year without penalties.

You May Like: Which Credit Union Is Best For Mortgage

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Potential Conflict Of Interest

There was concern that the current plan created a conflict of interest for Paulson. Paulson was a former CEO of Goldman Sachs, which stood to benefit from the bailout. Paulson had hired Goldman executives as advisors and Paulson’s former advisors had joined banks that were also to benefit from the bailout. Furthermore, the original proposal exempted Paulson from judicial oversight. Thus, there was concern that former illegal activity by a financial institution or its executives might be hidden.

The Treasury staff member responsible for administering the bailout funds was Neel Kashkari, a former vice-president at Goldman Sachs.

In the Senate, Senator Judd Gregg was the leading Republican author of the TARP program while he had a multimillion-dollar investment in the Bank of America.

Also Check: How Much Are The Fees To Refinance A Mortgage

Rent Out Extra Space In Your House

If you want to make extra payments but dont know where to find the money in your budget, consider putting your house to work.

Some examples of what you could do include:

- Renting out an extra room

- Turning an accessory dwelling unit into an Airbnb

- Renting out space in your garage for storage

- Renting out a parking spot

- Renting your pool or backyard out to someone for an event

Paying Off Your Mortgage Early: Is It Worth It

If you find yourself with a little extra cash at the end of the month, should you put it toward your mortgage loan or refinance to a shorter term? Theres no simple yes or no answer. There are both risks and benefits to paying off your loan early or switching loan terms, and the right decision will be different for everyone. In this section, well look at a few instances in which it makes sense to pay off your mortgage early and when it doesnt.

Get approved to refinance.

Also Check: What To Watch For When Refinancing Mortgage

What Does Paying Your Mortgage Biweekly Do

Some mortgage lenders allow you to sign up for biweekly mortgage payments. This means you can make half of your mortgage payment every two weeks. That results in 26 half-payments, which equals 13 full monthly payments each year. Based on our example above, that extra payment can knock four years off a 30-year mortgage and save you over $25,000 in interest.

Create Room In Your Budget

One of the most effective ways to pay off your mortgage faster is to pay more than the monthly amount due. That might seem obvious, but you might not realize just how far a little extra money can go.

For example, say you took out a 30-year fixed-rate mortgage of $250,000 at 5% annual percentage rate and have 25 years left on the loan. That would mean you owe $1,342.05 per month. Now imagine that you tack on just $20 extra to each payment. Youâd shorten the repayment period by eight months and save $5,722 in interest. Use a mortgage calculator to help you do the math.

For an extra $20 per month, youâd simply need to cut out one fancy coffee a week or a couple of takeout lunches. Obviously, putting even more money toward extra payments will result in even more savings.

Just keep in mind that you donât want to go overboard here and sacrifice other financial goals to pay down your mortgage faster. Mortgages are some of the cheapest loans out there, so be sure youâre paying off other higher-interest debt and investing before you start cutting back in other areas of your budget.

Read Also: What Is Mortgage Debt To Income Ratio

Do Extra Payments Automatically Go To Principal

The interest is what you pay to borrow that money. If you make an extra payment, it may go toward any fees and interest first. … But if you designate an additional payment toward the loan as a principal-only payment, that money goes directly toward your principal assuming the lender accepts principal-only payments.

Is Paying Off A 30

However, a 15-year mortgage means you will have your home paid off in 15 years rather than the full, 30-year mortgage so long as you make the required minimum monthly payments. … However, the monthly payments are higher on a 15-year mortgage because you are paying the principal off faster than a 30-year mortgage.

You May Like: How To Become A Mortgage Underwriter In Arizona

Fragomeni Real Estate & Mortgages

Carve out a space for your home officeAs the pandemic rolled out, working from home became the norm for many. But, it can be difficult at times to find a place to feel productive and dedicated to your work.No matter where you live, spare room or not, you can still carve out a space to call your home office.?#work#homeoffice#workingfromhome

Ways To Pay Off Your Mortgage Quickly

But, how can you pay off your mortgage early? Fortunately, the vast majority of todays mortgages are free of prepayment penalties, meaning you can pay off your home as fast as you want.

So if youre wondering how to lower your mortgage payments or pay off your home faster, here are several tried and true strategies that can help. Just remember that the right strategy for you depends on how much extra cash you have lying around, as well as how much of a priority it is for you to become mortgage-free.

Don’t Miss: How To Cut 30 Year Mortgage In Half

Paying Off Your Mortgage Early

You can repay your mortgage in full at any time before the end of your mortgage term. This is also known as redeeming your mortgage.

Find out how much you need to pay backYoull need your settlement figure. This is the amount you owe on your mortgage including interest. It may also include additional fees, such as an early repayment charge or a mortgage account fee.

Details of any early repayment charges can be found in your original mortgage offer or in Mobile and Online Banking. Take a look at our managing your mortgage online page for more information.

We can consider waiving an early repayment charge if you have an existing fixed rate mortgage with us and you’re diagnosed with dementia. Please get in touch so we can review your circumstances.

You can view your settlement figure in both Mobile and Online Banking and how to start the redemption process once youre ready.

For Mobile Banking:

- log on to your mobile account

- tap your mortgage on the homepage

- choose Manage my mortgage

- log on to your account

- find your mortgage on the homepage

- choose Get settlement figure.

Alternatively, you can get in touch with us to request your settlement figure.

Once you have your figure, should you decide to go ahead and redeem your mortgage, contact us and well guide you through the process. Well send you a mortgage redemption statement that will give you the full breakdown of all the details.

If youre not looking to pay back your mortgage completely

Change your deal

Moving home

Find A Lower Interest Rate

Work out what features of your current loan you want to keep, and compare the interest rates on similar loans. If you find a better rate elsewhere, ask your current lender to match it or offer you a cheaper alternative.

Comparison websites can be useful, but they are businesses and may make money through promoted links. They may not cover all your options. See what to keep in mind when using comparison websites.

Read Also: Can You Get Reverse Mortgage With Bad Credit

Ways To Pay Off Your Mortgage Early

Okay, you probably already know that every dollar you add to your mortgage payment puts a bigger dent in your principal balance. And that means if you add just one extra payment per year, youll knock years off the term of your mortgagenot to mention interest savings!

To get serious about paying off your mortgage faster, here are some ideas to help:

Are Biweekly Mortgage Payments A Good Idea

A biweekly payment plan can be a good ideabut never pay extra fees to sign up for one. Remember, theres nothing magical about them. The real reason it helps pay off your mortgage faster is because your extra payments add up to 13 monthly payments per year instead of the standard 12. So if your lender only lets you pay biweekly by charging you a fee, dont sign up.

Read Also: What License Do You Need To Sell Mortgage Insurance

Why You Shouldn’t Pay Off Your House Early

You have debt with a higher interest rate Consider other debts you have, especially credit card debt, that may have a really high interest rate. … This amount is substantially higher than the average mortgage rate. Before putting extra cash towards your mortgage to pay it off early, clear your high-interest debt.