Income To Afford A Milliondollar Home

As we said above, income is just one factor in your home buying budget.

The purchase price you can afford also depends on your:

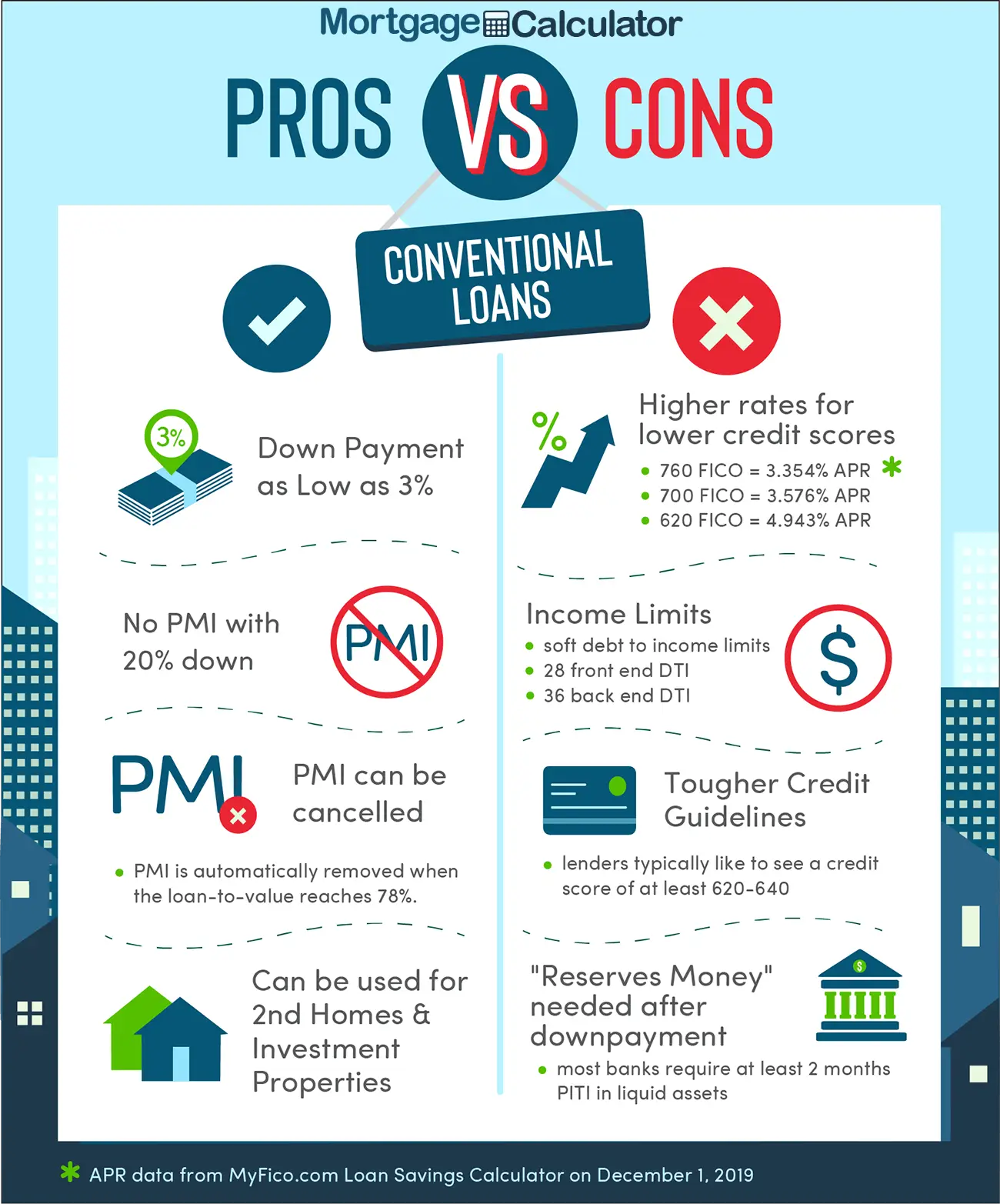

- Debttoincome ratio

- Down payment amount

We experimented with a few of these factors using our home affordability calculator to show you how much each one can affect your budget.

Prime borrower $147,000 income needed

Our first example looks at a traditional prime borrower. They have:

- A 20% down payment

- Only $250 in preexisting monthly debts

- An excellent mortgage rate of 2.75%

This borrower can afford a $1 million dollar house with a salary of $147,000. Their monthly mortgage payment would be about $4,100.

High DTI $224,000 income needed

Lets leave everything else the same as in the first example, but increase the borrowers monthly debt payments to $2,500.

For those paying multiple child support and alimony payments, that might be more realistic, even if their debts are only average.

And others have that level of debt payment even without family commitments. Think luxury car, boat, motorhome, and other bigticket toys.

In this scenario, the income needed to afford a home costing 1.031 million would be $224,000.

To afford this home, youd need a slightly higher down payment of $214,000. And monthly payments would cost about $4,220.

Clearly, existing debts make a big difference in home affordability. Your salary needs to be $77,000 higher to buy a similarlypriced home.

Lower credit $224,000 income needed

Brief History Of Mortgages In The Us

In the early 20th century, buying a home involved saving up a large down payment. Borrowers would have to put 50% down, take out a three or five-year loan, then face a balloon payment at the end of the term.

Only four in ten Americans could afford a home under such conditions. During the Great Depression, one-fourth of homeowners lost their homes.

To remedy this situation, the government created the Federal Housing Administration and Fannie Mae in the 1930s to bring liquidity, stability, and affordability to the mortgage market. Both entities helped to bring 30-year mortgages with more modest down payments and universal construction standards.

These programs also helped returning soldiers finance a home after the end of World War II and sparked a construction boom in the following decades. Also, the FHA helped borrowers during harder times, such as the inflation crisis of the 1970s and the drop in energy prices in the 1980s.

Government involvement also helped during the 2008 financial crisis. The crisis forced a federal takeover of Fannie Mae as it lost billions amid massive defaults, though it returned to profitability by 2012.

The FHA also offered further help amid the nationwide drop in real estate prices. It stepped in, claiming a higher percentage of mortgages amid backing by the Federal Reserve. This helped to stabilize the housing market by 2013. Today, both entities continue to actively insure millions of single-family homes and other residential properties.

Dont Overextend Your Budget

Banks and real estate agents make more money when you buy a more expensive home. Most of the time, banks will pre-approve you for the most that you can possibly afford. Right out of the gate, before you start touring homes, your budget will be stretched to the max.

Its important to make sure that you are comfortable with your monthly payment and the amount of money youll have left in your bank account after you buy your home.

Recommended Reading: Can You Get A Larger Mortgage For Renovations

Expect To Need At Least $100k Of Income For A $1m Home

Theres no magic formula that says you need X income to afford a $1 million house. Because income is just part of the equation.

With a really strong financial profile high credit, low debts, big savings you might afford a $1 million home with an income around $100K.

But if your finances arent quite as strong, you might need an income upwards of $225K per year to buy that million-dollar home.

Wondering how much house you can afford? Heres how you can find out.

In this article

| 2.75% | $2,900 |

*Estimates based on 30-year fixed-rate loan, property tax rate at 0.97% annually, home insurance premium of $600 per year, and no HOA dues.Interest rates are for examples purposes only. Your own interest rate will be different.

A million dollars was once a lot of money to pay for a home, and unless you lived in Los Angeles or San Francisco, you probably would never consider purchasing one.

But as home values continue to skyrocket across the country, million-dollar homes are becoming more common outside of California and New York. The good news is that you dont need to be a millionaire to afford one. But you should have your personal finances in order to ensure you get the best rate.

What Is Mortgage Required Income

Lenders consider two main points when reviewing loan applications: the likelihood of repaying the loan and the ability to do so .

Nerdwallet.com explains that mortgage income verification, even if they have impeccable credit, borrowers still must prove their income is enough to cover monthly mortgage paymen

Also Check: How To Apply For A 2nd Mortgage

What Is The Minimum Down Payment In Canada

The rules for the minimum down payment in Canada are as follows:

- If the purchase price is less than $500,000, the minimum down payment is 5%.

- If the purchase price is between $500,000 and $999,999, the minimum down payment is 5% of the first $500,000, and 10% of any amount over $500,000.

- If the purchase price is $1,000,000 or more, the minimum down payment is 20%.

Keep in mind that the minimum down payment is subject to the lenders approval, and that they may request more if you have a poor credit history or are self-employed.

Additionally, the minimum down payment is usually preferred to come from your own funds, but may be gifted or taken as a part of the Home Buyers Plan or First Time Home Buyer Incentive as discussed later in this blog.

How A Rental Suite Affects Your Mortgage Qualification

To see how much difference the change in rental income makes, lets run through an example.

GDS = /Gross household income + Gross rental income x 100

P = Mortgage Principal

I = Mortgage Interest

T = Property Taxes H = Heating

For example, if you have an annual mortgage payment of $17,400, property taxes of $3,000, heating bill of $1,320, gross household income of $72,000, and gross rental income of $9,600, your GDS under the old rules would be:

GDS = / $72,000 + x 100 = 28.28%

Under the new rules your GDS would be:

GDS = / $72,000 + $9,600 x 100 = 26.62%

Since your GDS ratio is lower under the new rules, youll be able to qualify for a higher mortgage and buy a more expensive home.

Recommended Reading: How Much Could We Get Approved For A Mortgage

What Else Is Included In Dti

Your debt-to-income ratio also considers auto loans, minimum credit card payments, installment loans, student loans, alimony, child support, and any other expenses you must make each month. It doesn’t typically include recurring monthly charges for utilities, internet service, cable or satellite TV, mobile phone subscription or other charges for ongoing services or other things where the cost is newly incurred each month.

To calculate if you have the required income for a mortgage, the lender takes your projected monthly mortgage payment, adds your expenses for credit cards and any other loans, plus legal obligations like child support or alimony, and compares it to your monthly income. If your debt payments are less than 36 percent of your pre-tax income, you’re typically in good shape.

What if your income varies from month to month? In that case, your lender will likely use your average monthly income over the past two years. But if you earned significantly more in one year than the other, the lender may opt for the year’s average with lower earnings.

Note: Your required income doesn’t just depend on the size of the loan and the debts you have but will vary depending on your mortgage rate and the length of your loan. Those affect your monthly mortgage payment, so the mortgage income calculator allows you to take those into account as well.

Example Mortgages On A 1 Million Dollar Home

Lets imagine you want a 1 million dollar home and can afford a 20% down payment. Based on current interest rates, your monthly payments would likely land up around $4,500 . This amounts to annual expenses of $54,000.

Assuming you have a sufficient credit score, what would you need to make to meet a 32% debt-to-service ratio? You would need to make over $168,750 to meet the 32% ratio .

Now imagine that you have an additional $1500 in monthly expenses – car loans, student loans, and other miscellaneous loans. Now your monthly payments are $6,000, and the annual expenses are $72,000. When lenders consider all your expenses, they are looking at your total debt service ratio. They are a bit more lenient when they consider these other expenses and look for ratios near 40% .

In this case, you would need to make over $180,000 to meet a 40% ratio and afford a 1 million dollar home.

These two examples are the typical baseline estimation of a mortgage for a million-dollar home. If you can afford a larger down payment, have a higher annual income, and a better financial record, you will likely make lower monthly payments and get more flexible interest rates.

Recommended Reading: How Can Hud Help Me With My Mortgage

What Are The Mortgage Repayments On 15 Million

This all depends on many factors such as the interest rate, the term of the mortgage, the amount of deposit you have and whether you opt for standard repayment or interest only mortgage.

For instance, 1.5 million mortgage monthly repayments can vary as much as £6,347 a month depending on a number of factors. The monthly payments below are based on a loan of £1.5 million and an interest rate of 3.5%.

| Mortgage Term | |

|---|---|

| £6,202 | £4,379 |

The above is for indicative purposes only and you should always check with your lender or one of the advisors we work with for the most up-to-date information.

If you want to know how much a mortgage of more than £1.5m will set you back each month, make an enquiry and the experts we work with will crunch the numbers for you. Whether youre curious about £1.8 million mortgage payments or need to know the cost of a £2 million mortgage, they can give you the right advice.

Also Check: What Banks Look For When Applying For A Mortgage

How To Calculate How Much Income You Need

If youre borrowing funds to buy a home, a mortgage professional will put your finances to the test.

First, they will look at your gross debt service ratio. Your GDS ratio is calculated by adding up all your monthly housing expenses , dividing that number by your household income, and multiplying by 100. If your GDS works out to be 39% or less, you should be able to afford the home, according to the Canada Housing and Mortgage Corporation. That said, some lenders may limit you to a lower GDS ratio. The Financial Consumer Agency of Canada uses a GDS of 32% as a guideline.

Then there is GDS ratios cousin: The total debt service ratio. TDS is similar to GDS, but it also accounts for any other debt obligations you may in addition to housing expenses. TDS is calculated by adding up all those expenses, dividing that number by your household income, and multiplying by 100. Most mortgage lenders let you have a TDS ratio of up to 44%.

To identify the income you need to buy an average home, we did a reverse calculation and applied the 39% GDS ratio guideline to August 2022 benchmark home prices. The TDS ratio was not factored in, because that would require knowing a borrowers non-mortgage debt obligations. That said, the income requirements may be different for you, if you are currently carrying a lot of non-mortgage debt .

Our calculations are based on a down payment of 20%, annual property taxes of 0.75% of the purchase price, and estimated heating costs of $100 per month.

Recommended Reading: How Much Does Mortgage Protection Insurance Cost

Here’s What Monthly Payments Might Look Like On A $1 Million Home

Let’s assume you have your $200,000 down payment and you qualify for a jumbo loan for the remaining $800,000. You’re ready to buy your million-dollar place.

You’d need to get a personalized rate quote, as different borrowers qualify for different rates. But these examples can give you a good idea of what you’d end up paying per month.

Don’t forget, your mortgage principal and interest aren’t the only payments you need to make. You’ll have to pay taxes and insurance too. These can vary dramatically depending on where you live. Here are some approximate monthly payments for a 30-year or 15-year mortgage.

| LOAN TERMS |

|---|

Data source: Estimates usingThe Ascent’s mortgage calculator.

You’d need about $56,100 a year to pay for the 30-year mortgage in our example. Since research from The Ascent put the median household income at almost $62,000 a year, a $1 million home is well out of reach for most people. This is why most people’s homes cost a fraction of this amount.

Estimating How Much House You Can Afford

How much house you can afford depends on several factors, including your monthly income, existing debt service and how much you have saved for a down payment. When determining whether to approve you for a certain mortgage amount, lenders pay close attention to your debt-to-income ratio .

Your DTI compares your total monthly debt payments to your monthly pre-tax income. In general, you shouldnt pay more than 28% of your income to a house payment, though you may be approved with a higher percentage.

Keep in mind, however, that just because you can afford a house on paper doesnt mean your budget can actually handle the payments. Beyond the factors your bank considers when pre-approving you for a mortgage amount, consider how much money youll have on-hand after you make the down payment. Its best to have at least three months of payments in savings in case you experience financial hardship.

Along with calculating how much you expect to pay in maintenance and other house-related expenses each month, you should also consider your other financial goals. For example, if youre planning to retire early, determine how much money you need to save or invest each month and then calculate how much youll have leftover to dedicate to a mortgage payment.

Ultimately, the house you can afford depends on what youre comfortable withjust because a bank pre-approves you for a mortgage doesnt mean you should maximize your borrowing power.

Recommended Reading: How Much Will I Be Preapproved For A Mortgage

How Much Do You Need To Earn In Each Province And Some Large Cities To Afford An Averaged Price Home There

There is no simple answer to mortgage affordability across Canada as each municipality in every province has their own municipal property rate.

Weve used the highest averaged municipal rate on a provincial basis to figure out the taxes on the average property price in that province.

We also indicated the qualifying income needed for each of these provinces and the top ten metropolitan markets based on those tax rates and other factors such as qualifying stress test rates.

As you can see from the chart below that qualification income amounts are not always proportional to the property price as some provinces have twice the municipal tax rate compared to another province.

| Province/ City | |

| $3087 | $121,672 |

Note:

What Monthly Expenses Do You Have

! Please enter an amount less than }.

Estimate your monthly expenses such as groceries, transportation, child care, insurance, shopping, media and regular contributions to savings.

Please do not include rent or housing expenses.

If you’re buying a home with a spouse, partner, friend or family member, include their monthly expenses as well.

If this amount is higher than your monthly income before taxes, please contact us to discuss your options.

Step 6 of 6

Also Check: How To Create A Rocket Mortgage Account

What Would My Mortgage Payments Be For A $1000000 House

To get a picture of what you would pay on a million-dollar mortgage, its important to consider the interest rate and payment frequency. Both these factors can influence your mortgage payments.

Mortgages with fixed interest rates tend to be slightly higher, though they also have less risk than a variable-rate mortgage. Generally, mortgages with a shorter amortization period will have lower rates, but higher payments.

The following table represents the approximate payment amounts for a $1,000,000 mortgage with a down payment of $200,000 with a term of five years. It shows what you can expect to pay for bi-weekly or monthly payments with two common interest rates: 2.5% and 3.0%.

| Amortization Period |

| $398,249 |

Mortgage Required Income Calculator

The best way to think about how much home you can afford is to consider what your maximum monthly mortgage can be. As a general rule of thumb, lenders limit a mortgage payment plus your other debts to a certain percentage of your monthly income, which can be approximately 41%.

The amount a borrower agrees to repay, as set forth in the loan contract.

Don’t Miss: Can You Get A Conventional Mortgage On A Manufactured Home

How Much Can I Afford

How much you can afford to spend on a home in Canada is most determined by how much you can borrow from a mortgage provider. That is unless you have enough cash to purchase a property outright, which is unlikely. Use the above mortgage affordability calculator above to figure out how much you can afford to borrow, based on your current situation.

Dont Miss: How To Get A Million Dollar Mortgage