Rules For Refinancing Va Loans

To refinance into a VA loan a mortgage backed by the Department of Veterans Affairs youre required to wait at least 210 days or long enough to have made six payments, whichever is longer. This requirement applies whether you’re getting a VA cash-out refinance or a VA Interest Rate Reduction Refinance Loan, known as an IRRRL.

Mortgage Refinance And The Stress Test

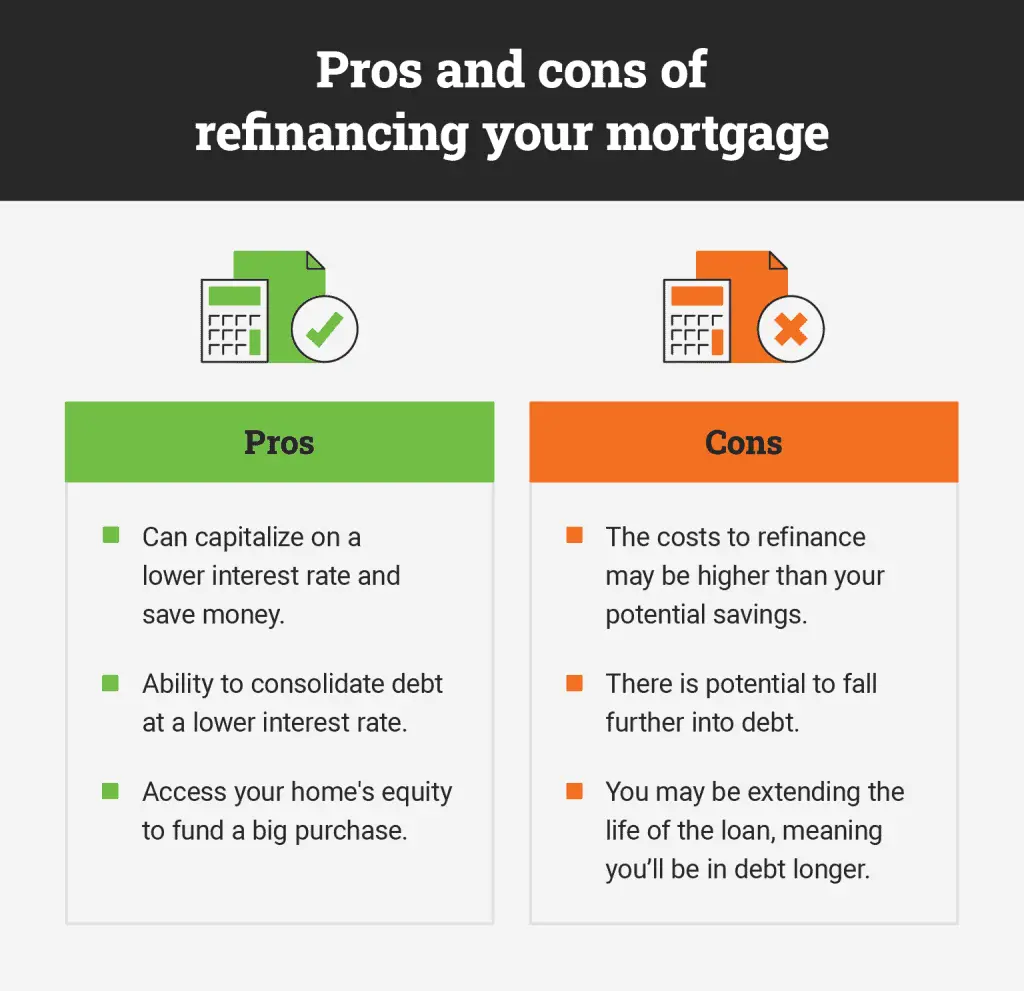

The mortgage stress test is conducted whenever you apply for a new mortgage. A mortgage refinance involves a new mortgage, which means that your mortgage refinance lender will require you to pass the stress test in order to be approved for the refinance. If youre borrowing more money by accessing your home equity, your monthly mortgage payments will increase. This can make it harder to pass the stress test. If your mortgage is being refinanced at a lower interest rate, this will lower your mortgage payments, which will make it easier to pass the stress test. Borrowers with abad credit scoremight find it difficult to be approved for a mortgage refinance from a major bank.Alternative mortgage lenders, such as credit unions and monoline lenders, can be an alternative for bad credit borrowers looking to borrow more money but were denied a mortgage refinance.

Can I Avoid Closing Costs

When you refinance, part of your consideration should be if youâll have to pay closing costs. If the answer is yes, it may negate your reasons for the refi .

If you want to avoid closing costs on a refinance, youâll likely need to wait until you have more equity in your home. You can also try asking your lender if they offer any programs to help cover these costs.

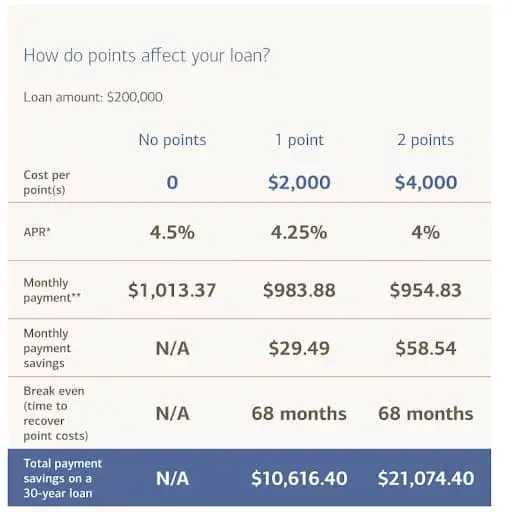

There is also such thing as a âno-closing-cost refinanceâ This means the lender will cover the closing costs, but they may raise your interest rate or add points to the loan to make up for it.

Don’t Miss: Is Mortgage Insurance For The Life Of The Loan

Refinance Waiting Period By Loan Type

Now lets discuss specific refinance waiting periods by loan type and transaction.

Conventional Loans

If were talking about a standard conventional mortgage, such as those backed by Fannie Mae and Freddie Mac, you can refinance almost immediately if the new loan doesnt result in cash out.

In other words, if youre simply executing a rate and term refinance, where the interest rate and/or term of the loan changes, its generally fine to refinance right away.

But if you want to tap into your equity via a cash-out refi, there is a six-month waiting period.

This prevents borrowers from underpaying for properties and then immediately sucking out the equity at a new inflated price.

However, there are some exceptions, such as if the property was inherited or legally awarded via divorce, separation, etc.

Theres also the delayed financing exception, whereby a cash buyer can execute a cash-out refinance if they purchased the subject property within the past six months.

But really the homeowner is just getting their initial investment back, less any down payment requirement associated with the mortgage they take on .

When it comes to government loans, the rules are a little different.

FHA Loans

If you want to do a rate and term refinance on one FHA loan to another FHA loan , the waiting period is 210 days and six monthly mortgage payments must have been made.

In essence, most borrowers will need to wait at least six months to go from one FHA loan to another.

USDA Loans

VA Loans

Rules For Refinancing Fha Loans

An FHA loan is a mortgage insured by the Federal Housing Administration. The FHA has several types of refinances, each with its own rules.

If you want to get an FHA refinance to borrow more than you owe and take the difference in cash, you’re looking at an FHA cash-out refinance.

If you don’t want to take cash out, and you’re willing to get an appraisal, you may choose an FHA rate and term refinance or FHA simple refinance.

If you have an FHA loan and want to refinance into another FHA loan without getting an appraisal, an FHA streamline refinance may be what you’re looking for.

You May Like: What Is The Mortgage Rate Now

How Soon You Can Refinance: Typical Waiting Periods By Home Loan

Refinancing soon after you close on your mortgage is possible, though you may need to wait up to 24 months in some cases.

Edited byChris JenningsUpdated April 6, 2022

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. By refinancing your mortgage, total finance charges may be higher over the life of the loan. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

A mortgage refinance allows you to replace your current mortgage with a new loan to seek better terms.

How soon you can refinance depends on the type of mortgage you have and what youre looking to accomplish with the new loan. Even if youre just a few months into your mortgage, you might be able to refinance right now.

If youre looking to refinance to save on interest costs or lower your monthly payment, heres what you should know:

Mortgage Refinance Vs Heloc

AHome Equity Line of Credit is similar to a mortgage refinance in the sense that you can borrow your home equity, however, there are major differences between these two products.

A HELOC is a revolving account that allows you to borrow money at any time. On the other hand, a mortgage refinance would be a one-time event where you receive a lump-sum amount.

HELOCs also have different credit limits, where you can only borrow up to 65% of the homes value if you have no mortgage, or up to 80% when combined with a mortgage.

HELOC ratesare variable, while refinance mortgage rates can be either fixed or variable. If you choose a fixed refinance mortgage rate, you will be able to lock in a rate. Variable HELOC rates mean that you will be paying more interest if interest rates rise. Refinance mortgage rates are also generally lower than HELOC rates.

Read Also: How Much Do You Get Approved For A Mortgage

How Long Are You Planning To Stay In Your Home

Answering this question will help you determine if refinancing will even make sense financially. Why? Like your original mortgage, refinancing will require an appraisal, an inspection, and closing costs somewhere in the range of 2% to 5% of the loan value. Will you be in the home long enough to recoup those fees?

Lets look at a hypothetical situation: Imagine your current mortgage is $1500 a month, but youre thinking of refinancing. Closing costs and other fees are estimated to come to $4800, but your monthly payment is expected to drop by $200 a month. With an annual savings of $2400, youd only start to see real savings after two years.

Do you intend to stay in your home for at least that long? Refinancing might make sense. If you are not planning to stay put for more than a couple of years, your potential savings may not cover the cost of refinancing. Obviously, your math will differ.

How Soon Can You Refinance A Mortgage

Maybe you just bought a house, or even refinanced recently. But it might not be too soon to refinance again.

Many homeowners can refinance into a lower-rate loan with no waiting period. And others need to wait as little as six months. So theres a good chance youre eligible to refinance at todays rates.

In this article

Read Also: What Is My Credit Score For A Mortgage

Rules For Refinancing Conventional Loans

You probably have a conventional mortgage if your loan isn’t backed by the Federal Housing Administration, U.S. Department of Veterans Affairs or U.S. Department of Agriculture, and if it’s not a jumbo loan. A conventional mortgage meets qualification standards set by Fannie Mae and Freddie Mac.

In most cases, you may refinance a conventional loan as soon as you want. You might have to wait six months before you can refinance with the same lender. But that doesn’t stop you from refinancing with a different lender.

An exception is cash-out refinances. To get a cash-out refinance on a conventional mortgage you must have owned the home for at least six months, unless you inherited the property or were awarded it in a divorce, separation or dissolution of a domestic partnership.

Why Do You Need To Refinance Your Mortgage Right Away

- Interest rates went down considerably

- Your borrower profile improved dramatically

- You want a different loan product

- A life event such as divorce occurred

- You paid cash and want your money back

First lets talk about why someone would want to refinance their mortgage shortly after taking it out.

The most common and topical reason is because mortgage rates fell, substantially.

Its impossible to time the market and buy a home at exactly the right time when it comes to mortgage rates.

Ultimately, they might be low or high when you buy, and theres not much you can do about it if you need/want a home at a certain time.

The good news is you can always refinance your mortgage after the fact if rates improve enough to justify the move, assuming you qualify.

Another common reason to refinance rapidly is if your borrower profile improved dramatically.

Say you had marginal credit, but after six months of paying your mortgage and cleaning up your debt and other things, your scores jumped.

You now qualify for a lower rate and/or an entirely new loan product, such as a conventional loan as opposed to an FHA loan.

To that same end, you may have had a change of heart and want a product change, say from an ARM to a fixed-rate mortgage.

Perhaps you thought the 5/1 ARM was a good idea, then discovered you couldnt sleep at night. Maybe the 30-year fixed is the only loan program for you.

Don’t Miss: What Qualifies You For A Mortgage Loan

Rules For Refinancing Usda Loans

The U.S. Department of Agriculture offers two mortgage programs for rural home buyers: guaranteed loans and direct loans. To refinance a guaranteed loan, you must have had the mortgage for at least 12 months. For direct loans, there is no waiting period for refinancing.

The USDA offers three options for refinancing into another USDA loan. If you get a streamlined refinance or non-streamlined refinance, you must have made on-time payments in the last 180 days. For the streamlined assist program, you must have been current on your mortgage payments in the last 12 months.

How To Know When To Refinance Your Mortgage

Here are some key points you should consider when deciding whether to refinance your mortgage:

- Your credit score. With most mortgage lenders, youll need a of at least 620 to qualify for a mortgage refinance. To get the lowest mortgage rate, youll need a 740. Also keep in mind that, if your credit is lower than it was when you took out your current mortgage, you may not qualify for as favorable a rate as you did before.

- Your debt-to-income ratio . For conventional loans, some lenders will work with a DTI as high as 43%. FHA loans will go a little higher, usually accepting DTIs of 50%. Lower, however, is generally better.

- How long youre staying. When you refinance, youll need to pay closing costs. If you plan to move out in the near future, you may not break even.

- How much equity you have in your home. In order to qualify for a mortgage refinance you generally need at least 20% equity in your home.

Dont try to time the market. Waiting on rate swings is as troublesome as timing the stock market. Dont wait to see what happens with mortgage rates tomorrow if you can save money or move closer to your financial goals by refinancing today.

Don’t Miss: How Much Should Your Monthly Mortgage Be

When Can You Refinance Your Home

How long before you can refinance depends on several factors:

Do you have a solid long-term strategy? First and foremost, have you asked yourself why youre refinancing? Are you trying to lower your rate? Do you need extra cash for home improvements? Are your reasons financially, and logically sound?

Can you use the same lender? Depending on how soon you refinance you might not be able to use your current lender. Switching lenders may result in new closing costs, and other fees. If youre refinancing for a small decrease in interest, calculate to ensure the decrease will benefit you enough.

Is the money right? Lets say you currently have a $200,000 mortgage at 5 percent interest, your monthly payments would be around and $1073.64. If you secured a new loan at 3.75 percent you could save about $147.41, monthly, from a refinance.

How does the forecast look? The Mortgage Bankers Association predicts 30-year fixed-rate mortgages will rise gradually over 2017, averaging 4.7 percent in the fourth quarter of 2017. Similarly, the National Association of Realtors anticipates the 30-year fixed to be around 4.6 percent at the end of 2017.

Historic mortgage rate trends from 1960-present

What is your credit score? How soon you can refinance may be out of your hands if your credit score isnt high enough. The better your credit score, the lower the interest rate youll likely be offered. If your credit score needs improvement, take some time to focus on this before moving forward.

Reasons To Refinance Your Home Loan

In general, people refinance to lower their payments or for other financial reasons.

You can get a better interest rate

The lower your interest rate, the lower your monthly payments and your overall payments over time. Be sure to do the math about how much a lower interest rate would save you vis-a-vis the costs of refinancing, though, to make sure it makes financial sense.

Your credit score has improved

A better credit score can net you a mortgage with better terms, like lower interest rates. If your credit score jumps significantly, its worth checking out whether you can reap the potential benefits.

You want to change the loan term

Whether the loan term is a 15- versus 30-year mortgage affects both the monthly payment and the speed with which you build equity in the house. In a 15-year mortgage, youll generally pay a higher amount, though the trade-off is youll accrue equity faster. In a 30-year, your monthly payment will be lower, but youll gain equity at a slower rate.

If you originally got a 15-year mortgage but find the payments challenging, refinancing to a 30-year loan can lower your payments by as much as several hundred dollars per month. Conversely, if you have a 30-year, a 15-year mortgage can speed up your equity accumulation.

You want to change an ARM

You want to eliminate mortgage insurance payments

You want to tap your homes equity

You went through a divorce

Dont Miss: How Much Will Lenders Give For Mortgage

Recommended Reading: What Is Apr In Mortgage Interest Rate

How Do You Know If You Have A Prepayment Penalty

By law, your lender is required to disclose any prepayment penalty fee on your monthly mortgage bill, your mortgage payment coupon book if you have one, and any communication you receive from your lender about your loan, including information about payments and interest rates. Your mortgage note should also clearly disclose the prepayment penalty fee in your contract.

If you refinanced after 2014 and you have a prepayment penalty listed on your mortgage correspondence, check to make sure it hasnât expired already. It shouldnât last more than three years from the time of refinancing. If itâs stillon your correspondence and itâs been more than three years since you refinanced, contact your lender and ask them to remove it. It shouldnât be there anymore.

Consider Your Credit Report

Taking out a mortgage can impact your credit report, and if you havent had your home for very long, youve probably not made enough monthly payments to boost your score yet. Applying for a refinance loan shortly afterward pings your credit report once again and could affect your eligibility. This could make it challenging to get a new loan to replace the old one or negatively impact the rate youre offered.

Read Also: What Does Buying Mortgage Points Mean

Your Credit Rating Rose

The interest rates you get for your mortgage depend mainly on your credit score. While your credit score may not usually change quickly, it could surge after clearing disputed charges or paying off large debts. Also, the more time that passes after a bankruptcy, the less of an effect the event has on your credit. Talk to your lender if your credit score has risen significantly since you took out your home loan to see if you can qualify for lower rates through refinancing with your new, better credit score.

How Soon Can I Refinance After Buying A House

If youve recently bought a house, or are looking to in the near future, rising interest rates shouldnt come as a surprise. However, the rate you have right now doesnt have to be the rate you have forever. If youre looking to reduce mortgage payments, increase home equity, or refinance an adjustable-rate mortgage to fixed, you may wonder: how soon can I refinance after buying a house? Before making any decisions, consider reasons to refinance your home, and decide which is most important to youthis will help you to select the best option moving forward, whether its a conventional refinance, FHA refinance, VA refinance, USDA, or jumbo.

Also Check: Do You Have To Pay Back A Reverse Mortgage

How Soon After Purchasing My Home Can I Refinance

With historically low interest rates, youre probably seeing a fair share of news items declaring what a great time it is to refinance your home. After all, refinancing can be a smart financial move if it results in lowering monthly payments, reducing loan duration, or building home equity more quickly. But the bigger question lingers: How soon can you refinance after buying a house or condo?

Before contacting a loan officer or mortgage servicer about refinancing, take a read through the next few sections of this post to see if refinancing is right for you.