How To Account For Closing Costs

Once youve calculated the total principal and interest expense on your mortgage, factoring in closing costs or fees will be straightforward. Since closing costs are paid in full when you close on the loan, you can simply add them to your overall loan cost without using any long formulas. Some examples of upfront closing costs include the following:

- Mortgage lender fees

- Third-party mortgage fees

- Prepaid mortgage costs

While there may be other categories of upfront fees, the process for calculating them remains the same: Just add them to the total cost of the mortgage loan. Keep in mind that this will exclude any added monthly expenses paid in escrow, like taxes or homeowners insurance. Our next section explains how to factor in monthly expenses.

You May Like: What Is A Good Tip On A Mortgage

Costs Included In Your Mortgage Payment

In addition to the principal and interest, there are other upfront and monthly costs to consider as part of the homebuying process:

- Down payment: Depending on your home loan type, a typical down payment is usually 20% — though some types of loans will let you put down less — and even, in some cases, nothing.

- Closing costs: When you close on your new home, your closing cost may range from 3% to 6% of the total mortgage amount. These costs include:

- Origination fees. These costs are charged by the lender for “originating,” or creating your loan. Other costs in this category include application fees, underwriting fees, processing fees and administrative fees.

- Points. If you decide to pay for points, you’ll pay more upfront in exchange for a lower monthly payment. One point equals 1% of the loan amount.

- Taxes and government fees. These are charged by your local government.

- Prepaid expenses and deposits. You’ll typically be required to make an upfront deposit into an escrow for your property taxes and homeowners insurance.

What Is Private Mortgage Insurance

Mortgage insurance protects the mortgage lender against loss if a borrower fails to pay on a loan or commonly known as defaults. Private mortgage insurance is typically required for borrowers of conventional loans with a down payment of less than 20%. Once youve paid down the mortgage balance to 80% of the home’s original appraisal value you are able to ask your mortgage service to remove PMI.

You May Like: Can I Get A 30 Year Mortgage

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Consider The Cost Of Homeowners Insurance

Almost every homeowner who takes out a mortgage will be required to pay homeowners insurance another cost that’s often baked into monthly mortgage payments made to the lender.

There are eight different types of homeowners insurance, so when you buy a policy, ask the company about which type of coverage is best for your situation. The insurance policies with a high deductible will typically have a lower monthly premium.

Recommended Reading: Can You Split Your Mortgage Payment

How Biweekly Mortgage Payments Work To Help You Pay It Off Faster

If youd rather pay less interest AND pay off your house faster, youll want to know about biweekly mortgage payments.

Biweekly mortgage payments are an easy way to save massive money on interest without breaking the bank!

Especially since only making your standard house payment for 30 years can cost thousands of dollars in interest.

Why Use A Mortgage Payment Calculator

When planning to buy a home, its easy to focus on the headline figures, like the final purchase price or your overall mortgage amount. But in many way, the most relevant number for your mortgage will be your regular repayments. After all, your mortgage payments are the amount that youll need to take from your pay cheque each month to keep your mortgage under control.

Using a mortgage payment calculator like the one above takes the guess work out of your mortgage payments. Our calculator lets you understand how much youll need to pay each month for any size of mortgage, with any rate. This means you can compare homes and mortgage products with confidence, all the while knowing exactly how much youll be on the hook for in each scenario.

You May Like: Chase Recast Calculator

Don’t Miss: What Does A Mortgage Attorney Do

Are Mortgage Points Right For You

Buying mortgage points is a way to pay upfront to lower the overall cost of your loan and reduce its monthly payment. It makes the most sense if you plan to be in the home for a long period of time. The amount youll save each month is likely to make the upfront cost worth it.

Of course, if you dont plan to stay in a home for a long time, paying points is likely to lose you money overall.

Another consideration is whether you should put money toward points or a larger down payment. A larger down payment can often help you secure a lower interest rate anyway. Additionally, hitting the 20% down payment mark can also let you avoid the additional cost of PMI.

A bigger down payment can get you a better interest rate because it lowers your loan-to-value ratio, or LTV, which is the size of your mortgage compared with the value of the home.

Borrowers should consider all the factors that could determine how long they plan to stay in the home, such as the size and location of the property and their job situation, then figure out how long it would take them to break even before buying mortgage points.

How To Calculate Mortgage Payments

Zillow’s mortgage calculator gives you the opportunity to customize your mortgage details while making assumptions for fields you may not know quite yet. These autofill elements make the home loan calculator easy to use and can be updated at any point.

Remember, your monthly house payment includes more than just repaying the amount you borrowed to purchase the home. The “principal” is the amount you borrowed and have to pay back , and the interest is the amount the lender charges for lending you the money.

For most borrowers, the total monthly payment sent to your mortgage lender includes other costs, such as homeowner’s insurance and taxes. If you have anescrow account, you pay a set amount toward these additional expenses as part of your monthly mortgage payment, which also includes your principal and interest. Your mortgage lender typically holds the money in the escrow account until those insurance and tax bills are due, and then pays them on your behalf. If your loan requires other types of insurance like private mortgage insurance or homeowner’s association dues , these premiums may also be included in your total mortgage payment.

Don’t Miss: Why Get A Reverse Mortgage

How A Mortgage Calculator Helps You

Determining what your monthly house payment will be is an important part of figuring out how much house you can afford. That monthly payment is likely to be the biggest part of your cost of living.

Using NerdWallets mortgage calculator lets you estimate your mortgage payment when you buy a home or refinance. You can change loan details in the calculator to run scenarios. The calculator can help you decide:

What Is The Average Interest Rate On A Mortgage

Mortgage interest rates change day-to-day and are influenced by various economic factors, including:

Below were the average monthly rates for 30-year fixed-rate mortgages from 20102020, according to the Federal Reserve Bank of St. Louis:

Image source: Federal Reserve Bank of St. Louis.

Of course, the interest rate you see at the closing table could be higher or lower than the average rate. Thats because your interest rate depends on whats happening in the economy at largeplus individual factors, such as the following:

- Interest rate type

You May Like: What Does Prequalification For A Mortgage Mean

Add All Fixed Costs And Variables To Get Your Monthly Amount

Figuring out whether you can afford to buy a home requires a lot more than finding a home in a certain price range. Unless you have a very generous and wealthy relative who’s willing to give you the full price of your home and let you pay it back without interest, you can’t just divide the cost of your home by the number of months you plan to pay it back and get your loan payment. Interest can add tens of thousands of dollars to the total cost you repay, and in the early years of your loan, the majority of your payment will be interest.

Many other variables can influence your monthly mortgage payment, including the length of your loan, your local property tax rate and whether you have to pay private mortgage insurance. Here is a complete list of items that can influence how much your monthly mortgage payments will be:

How To Calculate A Mortgage Payment

Under “Home price,” enter the price or the current value . NerdWallet also has a refinancing calculator.

Under “Down payment,” enter the amount of your down payment or the amount of equity you have . A down payment is the cash you pay upfront for a home, and home equity is the value of the home, minus what you owe.

On desktop, under “Interest rate” , enter the rate. Under “Loan term,” click the plus and minus signs to adjust the length of the mortgage in years.

On mobile devices, tap “Refine Results” to find the field to enter the rate and use the plus and minus signs to select the “Loan term.”

You may enter your own figures for property taxes, homeowners insurance and homeowners association fees, if you dont wish to use NerdWallets estimates. Edit these figures by clicking on the amount currently displayed.

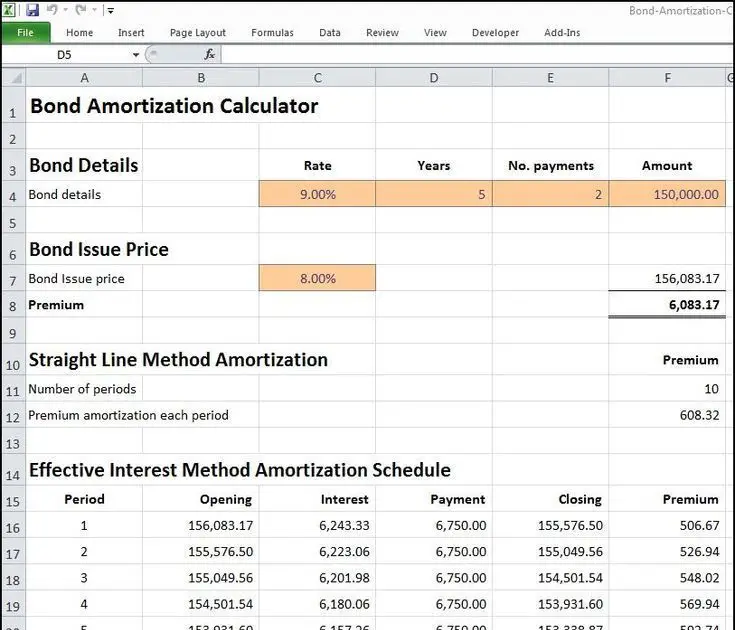

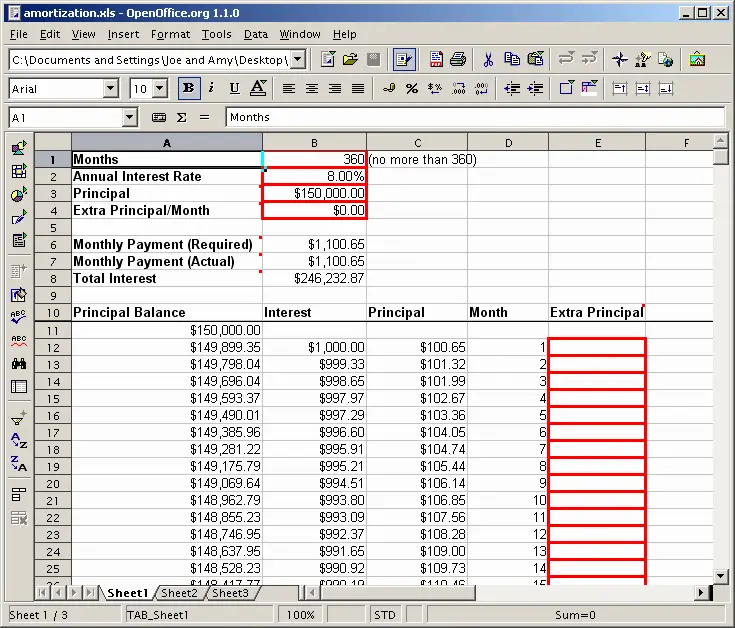

The mortgage calculator lets you click “Compare common loan types” to view a comparison of different loan terms. Click “Amortization” to see how the principal balance, principal paid and total interest paid change year by year. On mobile devices, scroll down to see “Amortization.”

You May Like: How Much Is A Mortgage On A 265 000 Home

What Happens If I Make A Large Principal Payment On My Mortgage

If you make a large payment on your mortgage, the extra payment goes toward paying down your principal. So in many cases, making a large payment is advantageous if you can afford it. It enables you to pay down your mortgage sooner and build equity faster.

And paying down the principal also helps you reduce your interest. The reason is that your lender calculates your interest from the amount of your principal. So if you lower your principal, youll lower your remaining interest as well.

With some mortgages, though, your lender will assess a prepayment penalty if you pay your mortgage down early. The prepayment penalty exists to compensate the lender for the interest it loses if you pay off your mortgage more quickly than expected. So youll probably want to sit down and do the calculations to figure out the best option for your finances. Determine whether your finances will benefit more if you pay your mortgage early and lower its overall cost or if you pay it slowly and steadily to avoid the prepayment penalties.

What Loans Do Home Buyers Choose

Across the United States 88% of home buyers finance their purchases with a mortgage. Of those people who finance a purchase, nearly 90% of them opt for a 30-year fixed rate loan. The 15-year fixed-rate mortgage is the second most popular home loan choice among Americans, with 6% of borrowers choosing a 15-year loan term.

| Loan Type |

|---|

| 12% |

Source: Freddie Mac’s 2016 home buyer statistics, published on .

When interest rates are low home buyers have a strong preference for fixed-rate mortgages. When interest rates rise consumers tend to shift more toward using adjustable-rate mortgages to purchase homes.

Also Check: How To Pick A Mortgage

How Much Can You Afford Based On Purchase Price

Aside from the monthly mortgage payment , a homeowners budget should account for utilities, routine maintenance, and emergency repairs. Many new homeowners are surprised to learn the true cost of owning a home.

Heres a rule of thumb to help you get a sense of what kind of home you can afford. Multiply your gross monthly income by 28%. The result is the maximum you should spend on your monthly payment for housing . So if you earn $7,500 per month gross, you should spend no more than $2,100 on housing.

That 28% may not seem like much. But as the total costs of homeownership add up and add to expenses such as making payments on other loans, transportation, and entertainment youll be glad you have an extra cushion of money in your monthly budget.

Loan Deposit And Credit Records

Most borrowers that qualify for financing save substantial funds for deposit. They also have a good credit history showing on-time payments without large outstanding balances. In the fourth quarter of 2020, only 0.37% of mortgages from borrowers with impaired credit history were approved by lenders.

What is Loan-to-value Ratio?

LTV stands for loan-to-value. Its a ratio that compares the size of the loan against the value of the dwelling.

For example, if you saved a £50,000 deposit for a £200,000 home, your loan amount would be £150,000. To calculate the LTV ratio, divide £150,000 by £200,000. In this example, the LTV ratio is 75%.

In the fourth quarter of 2020, a tiny 0.16% of gross advances went to loans with an LTV over 95%. Meanwhile, 1.06% went to loans with an LTV between 90% and 95%. An estimated 38.76% of advances were granted to loans between 75% and 90% LTV, while 60.02% of gross advances went to loans with an LTV below 75%.

Lenders prefer to extend credit to borrowers with relatively low LTV values. If a borrower obtained funding at 100% LTV, any weakness in the local property market could expose the lender to outright potential losses. For this reason, borrowers in the highest LTV quartile may pay 1% APR higher than borrowers in the lower half of the market.

Recommended Reading: How Is Interest Applied To A Mortgage

Whats Included In Your Monthly Mortgage Payment

If youve been renting, you pay your landlord a certain amount every month. That amount covers your cost to live in your rental unit, but it may also include water, pet rent, reserved parking, electricity, waste services, and maybe even something for access to the onsite fitness center, all depending on your lease.

Fast forward a bit to when you may decide to get a house. At closing, your loan paperwork will contain a payment amount based on interest rate, loan amount, and the term of repayment. Your closing paperwork will also include a payment letter that gives you all of the who, what, and where of your first mortgage payment.

The amount on your payment letter includes principal and interest, but it may also include several other items such as homeowners insurance, mortgage insurance and property taxes.

This is often referred to as PITI and is an important aspect of the breakdown of your monthly mortgage payment.

Recommended Reading: What Is The Current Interest Rate For Interest Only Mortgages

What About Variable Rates

Weve been talking about fixed rates so far, where the interest rate doesnt change. In a variable rate mortgage, your interest rate can change, often at the whim of the bank. Usually, this variable rate is determined by the Bank of Englands bank rate, plus two or three percent. On a standard variable rate, the lender has total control over your interest rate.

If you thought compound interest was tricky, variable rates are positively devilish. Most banks just quote a cost for comparison: this is an educated guess of what your average interest rate will be if you stay on that mortgage. These educated guesses are about as good as we can do: if you do figure out how to predict interest rates accurately, call us.

This is important because most mortgages have a fixed rate for a short period: 2-5 years, typically. The day your mortgage leaves this introductory rate, youll be paying a variable rate, and your payments can change every month!

Don’t Miss: What Is The 30 Year Fha Mortgage Rate

Brief History Of Mortgages In The Us

In the early 20th century, buying a home involved saving up a large down payment. Borrowers would have to put 50% down, take out a three or five-year loan, then face a balloon payment at the end of the term.

Only four in ten Americans could afford a home under such conditions. During the Great Depression, one-fourth of homeowners lost their homes.

To remedy this situation, the government created the Federal Housing Administration and Fannie Mae in the 1930s to bring liquidity, stability, and affordability to the mortgage market. Both entities helped to bring 30-year mortgages with more modest down payments and universal construction standards.

These programs also helped returning soldiers finance a home after the end of World War II and sparked a construction boom in the following decades. Also, the FHA helped borrowers during harder times, such as the inflation crisis of the 1970s and the drop in energy prices in the 1980s.

Government involvement also helped during the 2008 financial crisis. The crisis forced a federal takeover of Fannie Mae as it lost billions amid massive defaults, though it returned to profitability by 2012.

The FHA also offered further help amid the nationwide drop in real estate prices. It stepped in, claiming a higher percentage of mortgages amid backing by the Federal Reserve. This helped to stabilize the housing market by 2013. Today, both entities continue to actively insure millions of single-family homes and other residential properties.