Come Up With The Money

Once youve got a specific dollar figure, you can lock down sources of the extra money required to climb this financial mountain. Not all of the following steps ensure success but in combination they may get you to the summit.

Cut back on spending and stick to a budget In order to make the goal of paying off your mortgage in five years or less, most households need to cut back on spending and stick to a budget. With the goal of paying off the home loan in such a short timeframe, it is short-term pain for a long-term gain. And, you may actually decide that some of those previous purchases were more frivolous than they were necessary.

Boost your monthly income Some homeowners may not have the necessary income to make paying off their home within five years a reality. However, they shouldnt give up on their goal. Boosting your income with a side hustle, promotion or new job could make your dream a reality. There are numerous side hustles available and many employees are significantly increasing their income in the current job market. If you need to learn a new skill to qualify for a promotion or new job, many free online courses are available on the internet.

Will My Mortgage Payment Go Down After 5 Years

Mortgage Payments Can Decrease on ARMs If you have an adjustable-rate mortgage, there’s a possibility the interest rate can adjust both up or down over time, though the chances of it going down are typically a lot lower. … After five years, the rate may have fallen to around 2.5% with the LIBOR index down to just 0.25%.

Refinance To A Shorter Term

Another option involves refinancing, or taking out a new mortgage to pay off an old loan. For example, a borrower holds a mortgage at a 5% interest rate with $200,000 and 20 years remaining. If this borrower can refinance to a new 20-year loan with the same principal at a 4% interest rate, the monthly payment will drop $107.95 from $1,319.91 to $1,211.96 per month. The total savings in interest will come out to $25,908.20 over the lifetime of the loan.

Borrowers can refinance to a shorter or longer term. Shorter-term loans often include lower interest rates. However, they will usually need to pay closing costs and fees to refinance. Borrowers should run a compressive evaluation to decide if refinancing is financially beneficial. To evaluate refinancing options, visit our Refinance Calculator.

Read Also: How Much A Month Is A 200k Mortgage

Factors To Consider When Paying Off The Mortgage Early

Living without any debt is an exciting goal, but paying off your mortgage needs to be done right. Here are some important considerations:

- Will you incur penalties for overpaying your mortgage?Some mortgage lenders have prepayment penalties or other loan terms designed to prevent you from prepaying. Make sure to contact your lender and read the fine print in your mortgage contract to determine if this applies to you.

- Do you have credit card or any other debts? Many other types of debt, like credit card debt, have higher interest rates. It’s usually more advantageous to pay off any consumer debt before you pay off the mortgage.

- Have you set aside a sufficient emergency fund? It’s generally a good idea to set aside money in an emergency fund to cover expenses that are not included in your budget or to protect from a rainy day. Build a solid financial foundation first!

- Is your debt oppressing you? Some people feel debt rules their lives. If debt is stressing you out, use the Mortgage Payoff Calculator to calculate how much extra money you need to put toward your mortgage every month to get out of debt sooner.

Once you’ve determined that you’re ready to pay off your mortgage, it’s time to start reaping the benefits!

Related: 5 Financial Planning Mistakes That Cost You Big-Time Explained in 5 Free Video Lessons

How To Pay Off Your Mortgage Early Using This Calculator

The calculator on this page helps you visualize different scenarios for making additional payments toward your mortgage. You can use it to determine how much more youd need to pay if you want to hit a particular time goallike paying off your mortgage in 10 years or by the time you retire.

Or if you have a specific amount of extra money to put toward your mortgage each month, you can use the calculator to see how quickly youd pay off the debt with the increased payments. It can also break down what that means in terms of principal and interest, but it doesnt take into account insurance and taxes.

You May Like: Can You Roll A Home Equity Loan Into A Mortgage

Meet The Mortgage Payment Calculator

This mortgage payment calculator will estimate exactly that. You can set everything from your amortization and payment frequency to extra payments. The calculator then determines your monthly mortgage payment and provides an amortization schedule showing how fast it will take to whittle down your principal.

How To Use Our Loan Interest Calculator

There are three main components when determining your total loan interest:

Total Loan Amount. This is the total amount you are borrowing. This does not include any down payment you are making.

Loan Term . This is the total length of the loan. Our calculator uses years to calculate the total interest accrued over this timeline.

Interest Rate. This is the rate charged on the loan. This should be a fixed interest rate.

To use the calculator, you will input these numbers into each section, select CALCULATE, and it will show your estimated monthly payment, as well as the total interest paid over the life of the loan.

-

Note: This calculator is designed for fixed-rate, simple interest loans only.

You May Like: How Much To Earn For 200k Mortgage

Costs Included In Your Monthly Mortgage Payment

Here are two formulas to visualize the costs that are included in your monthly mortgage payment:

Monthly mortgage payment = Principal + Interest + Escrow Account Payment

Escrow account = Homeowners Insurance + Property Taxes + PMI

The lump sum due each month to your mortgage lender breaks down into several different items. Most homebuyers have an escrow account, which is the account your lender uses to pay your property tax bill and homeowners insurance. That means the bill you receive each month for your mortgage includes not only the principal and interest payment , but also homeowners insurance, property taxes, and, in some cases, private mortgage insurance and homeowners association fees. Heres a breakdown of these costs.

How A Mortgage Calculator Can Help

As you set your housing budget, determining your monthly house payment is crucial it will probably be your largest recurring expense. As you shop for a purchase loan or a refinance, Bankrate’s Mortgage Calculator allows you to estimate your mortgage payment. To study various scenarios, just change the details you enter into the calculator. The calculator can help you decide:

Recommended Reading: How Much Does Mortgage Protection Insurance Cost

Find Mortgage Deals With Our Best Buy Tool

- You can search and compare mortgage deals

- It only takes a couple of minutes and no personal details are required to search

- Once youve got your result, speak to a mortgage broker if you need advice

A mortgage may be:

- Fixed rate. This provides the peace of mind from predictable payments

- Variable. There are different versions of variable rate mortgages. These include tracker loans, standard variable rate loans and discounted rates.

The best deal may also depend on your personal circumstances and reasons for borrowing.

If you are self-employed or freelance, for example, the best mortgage may depend on how many years you can provide accounts, as different lenders have different requirements.

If you want help finding your way through the mortgage maze, you can always use a suitably qualified mortgage broker.

Find out more about the fifferent types of mortgage and which one is right for you here.

Calculate The Balance Remaining On Any Mortgage

This mortgage balance calculator will figure the remaining balance of your…show instructions

To use this calculator just enter the original mortgage principal, annual interest rate, term years, and the monthly payment. Then choose one of the three options for calculating the number of mortgage payments made to determine the remaining balance.

Note: this mortgage balance calculator is only for fixed rate mortgages where the terms are constant. Don’t use for any mortgage where the terms will vary over time .

You May Like: How Do Commercial Mortgages Work

Accelerate Your Mortgage Payment Plan

Get creative and find more ways to make additional payments on your mortgage loan. Making extra payments on the principal balance of your mortgage will help you pay off your mortgage debt faster and save thousands of dollars in interest. Use our free budgeting tool, EveryDollar, to see how extra mortgage payments fit into your budget.

A Slowing Economy Could Lead To Lower Mortgage Rates

The forecast reflects expectations of a slowing economy in 2023 as the Federal Reserve continues to increase its benchmark interest rate to combat high inflation.While the Fed has made progress reducing inflation from a year-over-year peak of 9.1% in June to 7.1% as of December it’s still nowhere near the Fed’s target rate of 2%. For that reason, Fed officials expect rate hikes to continue in early 2023, according to Bankrate.

While rate hikes can reduce inflation by making it more expensive to borrow money, they also discourage investment. This can shrink the economy, and perhaps trigger a recession in which many people lose their jobs.

And since mortgage interest rates are largely influenced by the overall state of the economy, they typically decrease during a recession.

“With the Fed maintaining an aggressive posture and inflation still high, mortgage rates will roller coaster up and down during the first half of the year before a more substantive slide takes hold in the back half of 2023,” says Greg McBride, chief financial analyst at Bankrate, who predicts a “notable pullback” on mortgage rates as inflation trends lower.

A drop in mortgage rates would be positive news for potential homebuyers, as it will reduce their monthly homeownership costs.

You May Like: What Should Your Credit Score Be For A Mortgage

How Much Can You Afford To Borrow

Lenders generally prefer borrowers that offer a significant deposit. They typically request at least 5% deposit based on the value of the property. If a house is valued at £180,000, a lender would expect a £9,000 deposit. In this example, the lender would be willing to offer a loan amount of £171,000. Meanwhile, some lenders may offer first-time buyers a 100% mortgage with a £0 deposit. However, obtaining this sort of deal usually forces a borrower to pay a much higher interest rate on their loan. This is usually one percent higher than a mortgage that requires a deposit. Consider this expensive trade-off before choosing a zero-deposit deal.

If you know the interest rate youll be charged on a loan, you can easily use the above calculator to estimate how much home you can afford. For example, at 2.29% APR on a £180,000 home loan, it will require £788.61 of full repayment per month, or £343.50 per month with an interest-only payment. If your maximum monthly budget for a home payment is £1,000 per month, you would then divide this amount by the above payments to get the equivalent loan capital. The example is shown in the table below.

Default Calculation

| £551,596 £524,016 = £27,580 | £240,272 £228,258 = £12,014 |

If you had £200 in other monthly home ownership related fees, then this might take a renter equivalent of £1,000 down to £800.

Whats The Fastest Way To Pay Off My Mortgage

The fastest way to hammer down your loan principal is with big lump-sum prepayments.

Barring that, opting for accelerated mortgage payments is the next best thing.

How do lump-sum payments affect my mortgage?

About 900,000 borrowers made a total of $23 billion in lump-sum mortgage prepayments in 2019, according to MPC.

A lump-sum mortgage payment is a one thats applied directly towards your mortgage principal. Depending on your lender, you may be allowed to prepay up to 5%, 10%, 15%, 20%, 25% or 30% of the original principal amount of your mortgage each year.

Even if you pay small amounts, the effect is magnified over time, reducing your interest expense every month until the mortgage is paid off.

Lump-sum prepayments also help increase your home equity faster. If necessary, that allows you to use your equity for further borrowing someday, such as adding a HELOC.

The average lump-sum prepayment in 2019 was $19,100, reports MPC.

Also Check: What Is The Lowest 30 Year Mortgage Rate In History

Can I Clear My Mortgage With Early Repayment

Paying off your mortgage early has the big advantages that you cut the total cost of your mortgage and own your own home sooner.

If your savings earn less interest than you pay on your mortgage, it makes financial sense to put that money towards your mortgage, while retaining some savings for emergencies.

However, do check your lenders rules about repayments, to avoid charges. Many lenders limit overpayments to up to 10% of the outstanding mortgage balance each year.

The disadvantage of mortgage early repayment is that you cant use the money for something else such as clearing more expensive debts, or ploughing into investments and pensions.

It can also be hard to get money out again, unless you go to the time, trouble and expense of remortgaging or selling the property.

If you are wondering whether you should pay off your mortgage early or invest the money instead check out our article here.

How Smartasset’s Mortgage Payment Calculator Works

The first step to determining what youll pay each month is providing background information about your prospective home and mortgage. There are three fields to fill in: home price, down payment and mortgage interest rate. In the dropdown box, choose your loan term. Dont worry if you dont have exact numbers to work with – use your best guess. The numbers can always be adjusted later.

For a more detailed monthly payment calculation, click the dropdown for Taxes, Insurance & HOA Fees. Here, you can fill out the home location, annual property taxes, annual homeowners insurance and monthly HOA or condo fees, if applicable.

Also Check: How Do Second Home Mortgages Work

Is There A Penalty For Paying Off My Mortgage Early

You may have to pay a prepayment penalty if you pay off your mortgage within the first few years of the life of the loan. That amount can be heftyoften as much as 2% of the mortgage amountenough to impact your calculations about early payoffs. The good news is that you can avoid the prepayment penalty by waiting until it no longer applies or, in some cases, talking directly with your lender about it.

Get Forbes Advisors ratings of the best mortgage lenders, advice on where to find the lowest mortgage or refinance rates, and other tips for buying and selling real estate.

Is There A Disadvantage To Paying Off A Mortgage

A: Paying your mortgage off early and closing out an account could impact your credit score. Mortgages are considered “good debt,” and paying it off extremely early could negatively affect your score. But, remember, you can alwaysrefinance to a shorter-termif you are determined to pay it off sooner. In addition, you could possibly get a lower interest rate in the process and be able to pay your loan off sooner.

Related Articles

Read Also: What Portion Of Your Income Should Be Mortgage

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

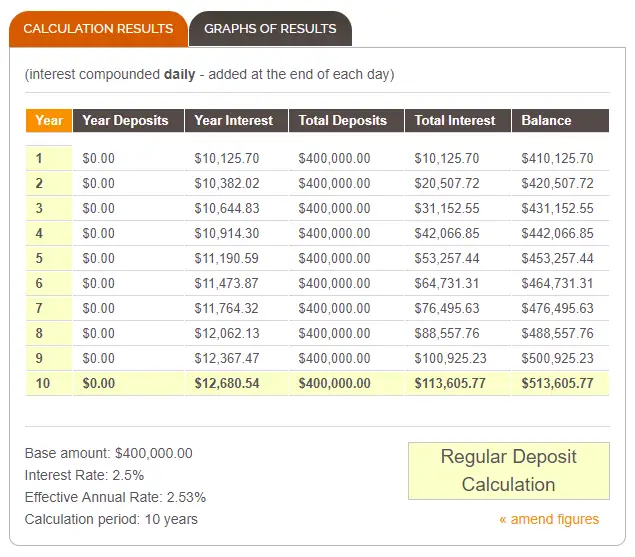

How Much Interest Am I Paying

While it may be tempting to only look at the monthly payment when searching for a loan, its important to calculate the total amount you are actually paying over the life of the loan. On average, the longer the loan term, the more you will pay in interest.

In the mortgage example above, over 30 years, the $300,000 mortgage will cost nearly $600,000 total, which nearly doubles the original cost of the loan. With the auto loan example, a $30,000 loan will end up costing nearly $35,000 after five years.

Understanding what you will pay in total for your loan can help you determine if your purchase is worth it. While buying a home that goes up in value long-term may be worth the interest paid, buying a new car that goes down in value may end up costing you even more in the long run.

Also Check: Are Current Mortgage Rates Good

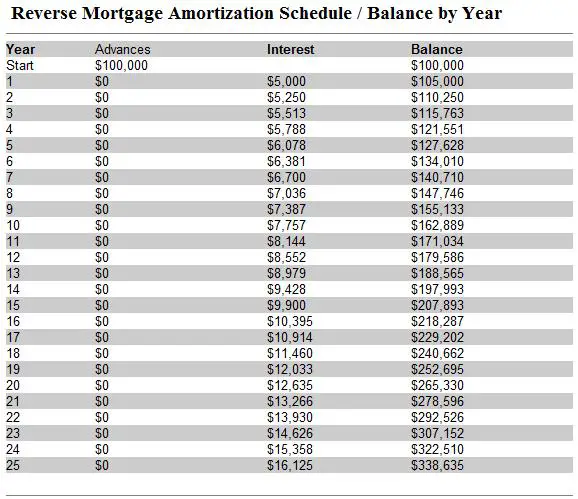

What Is An Amortization Schedule

Initially, most of your payment goes toward the interest rather than the principal. The loan amortization schedule will show as the term of your loan progresses, a larger share of your payment goes toward paying down the principal until the loan is paid in full at the end of your term.

A mortgage amortization schedule is a table that lists each regular payment on a mortgage over time. A portion of each payment is applied toward the principal balance and interest, and the mortgage loan amortization schedule details how much will go toward each component of your mortgage payment.