Pros Of Buying Mortgage Points

The biggest benefit of buying mortgage points is lowering the interest rate on your loan, no matter your . This saves you money not only on your monthly mortgage payments but also on total interest payments.

Buying down your rate also reduces the total cost of the home. Paying an extra $3,000 upfront could save you thousands more over the life of the mortgage loan.

Mortgage points are also tax-deductible. The IRS considers mortgage points to be prepaid interest, which may be deductible as home mortgage interest if you itemize deductions. If you deduct all interest on your mortgage, you may be able to deduct all of the points.

Calculate how much you can save on your mortgage payments with Total Mortgage.

What Do Discount Points Cost

Discount points cost roughly 1% of the loan amount per point.

Purchasing the three discount points would cost you $3,000 in exchange for a savings of $39 per month. You will need to keep the house for 72 months, or six years, to break even on the point purchase. Because a 30-year loan lasts 360 months, purchasing points is a wise move in this instance if you plan to live in your new home for a long time. If, on the other hand, you plan to stay for only a few years, you may wish to purchase fewer points or none at all. There are numerous calculators available on the Internet to assist you in determining the appropriate amount of discount points to purchase based on the length of time you plan to own the home.

The second factor to consider with the purchase of discount points involves whether or not you have enough money to pay for them. Many people are barely able to afford the down payment and closing costs on their home purchases, and there simply isn’t enough money left to purchase points. On a $100,000 home, three discount points are relatively affordable, but on a $500,000 home, three points will cost $15,000. On top of the traditional 20% down payment of $100,000 for that $500,000 home, another $15,000 may be more than the buyer can afford.

Using a mortgage calculator is a good resource to budget these costs.

Youll Save More The Longer Youre In The House

If you plan to stay in your home for a long time, discount points could work out nicely for you. The longer you stay in your home, the more youll save on your mortgage payments over time.

But again, this always needs to be balanced with what you could save by, say, refinancing your mortgage at a lower rate, or investing that extra money in improving your home.

Recommended Reading: What Is The Mortgage On A 3 Million Dollar Home

Advantages Of Lender Credits

Lender credits have one big benefit: Saving you money at the closing table.

This is especially helpful if youre stretching your budget to buy a home in the first place. Credits can also be a good tool if youve got a high monthly income and would rather save on upfront costs.

The good news is that in todays world, people have options, and the banks will work with you to help optimize your purchase and your transaction, says Cohn.

Better Mortgage Can Point The Way

The decision to purchase mortgage points depends on several factors, including the types of loans and interest rates available to you. If youre unsure whether purchasing mortgage points is the right move for you as a homebuyer, getting pre-approved can help clarify your budget and see details about your loan options. At Better Mortgage, you can get pre-approved in as little as 3 minutes.

You May Like: How To Become A Mortgage Broker In Massachusetts

How A Good Credit Score Can Lower Your Interest Rate

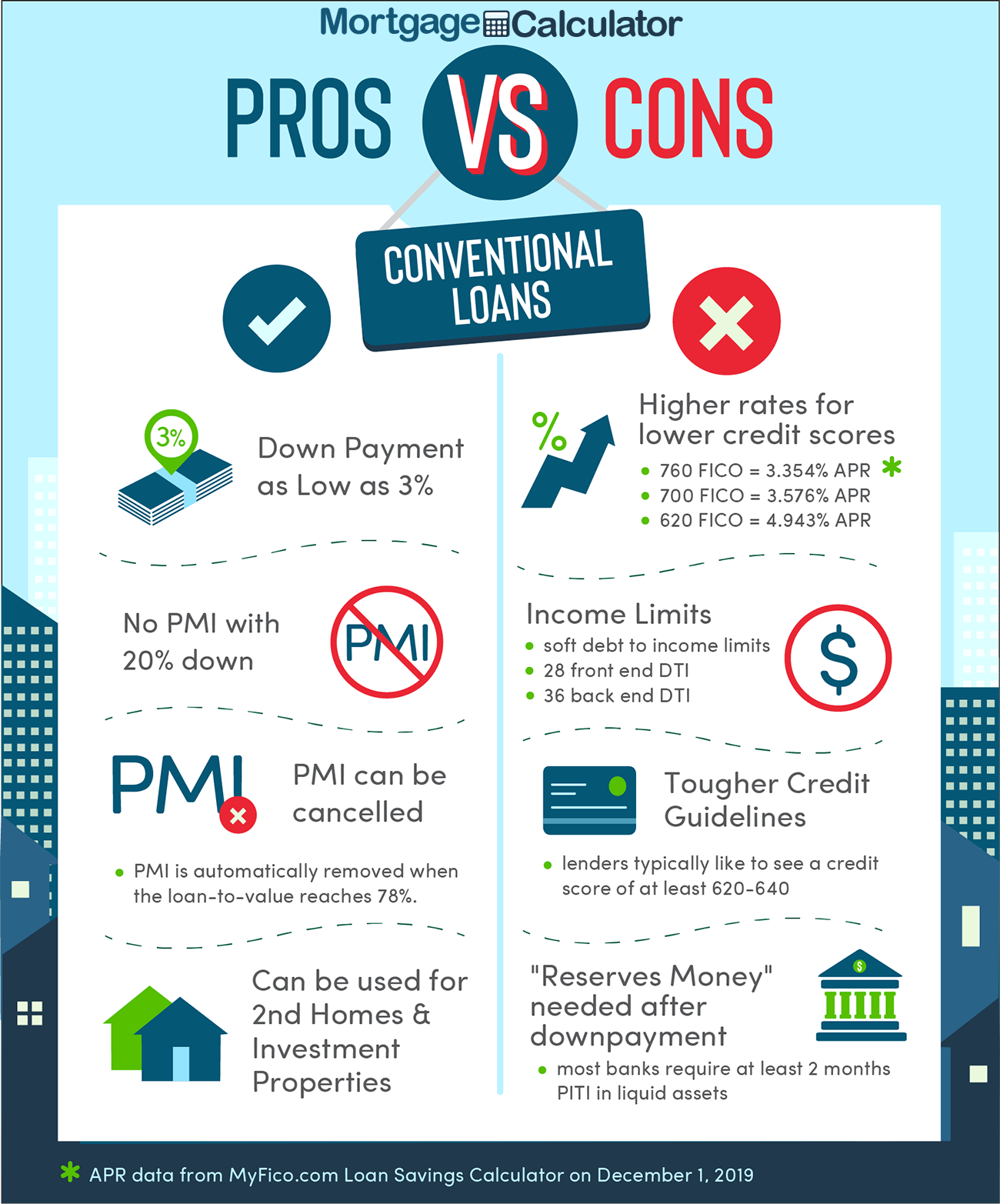

Buying mortgage points isn’t the only thing that can impact your loan’s interest rate. You may get offered different rates depending on the lender, type of loan and how much money you put down. Additionally, your credit can have a direct impact on your mortgage rate.

For example, using the FICO Loan Savings Calculator, you can see how increasing your FICO® Score can lead to lower interest rates. For a $300,000, 30-year fixed-rate mortgage, the national average rate is currently 4.378% for those with a FICO® Score in the 640 to 659 range. This translates to a monthly payment of $1,498.

However, increasing your credit scores to the 680 to 699 range would bring your rate down to 3.734% and monthly payment down to $1,387. To buy the same rate change, you’d have to purchase 2.576 mortgage points at a cost of $7,968.

Learn more about improving your credit, and ideally start working on your credit long before you buy a home.

Purchasing Points Vs Increasing Down Payment

If you are not planning to pay 20% down on your mortgage loan, you must factor the cost of private mortgage insurance into the above calculations. PMI is a premium paid along with your monthly mortgage payment until you reach 20% equity on the home. Letâs return to the example above. If you are only putting down 10% on the loan and your required PMI costs about $150 a month, that would cancel out the savings associated with buying points.

Work with your lender to determine when you can expect to reach 20% equity and compare that number to the break-even point to decide whether or not it makes more sense to increase your down payment instead of buying down your interest rate. You should also compare the costs of a 30-year fixed-rate loan with points to a 15-year fixed-rate loan without points.

Also Check: Will Mortgage Rates Continue To Drop

What Are Mortgage Origination Points

There is another type of mortgage points called origination points. Origination points are fees paid to lenders to originate, review and process the loan. Origination points typically cost 1 percent of the total mortgage. So, if a lender charges 1.5 origination points on a $250,000 mortgage, the borrower must pay $4,125.

How To Shop For A Mortgage

Comparing offers is critical to get the best deal on your mortgage. Make sure to get quotes from at least three lenders, and pay attention not just to the interest rate but also to the fees they charge and other terms. Sometimes its a better deal to choose a slightly higher-interest loan if the other aspects are favorable.

Recommended Reading: How To Sell Reverse Mortgages

What Are Points On A Mortgage Loan

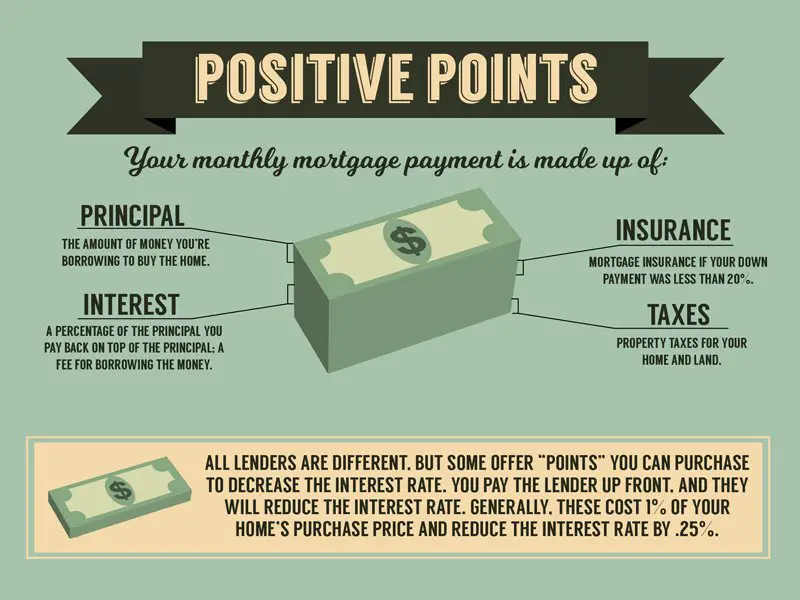

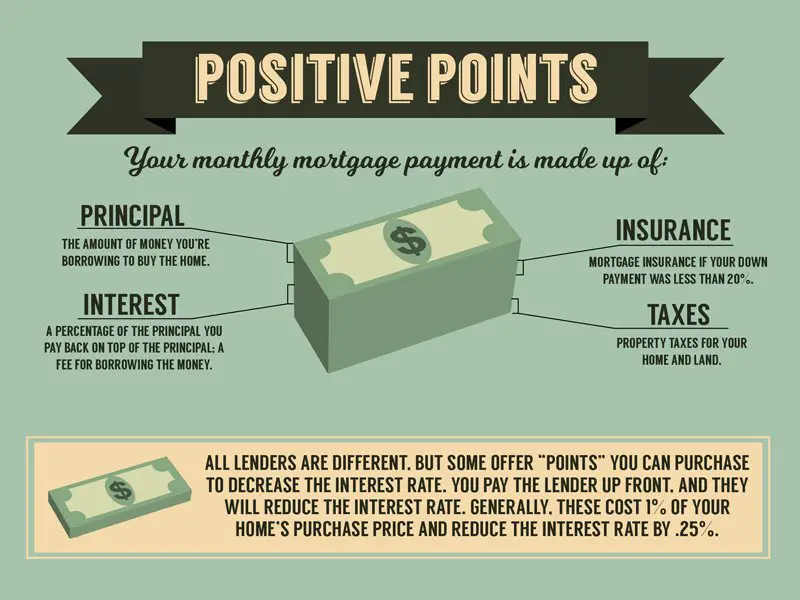

The interest rate on a loan is the primary factor determining your payment and how much you pay the lender over the life of the loan. Did you know that in some cases you can pay to reduce the interest rate on your mortgage loan? The process is called “buying points”. The more points you buy the higher your closing costs are but the lower your payment and interest rate is.

If you are planning to keep the loan for a long time, buying points can make a lot of financial sense. Then again if you sell or refinance too soon the points are a waste.

Curious to know more? This post discusses everything you need to know about buying points on a mortgage loan including examples.

Other Things To Know About Mortgage Points

The terms around buying points can vary greatly from lender to lender. Here are some important things to consider:

The lender and the marketplace determine your rate reduction, and it can change after the fixed-rate period for your mortgage ends. Thats why its important to make sure your break-even point occurs well before the fixed-rate expires. For Bank of America customers, however, if rates go up during the adjustable period, your rate will be lower based on the points you initially purchased.

Contact a tax professional to see whether buying mortgage points could affect your tax situation.

If you need to decide between making a 20 percent down payment and buying points, make sure you run the numbers. A lower down payment can mean also paying for private mortgage insurance , which could cancel out the benefit of buying points for a lower interest rate.

You May Like: What Does Taking A Second Mortgage Mean

You Could Get A Tax Break

Another upside of discount points is that they can give you a nice tax break, provided you meet certain requirements.

Any interest you prepay on your mortgage is tax deductible on the year you pay it, at least for the first $750,000 you borrow.

However, there are some terms and conditions for that tax break. Make sure you read the fine print and speak with a trusted financial adviser before buying points in the hopes of getting a tax break.

How Much Is One Point On A Mortgage

One point typically costs 1% of your loan amount and lowers your mortgage interest rate by about 0.25%. For example, on a $100,000 loan, one point would cost $1,000. Mortgage points also dont have to be round numbers they can also be fractions of a point.

How much each point lowers your mortgage interest rate varies by lender. It also depends on the type of loan product as well as the current interest rate environment. This is why it pays to shop around with a few lenders and compare quotes.

You can also purchase discount points for an adjustable-rate mortgage loan, which works the same as it would for a fixed-rate mortgage. However, most ARMs adjust after five or seven years.

Mortgage points are paid at closing and according to Consumer Finance, they are listed on your Loan Estimate and your Closing Disclosure on page 2, Section A. By law, the points listed on these documents must be connected to a discounted interest rate.

Also Check: How To Get A Mortgage On A Foreclosure

Breaking Even On Mortgage Points

The idea of breaking even is key to deciding between mortgage points, lender credits, or neither. For mortgage points, breaking even is when the extra money you paid upfront in points is made up in the amount of money you save in mortgage interest. If youre going to use mortgage points, you want to make sure youll stay in the home long enough to break even.

| Zero Mortgage Points |

|---|

A Lower Interest Rate Can Save You Money Over The Long Term

With a fixed-rate mortgage, the amount you’ll pay in total for principal and interest remains the same over the entire mortgage term because the interest rate stays the same. So, buying down the rate can save you money if you plan to stay in the property long-term. A small difference in the interest rate can add up to big savings over the 30 or so years you’ll be paying off your mortgage.

Example. If you took out a 30-year, $300,000, fixed-rate loan at 3%, you’d have monthly payments of about $1,265 and pay a total of $455,332 by the time you’ve paid off the loan. But if your interest rate is 2.75%, your monthly payments would be approximately $1,225, and you’d pay a total of $440,900.

With an adjustable-rate mortgage, though, paying points on a mortgage often reduces the interest rate only until the end of the initial fixed-rate period the reduction probably won’t apply over the life of the loan. Some lenders might also allow you to apply points to reduce the margin . So, you could potentially lower the interest rate for longer than just the introductory period.

Read Also: How Long Does Mortgage Underwriting Take

How Mortgage Points Work

Pamela Rodriguez is a Certified Financial Planner®, Series 7 and 66 license holder, with 10 years of experience in Financial Planning and Retirement Planning. She is the founder and CEO of Fulfilled Finances LLC, the Social Security Presenter for AARP, and the Treasurer for the Financial Planning Association of NorCal.

Mortgage points are used in the loan closing process and are included in closing costs. Origination points are mortgage points used to pay the lender for the creation of the loan itself whereas discount points are mortgage points used to buy down the interest rate of the mortgage.

How To Calculate Mortgage Points

Picture a scenario where you take out a 30-year-fixed-rate mortgage for $200,000 with an interest rate of 5.5%. Your monthly payment with no points translates to $1,136.

Then, say you buy two mortgage points for 1% of the loan amount each, or $4,000. As a result, your interest rate dips to 5%. You end up saving $62 a month because your new monthly payment drops to $1,074.

To figure out when youd get that money back and start saving, divide the amount you paid for your points by the amount of monthly savings . The result is 64.5 months or ~5.3 years. So if you stay in your home longer than this, you end up saving money in the long run.

Keep in mind that our example covers only the principal and interest of your loan. It doesnt account for factors like property taxes or homeowners insurance. Also, you may want to take advantage of various free mortgage point calculators that are available.

Read Also: Can You Add A Name To A Mortgage

Benefits Of Buying Down Your Interest Rate

The biggest advantage of buying down interest rates is that you get a lower rate on your mortgage loan, regardless of your credit score. Lower rates can save you money on both your monthly payments and total interest payments over the life of the loan.

In addition:

- If your income is too low for you to qualify for the house you want, you may be able to afford the purchase price with a reduced interest rate and payment

- If you can convince a home seller to pay discount points for you, buying down your rate may help you qualify for your mortgage loan

- Since discount points represent prepaid mortgage interest, the cost is often tax-deductible . Ask a tax professional for more information

First-time home buyers who anticipate staying in their homes for a long time may find buying down their interest rates to be a good decision. Thats because the early years of homeownership can be more expensive, and first-time home buyers incomes may be lower. A better rate can drop your monthly payments and even help you qualify for a more expensive home.

What Are Points And Lender Credits And How Do They Work

Generally, points and lender credits let you make tradeoffs in how you pay for your mortgage and closing costs. Points, also known as discount points, lower your interest rate in exchange paying for an upfront fee. Lender credits lower your closing costs in exchange for accepting a higher interest rate.

These terms can sometimes be used to mean other things. Points is a term that mortgage lenders have used for many years. Some lenders may use the word points to refer to any upfront fee that is calculated as a percentage of your loan amount, whether or not you receive a lower interest rate. Some lenders may also offer lender credits that are unconnected to the interest rate you pay for example, as a temporary offer, or to compensate for a problem.

The information below refers to points and lender credits that are connected to your interest rate. If youre considering paying points or receiving lender credits, always ask lenders to clarify what the impact on your interest rate will be.

Points

Points let you make a tradeoff between your upfront costs and your monthly payment. By paying points, you pay more upfront, but you receive a lower interest rate and therefore pay less over time. Points can be a good choice for someone who knows they will keep the loan for a long time.

Lender credits

See an example

When comparing offers from different lenders, ask for the same amount of points or credits from each lender.

Don’t Miss: Can I Trust Rocket Mortgage

Is It Worth Buying Down Your Rate

When mortgage rates rise, borrowers scramble to find the lowest rate and beat the market.

One option is to buy down your interest rate. Buying down the rate means paying an extra upfront fee to get a lower interest rate and monthly payment. This is referred to as buying mortgage points” or discount points.

When interest rates are low, few borrowers pay higher closing costs to get a discount. But as mortgage rates rise, borrowers are more likely to weigh the pros and cons of buying points. Heres what you should know.

In this article

| Save money over the life of the loan | Potentially less money to spend on a down payment |

Mortgage Points And Closing Costs Explained

Lisett Comai-Legrand About The Author

A mortgage point is the amount equal to 1% of the mortgage loan amount. For example, lets say that you take out a loan of $400,000, one point will be $4,000. This article explains mortgage points and closing costs, and offers a few tips to avoid paying them.

First of all, there are two kinds of mortgage points:

- Discount Points

Discount Points

Discount points are a type of pre-paid interest, and is given directly to the lender at closing for the reduction of the interest rate on your mortgage loan. So, the more points you pay, the lower the interest rate goes on the loan. You can pay up to 3 or 4 points, depending on how much you want to lower the rate.

Origination Points

An origination point is a fee that is charged by the lender to cover the processing of the loan. This fee is mostly a percentage of the loan amount rather than a fixed dollar amount.

How do you decide how many points you need, and how you should pay for them?

This is dependent upon factors like how much money you have at hand for closing costs and how long you plan to stay in the house. If you are planning to stay in your home for some time, using points to reduce the interest rate may be a better approach. If you are looking for the lowest possible closing rate, then you should opt for a zero-point option on the loan program.

Should You Pay for the Discount Points?

Closing Costs

Also Check: Why Are Mortgage Closing Costs So High

Recommended Reading: Why Are Reverse Mortgages A Bad Idea Dave Ramsey