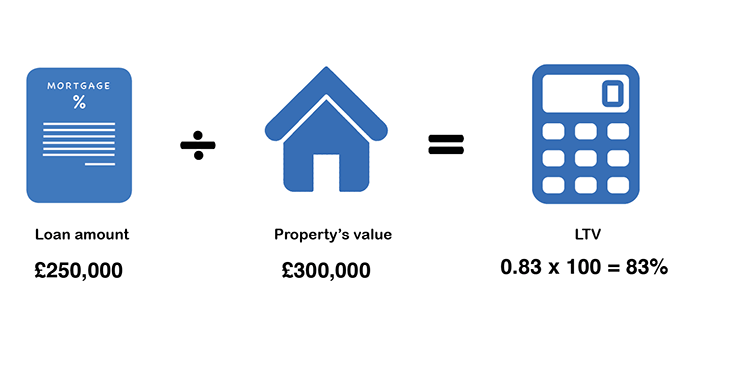

Divide Your Mortgage Amount By The Appraised Value Of The Property

Once you’ve calculated the total mortgage amount and the current appraised value of the property, you can find the LTV ratio. For example, if your property has a value of $300,000 and your mortgage amount is currently $180,000, then you can calculate the LTV ratio as:

**LTV ratio = x 100**LTV ratio = x 100LTV ratio = 0.6 x 100* *LTV ratio = 60%

Your LTV ratio is 60%, which is an ideal LTV ratio. With this ratio, you likely won’t need to purchase private mortgage insurance to offset the risk to the financial institution.

Financing Options For High Ltv Ratios

Depending on other factors, such as your credit history, existing debt and income, lenders may very well approve your loan application even with a high LTV. Youll need to pay private mortgage insurance each month until youve gained 20% equity in your home, but that could be a price worth paying to become a homeowner sooner rather than later.

But lets say youve checked with a few different lenders and none of them are willing to extend a mortgage with your current LTV. What then? There are several loan programs you can use to get over this speedbump:

- FHA loans

What Does The Ltv Mean For Your Mortgage

Generally, a low loan to value ratio is good, while a high LTV ratio is less desirable. The LTV will affect the amount you can borrow and the rate you can borrow at because a mortgage with a high LTV is riskier from the lenders standpoint.

Lenders need assurance that theyll not lose money by lending to you even if you cant keep up with repayments. When you cant repay the mortgage, the lender can repossess it and sell it to recover the loan value. However, if house prices fall, there is a risk that the sale of the house wont cover the outstanding balance.

A lower LTV means there is more equity in the property, and if house prices fall, there is less risk that the propertys value will be less than the mortgage amount.

For example, with a 60% LTV, house prices have to drop by 40% before the lender loses money compared to a 90% LTV where an 11% drop in house value results in negative equity and the sales price cant cover the balance on the mortgage.

As a result, lenders will insist on stricter terms if you have a high LTV ratio, which translates to higher interest rates or fees. The best mortgage deals are offered to low LTV customers, and with low LTV, youll have lower interest payments and end up paying less for your property overall.

Related guides:

Recommended Reading: Should You Get Mortgage Insurance

Ltv For Home Buying Vs Refinance

Lenders use loan-to-value calculations on both purchase and refinance transactions. But the math to determine your LTV changes based on the type of loan.

- Home purchase LTV is based on the sales price of the home unless the home appraises for less than its purchase price. When this happens, your homes LTV ratio is based on the lower appraised value, not the homes purchase price.

- Refinance LTV is always based on the appraised value of the property, not the original purchase price of the home.

Loan-to-value is especially important when using a cash-out refinance, as the lenders maximum LTV will determine how much equity you can pull out of your home.

What Does High And Low Loan To Value Mean

If you are interested in getting the right loan deals to buy a house, simply knowing the basic definition of LTV is not enough. It is important to know about the impact of LTV ratio. Does a high LTV value help you getting the correct deals? Do you need to emphasize on reducing the LTV value? The LTV value would obviously depend on the mortgage payment made and the appraised value of the property. These two constituents are used in the formula to determine the LTV value.

Let us go into further depth of high and low LTV

Also Check: Who Offers 20 Year Mortgages

A Quick Underwater Loan

Property value: $400,000 Loan amount: $500,000 Loan-to-value ratio : 125%

As you can see, the underwater borrower has a LTV ratio greater than 100% , which is a major issue from a risk standpoint.

For the record, you get 1.25 by dividing 500 by 400.

The problem with homeowners in these situations is that they have little incentive to stick around, even with a modified mortgage payment, as theyre so far in the red that theres little hope of recouping home value losses.

However, the popular Home Affordable Refinance Program allowed millions of underwater homeowners to refinance to lower rates with no LTV limit. And many of these folks are probably now back in the black.

Today, this type of program still exists, but is a permanent option known as a high-LTV refinance, or HIRO for short.

So there are options to refinance and get a lower interest rate, as long as your loan is owned by Fannie Mae or Freddie Mac, no matter the mortgage balance relative to the property value.

Same goes for FHA loans and VA mortgages thanks to the FHA streamline refinance and the VA IRRRL option.

Despite being far behind new homeowners entering the market in terms of building home equity, many of these formerly-underwater borrowers now have lots of equity thanks to rising home prices and several years of paying down their mortgages.

How To Calculate Your Loan To Value Ratio

Calculating your loan-to-value is simple. All you do is take your loan amount and divide it by the purchase price or, if youre refinancing, divide by the appraised value. Then multiply by 100 to get your LTV ratio.

X 100 = LTV

The loan-to-value ratio is always expressed as a percent. So if your result is 0.75, for example, your LTV is 75%.

Also Check: What Were The Lowest Mortgage Rates Ever

Build Sweat Equity With Home Improvements

Paying off principal on a loan will lighten the top shelf, but you can stabilize the bottom shelf in an existing home by increasing the property value. Several studies have found that a well-designed landscape can increase property value.

One study found that 68.2% of respondents agreed that a well-designed landscape could influence their decision to rent or buy a home. There are plenty of ways to build sweat equity in your home before you get it reappraised.

Frequently Asked Ltv Questions:

Q: Why do the lenders care about Loan to Value?

Lenders care about the LTV because it helps determine the exposure and risk they have in lending on a certain property. Statistics show that borrowers with a lower LTV are less likely to default on their mortgage. Also, with a lower LTV the lender will lose less money in case of a foreclosure.

Q: Can I drop my mortgage insurance on an FHA loan?

The loan is structured differently than a loan. On a 30 year fixed FHA loan, the monthly mortgage insurance can be removed after five years, as well as when the borrowers loan is 78% LTV.

Q: What does CLTV stand for?

CLTV stands for Combined Loan To Value. The CLTV calculation is as follows: / Appraised Value of Property = CLTV

_________________________________

You May Like: How Much Is Mortgage On 1 Million

How To Improve Your Ltv Ratio Before Refinancing

A lower LTV ratio can help you get approved for a refinance and receive a better rate that saves you money over the life of your loan. If your LTV ratio is higher than youd like it to be, you can lower it in several ways, including:

- Pay down your mortgage. As you make your mortgage payments, your LTV will go down. To speed up the process, consider biweekly payments or putting extra money from bonuses and tax refunds, for example, toward your balance.

- Wait for your home value to increase. Your home value is bound to fluctuate. Factors like a healthy economy and high demand in your neighborhood can cause your home to naturally appreciate.

- Renovate your home. Investing in home improvements may increase your homes appraised value. Not all renovations are created equal, however, so focus on the projects that offer the best return on investment.

- Pay upfront closing costs. If you have the means, you might want to cover your closing costs right off the bat. By doing so, you can reduce your overall borrowing amount. Note that closing costs usually range between 2% and 5% of the mortgage.

- Go with a standard refinance. Even though a standard refinance wont allow you to tap your home equity like youd be able to with a cash-out refinance, youll be able to keep your mortgage balance low.

Shopping around with different lenders is one way to ensure you get a great refinance rate. Credible can help you easily compare refinance options.

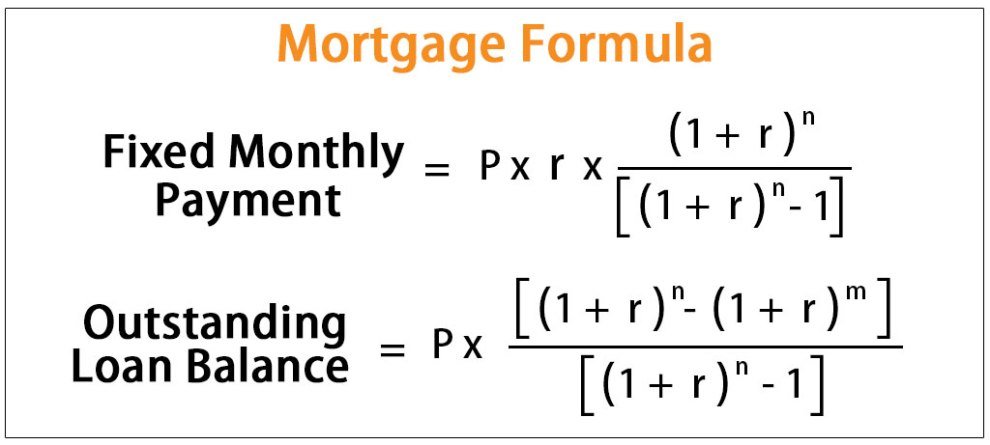

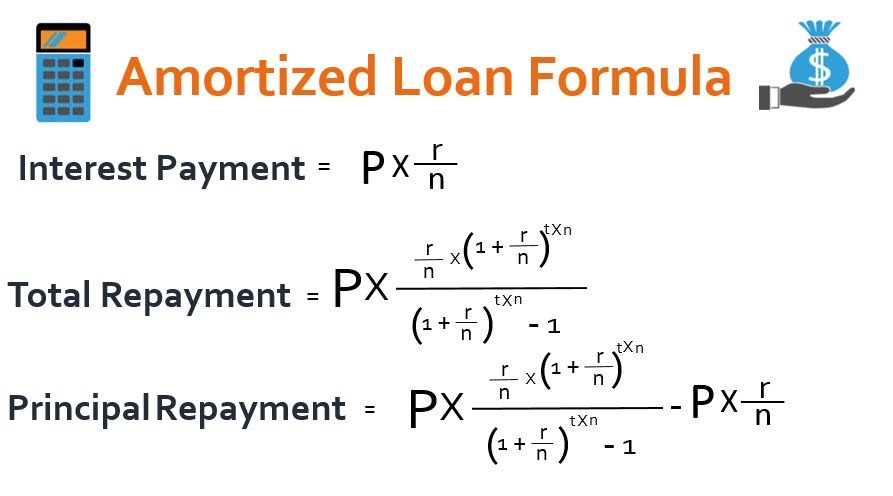

Getting Started With Calculating Your Mortgage

People tend to focus on the monthly payment, but there are other important features you can use to analyze your mortgage, such as:

- Comparing the monthly payment for several different home loans

- Figuring how much you pay in interest monthly and over the life of the loan

- Tallying how much you actually pay off over the life of the loan versus the principal borrowed, to see how much you actually paid extra

Use the mortgage calculator below to get a sense of what your monthly mortgage payment could end up being,

Don’t Miss: Why Are 15 Year Mortgage Rates Lower Than 30 Year

How Much Interest Do You Pay

Your mortgage payment is important, but you also need to know how much of it gets applied to interest each month. A portion of each monthly payment goes toward your interest cost, and the remainder pays down your loan balance. Note that you might also have taxes and insurance included in your monthly payment, but those are separate from your loan calculations.

An amortization table can show youmonth-by-monthexactly what happens with each payment. You can create amortization tables by hand, or use a free online calculator and spreadsheet to do the job for you. Take a look at how much total interest you pay over the life of your loan. With that information, you can decide whether you want to save money by:

- Borrowing less

- Finding a lower interest rate

- Choosing a shorter-term loan to speed up your debt repayment

Shorter-term loans like 15-year mortgages often have lower rates than 30-year loans. Although you would have a bigger monthly payment with a 15-year mortgage, you would spend less on interest.

Types Of Mortgages That Use The Ltv To Qualify Borrowers

The loan to value ratio is used to qualify borrowers, though it is just one of many different factors that may be considered. There are different choices for mortgages, and the type of mortgage you are seeking, along with the interest rate and payment, will be a part of both your decision and the lenders offer.

Recommended Reading: How To Calculate Mortgage Payment In Excel

Ltvs And Different Loan Types

While 80% is often used as a rule of thumb when it comes to LTVs, different loan types may have different rules when it comes to LTVs. That said, aiming for as low an LTV as possible can help ensure that youre getting the most competitive loan rates.

FHA Loans

A Federal Housing Loan loan is a type of loan backed by the government for first-time buyers. This type of loan can require as little as 3.5% down payment, but these loans may require a Mortgage Insurance Premium which can last for the life of your loan, regardless of your LTV. In addition, FHA loans may have stipulations regarding home equity loans. For these reasons, many home owners use an FHA refinance once they have a certain amount of equity in the home.

VA and USDA Loans

Write Your Current Mortgage Amount

Once you’ve calculated the appraised value of the property, you can mark down the total mortgage amount you need to pay. You can determine this number by performing a calculation where you subtract the down payment you’re contributing from the total value of the property. Then, you can use the amount left as the current mortgage amount. For example, if you have a $100,000 property and can put a down payment of $20,000, then the mortgage is $80,000 at the time of the calculation. Remember that this value changes over the lifetime of the mortgage.

You can also speak with the financial institutions that process your mortgage loan payments to determine the total costs of the loans at the time you make the calculation. The values change as you make payments, so it can be a good idea to check how your LTV changes. This is especially useful since there are benefits to having a lower LTV ratio, such as smaller interest rates on the loans you have and a higher likelihood of approval for other loans. Ideally, when you calculate LTV, it’s lower than 0.8 or 80%.

Related:Interest Rates: What They Are and How To Calculate Them

You May Like: What Is The Best Way To Apply For A Mortgage

Make A Larger Down Payment

When buying a home, making a larger down payment will lead to a lower LTV. Lenders and mortgage investors take your down payment as one indicator of the risk involved in your loan. From a lenders perspective, when home buyers invest more of their own funds upfront, lenders will see them as serious and invested borrowers.

Larger down payments also increase equity in the home. For example, if youve put $20,000 down on a home appraised for $100,000, your LTV on an $80,000 loan will be 80%. The larger the down payment, the smaller your LTV ratio .

Heres an example of how a larger down payment can decrease your loan-to-value ratio.

More Ltv Ratio Rules To Know

Your lender may limit you to a lower LTV ratio if youre buying or refinancing a rental property, a manufactured home, a two- to four-unit home or a second home. On the other hand, you may be able to borrow more than the limits listed above if:

- Youre taking out a home equity loan or home equity line of credit

- Your home is worth less than your mortgage balance and youre eligible for a Home Affordable Refinance Program replacement loan.

- Youre applying for Fannie Maes Community Seconds mortgage program or a down payment assistance program that lets you borrow up to 5% more than your home is worth.

You May Like: How Often Do You Pay Your Mortgage

Mortgage Example Of Ltv

For example, suppose you buy a home that appraises for $100,000. However, the owner is willing to sell it for $90,000. If you make a $10,000 down payment, your loan is for $80,000, which results in an LTV ratio of 80% . If you were to increase the amount of your down payment to $15,000, your mortgage loan is now $75,000. This would make your LTV ratio 75% .

Tips To Lower Your Ltv Ratio

If your LTV ratio seems too high, consider taking one or more of the following steps to lower it while also boosting your home equity:

- Ask for a cash gift to help with your down payment. A family member, employer or friend may be able to gift funds to use toward your down payment amount and closing costs.

- Make extra payments on your principal. Your LTV ratio drops with every mortgage payment. If you make even one extra payment each year, youll lower the LTV ratio faster.

- Pick a shorter-term loan. If your budget can handle a higher monthly payment, a 15-year fixed mortgage will lower your LTV ratio more quickly than a 30-year loan.

- Buy a less expensive home. Choosing a home at the lower end of your down payment budget might help you avoid a high-LTV ratio loan.

Don’t Miss: Does American Express Do Mortgages

Tips On Securing A Favorable Mortgage Rate

- If you cant make a reasonable down payment now, dont rush into the home buying game. Take some time to build up your funds so you can get a lower interest rate on your loan. Check out our reports on the best savings accounts and best certificate of deposit rates around.

- For help with budgeting and saving, consider working with a financial advisor. A financial advisor can help you define your goalsand reach them. SmartAssets financial advisor matching tool makes it easier to find an advisor who suits your needs. Simply answer a few of questions about your financial situation and preferences, and the program will connect you with up to three financial advisors in your area.

Home Loan Programs That Dont Require An Ltv Ratio

You wont need to deal with LTV ratio restrictions if youre eligible for one of the following loan programs:

- An FHA streamline loan. If you already have an FHA loan insured by the Federal Housing Administration and hope to refinance, you may qualify for an FHA streamline loan, which doesnt require your homes value to be verified.

- A VA IRRRL. Military borrowers can refinance without an LTV ratio calculation if they already have a VA loan backed by the U.S. Department of Veterans Affairs and qualify for an interest rate reduction refinance loan .

- A USDA streamline loan. Borrowers who took out a USDA loan backed by the U.S. Department of Agriculture to buy a rural home can lower their payment with a USDA streamline loan that doesnt require either a home appraisal or an LTV ratio limit.

Recommended Reading: What Is A Good Tip On A Mortgage