How Big Is The Uk Mortgage Market

Historically across the United Kingdom, around 65 thousand to 70 thousand mortgages are approved each month. This is from a low of around 30 thousand after the 2008 to 2009 global financial crisis. Prior to the recession, the monthly rate was closer to 80 thousand to 130 thousand mortgages completed each month.

The UK Mortgage Market is Over £1.5 Trillion

In the fourth quarter of 2020, there were £76.5 billion new mortgage originations in the UK, according to the Financial Conduct Authority . At the end of the fourth quarter of 2020, there were £1,438.4 billion in unsecuritised home loans outstanding, with £102.956 billion in securitised home loans. Total residential mortgages to individuals summed of £1.541 trillion across 13,404,487 loans in the fourth quarter of 2020.

Overall mortgage debt tends to grow around 3% to 6% per annum, though there can be significant fluctuations in that rate of growth due to factors like BREXIT, the global economic crisis which happened in 2008, COVID-19 lockdowns, etc. Segments of the market can change faster than the overall market due to those same sorts of factors along with various legal changes tied to foreign property ownership, the localised balance between immigration and construction, etc.

Why Should I Use A Mortgage Calculator

Typical Costs Included In A Mortgage Payment

- Principal: This is the amount you borrowed from the lender.

- Interest: This is what the lender charges you to lend you the money. Interest rates are expressed as an annual percentage.

- Property taxes: Local authorities assess an annual tax on your property. If you have an escrow account, you pay about one-twelfth of your annual tax bill with each monthly mortgage payment.

- Homeowners insurance: Your insurance policy can cover damage and financial losses from fire, storms, theft, a tree falling on your home and other hazards. If you live in a flood zone, youll have an additional policy, and if youre in Hurricane Alley or earthquake country, you might have a third insurance policy. As with property taxes, you pay one-twelfth of your annual insurance premium each month, and your lender or servicer pays the premium when its due.

- Mortgage insurance: If your down payment is less than 20 percent of the homes purchase price, youll probably be on the hook for mortgage insurance, which also is added to your monthly payment.

Dont Miss: Can You Do A Reverse Mortgage On A Mobile Home

Read Also: How Many Tax Returns For Mortgage

Los Angeles Homebuyers Can Take Advantage Of Historically Low Mortgage Rates Today

Own your very own piece of Los Angeles. Lock in low rates currently available in and save for years to come! In spite of the recent rise in rates current mortgage rates are still below historic averages. If you secure a fixed mortgage rate your payments won’t be impacted by future rate hikes. By default we show 30-year purchase rates for fixed-rate mortgages. You can switch over to refinance loans using the radio button. Adjustable-rate mortgage loans are listed as an option in the check boxes. Alternate loan durations can be selected and results can be filtered using the button in the bottom left corner. You can select multiple durations at the same time to compare current rates and monthly payment amounts.

Help your customers buy a home today byinstalling this free mortgage calculator on your website

As Seen In

How Much Interest Am I Paying

While it may be tempting to only look at the monthly payment when searching for a loan, its important to calculate the total amount you are actually paying over the life of the loan. On average, the longer the loan term, the more you will pay in interest.

In the mortgage example above, over 30 years, the $300,000 mortgage will cost nearly $600,000 total, which nearly doubles the original cost of the loan. With the auto loan example, a $30,000 loan will end up costing nearly $35,000 after five years.

Understanding what you will pay in total for your loan can help you determine if your purchase is worth it. While buying a home that goes up in value long-term may be worth the interest paid, buying a new car that goes down in value may end up costing you even more in the long run.

Also Check: How Much Will My Monthly Mortgage Payment Be

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Determine Your Mortgage Principal

The initial loan amount is referred to as the mortgage principal.

For example, someone with $100,000 cash can make a 20% down payment on a $500,000 home, but will need to borrow $400,000 from the bank to complete the purchase. The mortgage principal is $400,000.

If you have a fixed-rate mortgage, you’ll pay the same amount each month. With each monthly mortgage payment, more money will go toward your principal, and less will go toward paying interest.

Read more:The average monthly mortgage payment by state, city, and year

Recommended Reading: What Is The Average Cost Of A Mortgage Refinance

Whats The Difference Between Interest Rate And Apr

The interest rate is the amount that the lender actually charges you as a percent of your loan amount. By contrast, the annual percentage rate is a way of expressing the total cost of borrowing. Therefore, APR incorporates expenses such as loan origination fees and mortgage insurance. Some loans offer a relatively low interest rate but have a higher APR because of other fees.

Home Loans And Credit Cards

Home loans can be complicated. It is smart to use an amortization schedule to understand your interest costs, but you may need to do extra work to figure out your actual rate. You can use our mortgage calculator to see how your principal payment, interest charges, taxes, and insurance add up to your monthly mortgage payment.

You might know the annual percentage rate on your mortgage, and keep in mind that APR can contain additional costs besides interest charges . Also, the rate on adjustable-rate mortgages can change.

With credit cards, you can add new charges and pay off debt numerous times throughout the month. All of that activity makes calculations more cumbersome, but its still worth knowing how your monthly interest adds up. In many cases, you can use an average daily balance, which is the sum of each days balance divided by the number of days in each month . In other cases, your card issuer charges interest daily .

Don’t Miss: Does Charles Schwab Offer Mortgages

What Is A Mortgage Principal

A principal is the original amount of a loan or investment. Interest is then charged on the principal for a loan, while an investor might earn money based on the principal that they invested. When looking at mortgages, the mortgage principal is the amount of money that you owe and will need to pay back. For example, perhaps you bought a home for $500,000 afterclosing costsand made a down payment of $100,000. You will only need to borrow $400,000 from a bank or mortgage lender in order to finance the purchase of the home. This means that when you get a mortgage and borrow $400,000, your mortgage principal will be $400,000.

Your mortgage principal balance is the amount that you still owe and will need to pay back. As you make mortgage payments, your principal balance will decrease. The amount of interest that you pay will depend on your principal balance. A higher principal balance means that youll be paying more mortgage interest compared to a lower principal balance, assuming the mortgage interest rate is the same.

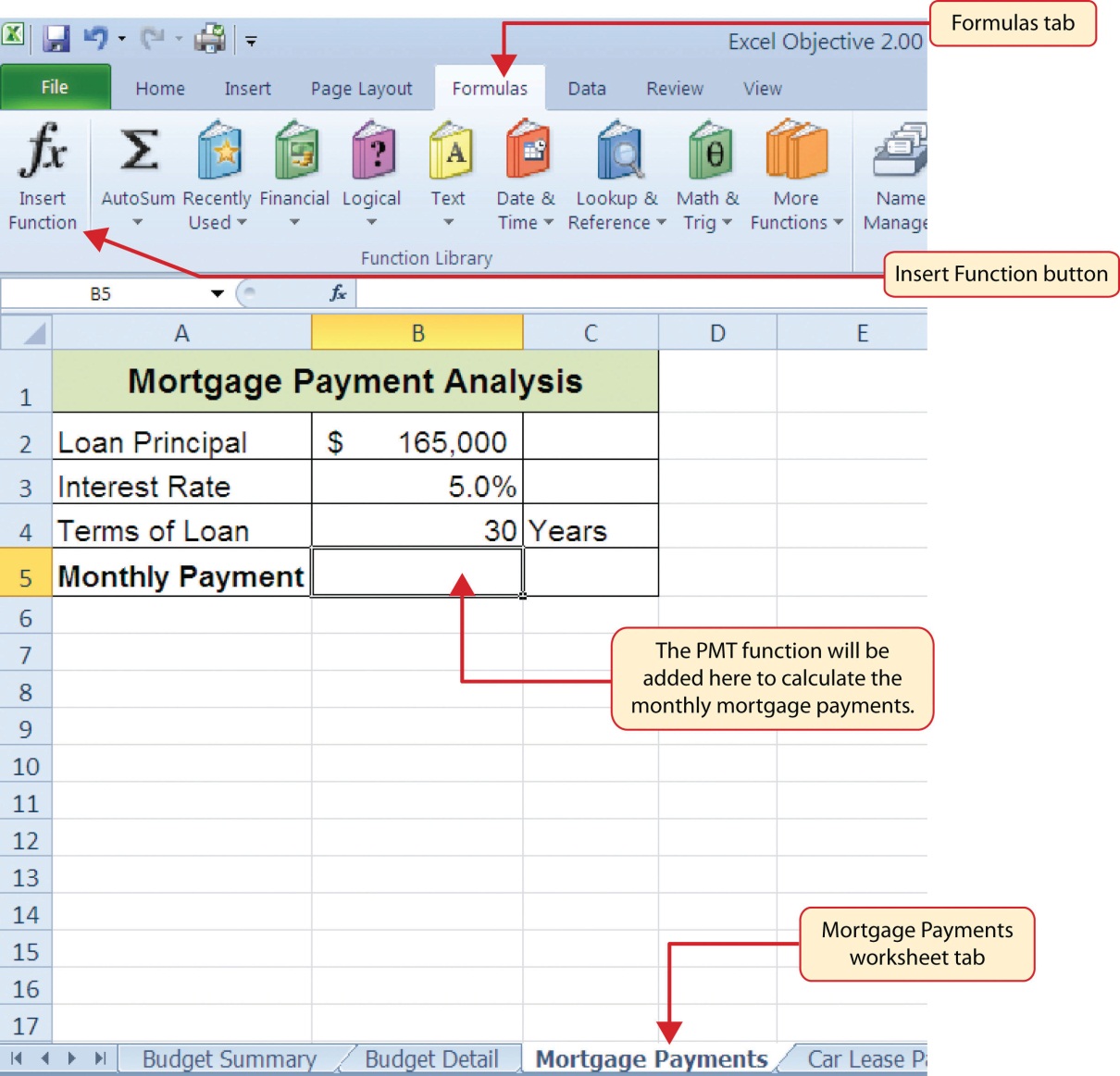

How To Use The Loan Amortization Calculator

With HSH.coms mortgage payment calculator, you enter the features of your mortgage: amount of the principal loan balance, the interest rate, the home loan term, and the month and year the loan begins.

Your initial display will show you the monthly mortgage payment, total interest paid, breakout of principal and interest, and your mortgage payoff date.

Most of your mortgage loan payment will go toward interest in the early years of the loan, with a growing amount going toward the loan principal as the years go by until finally almost all of your payment goes toward principal at the end. For instance, in the first year of a 30-year, $250,000 mortgage with a fixed 5% interest rate, $12,416.24 of your payments goes toward interest, and only $3,688.41 goes towards your principal. To see this, click on Payment chart and mouse over any year.

Calculate

The effect of prepayments

Now use the mortgage payment calculator to see how prepaying some of the principal saves money over time. The calculator allows you to enter a monthly, annual, bi-weekly or one-time amount for additional principal prepayment.To do so, click + Prepayment options.

You may also target a certain loan term or monthly payment by using our mortgage prepayment calculator. Of course youll want to consult with your financial advisor about whether its best to prepay your mortgage or put that money toward something else, such as retirement.

Loan amount

Read Also: How Do Mortgage Appraisals Work

Read Also: How Much Mortgage Can I Afford On 200k Salary

Changes In Mortgage Interest Rates

Most new mortgages are sold in the secondary market soon after being closed, and the prices charged borrowers are always based on current secondary market prices. The usual practice is to reset all prices every morning based on the closing prices in the secondary market the night before. Call these the lenders posted prices.

The posted price applies to potential borrowers who have been cleared to lock, which requires that their loan applications have been processed, the appraisals ordered, and all required documentation completed. This typically takes several weeks on a refinance, longer on a house purchase transaction.

To potential borrowers in shopping mode, a lenders posted price has limited significance, since it is not available to them and will disappear overnight. Posted prices communicated to shoppers orally by loan officers are particularly suspect, because some of them understate the price to induce the shopper to return, a practice called low-balling. The only safe way to shop posted prices is on-line at multi-lender web sites such as mine.

The Structure Of Mortgage Interest Rates

On any given day, Jones may pay a higher mortgage interest rate than Smith for any of the following reasons:

- Jones paid a smaller origination fee, perhaps receiving a negative fee or rebate.

- Jones had a significantly lower credit score.

- Jones is borrowing on an investment property, Smith on a primary residence.

- Jones property has 4 dwelling units whereas Smiths is single family.

- Jones is taking cash-out of a refinance, whereas Smith isnt.

- Jones needs a 60-day rate lock whereas Smith needs only 30 days.

- Jones waives the obligation to maintain an escrow account, Smith doesnt.

- Jones allows the loan officer to talk him into a higher rate, while Smith doesnt.

All but the last item are legitimate in the sense that if you shop on-line at a competitive multi-lender site, such as mine, the prices will vary in the way indicated. The last item is needed to complete the list because many borrowers place themselves at the mercy of a single loan officer.

Don’t Miss: How To Qualify For More Money For A Mortgage

Mortgage Interest Calculator Canada

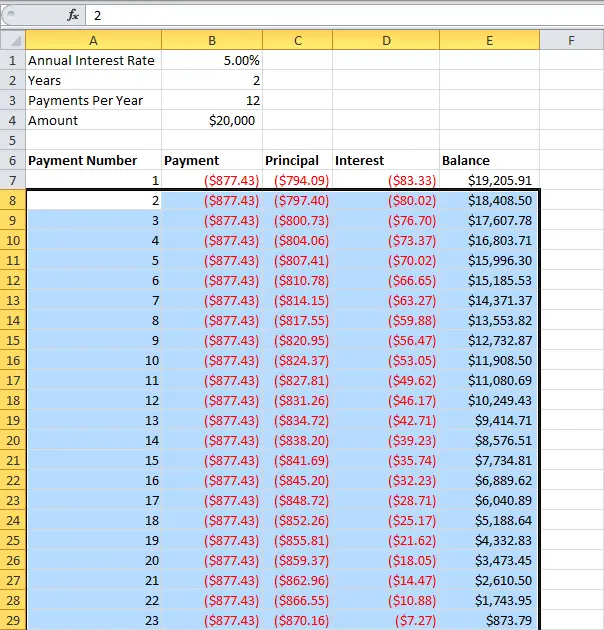

When you make amortgage payment, you are paying towards both your principal and interest. Your regular mortgage payments will stay the same for the entire length of your term, but the portions that go towards your principal balance or the interest will change over time.

As your principal payments lower your principal balance, your mortgage will become smaller and smaller over time. A smaller principal balance will result in less interest being charged. However, since your monthly mortgage payment stays the same, this means that the amount being paid towards your principal will become larger and larger over time. This is why your initial monthly payment will have a larger proportion going towards interest compared to the interest payment near the end of your mortgage term.

This behaviour can change depending on your mortgage type. Fixed-rate mortgages have an interest rate that does not change. Your principal will be paid off at an increasingly faster rate as your term progresses.

On the other hand,variable-rate mortgageshave a mortgage interest rate that can change. While the monthly mortgage payment for a variable-rate mortgage does not change, the portion going towards interest will change. If interest rates rise, more of your mortgage payment will go towards interest. This will reduce the amount of principal that is being paid. This will cause your mortgage to be paid off slower than scheduled. If rates decrease, your mortgage will be paid off faster.

Don’t Forget Taxes Insurance And Other Costs

If you’re buying a home, you’ll also need to consider some other items that can significantly add to your monthly mortgage payment, even if you manage to get a great interest rate on the loan itself. For example, your lender may require that you pay for your real estate taxes and insurance as part of your mortgage payment. The money will go into an escrow account, and your lender will pay the bills as they come due. These costs are not fixed and can rise over time. Your lender will itemize any additional costs as part of your mortgage agreement and recalculate them periodically.

Recommended Reading: Should You Shop Around For Mortgage Lenders

Calculating Daily Interest Manually

The High Cost Of Quick Decisions

Between 2015 and 2016, nearly one in three UK consumers chose mortgage products which cost them more than £550 per year. They got more expensive options over cheaper alternatives that were readily available and which they also qualified for. This fee difference amounts to 12.7% of what consumers spend annually on their mortgage.

The remortgage market is more competitive amongst lenders than the first-time buyer market. So only around 12% in that category opted for strongly dominated product choices. About 18% of first-time buyers fall into the strongly dominated product choice category, and well over 20% of mover mortgages fall in this category. Movers who are in a rush often make emotionally driven or time-sensitive decisions. This compromises their ability to obtain the best deal the way a person who is remortgaging can.

About 14% of borrowers in the top credit score quartile secured strongly dominated products, while more than 20% of consumers in the bottom quartile did not. In general, people who are young, including borrowers with low incomes, low credit scores, and limited funds for deposit are more likely to get an unfavourable mortgage deal. If there are factors that make your transaction more complex, you might find it more challenging to obtain a good loan.

Don’t Miss: How Much Mortgage On 80k Salary