What Do You Need To Apply For A Loan With Freedom Mortgage

The application and underwriting requirements will vary depending on the loan youre applying for. But you typically need to go through a credit check, provide your Social Security number, pay stubs, or W-2 forms. For VA loans, you may have to provide a certificate of eligibility that proves you meet certain requirements for this type of loan.

Va Loan Churning Controversy

- In mid-2018 they faced allegations of loan churning

- Where lenders serially refinance borrowers whether it benefits the homeowner or not

- In order to make large commissions on the transaction

- They faced restrictions from Ginnie Mae in terms of securitizing these loans

As mentioned, Freedom Mortgage is one of the largest VA lenders out there.

In mid-2018, Freedom Mortgage got caught up in the VA loan churning debacle where lenders were essentially accused of unnecessarily refinancing borrowers into new loans in order to make large commissions.

For example, refinancing a brand new loan by some nominal amount, say .25% lower in rate, but charging borrowers thousands in the process.

Aside from harming homeowners who may have not benefited much if at all from a refinance, it also meant MBS investors were getting a raw deal when the loans packaged into securities were constantly being paid off via a fast refinance.

Because of the accusations, Freedom Mortgage was restricted from creating Ginnie Mae multi-lender pools with VA loans, along with two other GNMA issuers.

Freedom says it has since been working with Ginnie Mae to ensure its prepay speeds are in line with those of other lenders to remain in compliance.

The takeaway here is to do your homework and know what youre getting into, no matter which lender you choose to work with.

You should know if a refinance or particular loan product is suitable, instead of simply taking a lender or loan officers word for it.

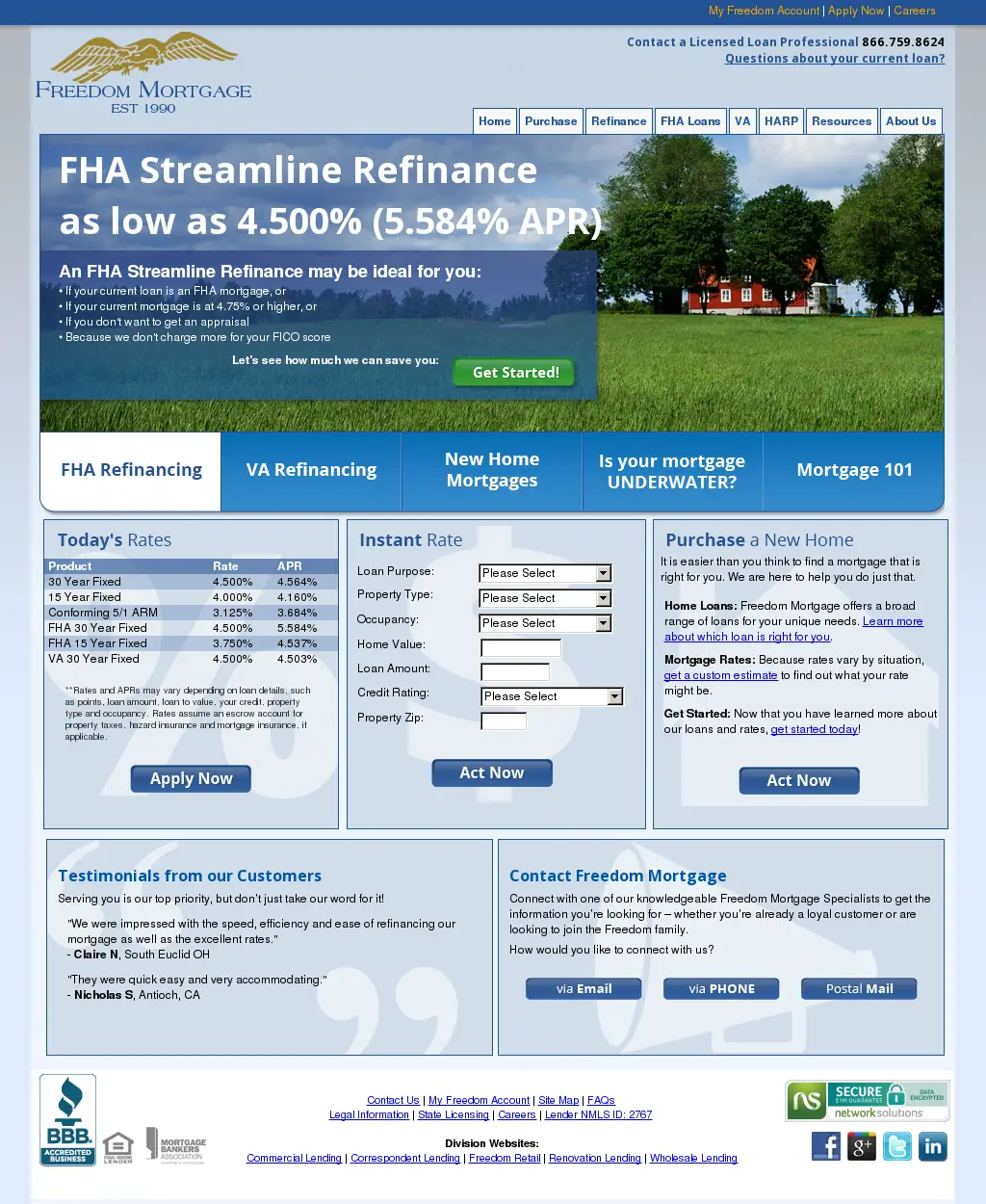

What Mortgage Programs Are Available

Besides conventional mortgages, Freedom Mortgage offers the following mortgage types:

- FHA loans: FHA loans are mortgages insured by the FHA. They offer competitive mortgage rates and have less stringent eligibility requirements. However, borrowers must pay a mortgage insurance premium. For instance, you can apply for an FHA loan with a credit score as low as 580. Co-applicants are allowed and you can qualify for a down payment as low as 3%.

- Jumbo loans: Any mortgage with a loan amount above the conforming loan limits set by the Federal Housing Finance Agency .

- USDA loans: A zero down payment mortgage loan with low mortgage rates for suburban and rural homebuyers. The USDA doesn’t require a minimum credit score, but most mortgage lenders require a minimum credit score of 640.

- VA loans: A zero down payment mortgage or a refinance of up to 120% of the home’s value for American military members, veterans, and their spouses. VA loans offer competitive mortgage rates, and don’t have a minimum credit score. However, the mortgage lenders that offer them will typically require a credit score of at least 640.

Also Check: How Does Filing Bankruptcy Affect Your Mortgage

Customer Service Reviews At Major Lenders

| CFPB Complaints, 20214 | |

| 0.20 | 827/1,000 |

Theres no denying that Freedom was below the industry average in J.D. Powers 2021 Customer Satisfaction Study. How much this bothers you will likely depend on your priorities. Many would prefer lower rates and fees to Cadillac-level service.

Meanwhile, on the plus side, Freedom has a respectable A+ ranking with the Better Business Bureau and is an accredited BBB business.

Breakdown Of Freedom Mortgage Overall Score

-

Affordability: A key benefit of working with this lender: Once youve applied for a loan with Freedom Mortgage, itll alert you to better deals if they come up.

-

Availability: Freedom Mortgage operates nationally, with a range of loan products but specializing in FHA and VA loans.

-

Borrower experience: This lender has made headlines for some regulatory violations, and customers on the Better Business Bureau tend to rate it in the middle of the pack.

You May Like: What Is Mortgage Interest Deduction

Predatory Practices Disguised As Application Functionality

This is the worst loan servicing tool I have ever dealt with. It took forever to be able to get my online account set up after it was transferred. I was only able to sign up using safari on mobile instead of chrome. This made me late setting up my initial payment when I have had available funds the entire time. I posted two payments back to back at the beginning of November so I could set up recurring payments and now my payment was not processed in December so I had to post another one time payment and am not able to set up recurring payments until this has processed. You know what youre doing to people, setting them up for failure and to be late making payments. Either your software development team is garbage or this is predatory behavior. Either way you need to get it together.

Awful Customer Service Especially For Military/veterans

I spoke with a Senior Loan Advisor name Brian on 8/18/2022 and he took my application and he promised he would contact me on 8/22/2022 and here it is today 8/26/2022 and he still hasn’t responded. I left numerous emails and voicemails and this Senior Loan Advisor has completely ignored me. This is very “UNPROFESSIONAL” Freedom suppose to be one of the better companies especially for veterans or so i’m told. I totally disagree with that. I guess business is so good that they can ignore their customers which my current mortgage is with them because it was sold to them and not by my choice. My advice especially to veterans/military is to stay as far away from this company as possible. I rate them at a negative one.

Date of experience:August 29, 2022

You May Like: What Is The Mortgage Payment On 240k

Alternatives To Freedom Mortgage

- LoanDepot reviewThis lender offers both an online option and more than 200 branches nationwide.

- United Wholesale Mortgage review This lender can be an option if youre working with a mortgage broker.

- Mr. Cooper mortgage review This online-only lender offers a wider range of niche mortgage products.

Freedom Morgage Doesn’t Care About You

This terrible company acquired my loan, I did not choose them. Freedom Morgage came to us last November and asked us if we would like a rate reduction, we said yes. they dragged their feet until we got a closing date of March 28th, 2022. my wife was admitted to the intensive care unit and passed away on the 28th. This POS company said they could no longer offer the rate because we didn’t make the closing. they did offer me a rate at double my current rate. this is how they treat a 22 year US army disabled veteran with a 100% disability. “thank you for your service” my ass.

Date of experience:October 10, 2022

Read Also: Can You Refinance Into A 15 Year Mortgage

Freedom Mortgage Rates And Fees

-

Freedom Mortgage earns 4 of 5 stars for average origination fee.

-

Freedom Mortgage earns 5 of 5 stars for average mortgage interest rates.

Borrowers should consider the balance between lender fees and mortgage rates. While it’s not always the case, paying upfront fees can lower your mortgage interest rate. Some lenders will charge higher upfront fees to lower their advertised interest rate and make it more attractive. Some lenders just charge higher upfront fees.

Which Loan Products Does Freedom Mortgage Offer

Freedom Mortgage offers a few different products, including both buying and refinancing options. If youre interested in buying a home, Freedom Mortgage provides these home loan choices:

- Conventional loans

FHA, VA, and USDA loans are all considered government-backed loans because different government agencies insure them. FHA loans are insured by the Federal Housing Administration, VA loans are insured by the Department of Veterans Affairs, and USDA loans are insured by the U.S. Department of Agriculture.

Conventional loans are insured by private lenders instead of a government agency. This generally means they have stricter eligibility requirements, including a higher credit score or lower debt-to-income ratio. But conventional loans might not have as many restrictions as government-backed loans, which could make them more accessible. For instance, you dont necessarily need to be a military member or buy a home in an eligible rural area, as you would with a VA or USDA loan.

If youre already a homeowner with an FHA or VA loan, Freedom Mortgage offers a few refinancing options. This includes:

- VA cash-out refinance

- VA interest rate reduction refinance loan refinance

In addition to several loan options, Freedom Mortgage also offers educational materials on its website. These can be helpful if youre learning how to get a loan and which one to choose, or how refinancing works.

Read Also: Why Do I Pay Escrow On My Mortgage

Conventional Loans At Freedom Mortgage

Conventional loans are both offered and backed by private lenders rather than insured by a government agency. These loans have some important differences from government-backed loans.

For instance, the home youre buying doesnt have to be your primary residence. These loans generally require a down payment, which could be as low as 3%, depending on your situation. Youre usually required to pay private mortgage insurance with a conventional mortgage unless you make at least a 20% down payment.

Conventional loans dont necessarily have high credit score requirements, but excellent credit could qualify you for a better rate. The average closing costs are between 2% and 5% of the purchase price, though this amount can vary by lender.

| Loan amount |

| 620+ |

Preparing Your Credit For A Mortgage Loan

Though Freedom Mortgage specializes in helping potential homeowners get or refinance loans despite credit blemishes, you should work on your credit before applying for a home loan.

Youll find resources on how to rehabilitate your credit here. Read some of our most popular articles on this topic.

Ultimately, ensure that you focus on paying your bills on time especially credit cards and personal loans. Also, pay down your credit card balances to 30% or less of the credit limit. If you have any inaccurate information impacting your score, get it removed.

Improvements of a few points on your FICO score could qualify you for a better interest rate, which will save you thousands of dollars over the life of your loan.

Update: This article has been updated to reflect the current conventional loan amount for 2022. Unverifiable information has been removed.

Disclaimer: This story was originally published on November 25, 2019, on BetterCreditBlog.org. To find the most relevant information concerning Freedom Mortgages, please visit their website:

Don’t Miss: How Much To Pay Mortgage Off Early

What Freedom Mortgage Customers Are Saying

Freedom Mortgage has decent ratings across different online review sites. This includes an A+ rating with the Better Business Bureau and a 3.86 out of 5.0-star rating based on over 2,600 customer reviews. Its TrustPilot rating is 1.5 out of 5.0 stars, which is considered bad, falls short, but its a small pool of only 46 reviews.

Overall, Freedom Mortgage customers are generally happy with its easy and efficient application process. However, many bad reviews mention poor customer service or the process being pushed back multiple times.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Don’t Miss: Can I Add A Loan To My Mortgage

What Mortgage Programs Does Freedom Mortgage Offer

Freedom Mortgage Refinance offers the following mortgage types:

- Conventional mortgages: This includes any mortgage that is not insured or guaranteed by the federal government.

- FHA: Mortgages insured by the FHA, which usually have less stringent eligibility requirements, but borrowers must pay a mortgage insurance premium. Co-applicants are allowed and you can qualify for a down payment as low as 3%.

- FHA 203k: An FHA mortgage you can also use to finance home improvements.

- USDA: A zero down payment mortgage loan with low rates for suburban and rural homebuyers.

- VA: A zero down payment mortgage or a refinance of up to 120% of the home’s value for American military members, veterans, and their spouses.

Mortgage Options At Freedom

Freedom Mortgage offers a broad range of mortgage products and refinance loans. The companys full portfolio of home purchase loans includes:

- Conventional loans: A loan conforming to guidelines set by Freddie Mac and Fannie Mae. First-time home buyers can qualify with as little as 3% down payment and 620 minimum credit score. You can usually stop paying private mortgage insurance after a few years

- FHA loans: You can put down as little as 3.5% of the home purchase price. But youll have to pay mortgage insurance premiums for the life of the loan until you sell or refinance. This is a popular loan type for first-time home buyers

- VA loans: Ideal for veterans, active-duty service members, and others who are eligible. Zero down payment, easier credit, competitive rates, and no mortgage insurance

- USDA loans: Another zero-down loan option starting, usually, at a 640 credit score. Only for homes in rural areas and suburbs designated eligible by the US Department of Agriculture

- Fixed-rate mortgages : Fixed-rate loans offer regular monthly payments over the life of the loan term, often 15 or 30 years

- Adjustable-rate mortgages : Adjustable-rate loans have a fixed interest rate for the first few years. Then their rates can float up and down with wider interest rates

At the time of writing, Freedom has suspended its jumbo loan program, but check with the company to see if theyve reinstated the program.

Read Also: How Long Is A Mortgage Rate Good For

Whats The Process For Getting A Mortgage With Freedom Mortgage

Freedom Mortgage urges you to check your credit report and speak with a loan officer to inquire about pre-qualification before searching for homes. That way, you can get an idea of how much home you can afford before searching.

You can find a detailed application checklist on the website thatll help you gather and prepare all the necessary information and documents. Its useful to gather the information prior to your conversation with a loan officer, as it will help speed the process. Once the loan officer reviews your financial situation and pre-qualifies you, you can start making offers on homes. After youve found the home you want, youll apply for the actual loan.

The application process is usually more complex than pre-qualification, meaning youll need to provide supporting documents and spend time reading over and signing paperwork to set the process in motion. Some of the documents you may have to provide include pay stubs, tax returns and recent bank account statements.

Once the seller accepts your offer and youve received approval on the loan, you will be ready for closing. This is the final stop along the road to homeownership. However, an appraisal may be necessary if you choose an FHA or VA loan. An FHA or VA appraiser may need to inspect the property to ensure it meets all necessary standards. Once it passes the appraisal, you can move to the final step: closing.

Va Loan At Freedom Mortgage

VA loans are offered by private lenders, such as Freedom Mortgage, and insured by the Department of Veterans Affairs. Only military veterans, active-duty military members, and surviving spouses are eligible for VA loans. If you fall into one of these categories, you may still be required to get a certificate of eligibility to prove that you could qualify for a VA loan.

Freedom Mortgage offers VA loans to borrowers who meet the eligibility requirements and have a of 600 or above. These mortgage loans dont often have income requirements, but your debt-to-income ratio may need to be 41% or lower. If you opt for a VA loan, youll likely need to pay a VA funding fee at closing. But qualified individuals can put down as little as 0% for a down payment.

| Loan amount |

| 600+ |

Read Also: Why Are Mortgage Rates Lower Than Prime

What Can You Do Online With Freedom Mortgage

You can learn about your loan options on Freedom Mortgages site. There are educational resources that help you understand terms associated with mortgages as well as comprehensive guides, such as how to understand your credit score. You can also find an application checklist, moving checklist and a thorough explanation of the closing process.

While the educational resources are helpful, you cant start the loan application process through the site. You cant get an online login until you have a loan number, which means you already have a mortgage. The online features are used to make payments and for you to track your loan balance.

To get things started, you have to call a representative or find a loan officer in your area. Luckily, the site offers a portal so that you can search for someone in your area. However, if there isnt a representative near you, youll do everything via telephone. Its a downside if you were hoping to apply in-person.

The Eagle Eye Program

Once you close your loan, Freedom Mortgage will monitor the mortgage rate environment on your behalf via their Eagle Eye Program.

If interest rates fall substantially, youll be notified about a possible money-saving refinance.

They may also contact you if the value of your home increases to the point where you might be able to tap equity to free up cash.

Or if there is a new special program or opportunity that may interest you.

After opting in, they will text these so-called Eagle Eye Alerts up to four times per month, though in some months they may not send any.

This is an easy way to keep track of mortgage rates over time, but be sure to do your own due diligence.

It doesnt always make sense to refinance, and you should also still shop around with other lenders.

Don’t Miss: How To Check House Mortgage