Create A Monthly Budget

Do you have too much month at the end of your money? Do you ever look into your wallet and wonder where that money has gone? We have all had this experience at some time or another, and we dont ever want to again!

The best way to ensure that you know where your money is going is to create a budget. Most people think of the word budget as a restriction someplace to list all of your debts and bills that have to be paid with no regard for having a life.

It helps instead to view a budget as a spending plan. In a spending plan, you PLAN how you will allocate your take-home pay. Do you HAVE to spend $200 per month on ballroom dancing lessons? If the answer is yes, put that in your budget and find other places to trim down if you need to.

Creating a thoughtful, complete spending plan allows you to know exactly where your money is going each month so you can tackle that mortgage faster.

Choosing A Mortgage Term

Choosing the right mortgage length may seem difficult, but this decision will influence your long-term financial health. The options can seem overwhelming, especially if youre a first-time home buyer. Its important to pick one that meets your financial needs since youll likely have your mortgage for a significant period of time. Find out which mortgage term best fits your lifestyle and puts you on the right track towards homeownership.

Its Also Possible To Pay Extra To Reduce Your Loan Term

- Theres another option if your loan term is longer than youd like and you dont want to refinance

- You can simply pay extra each month toward principal to shorten your loan term

- Aside from shedding years off your loan, youll also save by way of less interest

- And it gives you payment flexibility versus a shorter-term mortgage

If you cant or dont want to refinance, you can also just pay extra each month to effectively shorten the loan term.

To summarize, the longer the loan term, the lower the mortgage payment, but the more interest youll pay, and the longer it will take to build home equity.

Further complicating matters is the fact that some folks dont want to pay off their mortgages, and would rather invest their money elsewhere.

This is especially true with interest rates so low and returns in the stock market and elsewhere so high.

Either way, make a plan and think about what your short-term and long-term goals are before diving in.

Tip: If you arent sure what loan term to pick, you can always make larger payments on a longer-term loan .

If you go with a shorter term, youre stuck with a larger monthly payment no matter what.

To err on the side of caution, you can go with the standard 30-year term and make extra principal payments if and when you desire.

You May Like: What Is Mortgage Pmi Rate

Loan Options For Mobile Homes

Unless your manufactured home qualifies as real estate, you wont be able to finance the home purchase with a conventional or government-backed mortgage program.

Thats OK, though. These homes can still be financed, just not with home mortgages.

There are a few different loan options if you cant get traditional mortgage financing for your mobile home.

Mortgage Loans Around The World

September 29, 2008by Harry Sitin Mortgage and Loans

In so many articles about the housing and mortgage crisis in the United States, adjustable rate mortgages are invariably mentioned as one of the culprits. People cant pay when the interest rate on their loan resets. The words ARM and dangerous are often used in the same sentence. Should ARMs bear the blame though? I linked to the mortgage loans offered by a Canadian bank in a previous post. There are no fixed rate loans in Canada. All they have in Canada are ARMs. If ARMs cause mortgage loan defaults and foreclosures, Canada would be in constant chaos.

As a follow-up to my post two weeks ago about understanding the world, I decided to expand my horizon beyond North America and take a look at mortgage loans in some other countries. Thanks to the power of the Internet and Google translation tools, I can do this relatively easily. I only limited my primitive research to developed countries. In each country, I picked a random bank, which should represent the available mortgage products in that country. I got the names of the banks from List of Banks in Wikipedia.

Canada CIBC. No fixed rate loans. ARM and hybrid ARM with rate fixed up to 10 years. Refinance or take variable rate after the fixed rate period is over.

France Societe Generale. Fixed rate loans up to 30 years. ARMs are also available.

Japan Mizuho. Fixed rate loans up to 20 years. ARMs are also available.

Say No To Management Fees

Recommended Reading: How Much Will We Get Approved For A Mortgage

Real Property Versus Personal Property

Real property must include land, along with property that cant be quickly or easily removed from the land things like a house, an in-ground pool, or a paved driveway.

Property that can be moved and used elsewhere a car, a boat, or a true mobile home, for example is considered personal property.

How can you learn whether an existing manufactured home is real or personal property? By finding out how the current owner pays taxes.

If the taxes go to the DMV, the home is considered personal property. In addition, a home on leased land wont be considered real property. If youre buying a new home from a dealer, youll need to place the home on land you own or land youre buying.

What Is Considered A Longer

Commonly, people take out a mortgage for 25 years, but you can get mortgages with shorter or longer terms than this. Anything over 25 years is generally considered a long-term mortgage.

The number of people opting for longer-term mortgages of 30 or 35 years has been increasing, and some lenders even offer 40-year mortgage deals in certain circumstances.

With more time to repay off their loan, homeowners will have lower monthly payments but will pay more in interest overall.

Recommended Reading: How To Qualify For A Mortgage On A Second Home

Mortgage Insurance: What You Need To Know

Mortgage insurance helps you get a loan you wouldnt otherwise be able to.

If you cant afford a 20 percent down payment, you will likely have to pay for mortgage insurance. You may choose to get a conventional loan with private mortgage insurance , or an FHA, VA, or USDA loan.

Mortgage insurance usually adds to your costs.

Depending on the loan type, you will pay monthly mortgage insurance premiums, an upfront mortgage insurance fee, or both.

Mortgage insurance protects the lender if you fall behind on your payments. It does not protect you.

Your credit score will suffer and you may face foreclosure if you dont pay your mortgage on time.

Cons Of An Adjustable

- Variable rates can be risky. Since mortgage rates fluctuate depending on the housing market, you could pay higher interest rates than fixed terms. A rise in interest rates will result in higher monthly payments.

Finding the best mortgage term for you isnt as stressful as it may seem. Doing your research and understanding your options can make the process easier and give you confidence when choosing a mortgage term. Speak to a Home Lending Advisor for more help understanding which mortgage term is right for you.

You May Like: Can A 70 Year Old Get A 30 Year Mortgage

When Should You Get A Mortgage

In so many words, the time to get a mortgage is when you’re buying a house but can’t afford to pay the entire price of the home in full and upfront. Think about it this way: If you’re looking to buy a house, you most likely won’t want to pay the full price of the home right then and there, and in cash.

The way to bypass that gigantic one-time transaction is by offering to pay a portion of the home’s value upfront this is called making a down payment while also taking out a loan from a bank to cover the rest of the home’s price. The money you’re borrowing from the bank will need to be repaid with interest and in exchange, you’ll get to occupy the home and renovate it as you wish.

Fannie And Freddie Conventional Manufactured Home Loans

With Fannie Mae and Freddie Mac conventional loans, you can put as little as 3 percent down. There are extra risk-based fees for manufactured home loans, so rates are slightly higher.

Fannie Maes MH Advantage loan works best when youre buying a new home from a Fannie Mae-authorized manufactured home dealer and placing the home on land you already own or land youre planning to buy.

Freddie Mac offers a similar loan program for manufactured homes. One key difference: Freddies loan can finance homes as small as 400 square feet while Fannies requires 600 square feet.

Private lenders throughout the nation offer Fannie and Freddie products, but you may have to shop around to find one that offers these manufactured home loans.

Recommended Reading: How Long Does Mortgage Approval Take

How Can I Pay Down A 30

You have options to pay off your mortgage faster even with a 30-year mortgage. You can choose to make biweekly payments instead of the regular monthly payment, meaning youll make one extra full payment over the course of the year. You can also choose to make a larger payment each month. Be sure to ask your lender to apply your extra payments to your principal balance.

One word of caution: Double-check that your mortgage doesnt have a prepayment penalty before going this route. Most of the time, such a penalty only applies if you pay off your entire mortgage early. But in some cases, you might face a fee if you make small payments toward principal ahead of time.

What Is A Mortgage Term

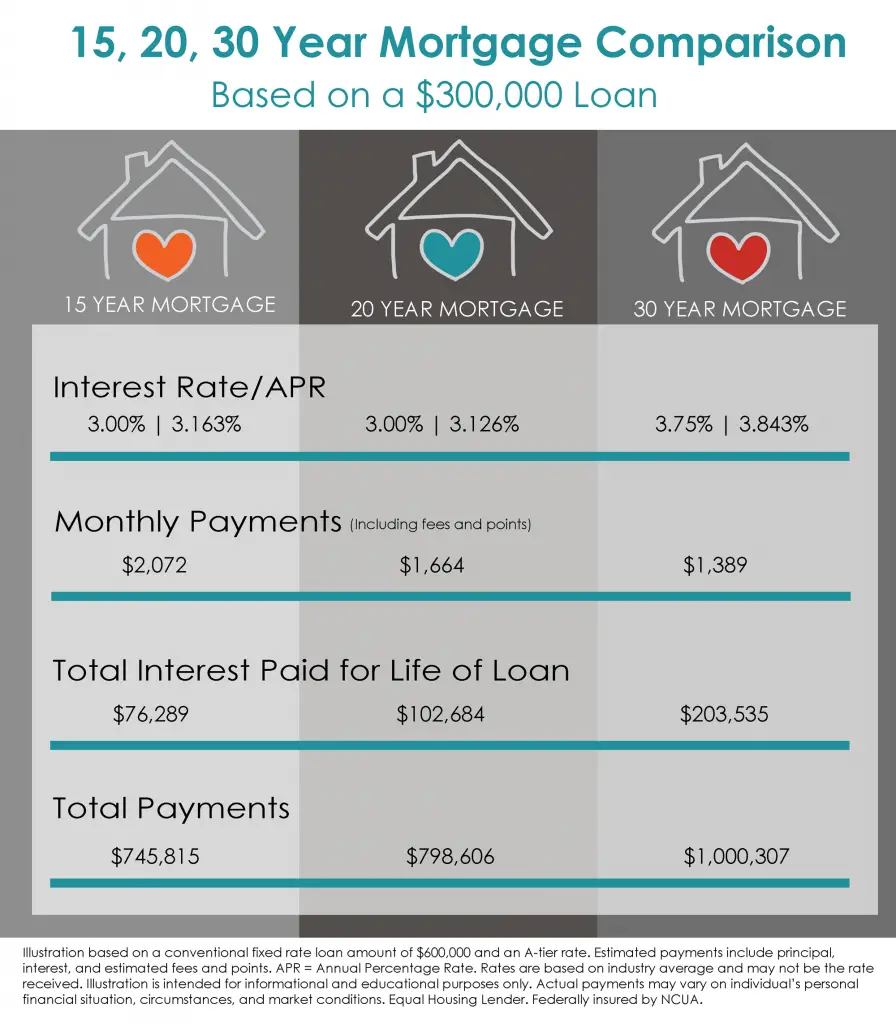

A mortgage term is the number of years you have to pay off your mortgage. A 15-year term means you have 15 years to pay off your mortgage, and a 30-year term means you have 30 years. You have a payment due each month. A 30-year term normally has lower monthly payments than 15-year mortgages since your total mortgage balance is spread out over a longer period of time, resulting in smaller monthly payments. A shorter term means your balance is spread over a shorter period of time, making your monthly payments higher.

The interest rates and payments can differ dramatically depending on your mortgage term length. When you get a mortgage, your lender is loaning you a large amount of money, known as mortgage principal, to buy a home. The lender also charges interest on the principal and your interest payments are in addition to your mortgage principal.

Longer term mortgages, such as a 30-year mortgage, usually result in higher total interest paid over the life of the loan as interest is calculated based on the loan balance each month. The longer you take to pay down the balance, the more interest youll pay. Shorter term mortgages often have higher monthly payments but, because you pay the loan off sooner, your total interest paid can be substantially lower.

Also Check: Can You Get A Second Mortgage With Bad Credit

Principal And Interest Of A Mortgage

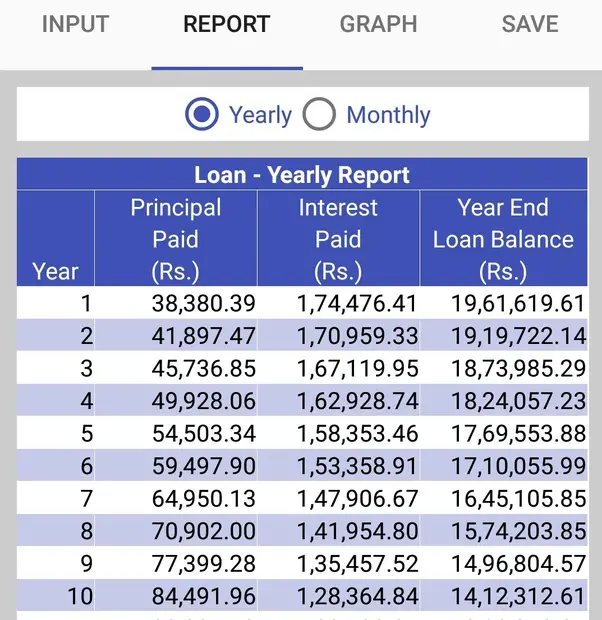

A typical loan repayment consists of two parts, the principal and the interest. The principal is the amount borrowed, while the interest is the lenders charge to borrow the money. This interest charge is typically a percentage of the outstanding principal. A typical amortization schedule of a mortgage loan will contain both interest and principal.

Each payment will cover the interest first, with the remaining portion allocated to the principal. Since the outstanding balance on the total principal requires higher interest charges, a more significant part of the payment will go toward interest at first. However, as the outstanding principal declines, interest costs will subsequently fall. Thus, with each successive payment, the portion allocated to interest falls while the amount of principal paid rises.

The Mortgage Payoff Calculator and the accompanying Amortization Table illustrate this precisely. Once the user inputs the required information, the Mortgage Payoff Calculator will calculate the pertinent data.

Aside from selling the home to pay off the mortgage, some borrowers may want to pay off their mortgage earlier to save on interest. Outlined below are a few strategies that can be employed to pay off the mortgage early.:

Mortgage Loan Dos And Donts

5 Minute Read | September 24, 2021

Feeling overwhelmed about your mortgage options? No wonder! Youve got plenty of choices when it comes to financing the purchase of your home, and it can be hard to know which one is best.

Daves favorite way to pay for a home is with cash. It may sound crazy, but people like you do it every day! If thats not feasible for you, the next best thing is a smart home mortgage loan. It may be easy to dive headfirst into the mortgage option that will allow you to buy a home with next to nothing down. But a bad mortgage product can be a liability in your financial portfolio. A home should be a blessing to your family, not a financial nightmare!

Thats why its a good idea to know whats out there and why you need to avoid some of the more popular mortgage options.

If you need help with mortgages, we recommend talking with Churchill Mortgage. They can answer any mortgage questions you have.

Don’t Miss: How Does Selling A House Work With A Mortgage

This Meant That Those Who Bought A House Or Property Typically Already Had A Lot Of Money

Some borrowers refinance mainly because they have an adjustable-level mortgage loan and they wish to lock in a hard and fast level. But You can also find cases when it makes sense to go from a fixed-fee to an adjustable-charge home finance loan or from one ARM to a different: Particularly, if you intend to promote inside of a couple of years and you simplyre comfortable with the potential risk of taking on a better price in case you end up keeping with your latest dwelling for a longer time than prepared.

It Can Be Harder To Put 20% Down

You might qualify for a bigger loan with a 30-year term compared to a 15-year term. But it can also be more challenging to come up with a sizable down payment when youre buying a more expensive house.

For example, youll need $40,000 to put 20% down on a $200,000 house. The amount jumps to $60,000 for a $300,000 house. Not having 20% to put down doesnt mean you cant buy a house. It simply means youll have to pay PMI and you may not get the best possible interest rate.

Don’t Miss: How Much Mortgage Can I Afford With 100k Salary

The Average Mortgage Length In The Us

When deciding between certain products, it can be easy to just go with the most popular. But when it comes to choosing the right mortgage product to fit your goals, going with the most popular option may not be the best decision.

The average mortgage length is a good place to start. Learning more about other term length options and the benefits and drawbacks of each one will help you find the right mortgage for you.

How Old Will You Be When You Finish The Mortgage

The longer the mortgage term, the older youll be when you make the final repayment. That might not be a problem as some mortgage providers have increased its limit to 80 years old, but you are less likely to be working and therefore bringing in as much money every month.

Of course, its not just long term mortgages you need to plan for. Any mortgage loan you apply for is going to be subject to some affordability tests to make sure you really can make the monthly repayments, even if circumstances change.

Read Also: How To Get A Conventional Mortgage

Historical Mortgage Rates In A Chart

This is a particularly fascinating time to be an interest-rate enthusiast. The Federal Reserve the U.S. central bank is raising rates in response to rising inflation.

The U.S. economy hasnt seen inflation like were currently experiencing since the 1970s. Many experts believe things could get worse because inflation has embedded itself so completely into the economys psyche.

These figures come from Freddie Mac, which began tracking 30-year fixed-rate mortgage rates in April 1971:

|

Mortgage Rates |

Where they were by the end of the decade |

|

1970s |

Thanks to Freddie Mac, theres solid data available for 30-year fixed-rate mortgage rates beginning in 1971.

Rates in 1971 were in the mid-7% range, and they moved up steadily until they were at 9.19% in 1974. They briefly dipped down into the mid- to high-8% range before climbing to 11.20% in 1979. This was during a period of high inflation that hit its peak early in the next decade.

What Is The Best Length Of Time For A Mortgage

There is no single best term length for a mortgage. The ideal terms depend on your financial circumstances, age, and financial goals. A 15-year mortgage will cost you less in the long run, but it won’t be helpful if you can’t afford the steep monthly payment. A 30-year mortgage will make your monthly payments more manageable and may free you to invest that extra money elsewhere, but you will pay more in interest in the long term. Assess your financial situation carefully before you decide on your mortgage terms.

Don’t Miss: How Much Is A 600000 Mortgage