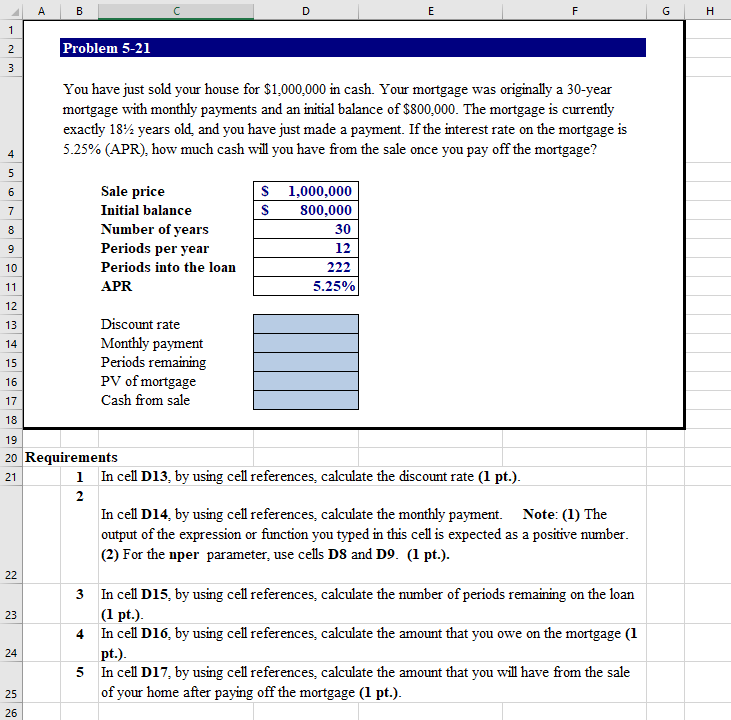

Minimum Qualifying Rate For Both Mortgage Stress Tests Left At 525%

As part of its annual review of the stress test for uninsured mortgages, the Office of the Superintendent of Financial Institutions today confirmed the minimum qualifying rate will remain at 5.25%.

That means borrowers making a down payment of 20% or more will need to prove they can afford payments based on their contract rate plus 2% or 5.25%, whichever is higher. Currently, about 90% of mortgage borrowers are being qualified at the 5.25% minimum qualifying rate rate as opposed to their contract rate plus 2%, OSFI said.

The Department of Finance followed suit by leaving the MQR unchanged for insured mortgages, or those putting down less than 20%.

Maintaining the current minimum qualifying rate will ensure prudent underwriting standards for insured mortgages, read a joint statement from the Deputy Prime Minister and the Minister of Finance. We will continue to monitor the housing market and review the minimum qualifying rate in order to adjust it as warranted.

OSFI said it made its decision based on the current environment of increased household indebtedness and low interest rates, adding it is essential that lenders continue to test borrowers to ensure they can afford their mortgages during more adverse conditions.

He added that the supply and demand imbalance in the housing market is a long-term prudential risk.

OSFI reviews the MQR each December and said it will make further adjustments if conditions warrant.

How Do Your Credit Scores Affect Your Rate

Your credit scores influence your mortgage interest rate. Lenders call it risk-based pricing. Higher credit scores indicate a lower risk that youll default on a loan so you get a better interest rate. The lower your credit scores, the higher your interest rate.

» MORE:Mortgage rates and credit scores: Dont make a $30,000 mistake

Whats A Good Interest Rate On Personal Loans

Personal loans are typically unsecured. That means theres nothing the creditor can repossess and sell to make back some of its loss if you dont pay the loan. Because of that, the interest rates on these loans are typically higher than those on an auto or mortgage loan might be. They do tend to be lower than credit card rates, though.

The National Credit Union Administration publishes average rates for different types of investments and loans periodically. On for unsecured loans with a term of three years were published. The average rate for loans from credit unions was 9.28%. The average for loans from banks was 10.21%.

Again, with excellent credit and a strong income, you may be able to get rates better than this. However, if your rates are at or lower than these amounts, they may be good.

Recommended Reading: How To Buy Mortgage Leads

What To Know About Loans Fees

The industry term for the upfront fees you pay when you get a home loan is closing costs. The fees for your appraisal, title insurance, and any lender origination charges are all part of your closing costs. These fees vary depending on the size of your loan, but are usually 3% to 6% of your loan balance. Keeping track of your closing costs is crucial because a higher closing cost will result in a higher APR.

Osfi Sees Modest Risk In Housing Credit

Asked why OSFI didnt raise the floor rate today, Gully said mortgage credit risk has risen only modestly.

While housing-related vulnerabilities remain elevated, residential mortgage credit risk has risen only modestly, he said. Our view is other measures taken by OSFI and other federal financial sector agencies have contributed to a margin of safety in the market.

His comment echoed remarks from OSFI head Peter Routledge last month. Since then, house prices in Canada have continued to rise, reaching a record high $720,850 in November, according to the Canadian Real Estate Association. Thats up over 19% compared to a year ago.

Despite this exuberance and rising mortgage credit levels, Canadians are dedicating less income to debt service payments such as mortgage payments, automobile loans and credit card payments, Routledge said at the time.

Overall, residential mortgage credit growth is rising at a pace of about 10% annually, he added.

Gully was asked if anticipated interest rate hikes in 2022 from the Bank of Canada played any role in OSFIs decision to leave the MQR unchanged, but he pointed to the dynamic structure of the stress test that already accounts for interest rate fluctuations.

Read Also: Is Total Mortgage A Good Company

Average Mortgage Interest Rate By Credit Score

National rates aren’t the only thing that can sway your mortgage rates personal information like your credit history also can affect the price you’ll pay to borrow.

Your is a number calculated based on your borrowing, credit use, and repayment history, and the score you receive between 300 and 850 acts like a grade point average for how you use credit. You can check your credit score online for free. The higher your score is, the less you’ll pay to borrow money. Generally, 620 is the minimum credit score needed to buy a house, with some exceptions for government-backed loans.

Data from credit scoring company FICO shows that the lower your credit score, the more you’ll pay for credit. Here’s the average interest rate by credit level for a 30-year fixed-rate mortgage of $300,000:

| FICO Score |

|

5.57% |

Should You Choose Low Mortgage Rates And High Processing Fees Or Vice Versa

In this article:

In general, the lowest mortgage rates come with the highest processing fees. That said, mortgage rates and costs vary widely between lenders for the same loan to the same borrower.

The best combination of interest rate and fees depends on a few factors, and everyones sweet spot is probably a little different.

Read Also: Mortgage Recast Calculator Chase

Don’t Miss: Can You Refinance A Second Home Mortgage

How Does Credit Card Interest Work

Unlike auto and home loans, banks and lenders have no collateral to collect in the event that a borrower defaults or stops making payments on their credit card. As a result, credit cards will have a higher interest rate than other loan types to offset overall losses. The average credit card interest rate is in the 14-24% range.

Credit card balances are limited. If you handle them correctly, you can avoid paying significant amounts of interest. Credit cards are a great tool if you know how to manage them, but you dont want to end up with too many credit cards that you cant manage the balances.

Tip : Work On Improving Your Credit Score

Your is probably the most important single factor in determining whether youll be approved and if so, for how much and at what interest rate. Interest rates reflect factors beyond your control, so the best youll be able to do is get the lowest rates available.

But interest rates also reflect your lenders assessment of the risk you present as a borrower. Your credit score helps lenders predict your future behavior as a borrower based on how youve handled your debts in the past.

All lenders look at your credit score and history to determine your mortgage eligibility. In general, the higher your credit score, the lower your rate. You keep your credit score up by making timely payments for your house, car, credit card and so on.

You May Like: What’s The Going Mortgage Interest Rate

Rates Are Back In Historically Low Territory

After the dramatic, and consistent, rise in interest rates throughout the summer, many rate watchers failed to notice that rates have actually been falling now for several weeks. This leaves one to wonder if the market had been essentially pricing in an anticipation of no Fed action.

Related Article: Buy vs Rent: 6 Examples to Help You Decide

After 30 year fixed mortgage rate reached a peak at around 4.875 percent, they have fallen to below 4.5 percent. It looks likely to fall further after this weeks news from the Fed.

This is good news for all prospective homeowners. It is especially good news for people who thought they had missed their window to be able to refinance at a low rate.

You May Like: Can You Get A Reverse Mortgage On A Condo

Are Mortgage Rates High Right Now

Rates have been higher a lot higher than they are today. In October of 1981, for example, average rates topped 18 percent. Forty years later, in October of 2021, average rates on 30-year mortgages were below 3 percent. So, most homebuyers today are paying rates much closer to record lows than to record highs.

Tim Lucas

Editor

Recommended Reading: How Much Could We Get Approved For A Mortgage

Debt Service Ratios And Mortgage Affordability

Yourmortgage affordabilityis based on your down payment, GDS ratio, and TDS ratio.

Your Gross Debt Service Ratio is the percentage of your housing costs compared to your monthly income. Housing costs include your mortgage payment,property taxes, and condo fees, depending on your property.

Your Total Debt Service Ratio is the percentage of your housing costs plus other debts that you may have, such as credit card balances or car loans andstudent loans, compared to your monthly income.

The Canada Mortgage and Housing Corporation introduced changes on July 5th, 2021 that would reverse the increased restrictions from mid-2020 for new insured mortgages. A minimum credit score of600 would be required to qualify forCMHC insurance, as well as a GDS ratio of 39% and TDS ratio of44%.

The CMHC also will not accept non-traditional sources for your down payment that increase your level of debt, such as if you took out apersonal loanfor your down payment.

You can use amortgage stress test calculatorto see if you can pass the stress test by estimating your current GDS and TDS ratios, as well as seeing whether your down payment meets the minimum requirements.

The Fed Versus The Mortgage Marketplace

It can be argued that the Feds position is especially weak in the mortgage marketplace. Sure, the Fed can raise bank rates but mortgage borrowers increasingly dont get financing through a bank. According to the Mortgage Bankers Association , a majority of loans 54 percent in 2017 are now originated by non-banks.

While the Fed raised bank rates four times in 2018, for a 1 percent increase, mortgage rates went up by just .51 percent.

Non-banks get much of their money from investors. Their rates reflect the free-market supply and demand for capital. Sometimes the free market and the Fed value money very differently. For instance, while the Fed raised bank rates four times in 2018, for a 1 percent increase, mortgage rates went up by just .51 percent.

What we have today at least with mortgages is not the Fed leading the marketplace. Its the mortgage market leading the Fed and that suggests still-lower rates ahead.

Read Also: Rocket Mortgage Conventional Loan

Don’t Miss: Will Section 8 Help Pay Mortgage

Mortgage Rates Vs Recessions: Do They Go Up Or Down During Hard Times

Its time for another mortgage match-up, the latest installment mortgage rates vs. recessions.

This is a timely post seeing that mortgage rates have gone absolutely bonkers lately and talks of another recession are heating up.

The Fed created a very accommodative monetary policy over the past decade via Quantitative Easing , which pushed mortgage rates to record lows.

But that eventually triggered troubling inflation, forcing the Fed to act aggressively the other way, which could result in a recession sometime soon.

The question is does a recession portend lower mortgage rates, higher mortgage rates, or nothing at all?

How Does Interest Work On A Car Loan

When you apply for a car loan, the car is used as collateral.Most lenders will require you to have auto insurance to protect the collateral while the loan is being repaid. If you miss any payments, the bank can repossess the car to cover the costs of the loan.

Because the process of repossessing a car is fairly straightforward and doesnt cost the lender very much in fees, borrowers can expect lower interest rates on car loans. Auto loans typically have interest rates in the 4-5% range.

Don’t Miss: Can I Get A Mortgage With A 575 Credit Score

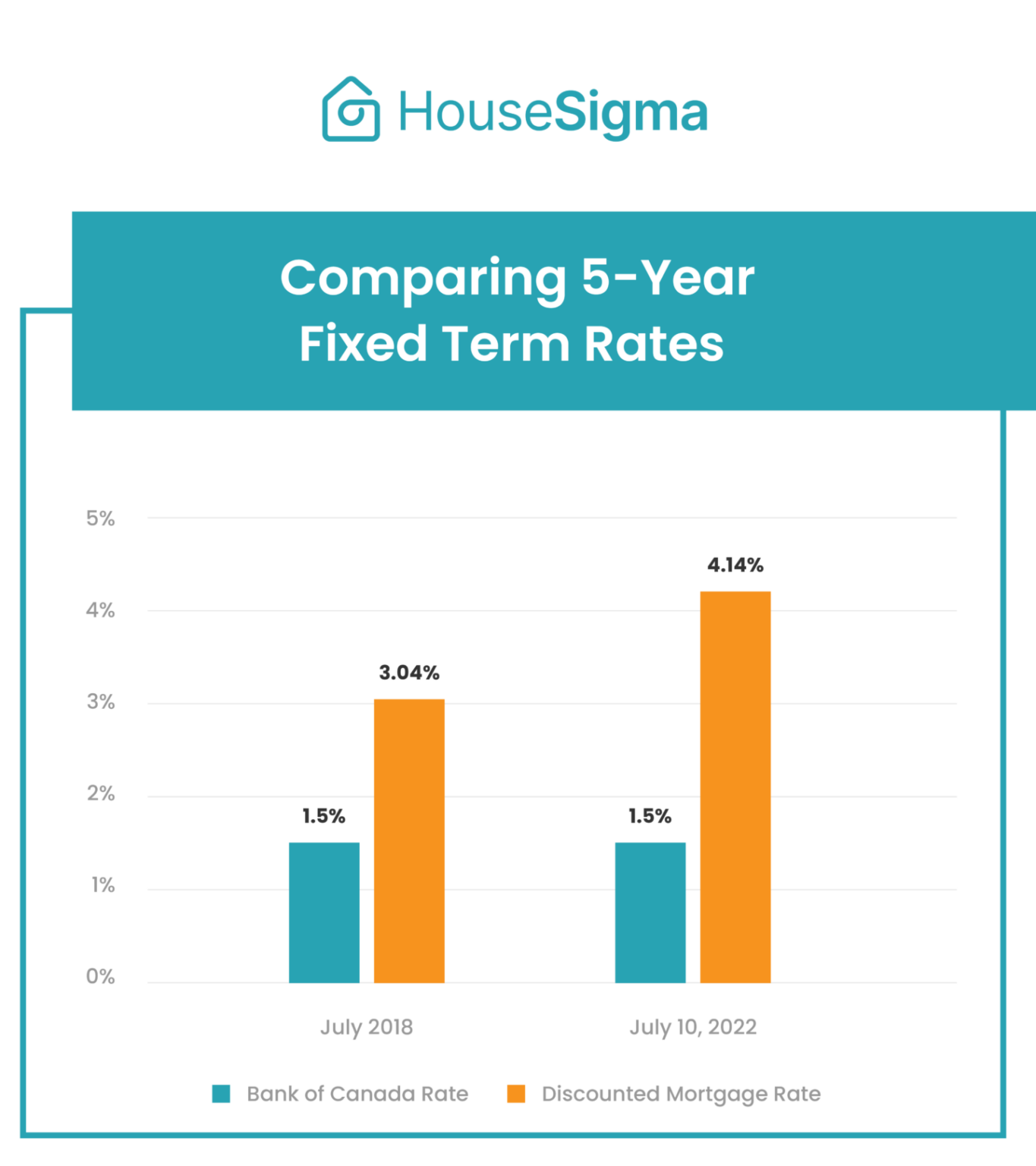

Highlights From The Bank Of Canada’s October 26 2022 Announcement

On October 26, 2022, the Bank of Canada increased the key overnight rate by 0.50%. The target for the overnight rate is now 3.75%.

- Canadians with variable-rate mortgages and home equity lines of credit will see their rates rise accordingly by 0.50%. They should calculate what their new mortgage payment will be and budget for more increases to come.

- Canadians with fixed-rate mortgages arenât affected by the announcement directly, but can expect higher rates when they renew at the end of their current mortgage term.

- As rates rise, so does the mortgage stress test. With today’s announcement pushing variable rates up by 0.50%, anyone who is getting a new variable-rate mortgage will need to pass a stress test that is 0.50% higher. To calculate how much you can qualify for, use our mortgage affordability calculator.

- Although the Bank made it clear that further rate hikes will be necessary to get inflation under control, it did say that it would be examining the economic effects of this year’s rate increases. This suggests that the end of rising rates may be on the horizon if the Bank feels that inflation is being pushed back down sufficiently.

How Big Of A 30

There are a few considerations to look into when determining how much of a mortgage you can afford. While lenders consider factors include your assets, liabilities, and income, your DTI will be the most significant factor in determining how much you can afford. The front-end DTI considers how much of your monthly income goes toward housing expenses. Lenders want to see this ratio at 28% or less.

Also Check: How To Figure Out Mortgage Interest

What Is A Mortgage Rate

For most home buyers embarking on their journey to buy a house, theyll first need to get a mortgage loan. Lenders make these loans in return for your interest payments. Your mortgage interest rate is applied to the amount of the loan, and your monthly mortgage payment is made up of principal, interest, taxes and insurance collectively known as PITI.

Mortgage rates determine how much interest accrues on your home loan. The higher your rate, the more interest you’ll pay and the more you’ll end up paying for your house in total.

The Fed Is Raising Rates To Combat Inflation But May Have To Lower Them Soon After

All the easy money over the last several years led to major inflation and the Fed is now on the offensive, even though it might be too late to avoid a major downturn.

Theyve been hard at work fighting inflation by raising the target federal funds rate and reducing their swollen balance sheet.

Instead of buying Treasuries and MBS, theyre now letting them run off. And they could eventually sell MBS outright, which could flood the already weak market.

Simply put, with the Fed not a buyer, and worse a seller, supply goes up.

Unless demand rises somehow, the price of the bonds goes down and the yield must come up.

This translates to higher interest rates for consumers on things like home loans, auto loans, and so forth.

This is made even worse when inflation expectations are high, delivering a one-two punch to mortgage rates.

Now if the Fed keeps raising rates and unloading its balance sheet, theres a chance of a recession.

Its not clear when this would happen, though 2023 could be the year.

If it transpires, the Fed could be forced to lower its target fed funds rate to stimulate growth and get the economy chugging again.

Could that finally be the reprieve the mortgage industry would be waiting for?

Recommended Reading: How Old Is Too Old To Get A Mortgage

North Carolina Jumbo Loan Rates

North Carolina county conforming loan limits are set at $647,200. If you need to take out a home loan in North Carolina that exceeds the conforming loan limit in that particular county, you will be taking on what is considered a jumbo loan. Conforming loans can be re-sold on the secondary mortgage market and they qualify for normal interest rates. Jumbo loans are riskier for lenders because more money is at stake, as such they come with higher interest rates. Note that jumbo loan rates are currently lower than fixed rates in North Carolina.

The average 30-year fixed jumbo loan rate in North Carolina is 3.27% .

How To Get A Mortgage

A mortgage is a type of loan designed for buying a home. Mortgage loans allow buyers to break up their payments over a set number of years, paying an agreed amount of interest.

Because a home is typically the biggest purchase a person makes, a mortgage is usually a households largest chunk of debt. Getting the best possible terms on your loan can mean a difference of hundreds of extra dollars in or out of your budget each month, and tens of thousands of dollars in or out of your pocket over the life of the loan. Its important to prepare for the mortgage application process to ensure you get the best rate and most affordable monthly payments.

Here are quick steps to prepare for a mortgage:

Different types of mortgages

There are many different types of mortgages, broadly put into three buckets: conventional, government-insured and jumbo loans, also known as non-conforming mortgages. There are also different loan terms within these categories, such as 15 years or 30 years, and different interest rate structures, generally either fixed or adjustable .

Don’t Miss: How To Become A Licensed Mortgage Loan Officer