What Is The Minimum Down Payment On A House

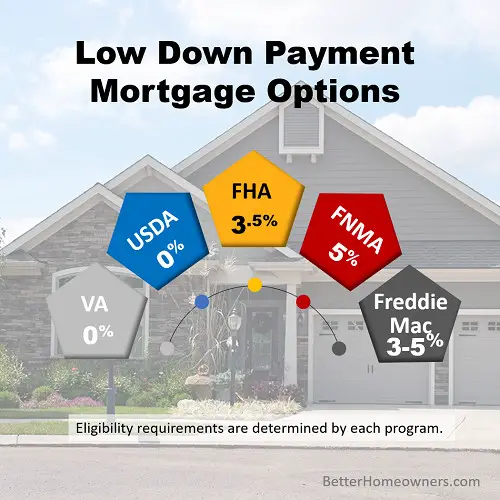

There is no law or rule for a universal minimum down payment, but the more you pay upfront, the lower your monthly mortgage payments, the lower the interest rate you will qualify for, and the less likely you will be to have to pay mortgage insurance or other fees. Generally, however, 3%-5% would be the absolute minimum, and only for certain borrowers.

Are There Any Downsides To Low

The most common difference in lower down payment loan options is that mortgage insurance is included in the payment this is not necessarily a bad thing, just something that needs to be planned and budgeted for. MI offers the lender some protection against loss in the event you default on the loan, but the good news is you can cancel the MI once you reach 20% equity in your home.

Homeready And Home Possible Loans From Fannie Mae And Freddie Mac

You may also want to consider a HomeReady® mortgage from Fannie Mae or a Home Possible® loan from Freddie Mac if you have a low-to-moderate income compared to others in your area without regard to whether youre a first-time home buyer. Both loans allow you to buy a home with a 3% down payment and lower mortgage insurance options. You cant earn more than 80% of the median income in your area to qualify. Unlike USDA loans, this stipulation only applies to the parties on the loan, not your entire household.

Read Also: Does Prequalifying For A Mortgage Hurt Your Credit

Do You Need To Put 20% Down On A House

You may have heard that you need to make a 20% down payment on a home, but that’s really just the threshold many lenders use for requiring mortgage insurance on a conventional loan. You don’t have to make a 20% down payment to buy a house.

In 2021, the typical down payment for first-time home buyers was 7%, according to the National Association of Realtors. The typical down payment was 17% for repeat buyers.

Making a lower down payment can get you to your goal of homeownership more quickly. However, a higher down payment brings down the principal , which might cost you less overall. Weigh the pros and cons to decide whats best for you.

» MORE: What’s the typical down payment on a house?

Fannie Mae Homeready Loans

Many mortgage lenders offer the Fannie Mae HomeReady mortgage. This mortgage is backed by Fannie May, a government-sponsored enterprise .

If you apply for a HomeReady loan, you will be required to pay only a 3% down payment. This amount is typically afforded by many home buyers and is much lower than other types of conventional loans.

Recommended Reading: What Is A Fixed Mortgage Rate For 30 Years

Benefits Of Putting 20% Down

While saving up enough money for a 20% down payment may not be necessary, there are benefits. A 20% down payment means youâll have a smaller monthly mortgage to pay . Plus, youâll usually get a better interest rate because a larger down payment is a sign that youâre financially stable and a good credit risk.

Another cost savings: not being required to pay for private mortgage insurance on conventional loans. PMI is insurance that a lender might require you to purchase for a conventional loan if your down payment is less than 20% because you would be considered a higher-risk borrower. This is an extra monthly expense you’ll need to pay along with your mortgage payment, and it typically costs between 0.5% and 1% of the mortgage amount each year but may run higher. Keep in mind, FHA and USDA loans require a monthly mortgage insurance premium and this will be required even if you put 20% or more down.

What Is A Usda Loan

A USDA loan is a mortgage that is either issued or guaranteed by the United States Department of Agriculture. Also known as Section 502 or 504 loans, these programs are specifically reserved for people with low or moderate incomes looking to buy in designated rural parts of the country.

According to the Housing Assistance Council, 97% of U.S. land is located within USDA loaneligible boundaries, where about one-third of all Americans currently reside.

However, relatively few people take advantage of these loans, with the USDA estimating that only 99,000 borrowers have these mortgages currently. Many may presume these loans are relegated only to extremely remote areas such as farmland, when the reality is that USDA mortgages are surprisingly versatile. They can be used to purchase townhouses as well as single-family homes, fund new construction, or renovate an existing home.

USDA home loans are a fantastic option for qualified homebuyers and arent limited to rural properties like farms, says Tan Tunador, a senior loan officer with Atlantic Coast Mortgage in Loudon County, VA.

Also Check: What Is Current Mortgage Refinance Rate

% Down Reduces Your Mortgage Payment

The more money you pay upfront, the less you have to borrow from the lender, and the lower your monthly payment will be.

Example: Lets say you buy a $300,000 home at a fixed rate of 4.25%. The following payment scenarios exclude additional fees and costs such as taxes and insurance.

- With a 20% down payment , youd borrow $240,000, and your monthly payment would be $1,548.

- With a 5% down payment , youd borrow $285,000, and your monthly payment would be $1,950.

What Is The Average Down Payment On A House

The typical down payment on a mortgaged home in 2021 was 10-19% of the purchase price of the home. While 20% is the traditional down payment amount, 59% of buyers put down less than 20%, according to theZillow Group Consumer Housing Trends Report 2021.

Heres a breakdown of down payment percentages from buyers who reported purchasing a homes with a mortgage in 2021:

- 18% of buyers have a down payment of more than 20%

- 20% of buyers have a down payment of 20%

- 24% of buyers have a down payment of 10-19%

- 13% of buyers have a down payment of 6-9%

- 12% of buyers have a down payment of 3-5%

- 10% of buyers have a down payment of less than 3%

- 4% of buyers dont remember the size of their down payment

Younger buyers are more likely to purchase a home with less than 20% down. Sixty-three percent of Gen Z and Millennial buyers make a down payment of less than 20%. And 64% of Gen Xers do the same. Far fewer Boomers and Silent Generation buyers put down less than 20% down, just 41%.

Read Also: How Much Will Lenders Give For Mortgage

Faqs About Low Down Payments

Q: What is the minimum down payment to pay for a mortgage?A: That depends on what type of loan you are looking for. Some loans, like a USDA or VA loan, can have no minimum down payment. Other low down mortgage options can be as low as 3% down.

Q: How do I know if I need mortgage insurance?A: It depends on the insurance program. Typically, FHA and conventional loans under 20% of the property value will require mortgage insurance. Your mortgage professional can tell you if you need mortgage insurance.

Q: How much does mortgage insurance cost?A: Your mortgage insurance cost will depend on factors such as loan and down payment amount, credit score and type of mortgage. With these factors in mind, the average mortgage insurance rate costs between .58% and 1.86% of the loan.

Q: Who should take out a low down payment mortgage?A: Low down payment mortgages are popular among first time homebuyers and homebuyers who dont want to put a 20% down payment on a property.

At Blue Water Mortgage, weve got your back, even if youre concerned about your credit score.

Our team of experienced mortgage professionals has helped numerous clients secure the low down payment loan they need. Contact us today to find out how we can help you.

How To Find A Mortgage For Low Down Payment

There are a variety of low-down-payment mortgages available that require few requirements for one to qualify to be offered the facility. Some of the requirements that one has to have in order to qualify for the mortgage are a minimum credit score, homeownership education for first-time buyers, should not own another property at the time of purchase and other mortgage facilities exclude student loan debt from payment ratio.

Mortgages for low down payments enable the buyer to use their money elsewhere where it might attract bigger returns or pay other debts and increase ones savings in the long run. It is important to note that just because the mortgage attracts a low down payment, does not necessarily mean that the decision is wise. You may end up paying a higher interest rate over the period of the loan and be charged other extra fees, pay private mortgage insurance and have less equity upfront thus being unable to access home equity loans when in need of credit. It also increases ones chance of being underwater in their own home in the event that the market crashes.

Another important thing to consider will be the monthly payments to pay back your mortgage. As these may determine too how much down payment you can afford at the time of purchasing.

Recommended Reading: What Are Current Mortgage Rates In Nc

Minimum Down Payment Requirements

The minimum down payment required for a house varies depending on the type of mortgage you’re planning to apply for:

-

0% down payment mortgages. Guaranteed by the U.S. Department of Veterans Affairs, VA loans usually do not require a down payment. VA loans are for current and veteran military service members and eligible surviving spouses. USDA loans, backed by the U.S. Department of Agriculture’s Rural Development program, also have no down payment requirement. USDA loans are for rural and suburban home buyers who meet the program’s income limits and other requirements.

-

As low as 3% down payment mortgages. Some conventional mortgages, such as HomeReady and Home Possible, require as little as 3% down. Conventional loans are not backed by the government, but they follow the down payment guidelines set by the government-sponsored enterprises or GSEs Fannie Mae and Freddie Mac.

-

As low as 3.5% down payment mortgages. FHA loans, which are backed by the Federal Housing Administration, require as little as 3.5% down if you have a credit score that’s at least 580. If you have a credit score that’s between 500 and 579, FHA loans require a 10% down payment.

-

As low as 10% down payment mortgages. Jumbo loans are home loans that fall outside of the Federal Housing Finance Agency’s conforming loan limits. Because these outsized loans can’t be guaranteed by the GSEs, lenders tend to ask for higher down payments in order to offset some of the risk.

Low Down Payments With An Fha Loan

The FHA loan is a popular program with first time homebuyers. It is also available to homebuyers who have experienced bankruptcy or foreclosure. The down payment can be as low as 3.5% with a FICO® score of at least 580. With a score less than 580, a 10% down payment will be required.

Requirements of the FHA loan program include but arent limited to:

- MIP is required.

- Debt-to-Income Ratio must be less than 43%.

- The home must be the borrowers primary residence.

Don’t Miss: How Much Do You Pay For Mortgage Per Month

Freddie Macs Homeone Loan

Freddie Macs HomeOne loan is equivalent to Fannie Maes Standard 97 mortgage. It has no income restrictions, and at least one borrower must be a first-time homebuyer, defined as someone who hasnt owned a home in the last three years.

The first-time homebuyer requirement doesnt apply if youre refinancing, of course. But the loan youre refinancing must be owned by Freddie Mac.

As with HomePossible, this loan program doesnt have a minimum credit score requirement or maximum DTI, but your overall financial profile must be accepted by Freddie Macs underwriting system.

You can use a HomeOne loan to finance a single-unit property, like a house or condo. The minimum down payment is 3%, but you can get down payment assistance as a gift, grant or Affordable Seconds loan, which is similar to Fannie Maes Community Seconds.

You must get a fixed-rate mortgage ARMs are not allowed. You will need to carry PMI until you have 20% equity.

How To Get A Low Down

If youve been longing to buy your first home, it might be the right time to make a move as mortgage rates are among the lowest ever.

Yet you might think you cant afford the down payment or closing costs. After all, many people believe you need 20% to buy a house. While that amount is preferable, there are many programs offering financial assistance to first-time buyers and mortgages requiring as little as 3% down.

Also Check: How Much House Can I Afford Based On Mortgage Payment

Conventional 97 Loans: 3% Down

A Conventional 97 loan allows you to put 3% down on a conventional mortgage. You need a credit score of at least 620 to qualify, since Conventional 97 loans conform to Fannie Maes underwriting rules.

As with many other low-down payment mortgage loans, the downside is that you must pay private mortgage insurance if you put less than 20% down on a conventional home loan. On average, PMI ranges from 0.58% to 1.86% of your loan amount per year, depending on your credit score and the size of your mortgage. But you can stop paying PMI once your loan balance reaches 80% of the appraised value of your home.

Check your home buying eligibility. Start here

Get A More Accurate Estimate

Get pre-qualified by a lender to see an even more accurate estimate of your monthly mortgage payment.

-

How much house can you afford? Use our affordability calculator to estimate what you can comfortably spend on your new home.

- Pig

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you’re in the right range.

- Award Ribbon VA mortgage calculator

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

Recommended Reading: What Type Of Credit Is A Mortgage

What Is A Down Payment

A down payment is the amount of money you spend upfront to purchase a home and is typically combined with a home loan to fulfill the total purchase price of a home. In addition your down payment amount, your credit score, credit history, total debt and annual income will influence how much of a loan you can qualify for.

A great tool to see how much you can afford based upon your down payment and annual income is our affordability calculator. It will also take into account your monthly debts, the interest rate on your debt, your loan term, and many other settings that you can personalize to give you a more accurate result on a home price.

Down Payments For Investment Property Loans

If you dont plan to live in your investment property, expect to put down 15-25% on an investment property loan.

Lenders see investment properties as a riskier venture, as you are more likely to default on a property you do not live in. As with traditional mortgages, there are a few different types of investment property mortgages you should familiarize yourself with. If you go with a conventional mortgage, you will need high income, excellent credit, and seasoned cash reserves for the down payment.

With a portfolio loan, you will need to put down at least 20%. However, most portfolio lenders allow you to borrow the down payment, unlike conventional mortgage lenders. That means you can use business credit lines and cards like Fund & Grow helps you secure, to draw on and cover the down payment.

Income matters less, while the quality of your deal matters more. Portfolio lenders scrutinize the profit margins on your deal, and look less at your income or the source of your down payment. In fact, many portfolio lenders like Visio and LendingOne dont require any income documentation whatsoever.

Portfolio lenders underwrite your loan in the context of your likelihood to make money on the property, rather than traditional mortgage qualifications.

You May Like: How Much Do Mortgage Underwriters Make

Down Payment For Rental Property Requirements

A down payment between 15 and 25 percent of the purchase price will typically be required for a rental property. The amount will vary based on the type of financing being used for the investment. When it comes to traditional financing, many investors assume they need to put 20 percent down however, this rule is actually for homebuyers hoping to avoid private mortgage insurance. If investors opt for traditional lenders when purchasing a rental property, several financial requirements will determine the expected down payment.

Investors who work with a private money lender or nontraditional financing method, on the other hand, will encounter more flexible loan requirements. These lenders will set the loan terms with the borrower in mind, potentially leaving room for smaller down payment requirements. Therefore, investors should research financing methods to get an idea of the minimum down payment they will need and start there.