Understanding Your Mortgage Repayment Schedule

If youve ever looked at your mortgage statement after a few years and thought, I havent paid this thing down a bit!, youre witnessing the effects of amortization.

Amortization is the payment schedule by which your loan balance goes from its starting balance to $0 over time.

The size of your principal and interest portions change each month based on this schedule. And unfortunately, amortization always favors the bank.

That means the early years of a loan require large interest payments, and include very little loan payback.

Only once youve held the loan a substantial amount of time do you start paying more toward your balance each month than toward interest.

For example: If you were to borrow $300,000 from the bank at a mortgage rate of 4 percent, after 10 years, here is how much you would still owe:

- A 15-year mortgage would have $119,000 remaining, or 40% of the original loan

- A 20-year mortgage would have $180,000 remaining, or 60% of the original loan

- A 30-year mortgage would have $235,000 remaining, or 78% of the original loan

With the 15year home loan, your loan is more than halfway paid. With the 30year mortgage, youve barely made a dent.

This is one of the reasons why homeowners are increasingly favoring 15year refinances over 30year ones.

Thankfully, todays rates are low enough to make 15year mortgages accessible for many homeowners who couldnt afford them before.

Read Also: Chase Mortgage Recast

Disadvantages Of Refinancing With The Same Lender

- Missing out on better offers. Having a great relationship with your existing lender is worth a lot, but you also need to weigh this against the bottom line. If you dont look at what products and rates competitors can offer, you could be leaving a ton of savings on the table.

- Negotiating at a disadvantage. Your lender knows how much interest you currently pay on your loan, which means they can offer you a slightly lower interest rate for your refinance without having to truly compete with other lenders. This is why youll still need to negotiate and shop around, even if end up sticking with your current lender.

- Not getting the customer experience you want. Some lenders lean into new technologies more than others, and it pays to go with one that shares your values. If you want digital document submission, e-closing or a mobile app, youll need to search for a lender as invested in the online experience as you are.

- Having to resubmit documentation. You may expect that, since your lender has all of your documentation from a previous loan, youll save time and effort this time around. Unfortunately, that may not be the case. Youll likely have to undergo a new , recertify your employment, get a new home appraisal and submit many other documents all over again.

Are You Looking For The Best Refinance Mortgage Rates And Information To:

- Lower Your Rate?

- Remodel or renovate your home?

- Any combination of the above?

We are laser-focused on approving mortgage refinances for these reasons or any other reason in a simple, no-nonsense way, at the absolute best rate.

As a leading Canadian Mortgage Broker having worked with hundreds of mortgage refinance transactions, I take all the best information I have learned over the past 14 years and distilled it into the article below. Or feel free to connect with us for a no-obligation conversation.

For your best refinance result, lets take a look at:

- What is a mortgage refinance?

- How does a mortgage refinance work?

- Pros and cons of refinancing is it worth it?

- Step by step how to complete a mortgage refinance from start to finish.

- Top tips and advice for your best refinance result

- Refinance Vs Home Equity Line of Credit

- Refinance if you have low credit.

You May Like: How To Get A Lower Interest Rate On Mortgage

Consider The Loan Term When Refinancing

For those who dont want a mortgage hanging over their head for 30 years, the use of a rate and term refinance illustrated above can be a good strategy.

Especially since the big difference in interest rate barely increases the monthly payment.

But you dont need to reduce your loan term to take advantage of a rate and term refinance.

You can simply refinance from one 30-year fixed into another 30-year fixed, or from an adjustable-rate mortgage into a fixed mortgage to avoid a rate reset.

Some lenders will also let you keep your existing term, so if youre three years into a 30-year fixed, you can get a new mortgage with a 27-year term.

If you go with another 30-year loan term, the refinance will generally serve to lower monthly payments, which is also a common reason to refinance a mortgage.

Many homeowners will refinance so they can pay less each month if theyre short on funds, or wish to put their money to work elsewhere, such as in another, higher-yielding investment.

So there are plenty of options here just be sure youre actually saving money by refinancing, as the closing costs can eclipse the savings if youre not careful.

Types Of Mortgage Refinances

Whether youre looking to refinance a conventional or government-backed mortgage, there are generally four types of refinances:

Rate and term refinance. A rate-and-term refinance is exactly what it sounds like: you refinance your mortgage to reduce the interest rate, shorten the term of the loan, or both.

Cash-out refinance. A cash-out refinance is when you replace your mortgage with a new one for more than your current loan balance. The difference goes to the homeowner as cash that can be used for home improvements or other financial responsibilities. There are conventional, as well as FHA and VA cash-out refinancing options.

Streamlined refinance. The FHA, VA and USDA offer streamlined refinancing options that may allow you to skip the usual appraisal and credit check, saving you time and money. The FHA streamline and VA IRRRL both require that the refinancing result in a financial benefit: either a reduction in your monthly payment or interest rate.

Renovation refinance. A renovation refinance loan works somewhat like a cash-out refinance, in that you take out a larger loan than what you previously owed. The proceeds from the refi go toward fixing up your home. With some renovation refinances, like the FHA 203 loan, the lender actually directly pays your contractor. Renovation refinances sometimes allow you to borrow against the value of the home once the upgrades are completed rather than its current value.

Don’t Miss: Can I Refinance My 2nd Mortgage

The Pros And Cons Of Switching Lenders When You Refinance Your Mortgage

6 min read

https://money.com/mortgage-refinance-best-rate-new-lender-flip/

If youre thinking about refinancing your home loan, consider switching to a new mortgage lender.

Lender allegiance can backfire if you dont shop around to see if there are better rates, says Heather McRae, a senior loan officer at Chicago Financial Services. Thats especially true in todays refi market, where lenders are aggressively competing to woo customers.

According to a Black Knight report, lender retention is at an all-time low. Mortgage servicers retained just 18% of the estimated 2.8 million homeowners who refinanced in the fourth quarter of 2020, the lowest share on record.

Here are the benefits and drawbacks of changing lenders when you refinance your mortgage.

They Might Have Capacity Issues

According to national property database ATTOM Data Solutions, refinances during the first quarter of 2021 were at the highest levels in more than 14 years. That means financial institutions have been busy churning out a record number of home loans. If your original lender is popular, you might experience closing delays.

As part of the loan shopping process, youll need to ask your lender if it has the capacity for another refinance loan and how long it might take. Across the industry, lenders are taking 47 days on average to close refinance loans, per data from ICE Mortgage Technology but some are able to turn things around more quickly.

You May Like: When Should You Prequalify For A Mortgage

Cons Of Refinancing With Same Bank

You can lose out on potential savings Your lender knows your current interest rate and may offer marginally lower rates as an incentive. This discounted rate may be higher than rates offered by other refinance lenders. Take time to shop around and compare rates and terms offered by other lenders before signing. This will give you the power to negotiate a better deal with your bank. If your bank cant match the rate offered by another lender, youre better off changing lenders anyway.

The Bank may not have capacity to accommodate the refinance Homeowners rush to refinance when interest rates are low. On average, banks take about 45 days to close a refinance, it may take longer if several are being processed. This delay may not work for you if you need the money urgently.

When To Refinance Your Mortgage

The first thing you should know is that it is profitable to refinance a mortgage if you have paid off less than 50% of the debt.

Most likely, your mortgage payments are annuity, i.e. fixed the same at the beginning and at the end of the loan term. But their structure is different.

At the beginning of the term, the payment consists mainly of interest, and only a small proportion relates to the principal debt. As you repay the loan, the percentage in the payment structure decreases and the share of the principal debt increases.

Therefore, if you have already paid off more than half of the mortgage loan, then it is not so profitable for you to take a new one and start paying interest again.

If six months have not passed since the mortgage was issued, then you will not be approved for an on-lending application. Well have to wait a bit.

But if you have been paying off your mortgage for more than six months, it is difficult for you to cope with current payments, and the bank does not approve of restructuring, feel free to consider refinancing.

If you consistently pay your mortgage without experiencing difficulties, but want to improve conditions, study program options and start calculating.

First, look at the difference between the current and potential rates. If the difference is more than 1.5-2% calculate the possible savings on the mortgage calculator.

Also Check: How To Pay House Mortgage Faster

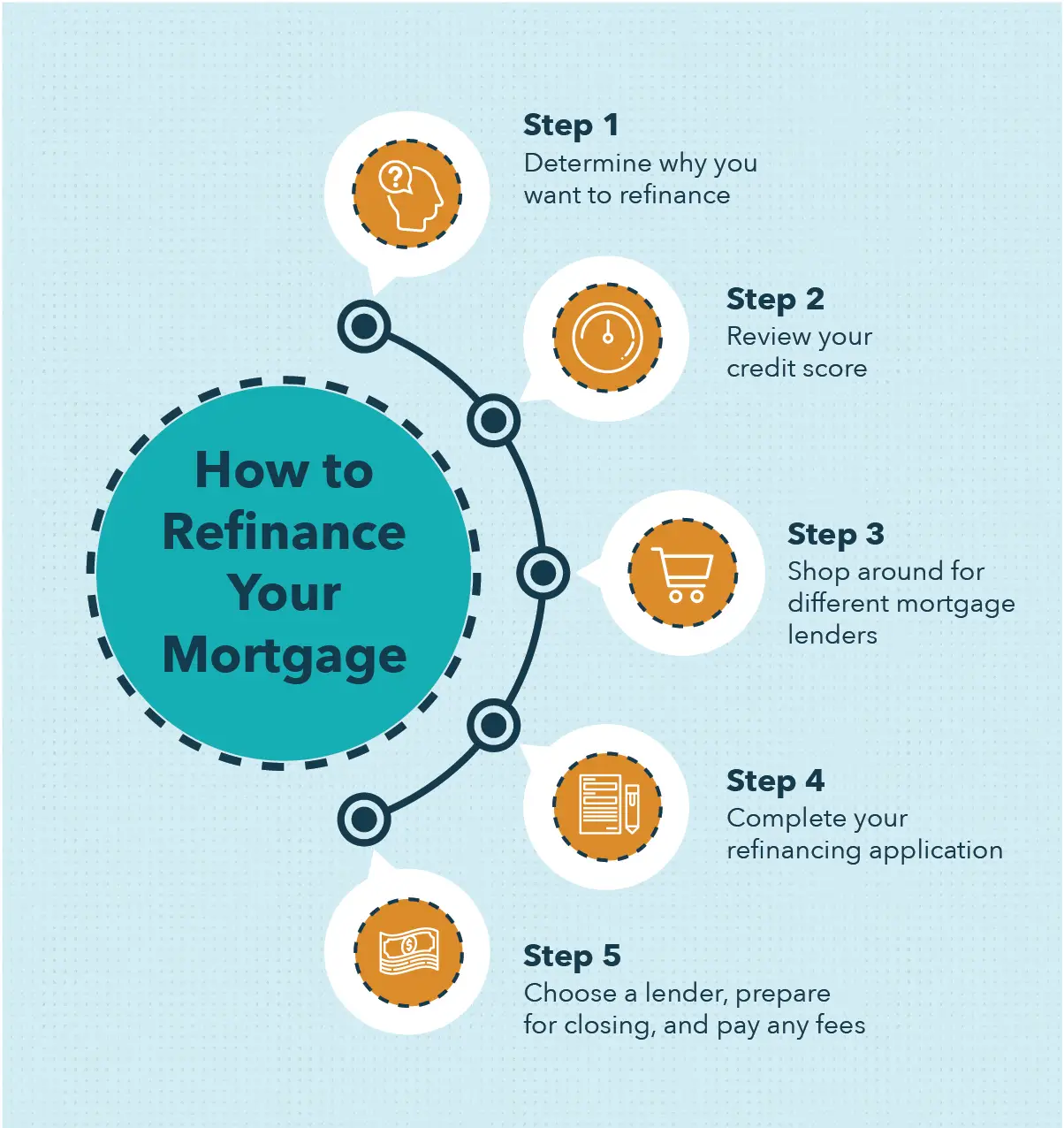

How Do You Refinance Your Mortgage

Before jumping into anything, you should always crunch the numbers to make sure refinancing makes financial sense. Our refinance calculator can help, and you can go through a checklist of reasons to refinance your mortgage.

You should always shop around for a lender, even if you want to start by contacting the one who has your current mortgage. Next, gather the required documents, as noted above, and apply.

You may also consider locking in your interest rate. Then prepare to close.

Do You Need An Appraisal To Refinance With The Same Lender

Regardless of whether you are taking out a refinance loan with your current mortgage lender or a different one, you will likely need to have an appraisal completed. The real estate market changes rapidly and before a bank or lender can extend you additional credit , they will need to learn how much your home is worth. An appraisal also helps to determine if you will still require PMI because if the homeowner overextends themselves, banks will need additional insurance to cover their risk in case of loan default. In sum, nearly every company that offers refinance loans requires an appraisal to be completed within the last year.

Read Also: What Is Ltv In Mortgage Terms

Cash Out Will Typically Slow Loan Repayment

If youre looking to pay off your mortgage in full some day soon, the cash out refi isnt the best move.

But if you need cash for something, whether its for an investment or to pay off other more expensive debts, this could be a worthwhile decision.

In short, cash out refinancing puts money in the pockets of homeowners, but has its drawbacks because youre left with a larger outstanding balance to pay back as a result .

While you wind up with cash, you typically get handed a more expensive monthly mortgage payment in most cases unless your old interest rate was super high.

In our example, the monthly payment actually goes down thanks to the substantial rate drop, and the homeowner gets $50,000 to do with as they please.

While that may sound great, many homeowners who serially refinanced over the past decade found themselves underwater, or owing more on their mortgage than the home is currently worth, despite buying properties on the cheap years ago.

This is why you have to practice caution and moderation. For example, a homeowner might pull cash out and refinance into an ARM, only for home prices to drop and zap their remaining equity, leaving them with no option to refinance again if and when the ARM adjusts higher.

That being said, only pull cash out when absolutely necessary because it has be paid back at some point. And its not free money. You must pay interest and closing costs so make sure you have a good use for it.

Why It Pays To Shop Around When You Refinance

If you care less about convenience and more about saving money, it definitely pays to check out refinancing options with other lenders. This takes time, but Pierce says its well worth it.

If you dont shop around, you wont know whether your lender is offering a competitive deal, she says.

Dont look at just interest rates, though, adds Anastasio. Also compare loan fees, loan repayment terms, and products to make sure the loan fits your needs and budget. In 2020, closing costs for a refinance averaged nearly $3,400, including taxes, according to ClosingCorp, a real estate data provider. Yet they can vary widely, from around 2% to 6% of your loan amount.

Also pay close attention to whether the loan comes with points, which are fees you have to prepay to get a lower interest rate. A mortgage point equals 1% of your total loan amount, and one point usually reduces interest rates by about 0.25%.

Having all the information, including lender fees and other costs, will help you decide if you should switch mortgage lenders, Pierce says.

Read Also: Can I Use Land As Collateral For A Mortgage

Which Lender Do I Choose

Its hard choosing the right lender as they offer different products and service. The key is to find a lender that has a product suited to your situation. This becomes a difficult task when your situation is unusually complicated or you have a bad credit history.

One of the worst things you can do is to simply stay with your current bank for the life of the loan. You could potentially be missing out on a deal with one of Australias 40 plus lenders.

Mortgage Rate Trends: Where Rates Are Headed

The days of sub-3 percent mortgage interest on the 30-year fixed are behind us, and rates have so far risen beyond 7 percent in 2022.

“Low interest rates were the medicine for economic recovery following the financial crisis, but it was a slow recovery so rates never went up very far,” says McBride. “The rebound in the economy, and especially inflation, in the late pandemic stages has been very pronounced, and we now have a backdrop of mortgage rates rising at the fastest pace in decades.”

Read Also: Does Refinancing Your Mortgage Hurt Your Credit Score

When Should You Refinance Your Mortgage

You should consider refinancing your mortgage if at least one of the following criteria is true:

- It allows you to lower your monthly mortgage payment by increasing the length of your loan term.

- Refinancing into a lower interest than what you currently have can reduce your costs over the long term.

- Conversely, you can refinance into a shorter term to pay off your house faster, though monthly costs will be higher.

- You can get rid of mortgage insurance with the help of a refinance.

Related: Compare Current Mortgage Rates

Application Requirements To Refinance

Because you need to get a new mortgage when you refinance your home, you will need to apply for a new mortgage. If you are refinancing a conventional loan, you will be required to complete a new application and provide financial documents.

The application to refinance a VA and FHA loan can be easier when you use the streamline program. If you are a current Freedom Mortgage customer and qualify for a lower rate with the streamline program, we can often start your application for VA or FHA refinancing right over the phone or online! By refinancing, the total finance charges may be higher over the life of the loan.

Read Also: How Do I Get Preapproved For A Mortgage

Choosing A Refinance Lender

Whether youre looking for the reach of a traditional bank or the personalized service of a credit union, always shop multiple lenders and compare the interest rate and terms each lender offers. Even though it might be easy to refinance with your current mortgage lender, it may not offer the best deal.

Everything can be negotiated. Your lender is required to provide you with a Loan Estimate after you apply to refinance. Compare fees listed under the “origination charges” on the document. If you are not comfortable with a fee, negotiate for it to be removed or reduced.

What is the real cost of your new mortgage going to be? Look at the annual percentage rate, or APR. This number covers all the costs of the mortgage including the interest rate and fees.

Things You Should Know

© Copyright Bankwest, a division of Commonwealth Bank of Australia ABN 48 123 123 124 AFSL / Australian credit licence 234945. All rights reserved. To use this Website, you are required to read the Financial Services Guide . Bankwest is a division of Commonwealth Bank of Australia, which is the product issuer unless otherwise stated. Rates stated are subject to change without notice. Any advice given does not take into account your objectives, financial situation or needs so please consider whether it is appropriate for you. For deposit and payment products, please ensure you read and consider the Product Disclosure Statement before making any decision about the product. Separate App Terms of Use also apply. Fees and charges may apply. For lending products, lending criteria and fees and charges apply. Terms and conditions apply and are available on request. Target Market Determinations are available here.

Also Check: What Is The Best 10 Year Fixed Rate Mortgage