How Mortgage Brokers Get Paid

Often, lenders pay the broker a fee or commission for selling their products, so you don’t pay the broker anything.

Some brokers get paid a standard fee regardless of what loan they recommend. Other brokers get a higher fee for offering certain loans.

Sometimes, a broker will charge you a fee directly instead of, or as well as, the lender’s commission.

If you’re not sure whether you’re getting a good deal, ask around or look online to see what other brokers charge.

How Much Does A Mortgage Broker Cost

A mortgage broker may be compensated through a combination of fees paid from borrowers and commissions that are paid out by the lending institutions who want them to originate loans. The costs vary greatly but a mortgage broker generally earns between 1% and 3% of the total loan amount. The total amount paid by the borrower will vary based on the type of loan, what broker is used, and how much the broker is earning in commissions from the lending institution.

A mortgage brokers pay could show up on your closing costs sheet in a variety of ways. They may charge loan origination fees, upfront fees, loan administration fees, a yield-spread premium, or just a broker commission. When working with a mortgage broker, you should clarify what their fee structure is early on in the process so there are no surprises on closing day.

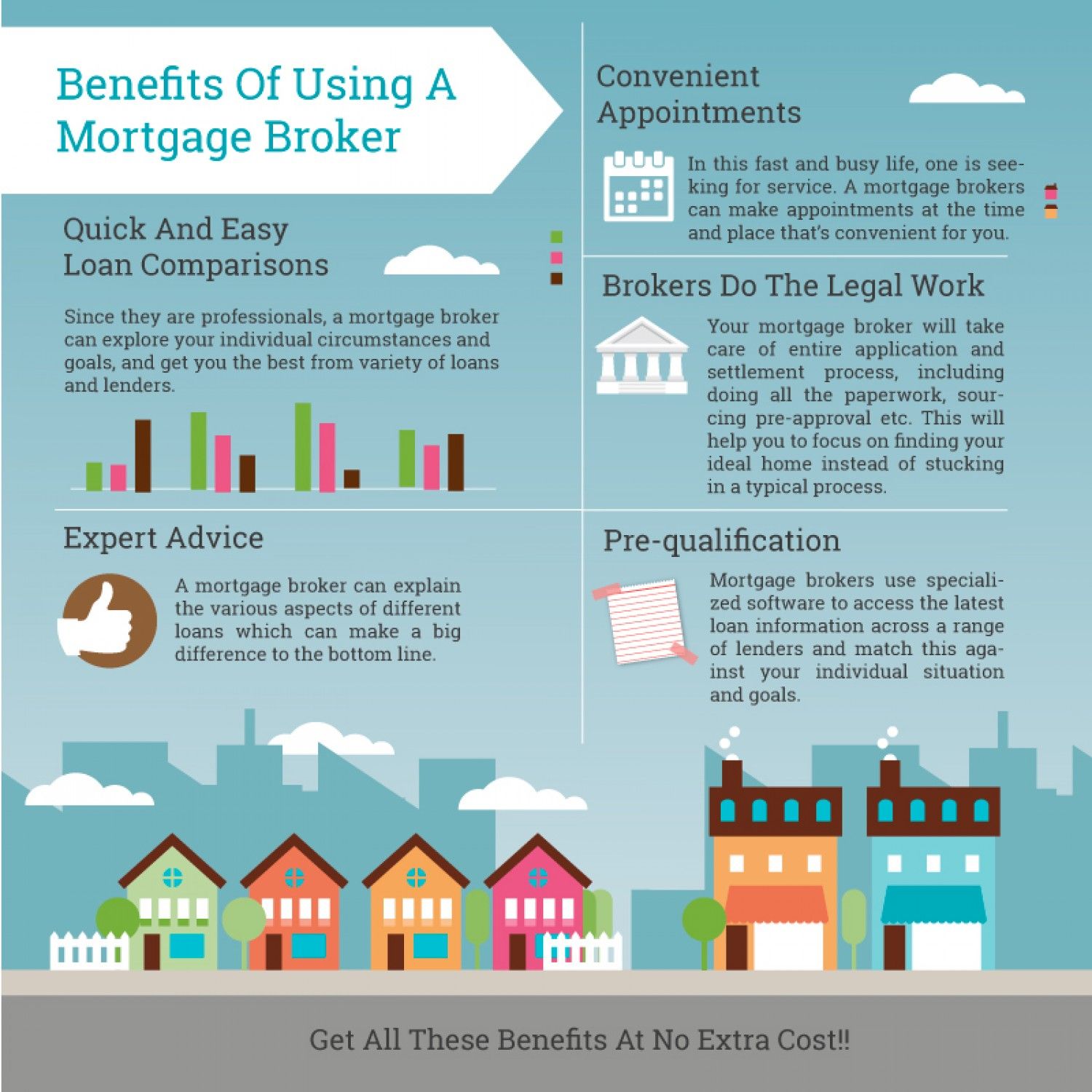

Pros Of Working With A Mortgage Broker

- A mortgage broker can help you save on fees: When you obtain a mortgage, youre likely to be charged an origination fee, application fee, appraisal fee and more. A mortgage broker may be able to get the lender to waive some or all of those fees.

- A mortgage broker can save you money on the loan itself: Brokers have access. to a broader assortment of loans and lenders and may be able to find a better deal than you could get for yourself.

- A mortgage broker can save you time: Brokers can do all the research on rates and fees they negotiate for you and keep the mortgage process on track.

- A mortgage broker can save you from making a big mistake: Brokers can help you avoid pitfalls because they know the mortgage industry, the differences among lenders and the twists and turns in the mortgage process.

- A mortgage broker can find the right lender for tricky situations: If your credit history isnt great or the property youre buying is unusual, a broker can find a lender who has more flexibility with credit scores and down payment amounts or who specializes in certain types of properties.

Recommended Reading: How To Write An Appeal Letter For Mortgage Assistance

Do Mortgage Brokers Make More Than Loan Officers

While their incomes can vary widely by experience, the available data indicate that mortgage brokers tend to earn more on average than mortgage loan officers. For example, Payscale reports an average base salary of $49,369 for mortgage loan officers vs. $58,304 for brokers. Similarly, Glassdoor reports an average base salary of $43,241 for mortgage loan officers vs. $63,469 for brokers.

In many cases, mortgage brokers may have begun their careers as loan officers but later broke off on their own for the opportunity to earn a higher income or enjoy greater independence.

Move To A Different Area

Theoretically, you could increase how much a mortgage broker makes by moving, but this is more complicated than it sounds. If you cross state borders, you will need to get licensed again. No matter how far you move, you will also likely need to start over with marketing and building a client base. So, while this option offers the potential for a long-term increase, it will likely result in a short-term decrease.

Read Also: How Much Does 1 Extra Mortgage Payment Save

What Is The Average Mortgage Broker Salary

Brokers are compensated well for the effort they put into these relationships. According to ABS stats, the average mortgage broker brings in $2,009.10 a week. Thats a fair bit more than the national average full-time income of $1,288.70 a week. Some mortgage brokers, such as senior practitioners and practice owners, make even more than this.

What Mortgage Brokers Do

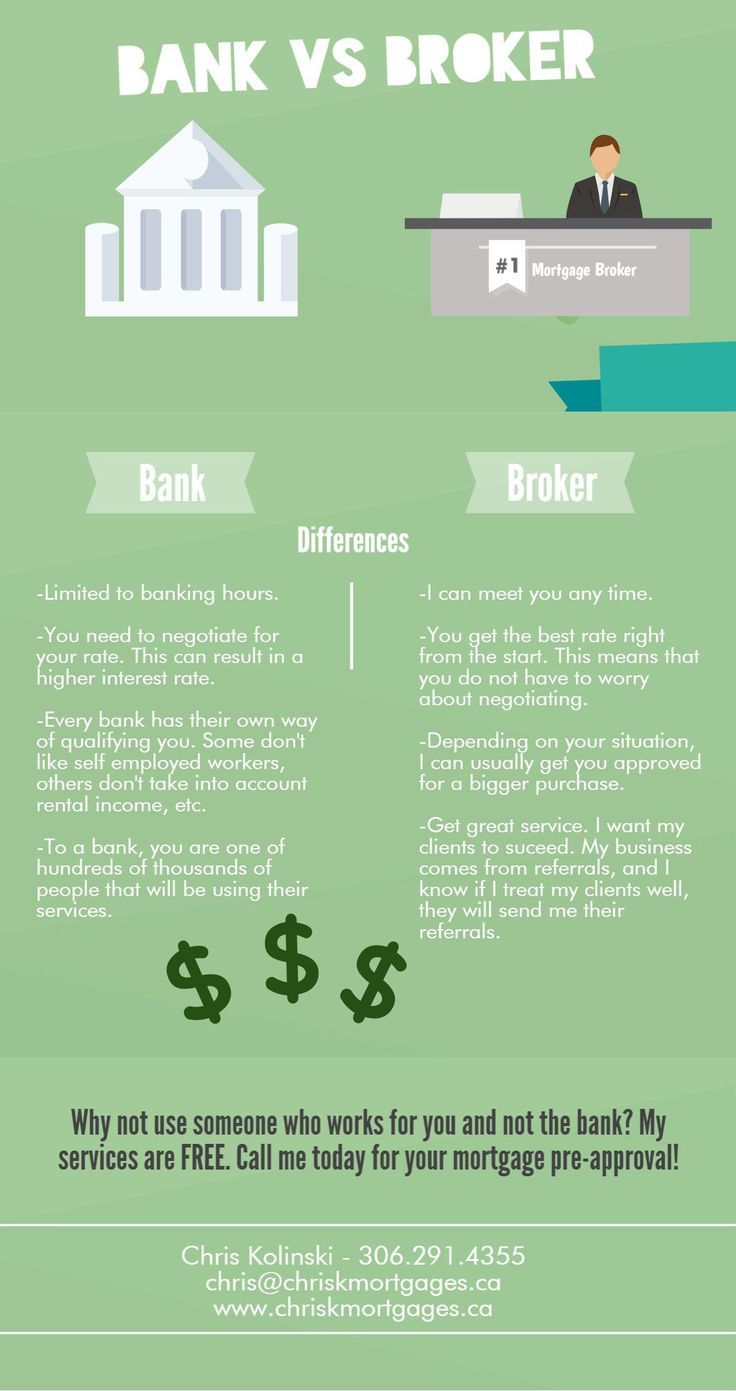

If you go to a bank for a mortgage or home loan, it will offer only loans carried by that bank. Since its just one institution, its home loan options may be limited and may not suit your needs.

If you go to a mortgage broker, he or she should have a variety of loan options from various lenders. Its the mortgage brokers job to find the best mortgage rate, tailored for you.

So, if you need to get a house but cant afford more than a 5% down payment on a 30-year mortgage, your loan broker should approach lenders with those terms.

Hopefully, with the help of that mortgage broker, youll find a lender that will offer you the mortgage you need more quickly than you would shopping for mortgage rates on your own.

Don’t Miss: Can You Mortgage A House You Own

How Big A Fee Should A Mortgage Broker Charge

A mortgage brokers fee can vary from around 0.3 per cent of the loan size to as much as 1 per cent no-one should ever be asked to pay more than this. So for an average-size mortgage of £150,000 a fee at 0.3 per cent would be £450.

Make sure you confirm your mortgage brokers fee in advance with a written quote. Also get written confirmation that if your mortgage deal falls through, there will be no fee to pay. Remember that using a mortgage broker should mean that you spend less money over the long term, so have the adviser explain to you how their fee is justified.

The Average Yearly Pay For A Mortgage Broker

Related

Mortgage brokers work with homeowners and homebuyers. Their job is to research a variety of loan options from multiple lenders and find the best mortgage rate for their client. As independent advisers, they’re instrumental in matching the consumer to the right lending institution for his needs. Like most sales professionals, mortgage brokers charge a commission for their services. Experienced brokers earn around $55,000 per year currently, but the pay scale rises above six figures for people who are truly dedicated to their trade.

Also Check: How To Pay Off Mortgage In Five Years

Then There Are Costs To Consider

One of the most common mistakes in trying to come to an accurate mortgage broker salary expectation is focusing purely on upfront and trail commissions.

The fact is that there are number of upfront and ongoing costs to consider.

As a general rule, you only start becoming profitable as a mortgage broker after the first 6-12 months.

After that, it generally takes up to 2 years to earn a healthy pay packet.

These costs include:

Learn more about the costs of broking.

Should I Use Buy Points Or Make A Larger Down Payment

- Down payment: A down payment is a percentage of a homes purchase price you pay upfront. Put another way, its the portion of the price you arent financing with a mortgage.

- Mortgage points: A point is an upfront fee that reduces your mortgage rate for the life of your loan.

There is no single answer to this question, but your mortgage broker can help you understand the pros and cons of the different options, such as buying points.

Generally, homebuyers who dont plan on staying in the home long-term might not want to spend cash on points . Since you wont have that mortgage for 30 years, the amount you spend on points will likely outweigh what you save on interest.

The same goes for a down payment. If you get a conventional mortgage and put less than 20 percent down, youll be required to pay private mortgage insurance until your equity in the property reaches 20 percent. However, if putting down 20 percent means using all of your savings, then you might want to explore other options.

Also Check: Which Bank Is Good For Mortgage Loan

Paying A Mortgage Adviser Fees Or Commission

You have the right to know in advance how your mortgage broker will be paid. Remember to ask him or her whether they take a fee from you, commission from the bank/lender, or both. You should also ask how much the fee and/or commission will be, and confirm that any fee you pay will depend on the mortgage deal going ahead.

Some mortgage brokers will let you decide whether to pay a fee or let them take commission instead.

How Are Brokers Paid

When you settle a home loan, you will be paid an upfront commission.

Based on the commission structure of a few major banks, upfront commission rates can vary from 0.50% to 0.7% , so for a $1,000,000 loan, you could receive up to $7,000 in upfront commission.

Youll receive trail commission based on the balance of the loan as long as the loan is paid on time.

In most cases, the trail is 0.15% + GST p.a. paid monthly.

This all sounds great but it’s not as straightforward as all that.

Recommended Reading: Can I Get A Mortgage To Buy A Foreclosure

Questions To Ask Your Mortgage Broker

Ask questions. Lots of them. For example:

- Do you offer loans from a range of different lenders? What sort of lenders do you work with? What kind of lenders can’t you access?

- How do you get paid for the advice you’re giving me? Does this differ between lenders?

- Why did you recommend this loan to me? Why is this loan in my best interests?

- What fees will I have to pay when taking out this loan?

- What features come with this loan? Can you show me how they work?

- How do the fees and features of this loan affect how much the loan will cost me?

- Can you show me a couple more options, including one with the lowest cost?

- What is the threshold for lender’s mortgage insurance and how can I avoid it?

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

You May Like: Can You Get A Mortgage Loan On Unemployment

What Is Their Track Record

Does the mortgage broker have a good reputation? How long have they been in business? Do they act in the best interests of the homebuyer? Read reviews and ask for references to learn about a brokers customer service.

Use this checklist as a guide as you shop around for a mortgage broker and choose the one that offers the best overall value.

What Is A Mortgage Broker

Mortgage brokers are licensed mortgage loan originators who work with multiple lenders to find mortgages for their clients. They differ from mortgage loan officers who work for a single lender, such as a bank or credit union, and are limited to offering that lenders mortgage products.

Prospective borrowers often choose to work with a mortgage broker rather than a loan officer in hopes of getting the best possible interest rate or if they have other issues that might affect their loan application, such as a less-than-perfect .

Borrowers can use mortgage brokers both for their initial mortgages and for refinancing with a new loan.

Recommended Reading: When Is It Worth To Refinance A Mortgage

Okay Great So What Do Brokers Make

- A survey said they were paid 2.25 points per loan on average

- On a $300,000 loan amount that would be $6,750 in compensation

- While it sounds like a tidy sum, you have to consider their volume and operating costs as well

- Its pretty close to what real estate agents make, usually 2.5% of the sales price

A press release from 360 Mortgage Group detailing the compensation changes said mortgage brokers generate an average revenue of 2.25 mortgage points on a home loan.

For example, on a $500,000 mortgage, theyd make roughly $11,250 in revenue. That sounds pretty good, doesnt it?

But as mentioned, we have to subtract the costs of doing business, which are variable. From there, youd have your profit per loan.

Not a bad take for helping people get mortgage financing, depending on how many loans are closed each month, and what expenses are involved.

As you can see, mortgage broker salary will definitely vary based on the size of the loans they typically close. In more expensive areas of town , brokers might make six-figures or much, much more.

While those in lower-priced metros could make significantly less if costs are still relatively similar.

Additionally, brokers who focus on mortgage refinances might have higher loan volume than those who help home buyers purchase real estate, as the latter can be harder to come by and slower to close.

What Questions Should You Ask When Choosing A Mortgage Broker

Broker fees are not the only factor to consider if you decide to use a mortgage broker. You need to collect additional information to make the right choice. Make sure you ask your broker enough questions, both when deciding whether to work with them and also when negotiating the loan amount, rate, and conditions.

Heres a quick checklist of the things you need to consider when vetting a mortgage broker and the questions you can ask them.

Don’t Miss: What Are Points And Credits On A Mortgage

Is A Mortgage Brokers Fee Worth The Money

A mortgage brokers fee can be made back very quickly if your deal is even slightly better than the next best offer available.

For example, suppose you were to borrow £150,000 at an interest rate of 2.5 per cent. Your monthly repayments would be £673 and youd repay a total of £201,903 over 25 years.

If your mortgage broker could improve on that by even 0.1 per cent , then youd repay £666 per month and a total of £199,694 saving £2,209. Allowing for a £500 broker fee, this still saves £1,709, and youd make back the £500 fee after six years.

Bear in mind that this example is illustrative only but it shows how even a small difference in interest rates over time can result in big savings. In reality, a mortgage broker can often beat high street deals by more than this amount, making it worth seeking advice every time you remortgage.

For this reason, even with a broker who is paid by commission, its worth asking them if there are better deals out there that can be accessed for a fee.

How Does A Mortgage Broker Get Paid

- They can choose to get paid by either the lender or the borrower

- They can charge an origination fee directly, which comes out of the borrowers pocket

- Or elect to get paid by the lender, which is indirectly paid by the borrower

- The latter results in a slightly higher interest rate, meaning its paid over time via higher monthly mortgage payments

In the recent past , mortgage brokers could make money on both the front and back end of a mortgage loan.

Simply put, they could charge a loan origination fee directly to the borrower and also get paid by the mortgage lender via a yield spread premium , which was the commission the bank or lender provided in exchange for a mortgage rate above market.

In short, the higher the interest rate, the more YSP the broker would receive from the lender.

YSP was also referred to as par-plus pricing, rate participation fee, service release fee, and many other variations.

Brokers had the ability to make several points on the back end of a loan, potentially earning thousands of dollars, sometimes without the borrowers knowledge.

They could also collect money on the front end of a loan via out-of-pocket closing costs like loan origination fees and processing costs, which the borrower paid directly.

For example, back in the day it was possible for a broker to charge one mortgage points upfront for origination, receive another two points on the back from the lender, and also tack on things like loan processing fees.

Read Also: Do I Have To Pay To Refinance My Mortgage

How Does Their Application Process Work

A mortgage broker should make purchasing real estate easier for borrowers. The best brokers can provide data and insight into their mortgage application process. The following information will help you compare different brokers:

- Average time to close a loan

- Third-party fees typically included.

- List of third-party companies they use

- Cost to lock a mortgage rate

- Online platform to track application

- Clear eligibility criteria to qualify for lenders in their network

- List of documents you need to complete your loan application