How Is A Hecm Purchase Amount Calculated

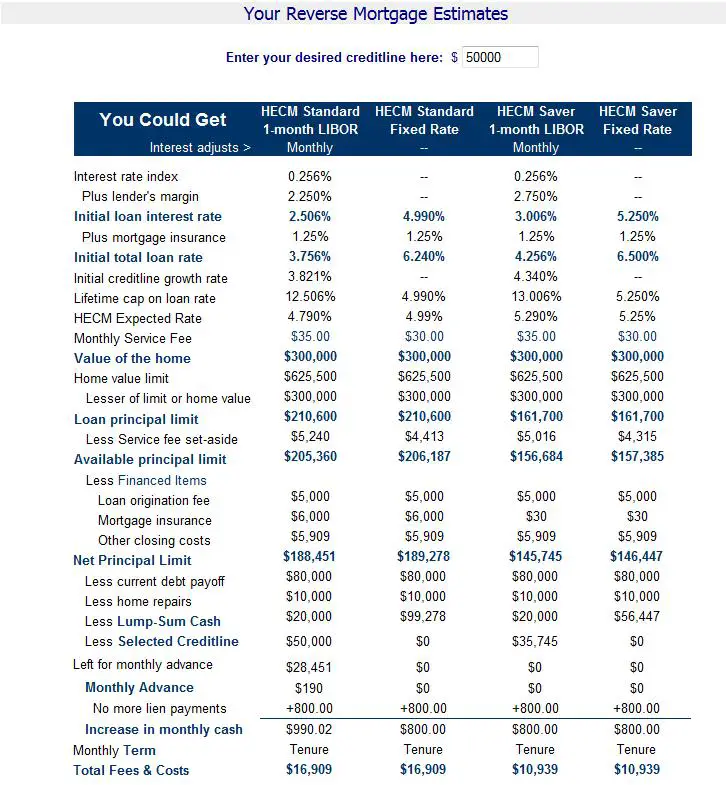

You and your seller determine the purchase price of the property you wish to buy. Your age, the interest rates, the property value or purchase price and the HUD maximum limit all go into the calculator to determine the benefit amount or Principal Limit for your transaction. The lender you choose actually closes and provides the funding for the loan however the loan does not work without the HUD/FHA insurance so the lender must be certain to adhere to the HUD guidelines and requirements. Every lender uses the HUD reverse mortgage calculator to determine the benefit or loan amount based on your circumstances.

What Is A Reverse Mortgage

Taking a reverse mortgage is a popular financial strategy that helps generate more income during retirement. While people might find it confusing, this is not at all a second mortgage which requires monthly payments. Instead, a reverse mortgage is the opposite of a traditional mortgage: It usually comes in a line of credit paid to you by a lender. The total amount is based on the equity of your home and your life expectancy. It allows you to withdraw a portion of your home equity and convert it into cash. But just like a regular mortgage, it uses your home as collateral.

With a reverse mortgage, borrowers get paid for their home without having to sell and move out of their property. You can withdraw from the credit line as needed, and you dont have to pay it immediately. Think of it as a bank pre-paying you for your property before you actually move out. You dont need to make monthly mortgage payments. But of course, you eventually have to pay it back.

You only need to repay the reverse mortgage when:

- You sell your home.

- When the home is sold after you die.

Important Note: Be sure to maintain the property, pay real estate taxes, and homeowners insurance. Failing to do so means your lender will require you to pay back the loan. If you cannot pay it back, you risk losing your home to foreclosure.

HECM Payouts & a Younger Spouse

- Living expenses

- Assisting your child with college

- To buy another home that meets your needs as you age

What Is A Reverse Mortgage To Purchase

A reverse mortgage to purchase is when you use a reverse mortgage instead of a traditional or forward mortgage to purchase a property. It allows borrowers to purchase a home with a loan program that does not require the borrower to make monthly mortgage payments on the loan. Borrowers are still responsible for their maintenance on the property, the timely payment of their taxes, insurance and any property charges .

Don’t Miss: Why Are Mortgage Rates Lower Than Prime

Add A Free Reverse Mortgage Calculator Widget To Your Site

You can get a free online reverse mortgage calculator for your website and you don’t even have to download the reverse mortgage calculator – you can just copy and paste! The reverse mortgage calculator exactly as you see it above is 100% free for you to use. If you want to customize the colors, size, and more to better fit your site, then pricing starts at just $29.99 for a one time purchase. Click the “Customize” button above to learn more!

Reverse Mortgage For Home Purchase

In 2009, HUD announced the availability of the reverse mortgage loan for purchase transactions. Prior to this announcement, the reverse mortgage was used solely to refinance existing homes. With the advent of the purchase reverse mortgage, borrowers age 62 and over* can use the loan to purchase a new home as well as just pay off an existing lien or extract equity from a property they already own.

*Borrowers must be age 62 and over to qualify for a reverse mortgage however, eligible younger spouses of homeowners can also benefit from a purchase reverse mortgage.

A younger spouse who also lives in the home and is on title and agrees to the terms of the reverse mortgage is not a borrower on the loan but is known as an eligible non-borrowing spouse and can also live in the property for life without making a monthly payment on the loan even if something happens to the borrowing spouse.

With a purchase reverse mortgage, borrowers use 100% of their eligible loan amount from the start of the loan to purchase the property. So, unlike the line of credit option on a refinance transaction where a non-borrowing spouse may not have access to remaining funds if something happens to the borrowing spouse before the line of credit is exhausted, the entire available line is used from the start.

Don’t Miss: What Are The Qualifications For A Reverse Mortgage

Understanding Reverse Mortgage Calculators

Before you try a reverse mortgage calculator to estimate your reverse mortgage loan amount, lets review how the calculation works.

There are two types of Reverse Mortgages:

Each of these programs will yield different amounts of money.

Your reverse mortgage lender will determine your actual loan amount by using:

- Available reverse mortgage loan program terms

- The value of your home

- Prevailing interest rates

- The amount of any outstanding loans against your house

- Your age and the age of all other titleholders

Using this information, the lender will indicate what percent of your home value can be borrowed. A reverse mortgage calculator can only approximate these values.

Because HECM Reverse Mortgages are Federally insured, there is a maximum property value that can be mortgaged. As of 2022, the limit on HECM Reverse Mortgages is $970,800.

This means that even if your home is worth more, the amount that you qualify for will be a percent of the maximum amount. Most reverse mortgage calculators can only provide information on the HECM reverse mortgage.

Proprietary jumbo loan options do not use this limit, and they often have very different fee structures. As such, most reverse mortgage calculators do not account for these available options and you need to speak to a lender to get quotes.

Use A Reverse Mortgage Calculator Or Talk With A Lender About Your Reverse Mortgage Calculations

A reverse mortgage lender is a great resource to get an accurate reverse mortgage calculations. They can help you design a program to meet your unique needs.

For an official estimate, contact a reverse mortgage lender by completing our information request form. Still have questions about the reverse mortgage calculations? Call us at 866-759-2559.

Also Check: How To Fill Out A Pre Approval For Mortgage

How Is A Reverse Mortgage Calculated

Seniors considering a reverse mortgage often ask How much money can I get from a reverse mortgage? or How much can I borrow? The amount a borrower can receive from a reverse mortgage, also referred to as a Home Equity Conversion Mortgage , varies. With a HECM, borrowers cannot cash out on 100 percent of their home equity. Instead, the maximum funds available is calculated by using the following:

Age of the youngest borrower on title or eligible non-borrowing spouse1 The lesser of the appraised value of your home, sales price, or the Federal Housing Administration lending limit Current interest rates Balance of your existing mortgage, if applicable, and other financial obligations

An example of how a reverse mortgage is calculated2Michael is 68 and his wife Lisa is 65. Their home was recently appraised at $300,000, and they have an existing mortgage balance of $70,000. They are looking to retire but, are concerned that they do not have enough cash flow or overall savings to do so. Their friend has a reverse mortgage and is satisfied with the product. After hearing about her experience, they decide to reach out to a lender to research their options.

To calculate how much you may be eligible to receive from a reverse mortgage, try our reverse mortgage calculator above or call 1 976-6211 to talk to a licensed loan advisor.

Important Disclosures

Prepare For Closing Costs And Other Fees

Just like a traditional mortgage, you must be ready to cover the closing costs for a reverse mortgage. Generally, taking a reverse mortgage is more expensive than other types of home loans. Take note of the following upfront costs:

- Origination fees Lenders cannot charge over $2,500 of the first $200,000 of the homes value plus 1% of the amount over $200,000. As a rule, HECM total origination fees are capped at $6,000. The cap is written in the law to keep closing costs accessible to borrowers.

- Real estate closing costs These are third party closing costs that covers necessary processing fees. It includes home appraisal, inspection, surveys, title search and insurance, recording fees, mortgage taxes, and credit background checks.

- Initial mortgage insurance premium Lenders charge an initial and annual MIP which is paid to the FHA. The initial MIP costs 2% of the loan. MIP is different from homeowners insurance costs that protect you from property damage and loss. This is meant to guarantee you receive your expected loan advances.

Can I Finance the Closing Costs?

For borrowers who do not want to pay out of pocket, you can cover the HECM upfront costs by financing them into your loan. This means the proceeds on your reverse mortgage will pay for the closing costs. But beware. Financing closing costs reduces the loan amount, which makes your payout smaller. Think of this before deciding to finance closing expenses.

Read Also: How Do You Apply For A Mortgage

What Are The Different Types Of Reverse Mortgages

HECM Reverse Mortgages

The most common reverse mortgage is a Home Equity Conversion Mortgage , the only reverse mortgage insured by the Federal Housing Administration . Available to homeowners age 62 and older, it allows the borrower to convert a portion of their home equity into cash or a growing line of credit and defer repayment of the loan balance until a later date. So long as the borrower lives in the home and pays the property-related taxes, insurance, and upkeep expenses, the borrower can continue to defer repayment of the loan balance.

The HECM loan balance usually becomes due and payable when the last surviving borrower permanently leaves the home. Since a HECM is a non-recourse loan, when the loan matures and is due and payable, the FHA guarantees that neither the borrower nor their heirs will owe more than the home is worth at the time it is sold.

Note: You can use our free reverse mortgage calculator to see what you may qualify for. No personal information is required to see what you may qualify for.

Proprietary Reverse Mortgages

Over the last several years, there has been a rise in investor-owned reverse mortgage products. These are called private or proprietary reverse mortgages. There are a few proprietary products out there, and they tend to be similar to a HECM in many ways. Here are some situations where a proprietary reverse mortgage may be a better fit for a borrower as compared to a HECM:

Reverse Mortgage Payment Options

Depending on your situation, you may have some options for how to receive your RM proceeds. A reverse mortgage lender could help you design a program to meet your unique needs.

For an official estimate, contact a reverse mortgage lender by completing our information request form.

Options for accessing your home equity might include:1. Payoff Your Existing MortgageAs stated above, if you owe anything on your home, a reverse mortgage must be used to pay off your existing mortgage. This is a key benefit since it eliminates your traditional monthly mortgage payments.

2. CashThe HECM Fixed Rate reverse mortgage enables eligible homeowners to take out some cash. This can be done in a lump sum, from their home equity. This cash can be used for ANY purpose.

Although you dont make a monthly payment, interest charges accrue on the total loan amount. This occurs every month you carry the reverse mortgage. As a result, the total size of your loan will increase over time. Though the total amount owed can never exceed the value of your home.

This is an important factor as some people are thinking along the lines of, Well I would never want to leave my children in debt.

When a person inherits a home that has a reverse mortgage on it, there is no financial obligation on that person to do anything at all with the home.

If there is little to no benefit in selling the house based on what is owed, they can simply remove any of your personal belongings they want and walk away.

Recommended Reading: Where Can I Find My Mortgage Account Number

How We Came Up With This Reverse Mortgage Calculator

Reverse mortgage amounts can be difficult to estimate because a reverse mortgage itself works in a fundamentally different way from traditional mortgages. One of the complications is what you intend to do with the funds you get from the loan.

For example, with a traditional mortgage, you can do a cash-out refinance for a very specific loan amount. But with a reverse mortgage, you may also want to receive monthly payments in lieu of cash out.

We came up with this reverse mortgage calculator by starting with your maximum eligibility. Thats the loan-to-value ratio of 80%. In the example above, that eligibility came to $240,000. That will be the amount of the new reverse mortgage. However, any current mortgage indebtedness you have on the property will also be paid out of the proceeds of the reverse mortgage.

That will reduce the amount of equity youll receive from the reverse mortgage, which was why its important to answer the question, how much can you borrow? More specifically, the number youll see in the calculator wont be the actual amount of equity youll get from the loan. And even though the total loan amount will be $240,000, the most important question with a reverse mortgage is how much equity youll walk away with.

Thats the ultimate number the reverse mortgage calculator works to provide.

A Reverse Mortgage Calculator Example

Assume you are 65 and own a $300,000 home with $50,000 left to pay off on an existing mortgage. You might qualify for a reverse mortgage loan of around $120,000 .

Yet, that does not mean that you immediately get access to $120,000.

The reverse mortgage company will first cut a check to your current mortgage holder. This will pay off your existing mortgage. This happens first and foremost so you do not have the option to bypass that to access the full $120,000.

This will give you the HUGE benefit of eliminating your monthly mortgage payments. Which in turn improves your monthly cash flow.

Bear in mind that property taxes and homeowners insurance are still your responsibility.

Also Check: Who Do I Pay My Mortgage To

What Are The Different Types Of Loan Payout Options

While you can choose how you want the loan amount to be paid out when youre approved for a reverse mortgage when youre wondering how to calculate a reverse mortgage dont overlook your payout method. Your payout method will contribute to how much you can get from a reverse mortgage in the end.

From a glance, getting paid out in one lump sum instead of monthly payments may seem to not make a difference. But, it can affect the principal amount of your loan. Receiving your entire reverse mortgage in one lump sum payment may mean youre giving up some money in the future. When you choose a fixed monthly payment or a line of credit, you have the ability to receive a payout if the value of your home increases over time. However, when you receive one lump sum at the beginning, the opportunity for receiving a higher payout is usually taken off of the table.

Reverse Mortgage Rates For Seniors

A reverse mortgage loan is a great option for pensioners and retirees that typically have a lot of their wealth tied up in assets. Starting from the age of 60, these loans allow seniors to convert the equity they have built up in their homes to cash that they can use as they wish. The other benefit is that unlike a traditional loan, in a lot of cases borrowers do not have to have a making an income at the time of application and the loan is typically only paid back when the borrower sells, moves out or passes away.

You May Like: Is A Home Equity Line Of Credit Considered A Mortgage

How Reverse Mortgages Are Repaid After Death

Ultimately, reverse mortgages are repaid through the sale of a home. Once the property goes into the market after your death, your estate receives the money when its sold. This money must then be used to pay off the reverse mortgage. Since interest accrues over the life of the loan, the amount needed to pay off a reverse mortgage will likely be more than the original loan proceeds.

Once the full loan amount is due, the loan balance may be higher than the homes value. But if your home appreciates and if you kept a low balance, the proceeds from the homes sale may be enough to cover the reverse mortgage. If this is not enough, your estate may use other assets to allow your heirs to pay off the remaining balance. However, if they want to keep the house, they must pay the reverse mortgage. If they do not have enough funds, they need to qualify for refinancing to take out a new mortgage and pay off the loan.

Note that many reverse mortgages do not allow the loan balance to surpass the home equitys value. Then again, depending on market fluctuations, your home might still have less equity than when you first took the loan.

The following sections list common scenarios after the borrowers death:

Differences Between Conventional Loans And Reverse Mortgages

Conventional mortgages or lines of credit can give you access to a higher percentage of the homes value. But there are two MAJOR trade-offs between a conventional loan vs. a Reverse Mortgage.

1. No Monthly PaymentsA reverse mortgage does not require you to make monthly payments toward the loan. But a conventional loan most certainly would.

Now, for those people who are concerned with maintaining equity in their homes, not to worry. Not being obligated to make monthly mortgage payments is not the same as saying that you cant.

If youre interested in trying to keep the interest down and the equity up, you CAN make a payment toward a Reverse Mortgage. You can pay as much as you want to pay, whenever you want to pay it. There is no penalty for paying down a RM.

There are a couple of things you ARE obligated to do. But they are things that you are most likely doing already anyway.

2. The Term of the LoanThe other major difference between a reverse mortgage and other types of home loans is the term. As long as you continue to live in your home, keep up with the taxes, insurance, and maintenance, the loan will not become due. The loan will become due once you have left this property for good.

Read Also: How 10 Year Treasury Affect Mortgage Rates