Costs Included In Your Monthly Mortgage Payment

Here are two formulas to visualize the costs that are included in your monthly mortgage payment:

Monthly mortgage payment = Principal + Interest + Escrow Account Payment

Escrow account = Homeowners Insurance + Property Taxes + PMI

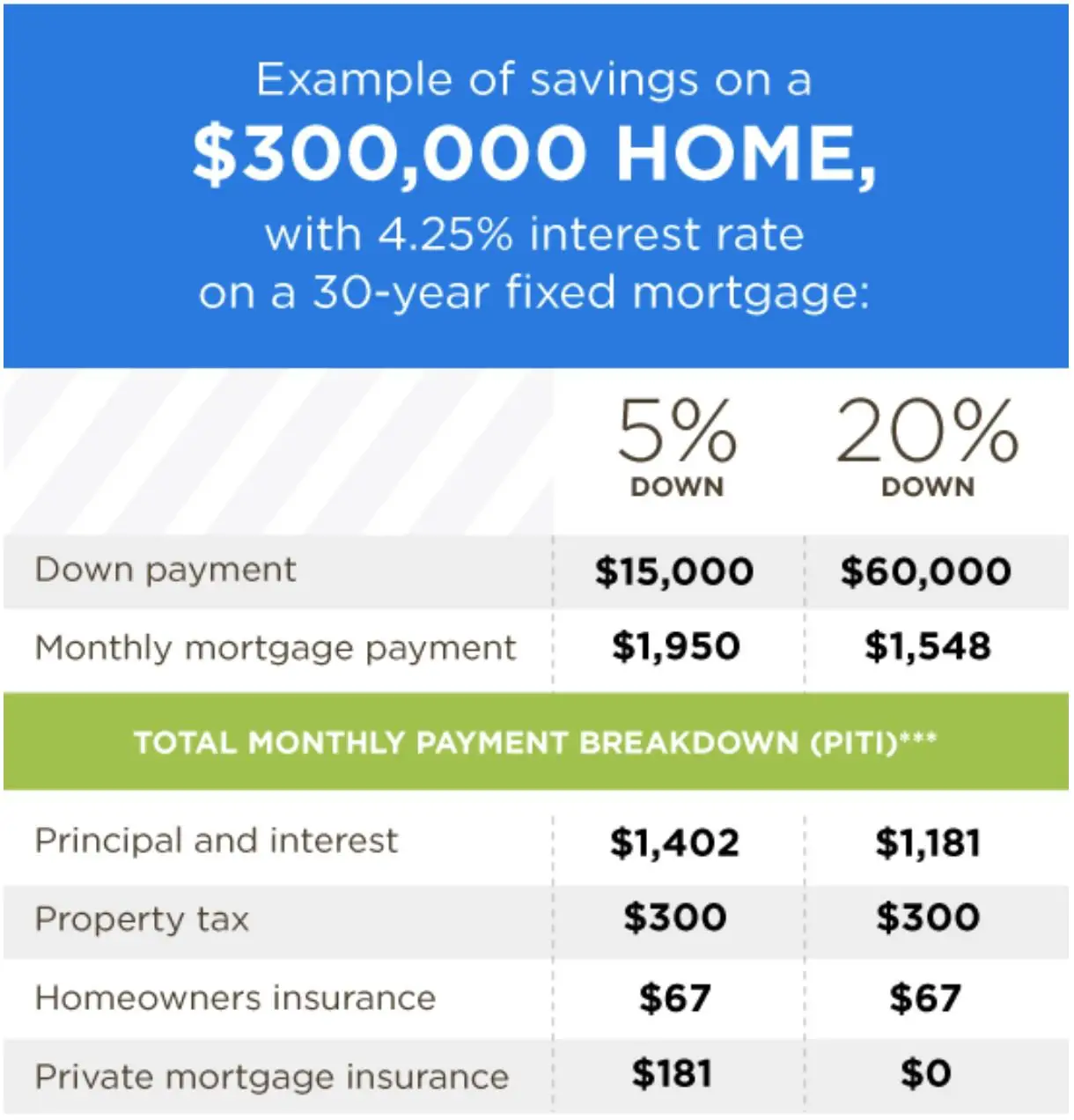

The lump sum due each month to your mortgage lender breaks down into several different items. Most homebuyers have an escrow account, which is the account your lender uses to pay your property tax bill and homeowners insurance. That means the bill you receive each month for your mortgage includes not only the principal and interest payment , but also homeowners insurance, property taxes, and, in some cases, private mortgage insurance and homeowners association fees. Heres a breakdown of these costs.

How Does A Mortgage Work

A mortgage is a secured loan that is collateralized by the home it is financing. This means that the lender will have a lien on your home until the mortgage is paid in full. After closing, youâll make monthly paymentsâwhich covers principal, interest, taxes and insurance. If you default on the mortgage, the bank will have the ability to foreclose on the property.

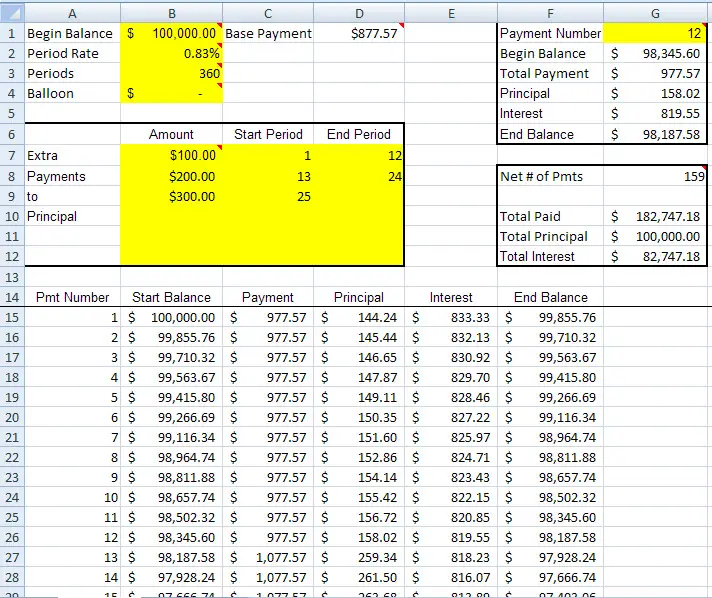

Mortgage Monthly Repayments Table

The repayments have been calculated using our online mortgage calculator which you can use yourself or look at the tables below for the repayments on a £100,000 loan. Its divided up into the length of the loan and the interest rate you will pay. These rates are applicable for new mortgages or remortgages and are on a repayment basis for a loan of £100,000 to repaid in the number of years shown.

| Rate | |

|---|---|

| £716 | £644 |

Please note these rates are for illustrative purposes only and you should not rely on these rates but get a professional financial quote for your £100,000 mortgage offer.

All the values are in pounds sterling for the years provided and this is the monthly repayment for each month of your £100,000 mortgage. Please see our mortgage calculator to see different rates, the total repayments youll make over the life of the loan and the total interest paid. You can also enter different interest rates and time and loan periods. See our mortgage calculator here for full information.

Whatever your reasons for needing a £100,000 mortgage be sure to seek professional advice either from a mortgage broker or an independent financial adviser who can help your find the right product whether on fixed rate, tracker rates or offset mortgages to fit your exact circumstances.

Most Popular

Also Check: Can You Transfer A Mortgage To Another Person

You May Like: How To Become A Mortgage Broker In Massachusetts

Fha Mortgage Loans Vs Other Low Down

If FHA loans arent your thing, here are some government-backed or conventional loan options to consider.

Government-backed loans: Active and former members of the U.S. Military, National Guard and Reserve, as well as spouses of veterans who died in service or as a result of a service-related injury, may take out a VA loan provided they meet the other eligibility requirements. With a VA loan, a borrower can purchase a house for little or no down payment and without having to pay PMI, although there are some trade-offs, including the need to pay certain closing costs.

Conventional loans: If youre purchasing your first house or have low to moderate income, your lender might be able to offer one of Fannie Maes My Community Mortgage loans for a down payment of as low as 3%. Like FHA loans, these loans require the borrower to pay PMI, but other conditions varymeaning that in certain cases, the loan could work out cheaper than an FHA loan.

Where To Get A $100000 Mortgage

A local bank or credit union may provide a personal experience, especially if you have an existing account there. But online lenders can offer a convenient process you can complete online without ever leaving your home.

Its always good practice to shop around with various lenders and request quotes to get the lowest available rates. You can prequalify for loan offers by giving some basic information to multiple lenders so they can perform a soft pull of your credit and review your credit score. Once you receive offers, you can compare the loan amount, interest rates, loan terms, fees and other variables from several lenders to find the lowest rate and most affordable option for you.

Credible simplifies this process by allowing you to compare all its partner lenders side-by-side and get prequalified rates within minutes.

Read Also: How To Get Removed From A Mortgage

Example : Buying A House With A $100k Salary And Great Credit

The $100,000 earner in our first example has an excellent credit score of 740. This person also has no monthly debts and is prepared to put down 20% on the home.

This buyer might qualify for an interest rate of 5.75 percent. For a payment of about $2,495, this buyer can buy a house listed at $450,000.

- Income: $100,000/year

- Estimated home value: $450,000

- Monthly payment: $2,495

*Interest rates shown are for sample purposes only. Your own rate will be different. All loan amounts were calculated using The Mortgage Reports mortgage calculator.

This scenario assumes a homeowners insurance rate of $1,200 a year, which is the U.S. average, along with a 0.78% tax rate. Since the borrower put 20% down, the lender did not charge any private mortgage insurance premiums.

Why Should I Use A Mortgage Calculator

Also Check: How To Check Eligibility For Mortgage

How To Calculate Mortgage Payments

Zillow’s mortgage calculator gives you the opportunity to customize your mortgage details while making assumptions for fields you may not know quite yet. These autofill elements make the home loan calculator easy to use and can be updated at any point.

Remember, your monthly house payment includes more than just repaying the amount you borrowed to purchase the home. The “principal” is the amount you borrowed and have to pay back , and the interest is the amount the lender charges for lending you the money.

For most borrowers, the total monthly payment sent to your mortgage lender includes other costs, such as homeowner’s insurance and taxes. If you have anescrow account, you pay a set amount toward these additional expenses as part of your monthly mortgage payment, which also includes your principal and interest. Your mortgage lender typically holds the money in the escrow account until those insurance and tax bills are due, and then pays them on your behalf. If your loan requires other types of insurance like private mortgage insurance or homeowner’s association dues , these premiums may also be included in your total mortgage payment.

How To Use The Mortgage Affordability Calculator

To use our mortgage affordability calculator, simply enter your and your partnerâs income , as well as your living costs and debt payments. The calculator can estimate your living expenses if you donât know them.

With these numbers, youâll be able to calculate how much you can afford to borrow. You can also change your amortization period and mortgage rate to see how that would affect your mortgage affordability and your monthly payments.

Recommended Reading: Is A Heloc Considered A 2nd Mortgage

How Much Equity Do I Need To Refinance My Home Mortgage At A Low Interest Rate

A good rule of thumb for refinancing is that you should have at least 20% equity in your home. That means that you have paid down at least 20% of your original mortgage.

However, many lenders look at your loan-to-value ratio instead of your equity. Your loan-to-value ratio is the amount of debt you owe on your mortgage divided by your homes market value. Most lenders want you to have a loan-to-value ratio of less than 80% to refinance your mortgage.

Dont Get More House Than You Need

You may have dreamed of owning a big house on a lake one day you may have even found the one you want but is that more house than you actually need? This is an important question to ask yourself. You dont want to bite off more than you can chew and suddenly find yourself house poor or fall behind on your monthly payments and risk foreclosure.

The bottom line is that theres nothing wrong with buying a nice starter home where you dont exhaust your entire monthly budget. You can always sell your home a few years down the road and buy your dream house. Even better, you could use the starter home as a long-term rental property or as an Airbnb for extra income.

Read Also: Why Are Reverse Mortgages A Bad Idea Dave Ramsey

Considerations Before Committing To A Mortgage

WOW: Look at those figures above! The amount of interest you will pay your bank over the period of the loan is outrageous, particularly when we consider what we have done to bail out the banks in our recent history. I know, you have no choice, you need a mortgage but, save what you can, while you can. Use a bigger deposit if you can, repay your mortgage early to save thousands on interest payments. Think about your financial future, when do you really want to pay of that mortgage, the answer should be as soon as possible.

Affordability: Be sure you can really afford to make the Mortgage repayments. Only you really know if you can afford a Mortgage or not and committing to a mortgage which you will struggle to repay will only cause you financial hardship and pain in the future. Remember,

Mortgages: READ THE SMALL PRINT: Your home may be repossessed if you do not keep up your Mortgage repayments .

Shop around: It always pays to shop around and see what deals are available. Most banks and building societies run promotions at various points of the year. Never assume that one lender is better than the other, look for the good deals as they could save you a lot of money.

Borrow Little, Repay Quickly: The best Mortgage is one repaid quickly. A quick repayment means less interest paid and less stress about your debt.

Get Your Fico Credit Score

Your FICO score has a big influence on the mortgage rates lenders will quote for you. The higher your score on a scale of 300 to 850, the more house you can probably afford. Your bank or credit card company may show your score for free, but keep in mind that these estimates are often different from the FICO score a lender sees.

Be wary of free credit reporting apps that dont show FICO scores. Some of these scoring models trend higher, giving a false impression of your borrowing power.

You May Like: What Is The 20 Year Fixed Mortgage Rate

How Much Difference Does 1% Make On A Mortgage Rate

The short answer: It can produce thousands or even potentially tens of thousands in savings in any given year, depending on the purchase price of your property, your overall mortgage rate, and the total amount of the mortgage being financed.

By way of example, say that Taylor, a 30-year-old who is a first-time home buyer, wishes to obtain a 30-year fixed FHA loan on a new home with a 20% down payment. Below, you can get a sense of just how much that they stand to save given a 1% difference in interest savings on their 30-year mortgage.

How A Broker Can Help With A 100000 Mortgage

As there are so many lenders, and criteria vary so much between them, it would be incredibly labour intensive to establish which one would offer the income multiple necessary to achieve the mortgage you need. The brokers we work with are experts in this area and know how much each specific lender would expect you to earn in order to get a £100,000 mortgage.

As they have access to every lender on the market, they can ensure that you only approach those whose criteria you are likely to meet for this level of borrowing. Whether youre looking for a lender who will consider self-employed income more favourably or maximise the length of term available to you, we can match you with an expert who will tailor their advice to help you achieve the loan you need.

Recommended Reading: What Is The Meaning Of Mortgage Insurance

How To Use This Mortgage Calculator

This mortgage payment calculator will help you find the cost of homeownership at todays mortgage rates, accounting for principal, interest, taxes, homeowners insurance, and, where applicable, homeowners association fees.

You should adjust the default values of the mortgage calculator, including mortgage rate and length of loan, to reflect your current situation.

You can use the mortgage payment calculator in three ways:

The 30% Rule For Home Buyers

Many personal finance experts recommend spending around 30% of your monthly income on housing costs.

If your annual salary is $100,000, the 30% rule means you should spend around $2,500 per month on your house payment. With a 10% down payment and a 6% fixed interest rate, you could likely afford a home worth around $350,000 to $400,000 .

Experts call this the 30% rule, but home buyers should treat it more like a general guideline.

For example, a $100,000 earner with no existing debt and no children may be able to spend 40% or more of their income on housing expenses. Another $100,000 earner who has two car payments, a big student loan balance, and a big family may spend only 25% on housing.

Your other homeownership costs property taxes, homeowners insurance, private mortgage insurance, and HOA dues will also impact your home-buying budget. The less you spend on these extra monthly fees, the more home you can ultimately afford.

Also Check: What Is The Mortgage Payment On 240k

How Much Do I Qualify For Mortgage

This rule says that your mortgage payment should be no more than 28% of your pre-tax income, and your total debt should be no more than 36% of your pre-tax income.

Just so, how much can I borrow for a mortgage based on my income?

Four components make up the mortgage payment, which are: interest, principal, insurance, and taxes. A general rule is that these items should not exceed 28% of the borrowers gross income. However, some lenders allow the borrower to exceed 30% and some even allow 40%.

Also, how much do I need to make to afford a 300k house? The oldest rule of thumb says you can typically afford a home priced two to three times your gross income. So, if you earn $100,000, you can typically afford a home between $200,000 and $300,000.

Likewise, how much do I need to make for a 250k mortgage?

To afford a house that costs $250,000 with a down payment of $50,000, youd need to earn $43,430 per year before tax. The monthly mortgage payment would be $1,013. Salary needed for 250,000 dollar mortgage.

How much should I spend on a house if I make 100k?

Some experts suggest that you can afford a mortgage payment as high as 28% of your gross income. If true, a couple who earn a combined annual salary of $100,000 can afford a monthly payment of about $2,300/month. That could translate to a $450,000 loan, assuming a 4.5% 30-year fixed rate.

You May Like Also

Dont Miss: How Do Mortgage Rates Work

What’s The Difference Between An Adjustable And A Fixed

A fixed-rate mortgage is based on a fixed interest rate. This is the rate used to calculate the monthly payments that will remain fixed over the loan term. The benefit is certainty about the level of your monthly payment over the life of the loan.

With an adjustable-rate mortgage , the interest rate can adjust periodically. Typically the interest rate is fixed for an initial period and then adjusts periodically. Sometimes there is a cap on the amount of the adjustment. Often whether the rate changes and by how much is based upon some sort of benchmark such as the rate on 1-year Treasury Bills. An ARM might start off with a lower rate than a fixed-rate mortgage, but if interest rates rise, the interest rate could skyrocket drastically, increasing your monthly payment.

Don’t Miss: What Would A Mortgage Be On A 400 000 House