How Long Does Home Loan Approval Take

The length of time it takes for a lender to approve or reject your home loan application may vary, depending on factors such as the particular lender you choose and your financial situation.

In some cases, obtaining home loan pre-approval or conditional approval beforehand may speed up the time it takes your chosen lender to assess your formal application.

Is A Variable Rate Better

If yourecomparing a variable rate and a fixed rate mortgageat the same point in time, a variable rate will almost always be lower than a fixed rate. Just as how a longer term mortgage will have a higher rate when compared to a shorter term mortgage, borrowers will pay a premium for locking-in a fixed rate.

Historically, variable rates have performed better than fixed rates, as found in a 2001 study by theIndividual Finance and Insurance Decisions Centre. Thats because interest rates have generally fallen over the past few decades, meaning that borrowers with a variable mortgage rate would have benefited from falling interest rates.

In 2020, a low interest rate environment increased the popularity of variable rate mortgages as borrowers were enticed to low mortgage rates. However, interest rates have been rising and are expected to increase further into 2023.

While the focus can be on the direction of the change, you should also pay attention to how large the interest rate changes can be. The pace that rate hikes are occurring, due to highinflation in Canadaand countering Bank of Canada rate hikes, might slow down or stop entirely. This can affect your variable vs. fixed rate decision.

Since variable rates are often already priced at a discount to fixed rates, variable rates would be a better choice if interest rates dont move at all. Variable rates might still be a better choice if interest rates only increase slightly and later on in your mortgage term.

How Does A Mortgage Work

A mortgage is a type of secured loan where the property often your home is the collateral. So youll never be able to take out a mortgage without having some sort of real estate attached to it. Mortgage loans are issued by banks, credit unions, and other different types of lenders.

Aside from paying the loan back, you pay for a mortgage in two ways: fees and interest. Interest is paid on your loan balance throughout the life of the loan and is built into your monthly payment. Mortgage fees are usually paid upfront and are part of the loans closing costs. Some fees may be charged annually or monthly, like private mortgage insurance.

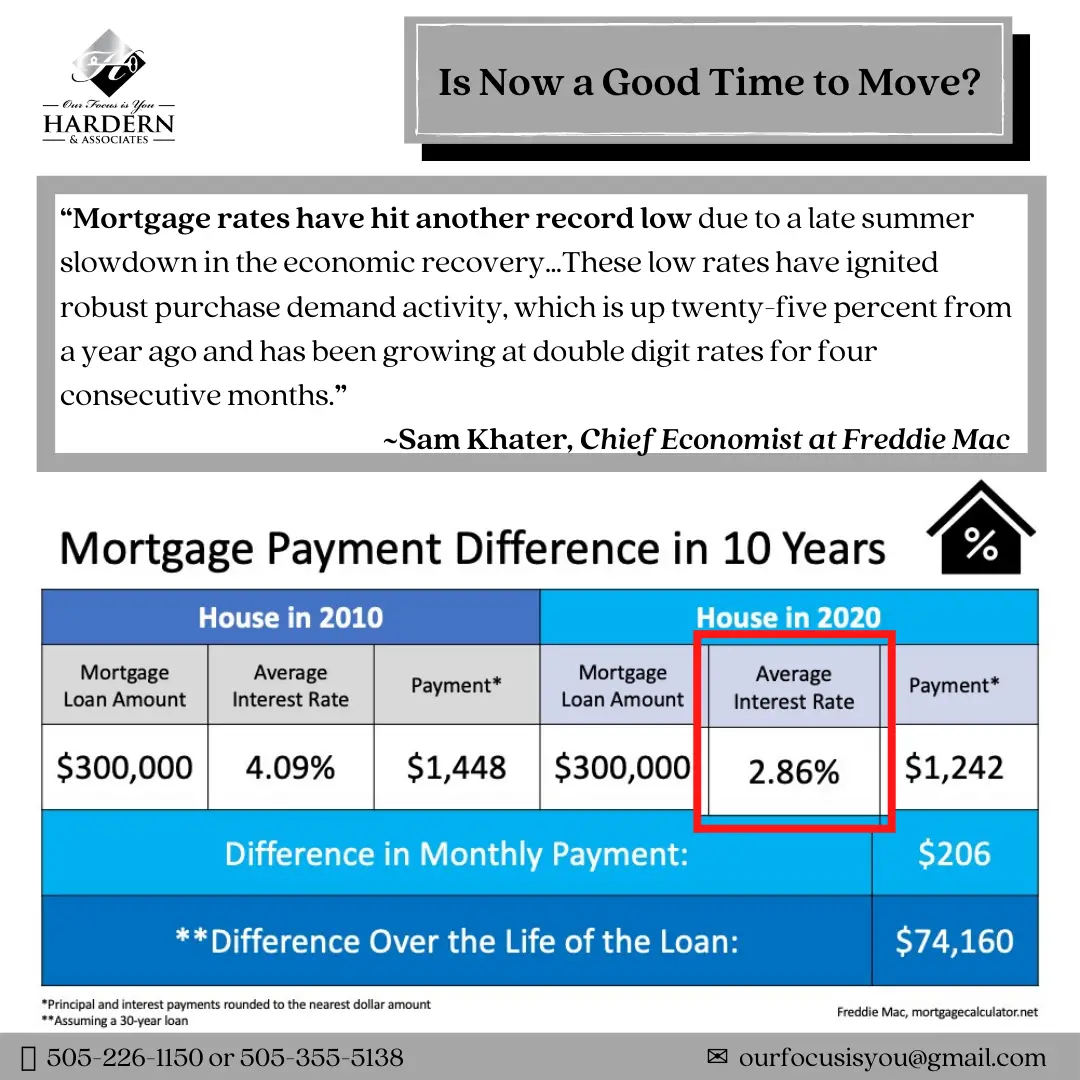

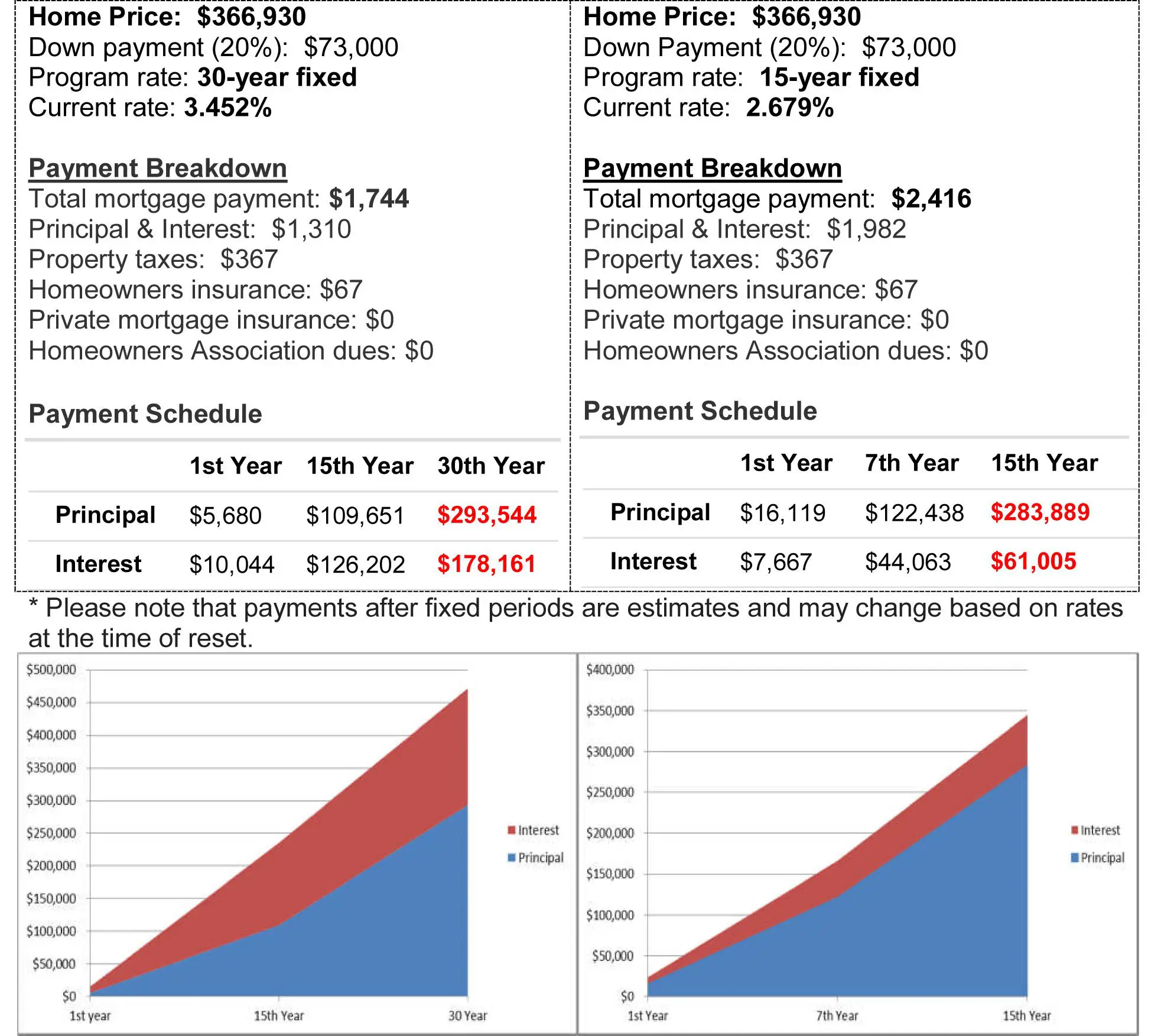

Mortgages are repaid over what is known as the loan term. The most common loan term is 30 years. You can also get a mortgage with a shorter term, like 15 years. Short-term loans have higher monthly payments but lower interest rates. Mortgages with longer terms have lower monthly payments, but youll typically pay a higher interest rate.

You May Like: What Are Current Mortgage Rates

How Do I Get A Mortgage

To get a mortgage, you need to start by getting your finances in order. Having a strong financial profile will a) increase your chances of being approved for a loan, and b) help you score a lower interest rate. Here are some steps you can take to beef up your finances:

- Figure out how much home you can afford. The general rule of thumb is that your monthly home expenses should be 28% or less of your gross monthly income.

- Find out what credit score you need. Each type of mortgage requires a different credit score, and requirements can vary by lender. You’ll probably need a score of at least 620 for a conventional mortgage. You can increase your score by making payments on time, paying down debt, and letting your credit age.

- Save for a down payment. Depending on which type of mortgage you get, you may need as much as 20% for a down payment. Putting down even more could land you a better interest rate.

- Check your debt-to-income ratio. Your DTI ratio is the amount you pay toward debts each month, divided by your gross monthly income. Many lenders want to see a DTI ratio of 36% or less, but it depends on which type of mortgage you get. To lower your ratio, pay down debt or consider ways to increase your income.

Then, it’s time to shop around and get quotes from multiple lenders before deciding which one to use.

Whats The Difference Between Interest Rate And Apr

The interest rate is the percentage that the lender charges for borrowing the money. The APR, or annual percentage rate, is supposed to reflect a more accurate cost of borrowing. The APR calculation includes fees and discount points, along with the interest rate.

A major component of APR is mortgage insurance a policy that protects the lender from losing money if you default on the mortgage. You, the borrower, pay for it.

Lenders usually require mortgage insurance on loans with less than 20% down payment or less than 20% equity .

Don’t Miss: What Is Meant By Points In A Mortgage

Are Interest Rates And Apr The Same

Interest rates and APR are not the same. An annual percentage rate reflects additional charges associated with your mortgage, which includes the interest. The interest rate reflects the cost homeowners pay to borrow money. These fees include charges such as origination fees and discount points, which is why the APR is typically higher than the interest rate.

You May Like: What Are The Requirements To Get A Reverse Mortgage

How To Apply For A 30

Before you apply for a mortgage, review your credit profile and make any necessary improvements. To qualify for the lowest interest rate, your credit should be as strong as possible.

Then, calculate how much home you can afford, including how much of a down payment you can make. Part of this initial process should include shopping around for lenders to get an idea of rates and products that best fit you.

Mortgages are available through banks, credit unions and many online lenders. Find out what rates each lender is offering as well as the annual percentage rate the total cost of a loan, including fees.

Related:Best Mortgage Lenders

When youre ready to apply for a mortgage, compile all necessary documentation like income verification, recent bank account statements and other proof of assets.

You can start the application process by seeking a preapproval letter from the mortgage lender. This letter will give you an estimate of your specific loan rate and terms, if you qualify. It also helps establish exactly how much home you can afford and gives you more negotiating power with sellers when you have a letter showing you are already approved for financing.

Don’t Miss: Can A Senior Get A Mortgage

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Showing results for:

About These Rates: The lenders whose rates appear on this table are NerdWallets advertising partners. NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a lenders site. The terms advertised here are not offers and do not bind any lender. The rates shown here are retrieved via the Mortech rate engine and are subject to change. These rates do not include taxes, fees, and insurance. Your actual rate and loan terms will be determined by the partners assessment of your creditworthiness and other factors. Any potential savings figures are estimates based on the information provided by you and our advertising partners.

Trends and insights

Data source: ©Zillow, Inc. 2006 2021. Use is subject to theTerms of Use

What Is A Mortgage Point

Some lenders may use the word “points” to refer to any upfront fee that is calculated as a percentage of your loan amount. Point is a term that mortgage lenders have used for many years and while some points may lower your interest rate, not all points impact your rate. Mortgage points can be found on the Loan Estimate that the lender provides after you apply for a mortgage.

Read Also: How Do You Calculate Points On A Mortgage

Why Is My Mortgage Rate Higher Than Average

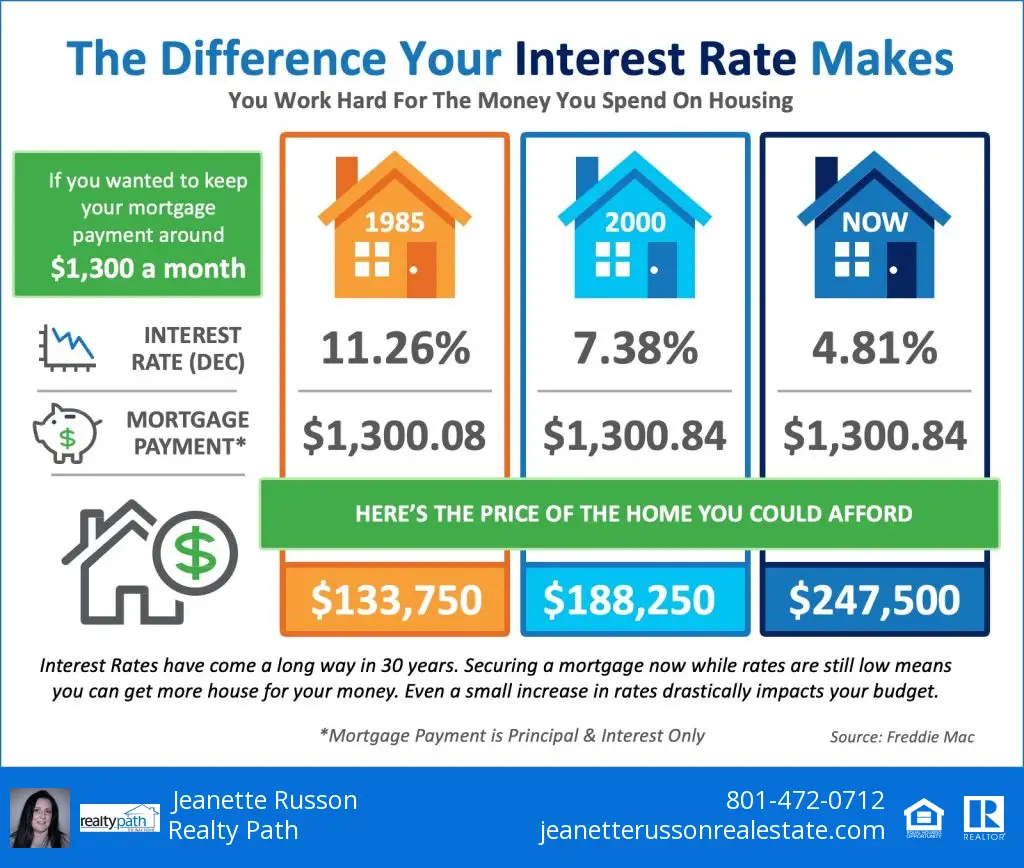

Not all applicants will receive the very best rates when taking out a new mortgage or refinancing. Credit scores, loan terms, interest rate types , down payment size, home location and loan size will all affect mortgage rates offered to individual home shoppers.

Rates also vary between mortgage lenders. It’s estimated that about half of all buyers only look at one lender, primarily because they tend to trust referrals from their real estate agent. Yet this means that they may miss out on a lower rate elsewhere.

Freddie Mac estimates that buyers who got offers from five different lenders averaged 0.17 percentage points lower on their interest rate than those who didn’t get multiple quotes. If you want to find the best rate and term for your loan, it makes sense to shop around first.

Why Should I Compare Mortgage Rates

Choosing a mortgage is a major financial decision since it involves borrowing a significant amount of money. The mortgage interest rate is one of the factors that affects the total amount of money you will have to pay over the course of the amortization period. So, you could save money by finding the lowest rate. But, along with the mortgage rate, you should also compare the terms and conditions of each type of mortgage in order to find the right one for you.

Don’t Miss: How To Calculate Self Employed Income For Mortgage

Current National Mortgage And Refinance Rates January 3rd 2023

Jeff Ostrowski covers mortgages and the housing market. Before joining Bankrate in 2020, he wrote about real estate and the economy for the Palm Beach Post and the South Florida Business Journal.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity,this post may contain references to products from our partners. Here’s an explanation for how we make money

How Are Mortgage Rates Impacting Home Sales

High mortgage rates continue to impact the housing market. The number of existing homes sold declined for the ninth straight month in October the longest decline on record, according to the National Association of Realtors.

“More potential homebuyers were squeezed out from qualifying for a mortgage in October as mortgage rates climbed higher,” said Lawrence Yun, chief economist at NAR, in a statement.

Recommended Reading: Can You Buy A House With A Reverse Mortgage

Should I Fix My Home Loan

The decision of whether or not to fix your home loan is a personal one, and should be considered carefully in light of your financial needs.

For example, if you think variable interest rates will rise in the near future, getting a good deal on a fixed rate could be one way to lock in a rate youre happy with for a few years.

On the other hand, ASICs Moneysmart notes that fixed rate home loans often have fewer features than variable ones, and locking in now could mean you miss out on some savings if variable rates fall during your fixed term.

If youre unsure, taking out a split loan could be one option to consider, though some lenders may charge a fee for this.

Is It Worth Refinancing To A 15

You can save money and build home equity faster with a 15-year mortgage than with a 30-year mortgage. But the monthly mortgage payment will be higher on a 15-year mortgage because there is less time to pay off the loan.

Its worth comparing 15-year mortgage rates if youll be able to afford the monthly payments and still have enough money for other needs, such as saving for retirement.

Getting a lower interest rate could save you hundreds of dollars over a year of mortgage payments and thousands of dollars over the life of the mortgage.

When you compare 15-year refinancing offers using the Loan Estimates you receive from lenders, youll feel confident when you identify the offer that has the best combination of rate and fees.

You May Like: How To Get A Mortgage Loan After A Foreclosure

When Should You Lock In Your Mortgage Rate

When you receive a mortgage loan offer, a lender will usually ask if you want to lock in the rate for a period of time or float the rate. If you lock it in, the rate should be preserved as long as your loan closes before the lock expires.

If you donât lock in right away, a mortgage lender might give you a period of timeâsuch as 30 daysâto request a lock, or you might be able to wait until just before closing on the home.

Once you find a rate that is an ideal fit for your budget, itâs best to lock in the rate as soon as possible, especially when mortgage rates are predicted to increase. While itâs not certain whether a rate will go up or down between weeks, it can sometimes take several weeks to months to close your loan.

If you donât lock in your rate, rising interest rates could force you to make a higher down payment or pay points on your closing agreement in order to lower your interest rate costs.

Highlights From The Bank Of Canada’s October 26 2022 Announcement

On October 26, 2022, the Bank of Canada increased the key overnight rate by 0.50%. The target for the overnight rate is now 3.75%.

- Canadians with variable-rate mortgages and home equity lines of credit will see their rates rise accordingly by 0.50%. They should calculate what their new mortgage payment will be and budget for more increases to come.

- Canadians with fixed-rate mortgages arenât affected by the announcement directly, but can expect higher rates when they renew at the end of their current mortgage term.

- As rates rise, so does the mortgage stress test. With today’s announcement pushing variable rates up by 0.50%, anyone who is getting a new variable-rate mortgage will need to pass a stress test that is 0.50% higher. To calculate how much you can qualify for, use our mortgage affordability calculator.

- Although the Bank made it clear that further rate hikes will be necessary to get inflation under control, it did say that it would be examining the economic effects of this year’s rate increases. This suggests that the end of rising rates may be on the horizon if the Bank feels that inflation is being pushed back down sufficiently.

You May Like: Can A Trust Take Out A Mortgage

Todays Refinance Rates Decline

The average 30-year fixed-refinance rate is 6.79 percent, down 11 basis points since the same time last week. The 15-year fixed refi average rate is now 6.09 percent, down 14 basis points over the last week. The average rate for a 10-year fixed-refinance loan is 6.18 percent, down 19 basis points from a week ago.

Also Check: What An Average Monthly Mortgage Payment

Current Mortgage Rate Trends

The average mortgage rate for a 30-year fixed is 6.74%, more than double its 3.22% level at the start of the year.

The average cost of a 15-year, fixed-rate mortgage has also surged to 6.07%, compared to 2.43% in early January.

In the current environment, ARMs might be more affordable than those with fixed rates. The average 5/1 ARM was 5.45% at the end of October.

You May Like: Can You Get A Mortgage While In Chapter 13

Are Mortgage Rates High Right Now

Rates have been higher a lot higher than they are today. In October of 1981, for example, average rates topped 18 percent. Forty years later, in October of 2021, average rates on 30-year mortgages were below 3 percent. So, most homebuyers today are paying rates much closer to record lows than to record highs.

Tim Lucas

Editor

What Is Lenders Mortgage Insurance

Lenders mortgage insurance is a type of insurance that a lender takes out to protect itself in case of default from the borrower, but which the borrower must pay for.

It usually applies to home loans with a high LVR , or in other words when the borrower has a deposit of less than 20% of the propertys value.

Recommended Reading: What Is The Mortgage Rate On Investment Property

What Is A Comparison Rate

A comparison rate is an interest rate figure designed to represent the total annual cost of the loan, including its annual interest rate and most ongoing and upfront fees and charges.

Under the law and on the Canstar website, all comparison rates for home loans in Australia are based on a $150,000 loan over 25 years.

Choosing The Right Mortgage Lender

The lender or loan program thats right for one person might not be right for another.

Explore your options and then pick a loan based on your credit score, down payment, and financial goals, as well as local home prices.

Whether youre getting a mortgage for a home purchase or a refinance, always shop around and compare rates and terms.

Typically, it only takes a few hours to get quotes from multiple lenders and it could save you thousands in the long run.

Current mortgage rates methodology

We receive current mortgage rates each day from a network of mortgage lenders that offer home purchase and refinance loans. Mortgage rates shown here are based on sample borrower profiles that vary by loan type. See our full loan assumptions here.

Don’t Miss: Which Bank Is Good For Mortgage Loan