Benefits To Paying Pmi As A Borrower

Although PMI is designed to safeguard the lender rather than the borrower, there are some indirect benefits for the borrower. Well go through two of the most important ones here:

- PMI allows for a smaller down payment. PMI allows for down payments as little as 3% because it mitigates some of the risks for lenders in the event of a borrower default. Without PMI, a traditional loan would require a minimum of a 20% down payment. PMI enables you to become a homeowner more quickly.

- PMI is a tax-deductible expense. The mortgage insurance tax deduction has been extended by Congress until the 2021 tax year, so if you havent paid your taxes yet, this is still deductible. You submit it along with the deductible mortgage interest you should have received from your mortgage servicer on Form 1098. However, always consult with an accountant when filing your taxes.

Depending on your financial condition and other priorities, even if you have the funds for a 20% down payment, it may make sense to make a smaller down payment and opt for PMI. Talk with your loan officer to determine the best option for you.

Cancellation Law

Jim Hensen, a Utah congressman who had his own troubles eliminating PMI on his condo, helped lead the charge to the passage of the Homeowner Protection Act .

How Long Do I Have To Pay Mortgage Insurance On An Fha Loan

Contents

Although the law has changed this issue more than once, the current directive states that borrowers who lend less than 10 percent between FHAs must pay for FHA mortgage insurance until the full term of the loan is over. However, if you put down at least 10 percent, you can get FHA MIP after 11 years of your payments.

Can PMI be borrowed between FHAs? FHA MIP. Mortgage insurers are not the only borrowers who have to pay mortgage insurance. Getting rid of PMI is relatively simple: Once you accrue 20 per cent equity in your home, by making payments to reach that level or by increasing the value of your home, you can request that PMI as.

What’s The Difference Between Homeowners Insurance And Mortgage Insurance

You dont need to be an insurance expert when you set out to buy your first home, but it can be a challenge when you come across the terms homeowners insurance and mortgage insurance for the first time. As you learn about your insurance needs at this important new milestone in your life, it may help to know that there is a difference between homeowners insurance and mortgage insurance. Depending on many factors, not every home owner needs mortgage insurance, but to ensure their new home is sufficiently protected, homeowners insurance is usually a necessity.

As you start house hunting and explore the process of getting pre-qualified for mortgage loans, heres a look at each type of insurance, why you would need it, what it can help cover and when you might buy it.

You May Like: How To Sue A Mortgage Lender

What Is The Ltv Ratio

The LTV or loan to value ratio is the portion of the value of the house that you are borrowing through a mortgage. In other words, the percentage of your homes value that is financed by the mortgage.

Example – Imagine that you want to purchase a house that costs $100,000 and you can only afford to make a 10% down payment. What is your LTV ratio?

Down Payment = 10% * House Price = 10% * $100,000 = $10,000

Mortgage Amount = House Price Down Payment = $100,000 – $10,000 = $90,000

LTV ratio = Mortgage Amount /Home Value = $90,000/ $100,000 = 90%

You pass the halfway point of your mortgage term – On a 30-year mortgage, for example, PMI must be removed 15 years into the loan. This is true even if the mortgage balance exceeds 78% of the original purchase price of the house.

You refinance your mortgage –The last way to get rid of PMI is torefinance your mortgagesuch that the new loan balance is less than 80% of the homes current value. This will allow you to avoid paying PMI after the refinancing of the mortgage.

How To Avoid Pmi Insurance

In addition to canceling PMI, its also possible to completely avoid paying mortgage insurance from the start of your loan.

How To Avoid PMI Insurance:

Make A 20% Down Payment

The easiest way to skip PMI from the start is to make a large down payment. By making a 20% down payment on a conventional loan, your LTV will automatically be 80%, allowing you to pay your loan without mortgage insurance.

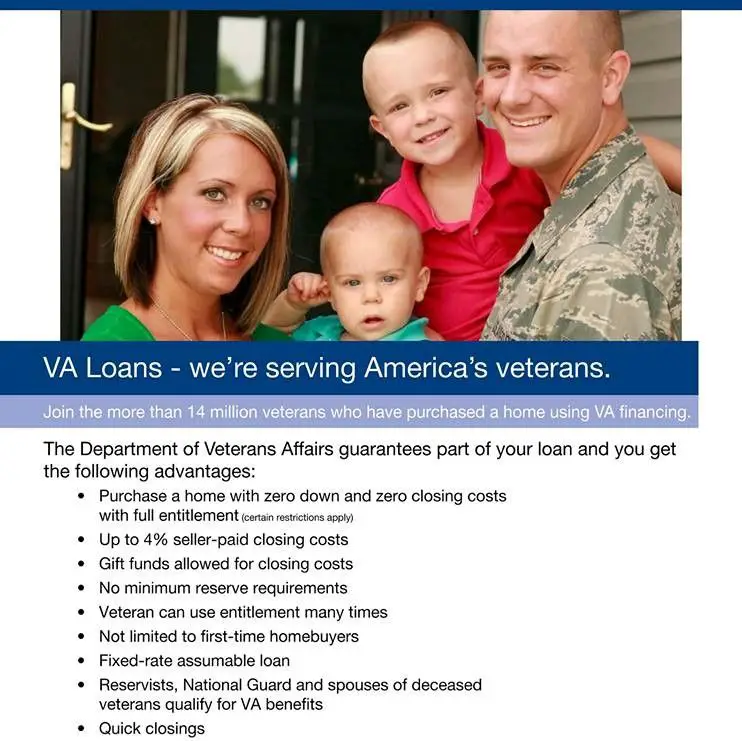

Get A VA Loan

Among all of the loan types available, VA loans are the only type that dont require mortgage insurance regardless of your down payment. Instead, borrowers are required to pay an upfront funding fee. This fee helps to offset the cost of administering the loan. This helps to ensure that VA loans continue to require no down payment and no monthly mortgage insurance.

The VA financing fee is waived for a select group of clients:

- Anyone who is presently receiving disability compensation from the VA

- Anyone who is presently receiving disability compensation from the VA

- Purple Heart recipients

Another way to eliminate monthly PMI on a Conventional loan is to ask your loan officer about a lender paid mortgage insurance loan. This involves increasing the rate so that the monthly premium is not required. An experienced loan officer can show you the break even for increasing the rate and help determine if this is the best option.

You May Like: How To Pay Points On Mortgage

Prior Mip Cancellation Flexibility

In some cases, borrowers could call their lenders and request a cancellation of the MIP if their home’s value had increased sufficiently to reach the 78 percent LTV threshold or if they prepaid their loan balance to reach 78 percent LTV. Lenders were even open to cancelling MIP before the 78 percent LTV had been reached, such as at 80 percent. HUD gave lenders discretion on cancelling the MIP before the 78 percent LTV was reached, but HUD regulations required that lenders automatically remove the MIP once that threshold had been reached.

HUD continues to give individual lenders the freedom to dictate how and when a borrower can cancel the MIP, but in general, lenders are more strict than the FHA when it comes to cancelling MIP, and they don’t typically bend the rules for borrowers who want to cancel early without meeting cancellation guidelines. HUD requires FHA borrowers to contact their lenders directly to obtain cancellation policy information.

Can I Cancel Pmi On A Fha Loan

If you bought a home with an FHA loan several years ago, you may be eligible to cancel your FHA PMI today. If the balance of the loan is 78% of your original purchase price, and you have been paying FHA PMI for 5 years, your lender or mortgage insurance service must cancel today by law.

Do you have to keep PMI on loan between FHAs? FHA mortgage loans do not require a PMI, but require an Initial Mortgage Insurance Premium and a mortgage insurance premium instead. Depending on the terms and conditions of your home loan, most FHA loans today will require an MIP for 11 years or the lifetime of the mortgage.

You May Like: What Does A Mortgage Lawyer Do

Different Types Of Private Mortgage Insurance

Monthly BPMI. Monthly borrower-paid mortgage insurance is the most common choice. The premium is based on a percentage of your loan amount and is part of your monthly mortgage payment.

Single premium. This may also be called upfront PMI and allows you to prepay the premium in a lump sum to avoid paying it monthly.

Lender paid. If you agree to a bump in your mortgage interest rate, your lender may offer lender-paid mortgage insurance . The lender pays the PMI insurance premium on your behalf with this option.

Split premium. You can mix and match monthly and single premiums, paying a portion of the PMI upfront and adding the remaining balance to your monthly payment.

Read Also: What Will My Mortgage Interest Rate Be

What Is Mortgage Default Insurance

If your initial down payment for your mortgage is less than 20 per cent of your purchase price, and your potential home price is below $1-million , you are required to purchase mortgage default insurance . Mortgage default insurance is offered by providers such as the Canada Mortgage and Housing Corporation , a crown corporation or private mortgage insurers like Genworth Financial Canada and Canada Guaranty.

CMHC insurance pays out the lender if the borrower defaults on their payments for whatever reason there is no payout to you, and the CMHC can later come after you or your estate for these costs, as you are still liable for them.

It enables banks and lenders to offer mortgages and lower interest rates to first-time home buyers. It protects the lender in case these borrowers default and it lets a larger number of people become homeowners.

To learn more about how mortgage default insurance works and how much it costs when your downpayment is less than 20 percent, head to our CMHC Mortgage Default Insurance Calculator.

Recommended Reading: Does Prequalifying For A Mortgage Affect Your Credit

Recommended Reading: What Would A Mortgage Payment Be On 175 000

Department Of Veterans Affairs

If you get a Department of Veterans Affairs -backed loan, the VA guarantee replaces mortgage insurance, and functions similarly. With VA-backed loans, which are loans intended to help servicemembers, veterans, and their families, there is no monthly mortgage insurance premium. However, you will pay an upfront funding fee. The amount of that fee varies based on:

- Your type of military service

- Your down payment amount

Understanding Mortgage Default Insurance

Mortgage default insurance is required by the Government of Canada when home buyers are putting less than the 20% down payment typically needed to qualify for a conventional mortgage. This type of insurance compensates mortgage lenders for losses caused by a mortgage default. The most common reason for defaulting is not making your mortgage payments.

To be eligible for mortgage default insurance, you will first have to meet your bankâs lending qualifications as well as the underwriting standards of your mortgage insurer. The insurance is offered by a number of mortgage insurers, including Canada Mortgage and Housing Corporation .

While this insurance is primarily protecting your lender from losing money if you default, it can also benefit you by allowing you to buy a home sooner with a down payment as low as 5%.*

Other things to know about mortgage default insurance:

Speak to a mortgage specialist to learn more about mortgage default insurance.

* The minimum down payment requirement for mortgage default insurance depends on the purchase price of the home. For a purchase price of $500,000 or less, the minimum down payment is 5%. When the purchase price is above $500,000, the minimum down payment is 5% for the first $500,000 and 10% for the remaining portion. Mortgage default insurance is available only for properties with a purchase price or as-improved/renovated value below $1,000,000.

Also Check: What’s A Good 30 Year Mortgage Rate

Mortgage Due Dates : Is There Really A Grace Period

If you recently took out a mortgage, or have been thinking about purchasing real estate, you may be wondering when your mortgage payments will be due each month, among other things .

Well, mortgage payments are generally due on the first of the month, every month, until the loan reaches maturity, or until you sell the property.

So it doesnt actually matter when your mortgage funds if you close on the 5th of the month or the 15th, the pesky mortgage is still due on the first.

The only difference is when the first mortgage payment is due, which Ive explained in my when mortgage payments start post.

You May Like: Reverse Mortgage Manufactured Home

How Can I Avoid Paying Cmhc Fees

As mentioned, CMHC insurance makes it possible for people to buy a home and get approved for a mortgage with a minimal down payment amount. Even as little as 5% of the purchase price of a home is enough to secure a mortgage for many borrowers. But for others, CMHC fees are a nuisance that they want to avoid from the get-go. The question is, how can you avoid having to pay these fees in the first place?

The most obvious way to avoid paying CMHC fees is to put at least 20% down when you buy a home. This way, no mortgage insurance is required, as the loan is considered less of a risk to the lender. You might also be able to avoid CMHC insurance when you refinance your mortgage and leave a minimum of 20% equity in the property.

There may also be a way to avoid these fees if you move to another home and take advantage of whats known as a portability option. This can help eliminate the insurance premiums on a new insured home loan to purchase another property. At the very least, it may help to reduce the insurance fees being paid.

Don’t Miss: What Are Essential For Completing An Initial Mortgage Loan Application

How Long Does It Take For Cmhc Approval

According to a variety of brokers that we talk to, CMHC turnaround time can vary from 2-5 business days. If you have a complex file or are purchasing a strata property with depreciation or engineering report to review, then this may take longer.

A standard subject removal is 7-10 days , and CMHC approval is typically manageable within the standard subject removal timeframe.

If you are thinking of writing a subject free offer or have a quick subject removal, you can also ask your broker to give them a call in advance to see if there are any red flags on the property/building if strata. It will give you a better idea of whether or not the lender will be willing to give you the mortgage based on CMHC.

Option : Refinance To Get Rid Of Pmi

When mortgage rates are low, you might consider refinancing your mortgage to save on interest costs or reduce your monthly payments. At the same time, refinancing might enable you to eliminate PMI if your new mortgage balance is below 80 percent of the home value. Its a double dose of savings.

The refinancing tactic works if your home has gained substantial value since the last time you got a mortgage. For example, if you bought your house four years ago with a 10 percent down payment, and the homes value has risen 15 percent since then, you now owe less than 80 percent of what the home is worth. Under these circumstances, you can refinance into a new loan without having to pay for PMI.

With any refinancing, youll want to weigh the closing costs of the transaction against your potential savings from the new loan terms and eliminating PMI.

Who this affects: This strategy works well in neighborhoods where home values are on the upswing. If your home value has declined, refinancing could have the opposite effect you might be required to add PMI if your home equity has dropped.

Refinancing to get rid of PMI typically doesnt work well for new homeowners. Many loans have a seasoning requirement that requires you to wait at least two years before you can refinance to get rid of PMI. So if your loan is less than two years old, you can ask for a PMI-cancelling refi, but youre not guaranteed to get approval.

Don’t Miss: What Does A Fixed Mortgage Mean

Do I Need Cmhc Insurance

CMHC insurance is required if yourdown paymentis less than 20%. You wont be able to get an uninsured mortgage from any major bank in Canada if your down payment is less than 20%. This requirement is put in place by the Office of the Superintendent of Financial Institutions , an agency of the federal government that regulates financial institutions such as banks and federal credit unions.

If you make a down payment of at least 20% or more, you do not need CMHC insurance. However, your mortgage lender can still require you to get CMHC insurance even if you make a higher down payment in certain cases, such as if youre purchasing in a remote location where it might be difficult to find a buyer.

CMHC insurance is not available if:

- Your purchase price is $1,000,000 or above, or

- Your amortization period is longer than 25 years

In these cases, you must make a down payment of 20% or higher to get a mortgage.

Can A Bank Refuse To Remove Pmi

PMI paid to a lender cannot be deducted unless you refinance your mortgage. In this case, PMI should not be referenced in your mortgage note. FHA Mortgage. If your LTV ratio is 90% or less, you are only required to pay the monthly mortgage insurance for the first eleven years of your loan.

How do I remove a lender from my PMI?

That mortgage rate will not change forever, so you will have to repay the loan in full to get rid of the LPMI â premium.â You can do this by paying off the loan out of your savings , refinance the loan, or sell the house and pay the debt.

Is a lender required to remove PMI?

The lender or server must automatically terminate your PMI when your mortgage balance reaches 78 percent of the original purchase price in other words, when your loan-to-value ratio drops to 78 percent. This is provided you are in good condition and have not missed any mortgage payments.

Can lender paid PMI be Cancelled?

There is no simple way to get rid of LPMI. You basically have two options: sell the house or refinance the mortgage. With refinancing in general, you need to ensure that you get a lower rate and that you can afford the final costs to make it financially worthwhile.

Read Also: How To Apply For A Mortgage Loan