How Long Does Preapproval Last

Preapproval doesn’t last forever. Check your expiration date and keep it in mind as you look at homes. Though it varies from lender to lender, preapproval is typically valid for 60 90 days. If you haven’t settled on a house, you can request a renewal by giving your lender your most up-to-date financial and credit information.

Documents Required To Get A Mortgage Pre

While the process of getting pre-approved might seem like an intimidating task it is actually not that hard, as long as you have all the right documentation and information. In Canada, the bank requires this information from you.

- Identification in the form of a photo I.D.

- Name, address, telephone number of your solicitor/notary

- Proof of employment, salary and the amount of time youve been employed

- Bank account information and any information on other investments you might have

- Confirmation of your down payment

- Information on your assets: vehicles, investments, other property that you might own

- Information on all of you liabilities: credit card balances, lines of credit, car loans, student loans

What Is A Preapproval Letter

A mortgage preapproval letter is an important part of the home buying process. A preapproval letter is a physical representation of the amount you can afford that you can hand a seller with your offer. Its not a commitment to lend, but it is a promise that you should be able to secure financing if all goes well.

You can also change the amount on your preapproval letter, up to your full preapproval amount. That way, youre not showing the seller that youre approved for thousands more if it doesnt match the offer you want to make on the house.

A mortgage preapproval letter is not an absolute necessity in order to purchase a home, but it does put you a step ahead. Most home sellers will be looking for a preapproval letter or other proof of funds to make sure that you can execute on the purchase contract before they will accept your purchase offer. Preapproval letters are especially helpful in a sellers market, where your offer may be up against those of multiple other potential buyers.

A preapproval letter usually comes with a certain amount that the lender is willing to lend as well as an expiration date for how long the preapproval letter is good. In order to get a preapproval letter, a lender will usually gather all of your financial information and run your credit. While there is no exact needed to buy a house, the higher the better!

Don’t Miss: How To Find The Best Mortgage Lender

What Factors Are Considered For Pre

Lenders verify certain borrower information before providing a pre-approved offer. These include verification of employment, income, assets and credit score. A full credit report and credit score are pulled at the time of application vs. a limited credit report that is often used with pre-qualification offers.

You May Like: How Much Is Mortgage On 1 Million

Proof Of Employment And Income

Income includes, salary, alimony, and any other forms of documented income. To verify income, lenders typically require your two most recent pay stubs and two years of W2 tax forms. If you are self-employed or own your own business, you will be asked to provide two years of personal and business tax returns, including all schedules and supporting documents.

You May Like: What Is The Shortest Mortgage Term Available

What Factors Lenders Consider When Granting Your Mortgage Preapproval

Lenders scrutinize all of your financial decision-making, from how youve managed credit to how stable your income is. Heres a brief overview of the most important mortgage preapproval factors:

- Your credit score. Your credit score will make or break a mortgage preapproval. Some loan programs permit scores as low as 500, but the road to preapproval will be very bumpy, and youll pay a higher rate. The gold standard is 740 for the lowest rate taking these simple steps can help give you a boost before you apply:

- Pay everything on time. Recent late payments will knock your score down faster than any other credit action.

- Keep your credit balances low. Although its best to pay balances off to zero, try to keep your credit charges at or below 30% of the total amount you can borrow. For example, if you have $10,000 worth of credit, dont charge more than $3,000 in any given time period.

Two Smart Homebuying Moves: Mortgage Prequalification And Preapproval

Find out how much house you can borrow before you start looking and how you can make the strongest offer possible on the property you choose.

If youre ready to make your dream of owning a home a reality, youve probably already heard that you should consider getting prequalified or preapproved for a mortgage. Its time to understand exactly what each of those terms means and how they might help you. And when youre working toward a goal this big, you want every advantage.

Ready to prequalify or apply? Get started

Read Also: Is A Home Loan A Mortgage

Research Lenders Near You

Before contacting a lender to get pre-approved, youll want to compare rates and also interview each of the lenders you plan on working with. You can start by reading lender reviews online or asking friends and family members if they have any recommendations. Another great way to check if a lender is right for you is by talking to them directly. Ask the lender questions about themselves, the lending process and the loans they offer. Loan requirements will vary by lender, along with the interest rates they offer, origination fees, points and closing costs. Shopping around helps you find a lender that fits all your loan needs.

How To Use The Mortgage Affordability Calculator

To use our mortgage affordability calculator, simply enter you and your partners income , as well as your living costs and debt payments. The calculator can estimate your living expenses if you dont know them.

With these numbers, youll be able to calculate how much you can afford to borrow. You can change your amortization period and mortgage rate, to see how that would affect your mortgage affordability and your monthly payments.

You May Like: What Should My Mortgage Be

You May Like: How To Mortgage Property In Monopoly

Is There Anything Better Than A Mortgage Pre

With this competitive housing market, mortgage pre-approval letters have unfortunately started losing their authority. Most buyers have them, and in a multiple-offer situation, they just dont have what it takes to make you stand out.

Fortunately for you, theres something better!

If you want a true competitive advantage, Churchill Mortgages Certified Homebuyer program is a great option. When you become a certified homebuyer, you have all the advantages of a pre-approval like credibility as a homebuyer, confidence in your search, and an accelerated closing process.

But unlike with pre-approved mortgages that only involve a loan officer, your certified homebuyer application is reviewed by a mortgage underwriterwhich is a huge advantage when you start shopping for houses! Youll be able to close faster and have a leg up on other buyers who will probably have to wait for an underwriter to review their application.

Dont sell yourself short with a standard pre-approval. Take your home-buying credentials to the next level today and get in touch with a Churchill Mortgage expert!

About the author

Also Check: When Is Best To Refinance Mortgage

How The Mortgage Preapproval Process Works

There are five basic steps in the mortgage preapproval process.

Recommended Reading: How Long Can You Go Without Paying Mortgage Before Foreclosure

When Should You Get Pre

The best time for you to get pre-approved for a home mortage is now. This allows you to narrow your search by shopping for homes in your approved price range. Many financial factors affect your home loan approval, and you can start preparing to increase your approved mortgage amount by learning about how to improve your credit score. Other ways of getting your financial house in order include saving for a down payment and identifying which debt is negatively affecting your loan amount to develop a plan.

How To Prequalify For A Mortgage

You have decided to buy a house, but don’t have enough money to make the purchase. Your situation isn’t unique, few people have enough cash on hand to buy a home. However, banks and mortgage companies offer loans, called mortgages, which provide people with the difference between what they have saved and the price of the home they wish to purchase.

While many people find the home they want and then look for a mortgage, it’s a good idea to look at your mortgage options first. It’s important to know how much you’ll be able to borrow before you find a house.

Read Also: Is 680 Credit Score Good Enough For Mortgage

Start Preparing For Your First Home With Avail

Since having good credit is the backbone of getting a good mortgage, its important to start improving, and maintaining, your credit score as soon as possible. One way to do this as a renter is to use , which could help you improve your FICO 9, FICO XD, and VantageScore credit score with each rent payment you make on time*.

If youre currently using Avail to pay rent online but arent using CreditBoost, you can easily turn it on in your tenant dashboard to start reporting past or ongoing rent payments. Dont have an account yet? Make a renter account and invite your landlord today.

Get more information on mortgages, as well as financially preparing for a home and working with a realtor, at our First-Time Homebuyer Resource page.

Get Information From A Source You Trust

Its natural to have questions. Besides the basics such as the interest rate and term, its a good idea to ask about other things like prepayment charges if you plan to sell your property or pay down your mortgage loan faster. To ensure that you get accurate, actionable information we recommend seeking answers from a trusted source. TD Mortgage Advisors are well versed in every aspect of the mortgage process and can be an easily accessible source of information.

Recommended Reading: Can I Throw Away Old Mortgage Papers

Also Check: Does The Va Offer Reverse Mortgages

The Benefits Of Getting Preapproved Before Home Shopping Right By You Mortgage

Prequalification can help when it comes time to make an offer. A pre-qualification letter is required for offers in our market, said Kaderabek. Sellers are smart and dont want to sign a contract with a buyer who cant fulfill their contract. This is one of the first questions we ask potential buyers: Have you met with the lender and determined the pre-conditions of the loan? Qualification status? If not, we have options for lenders. If so, we request a copy of the prequalification letter and keep it on file.

Pre-authorization is the next and more involved step. Pre-qualification is a good indicator of creditworthiness and creditworthiness, but pre-approval is the last word, Kaderabek said. To get pre-approved, borrowers must complete a formal mortgage application and submit all necessary documents to the lender to conduct an extensive credit and financial background check. The lender will pre-approve a certain amount.

Going through the pre-approval process offers a better idea of the interest rate that will be charged. Some lenders allow borrowers to charge an application fee to lock in an interest rate or get pre-approved, which can run into the hundreds of dollars.

The lender will provide a written conditional commitment to a certain loan amount and allow the borrower to find a home at or below that price level. This gives borrowers an advantage when dealing with sellers because they are one step closer to getting a real home loan.

How You Can Get A Larger Mortgage

If you can make your mortgage payments on a fixed income, your lender will most likely approve you for a larger loan amount. Maintaining your monthly expenses in check can help you increase the amount of preapproval you receive. A lender who provides a longer term may be able to approve you for a larger mortgage, and you may be able to apply for one with a longer term.

Read Also: How Much You Qualify For A Mortgage

The Buyers Credit Score Dropped Below The Minimum

Mortgage pre-approvals are test runs for a buyers actual mortgage approval. So, if the buyers credit score drops before finding a home, the buyers pre-approval may be invalidated.

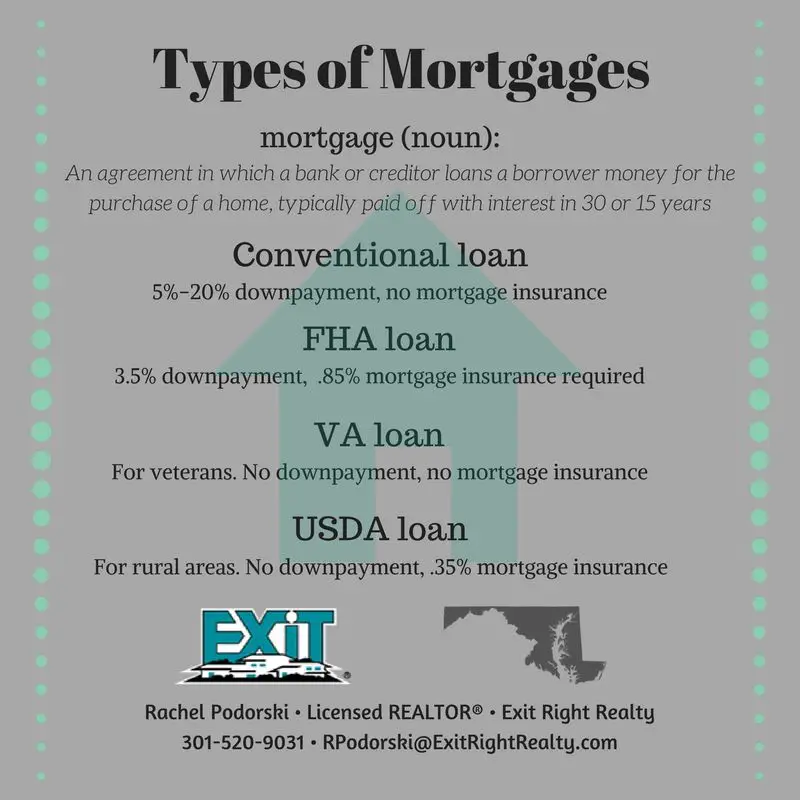

In general, the minimum credit score requirements are:

- FHA: 500 credit score

Learn more about how to fix your credit score to buy a home.

How Long Does A Mortgage Pre

Mortgage pre-approvals are valid for 90 days after you get one. If mortgage rates rise by at least one percentage point, youll need to get a new one. Learn more about how long a pre-approval is good for.

When a pre-approval expires, its no longer valid as proof for purchase. You should never use an expired pre-approval to set a maximum home purchase price or to craft a household budget.

Expired pre-approvals can be renewed online or in person at any time.

Buyers with lender-assisted pre-approvals may get asked to provide additional financial documentation, including pay stubs and proof of residency.

Pre-approvals are also invalidated when a buyer changes jobs, income, or residence or experiences an atypical drop in credit score.

Don’t Miss: What Is A Mortgage Quote

Collection Of Financial Documents

To get preapproved, youll need to provide your lender with financial documents for them to review as part of your application. These include, but are not limited to:

- Proof of income

- Social Security number

- A current drivers license

Other documents may be required, too. For instance, if a family member gives you money for your down payment, you will need to provide a gift letter accounting for the funds. Your lender will then review these documents and use the information to determine how big of a loan theyre willing to lend to you.

What If You Don’t Get Pre

After reviewing a mortgage application, a lender will provide a decision to pre-approve, deny, or pre-approve with conditions. These conditions may require the borrower to provide extra documentation or reduce existing debt to meet the lending guidelines. If denied, the lender should explain and offer options to improve a borrower’s chances for pre-approval.

Also Check: Are Closing Costs Covered By Mortgage

What To Do If A Lender Refuses Your Mortgage Application

A lender could refuse you for a mortgage even if youve been preapproved.

Before a lender approves your loan, theyll verify that the property you want meets certain standards. These standards will vary from lender to lender.

Each lender sets their own lending guidelines and policies. A lender may refuse to grant you a mortgage if you have a poor credit history. There may be other reasons. If you dont get a mortgage, ask your lender about other options available to you.

Other options may include:

- approving you for a lower mortgage amount

- charging you a higher interest rate on the mortgage

- requiring that you provide a larger down payment

- requiring that someone co-sign with you on the mortgage

How Long Does Prequalification Or Preapproval Take

Aside from their distinct roles in homebuying, prequalification and preapproval can take different amounts of time. Prequalifying at Bank of America is a quick process that can be done online, and you may get results within an hour. For mortgage preapproval, youll need to supply more information so the application is likely to take more time. You should receive your preapproval letter within 10 business days after youve provided all requested information.

Recommended Reading: When Does Mortgage Insurance End