Mortgage Discount Points Vs Apr

Buying discount points on your mortgage is effectively a way of prepaying some of your interest, and looking at the annual percentage rate can help you compare loans with different rate and point combinations. The APR incorporates not just the interest rate, but also the points you pay and any fees the lender will charge. Check out a quick explanation from Greg McBride, CFA, Bankrate chief financial analyst:

How Do Mortgage Discount Points Differ From Mortgage Origination Points

As mentioned, mortgage discount points are essentially a form of pre-paid interest that help you lower the interest rate on your loan. Generally, your interest rate will be reduced by 0.25% per each mortgage discount point you purchase.

You can lower your monthly payment by lowering the interest rate on your mortgage. Always remember that this also means an up-front payment. And the longer you want to live in your house, the more you will benefit from purchasing points.

How Mortgage Points Differ From Mortgage Origination Points

You might have also heard the term mortgage origination points. This refers to the origination fees paid to your mortgage lender for the processing and assessment of your loan. Sometimes you can negotiate these charges with your loan officer, depending on your credit score and down payment. However, these points will not lower your interest rate.

Also Check: Can You Get A Mortgage Loan On Unemployment

How Much You May Potentially Save

Lets look at an example:

- You take out a $200,000, 30-year fixed-rate mortgage at 5.125%

- If you buy 1.75 mortgage points, your lender will offer you an interest rate of 4.75%

- Every point will cost you $2,000

- You will pay $3,500 for those 1.75 mortgage points

In this scenario, you decide to forgo purchasing any mortgage points:

- Your interest rate remains 5.125%

- After 30 years, and not repaying the loan early, you will pay roughly $392,000

And in this second scenario, you decide to purchase the 1.75 mortgage points :

- You wind up paying roughly $376,000 over the life of your loan

- Savings: over the 30-year mortgage, you saved just over $16,000

While the figures used in these examples make a few assumptions, it is important to know the variables you need to consider when purchasing mortgage points. Some of these variables include:

- The mortgage lender

Whether it is smart to buy mortgage points to lower your interest rate depends on your financial situation. In other words, it is not always the best option for every homebuyer.

About Negative Points And Fractional Points

Negative discount points are an option a lender may offer to reduce closing costs. They work just opposite of positive discount points instead of paying money to receive a lower rate, you are essentially given money in return for a higher rate.

These are often a feature of “no closing cost” mortgages, where the borrower accepts a higher rate in return for not having to pay closing costs up front. This Mortgage Points Calculator allows you to use either positive or negative discount points.

Fractional points are commonly used by lenders to round off a rate to a standard figure, such as 4.75 percent, rather than something like 4.813 percent. Mortgage rates are typically priced in steps of one-eighth of a percent, like 4.5, 4.625, 4.75, 4.875 percent, etc., but the actual pricing is more precise than that. So lenders may charge or credit a fractional point, like 0.413 points or 1.274 points to produce a conventional figure for the mortgage rate.

Read Also: Do I Have To Refinance To Remove Mortgage Insurance

Should I Buy Down My Mortgage Rate

Buydowns are most beneficial when a seller or builder offers to pay the discount points on behalf of the buyer without significantly increasing the purchase price of the home. However, if the buyer intends to pay the points themselves, there are certain circumstances in which mortgage buydowns are more suitable.

To begin, you must have enough savings that you can afford to pay for a down payment and closing costs and still have a significant amount of cash left over. If thats the case, having lower payments in the first few years may be beneficial if you expect your income to be considerably higher in the future.

For example, a buydown may make sense for a graduate student who believes their income will double after receiving their degree. Buying down a mortgage would also make sense if a stay-at-home parent were planning to return to work a couple of years after obtaining their loan.

But keep in mind that buydowns are all about paying more money upfront so you can save money in the long run. Therefore, buydowns only really make sense if the buyer in question intends to own the home for an extended period of time.

How Do Mortgage Points Work

Mortgage points, also known as discount points, are a form of prepaid interest. You can choose to pay a percentage of the interest up front to lower your interest rate and monthly payment. A mortgage point is equal to 1 percent of your total loan amount. For example, on a $100,000 loan, one point would be $1,000. Learn more about what mortgage points are and determine whether âbuying pointsâ is a good option for you.

Estimated monthly payment and APR example: A $464,000 loan amount with a 30-year term at an interest rate of 6.500% with a down payment of 25% and no discount points purchased would result in an estimated principal and interest monthly payment of $2,933 over the full term of the loan with an Annual Percentage Rate of 6.667%.1

Read Also: How Much Would A 70000 Mortgage Cost

Types Of Mortgage Points

So what types of points are we playing for here? Just like with basketball , there are different types of mortgage points: origination points and discount points.

Lets get origination points out of the way . This type of mortgage point is basically a fee that doesnt lower your interest rate. It just pays your loan originator. Trust us, youre better off paying out-of-pocket for their service. Skip origination points.

Next up , lets talk discount points. Lenders offer mortgage discount points as a way to lower your interest rate when you take out a mortgage loan. The price you pay for points directly impacts the total interest of the loan. And the more points you pay, the lower the interest rate goes.

That might sound all sunshine and roses at first, but get thisits going down because youre prepaying the interest. In reality, youre just paying part of it at the beginning instead of paying it over the life of the loan.

Considerations For Negative Points

When you obtain negative points the bank is betting you are likely to pay the higher rate of interest for an extended period of time. If you pay the higher rate of interest for the duration of the loan then the bank gets the winning end of the deal. Many people still take the deal though because we tend to discount the future & over-value a lump sum in the present. It is the same reason credit cards are so profitable for banks.

Buyers who are charged negative points should ensure that any extra above & beyond the closing cost is applied against the loan’s principal.

If you are likely to pay off the home soon before the bank reaches their break even then you could get the winning end of the deal. There are many reasons a buyer might repay the loan soon including stock options which are coming due soon, an inheritance in the near future, or a professional flipper who only needs financing in the short term while they rehab the home.

Also Check: Is Quicken Loans A Mortgage Broker

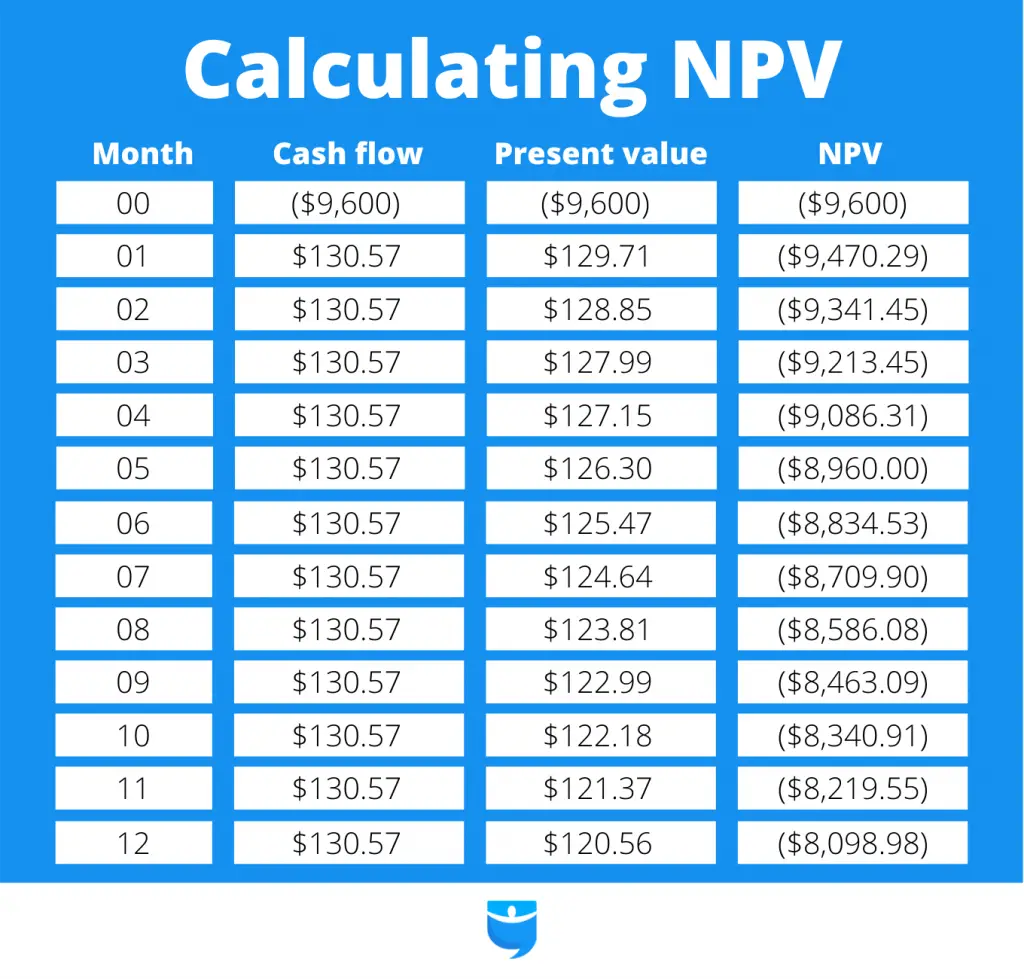

Calculating Your Savings From Discount Points

Before you decide to buy a mortgage point, do the math to make sure that the points you are considering buying will be worth it. How long you plan to keep the home will play a big role in whether or not you get your moneys worth.

If you intend to keep this home for the long term and plan to make 30 years worth of payments, youll likely see a return in savings. On the other hand, if you sell the home within a few years, you may not recoup your costs.

What Is The Break

The break-even point is when the interest you saved is equal to the amount you paid for mortgage points. They sort of cancel each other out.

Alright, its time to go back to math class again. Lets calculate the break-even point from our example we used before. To do this, just divide the cost of the mortgage point by the amount youd be saving per month . And there you have it, that answer is the break-even point.

$2,400 / $36 = 67 months

In other words, in 67 months, youd have saved over $2,400 in interestthe same amount you paid for the mortgage point. After reaching the break-even point, youll pocket that $36 each month, which will be the money you save on interest because of the mortgage point you bought.

Also Check: Can My Parents Cosign On A Mortgage Loan

Scenarios Where Buying Mortgage Points May Make Sense

Understanding how much points cost, the impact on your monthly payments and your break-even point is a good place to start. From there, you can consider your specific situation to determine if buying points is a smart idea.

Generally, buying mortgage points could make sense when:

- You plan on living in the home beyond the break-even point.

- You likely won’t benefit from refinancing your mortgage before the break-even point.

- Buying points won’t strain your finances.

However, if you need the cash for other expensessuch as moving, remodeling or monthly billsyou want to make sure buying points won’t leave you in a bind. Additionally, if you plan on selling the home soon, or you think you might refinance, the savings from buying a lower interest rate will be limited.

In fact, if you suspect you might not stick with the same mortgage for long, it could make more sense to ask for lender credits rather than buying mortgage points. Lender credits could basically be seen as selling points rather than buying them, because the lender pays you to accept a higher interest rate. It can make sense if you’re having trouble affording a down payment or the closing costs. Or if you suspect you may move or refinance soon.

Mortgage Points: The Bottom Line

Homebuyers can lower their interest rate and pay less each month and over the life of their loan through mortgage points. Even so, buyers who plan to relocate or refinance soon should restrategize since they may not have enough time to break even and start saving.

Bear in mind that points also raise closing expenses. As such, if youre a home buyer paying points, be ready for the increased upfront fees. All in all, as long as a borrower has cash on hand, paying points can be a good method to save money if they plan on staying on their property for a long time.

You May Like: Can You Get A New Mortgage With An Existing Mortgage

Crucial Things To Know About Buying Mortgage Points

What Are Mortgage Points?

What are the benefits and drawbacks of buying mortgage points?

How can I benefit from mortgage points?

Are there any disadvantages of purchasing mortgage points?

Should You Buy Mortgage Points?

When do you reach break-even?

What percentage of your monthly payment can you reduce?

FAQ about Mortgage Points

How many points are you allowed to purchase?

The Bottom Line?

Check Out Todays Mortgage Rates

Interest rates vary depending on the type of mortgage you choose. See the differences and how they can impact your monthly payment.

Estimated monthly payment and APR calculation are based on a down payment of 25% and borrower-paid finance charges of 0.862% of the base loan amount. If the down payment is less than 20%, mortgage insurance may be required, which could increase the monthly payment and the APR. Estimated monthly payment. Estimated monthly payment does not include amounts for taxes and insurance premiums and the actual payment obligation will be greater.

Calculators are provided by Leadfusion. This calculator is being provided for educational purposes only. The results are estimates that are based on information you provided and may not reflect U.S. Bank product terms. The information cannot be used by U.S. Bank to determine a customer’s eligibility for a specific product or service. All financial calculators are provided by the third-party Leadfusion and are not associated, controlled by or under the control of U.S. Bank, its affiliates or subsidiaries. U.S. Bank is not responsible for the content, results, or the accuracy of information.

Equal Housing Lender

Recommended Reading: Is There A Zero Down Mortgage

What Do Discount Points Cost

Discount points cost roughly 1% of the loan amount per point.

Purchasing the three discount points would cost you $3,000 in exchange for a savings of $39 per month. You will need to keep the house for 72 months, or six years, to break even on the point purchase. Because a 30-year loan lasts 360 months, purchasing points is a wise move in this instance if you plan to live in your new home for a long time. If, on the other hand, you plan to stay for only a few years, you may wish to purchase fewer points or none at all. There are numerous calculators available on the Internet to assist you in determining the appropriate amount of discount points to purchase based on the length of time you plan to own the home.

The second factor to consider with the purchase of discount points involves whether or not you have enough money to pay for them. Many people are barely able to afford the down payment and closing costs on their home purchases, and there simply isn’t enough money left to purchase points. On a $100,000 home, three discount points are relatively affordable, but on a $500,000 home, three points will cost $15,000. On top of the traditional 20% down payment of $100,000 for that $500,000 home, another $15,000 may be more than the buyer can afford.

Using a mortgage calculator is a good resource to budget these costs.

Current Local Mortgage Rates

Compare your potential loan rates for loans with various points options.

The following table shows current local 30-year mortgage rates. You can use the menus to select other loan durations, alter the loan amount, change your down payment, or change your location. More features are available in the advanced drop down

Don’t Miss: Can I Refinance My Mortgage Within A Year

Are Mortgage Points Right For You

Buying mortgage points is a way to pay upfront to lower the overall cost of your loan and reduce its monthly payment. It makes the most sense if you plan to be in the home for a long period of time. The amount youll save each month is likely to make the upfront cost worth it.

Of course, if you dont plan to stay in a home for a long time, paying points is likely to lose you money overall.

Another consideration is whether you should put money toward points or a larger down payment. A larger down payment can often help you secure a lower interest rate anyway. Additionally, hitting the 20% down payment mark can also let you avoid the additional cost of PMI.

A bigger down payment can get you a better interest rate because it lowers your loan-to-value ratio, or LTV, which is the size of your mortgage compared with the value of the home.

Borrowers should consider all the factors that could determine how long they plan to stay in the home, such as the size and location of the property and their job situation, then figure out how long it would take them to break even before buying mortgage points.

How Much Do They Cost

Points cost 1% of the balance of the loan. If a borrower buys 2 points on a $200,000 home loan then the cost of points will be 2% of $200,000, or $4,000.

Each lender is unique in terms of how much of a discount the points buy, but typically the following are fairly common across the industry.

Fixed-Rate Mortgage Discount Points

Each point lowers the APR on the loan by 1/8 to 1/4 of a percent for the duration of the loan. In most cases 1/4 of a percent is the default for fixed-rate loans.

Adjustable-Rate Mortgage Discount Points

Each point lowers the APR on the loan by 3/8 of a percent , though this discount only applies during the introductory loan period with the teaser-rate.

Cost of Discount Points

As mentioned above, each discount point costs 1% of the amount borrowed. Discount points can be paid for upfront, or in some cases, rolled into the loan.

Fractional Discount Points

Some lenders may offer loans with fractional discount points. In mortgage rate listing tables it is not uncommon to see a loan with 1.1 discount points.

Read Also: How Does The Fed Rate Affect Mortgage Rates

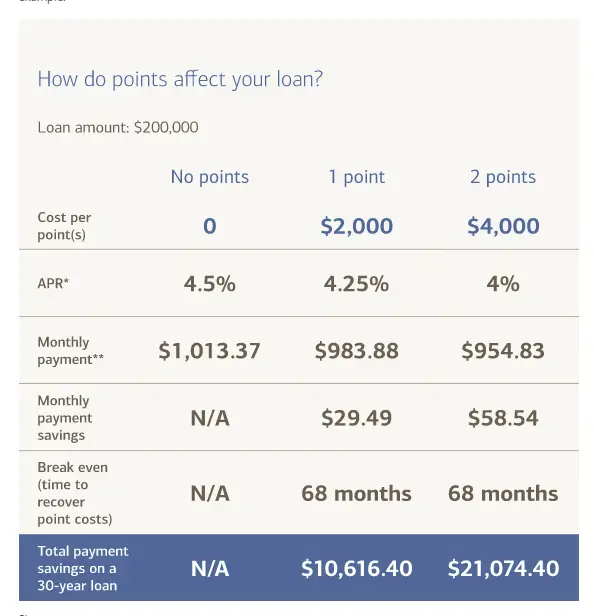

Example Of How Mortgage Points Can Cut Interest Costs

If you can afford to buy discount points on top of the down payment and closing costs, you will lower your monthly mortgage payments and could save lots of money. The key is staying in the home long enough to recoup the prepaid interest. If you sell the home after only a few years, or refinance the mortgage or pay it off, buying discount points could be a money-loser.

Here is an example of how discount points can reduce costs on a $200,000, 30-year, fixed-rate mortgage:

| Loan principal | |

|---|---|

| None | $20,680 |

In this example, the borrower bought two discount points, with each costing 1 percent of the loan principal, or $2,000. By buying two points for $4,000 upfront, the borrowers interest rate shrank to 3.5 percent, lowering their monthly payment by $56, and saving them $20,680 in interest over the life of the loan.