How Do I Get A Mortgage

There are four basic steps to getting a mortgage

North Carolina Arm Loan Rates

An adjustable-rate mortgage typically offers a lower initial interest rate than a fixed-rate mortgage. That rate is available for one, three, five, seven or 10 years . When that initial period ends the rate can increase or decrease once per year. The rate usually increases.

One plus of an adjustable-rate mortgage is that the interest rate cant suddenly jump to a level that is extremely high. The interest rate is capped at a certain amount, specified in the loans terms, protecting you from that scenario. Before deciding on an ARM, though, you should weigh the potential maximum interest rate carefully to see if its one that you can afford to pay or not.

The average rate for a 5/1 ARM in North Carolina is 2.75% .

Top 5 Bankrate Mortgage Lenders In North Carolina

- Fairway Independent Mortgage Corporation

- Cardinal Financial

Methodology

Bankrate helps thousands of borrowers find mortgage and refinance lenders every day. To determine the top mortgage lenders, we analyzed proprietary data across more than 150 lenders to assess which on our platform received the most inquiries within a three-month period. We then assigned superlatives based on factors such as fees, products offered, convenience and other criteria. These top lenders are updated regularly.

Read Also: What Does Arm Mean In Mortgages

How To Use Our Mortgage Rate Tool

You need six pieces of information to start comparing rates:

North Carolina Mortgage Rates

| Mortgage Calculator/Mortgage Rates/North Carolina Mortgage Rates |

| NMLS: 424182 |

|

| Data provided by Icanbuy, LLC. Payments do not include amounts for taxes and insurance premiums. Click here for more information on rates and product details. |

Don’t Miss: Does Having A Mortgage Help Your Credit

North Carolina State Mortgage Resources And Intricacies

There are plenty of great resources available for people who are looking to buy a home in the state of North Carolina. Two websites to consider visiting are the state HUD website for homeowners assistance programs and the states first-time homebuyer help website. By using these websites and reaching out to licensed mortgage brokers and realtors, you can get all the information you need to get through the application process, refinancing or mortgage process in North Carolina.

Its also important to note that property taxes in the state of North Carolina ranked 36th in the country with an effective property tax rate of 0.78%.

Refinancing Your Mortgage In North Carolina

Mortgage refinance rates are at all-time lows right now, so it could be a good idea to switch your current mortgage for one with a better interest rate especially if the new rate would be significantly lower.

You may decide to refinance with the same lender that gave you your initial mortgage, but it’s not always the best idea. A different lender may offer you a better deal the second time around. Shop around for a company that will offer the best interest rate and charge relatively low fees.

Recommended Reading: What Does A Mortgage Loan Officer Do

How Does Your Credit Score Affect Your Rate

Your credit score measures your likelihood of making continuous, on-time mortgage payments. Homebuyers with higher credit scores seem less risky to lenders. So, in general, the higher your credit score, the lower your mortgage rate. But other factors such as your personal debt, down payment size, and loan program also influence your rate.

How Do I Get The Lowest Mortgage Rates

There are six steps you can take get the lowest rate:

Read Also: How To Make Extra Payments On Mortgage

What Are The Mortgage Rate Trends In 2022

The current macroeconomic environment makes it very likely that the average 30-year, fixed-rate mortgage will end the year above 7%, Channel says. Consumers looking for signs that inflation is cooling off, should start by keeping track of grocery and fuel bills, Channel adds. If those monthly expenses stop going up, it could mean inflationary pressure is finally leveling off.

North Carolina Mortgage Taxes

North Carolina, like most states, charges real estate transfer taxes. That tax is $1 per $500, or 0.20%. Certain areas may also increase that tax up to 0.4%. In North Carolina, the seller typically pays this fee.

Another perk of being a homeowner is that you can deduct the mortgage interest that you pay throughout the year from your taxable income when you are filing your federal income taxes. This deduction also applies for North Carolina state income taxes, as the states rules are similar to the federal guidelines for itemized deductions.

You May Like: How Many Times Annual Salary For Mortgage

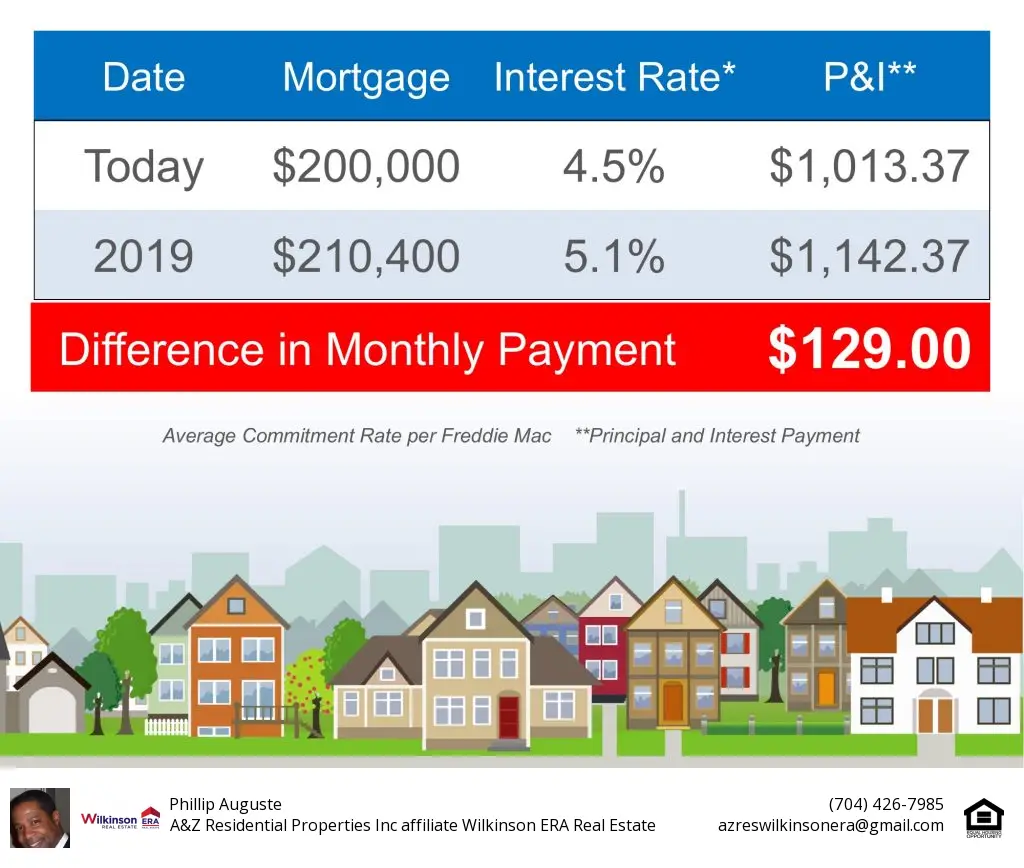

Why Does My Mortgage Interest Rate Matter

Your mortgage interest rate impacts the amount youll pay monthly as well as the total interest costs youll pay over the life of your loan. While it may not seem like a lot, a lower interest rate even by half of a percent can add up to significant savings for you.

For example, say a borrower with a good credit score and a 20 percent down payment takes out a 30-year fixed-rate loan for $300,000. In this case, an interest rate of 4.75% instead of 5.25% translates to more than $90 per month in savings in the first five years, thats a savings of $5,500.

Its equally important to look at the total interest cost of your loan. In the same scenario, a half percent decrease in interest rate means a savings of almost $33,000 in total interest owed over the life of the loan.

North Carolina Fha Loans

If you have a lowercredit score, try the FHA loan. You need just a 580 credit score and a 3.5percent down payment. FHA loans have high debt to income ratio allowances of 45- 50 percent. You can use gift funds for FHA down payments but may have to contributesome of your own money if you have a 500 â 579 credit score. Lenders require a10 percent down payment and 3.5 percent of the funds must be yours.

Don’t Miss: When Can Mortgage Insurance Be Removed From An Fha Loan

North Carolina State Mortgage Rate Trends

Mortgage and refinance rates in North Carolina have been steadily dropping since late 2018 and early 2019. Rates briefly spiked as they did across the country just before the start of that downward trend. The spike was not as pronounced as it was in some other states, though.

As a benchmark, interest rates in May 2018 were about 4.25% for 30-year fixed-rate loans. During the late 2018 spike, those interest rates climbed near the 4.8% mark before dropping to where they are now, which is about 3.50% currently. Interest rates on 5/1 and 7/1 adjustable-rate mortgages followed suit, but started and ended lower. In May of 2018, rates on these lending products were around the 4% mark, and now both sit around 3%.

North Carolina Va Loans

Veterans can get 100percent financing from a North Carolina VA lender. You’ll need a 620 credit scoreand to prove you can afford the new mortgage plus your existing debts and thecost of living. VA loans don’t require money down. They also don’t charge mortgageinsurance. Veterans pay an upfront funding fee, but it’s low.

You May Like: What Is The Payment On A 160 000 Mortgage

Refinancing In North Carolina

North Carolina has quite a few protections for borrowers when they buy a house or refinance. However, its still a good idea to remain wary of deals that seem too good to be true.

In North Carolina like in other states homeowners generally refinance with one of two goals in mind: a rate-and-term refinance or cash-out refinance.

A rate-and-term refinance gives you the opportunity to achieve all or any of the following:

- Get a lower mortgage rate

- Reduce your monthly payment

- Switch from an adjustable-rate mortgage to a fixed-rate one or the other way around

- Get a longer or shorter loan term

However, you cant take any cash out with one of these.

With a cash-out refinance, you may still benefit from some of those bullet points. But the main goal is to take out some of the equity youve built up in your home as a cash lump sum. Equity is simply the amount by which the current market value of your home exceeds your mortgage balance.

Both forms of refinance are common in North Carolina, and there arent any specific rules homeowners need to be aware of when they go either route.

Find A Bank Of America Lending Specialist In Your City

At Bank of America, we know there are many North Carolina mortgage loan officers to choose from. Thats why its important to do your homework and find the one that best meets your needs. Our North Carolina home loan offices and lending specialists provide tailored guidance for your unique situation, and online resources and mortgage calculators and mortgage rate information that help clarify the home buying process from beginning to end.

Whether youre buying a home or refinancing your current home, your local Bank of America mortgage loan officer will review your unique situation and give you customized information so you can decide how much you can comfortably afford for a home.

Read Also: What Is Mortgage Payment On 600 000

North Carolina Conventional Loans

Borrowerswith good credit may secure a conventional loan. You need at least a 660+credit score and a max 36 percent debt ratio. If you’ve never owned a home a 3percent down payment is enough. If you’ve owned a home, you’ll need 5 percentdown. Any down payment lower than 20 percent requires Private MortgageInsurance. You can cancel it when you owe less than 80 percent of the home’s currentvalue.

What Determines My Mortgage Interest Rate

Your mortgage rate is influenced by a variety of factors that fit into two categories:

- The current economic climate: Factors like inflation and the Federal Reserves benchmark rate can have a big influence on current mortgage rates

- The specifics of your financial life: Within the context of the mortgage market, your personal finances help determine your precise interest rate

While you cant control the federal funds rate or other economic conditions, you can do things to improve your personal finances before applying for a mortgage loan.

Any change to one of the following seven things can directly impact the specific interest rate youll qualify for.

You May Like: Can You Haggle With Mortgage Lenders

Least Expensive Places To Live In North Carolina

1. Rocky Point, NCAt 18% below the national average for cost of living, people looking to buy in Rocky Point are in for some significant savings. The biggest area of savings is on housing, which is 61% below the national average in the area. The median home price in the area is $134,932 and renters should expect to pay about $422.66 per month.

2. Lexington, NCAt an impressive 12% below the national average, residents of this city should expect deep savings in housing, utilities and transportation. The current average cost of a gallon of gas is slightly below $2.00. The median price of a home is $267,190 and the median rent is $836.99.

3. Thomasville, NC The cost of living in Thomasville comes in at 12% below the national average, and the median price of a home and rent are the same as in Lexington: $267,190 for the median home price and $836.99 for the median rent price.

4. Graham, NCHousing in Graham, North Carolina, is 29% below the national average. The current median home price is $247,758 and the median rent is $776.12 per month. Utility and transportation costs all come in well below the national average.

5. Hendersonville, NC With an overall cost of living that is 10% below the national average, Hendersonville is one of the least expensive cities to live in the state of North Carolina. Housing is 25% below the national average, with the median home price at $261,336 and the median rent at $818.65 per month.

Nc Home Advantage Mortgage

With an NC Home Advantage Mortgage, offered through the NCHFA, borrowers can get a fixed-rate mortgage coupled with down payment assistance up to 5 percent of the loan principal. This is available to both first-time and repeat homebuyers. To qualify:

- Your annual income must be $126,000 or less

- Your credit score must be 640 or higher

- You must be a legal resident of the U.S. and buying a home in North Carolina

- You must occupy the home as your primary residence within 60 days of closing

- You are applying for a qualifying mortgage through a participating lender

The NC Home Advantage Mortgage is available for single-family homes, condos, duplexes and townhouses, as well as new manufactured homes if your credit score is 660 or higher.

Don’t Miss: Which Mortgage Lenders Use Fico Score 2

Most Expensive Places To Live In North Carolina

1. Asheville, NC While most costs in the city of Asheville fall below the national average, the city is still expensive when you weigh it against the rest of the state. The median home price in the area is $318,199 and the median rent is $996.78. Grocery costs are 4% below the national average, with a loaf of bread costing about $3.20.

2. Charlotte, NC Charlotte is also slightly below the national average, but still expensive for the state of North Carolina. This city is the hub for Bank of America and has a median home price of $296,685 and a median rent of $929.39.

3. Wilmington, NC While youll save significantly on housing in Wilmington, youll pay for it in higher than the average utility, grocery and transportation costs. The median home price in Wilmington is only $280,723, but grocery costs are 3% above the national average. Expect to pay about $3.43 for a loaf of bread.

4. Fayetteville, NCMedian home prices in Fayetteville are $247,758 and median rent in the city is $776.12. Utility and grocery costs in Fayetteville are below the national average but higher than what you will find in the rest of the state. The average energy bill is $158.94.

5. Gastonia, NC The median home price in Gastonia is $218,127 and the median rent is $683.30, which is higher than what youll find in most of North Carolina. Utility costs in the city are only about 8% below the national average, with an average energy bill of $153.91 per month.

North Carolina Mortgage Resources

Certain North Carolinian homebuyers have a couple options when it comes to funding a home purchase.

The North Carolina Housing Finance Agency offers mortgages that come with down payment assistance for up to $8,000. First-time and move-up homebuyers can both apply for that program, which is called the NC Home Advantage Mortgage. The NC Housing Finance Agency also provides eligible first-time buyers and military veterans with Mortgage Credit Certificates for up to $2,000 in tax savings per year.

You May Like: How Much Mortgage Qualify For