What Is The Difference Between A 5/1 And A 7/1 Arm

Its simply a matter of understanding the shorthand. The first number is the number of years in the introductory period. The second refers to how often the mortgage can reset the interest rate. So, a 7/1 ARM has a 7-year introductory period and the interest rate can be adjusted every year. A 7/6 ARM has a 7-year introductory rate and the rate can adjust every 6 months.

What Is An Arm Loan

An adjustable rate mortgage is a home loan with a variable interest rate that fluctuates based on market conditions.

The rate on an ARM loan, which typically lasts for 30 years, changes at predetermined times over the life of the loan, with limits in place to cap increases and decreases. Each ARM loan has two numbers associated with it, indicated as 7/1 ARM, for example. These indicate what the rate adjustment schedule is. The first number indicates the initial fixed-rate period, while the second number indicates how often the variable rate will update. So a 7/1 ARM loan will have the same interest rate for seven years. After that, the rate may readjust once a year through the end of the loan.

You Should Get An Arm If

An adjustable-rate mortgage is a better fit if:

- You Plan on Paying Off Your Loan Within 5 to 10 Years. You can take out ARMs with a low fixed-interest period for up to 10 years. If you plan on knocking out your mortgage loan before the introductory rate period ends, its a moot point.

- You Plan on Selling Within 5 to 10 Years. The same logic applies if you plan on moving again before the fixed period ends.

- Your Priority Is Becoming a Homeowner. If you want to get your foot in the door with a starter home and move in a few years, an ARM can help. However, if you think your starter home might end up being your forever home, an ARM could cost more in the long run.

- You Dont Mind Gambling & Refinancing. Mortgage rates might fall back down before the initial period ends and the rate adjustments start. But even if youd take that bet, you still have to swallow the bitter pill of refinancing fees and costs.

Also Check: How To Figure Mortgage Rates

Fixed Vs Adjustable Rate Mortgages

ARMs arent worse or better than fixed-rate mortgages. It surprises home buyers to learn that adjustable-rate and fixed-rate mortgages are mostly the same.

Both ARMs and fixed-rate loans:

- Pay off in 30 years or fewer

- Follow standard mortgage approval guidelines

- Can be underwritten entirely and approved online

In addition, adjustable and fixed-rate mortgages can finance any residential property, including standalone houses, condos, townhomes, multi-units, and manufactured homes.

The difference between ARMs and fixed-rate mortgages is that ARM mortgage rates can change over time, whereas fixed-rate mortgage rates cannot. But, because the interest rate changes, home buyers using ARMs can get more favorable terms from their bank, such as lower overall rates.

According to Freddie Mac, ARMs interest rates are 0.64 percentage points cheaper than 30-year fixed-rate mortgages, on average. This equates to $450 in savings per year per $100,000 borrowed.

How Does An Arm Loan Work

With an ARM mortgage, an initial interest rate is offered that is typically lower than the going rate for a fixed-rate mortgage. After a specific amount of time, the interest rate changes based on a formula used by the lender.

Adjustable-rate mortgages can vary in how they are structured, but here are the basic features of ARMs.

Read Also: How Much Is The Average Monthly Mortgage

What Is A 5/1 Arm Loan

A 5/1 ARM is a type of adjustable rate mortgage loan with a fixed interest rate for the first 5 years. Afterward, the 5/1 ARM switches to an adjustable interest rate for the remainder of its term.

The words variable and adjustable are often used interchangeably. When people refer to variable-rate mortgages, they likely mean a mortgage with an adjustable rate. A true variable-rate mortgage has an interest rate that changes every month, but these arent common.

An ARM has a fixed rate for the first several years of the loan term thats often called the teaser rate because its lower than any comparable rate you can get for a fixed-rate mortgage. Rates may be fixed for 7 or 10 years, although the 5-year ARM is a very common option.

Once the fixed-rate portion of the term is over, the ARM adjusts up or down based on current market rates, subject to caps governing how much the rate can go up in any particular adjustment. Typically, the adjustment happens once per year.

When the rate adjusts, the new rate is calculated by adding an index number to a margin specified in your mortgage documentation. Common indexes used to figure out rates for ARMs include the Secured Overnight Financing Rate , the Cost of Funds Index and the Constant Maturity Treasuries .

Each time your interest rate changes, your payment is recalculated so that your loan is paid off by the end of your term. Terms on ARMs are usually 30 years, but they dont have to be.

How Do You Calculate A Mortgage Payment

In addition to your principal and interest payments, a monthly mortgage payment may also include several fees, like private mortgage insurance , taxes and homeowners association fees.

Your lender will be able to provide you with a line-item breakdown of your mortgage payment. Using a mortgage calculator is an easy way to find out what your monthly payments will be. You can also look at an amortization schedule, which shows you how much youâll pay over time.

Also Check: How To Pay Your Mortgage Quicker

Types Of Arm Loan Terms

Most ARM loans are actually hybrid ARMs. They combine features of a fixed-rate mortgage with those of an adjustable-rate mortgage. Theyre expressed with two numbers, like 3/1. The first number is the length of your fixed-rate period. The second number is how often the rate will adjust after the initial period.

If you see ARMs advertised as 2/28 or another larger number, that indicates the number of years the rates will be adjustable. They could adjust every six months rather than annually. If you have questions about exactly how a specific ARM works, ask the lender or review your loan estimate.

3/1 ARM

A 3/1 ARM has a fixed rate for the first three years. After that, the lender can adjust rates annually based on the performance of the index it uses.

5/1 ARM

A 5/1 ARM has a fixed rate for the first five years and adjusts annually after the initial period ends.

7/1 ARM

A 7/1 ARM has a fixed rate for the first seven years and adjusts annually after that.

10/1 ARM

A 10/1 ARM has a fixed rate for the first 10 years. After that, it adjusts annually.

Who Are Arms Good For

Likely Movers: Adjustable-rate mortgages are not for everyone, but they can look very attractive to people who are either planning to move out of the house in a few years. If your reset point is seven years away and you plan to move out of the house before then, you can manage to get out of Dodge before the costlier payment schedule kicks in.

Growing Incomes: Those who will benefit greatly from the flexibility of an ARM are people who expect a sizeable raise, promotion, or expansion in their careers. They can afford to buy a bigger house right now, and they will have more money to work with in the future when the reset date arrives. When the reset happens if rates haven’t moved up they can refinance into a FRM. Homebuyers working for a hot startup who are waiting for their stock options to vest also fit in this category. If you believe the home will appreciate significantly and your income will go up then you can refinance an ARM into a fixed-rate loan.

Home Flippers: Real estate investors who rapidly turn over homes plan on selling most homes before any ARM rate reset would take place, so opting for whichever loan offers the lowest rate is a prudent move if they are experienced and are certain they’ll sell the home soon.

Read Also: Do All Banks Have The Same Mortgage Rates

What Happens When My Arm Loan Adjusts

An ARMs interest rate may increase or decrease during the adjustment period based on the value of an index. ARMs adjusted interest rate is the sum of the index value at the time of adjustment and the margin. The index value is variable, while the margin value is constant throughout the lifetime of the loan.

An index is a benchmark variable interest rate that is published by an independent third party regularly and available publicly. Typical index rates that are associated with ARMs are SOFR , T-Bill and CMT .

A is a fixed percentage rate that you add to your index rate to obtain the fully indexed rate for an adjustable-rate mortgage.

Example: If at the time of adjust the index rate is 3 percent and your margin is 2 percent, then your fully indexed interest rate would be 5 percent during that adjustment.

There are three different capsthat limit how much your interest rate canchange during the adjustment period: the initial cap, the periodic cap, and the lifetime cap.

The initial capis the amount the interest rate can fluctuate in the very first adjustment.

The periodic capis defined as the maximum amount each interest rate adjustment can be after the initial rate change.

The lifetime cap determines the maximum amount the interest rate can change over the entirety of the loan period.

Your Financial Situation Could Be Drastically Different When Rates Change

Similarly, there’s always the chance you may encounter life situations that could impact your ability to pay a potentially higher interest rate on top of your mortgage payment. For example, switching to a lower-paying career, receiving a pay cut or taking time off work to care for family could have a major effect on your financial situation. Or, if you were to suddenly have a child to take care of, you’d want to be sure your mortgage payments were still affordable.

Read Also: Will A Cosigner Help Me Get A Higher Mortgage

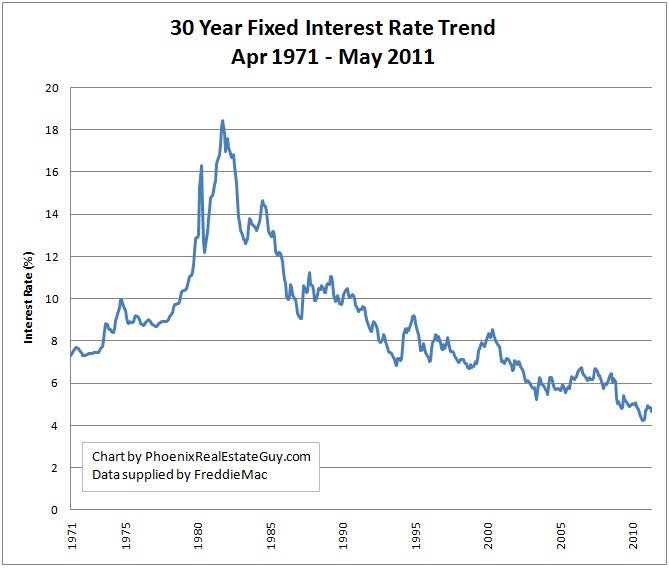

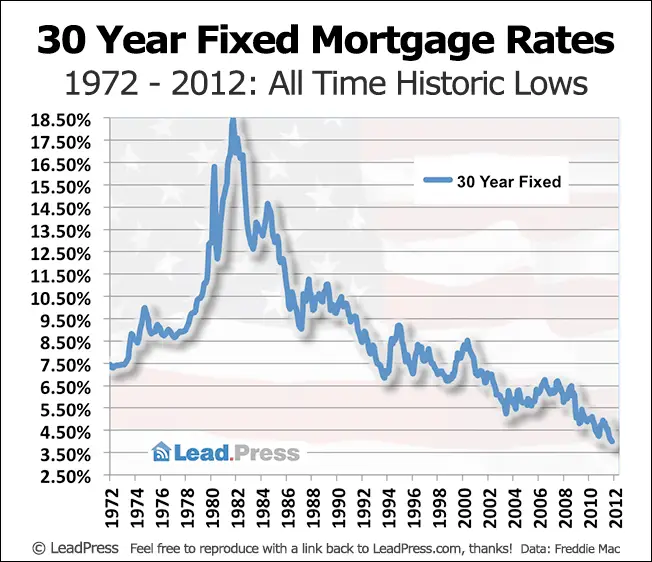

How Are Mortgage Rates Determined

Mortgage rates, in general, are determined by a wide range of economic factors, including the yield U.S. Treasury bonds, the economy, mortgage demand and the Federal Reserve monetary policy.

Borrowers have no control over the wider economy, but they can control their own financial picture to get the best rate available. Typically, borrowers with higher FICO scores, lower debt-to-income ratios and a larger down payment can lock in lower rates.

Related:How To Improve Your Credit Score

What Is An Adjustable Rate Mortgage

Consider this: The resetting of adjustable-rate mortgages during the financial crisis explains why, in part, so many people were forced into foreclosure or had to sell their homes in short sales. After the housing meltdown, many financial planners placed adjustable-rate mortgages in the risky category. While the ARM has gotten a bum rap, its not a bad mortgage product, provided borrowers know what they are getting into and what happens when an adjustable-rate mortgage resets.

Also Check: How Much To Buy Mortgage Points

Interest Rate Errors And Overcharges

In September 1991, the Government Accountability Office released a study of Adjustable Rate Mortgages in the United States which found between 20% and 25% of the ARM loans out of the estimated 12 million at the time contained Interest Rate Errors. A former federal mortgage banking auditor estimated these mistakes created at least US$10 billion in net overcharges to American home-owners. Such errors occurred when the related mortgage servicer selected the incorrect index date, used an incorrect margin, or ignored interest rate change caps.

In July 1994, Consumer Loan Advocates, a non-profit mortgage auditing firm announced that as many as 18% of Adjustable Rate Mortgages have errors costing the borrower more than $5,000 in interest overcharges.

In December 1995, a government study concluded that 50â60% of all Adjustable Rate Mortgages in the United States contain an error regarding the variable interest rate charged to the homeowner. The study estimated the total amount of interest overcharged to borrowers was in excess of $8 billion. Inadequate computer programs, incorrect completion of documents and calculation errors were cited as the major causes of interest rate overcharges. No other government studies have been conducted into ARM interest overcharges.

Current Mortgage Rates For Jan 9 202: Major Rate Decreases

This last week mortgage rates were varied, but the 30-year rate shrank significantly. The Fed’s interest rate hikes are increasing costs for prospective homebuyers.

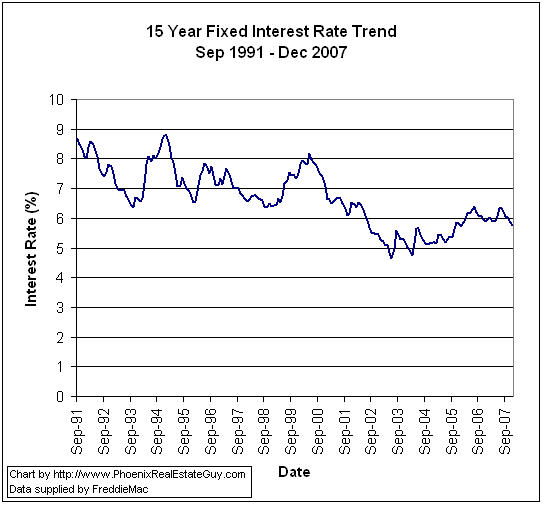

While a closely followed mortgage rate trended down, rates in general were varied over the last seven days. While 15-year fixed mortgage rates made gains, interest rates on 30-year fixed-rate mortgages sank. For variable rates, the 5/1 adjustable-rate mortgage climbed.

Mortgage rates increased dramatically in 2022, as the Federal Reserve hiked interest rates repeatedly throughout the year. Interest rates are dynamic and unpredictable — at least on a daily or weekly basis — and they respond to a wide variety of economic factors. But the Fed’s actions, designed to mitigate the high rate of inflation, had an unmistakable impact on mortgage rates.

The outlook for 2023 remains uncertain. Though higher rates are likely to here to stay, the biggest increases may be behind us. That noted, trying to time the market is tricky. If inflation persists, more interest rate hikes could follow. As such, you may have better luck locking in a lower mortgage interest rate now instead of waiting after all, you can always refinance later on. No matter when you decide to shop for a home, it’s always a good idea to seek out multiple lenders to compare rates and fees to find the best mortgage for your specific situation.

Don’t Miss: How Much Will Extra Principal Payments Reduce My Mortgage

How To Qualify For An Arm Loan

As with all mortgages, ARM loans come with several requirements. You should be prepared to prove your income with W-2s, pay stubs and other documentation. Your income level will help the lender determine how large of a mortgage payment you qualify for.

Additionally, youll need a relatively good credit score to qualify. For example, most loans will require at least a 620 FICO® Score.

What Is A Hybrid Arm

Also contributing to the turnaround is the fact the lending industry is offering more palatable versions of the product to consumers. Todays hybrid ARMs offer a break on interest and a fixed payment amount for the introductory period before reverting to adjustable rates at the 3, 5, 7 or 10-year mark.

Right now, that break doesnt amount to much, given how low interest rates are for 15-and-30-year mortgages. But interest rates have risen steadily over the past year and are expected to continue rising, so the spread between a 30-year fixed rate mortgage and the first few years of an ARM may widen enough to make it even more appealing.

If you are just getting started in the workforce and homebuying market, every dollar counts and ARMs can save a few dollars, at least until the dreaded adjustment period kicks in.

Recommended Reading: Can You Get Help With Mortgage Payments

How Do Lenders Calculate My Dti

At a minimum, lenders will total up all the monthly debt payments youâll be making for at least the next 10 months Sometimes they will even include debts youâre only paying for a few more months if those payments significantly affect how much monthly mortgage payment you can afford.

Lenders primarily look at your DTI ratio. There are two types of DTI: front-end and back-end.

Front end only includes your housing payment. Lenders usually donât want you to spend more than 31% to 36% of your monthly income on principal, interest, property taxes and insurance. For example, if your total monthly income is $7,000, then your housing payment shouldnât be more than $2,170 to $2,520.

Back-end DTI adds your existing debts to your proposed mortgage payment. Lenders want this DTI to be no higher than 41% to 50%. Letâs say your car payment, credit card payment and student loan payment add up to $1,050 per month. Thatâs 15% of your income. Your proposed housing payment, then, could be somewhere between 26% and 35% of your income, or $1,820 to $2,450.

Is There A Maximum Interest Rate For An Adjustable Rate Mortgage

Yes, adjustable rate mortgages have three rate caps that restrict how much your interest rate can change. One cap restricts the amount the interest rate can change at the first adjustment, the second restricts the amount the interest rate can change every adjustment period after the first adjustment period, and the third cap restricts the maximum interest rate you can pay for as long as you have the mortgage.

Read Also: How To Calculate Pmi For Mortgage

How Do You Get Preapproved For A Mortgage

Borrowers can get preapproved for a mortgage by meeting the lenderâs minimum qualifications for the type of home loan youâre interested in. Different mortgages have different requirements. For example, a conventional mortgage usually has higher credit score and down payment requirements than government loans, such as Federal Housing Administration and Veterans Affairs mortgages.

The most important task for a prospective homeowner seeking a preapproval letter is to gather all the financial paperwork needed to give the lender a solid picture of your income, debts and credit history. This information helps underwriters estimate how much of a loan you can afford and the costs of the loan.

The preapproval process will cover:

Considerations When Choosing An Arm Loan

When deciding whether to choose an adjustable-rate mortgage, take these other factors into account:

- Unexpected changes: You may plan to move or sell your home within a few years, but the unexpected could arise, leaving you unable to sell the home as originally planned. This, in turn, could mean that youll be stuck with a higher interest rate than you bargained for. Make sure youre able to cover a potentially much higher payment before you apply.

- Rising rates: Although your interest rate could go down, it could also rise during your loan term. If your interest rate increases, youll have a higher monthly payment. Always save money to account for the possibility of higher rates.

- Prepayment penalty: Some ARMshave a prepayment penalty. Speak with your lender and be sure you understand the terms of the loan before moving forward.

Recommended Reading: How To Take Money Out Of Mortgage