How Many Conventional Loans Can You Have

If youre already a homeowner with a mortgage on your primary residence and youre hoping to finance the purchase of a vacation home or youre looking to get into real estate investing and want to finance the purchase of more than one rental property, you may be wondering just how many conventional loans you can have.

The quick answer is you can have as many conventional loans as you can afford. However, the more mortgage loans you have , the more requirements youll have to meet in order to qualify for financing. Weve compiled a list of conventional loan facts and a guide on how to determine how many conventional loans you can have to help make it easier to understand financing for multiple properties:

Limited To 10 Properties

Fannie Mae does limit the number of properties that can be owned or financed when applying for new loan to purchase or refinance a non-primary residence . Fannie Mae restricts the number of single family residences properties to a maximum of ten properties owned when purchasing a second home or an investment property however, some mortgage lenders have overlays that reduce this limit to four financed properties so be sure to ask if your mortgage lender sells directly to Fannie.

To be clear, Fannie Mae limits the total number of properties owned, not to the number of mortgages held. For example: if two loans are secured by the same property then this is only counted once. Also, this restriction is applicable for residential properties held in an individuals name, LLC, or partnership but does not include properties held by corporations.

Qualifying For A Mortgage When You Own Multiple Homes

As you buy more homes, whether you finance them or not, youre generally going to be asked for more paperwork each time. To make your life easier, youll want to have your paperwork organized so your loan officer and mortgage underwriter can easily review your loan for qualification and, ultimately, final approval.

The chart below provides a checklist to keep handy when youre applying for a new loan and already own more than one property.

| Type of information |

|

You May Like: What Is The Average Time To Pay Off A Mortgage

Financing Your First Few Rental Properties

Most traditional lenders will make loans on up to four properties as long as your:

- Loan-to-value is in the conservative range of 75% to 80%

- Existing rental properties are performing well

The process for getting more than one loan is similar to what you probably went through when you purchased your own home using a conventional mortgage:

- Long-term, low fixed interest rate

- Low or no mortgage insurance premium required, depending on the size of your down payment

- No up-front insurance premium required

- Proof of income from W-2s or tax returns, statement of assets and liabilities

- Financial statements on any existing investment properties, including P& L, rent roll, and existing loan information

Many investors find that working with a small bank or a mortgage broker is a better way to obtain loans for multiple properties. Loan officers at local banks may be more willing to take the extra time to understand your long-term investment goals, while mortgage brokers often have access to alternative loan financing programs from lenders who are open to negotiation.

Can You Use A Va Or Fha Loan For An Investment Or Rental Property

If the home you buy will not be your primary residence, you will not qualify for a VA or FHA loan. The Department of Veterans Affairs and the Federal Housing Administration require that these loans only be used for primary residences.

It may be possible for you to purchase a property with up to four units with an FHA loan, if you occupy one of the units as your residence. Learn more about FHA loans for investment properties.

Recommended Reading: Can You Borrow Extra Money On Your Mortgage For Renovations

Learn About Landlord And Tenant Laws

Do some upfront research to learn whats involved in being a landlord. Find out about local services such as your landlord association and tenant board, and read about your rights and responsibilities when it comes to things like choosing tenants, property maintenance and eviction procedures. Many provinces have fines for landlords who dont live up to their obligations. Thats an extra expense you probably dont want.

Owning a rental property can be very rewarding when you do appropriate planning. As a landlord, you have the potential benefit from increases in your propertys value, as well as a regular stream of rental income. Over time, this can help you build a more financially secure future.

Also Check: Is Citizens Bank Good For Mortgages

Why Invest In Real Estate

Before we break down how to finance properties and answer the question âhow many mortgages can you haveâ, itâs important to understand why people invest in real estate in the first place â and the incredible financial benefits that can come from it.

The great thing about real estate is that you can do it on your own schedule. For some, real estate investment is a side-gig that they grow gradually over time, alongside their career. For others, real estate investment is a full-time commitment and is run as their business.

The reasons that people get interested in real estate investment include:

- A desire to invest in something that is tangible, unlike stocks and bonds, which are more difficult to understand and evaluate.

- Improved return on investment that can be used as retirement savings or income, due in part to the tendency of home values to rise over time.

Next, letâs look at the financing options for real estate investing.

Recommended Reading: How Is Interest Rate Determined On A Mortgage

How Many Mortgages Can You Have The Simple Answer

Fortunately, theres a very simple answer to this common question about multiple mortgages: how many mortgages you can have is up to the lender. This even includes the The Federal National Mortgage Association .

Back in 2009, FNMA did away with a rule that had previously limited lenders to financing just four properties at once. In their announcement, they explained that, Experienced investors play a key role in the housing recovery.

As such, you can actually take up to as many as 10 loans at once with FNMAs 5-10 Properties Program.

Heres the criteria you must meet to qualify:

- You must already own 5 10 properties with financing

- For a mortgage to purchase, you need 25% down payment for 1-unit 30% for 2-4 units

- For a mortgage to refinance, you need 30% equity, regardless of property type

- A credit score of at least 720

- No late payments on any of your mortgages for the past year

Obviously, thats a pretty long list of very rigid rules. So, it probably shouldnt come as too much of a surprise that not many lenders have taken up FNMA on their offer over the years.

In fact, youd actually have a very hard time finding a lender who would be willing to offer you this program, even though its been approved by FNMA.

Most traditional lenders regard the mortgage application process for this program as more trouble than its worth. After all, keep in mind that most of their customers just want a single mortgage for the home in which they plan to live.

How Many Mortgages Can You Have At One Time

In theory at least, there is no limit on how many mortgages you can have. Be it for residential purpose, buy to lets, holiday homes, or for any other purpose. It ultimately only depends on the lender how much he will lend and under what policies.

1. How many residential mortgages can you have?

If you want to take out a second residential mortgage, then typically you will have to prove to the lender that one of the properties in question is your primary residence. Apart from this, you will also have to provide a justifiable explanation to your lender on why you need a mortgage for your second residential property.

Residential mortgages are typically cheaper than the buy to let mortgages. Therefore, to avoid illegal subletting, lenders need a solid reason for why you need a second residential mortgage. Second homes can be used to accommodate relatives, to reduce commute time during working days, or as a holiday retreat. These are some good examples and are legitimate reasons that can be accepted by the lenders.

2. How many Mortgages can you have as a Real Estate Investor

Almost a decade ago, Real Estate investors could only get approved for four mortgage loans at once. But in 2009 FNMA issued a change to this limitation. To deal with the crashing housing market at that time, FNMA proposed that Real Investors could have as many as 10 mortgage loans at once.

3. How many mortgages buy to let Mortgages can you have?

4. How many Mortgages can you have on one property?

Don’t Miss: What Is Coe In Mortgage

Rental And Investment Property Loan Requirements

The loan application process for rental and investment properties is a lot like applying for a primary home loan. It is still a good idea to get the home inspected and it will likely still need to be appraised. You should expect to provide your financial history, proof of income, and submit to a credit check. You will also still need to pay closing costs.

What Is A Blanket Mortgage

In the event that you want to own multiple properties while using mortgages for financing, you can utilize whatâs called a âblanket mortgageâ instead of individual mortgages.

This type of mortgage pools all your investments under a single financial agreement.

Advantages

A blanket mortgage makes the paperwork, monthly pay system and overall hassle much easier.

Disadvantages

This includes high rates and fees and the fact that every property serves as collateral for the others, making a default a very scary proposition.

Read Also: What Does Icd Stand For In Mortgage

Why Dont Big Banks Like To Lend On Rentals

I think long-term rental properties are one of the best investments. Part of my retirement strategy is buying as many long-term rental properties as I can. The problem with buying many properties is most lenders dont like lending to an investor who already has four mortgages. Most big banks will tell you it is impossible for them to give the fifth mortgage to anyone. The big banks have strict policies about loaning to investors because their primary business is lending to owner-occupied buyers. There is no law that says they cannot give investors more loans, it is simply the banks policies.

Most big banks will sell their loans off to other banks or as mortgage-backed securities. Because they sell their loans and do not keep them in-house as a portfolio lender does, the big banks have much stricter guidelines.

Recommended Reading: How Does The 10 Year Treasury Affect Mortgage Rates

See How Much You Can Afford

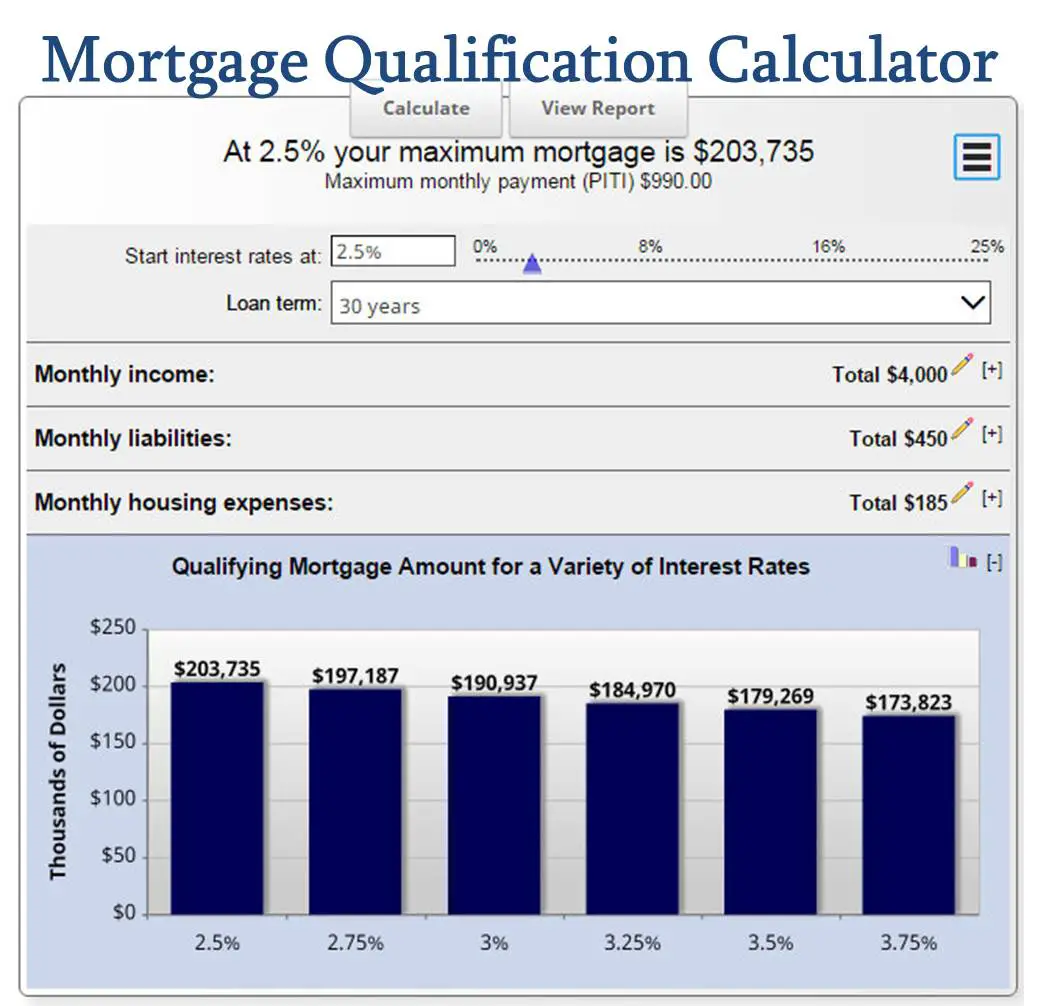

The price for a multi-unit or single-family property may be high, but rental properties have rental income to help offset your costs. This rental income, along with the amount of your down payment and your other income will help determine how much you can afford.

Keep in mind that to qualify for a rental property mortgage, you need at least 20% for a down payment. When thinking about how much you want to spend on a rental property, make sure you also consider closing costs and other one-time costs.

Use our affordability calculator to see how much you can comfortably spend on a rental property.

Recommended Reading: 10 Year Treasury Yield Mortgage Rates

You May Like: Can I Pay My Mortgage Twice A Month

Second Home Vs Investment Property

But what makes a home a second home or an investment property?

You can consider a second home to be like a vacation home. You’re buying it for your own pleasure, and you live in it for a certain period of time every year. If you don’t live in it on a semi-regular basis, lenders will instead consider it an investment property.

To qualify as a second home, the property must also be far enough away. Generally, lenders will only consider a property as a second home if it is at least 50 miles away from your primary residence. This might seem odd, but why would your second home, a home that you would consider a vacation home, be located any closer to where you already live?

An investment property is generally one in which you don’t live. Instead, you rent it out throughout the year. You might plan on holding the property until it appreciates enough in value to allow you to sell it for a healthy profit. Unlike a second home, an investment property can be located near your primary residence.

“An investment property is one that you purchase with the intention of generating income,” Jensen said. “You might use it personally, but it isn’t for your sole use. You plan on renting it out, in part of the whole thing, from time to time.”

But a second home? That’s a different animal.

What Affects My Investment Property Interest Rate

Fannie Mae and Freddie Mac guidelines arent the only things that affect your investment property mortgage rate. All the personal factors that determine mortgage rates are in play, too.

That includes:

- Loan-to-value ratio on the investment property

In fact, your personal finances including your credit report and possibly your tax returns will be put under even stricter scrutiny when you buy an investment or rental property than when you buy a home to live in.

It will take a more robust financial profile to qualify for your investment mortgage and to score a competitive rate on top of that.

Read Also: What Is An Origination Fee On A Mortgage Loan

You May Like: How Much Work History For Mortgage

What Are Commercial Real Estate Loans

When you take out a commercial real estate loan, it is secured by a commercial property as opposed to a residential property.

Commercial real estate is an income producing property used for a business, like:

Investors use commercial real estate loans to purchase commercial property, lease it out and collect rent from businesses.

When you are considering financing for a commercial property, it may be easier to get multiple mortgages than a traditional commercial mortgage.

How Many Investment Mortgages Can You Have

It is easier to get multiple investment property mortgages than residential mortgages because each property generates an income of its own.

You wont need to prove that you can afford both your residential mortgage and your investment mortgage from your income. Instead, each investment mortgage will be assessed based on the expected rental income of that property. Many investors have multiple commercial, buy-to-let, or holiday let mortgages.

Once you own three or more investment properties, you might consider applying for a portfolio mortgage that covers all the properties under one loan, rather than managing and paying off multiple mortgages at once. Read more in our guide to portfolio mortgages.

Recommended Reading: Can I Split My Mortgage Payment Into Two Payments

Complete Your Application Carefully

Applications for second home mortgages and second charge mortgages are closely scrutinised, as both are seen to carry more risk than a standard mortgage. Every detail will be checked for veracity.

Your broker will ensure that all of your paperwork has been completed correctly and catch any unintentional errors that could be flagged as fraud. Its crucial to accurately report details of your income, current debts, and planned usage of the property youre buying, as these will all be important factors in approval or refusal.

We know it’s important for you to have complete confidence in our service, and trust that you’re getting the best chance of mortgage approval at the best available rate. We guarantee to get your mortgage approved where others can’t – or we’ll give you £100*

Should You Flip Or Rent

Should you flip houses or purchase rental properties?

It all depends on your goals, and to what degree you can leverage your skills, expertise and your current financial situation.

In general, house flipping is usually the bigger gamble because these deals hinge on whether property values will rise in the near future. Although price depreciation is never a good thing for property owners, stable and/or falling prices have less impact on someone whose main source of income comes from rents versus a fast resale of a property.

In mid-2017, the highest flipping returns were in Pittsburgh, at 146.6% Baton Rouge, LA, at 120.3% Philadelphia, at 114% Harrisburg, PA, at 103.3% and Cleveland, at 101.8%, according to ATTOM Data Solutions. These cities topped the list because they had lots of affordable, older homes that could be quickly renovated. At the same time, housing prices there were also rising.

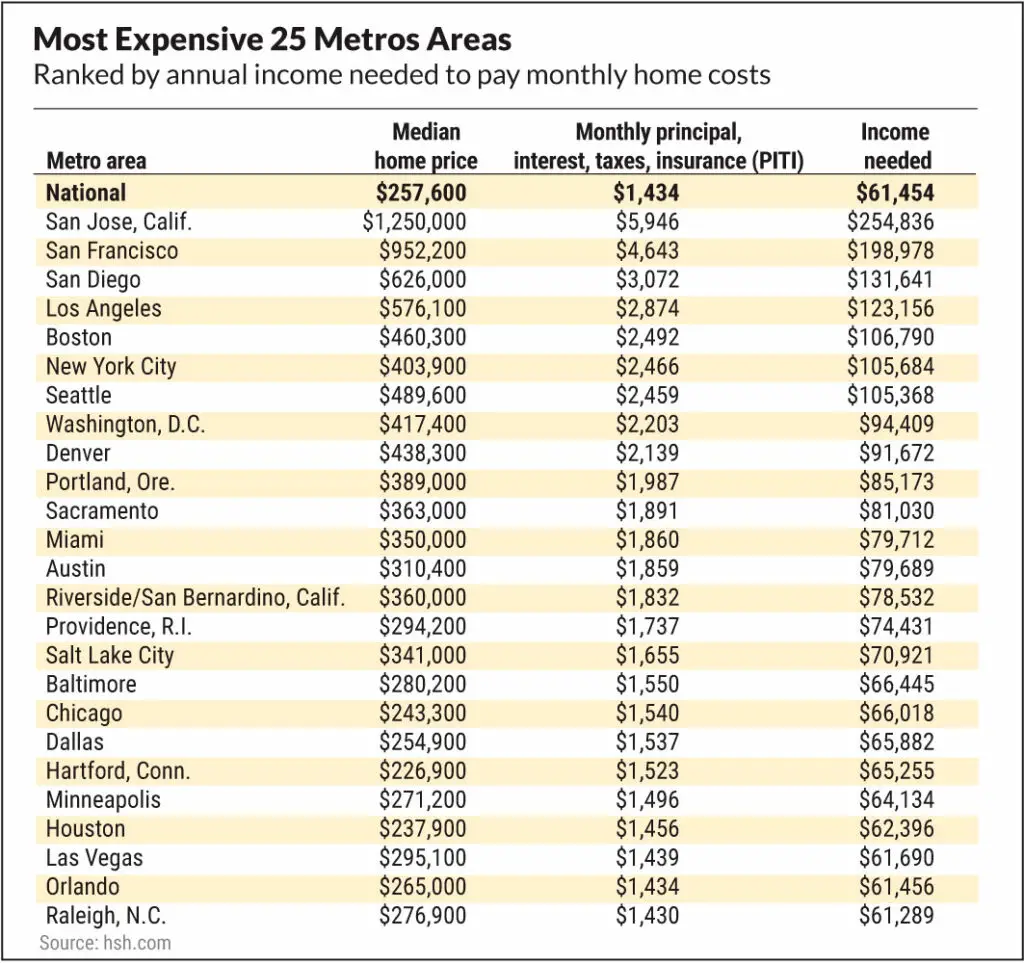

For rental properties, the best markets in early 2017 were Cleveland, with an 11.5% annual return Cincinnati, at 9.8% Columbia, SC, at 8.6% Memphis, TN, at 8.5% and Richmond, VA, at 8.2%. The worst markets were generally located in the biggest cities on either coast, where real estate prices have long been sky high.

But local markets are always changing. Like any other type of investment, real estate carries both risks and rewards. You can reduce the risks by thoroughly researching markets and your financing options, but you can never entirely eliminate them.

Also Check: What Does A Fixed Rate Mortgage Mean