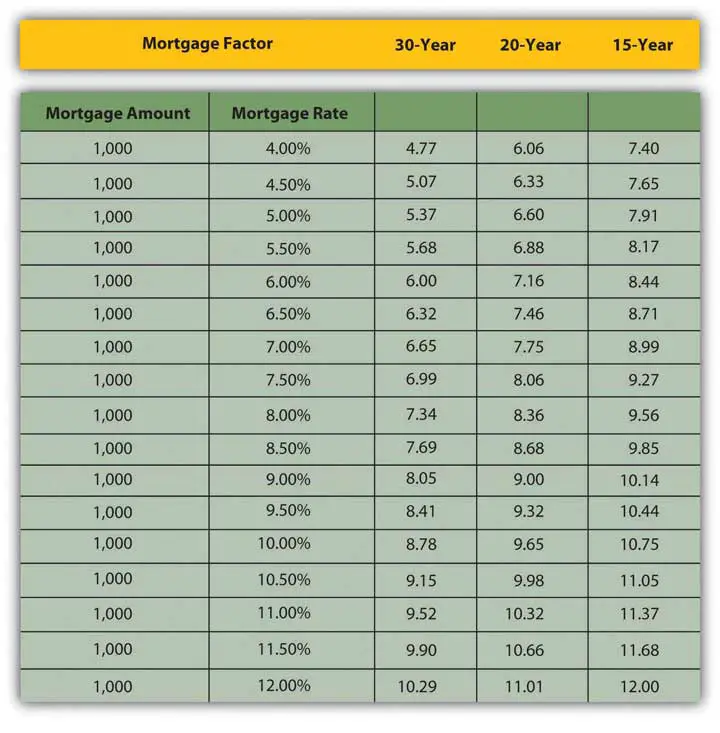

Quickly Estimate The Cost Of Interest Rate Shifts

For any fixed-rate mortgage, select the closest approximate interest rate to your loan from the left column, then scroll look at the payment-per-thousand column for the respective amount to multiply the number by. Then multiply that number by how many hundreds of thousands your home loan is.

- A 3% APR 15-year home loan costs $6.9058 per thousand. If you bought a $100,000 home that would mean the monthly payment would be 100 * $6.9058, so move the decimal places 2 spots to the right and you get a monthly payment of $690.58.

- The total loan cost would be 100 * $1,243.05 Again, move the decimal 2 places to the right & you get $124,305.

- And then if you wanted to figure out the cost of interest you would subtract the $100,000 from $124,305 to get $24,305.

Another way of thinking of the first thousand from the full cost per thousand category is that it includes the thousand you borrowed, so if you subtracted the first thousand from any of these figures that would represent the portion of spending allocated to interest on the loan.

This table scales by 1/8th of a percent from 2% to 10%. At the lower end 0%, 0.5% & 1.0% are added to highlight how little banks pay depositors relative to what they charge creditors. And at the top end 15%, 20% & 25% were added to show how extreme the spread is between deposits and what a credit card might charge a borrower.

| Interest Rate |

|---|

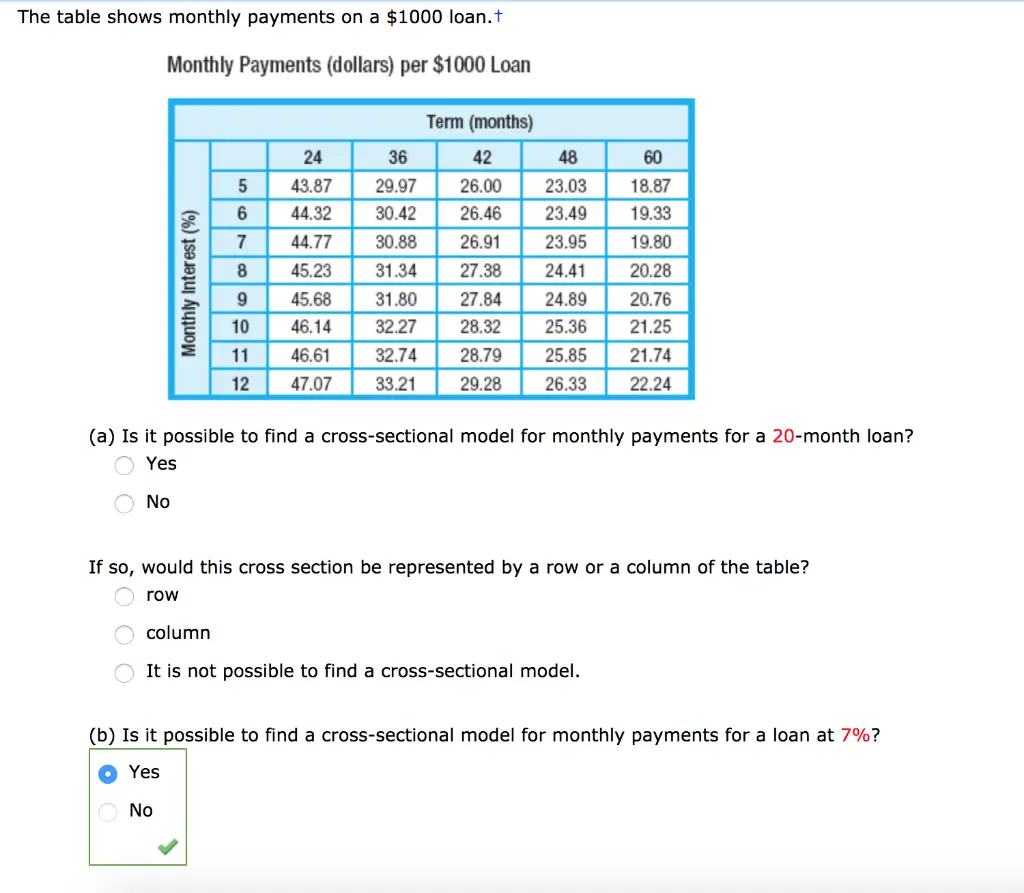

Loan Calculator To Determine Your Monthly Payment

Whether youre looking to buy a house or a car or need some help paying for school, borrowing money can help you reach your goals. Before you take out any loan, its essential to have a clear idea of how long youll have to repay it and what your monthly payment will be. A loan calculator can tell you how much youll pay monthly based on the size of the loan, the term, and the interest rate.

What Is Mortgage Required Income

Lenders consider two main points when reviewing loan applications: the likelihood of repaying the loan and the ability to do so .

Nerdwallet.com explains that mortgage income verification, even if they have impeccable credit, borrowers still must prove their income is enough to cover monthly mortgage paymen

Also Check: Is It Possible To Get An Interest Only Mortgage

Costs Associated With Home Ownership And Mortgages

Monthly mortgage payments usually comprise the bulk of the financial costs associated with owning a house, but there are other substantial costs to keep in mind. These costs are separated into two categories, recurring and non-recurring.

Recurring Costs

Most recurring costs persist throughout and beyond the life of a mortgage. They are a significant financial factor. Property taxes, home insurance, HOA fees, and other costs increase with time as a byproduct of inflation. In the calculator, the recurring costs are under the “Include Options Below” checkbox. There are also optional inputs within the calculator for annual percentage increases under “More Options.” Using these can result in more accurate calculations.

Non-Recurring Costs

These costs aren’t addressed by the calculator, but they are still important to keep in mind.

How Do Mortgage Rates Work

As anyone shopping for a new home or looking to refinance a home loan can tell you, it pays to lock in the lowest possible mortgage rate. Thats because a lower mortgage interest rate directly translates into smaller mortgage payments each month.

In simple terms, a mortgage is a type of home loan offered to those who wish to borrow a set amount of funds for the purchase of a piece of real estate property. These funds typically awarded to prospective buyers who either lack the cash to purchase a property outright or prefer to finance the purchase price of a home over time are secured by the property being purchased. Existing homeowners also have the opportunity to refinance a current home mortgage by taking out a new loan if they find that interest rates have fallen and that they can obtain better financing terms.

Read Also: What Credit Score For Conventional Mortgage

How Piti Affects Your Mortgage Qualification

When lenders assess whether or not you can afford a mortgage loan, theyll compare your estimated PITI with your gross monthly income .

Your PITI, combined with any existing monthly debts, should not exceed 43% of your monthly gross income this is called your debt-to-income ratio .

Your DTI is a primary factor in whether or not youll qualify for a mortgage.

Monthly Payment: Whats Behind The Numbers Used In Our Mortgage Payment Calculator

The NerdWallet mortgage payment calculator cooks in all the costs that are wrapped into your monthly payment, including principal and interest, taxes and insurance. Youll just need to plug in the numbers. The more info youre able to provide, the more accurate your total monthly payment estimate will be.

For example, you may have homeowners association dues built into your monthly payment. Or mortgage insurance, if you put down less than 20%. And then theres property taxes and homeowners insurance. It helps to gather all of these additional expenses that are included in your monthly payment, because they can really add up. If you dont consider them all, you may budget for one payment, only to find out that its much larger than you expected.

For you home gamers, heres how we calculate your monthly mortgage payments on a fixed-rate loan:

M = P /

The variables are:

-

M = monthly mortgage payment

-

P = the principal, or the initial amount you borrowed.

-

i = your monthly interest rate. Your lender likely lists interest rates as an annual figure, so youll need to divide by 12, for each month of the year. So, if your rate is 5%, then the monthly rate will look like this: 0.05/12 = 0.004167.

-

n = the number of payments over the life of the loan. If you take out a 30-year fixed rate mortgage, this means: n = 30 years x 12 months per year, or 360 payments.

Read Also: Does My Credit Score Affect My Mortgage Rate

What Is The Best Mortgage Term For You

A mortgage term is the length of time you have to pay off your mortgageâstated another way, itâs the time span over which a mortgage is amortized. The most common mortgage terms are 15 and 30 years, though other terms also exist and may even range up to 40 years. The length of your mortgage terms dictates how much youâll pay each monthâthe longer your term, the lower your monthly payment.

That said, interest rates are usually lower for 15-year mortgages than for 30-year terms, and youâll pay more in interest over the life of a 30-year loan. To determine which mortgage term is right for you, consider how much you can afford to pay each month and how quickly you prefer to have your mortgage paid off.

If you can afford to pay more each month but still donât know which term to choose, itâs also worth considering whether youâd be able to break evenâor, perhaps, saveâon the interest by choosing a lower monthly payment and investing the difference.

Interest: The Difference 15 Years Can Make

The longer the term of your loan say 30 years instead of 15 the lower your monthly payment but the more interest youll pay.

Say youve decided to buy a home thats appraised at $500,000, so you take out a $400,000 loan with an interest rate of 3.5%. First, lets take a look at a 30-year loan. For quick reference, again, the formula is: M = P /

Our P, or principal, is $400,000.

Remember, with i, we must take the annual interest rate given to us 3.5%, or 0.035 and divide by 12, the number of months in a year. This calculation leaves us with 0.002917, or i.

Our n, again, is the number of payments. And with one payment every month for 30 years, we multiply 30 by 12 to find n = 360.

When alls said and done, for a 30-year loan at 3.5% interest, well pay $1,796.18 each month.

For a 15-year loan, the math is nearly identical. All thats different is the value of n. Our loan is half the length, and so the value for n is 180. Each month well pay $2,859.53, over 60% more than with the 30-year loan.

Over the length of the loan, though, the 15-year loan is a far better deal, considering the interest you pay $514,715 in total. With the 30-year, you pay $646,624 total over $100,000 more.

Your decision between these two, quite simply, hinges on whether or not you can float the significantly higher monthly payments for a 15-year loan.

A little math can go a long way in providing a how much house can I afford? reality check.

Recommended Reading: What Would My Mortgage Be With Taxes And Insurance

Is It Better To Get A 30

Refinancing from a 30-year, fixed-rate mortgage into a 15-year fixed-rate note can help you pay down your mortgage faster and save lots of money on interest, especially if rates have fallen since you bought your home. Shorter mortgages also tend to have lower interest rates, resulting in even more savings.

You May Like: Reverse Mortgage Manufactured Home

How Much Difference Does 1% Make On A Mortgage Rate

The short answer: It can produce thousands or even potentially tens of thousands in savings in any given year, depending on the purchase price of your property, your overall mortgage rate, and the total amount of the mortgage being financed.

By way of example, say that Taylor, a 30-year-old who is a first-time home buyer, wishes to obtain a 30-year fixed FHA loan on a new home with a 20% down payment. Below, you can get a sense of just how much that they stand to save given a 1% difference in interest savings on their 30-year mortgage.

Read Also: Who Is A Mortgage Broker

Average Monthly Mortgage Payments

See Mortgage Rate Quotes for Your Home

The median monthly mortgage payment for American homeowners was $1,030, according to the US Census Bureau’s 2015 American Housing Survey. The survey also reported aggregate monthly housing costs totaling $1,492 for homeowners with a mortgage. This figure typically includes property taxes, which vary based on state and city, and property insurance, which varies based on the homes cost. You can see how your potential mortgage payment compares by using the form above.

How To Get The Best Deal

Got new car fever? Well, first, you need to do a little homework. With the internet, the mystery of the automobile buying process has been unveiled and you can be a well-informed buyer ready to negotiate for the best price. First of all, go to ConsumerReports.org to check out vehicle reliability. You may be eying that shiny red sports car, but if its review states that this manufacturer has a history of poor performance or something like electrical issues, you may want to reconsider.

Test drive the vehicle you have in mind, but renting one from a car rental company for a couple days is the ultimate test.

Recommended Reading: How Is A Mortgage Rate Determined

What Effect Will Interest Rates Have On My 1000 A Month Mortgage

If the interest rate on your mortgage goes up , youll be paying more interest each month. That means you are paying off less of the principal with the same £1,000 repayment. You may find, therefore, that to ensure you pay off the mortgage by the end of the term, that your repayments have to increase. Or, you may be able to negotiate a term extension so your monthly repayment stays the same.

Ask a quick question

We know everyone’s circumstances are different, that’s why we work with mortgage brokers who are experts in all different mortgage subjects.Ask us a question and we’ll get the best expert to help.

Onlinemortgageadvisor.co.uk is an information website all of our content is written by qualified advisors from the front line, for the sole purpose of offering great, relevant, and up-to-date information on all things mortgages.

Online Mortgage Advisor is a trading name of FIND A MORTGAGE ONLINE LTD, registered in England under number 08662127. We are an officially recognised Introducer Appointed Representative and can be found on the FCA financial services register, number 697688.

The Financial Conduct Authority does not regulate some forms of buy to let mortgage.

Think carefully before securing other debts against your home. As a mortgage is secured against your home, it may be repossessed if you do not keep up with repayments on your mortgage.

*OMA Mortgage Approval Guarantee is subject to you providing satisfactory documentation. See T& Cs.

Monthly Mortgage Payments By Region

The census data we reviewed allowed us to compare mortgage payments across different regions of the country. We found that median payments in 2015 were roughly 35 to 40 percent higher for Northeast and Western states than in the Midwest or the South.

| Region | |

|---|---|

| $75,520 | $180,000 |

While mortgage interest rates were similar for all regions, this did not correlate with similarities in payment amounts. In the wealthiest regions of the country, the Northeast and West, consumers had larger outstanding balances on their mortgages and made higher monthly payments. In the South, where median annual income was the lowest, mortgages had the highest interest rates, leading to payments slightly higher than in the Midwest.

Don’t Miss: How Much Do I Need For A Mortgage

Can I Still Get A Good Mortgage With 1000 A Month Repayments If I Have A Bad Credit History

Even if you have a bad credit history, the ability to repay £1,000 a month on a mortgage should allow you to secure a mortgage. How good or large that mortgage is, depends on other factors, as detailed above.

If you want to know more about exactly what mortgage you can get with a bad a credit history but the ability to make £1,000 monthly mortgage repayments, then why not speak with an experienced mortgage advisor, like those we work with.

The right mortgage advisor can answer all your questions and help you understand just what mortgage is available to you with a £1,000 per month for repayments, with or without a bad credit history.

Read Also: Can There Be A Cosigner On A Mortgage

What Taxes Are Part Of My Monthly Mortgage Payment

The taxes portion of your mortgage payment refers to your property taxes. The amount you pay in property taxes is based on a percentage of your property value, which can change from year to year. The actual amount you pay depends on several factors including the assessed value of your home and local tax rates.

Read Also: What Is A Current Mortgage Rate

Can You Afford A 100000 Mortgage

Is the big question, can your finances cover the cost of a £1,000.00 Mortgage? Are you sure you have considered all the costs? If you are increasingly answering ‘yes’ then it’s worth doing the final financial checks, review your monthly household budget (so you are ready to answer all the questions the mortgage advisor will ask and check that you have the deposit covered. See how much it will cost you to move home when buying a property worth £1,000.00

Do you need to calculate how much deposit you will need for a £1,000.00 Mortgage? Try our new Mortgage Deposit Calculator or quick on a deposit percentage below to see an illustration that you can tweak to suit your circumstances

Did you know that we review the UK’s leading mortgage providers each month and produce a comparative guide to the best mortgage deals? By collating the latest mortgage deals from each provider, we save you the time and effort of looking for and finding the best mortgage deals. We also provide regular mortgage updates, guides and mortgage news so you can make the right financial decision when choosing a mortgage.

Using an Independent Mortgage Advisor will saves you time and stress and affordability calculations and mortgage comparison can be completed centrally on your behalf. Use a mortgage broker which doesn’t charge you fees, so you get the best mortgage deals without the hassle.

What Are The Types Of Mortgages

In addition to there being multiple mortgage terms, there are several common types of mortgages. These include conventional loans and jumbo mortgages, which are issued by private lenders but have more stringent qualifications because they exceed the maximum loans amounts established by the Federal Housing Finance Administration .

Prospective homebuyers also can access mortgages insured by the federal government, including Federal Housing Administration , U.S. Department of Agriculture , U.S. Department of Veterans Affairs and 203 loans. Minimum qualifications for these mortgages vary, but they are all intended for low- to mid-income buyers as well as first-time buyers.

Dont Miss: Can You Get A 30 Year Mortgage On Land

Don’t Miss: Is It Better To Get A 15 Year Mortgage

Considerations Before Committing To A Mortgage

WOW: Look at those figures above! The amount of interest you will pay your bank over the period of the loan is outrageous, particularly when we consider what we have done to bail out the banks in our recent history. I know, you have no choice, you need a mortgage but, save what you can, while you can. Use a bigger deposit if you can, repay your mortgage early to save thousands on interest payments. Think about your financial future, when do you really want to pay of that mortgage, the answer should be as soon as possible.

Affordability: Be sure you can really afford to make the Mortgage repayments. Only you really know if you can afford a Mortgage or not and committing to a mortgage which you will struggle to repay will only cause you financial hardship and pain in the future. Remember,

Mortgages: READ THE SMALL PRINT: Your home may be repossessed if you do not keep up your Mortgage repayments .

Shop around: It always pays to shop around and see what deals are available. Most banks and building societies run promotions at various points of the year. Never assume that one lender is better than the other, look for the good deals as they could save you a lot of money.

Borrow Little, Repay Quickly: The best Mortgage is one repaid quickly. A quick repayment means less interest paid and less stress about your debt.