How To Avoid Borrower

Borrower-paid PMI is the most common type of PMI. BPMI adds an insurance premium to your regular mortgage payment. Lets take a look at what home buyers can do to avoid paying PMI.

Make A Large Down Payment

You can avoid BPMI altogether with a down payment of at least 20%, or you can request to remove it when you reach 20% equity in your home. Once you reach 22%, BPMI is often removed automatically.

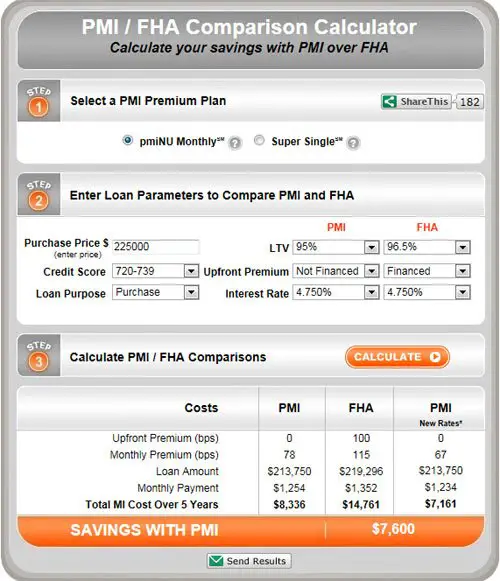

Take Out An FHA Or USDA Loan

While its possible to avoid PMI by taking out a different type of loan, Federal Housing Administration and U.S. Department of Agriculture loans have their own mortgage insurance equivalent in the form of mortgage insurance premiums and guarantee fees, respectively. Additionally, these fees are typically around for the life of the loan.

The lone exception involves FHA loans with a down payment or equity amount of 10% or more, in which case you would pay MIP for 11 years. Otherwise, these premiums are around until you pay off the house, sell it or refinance.

Take Out A VA Loan

The only loan without true mortgage insurance is the Department of Veterans Affairs loan. Instead of mortgage insurance, VA loans have a one-time funding fee thats either paid at closing or built into the loan amount. The VA funding fee may also be referred to as VA loan mortgage insurance.

Take Out A Piggyback Loan

A Guide To Private Mortgage Insurance

Katie Miller is a consumer financial services expert. She worked for almost two decades as an executive, leading multi-billion dollar mortgage, credit card, and savings portfolios with operations worldwide and a unique focus on the consumer. Her mortgage expertise was honed post-2008 crisis as she implemented the significant changes resulting from Dodd-Frank required regulations.

Its a myth that you need to put down 20% of a homes purchase price to get a mortgage. Lenders offer numerous loan programs with lower down payment requirements to fit a variety of budgets and buyer needs. If you go this route, though, expect to pay for private mortgage insurance . This added expense can drive up the cost of your monthly mortgage payments and, overall, makes your loan more expensive. However, its almost unavoidable if you dont have a 20% or more down payment saved up.

Private Mortgage Insurance

Why Do I Need A Pmi Policy

Private mortgage insurance minimizes the risk for lenders to offer loans to borrowers who dont have a 20% down payment and therefore have less equity in their homes once they are purchased. This equity would help pay the loan balance in the event you default and go into foreclosure.

Your lender requires you to have private mortgage insurance so that if you can no longer make payments on your home, the lender will still get paid . PMI basically safeguards the lender in the event of borrower default. It does not protect you, the borrower, if you fall behind on your mortgage payment. If you fall behind on your payments, your credit score could suffer or you could lose your home through foreclosure.

You May Like: Can You Add To Your Mortgage For Renovations

Refinance To Get Rid Of Pmi

When mortgage rates are low, you might consider refinancing your mortgage to save on interest costs or reduce your monthly payments. At the same time, refinancing might enable you to eliminate PMI if your new mortgage balance is below 80 percent of the home value. Its a double dose of savings.

The refinancing tactic works if your home has gained substantial value since the last time you got a mortgage. For example, if you bought your house four years ago with a 10 percent down payment, and the homes value has risen 15 percent since then, you now owe less than 80 percent of what the home is worth. Under these circumstances, you can refinance into a new loan without having to pay for PMI.

With any refinancing, youll want to weigh the closing costs of the transaction against your potential savings from the new loan terms and eliminating PMI.

Who this affects: This strategy works well in neighborhoods where home values are on the upswing. If your home value has declined, refinancing could have the opposite effect you might be required to add PMI if your home equity has dropped.

Refinancing to get rid of PMI typically doesnt work well for new homeowners. Many loans have a seasoning requirement that requires you to wait at least two years before you can refinance to get rid of PMI. So if your loan is less than two years old, you can ask for a PMI-canceling refi, but youre not guaranteed to get approval.

Private Mortgage Insurance Companies

MGIC Mortgage Guaranty Insurance Corporation

MGIC is a subsidiary of MGIC Investment Group and it provides private mortgage insurance to lenders of home mortgages across the U.S. The company offers primary coverage and pool insurance. Primary coverage gives the opportunity to people to become homeowners with less than 20% down payment and protects the lender against default. Pool insurance covers losses that are bigger than claim payments in the case of default.Mortgage Guaranty Insurance Corporationcurrently operates in all the states of the U.S., Puerto Rico, and Guam. MGIC is one of the largest private mortgage insurance companies which has more than 20% share in the market of PMI providers.

Radian Guaranty Inc.

Radian Guaranty Inc is the primary subsidiary of Radian Group. The subsidiary is in the business of providing private mortgage insurance to lenders and offers various mortgage, real estate, and title services.Radian Guaranty Inc.provides PMI on first-lien mortgage accounts and pool insurance. Currently, Radian works with more than 3,500 residential lenders to make homeownership possible for Americans. Its revenues account for half of the total revenues of its parent company.

Essent Guaranty Inc.

National Mortgage Insurance Corporation

Don’t Miss: What Is A Conforming Fixed Mortgage

Pass The Halfway Point Of Your Home Loan Term

Your PMI must also be terminated when you reach the midpoint in your mortgage term. . The Consumer Financial Protection Bureau explains:

There is one other way you can stop paying for PMI. If you are current on payments, your lender or servicer must end the PMI the month after you reach the midpoint of your loans amortization schedule. The midpoint of your loans amortization schedule is halfway through the full term of your loan. For 30-year loans, the midpoint would be after 15 years have passed.

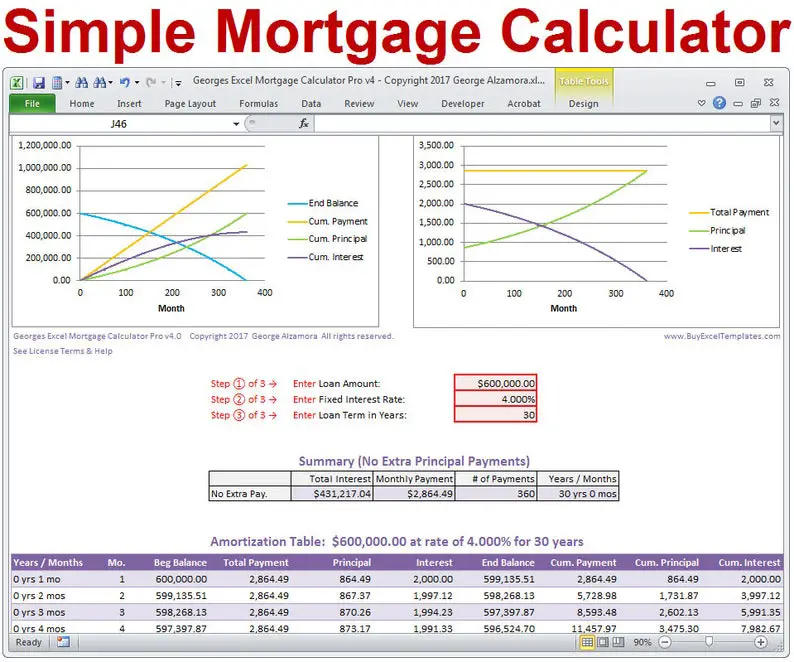

How Is Mortgage Insurance Calculated

When buying a new home or refinancing an existing mortgage, additional expenses often follow. For many folks, one is private mortgage insurance . That is a separate policy from a homeowners insurance coverage and instead protects the lender involved in the mortgage transaction. PMI is often required based on the borrower’s loan-to-value ratio but is not always necessary.

It’s prudent to be curious about the extra costs attached to your mortgage. If PMI appears on the estimate, you may wonder, what is that? Whyâs it required? Who provides it? And, how much is it? Discover the answers to these questions and learn how to calculate the cost of mortgage insurance in this guide.

Recommended Reading: Can You Take A Cosigner Off A Mortgage

Key Questions About Pmi

If the idea of paying private mortgage insurance gives you pause, it should. PMI is an avoidable extra cost associated with buying a home.That said, sometimes paying PMI is the right move it can help you get into a home that would otherwise be out of reach. So before you make the decision to take out a home loan that includes PMI, learn the answers to these four key questions first.

What If Your Credit Score Isnt All That Good

The same down payment would result in a higher PMI factor if your FICO score was 660, for example. PMI pricing is risk-based, meaning that the lower your credit score, the higher risk of default, so PMI is more expensive:

| Down Payment | |

| 0.60% | 0.3% |

The same $400,000 home with 10% down means the 0.60% PMI factor applies and works out like this:

$360,000 X 0.60% = $2160

$2160/12 = $180 added to your total monthly housing payment. This is $120 more per month for the PMI at the same down payment, simply due to the lower FICO score.

Knowing your FICO score when determining your financial ability to buy a home is incredibly important. That way you can take the steps necessary to build solid credit, saving you thousands of dollars in extra costs and fees to obtain your new home.

Your FICO score is crucial in securing the best possible rates and pricing for your new home purchase. Learn building a solid credit score here.

Read Also: Are Mortgage Rates Going Down Again

What Is A Jumbo Loan

A jumbo loan is used when the mortgage exceeds the limit for Fannie Mae and Freddie Mac, the government-sponsored enterprises that buy loans from banks. Jumbo loans can be beneficial for buyers looking to finance luxury homes or homes in areas with higher median sale prices. However, interest rates on jumbo loans are much higher because lenders don’t have the assurance that Fannie or Freddie will guarantee the purchase of the loans.

What Are Hoa Fees

Homeowners association fees are common when you buy a condominium or a home thats part of a planned community. Generally, HOA fees are charged monthly or yearly. The fees cover common charges, such as community space upkeep and building maintenance. When youre looking at properties, HOA fees are usually disclosed upfront, so you can see how much the current owners pay per month or per year. HOA fees are an additional ongoing fee to contend with, they dont cover property taxes or homeowners insurance in most cases.

Recommended Reading: How Long Is The Mortgage Process

Is Mortgage Insurance A Bad Thing

Private mortgage insurance is usually required if you put less than 20% down on a house.

Many homebuyers try to avoid PMI at all costs. Why? Because unlike homeowners insurance, mortgage insurance protects the lender rather than the borrower.

But theres another way to look at it.

Mortgage insurance can put you in a house a lot sooner. You might pay more than $100 per month for PMI. But you could start gaining tens of thousands per year in home equity.

For many people, PMI is worth it. Its a ticket out of renting and into equity wealth.

In this article

How To Calculate Pmi

Example 1: Calculating PMI cost with PMI rate

Assuming you want to purchase a home for $100,000 and you can make a $12,000 down payment. You can calculate your PMI amount as follows:

Step 1 â Determine your loan-to-value ratio.

LTV = mortgage loan / home purchase priceMortgage loan = $100,000 â $12,000 = $88,000LTV = $88,000 / $100,000 = 0.88LTV = 0.88 Ã 100 = 88%

It means you have 88% of the home amount left to pay off.

Step 2 â Multiply the mortgage loan amount by your specific PMI rate according to the lender’s chart. You can look up the PMI rate or ask your lender directly. Let’s assume your LTV of 88% tallies a PMI of 1.2 %.

PMI = $88,000 Ã 1.2/100

You will owe an annual PMI of $1,056.

Step 3 â Divide annual PMI by 12 to find the monthly PMI amount.

Monthly PMI = $1,056 / 12

Monthly PMI = $88

Example 2: How Credit score, LTV, and Adjustments can affect PMI cost

Two friends, Clyde and Trent, each wants to buy homes valued at $500,000 and $200,000, respectively. Clyde is purchasing the house as his second home, and he can make a down payment of 5% of the purchase price. While Trent is buying the house as an investment, and he can make a 10% down payment.

- We can assume Trent will get a better deal on PMI rate than Clyde based on his down payments or LTV ratio.

But if Clyde has a FICO credit score of 720 and Trent has a credit score of 630, their PMI can differ significantly depending on how the mortgage insurer prices the policy.

The OMNInsure PMI chart

Read Also: How Much Is Monthly Payment On 200 000 Mortgage

Your Pmi Rights Under Federal Law

Homeowners who pay for PMI should be aware of their rights under the Homeowners Protection Act. This federal law, also known as the PMI Cancellation Act, protects you against excessive PMI charges. You have the right to get rid of PMI once youve built up the required amount of equity in your home. Lenders have different rules for canceling PMI, but they have to let you do so.

Before you sign a mortgage with PMI, ask for a clear explanation of the PMI rules and schedule. This will enable you to accurately track your progress toward ending the PMI payment. If you feel your lender is not following the rules for eliminating PMI, you can report your complaint to the Consumer Financial Protection Bureau.

Remember: You might be able to eliminate PMI under a few other circumstances, too, such as when your home value rises or when you refinance the mortgage with at least 20 percent equity.

How Much Does Mortgage Insurance Cost

Conventional mortgage insurance rates vary usually, the lower your down payment and/or the lower your credit score, the higher the premiums. The rate you receive for your private mortgage insurance will depend on your credit score, the amount of money you have for your down payment, and insurer. But typically the premiums for private mortgage insurance can range from $30-70 per month for every $100,000 borrowed. So, if you bought a home with a value of $300,000, you might pay about $150 per month for private mortgage insurance.

On FHA loans, there is an up-front MIP and annual premium which is collected monthly.

You May Like: How Much Should Your Mortgage Payment Be Compared To Income

How Credit Scores Affect The Cost Of Pmi

Credit scores don’t just affect mortgage and homeowners insurance rates, they also affect PMIS. Here is an example of how factors such as creditworthiness impact the cost of mortgage insurance: Consider two individuals who each want to buy a home valued $100,000 and can each put down $10,000 or 10% of the value of the home. Although they can make the same down payment, their are major determinants when it comes to the cost of their mortgage insurance policies. To show this, we graphed the price difference across credit score silos for a mortgage insurance policy offered by Radian. The policy is for a borrower-paid mortgage insurance policy that covers a fixed rate loan with a term longer than 20 years. You can see that if Borrower A has a FICO credit score of 760 or higher and Borrower B has a score lower than 639, Borrower Bs mortgage insurance premiums would cost 4x Borrower As.

What Is The Ltv Ratio

The LTV or loan to value ratio is the portion of the value of the house that you are borrowing through a mortgage. In other words, the percentage of your homes value that is financed by the mortgage.

Example Imagine that you want to purchase a house that costs $100,000 and you can only afford to make a 10% down payment. What is your LTV ratio?

Down Payment = 10% * House Price = 10% * $100,000 = $10,000

Mortgage Amount = House Price Down Payment = $100,000 $10,000 = $90,000

LTV ratio = Mortgage Amount /Home Value = $90,000/ $100,000 = 90%

You pass the halfway point of your mortgage term On a 30-year mortgage, for example, PMI must be removed 15 years into the loan. This is true even if the mortgage balance exceeds 78% of the original purchase price of the house.

You refinance your mortgage The last way to get rid of PMI is torefinance your mortgagesuch that the new loan balance is less than 80% of the homes current value. This will allow you to avoid paying PMI after the refinancing of the mortgage.

Dont Miss: How Much Mortgage Can I Afford With 100k Salary

Read Also: How Many Investment Mortgages Can I Have

Are There Other Home Buyer Programs That Can Help

Yes! Programs are available through Fannie Mae and Freddie Mac that reduce rate pricing and PMI costs as long as you meet certain conditions, such as:

If you meet the criteria found under the Home Ready program for Fannie Mae or the Home Possible program for Freddie Mac, then they are worth pursuing, even if you have excellent credit.

Get An Updated Home Appraisal

Paying down a loan’s principal amount is not the only way to reach the elusive 78 percent mark. If a home’s value has appreciated since purchased, having it appraised again may wipe away the loan’s PMI. On average, home appraisals cost between $300 and $400, a small price considering how much it can save in future mortgage payments. Consider professional evaluation on your home to see if this is viable.

Don’t Miss: Does Ally Bank Do Mortgages

What Are The Different Types Of Pmi

In general, there are two types of mortgage insurance: mortgage insurance bought from the government, designed for those with FHA loans or private mortgage insurance for conventional loans which is bought from the private sector . MIP for FHA and VA loans is run differently and managed internally than private mortgage insurance, and they have their own set of rules.

Basically, the type of mortgage insurance required will depend on the type of mortgage loan you get.

How To Remove Pmi

There aremultiple ways to remove PMI, but they all require some contributions from the borrower. PMI for home loans can be removed in one of the following ways:

- LTV Ratio Reaches 78% If you make enough payments such that your LTV is 78%, then PMI should automatically be removed by the insurer. You can also get PMI manually removed when you have 20% ownership of the house, but you will have to reach out to your insurer to get it removed. In most cases, it takes homeowners 11 years to own enough equity in the home to get PMI removed. For example, on a $300,000 home price, if you have $234,000 outstanding in your mortgage, then you have achieved 78% LTV and PMI would be removed.

You May Like: How Long Until You Can Refinance A Mortgage