We Now Accept Documents Through E

Georgetown County Register of Deeds office is pleased to announce that we are accepting documents through E-Recording as of March 14, 2022. Our accepted vendor at this time will be Simplifile. We will add other vendors at a later date. Please note E-Recording documents received after 4:30 pm EST will not be processed until the next business day.

To set up an E-Recording account, you may visit our accepted vendor below at:

Simplifile : www.simplifile.com or call at 800-460-5657.

Helpful Documents

Read Also: How Much Is Mortgage On 1 Million

Review Information With Your Real Estate Agent

After doing the legwork to get the mortgage information about the property, its time to sit down and review the numbers. If youre a seasoned investor, this will be easy enough to do on your own. So long as you have the right knowledge, youll know what to look for. However, those new to the industry, or even the local market, should consult with a professional. If you dont have your own consultant or coach, getting in touch with a real estate agent can be a huge help.

A real estate agent who knows the market will be able to review the numbers with you and help you produce a fair offer to present to the property owners. The agent may also be able to offer you other insight into the property and its history. If its currently listed for sale, they can even contact the listing agent on your behalf and get additional information for you.

Finding Mortgage Information On A Property

Its Tough Being a Mortgage Sleuth

How do you get an idea of where to price a listing at or, better yet, gain from a sale? Gaining a snapshot of whats owed on a mortgage against the equity will help you arrive at a number! But what do you do if there are influences working in the background that completely stir things up?Whether you are a realtor or investor, trying to uncover mortgage information on a property is a bit tricky. It would be great if things were as simple as asking a property owner what the balance is on their mortgage. Sometimes the opportunity doesnt present itself for that conversation to happen.Instead, we have to rely on our own diligence to gain the insight we need when it comes to mortgage information.To effectively negotiate on property prices, it helps to have mortgage information. So, how do we find out mortgage details if we cant ask the property owner directly? It takes a LOT of time to access public records on mortgages. Youll make phone calls, send emails, do lengthy searches online, and perhaps visit your local county clerks office.Guess what? Were going to tell you how to get the information you need and how you can save precious time that could otherwise be devoted to growing your business!

Don’t Miss: When Does Mortgage Refinance Make Sense

Find Out How They Help Home Buyers And Sellers

A real estate attorney specializes in handling the legal issues related to the purchase of properties. They often represent buyers and sellers at closing, and their work may include creating and reviewing purchase agreements, mortgage documents, and title and appraisal reports.

Some states require a real estate attorney to manage the closing of a propertys sale. Others make the help of real estate attorneys optional. Real estate attorneys also represent property owners during legal disputes.

Tips On Transferring Property Out Of A Trust

- Inheriting a home can be a financial benefit but handling new property unwisely can cost you. Consider consulting a financial advisor to help you understand the implications of selling, renting or occupying the home. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Inherited property can be valuable. If you dont need a second home, selling the home can help you achieve your financial goals. To make the most of the opportunity, use this guide to selling inherited property.

You May Like: How To Figure Out Mortgage Rates

Property History Search By Owner

If you already know who the owning person or entity is behind a property, you can also navigate to the Ownership tab of Reonomys search app to simply search the name of the owner and find a propertys history that way.

Once you have clicked Apply, youll instead be taken to a list of properties, as the owner may own multiple properties. From that list, you can then click any address, where youll then go to the profile page of the individual asset as mentioned above.

Dont Miss: Rocket Mortgage Qualifications

When Should I Start Applying For A Mortgage

The best advice is to start the process before you even start seriously looking for somewhere to buy. If youre looking at properties before starting to arrange your mortgage, youve left it too late.

There are a number of reasons to begin applying for a mortgage before you start viewing properties or putting in an offer:

- You need to find out for sure how much you can afford. This is particularly important if youre in a more complex financial position, such as beingself-employed. Many home buyers end up losing a property because they couldnt borrow as much as they thought.

- Starting the mortgage process early will help to avoid delays and problems with your mortgage. The secret to smooth home buying is to reduce the surprises as much as possible. See how long it takes to get a mortgage.

- If you have your finances in place, youll be at an advantage compared to rival buyers who do not have a mortgage in principle. Most estate agents and their home selling clients will expect you to have a mortgage in principle when you make an offer.

- If you are thinking about buying jointly with anyone or buying with a friend, then this will affect the sort of mortgage you can get. And, how much you can borrow so you should sort this out before you start looking.

Recommended Reading: What Is The Current Mortgage Rate Right Now

How Much Should I Spend On A House

An affordability calculator is a great first step to determine how much house you can afford, but ultimately you have the final say in what youre comfortable spending on your next home. When deciding how much to spend on a house, take into consideration your monthly spending habits and personal savings goals. You want to have some cash reserved in your savings account after purchasing a home. Typically, a cash reserve should include three months worth of house payments and enough money to cover other monthly debts. Here are some questions you can ask yourself to start planning out your housing budget:

How Much House Can I Afford With A Va Loan

With a military connection, you may qualify for a VA loan. Thats a big deal, because mortgages backed by the Department of Veterans Affairs typically dont require a down payment. The NerdWallet Home Affordability Calculator takes that major advantage into account when computing your personalized affordability factors.

Remember to select ‘Yes’ under ‘Loan details’ in the ‘Are you a veteran?’ box.

For more on the types of mortgage loans, see How to Choose the Best Mortgage.

Recommended Reading: What Does Points Mean On A Mortgage Loan

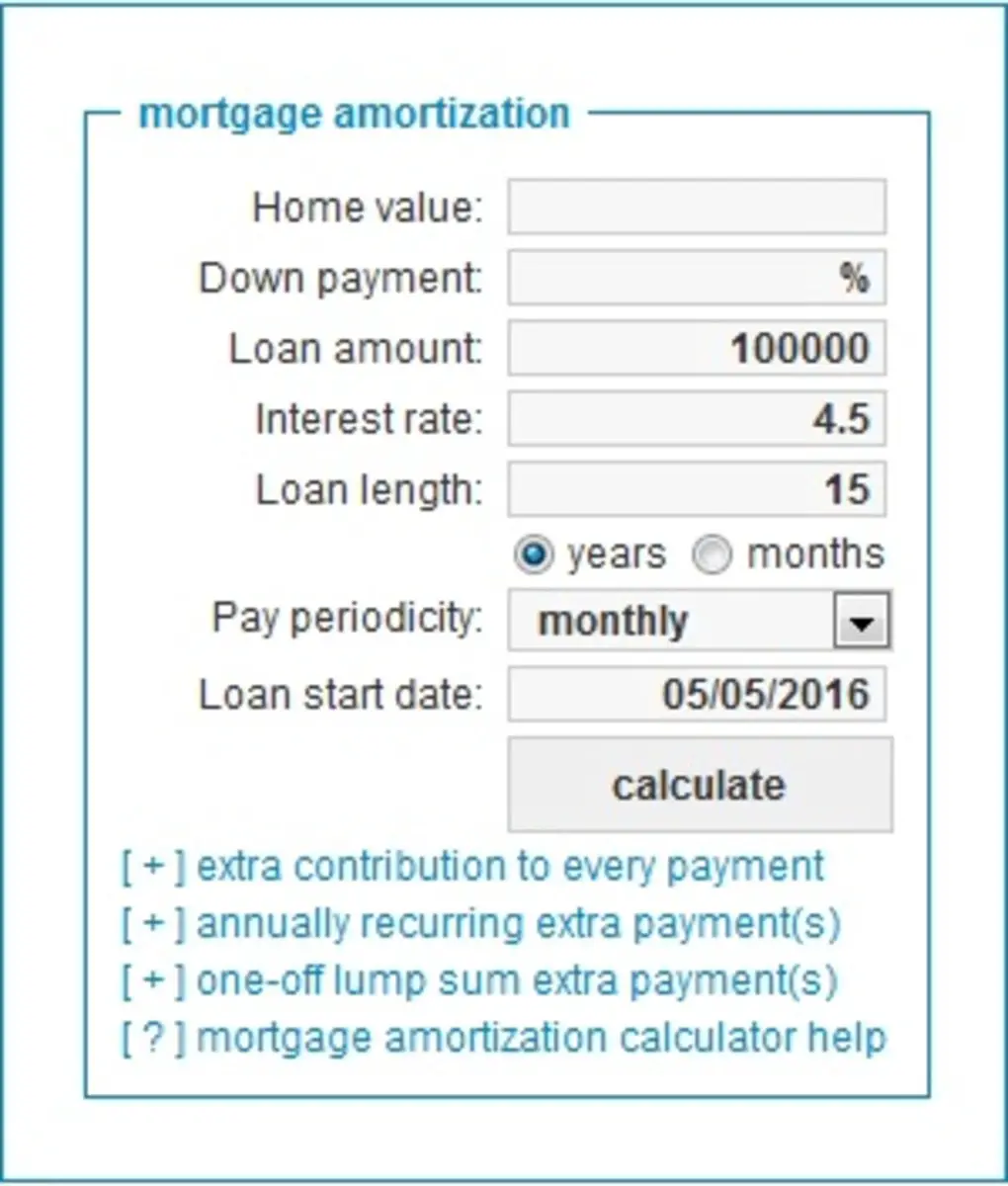

Calculating Your Interest Rate

Knowing the principal balance of your loan wont tell you how much you actually owe. For this, you need to understand the interest rate on the loan. Multiply the interest rate by the amount of the loan to see how much interest youre paying and add this to the balance to understand the total sum of the loan. If you take out a $1,000 loan with 10% interest, youre paying $100 in interest, making the total loan $1,1000.

If your loan has compound interest, you will need to calculate the interest rate for each year of the loan to determine the total interest for the life of the loan.

Conforming Loans Vs Non

Conforming loanshave maximum loan amounts that are set by the government and conform to other rules set by Fannie Mae or Freddie Mac, the companies that provide backing for conforming loans. A non-conforming loan is less standardized with eligibility and pricing varying widely by lender. Non-conforming loans are not limited to the size limit of conforming loans, like a jumbo loan, or the guidelines like government-backed loans, although lenders will have their own criteria.

Don’t Miss: How To Get A Copy Of Mortgage Note

What If The Bank Goes Bust Before The Closing

Youre preparing to close on your mortgage, but learn that your lender or bank is in dire financial straits. Should you start sweating?

The short answer is no. According to Ailion, any funds you have transferred to an escrow agent should be secure if your prospective lender gets into trouble, but you will have to find a new lender to get a loan.

Typically, lenders cease to underwrite loans if they approach insolvency.

Back in 2008, a few lenders did file for bankruptcy protection post-loan approval and pre-closing, and the borrowers on these loans had to scramble to move their loan to a new lender, Burgelin recalls. Thankfully, because most loans are typically underwritten by Fannie Mae, Freddie Mac or FHA guidelines, the appraisal you already had done can be shifted over to a different lender for the same loan type.

Visit The Countys Record Office

Not all counties offer this information online. Some counties do not publish property records online. The information does not include the homeowners name or the mortgage holder in some cases. In such cases, if you belong to a jurisdiction where online records will not serve your purpose, you will have to go to the county records office and use the public terminal to look up the land records for a property. You will need relevant information like a propertys address and the homeowners name to search the database. You can even order copies of recorded documents for a certain fee.

If you are a real estate agent or a wholesaler, going to the countys record office will put you in touch with the clerk in charge of these documents. Forming a good relationship with him will avail you further in the future.

Read Also: How Much Interest Are You Paying On Your Mortgage

What Do These Predictions Mean For Sellers

As a real estate property seller, rising property prices mean that youâll enjoy higher profits. It is good since youâll need it when purchasing your next investment property.

But it doesnât mean that higher profits are guaranteed. Make sure you work with an experienced real estate agent who knows the ins and outs of your local market.

Also, donât be in a rush to sell. Wait for the right time and the right buyer who gives you the right offer. Some buyers will give you a lowball offer. If you arenât distressed, stay on the real estate market for a bit longer to maximize your propertyâs value.

Always remember that the least desperate person in any deal always has the upper hand.

Related: Should Investors Work With Real Estate Agents Near Me?

Search For Your Mortgage Holder Online

You might be able to find out who owns your mortgage loan online.

- MERS mortgage lookup. If your loan is in the MERS system, you might be able to determine who owns or backs your loan by calling MERS or running a check on the MERS website.

- Fannie Mae loan lookup tool. Check the Fannie Mae lookup tool online to find out if Fannie Mae owns your loan. Loans are often sold to this government-sponsored enterprise.

- Is my loan owned by Freddie Mac? Also, check the Freddie Mac loan-lookup tool to find out if Freddie Mac owns your loan. Like with Fannie Mae, many loans are sold to Freddie Mac.

You May Like: What Does Paying Points Mean On A Mortgage

How To Track Down Your Mortgage Transfer Records

When your mortgage broker sells your loan to another lender, there might not be specific mortgage transfer records for your loan.

Q: Four years ago my husband and I refinanced our home with a mortgage broker, who immediately sold it to a big box lender, to whom we have been paying our mortgage payment for years. I happened to look at the records for our County Recorder of Deeds, but I donât see any evidence of the transfer to the big box lender.

Shouldnât I expect to see a recording of transfer from the mortgage broker to the big box lender and a recording of a satisfaction of the mortgage to the mortgage broker?

A: Weâll start with the easy part of your question. When a lender sells your loan or transfers the servicing of your loan, the loan or the lien that secures your loan is not âsatisfied.â So youâd never expect to see a release of your mortgage due solely to your lender selling off or transferring servicing rights to a different lender. As you have not repaid your loan, there is no release to be seen. Youâll see a release of the mortgage at the time the loan is paid off in full.

With that in mind, lenders will use MERS but when they need to file suit against the homeowner for a loan default, they will now file the assignment of the mortgage against the property.

Use A Mortgage Calculator

As a practical matter, youre much better off using a mortgage calculator to calculate your mortgage payment because its very hard to even input that formula properly in a regular calculator. Using a mortgage calculator takes the guesswork out of the formula for you and can help you calculate your mortgage payments much faster. There are several types of mortgage calculators, so its important to understand the purpose of each one so that you can be sure youre using the right one for your needs.

Save money with a lower interest rate.

Lock in your rate today before they rise.

You May Like: How To Get A 1 Million Dollar Mortgage

Funny Business Not Allowed

Some owners have tried to finagle short sales or foreclosures with relatives in the wings. The approach lets the bank take the defaulted house, a relative buys the home without declaring the relationship, and sells it back to the original owner at a discount, thereby seemingly getting rid of the bank loan and lender. This is considered financial fraud and a felony.

References

Read Also: Recast Mortgage Chase

What To Do When Mortgage Loan Records Are Lost

A: The issues of what happens when records are lost is an important one. Letâs start with the questions on keeping old records. Weâve frequently told our readers that they can toss out their financial records after seven years. Even so, there are some records you should keep forever, including certain financial documents, deeds to property, stock certificates, and others.

So, donât just toss all boxes dated from the year 2011 or before. Instead, go through the box and see if thereâs anything important in there. Given todayâs technology, you can easily scan any documents and keep an electronic copy. Again, original stock certificates, original title documents to cars and boats and items like that should be kept forever.

You May Like: How To Estimate Monthly Mortgage Payment

The Importance Of Finding Mortgage Information On A Property

Whether you are in the real estate industry or an investor, gaining insight into a propertys mortgage is essential. Debt burdens such as liens and liabilities on a

property co

me with risks. Realtors can leverage mortgage information to be more efficient in helping your clients. Investors, on the other hand, gain valuable intelligence on a property to be able to manage risks in their portfolio. Transparency of mortgage info from one end to the other prevents you from any unexpected surprises.

Go To A Title Search Web Site Like Ours Property Registry

To lookup the current owner of a property you will need to complete a title search, which will yield the owners full name, as well as other title information listed in the registry. Some land registries like Landgate will let you search your required title search online, others will not and a reseller like our website will be needed.

Read Also: Does Rocket Mortgage Service Their Own Loans

Recommended Reading: How Fast Can You Get Preapproved For A Mortgage

Public Record Property Owner Search

Public records websites are also a common way to begin a property owner search.

Sources of information include county assessor websites , as well as other public records sites like ACRIS.

Lets take a look at each of those examples to see just what types of information they actually provide.

The Harris County Appraisal District of Houston, Texas

HCAD has an online tool intended to provide information about property values and taxes.

The district includes approximately 1.8 million parcels of property with a total market value of approximately $575 billion.

To find commercial properties, HCAD allows users to search by account number, by address, or by owner name.

Very few users will have a propertys account number, unless you are the existing property owner. Most owner searches will be conducted .

This is a good starting point, assuming you have a specific property owner or parcel in mind.

If you wanted to search for all properties owned by John Smith, for example, it might be difficult to decipher the properties owned by the John Smith you have in mind.

Youd have to know enough about the owner for this information to be useful to youparticularly in a geography as large as Houston.

Even if the name were less common, youd still only retrieve information within the Harris County Appraisal District, which might not be representative of all the property that person owns.

The challenge here is that commercial real estate is often held in a limited liability corporation .