Benefits Of A Mortgage Loan Approved With Conditions

You can only obtain a conditional mortgage loan after youve found a specific home. However, you should not wait until after your offer to apply for a mortgage loan with conditions. There are many important reasons to get a mortgage loan approved with conditions before making an offer on a home including:

- A mortgage loan approved with conditions is more attractive to sellers and can set you apart from other buyers that only have pre-approval.

- If you stick with only pre-approval, you are likely to lose to other buyers, especially for the most desirable properties.

- Conditional loan approval can greatly reduce the closing time since most of the loan process is already done.

- Eliminate many of the unknowns and uncertainties in the home buying process with your conditional loan approval.

- Builders for new construction often require conditional loan approval before beginning the process. Most likely, you cannot start building a new home without conditional loan approval.

How To Apply For Conditional Loan Approval

Here are the steps to applying for conditional loan approval:

- Shop around with the best mortgage lenders to find the best home loan offer.

- Provide the lender you choose with all of the financial information it requests.

- Tell your lender you want a notice of conditional loan approval once your loan reaches that stage.

- Wait for an underwriter to review your information to determine whether you’re eligible for conditional approval for a home loan.

- If you’re conditionally approved, you’ll receive a notice or letter to that effect.

Keep in mind that underwriting could take just a few days, or it could take over a week. Your lender may be able to give you an estimate as to how long the process will take so you know what to expect.

Your lender may ask for quite a bit of documentation before beginning the underwriting process. That documentation could include:

- Bank account statements

- Recent tax returns

- A letter of employment verification

If you’re self-employed and applying for a mortgage, you may need to provide additional information, including:

- Profit and loss statements from your business, if you own one

- A copy of your business license

- Copies of contracts indicating that your workflow is ongoing

- A letter from an accountant verifying how long you’ve been in business

Complying with your lender’s requests will help make the underwriting process go smoothly. When the process is finished, you can get a letter or notice of conditional loan approval.

When To Get A Pre

Mortgage pre-approval letters are typically valid for 60 to 90 days. Lenders put an expiration date on these letters because your finances and credit profile could change. When a pre-approval expires, youll have to fill out a new mortgage application and submit updated paperwork to get another one.

If youre just starting to think about buying a home and suspect that you might have some difficulty getting a mortgage, going through the pre-approval process can help you identify credit issuesand potentially give you time to address them.

Seeking pre-approval six months to one year in advance of a serious home search puts you in a stronger position to improve your overall credit profile. Youll also have more time to save money for a down payment and closing costs.

When you are ready to make offers, a seller often wants to see a mortgage pre-approval and, in some cases, proof of funds to show that youre a serious buyer. In many hot housing markets, sellers have an advantage because of intense buyer demand and a limited number of homes for sale they may be less likely to consider offers without pre-approval letters.

Also Check: Does Student Loan Affect Mortgage

Is There Anything Better Than A Mortgage Pre

With this competitive housing market, mortgage pre-approval letters have unfortunately started losing their authority. Most buyers have them, and in a multiple-offer situation, they just dont have what it takes to make you stand out.

Fortunately for you, theres something better!

If you want a true competitive advantage, Churchill Mortgages Certified Homebuyer program is a great option. When you become a certified homebuyer, you have all the advantages of a pre-approval like credibility as a homebuyer, confidence in your search, and an accelerated closing process.

But unlike with pre-approved mortgages that only involve a loan officer, your certified homebuyer application is reviewed by a mortgage underwriterwhich is a huge advantage when you start shopping for houses! Youll be able to close faster and have a leg up on other buyers who will probably have to wait for an underwriter to review their application.

Dont sell yourself short with a standard pre-approval. Take your home-buying credentials to the next level today and get in touch with a Churchill Mortgage expert!

About the author

Ramsey Solutions

Order A Home Inspection

As you work through the mortgage process, you may also order a home inspection. Home inspections are usually recommended, though some buyers choose to waive them in a competitive market.

A thorough home inspection gives you important details about the home beyond what you may be able to see on the surface.

Some of the areas a home inspector checks include:

- Homes structure

Getting a home inspection is important because it helps the buyer know if a home may need costly repairs. If the home needs extensive repairs, you may want to look for another home.

Even if you do want to continue with the purchase, what is uncovered during an inspection can become part of a sales negotiation between buyer and seller, and their real estate agents.

Also Check: Does Chase Allow Mortgage Recast

Important Factors When Considering A Mcc

As will all things when it comes to buying a house, it is important to explore the costs and risks in applying for an MCC. This will help you decide if the benefits make it worth your while.

- Refinancing. MCCs are only eligible in combination with purchase loans, meaning you cannot apply for one as part of a refinancing. However, if you already have an MCC, and later decide to refinance, some states may allow you to request that your certificate be reissued against the new mortgage loan.

- Fees. The state housing agencies typically charge the borrower a one-time fee for the MCC, which will be included in your closing costs. In some programs, this fee is waived or reduced if the MCC is issued together with an HFA first-lien mortgage product. The size of the fees vary by state.The lender who issues the certificate will also charge a fee, although that is usually capped at a specific amount.

- The IRS. You might have to repay some of the tax credit back to the IRS if you meet all three of the following conditions:

- You sell the home within 9 years of buying it.

- You now earn much more in income than when you initially bought the home.

- You make a profit from selling the home.

- The maximum amount that the IRS can clawbackâpayable upon the sale of the homeâis 6.25% of the original principal loan balÂance, or 50% of your gains from the sale, whichever is less.

What Is Mortgage Preapproval

Preapproval is as close as you can get to confirming your creditworthiness without having a purchase contract in place. You will complete a mortgage application and the lender will verify the information you provide. Theyll also perform a credit check. If youre preapproved, youll receive a preapproval letter, which is an offer to lend you a specific amount, good for 90 days.

Recommended Reading: Why Do You Need Mortgage Insurance

How Far In Advance Should I Get Pre

The best time to get pre-approved for a mortgage is at least one year before you decide to purchase.

As a home buyer, pre-approvals are for your benefit, so its never too early to get one.

Getting pre-approved early is an advantage because one-third of mortgage applications contain an error. These errors can negatively affect your interest rate and ability to buy a home. Pre-approvals uncover those mistakes and give you time to fix them.

Getting pre-approved also sets your price range. Pre-approved buyers are less likely to overspend or underspend! on their residence as compared to buyers who use online mortgage calculators.

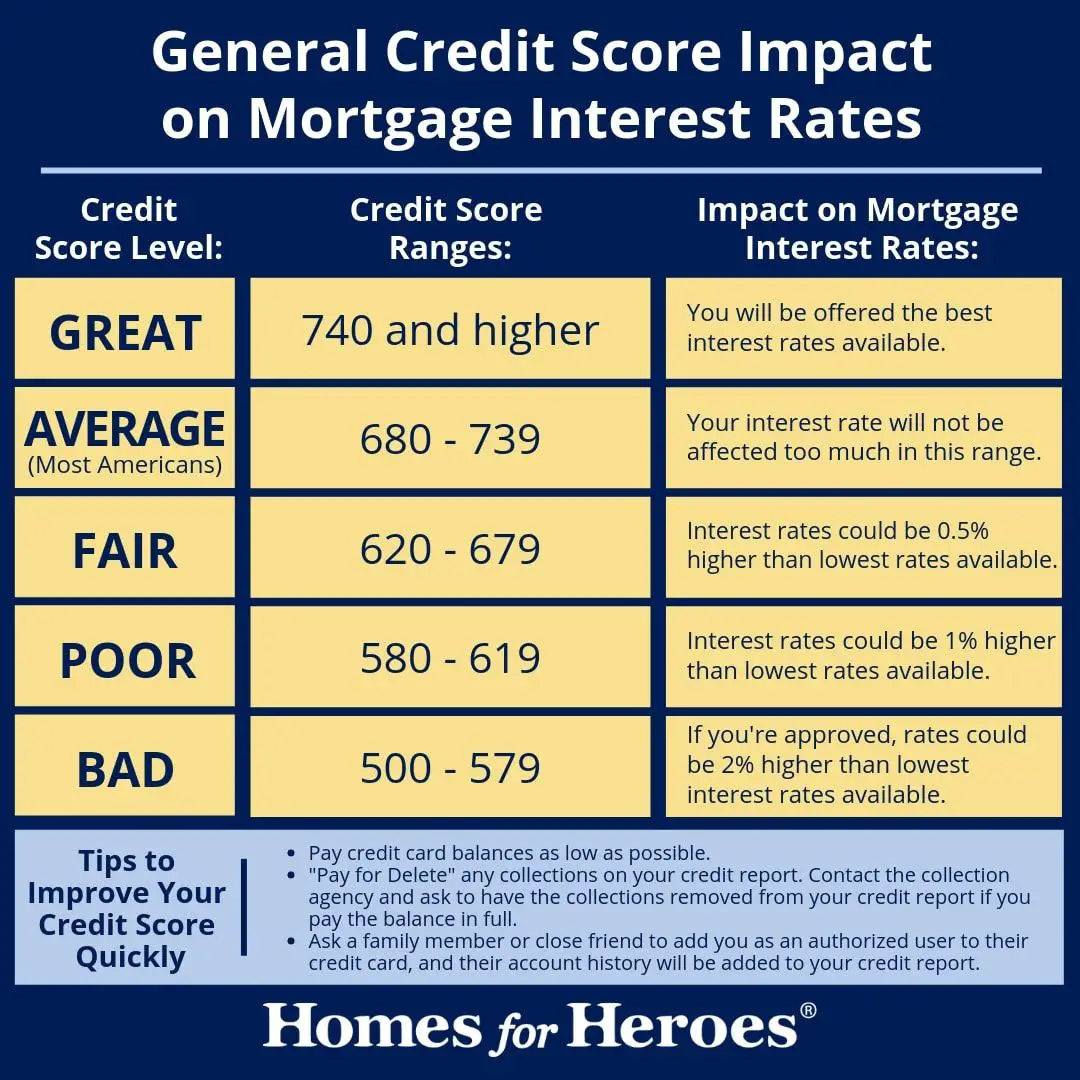

Can I Get A Home Loan With Bad Credit

Its possible to qualify for a mortgage even if your credit score is low. Its more difficult, though. A low credit score shows lenders that you may have a history of running up debt or missing your monthly payments. This makes you a riskier borrower.

To help offset this risk, lenders will typically charge borrowers with bad credit higher interest rates. They might also require that such borrowers come up with larger down payments.

If your credit is bad, be prepared for these financial hits. You may qualify for a mortgage with a low credit score. Youll just have to pay more for it.

Recommended Reading: Will Mortgage Rates Stay Low

Learn What You Need To Speed Up The Approval Process

Home shopping often starts in a lender’s office with a mortgage application and not at an open house. Most sellers expect buyers to obtain pre-approval for financing and are commonly willing to negotiate with those who prove that they can obtain a loan.

What Is The Minimum Credit Score For A Small Business Loan

The minimum personal credit score for a small business loan is typically 500. However, the minimum score may be higher or lower depending on the lender. To increase your chances of being approved for a loan, try to maintain a good credit score and make all your payments on time. Building your business credit score can also help you get approved for a loan with better terms.

Also Check: Can You Buy A House With A Reverse Mortgage

Categorization Of Credit Risk

From a risk perspective, the quality of the credit approval process is determined by the best possible identification and assessment of the credit risk resulting from a loan request. The credit risk can be categorized or distributed into three risk components.

Probability of default : the probability that a prospective borrower will default is assessed by its current and future ability to honor all debt-related payments interest and principal. The PD for companies is obtained from agencies. If the probability of default is lower, then the credit might be approved with a lower cost of borrowing i.e. at a lower interest rate or with no requirement of down payment against the loan. Pledging of collateral against the loan is a measure to partly manage the risk involved.

Loss given default : is an assessment of the amount of loss that a bank/lender could incur, should the borrower default on the loan. The LGD is affected by the collateralized portion, along with the cost of selling the collateral. Consequently, in the designing of credit approval processes, the computed value, and type of collateral also need to be taken into account.

Exposure at default : assesses the amount of exposure to loss the bank/lender is exposed to at any particular point in time and reflects the risk appetite of the lending institution.

What Do Lenders Consider Bad Credit

A bad credit score is typically considered a credit score that is below 580. A bad credit score can make it difficult to get approved for a loan and can lead to high-interest rates and other penalties.

Bad credit is often the result of missed payments, bankruptcy, or maxing out credit cards. To improve your score, you need to be proactive and make sure all your payments are on time and that youre not overextending yourself.

Don’t Miss: How Much Is Mortgage For 100k House

Is My Credit Score Good Enough For A Mortgage

Your , the number that lenders use to estimate the risk of extending you credit or lending you money, is a key factor in determining whether you will be approved for a mortgage. The score isnt a fixed number but fluctuates periodically in response to changes in your credit activity . What number is good enough, and how do scores influence the interest rate you are offered? Read on to find out.

How Long Does It Take To Get Preapproved

Depending on the mortgage lender you work with and whether you qualify, you could get a preapproval in as little as one business day, but it usually takes a few days or even a week to receive and, if you have to undergo an income audit or other verifications, it can take longer than that.

In general, if you have your paperwork in order and your credit and finances look good, its possible to get a preapproval quickly.

Also Check: How To Sell A Private Mortgage Loan

Which Is Right For Me

First-time homebuyers are more likely to find that getting prequalified is helpful, especially when they are establishing their homebuying budget and want an idea of how much they might be able to borrow.

Preapproval can be extremely valuable when it comes time to make an offer on a house, especially in a competitive market where you might want to stand out among other potential buyers. Again, a seller will be more likely to consider you a serious buyer because you have had your finances and creditworthiness verified.

Ready to prequalify, get preapproved or apply? Get started with the Digital Mortgage Experience.

Dont Miss: What Is The Formula For Calculating Monthly Mortgage Payments

The Difference Between Pre

Most prospective home buyers know that they should get pre-approved for a mortgage. This should happen before they start to consider all their home loan options and make an offer. While lenders will often use the terms pre-approval and credit approval interchangeably, home buyers should know the difference. This will put themselves in the strongest position possible when it comes time to make an offer. Heres what we know about pre-approval vs. full credit approval.

Read Also: How To Track Mortgage Interest Rates

Get Your Credit In Shape

A lower credit score can make it more difficult for you to get approved for a mortgage, and can also make your loan more expensive with a higher interest rate. If your credit score needs improvement, commit to paying down debt and try to keep your credit utilization ratio below 30 percent. With less debt, especially, your DTI ratio will be lower many lenders look for 36 percent or less.

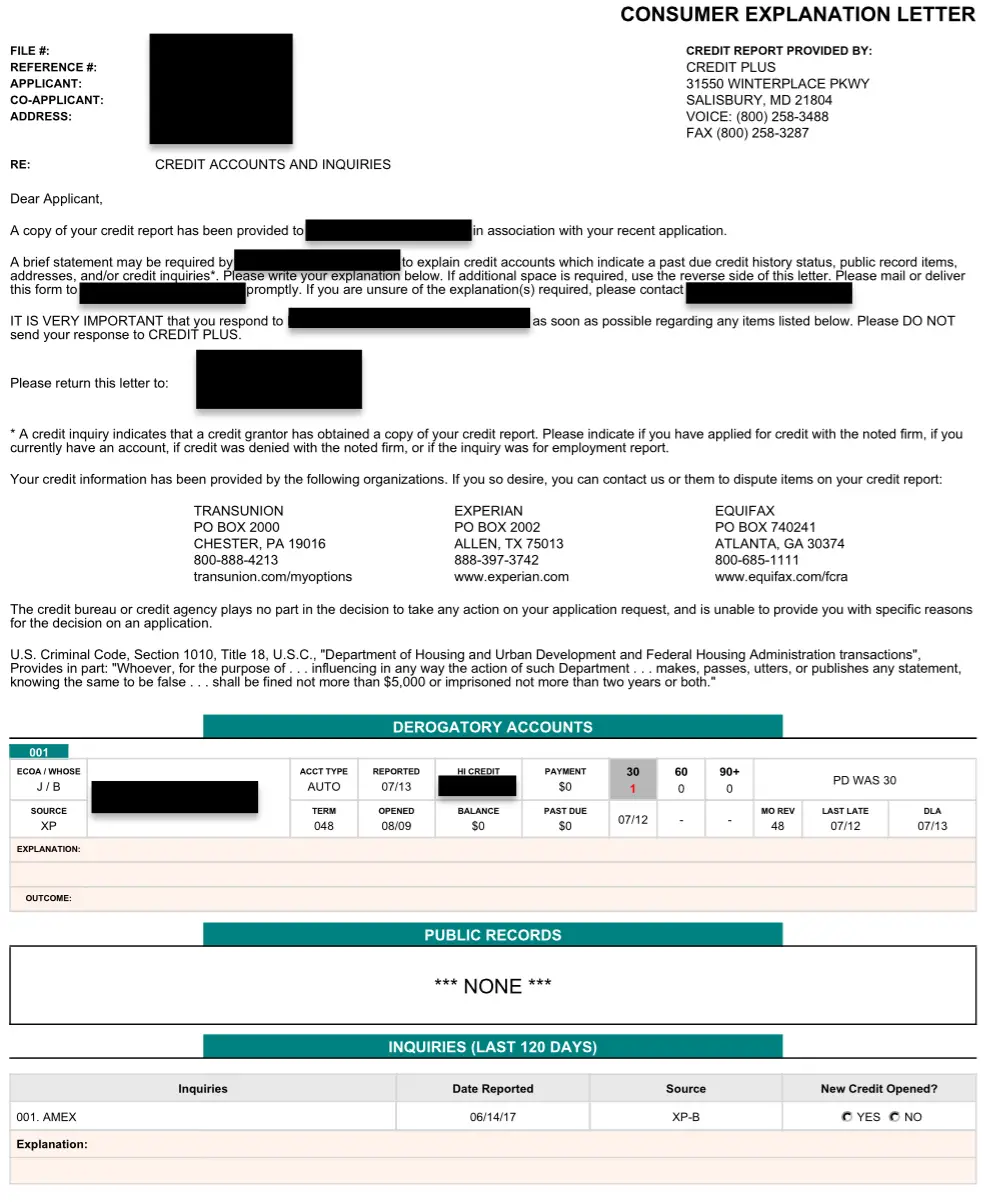

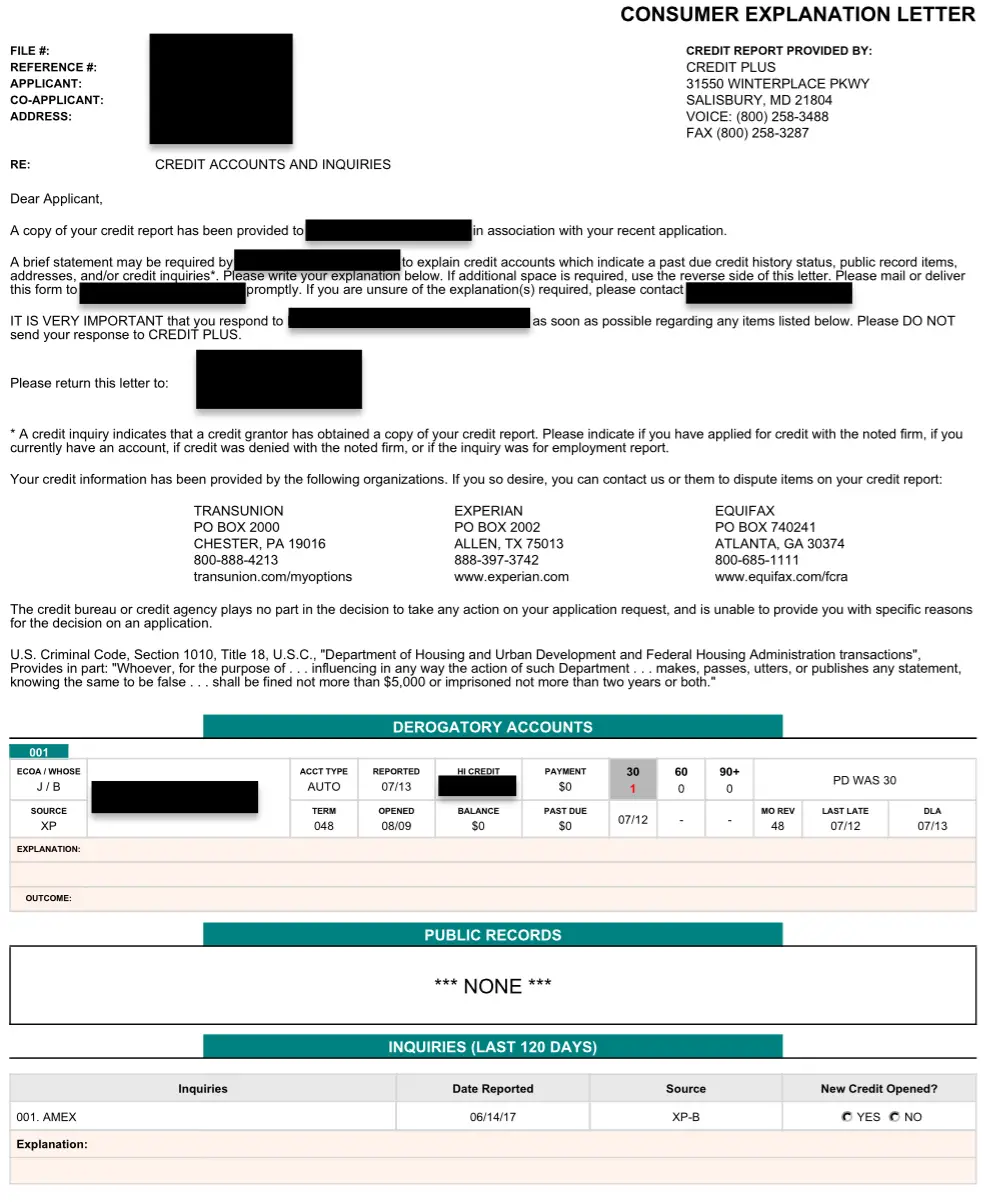

In addition, check your credit report to ensure there are no errors that could be negatively impacting your score. You can get a copy from the three major credit bureaus. If you do find a mistake, contact the agency to dispute it as soon as possible.

The Buyers Credit Score Dropped Below The Minimum

Mortgage pre-approvals are test runs for a buyers actual mortgage approval. So, if the buyers credit score drops before finding a home, the buyers pre-approval may be invalidated.

In general, the minimum credit score requirements are:

- FHA: 500 credit score

Learn more about how to fix your credit score to buy a home.

Read Also: How Do I Find A Good Mortgage Broker

What Is A Lender Credit

A lender credit is money provided by your mortgage lender to help cover a certain amount of your closing costs. However, this kind of credit isnât just free money. In exchange, youâll agree to pay a higher interest rate on your loan, which likely means making higher monthly payments.

Keep in mind that while a lender credit can cover a variety of closing costs, you canât use one for:

- Funds pay off other debts to allow you to qualify for a mortgage

- Cash reserves to show you have the ability to repay the loan if your income changes

Does Getting Pre

A pre-approval letter doesnt bind you to any lender. That being said, if you do decide to take out a mortgage through another lender, youll have to repeat the paper work. But if you take out a mortgage through the lender who issued you a mortgage pre-approval, theyll have your paperwork on file, which will save you time when youre closing on a house.

You May Like: How Much Should You Spend On Your Mortgage

Can I Get A Pre

Yes, you can get pre-approved for a mortgage with bad credit.

Its just not easy.

Lenders look at the whole picture, not just the credit report. Having a lot of money in reserve, a good income, a steady job and small amount of debt can overcome the bad FICO report you got for doing the opposite of all those things.

The hitch is youll still have to pay a higher interest rate and make a larger down payment, but at least youll qualify for a mortgage.

Many lenders rule out applicants with credit scores lower than 640. But a 2017 study by the technology company Ellie Mae found that 5% of all Federal Housing Administration-insured loans that closed in December of 2016 had FICO scores below 600.

Additionally, 3.4% had FICO scores between 550 and 599, while 1.5% had scores between 500 and 549. So dont think a bad credit history means theres mortgage in your future.

Is There A Difference Between A Mortgage Pre

A pre-qualification and pre-approval are both ways to determine how much house you can afford when shopping for a new home. Think of a mortgage pre-qualification as the rough draft for a home loan approval. Its your first pass on understanding your financial readiness to buy a home.

Although some mortgage lenders use these two terms interchangeably, a mortgage pre-qualification doesnt usually require a hard pull on your credit or documentation to verify your income and assets.If youre unsure of your credit score and financial preparedness, a mortgage pre-qualification is a good first step to determine how much you can afford for your new home.

See how much home you can afford with our home affordability calculator

Also Check: How Much Mortgage Can I Afford With 70000 Salary