What Percentage Of Your Income Should Your Mortgage Be

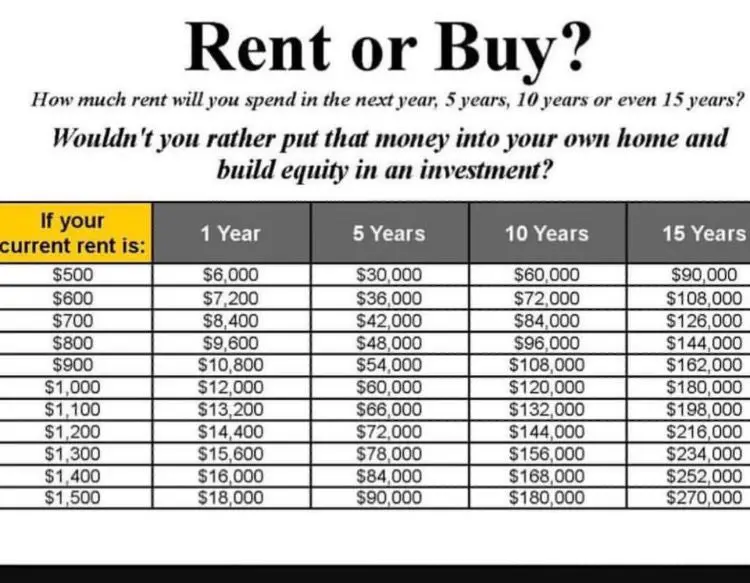

Calculating the percentage of income for your mortgage payments will help you understand exactly how much you can afford to spend. Buying real estate via a mortgage is the largest personal investment that most people make in their lifetime.

For this reason, working out how much you can comfortably borrow depends on several factors. Its not just a question of how much the bank is willing to lend you. Factors such as the mortgage percent of your net income , finances, priorities, and preferences are all part of the equation.

As a general rule, most prospective homeowners can finance a property that costs anywhere between two and two-and-a-half times their gross annual income . Now, lets imagine that you earn $100,000 per year. This would mean that you can afford a mortgage between $200,000 and $250,000. However, this calculation is only a general guideline.

Ultimately, when you consider buying a property, there are several essential factors to consider. Primarily, you need to have a good idea of the amount your lender thinks you can afford . Next, it helps to take a personal inventory and think about the type of home where you would like to live. If you plan to live in your new home for many years, what sort of things will you be willing to trade-offor notto afford your dream home?

Raise Your Credit Score

There are several ways to improve your credit score. First, its important to check your credit report from all three bureaus Experian, TransUnion and Equifax for inaccuracies. If there are mistakes in your credit history, you can file a dispute with the credit agencies. They are legally required to address any inaccuracies promptly.

If the information being reported is accurate, make sure to resolve any collections accounts, pay your outstanding debt on time every month and, if possible, reduce your overall credit card debt. The higher your credit score, the lower your interest rate.

Tips To Maximize Your Budget

Knowing where you spend money every month is key when planning to purchase that first home, so you want to get a handle on your budget. Increasing your gross monthly income is one way to improve your DTI. But if thats not possible, reducing your monthly debt will help. Here are some tips:

- Pay down debt: Make an extra payment one month and consider adding it to your principal Youd be surprised how quickly you can decrease your overall debt. But dont forget to check if there are any prepayment penalties.

- Consolidate debt: Consolidate all those high-interest debts into a consolidation loan with a lower interest rate. Keep in mind, this may cause a temporary dip in your credit score.

- Cut out bad habits: Whether it is impulse buying or paying for streaming services you rarely watch, reducing those monthly credit card charges ultimately means less debt.

At Wyndham Capital Mortgage, we want our borrowers to feel comfortable purchasing that first home. Understanding how you could reduce monthly debt payments and the guidelines mortgage lenders use to determine the percentage of income that should go toward a mortgage could help you buy that dream home. If you have any questions, reach out to your loan officer today.

Recommended Reading: How Much Does Mortgage Coach Cost

Tips For Buying A Home

In order to help ensure that you can afford your home and maintain it over time, there are some smart measures you can take. First, save up a cash reserve in excess of your down payment and keep it in reserve in case you lose your job or are unable to earn income. Having several months of mortgage payments in emergency savings lets you keep the house while looking for new work.

You should also look for ways to save on your mortgage payments. While a 15-year mortgage will cost you less over the loan’s life, a 30-year mortgage will feature lower monthly payments, which may make it easier to afford month-to-month. Certain loan programs also offer reduced or zero down payment options such as VA loans for veterans or USDA loans for rural properties.

Finally, don’t buy a bigger house than you can afford. Do you really need that extra room or finished basement? Does it need to be in this particular neighborhood? If you are willing to compromise a bit on things like this, you can often score lower home prices.

First: What Is A Mortgage Payment

Mortgage payments are the amount you pay lenders for the loan on your home or property, including principal and interest. Sometimes, these payments may also include property or real estate taxes, which increase the amount you pay. Typically, a mortgage payment goes toward your principal, interest, taxes and insurance.

Many homeowners make payments once a month. But there are other options, such as a twice a month or every two weeks.

You May Like: How To Buy A House At Auction With A Mortgage

These Rules Might Not Apply Depending On Where You Live

The three times your salary rule and the less than 30% of your monthly income rule are both helpful guidelines. But the amount you feel comfortable spending on your mortgage payments could differ depending on where you live and your other financial goals.

You should also consider what the market is like where you live, says Reyes. The three times your salary rule might not be realistic for people who live in areas with high cost of living.

If it seems like you might need to take out a bigger mortgage to afford to buy a home, Reyes recommends that you make sure youre in good financial standing in other areas of your life. Its important to have a significant emergency savings set aside to make up for the fact that your budget will be stretched a little thin. You should also have ample retirement savings and a separate stash of cash to cover your move-in and closing costs.

But bigger mortgages are not always desirable, explains Reyes. If your mortgage represents too big of a chunk of your income, a lender might charge higher interest rates and other fees to compensate for the higher risk you could default.

Dont Miss: Is The Mortgage Industry Slowing Down

Calculate An Affordable Home Purchase Price

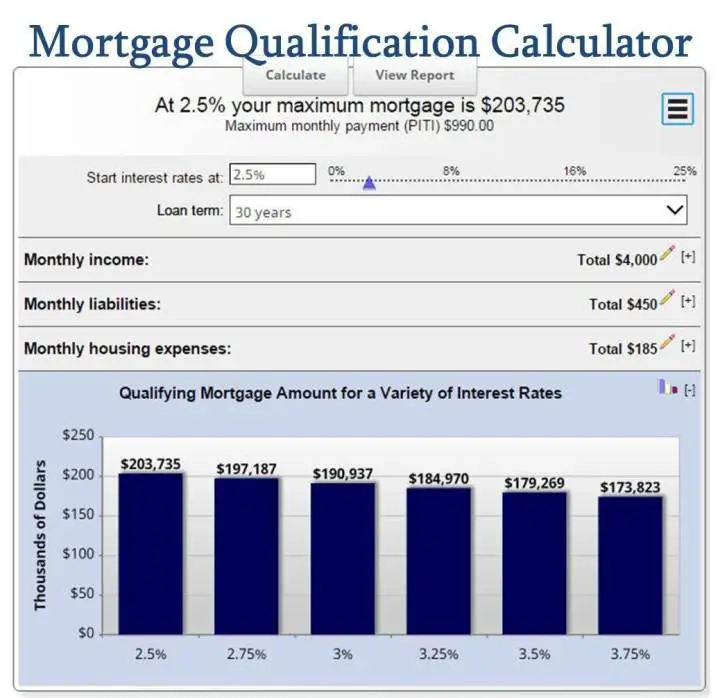

Combine your cash down payment with the amount of money youre prepared to borrow and youll have a maximum purchase price. However, dont hesitate to revise this estimate as you shop for houses and mortgages. Figuring out how much to spend on a house changes as the variables change.

For instance, lets say you get your heart set on a fixer-upper. Youll probably need to reduce the size of your down payment to have more cash available for renovations. Do the homes youre looking at have lower property tax bills or higher association fees than you expected? Have you found the perfect lender offering a lower interest rate?

Go back to the mortgage calculator, and revise your borrowing power.

Read Also: Can You Add Closing Costs Into Your Mortgage

Work With A Buyers Agent We Trust

For more guidance on buying a house you can afford, work with a real estate agent. A good agent will help you set the right expectations when shopping for a home in your price rangethey may even be able to find you a home for sale that other buyers dont know about.

For a quick and easy way to find a RamseyTrusted agent, try our Endorsed Local Providers program. We only recommend agents who truly care about your financial path and wont push you to overspend on a house so they can bring home a bigger commission check. Find your real estate agent today!

Read Also: How To Get Removed From A Mortgage

What Does A Mortgage Payment Include

To understand how much of your income should go toward a mortgage loan, you first must understand the components that make up a mortgage payment. Each month, a portion of your payment will go toward the following:

- Principal: The principal balance of a mortgage refers to the original sum borrowed to purchase the house.

- Interest: Alongside the principal, the largest component of your monthly mortgage payment is interest, which is the cost you pay the lender in exchange for borrowing money.

- Property taxes: The exact cost of property taxes depends on the location and assessed value of the home.

- Homeowners insurance: This type of insurance protects your home against things like accidents and natural disasters.

- Mortgage insurance: If you make a smaller down payment, your lender will also require this type of insurance, which protects their investment in the event that you default on the loan. This could be paid in the form of private mortgage insurance or a mortgage insurance premium , depending on the loan type.

Find out what you can afford.

Use Rocket Mortgage® to see your maximum home price and get an online approval decision.

Read Also: Is It A Good Idea To Pay Off Your Mortgage

Other Homebuying Costs To Consider

Buying a home is typically the most expensive purchase someone makes in their lifetime. On top of that, other small fees can really add up that can increase the total cost of that purchase. Youâre also on the hook for other costs, like:

- Regular maintenance: Youâll need to maintain your home. And sometimes that means ongoing upkeep for extras like a pool. On top of regular pool maintenance, thereâs also the patio or deck the pool sits in, which might need annual pressure washing, for example.

- Lawn care: If your community doesnât pay for a lawn maintenance crew, youâre on your own for all your lawn and hedging care. This means hiring a company to do it for you or buying the proper tools to do it yourself.

- Home improvements and repairs: This could be anything from a new garage door to changing kitchen cabinet handles. It could also be a new toilet or a new roof.

When youâre on the hunt for a home, a completed inspection report will let you know any major concerns to pay attention to. If some items are out of date, you could use those as negotiating tools to lower the cost of the home price or get new ones installed before purchasing.

What Is The 80/20 Budget Rule

With the 80/20 rule of thumb for budgeting, you put 20% of your take-home income into savings and spend the rest. Also known as the “pay yourself first” budget or the anti-budget, it’s a simple way to achieve and maintain financial stability by ensuring you have enough savings to see you through tough times.

Read Also: Does Making Biweekly Mortgage Payments Help

What Should I Do If I Am Spending Too Much On My Mortgage

If you are concerned that youre spending too much of your monthly income, there are a handful of different options to consider:

- Take a fresh look at your budget and determine whether youre stretching it too far in order to pay off your mortgage early

- Rent out a room in your home to bring in some extra cash each month

- Get a second job or pursue a side hustle

- Look at a cash-out refinance but only if it makes sense financially for you

- Downsize to a home thats more affordable

If youre a homeowner who is looking for a way to cover more expenses so you can stay on top of your mortgage payments, you also might want to consider a Hometap Investment you can tap into your equity to receive cash while staying in your home. Take our five-minute quiz to see if a Hometap Investment might be a fit to help you reach your financial goals.

Interest And Partial Principal

In the U.S. a partial amortization or balloon loan is one where the amount of monthly payments due are calculated over a certain term, but the outstanding balance on the principal is due at some point short of that term. In the UK, a partial repayment mortgage is quite common, especially where the original mortgage was investment-backed.

Read Also: How Do You Figure Out Your Mortgage Payment

Know Which Mortgage Option Is Right For You

Okay, now lets talk about types of mortgages. Most of them are garbage designed to help you pay for a home even if you cant afford it.

But when you do the math, you find that these mortgages charge you tens of thousands of dollars more in interest and fees and keep you in debt for decades longer than the option we recommend.

Thats why getting the right mortgage is so important! Setting boundaries on the front end makes it easier to find a home you love thats in your budget.

Here are the guidelines we recommend:

- A fixed-rate conventional loan. With this option, your interest rate is secure for the life of the loan, keeping you protected from the rising rates of an adjustable-rate loan.

- A 15-year term. Your monthly payment will be higher with a 15-year term, but youll pay off your mortgage in half the time of a 30-year termand save tens of thousands in interest.

Your mortgage lender will most likely approve you for a bigger mortgage than you can actually afford. Do not let your lender set your home-buying budget. Ignore the banks numbers and stick with your own.

Knowing your house budget and sticking to it is the only way to make sure you get a mortgage you can pay off as fast as possible.

How To Calculate Mortgage Affordability

First, lets define mortgage affordability. Though its sometimes used in reference to the cost of living in a particular city relative to the average income in that area, you should think about it as the amount a bank or financial institution will allow you to borrow based on your income, debt and living expenses.

Your mortgage affordability is based on:

- Your annual income before tax

- Your monthly debt payments, which includes credit cards, loans and car payments

- Housing costs such as property taxes, heat and half of your condo/HOA fees . For the latter, only half the amount is used, because condo fees can cover things like property maintenance, insurance and some utilities, which are not used in debt-service calculations for other types of properties.

According to the Canadian Mortgage and Housing Corporation, a mortgage is affordable when your gross debt service ratiowhich accounts for your housing costsdoesnt exceed 39%. To be considered affordable, your total debt service ratiowhich accounts for housing costs as well as other debt obligationsmust not surpass 44%.

Recommended Reading: Can I Pay My Mortgage Twice A Month

How To Lower Your Monthly Payments

If your mortgage calculator results are not yielding the lower monthly payments you hoped for, here are several techniques to try:

- Lower purchase price: The less you borrow, the lower your mortgage payment

- Bigger down payment: Putting more money down means youll borrow less. Also, the best mortgage rates generally go to borrowers with larger down payments, among other qualifying factors

- Avoid private mortgage insurance: When you put at least 20% down on a conventional loan or 20% home equity on a refinance you can avoid paying monthly private mortgage insurance premiums

- Longer loan term: A longer loan term means lower monthly payments. However, you will pay more in total interest over the life of the loan

- Shop for a lower rate: Rate shopping doesnt have to take long, and its well worth the savings. Here are tips to get your best mortgage rate

Figure Out 25% Of Your Take

Lets say you earn $5,000 a month . According to the 25% rule we mentioned earlier, that means your monthly house payment should be no more than $1,250.

Stick to that number and youll have plenty of room in your budget to tackle other financial goals like home maintenance and investing for retirement.

Recommended Reading: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

Read Also: Should I Add My Spouse To My Mortgage

How To Calculate The Qualifying Ratio For A Home Loan

One of the mistakes first-time home-buyers make is to put financial decisions into their mortgage brokerâs or bankâs hands, borrowing as much as the institution will lend them. Take control of your finances and control you debt by determining an ideal percentage of monthly income to devote to your mortgage. Keep in mind that most mortgages do not include additional expenses you may incur with real estate ownership, such as taxes, insurance and maintenance.

Recommended Reading: How Does Rocket Mortgage Work

How Do Buyers Pay For A House

Some buyers take money out of their retirement savings. Others liquidate other investment accounts and various assets like other property or use cash savings. Buyers also turn to relatives to help gather the amount needed to cover the purchase price. Once you have enough cash, you purchase the home .

Donât Miss: What Is A Fixed Mortgage Rate For 30 Years

Don’t Miss: How Much Will My Mortgage Be Calculator

How Much Should My Mortgage Be In The Real World

All this math can come across as a bit theoretical. And your goal when deciding on your mortgage amount should be more practical. You want a loan that will fit neatly within your lifestyle, needs, and ambitions.

The fact that a lender will give you $x amount because of your DTI, credit score, down payment, and personal finances doesnt necessarily mean you should borrow $x amount.

Yes, most of us borrow up to the maximum were allowed. But that doesnt mean you should.

What are your spending priorities?

It all depends on your lifestyle and priorities. Suppose you love foreign travel or gourmet eating or sailing or shopping. Borrowing the max amount might mean youre sacrificing other luxuries for years to come.

It could be best to settle on a more modest home and a smaller mortgage if that allows you to maintain your current lifestyle.

How secure is your income?

You should also bear in mind how secure your earnings are.

You likely dont want to be saddled with the biggest mortgage possible if youre in a job where firings are commonplace or if you plan to change jobs soon and youre not sure youll earn the same amount.

Lenders have these questions in mind, too. Thats why they typically want to see two years employment history on your mortgage application. They also want to know any income youre using to qualify for the loan will continue for at least three years.

Recommended Reading: Rocket Mortgage Conventional Loan