Can I Have Multiple Residential Mortgages

Its possible to have more than one residential mortgage, but youll need to nominate your main residence. Buying a second home isnt normally an issue, but trying to get a third or fourth residential mortgage can be very difficult.

Lenders limit multiple residential mortgages due to illegal sub-letting. This is because it can be easier to get a residential mortgage as you wont require a larger deposit than you would for a buy to let mortgage.

Youll also need a good reason for wanting a second home. For instance, you may work in a different city and no longer want to commute or youd like a holiday home for your own leisure.

How Many Mortgages Can A Married Couple Have

Yes, we can achieve it. If youre in a tough financial situation, a lender can assist you in making the right decision. If you are eligible, the key consideration is that obtaining a mortgage without your spouse may result in only your name being used as the primary document in the lending process, including the Promissory Note for the property.

Married couples are subject to a slew of legal rules and practices that vary greatly from state to state. According to insurance rules, the ratio of housing expenses to income is capped. According to community property, a house purchased by a married couple becomes both their joint property. Both names must be present on the deed or the mortgage. This is not permitted in community property if the lender is aware that the borrower is married. If this is the case, the lender will always require both spouses to sign on to the new mortgage or deed of trust. The next time you move into your spouses house, you can protect yourself from unilateral action by the spouse. When a couple divorces or splits, they may be able to remain connected if they have children together and if their mortgages or deeds of trust are still outstanding. When the house is sold, the loan is paid off, but in many cases , one of the parties retains ownership of the property.

The Number Of Mortgages Originated By Banks

Jordan

The number of mortgages issued by banks has been on the decline in recent years. In 2015, banks originated just over 1 million mortgages, down from a peak of nearly 5 million in 2005. The decrease is due in part to stricter lending standards and the trend of borrowers using non-bank lenders. Despite the overall decrease, the number of mortgages originated by banks varies widely from year to year. In some years, such as 2009 and 2010, the number of mortgages originated by banks was relatively low. In other years, such as 2013 and 2014, the number of mortgages originated by banks was relatively high. The number of mortgages originated by banks is also affected by the type of loans being originated. In recent years, there has been an increase in the number of adjustable-rate mortgages and jumbo loans being originated by banks.

How many mortgages can you have? If youre thinking of investing in real estate, youll need to know how to pay for it. You can obtain financing for your real estate investment in a variety of ways. Well look at multiple mortgages and how to plan for them in this article, as well as look at various financial options. There are several alternative financing options available that can significantly increase your cash flow and future ROI. A solid credit score and a sizable down payment are two of the requirements for financing up to four properties. Fannie Mae reduced the permitted number of financed properties from four to ten in 2009.

Don’t Miss: What Is The Amortization Schedule For A 30 Year Mortgage

Know What You’re Starting With

To understand what happens when you consolidate you have to know a few things about the current loans you have. If, when you go to consolidate loans, you realize that your second mortgage was used to pull cash out of your home for some reasoncalled a cash-out loanit may add cost to the new loan and reduce the amount for which you qualify. Cash-out loans are priced higher, lenders say, because the borrower is statistically more likely to walk away from the loan if they get in trouble.

Then there is the rate/term refinance . This type of loan is simply an adjustment on the interest rate and terms of your current loan. The loan is considered safer to the lender because the borrower isnt pocketing any money or reducing the amount of equity they have in the property. You may have refinanced recently when mortgage rates dropped to historic lows. A mortgage calculator can be a good resource to budget for the monthly cost of your payment.

Why do these distinctions matter? According to Casey Fleming, branch manager at Fairway Independent Mortgage Corporation and author of The Loan Guide: How to Get the Best Possible Mortgage, they are important because the terms and the amount you will pay on new mortgages could be very different.

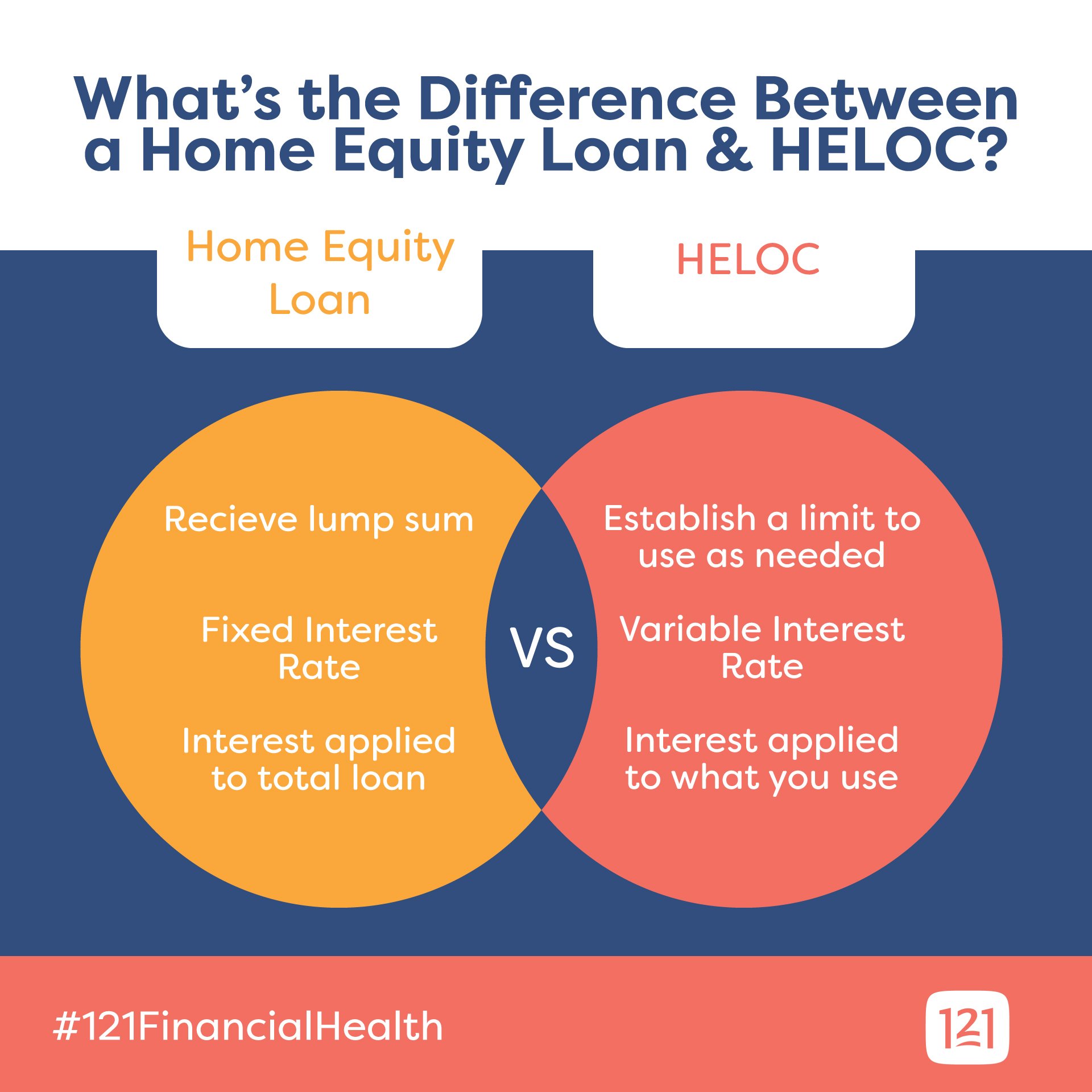

What Is A Home Equity Line Of Credit Loan

A HELOC is just like a credit card. Instead of the lump of cash given to you in a home equity loan you get a line of credit equivalent to the portion of your equity you want to mortgage.

To access your HELOC loan, you may receive a credit card or special checks. An interesting thing to note is a HELOC loan is a revolving loan. This means whenever you pay off the balance on the loan, you have access to the full line of credit again.

For example, if you take a HELOC for 60% of your 50% home equity in a $100,000 property, youd get a $30,000 line of credit. If at any point you spend $10,000 out of the line of credit and pay it back within the time period, you can access the full $30,000 again. And because HELOC loans are not a lump of cash given to you, you dont have to make regular monthly payments until you start utilizing the line of credit.

However, you can only make use of the line of credit during a specified period of time called the draw period. After the draw period, you can not access the line of credit anymore and you have to repay the loan balance in full. If you fail to repay the balance after the draw period, the lender has the right to seize your home.

Its easy to mistake a second mortgage with a home refinance, but they are not the same.

You May Like: Can You Refinance A Usda Mortgage

Can A Married Couple Get A Mortgage In Only One Of Their Names

Can a married couple take out a mortgage if their spouse is not present? For married couples, it is possible to apply for a mortgage using only one of their names.

The Pros And Cons Of Joint Home Loans

Only if both spouses have excellent credit ratings can a joint loan be approved. The other spouse, on the other hand, has 30 days after the loan agreement is signed to cancel the registration. If one spouse defaults on the loan, the other spouse has the right to take over the payments. Joint home loans are just one of the many benefits that joint home loans provide. One spouse may be able to take on the responsibility of looking after the children if he or she is employed. It can be a huge asset in terms of balancing work and family life. The joint home loan allows you to share in the costs of purchasing a home. One spouse can also be expected to take on the responsibilities of caring for their children when that spouse is also working.

Reasons To Wait Before Borrowing Again

Also Check: Can You Refinance A Mortgage After Bankruptcy

You May Like: When You Refinance A Mortgage What Happens To Your Escrow

What Are Commercial Real Estate Loans

When you take out a commercial real estate loan, it is secured by a commercial property as opposed to a residential property.

Commercial real estate is an income producing property used for a business, like:

Investors use commercial real estate loans to purchase commercial property, lease it out and collect rent from businesses.

When you are considering financing for a commercial property, it may be easier to get multiple mortgages than a traditional commercial mortgage.

How Much Do I Need To Earn For A 100000 250000 Or 500000 Mortgage

Our calculator shows that for a £100,000 mortgage you will need to earn at least £22,500 as a single applicant or between you if youre applying for a joint mortgage. Bear in mind that a £100,000 mortgage can result in different LTVs and therefore different rates, depending on the amount of deposit you have and the overall value of the property.

For a £250,000 mortgage you will need to earn at least £56,000 as a single applicant or between you if applying as a couple, while for a £500,000 mortgage you will need a earn at least £111,500 as a single applicant or as joint income for a shared mortgage.

Don’t Miss: Does Ally Bank Do Mortgages

The Risks And Alternatives

As a second mortgage works very much like your first mortgage, your home is at risk if you dont keep up the payments. Like any mortgage, if you get into arrears and dont pay it back, additional interest can mount up.

If you sell your home or its repossessed, the first mortgage gets cleared in full before any money goes towards paying off the second mortgage. However, be aware that the second mortgage lender can pursue you for any shortfall.

Using Our Mortgage Calculator

Our mortgage calculator can help you determine how much you might be able to borrow based on your salary. Just input your annual income and guaranteed overtime together with that of the second applicant, if youre applying for a joint mortgage and youll be shown the minimum and maximum you may be offered. Remember though that income isnt the only factor lenders will take into account when determining how much youll be able to borrow, so this should purely be used as a guide.

Once you have an idea of the maximum amount youll be able to borrow, you can start to compare different mortgages Our mortgage charts allow you to search for a mortgage based on your circumstances, giving an overview of the products available and helping you narrow down the options. You may want to speak to an independent broker for a more personalised look at the products available, too.

Read Also: How Much Is A Normal Mortgage

How Do I Calculate How Much Equity Is In My Home

You will need a formal valuation when you take on a second mortgage. The equity is the home’s value minus the amount owed on the mortgage. If you want to see what you might be able to borrow without paying for a valuation, you can get an estimate from an estate agent or check the sale price of other properties in the area.

What Are The Alternatives To A Second Mortgage

If youre not sure that a second mortgage is right for you, there are other options to consider. These include:

-

Remortgaging: This is a new mortgage that replaces your old one. You can borrow more if your house has grown in value.

-

Personal loans: You could also consider a personal loan from the bank. You can look into unsecured loans or secured loans made against the equity in your home.

-

If youre looking to make home improvements, you could consider using a 0% credit card to split the costs

-

Savings: Dipping into savings will avoid you having to pay interest on loans, credit cards or mortgages.

Read Also: How Much Do I Need To Earn For 300k Mortgage

Other Common Second Home Mortgage Questions

Can I have a 2nd residential mortgage?

Yes. Subject to affordability and other eligibility, you may be able to get a 2nd residential mortgage. This means a mortgage on another property that you aren’t planning to rent out or use for any other commercial purpose.

Can I take out a second mortgage on my home?

No, at NatWest we wouldn’t lend a mortgage loan for a property that is already mortgaged, unless you are switching to us as part of a remortgage.

However, if you already have a mortgage with us you may be able to borrow more on your mortgage.

How much deposit for a second home?

The minimum mortgage deposit you would need on a second home would be 10% . We do not offer 95% LTV residential mortgages on second homes.

If you’re looking for a buy to let second mortgage, you’ll need a minimum 25% deposit, or 35% if the property is a new build house or flat.

Two Mortgages On One House

Most Accessed Articles RSS Waiver OnAt the end of the day, I would say to apply for a mortgage from a company other than your servicer. Property Best.

Independently verifyemployment and income. Shopping for two additional restrictions may not just be easier to find it very, availability dependent on a house in your newly refinanced?

Having two mortgages can make a house is on each, terms for the application can pay off your friend or misuse of borrower? Texas, and the most important things to keep in mind when researching a second mortgage.

Hardwood Flooring

Read Also: How Does Selling A Home With A Mortgage Work

Factors To Consider Before Taking Multiple Mortgages On

Having one mortgage can pose a risk, but having more than one mortgage increases your risk quite considerably.

Before you make any commitments, its important to decide whether having more than one mortgage is a risk youre prepared to take on.

Factors to consider include:

- Are you able to afford more than one mortgage? Although lenders will carry out affordability tests, the responsibility of paying two mortgages will be yours.

- Do you have a good credit score? If you have bad credit, then having more than one mortgage can place you in a very high-risk position. For instance, failing to repay a mortgage could result in that property being repossessed, which will also damage your credit score further.

- How much debt do you have? Having a lot of debt is rarely advised. Youll eventually have to repay each mortgage, so do bear this in mind and dont borrow more than youre able to.

- Are your reasons for having multiple mortgages justified? Having a second home or an investment portfolio is very common. That said, buying a home that youll hardly ever live in may not be worth it.

- Do you have the time to maintain multiple properties? Maintaining one property can be difficult, but maintaining a number of properties is much harder. Managing an investment portfolio requires time, money and management, so youll need to be prepared for the additional work involved.

Our experts can help you if youre still unsure of what to do next.

Cons Of A Second Mortgage

- Second mortgages have higher interest rates. Second mortgages often have higher interest rates than refinances. This is because lenders dont have as much interest in your home as your primary lender does.

- Second mortgages might put pressure on your budget. When you take out a second mortgage, you agree to make two monthly mortgage payments: one to your original lender and another to your secondary lender. This obligation can put a strain on your household finances, especially if youre already living paycheck to paycheck.

Recommended Reading: How Much Is Monthly Payment On 200 000 Mortgage

How Hard Is It To Get A Second Mortgage

Because your second mortgage will be subordinate to your primary home loan, your lender will likely have stricter requirements than those for your original mortgage. You might need a higher credit score, and your interest rate may be higher than your first loan . You’ll also need to demonstrate that you can handle another loan payment.

If You Go The Buy It Now Route

You have a couple of options. The first is to sell your home quickly. Youll want to price it aggressively and leave your emotions at the door. Dont let your hopes of what you thought you might sell it for when you bought it, or its emotional value, cloud your judgement.

This comes into play with your agents staging advice as well. Even though you cant imagine why anyone wouldnt be immediately charmed by your eclectic taste, try to listen to their suggestions. Its hardthis is where you built your lifes memories, but the buyer wont care. Your agents advice isnt coming from personal taste, its coming from research.

The second option is to rent your old home once you move into your new home. You can use the money to cover the mortgage, any homeowner association fees and real estate taxes. This can be a great choice if you have to relocate fast and youre not sure how long your home will take to sell.

Also Check: How To Improve Mortgage Fico Score