Use A Lump Sum To Pay Off Your Loan Faster

Tax refund, bonus, commission, inheritance, yard sale, gift or lottery win? Whatever it may be, an unexpected windfall can be used to pay off a chunk of the principal in one fell swoop.

So there you have it. Check out our loan payoff calculator to see how overpayments can help you save money in the long run.

Also Check: Reverse Mortgage Mobile Home

Round Up Your Mortgage Payments

Keep in mind, though, that any extra amount paid to reduce your principal balance can knock years off your mortgage term. So if you cant afford an extra mortgage payment, round up your scheduled payments to the nearest $100 amount instead. This small move pays off in a big way.

To illustrate, if you have a mortgage payment of $1,140 and make an extra principal payment of $60 each month . In this example, youll shorten your mortgage term by three years.

Recommended Reading: Rocket Mortgage Payment Options

If Youre Sent A Court Order

If a creditor has taken court action against you, youll get a court order in the post. Once you have a court order, its too late to claim the debt is statute barred.

If you think the debt was already statute barred when the creditor applied for the court order, you might be able to get the court order changed.

The court order will tell you to pay the money back to the creditor, and explain how you have to pay. It might tell you to pay the whole amount straight away, or in monthly instalments. Its important you keep to the terms of the order. If you cant afford what the court has ordered you to pay, you might be able to get the court order changed.

Also Check: How To Invest In Mortgage Backed Securities

The Effect On Mortgage Payments

You might think that a lesser interest rate will reduce your monthly mortgage payments, but this isnt the case. You will have higher monthly payments that are much steeper over 15 years rather than 30.

Remember, your mortgage payment includes taking a monthly bite out of the principal amount you borrowed. This process is known as amortization. Divide that $180,000 by 180, or 12 months over 15 years. That works out to $1,000 a month. Now divide it by 360, or 12 months over 30 years. The number drops by half to $500 a month.

Of course, these are simplified equations because youre paying more toward interest and less toward principal in the earliest months of the mortgage loan. But what youre saving on interest wont make up for the difference in your mortgage payments. Your payments over 15 years will be somewhere in the neighborhood of two-thirds more than the lower monthly payments you would have with a 30-year loan when you take a reduced interest rate into consideration.

Read More:How to Figure Out Amortization of a Mortgage

Using The Mortgage Payoff Calculator

To use this calculator, begin by entering the years remaining on your mortgage, the length of your mortgage, the full amount you originally borrowed, the additional amount youâd like to pay each month and your mortgage rate.

For purposes of the amortization report, check whether you wish to see it displayed as a month-by-month or year by-year breakdown.

The length by which your mortgage will be shortened will be seen in the blue box above the imputs and your total interest savings will appear to the right. You can use the green triangles to adjust any of the figures you enter and the results will update automatically.

A few things to note: Itâs important to enter the original amount of your mortgage and not your current mortgage balance. The calculator will figure where you currently stand based on how long youâve been making payments.

Include any closing costs that were rolled into the original mortgage you want to enter the total amount you borrowed. Likewise, be sure to enter your mortgage rate and not the APR in the interest rate box to get a correct report.

The âMortgage Balances and Interestâ section is a graph that compares how your mortgage principle balance will decline over time with making additional monthly payments compared to making just your regular monthly payments. It also shows how your accumulated interest costs will accumulate over time as well for both options.

Read Also: How Much Is Mortgage On 1 Million

Recommended Reading: What Is A Good Dti For Mortgage

Assessment By The Lender

In addition to the Central Banks lending limits, its ConsumerProtection Code 2012 requires all regulated lenders to assess your personalcircumstances and financial situation thoroughly before agreeing to offer you amortgage.

The lender must carry out detailed assessments of the affordability of theproduct being offered and of its suitability for you. When offering you amortgage, the lender must give you a written statement, setting out the reasonswhy the mortgage product being offered is considered suitable for your needs,objectives and circumstances.

What Happens If I Pay An Extra $1000 A Month On My Mortgage

Paying an extra $1,000 per month would save a homeowner a staggering $320,000 in interest and nearly cut the mortgage term in half. To be more precise, it’d shave nearly 12 and a half years off the loan term. The result is a home that is free and clear much faster, and tremendous savings that can rarely be beat.

Don’t Miss: What Is Points On A Mortgage Loan

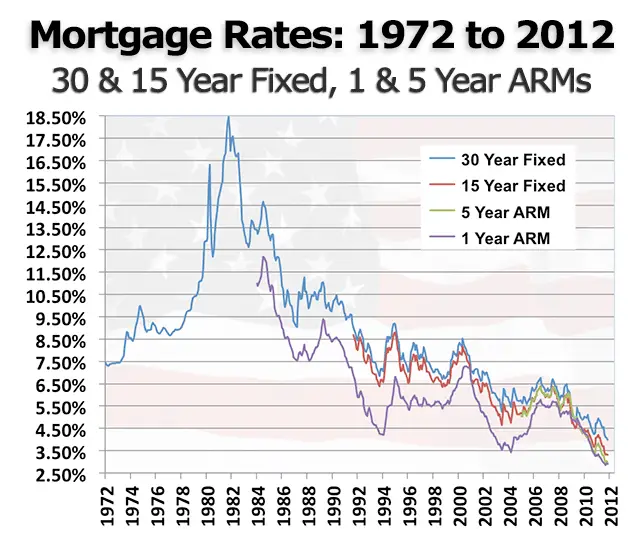

Cons Of An Adjustable

- Variable rates can be risky. Since mortgage rates fluctuate depending on the housing market, you could pay higher interest rates than fixed terms. A rise in interest rates will result in higher monthly payments.

Finding the best mortgage term for you isnt as stressful as it may seem. Doing your research and understanding your options can make the process easier and give you confidence when choosing a mortgage term. Speak to a Home Lending Advisor for more help understanding which mortgage term is right for you.

You May Like: Can A 70 Year Old Get A 30 Year Mortgage

Being Declined A Mortgage Because Of Your Age

Weve received many enquiries from applicants that have been declined a mortgage because of their age. Shortly after, we managed to secure the same applicants with a mortgage. If youve been declined a mortgage because of your age, we can help.

Its likely youve been declined because your application has been placed with an unsuitable lender. As weve mentioned, lenders have varied criteria for mortgages and age limits. Furthermore, each lender has different affordability measures for assessing applicants.

Our advisors are specialist brokers. Well assess your overall financial profile along with your age and only then will we find lenders that are suitable. This largely minimises the risk of being declined. Age certainly shouldnt be a barrier to getting a mortgage but a poorly structured application often can be.

Read Also: How Much Interest Is Charged On A Mortgage

Selling A Property In Italy With A Mortgage On It

If you own a property in Italy and are planning to sell, there are many bureaucratic hurdles to get over, more so if the property being sold has a mortgage on it. Initial questions even include: can you sell a property with a mortgage? The answer is yes, and these are all the steps to follow when selling a property with a mortgage on it in Italy.

A mortgage, as is widely known, is a loan that has a medium to long duration. Often, many years are required to pay it off when it is taken out for the purchase of a property. Despite a commitment of up to 30 years, in many cases people need to sell their mortgaged home. Selling a house with a current mortgage, however, is a complex matter in Italy because it requires precise knowledge of the subject in order for the procedure to be successful. We’re here with all the information you need to know about selling a house with a mortgage.

How Can I Pay Down A 30

You have options to pay off your mortgage faster even with a 30-year mortgage. You can choose to make biweekly payments instead of the regular monthly payment, meaning youll make one extra full payment over the course of the year. You can also choose to make a larger payment each month. Be sure to ask your lender to apply your extra payments to your principal balance.

One word of caution: Double-check that your mortgage doesnt have a prepayment penalty before going this route. Most of the time, such a penalty only applies if you pay off your entire mortgage early. But in some cases, you might face a fee if you make small payments toward principal ahead of time.

Also Check: How To Create A Mortgage Note

How To Compare Mortgages

Banks, savings and loan associations, and credit unions were virtually the only sources of mortgages at one time. Today, a burgeoning share of the mortgage market includes nonbank lenders, such as Better, loanDepot, Rocket Mortgage, and SoFi.

If youre shopping for a mortgage, an online mortgage calculator can help you compare estimated monthly payments, based on the type of mortgage, the interest rate, and how large a down payment you plan to make. It also can help you determine how expensive a property you can reasonably afford.

In addition to the principal and interest that youll be paying on the mortgage, the lender or mortgage servicer may set up an escrow account to pay local property taxes, homeowners insurance premiums, and certain other expenses. Those costs will add to your monthly mortgage payment.

Also, note that if you make less than a 20% down payment when you take out your mortgage, your lender may require that you purchase private mortgage insurance , which becomes another added monthly cost.

If you have a mortgage, you still own your home . Your bank may have loaned you money to purchase the house, but rather than owning the property, they impose a lien on it . If you default and foreclose on your mortgage, however, the bank may become the new owner of your home.

How Many Mortgages Can I Have On My Home

Lenders generally issue a first or primary mortgage before they allow for a second mortgage. This additional mortgage is commonly known as a home equity loan. Most lenders dont provide for a subsequent mortgage backed by the same property. Theres technically no limit to how many junior loans you can have on your home as long as you have the equity, debt-to-income ratio, and credit score to get approved for them.

Don’t Miss: Where Do Mortgage Brokers Work

The Mortgage Insurance Requirement

Private mortgage insurance, or PMI, is a policy that protects your lender in the event that you default on your mortgage loan. The insurer will pay off your balance if this occurs. Your lender is the beneficiary of the policy, but it wont pay for it. You must pay the mortgage insurance premiums, and these can be added on to your mortgage payment as well.

Mortgage insurance is almost universally required if you make a down payment of less than 20 percent, and FHA and USDA loans require it as well. These premiums can be higher for 30-year mortgage terms because you have an additional 15 years to default.

Read More:What Is PMI?

How To Sell A House With A Current Mortgage And Buy Another One In Italy

How does selling a house work if you haven’t paid off the mortgage? Selling a house with an ongoing mortgage, especially for those unfamiliar with the subject, can be quite complex in Italy. If, in addition to selling the property for which you have previously applied for financing, you wish to buy a house while already having a mortgage, the factors to be assessed multiply. The first step to take in order for the procedure to go well is to find out what options are available with regard to the management of the financing. Specifically, the possible options are as follows:

- guarantee replacement

- assignment to the buyer

- early extinction of the mortgage due to sale of the property.

Recommended Reading: How To Pay Down Your Mortgage Faster

Will My Mortgage Payment Go Down After 5 Years

Mortgage Payments Can Decrease on ARMs If you have an adjustable-rate mortgage, there’s a possibility the interest rate can adjust both up or down over time, though the chances of it going down are typically a lot lower. … After five years, the rate may have fallen to around 2.5% with the LIBOR index down to just 0.25%.

The Average Mortgage Length In The Us

When deciding between certain products, it can be easy to just go with the most popular. But when it comes to choosing the right mortgage product to fit your goals, going with the most popular option may not be the best decision.

The average mortgage length is a good place to start. Learning more about other term length options and the benefits and drawbacks of each one will help you find the right mortgage for you.

Also Check: What Can You Qualify For Mortgage

Making Sure Youve Got Extra Flexibility

These added costs dont mean you shouldnt take advantage of lower repayments, especially if paying less each month is the only way you can afford to get on the housing ladder.

However, its worth checking the mortgage deal to see if you can overpay. Being able to do this without penalties gives you added flexibility if you get a pay rise or a cash windfall. You can also pay the contractual amount if times get tough.

Its certainly worth thinking about as any extra money you put into your mortgage over your standard monthly amount will shorten the total length of the mortgage, saving you additional interest over the lifetime of the mortgage.

Can I Get Equity Release As An Older Borrower

There are two common types of equity release

- you take out a mortgage on your main residence in return for a cash lump sum or smaller multiple pay-outs, but continue to own your home. You can either make repayments or allow the interest to roll up. The loan is paid off when you die or go into long-term care and the property is sold. Eligibility starts at age 55.

- A home reversion plan you sell all or part of your home in exchange for a single payment or regular cash payments. You can continue to live in your home until you die or move into long-term care. Eligibility usually starts at age 60-65.

These types of mortgages can be a way of freeing up equity in your home to get a tax-free lump sum. This might be useful in supporting your retirement, but releasing equity may affect your tax position and what your estate is worth when you die. Also, having more cash might impact your eligibility for means-tested state benefits.

Also Check: How Old To Do A Reverse Mortgage

What Does It Mean To Be House Poor

House poor is a situation where most of your wealth is tied up in your house and much of your income goes toward servicing the mortgage debt and related expenses. An example would be if you had $100,000 in savings and used all of it to finance a $500,000 property with a $2,500 monthly mortgage payment when your net income is $3,000 per month.

Such a situation can give the illusion of economic prosperity but quickly unravel to foreclosure if things turn sour.

What Type Of Mortgages Are Best For Over 50s

Finding the best mortgage deal depends on how much youre looking to borrow and for how long, but if youre over 50 you could choose from all types of mortgage, including:

- this type of mortgage has a fixed interest rate for an agreed period, varying from one to 10 years. Your monthly repayment wont change during this time but will revert to your lenders standard variable rate once the fixed rate ends, unless you remortgage to a new deal.

- the interest rate you pay each month can go up or down, depending on the lenders mortgage rate.

- with this type of mortgage, the interest rateis tied to the Bank of England base rate. Most tracker mortgages have terms of two or five years.

- this offers a discount on the lenders SVR, normally for a set term of one to five years. Monthly repayments could fall as well as rise.

There are also mortgage products designed specifically for older borrowers, for example:

- this type of equity release mortgage allows you to release some of the equity in your home, as a tax-free lump sum to do with as you will.

- Retirement interest-only mortgage you only pay the interest on your mortgage. The loan amount is usually paid off when the last borrower moves into long-term care or dies.

Also Check: How Much Should You Pay A Mortgage Broker

How To Apply For A Mortgage If Youre Over 55

If the lender youve applied with has age restrictions, youll have to be sure the rest of your circumstances meet their requirements. For instance, your income will at least need to meet the requirements of the mortgage youre applying for. Although you may have an income from employment now, lenders will check whether youll be able to repay the mortgage once youve retired.

Its a good idea to collate information regarding your income post-retirement. For instance, if youre planning on using income from investments, savings or a pension, youll need to have the relevant paperwork to show lenders. This can be in the form of bank statements or evidence of pension payments.

Lenders will want to look ahead and whether youll be able to repay the mortgage in your later years. This is why you should also assess your own finances to showcase your ability to repay your mortgage, even when retired.