What Is A Discount Point

Discount points are fees you pay the lender upfront in exchange for a lower interest rate. Buying down the rate with discount points can save you money if youre planning on keeping your home for a long time. But if youre going to sell or refinance before the full loan term is up, paying more fees upfront may not make sense.

Discount points can be part of a good deal, but you need to make sure you know when they are being added to your loan. When youre comparing mortgage offers, be sure to ask if the interest rate includes discount points.

Refinance Renew Or Switch

Every mortgage has a limited term in Canada. Only 4.8% of mortgages in 2018 had a term greater than 5 years. The CMHC found that the5-year fixed-rate mortgagewas the most popular in Canada in 2019. When the term is over then your mortgage term expires and you will either need to pay off your mortgage in full, or take one of the following actions:renew, refinance, orswitch mortgages.

Also Check: How To Modify Mortgage Loan

Can My Monthly Payment Go Up

Your monthly payment can rise in a few cases:

Read Also: Should I Refinance My 30 Year Mortgage

What Is A Good Interest Rate On A Mortgage

A good mortgage rate is one where you can comfortably afford the monthly payments and where the other loan details fit your needs. Consider details such as the loan type , length of the loan, origination fees and other costs.

That said, today’s mortgage rates are near historic lows. Freddie Mac’s average rates show what a borrower with a 20% down payment and a strong credit score might be able to get if they were to speak to a lender this week. If you are making a smaller down payment, have a lower or are taking out a non-conforming mortgage, you may see a higher rate. Moneys daily mortgage rate data shows borrowers with 700 credit scores are finding rates around 6.5% right now.

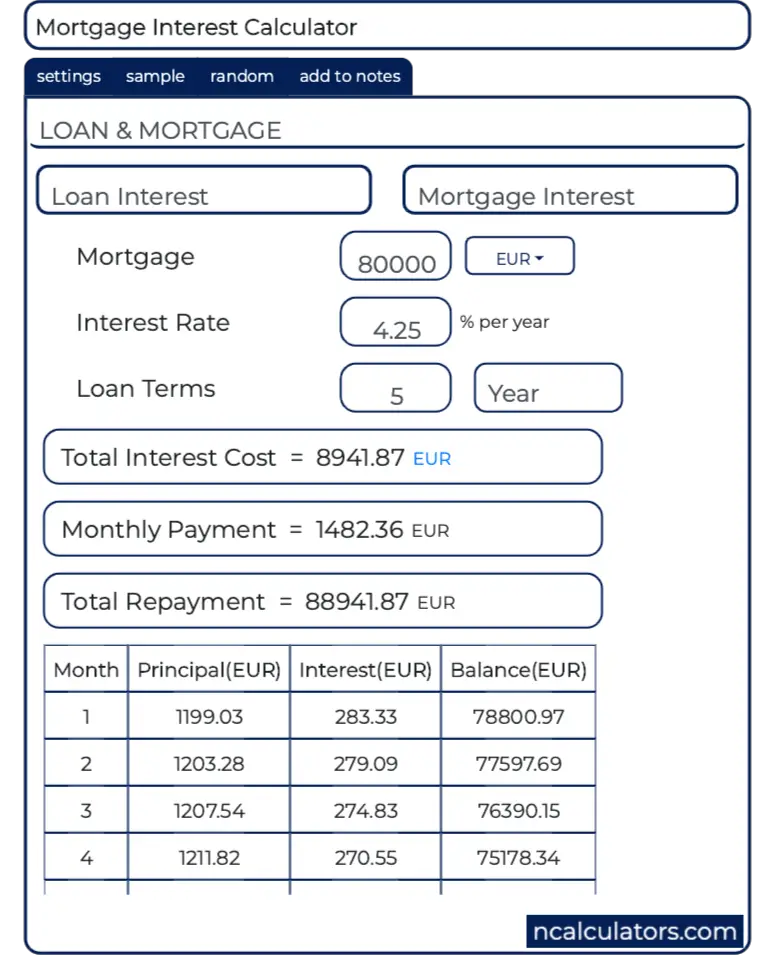

Computing Daily Interest Of Your Mortgage

To compute daily interest for a loan payoff, take the principal balance times the interest rate, and divide by 12 months, which will give you the monthly interest. Then divide the monthly interest by 30 days, which will equal the daily interest.

Suppose, for example, that your uncle gives you $100,000 for a New Year’s Eve present, and you decide to pay off your mortgage on January 5. You know that you will owe $99,800.40 as of January 1, but you will also owe five days of interest. How much is that?

- $99,800.40 x 6% = $5,988.02. Divide by 12 months = $499. Divide by 30 days = $16.63 x 5 days = $83.17 interest due for five days.

- You would send the lender $99,800.40 plus $83.17 interest for a total payment of $99,883.57.

Read Also: How To Get A Mortgage If Your Self Employed

Consider The Cost Of Homeowners Insurance

Almost every homeowner who takes out a mortgage will be required to pay homeowners insurance another cost thats often baked into monthly mortgage payments made to the lender.

There are eight different types of homeowners insurance. The insurance policies with a high deductible will typically have a lower monthly premium.

The Interest Rate Itself

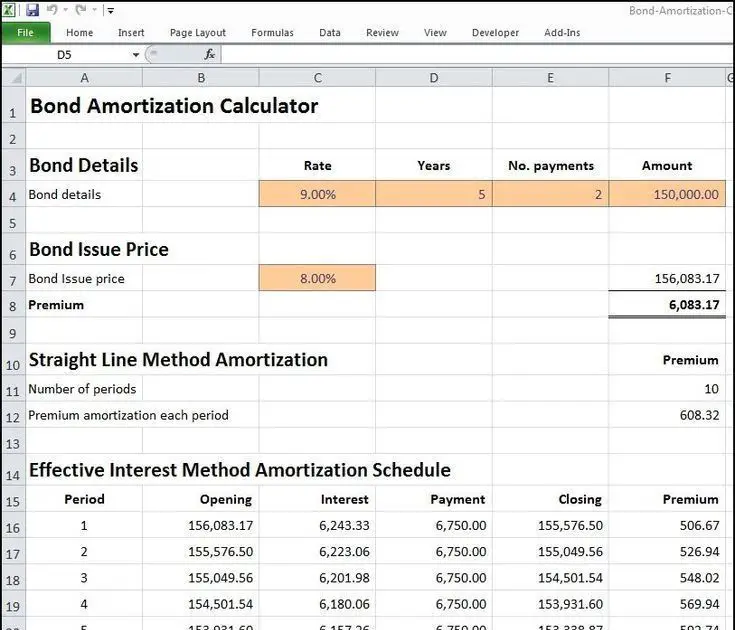

The particular interest rate assigned to you is the result of larger market data working in concert with your financial profile. And when we say financial profile we really mean credit score. While your debt-to-income ratio and loan-to-value ratio are also key factors, perhaps no single influence is more important to optimizing interest rate than an excellent credit score. A very good or great credit score can help make you eligible for superior interest rates.

A difference of even 1% can have a significant impact on the amount of interest you ultimately pay on your mortgage. Consulting an amortization schedule, a $200,000 mortgage at 4% interest over a 30-year term would generate $143,000 of total interest.*

That same $200,000 with an interest rate of 3% would yield significant savings over a 30-year term: $103,554 . The total monthly payment is also less: $843.21 vs. $954.83.*

The takeaway? Credit scores matter immensely when it comes to obtaining the best interest rates. And with lower rates, come lower monthly payments and lower overall interest paid.

Calculating interest is one thing. Building up good credit over a number of years so your credit score is in the top bracket is something else entirely. Always check your credit score in the months leading up to your big decision to ensure its in a range that will help you lock in an optimal rate.

Don’t Miss: How To Increase Your Mortgage Credit Score

Are Refinance Rates The Same As Mortgage Rates

Rates for a home purchase and mortgage refinance are often similar.

However, some lenders will charge more for a refinance under certain circumstances.

Typically when rates fall, homeowners rush to refinance. They see an opportunity to lock in a lower rate and payment for the rest of their loan.

This creates a tidal wave of new work for mortgage lenders.

Unfortunately, some lenders dont have the capacity or manpower to process a large number of refinance loan applications.

In this case, a lender might raise its rates to deter new business and give loan officers time to process loans currently in the pipeline.

Also, cashing out equity can result in a higher rate when refinancing.

Cash-out refinances pose a greater risk for mortgage lenders, so theyre often priced higher than new home purchases and rate-term refinances.

Since rates can vary, always shop around when buying a house or refinancing a mortgage.

Comparison shopping can potentially save thousands, even tens of thousands of dollars over the life of your loan.

Here are a few tips to keep in mind:

1. Get multiple quotes

Many borrowers make the mistake of accepting the first mortgage or refinance offer they receive.

Some simply go with the bank they use for checking and savings since that can seem easiest.

However, your bank might not offer the best mortgage deal for you. And if youre refinancing, your financial situation may have changed enough that your current lender is no longer your best bet.

What Factors Affect The Amount Of Interest You Pay

The following factors will affect the amount of your mortgage interest payments:

- The mortgage interest rate. This is the rate the lender charges you as the cost of financing. Even a small difference in the interest rate can add up to thousands over the life of the loan.

- The prime interest rate. The interest rate on your loan is often connected to the prime rate, or overnight rate, set by the Bank of Canada. The prime rate dictates the rate banks lend money to each other overnight. If you have a variable interest rate, paying attention to the prime interest rate can help you predict what your interest rate will do.

- The amount you borrow. The more you borrow from your bank, the more interest youll need to repay. For example, 5% of $1 million will always be a larger amount than 5% of $500,000.

- The outstanding loan amount. As you gradually pay off the money you borrow, you will be paying interest on a smaller loan amount and your interest payments will slowly reduce.

- The loan term. The time you take to pay off your loan will affect the amount of interest you pay paying your loan off over a shorter period of time will minimize your interest.

Also Check: Why Do Mortgage Loans Get Transferred

Increase Your Down Payment

Did you know that your down payment amount can have an impact on your mortgage rate? That’s because mortgage rates are generally tiered, and typically lower rates are available for those with a down payment of 20% or more. If possible, check with your lender to see if increasing your down payment will lower your mortgage interest rate.

Mortgage Interest Rates Forecast 2022

Experts are forecasting that the 30-year, fixed-mortgage rate will vary from 4.8% to 5.5% by the end of 2022.

While mortgage rates are directly impacted by U.S. Treasury bond yields, rising inflation and the Federal Reserveâs monetary policy indirectly influence mortgage rates. As inflation increases, the Fed reacts by applying more aggressive monetary policy, which invariably leads to higher mortgage rates.

âThe pressure to contain inflation will grow and the Fed will have to raise its fed funds rate eight to 10 times with quarter-point hikes this year,â says Lawrence Yun, chief economist and senior vice president of research at the National Association of Realtors . âAdditionally, the Fed will undo the quantitative easing steadily, which will put upward pressure on long-term mortgage rates.â

Here are more detailed predictions from economists, as of mid-April 2022:

- Mortgage Bankers Association : âMortgage rates are expected to end 2022 at 4.8%âand to decline gradually to 4.6%âby 2024 as spreads narrow.â

- NARâs Yun: âAll in all, the 30-year fixed mortgage rate is likely to hit 5.3% to 5.5% by the end of the year. Some consumers may opt for a five-year ARM at 4% by the end of the year.â

- Matthew Speakman, senior economist at Zillow: âCompeting dynamics suggest that there will be little reason for mortgage rates to decline anytime soon.â

Also Check: Is It Better To Use A Mortgage Broker

Example Of How Mortgage Points Can Cut Interest Costs

If you can afford to buy discount points on top of the down payment and closing costs, you will lower your monthly mortgage payments and could save lots of money. The key is staying in the home long enough to recoup the prepaid interest. If you sell the home after only a few years, or refinance the mortgage or pay it off, buying discount points could be a money-loser.

Here is an example of how discount points can reduce costs on a $200,000, 30-year, fixed-rate mortgage:

| Loan principal | |

|---|---|

| None | $20,680 |

In this example, the borrower bought two discount points, with each costing 1 percent of the loan principal, or $2,000. By buying two points for $4,000 upfront, the borrowers interest rate shrank to 3.5 percent, lowering their monthly payment by $56, and saving them $20,680 in interest over the life of the loan.

How Is My Interest Payment Calculated

Lenders multiply your outstanding balance by your annual interest rate, but divide by 12 because youre making monthly payments. So if you owe $300,000 on your mortgage and your rate is 4%, youll initially owe $1,000 in interest per month . The rest of your mortgage payment is applied to your principal.

Dont Miss: How Long To Pay Off 70000 Mortgage

You May Like: How To Pay Down Mortgage Without Refinancing

Structural Mortgage Market Shifts: Increasing Loan Duration & Explicit Government Backing

While the stamp duty holiday was widely discussed, the UK also pushed through other structural shifts to the mortgage market in the wake of the COVID-19 crisis.

In the UK, usually the longest term fixed mortgage you could normally get was five years. Boris Johnson has now. Nobody can pretend that this has anything to do with Covid, and in fact when Johnson announced it, his stated aim was to give young people access onto the housing ladder. This is a good example of how the magic money tree was discovered for Purpose A, i.e. Covid, and is being used for Purpose B, furthering social justice.Russell Napier

When governments guarantee loans they lower the risk of making the loans, which in turn increases the flow of capital into the associated market. That typically leads to faster appreciation.

Programs created to help people get into the market are initially effective, but after prices adjust to reflect said capital shifts and risk-free profits the market becomes structurally dependent on such programs & the incremental help they offer declines as prices rise.

The property market has been frenzied throughout the first half of 2021 with Rightmove stating the first half of the year has been the busiest since 2000. Average home prices across England, Wales and Scotland rose to £338,447, an increase of £21,389 or 6.7% since the end of 2020.

Fixed Rate Mortgage Penalty Interest Rate

For fixed-rate mortgages, lenders usually use the greater of three months of interest or an interest rate differential . Each lender has their own IRD calculation. The interest rate that they use for their IRD is usually based on either their current advertised mortgage rates or their posted rates, which can often be much higher.

| Advertised Rate IRD |

|---|

Read Also: How Much Do I Pay In Mortgage Interest

Fixed Versus Adjustable Interest Rates

A mortgage on which the interest rate is set for the life of the loan is called a fixed-rate mortgage or FRM, while a mortgage on which the rate can change is an adjustable rate mortgage or ARM. ARMs always have a fixed rate period at the beginning, which can range from 6 months to 10 years. The rate adjustment feature of an ARM makes it a lot more complicated than an FRM, which is why many borrowers wont consider an ARM.

Best For Car Enthusiasts

A FICO score/credit score is used to represent the creditworthiness of a person and may be one indicator to the credit type you are eligible for. However, credit score alone does not guarantee or imply approval for any financial product.

Our writers, editors and industry experts score credit cards based on a variety of factors including card features, bonus offers and independent research. Credit card issuers have no say or influence on how we rate cards.

- Earn unlimited 7x total points with GM.* 4x points on purchases everywhere else.*

- Welcome Offer:

- Get 15,000 bonus points after you spend $1,000 in your first three months.*

- Regular APR:

- 17.99%-27.99% variable purchase APR based on creditworthiness. Rates as of 10/1/2022

- Purchase Intro APR:

- 0% Intro Purchase APR for 12 Months*

- Balance Transfer Intro APR:

- $0*

Car connoisseurs rejoice, especially if your interests land in the General Motors manufacturing portfolio. Youll earn 7X points on GM purchases and 4X points everywhere else with this card, all for no annual fee and with no reward earning caps.

Don’t Miss: Should I Refinance My Mortgage Or Not

How Do Mortgage Rates Work

The mortgage rate a lender offers you is determined by a mix of factors that are specific to you and larger forces that are beyond your control.

Lenders will have a base rate that takes the big stuff into account and gives them some profit. They adjust that base rate up or down for individual borrowers depending on perceived risk. If you seem like a safe bet to a lender, you’re more likely to be offered a lower interest rate.

Factors you can change:

-

Your . Mortgage lenders use credit scores to evaluate risk. Higher scores are seen as safer. In other words, the lender is more confident that you’ll successfully make your mortgage payments.

-

Your down payment. Paying a larger percentage of the home’s price upfront reduces the amount you’re borrowing and makes you seem less risky to lenders. You can calculate your loan-to-value ratio to check this out. A LTV of 80% or more is considered high.

-

Your loan type. The kind of loan you’re applying for can influence the mortgage rate you’re offered. For example, jumbo loans tend to have higher interest rates.

-

How you’re using the home. Mortgages for primary residences a place you’re actually going to live generally get lower interest rates than home loans for vacation properties, second homes or investment properties.

Forces you can’t control:

» MORE: What determines mortgage rates?

Make Extra Principal Payments Monthly

There are pros and cons to choosing to make extra principal payments instead of refinancing.

Positives include:

- Save on interest by reducing principal and years paid on loan

- No additional closing costs for refinancing

Negatives include:

- No savings on interest rate

- Need for self-discipline

- Eliminates fewer years on total mortgage when compared to a 15-year refinance

Overall, making additional principal payments can be a win-win if you are disciplined enough to make the additional payments on a regular basis. If you can pay an extra $100 per month towards principal on a $100,000, 30-year mortgage, the average time shaved from the loan is nine years.

Read Also: What Is The Mortgage On 1.4 Million

Buying Your First Home In 2022

Even under normal conditions, buying a house presents challenges of one sort or another for buyers. Buying a house in 2022 comes with a number of challenges.

One factor has been a dwindling supply of homes in some parts of the country. This stems from a combination of some sellers taking their home off the market and increased demand for homes in many areas. In some cases, sellers may have decided that this isnt a good time to move, or perhaps theyve encountered a financial situation that has led to this decision. Due to the pandemic, many families have decided to move out of congested urban areas and into suburban areas. In many cases, the lower supply and increased demand have resulted in higher prices and stiff competition.