What Is Mortgage Preapproval

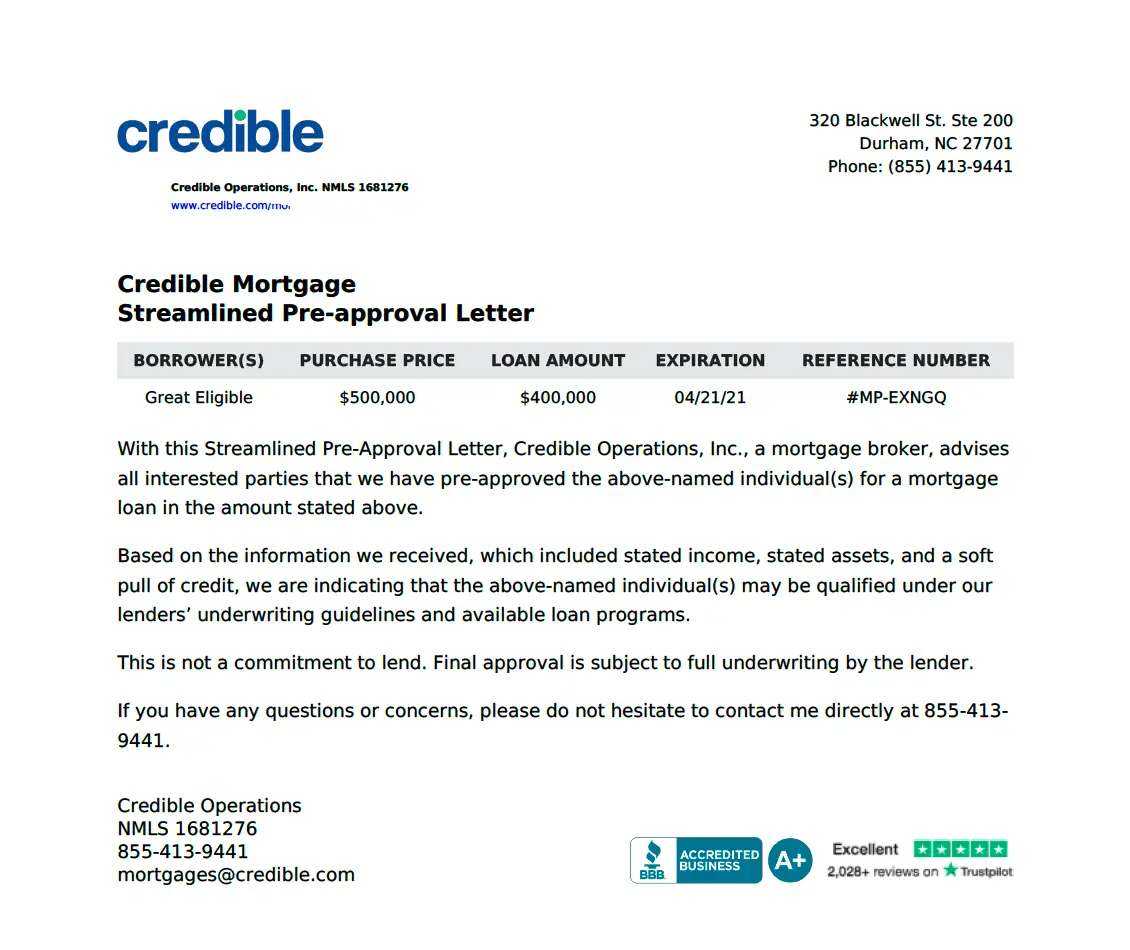

Preapproval is as close as you can get to confirming your creditworthiness without having a purchase contract in place. You will complete a mortgage application and the lender will verify the information you provide. Theyll also perform a credit check. If youre preapproved, youll receive a preapproval letter, which is an offer to lend you a specific amount, good for 90 days.

Does My Credit Score Affect My Pre

So we know that getting pre-approved for a home loan can have a small impact on your credit score. But, on the flip-side, does credit score affect mortgage pre-approval?

Absolutely! Your credit score is one of the main factors in securing a pre-approval and, ultimately, a mortgage loan.

Most lenders like to see a credit score of around 640 . The higher your credit score is, the lower your mortgage interest rate can be. And the lower your mortgage interest rate is, the lower your monthly payment is, and the less youll spend on interest expenses over the loan term.

Is Getting Pre Approved For A House A Hard Inquiry

A mortgage preapproval can have a hard inquiry on your credit score if you end up applying for the credit. Although a preapproval may affect your credit score, it plays an important step in the home buying process and is recommended to have. The good news is that this ding on your credit score is only temporary.

You May Like: Does Having A Mortgage Help Your Credit

Does Prequalification Hurt My Credit Score

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been previewed, commissioned or otherwise endorsed by any of our network partners.

Whether you need a loan to purchase a home or car, or youre in the market for a new credit card, youll want to take the time to see if you prequalify.

Prequalification provides consumers a way to find out what their chances are of being approved for a new loan or credit product before filling out an application form. Plus, the prequalification process wont negatively affect your the way it will once you formally apply.

Why You Need To Get Pre

Its all the time a good suggestion to get pre-approved earlier than searching for a house. Thats as a result of the pre-approval course of helps you:

- Set a finances: Youll have the ability to set up your worth vary and store for houses inside your finances, which may prevent time.

- Get organized: Since youll have lots of the paperwork gathered for the official house mortgage software later, this step helps you put together for the homebuying course of.

- Help your buy supply: While youre placing in a proposal, a mortgage pre-approval letter might help you stand out from different consumers, particularly in a bidding battle.

- Make a monetary plan: Should you dont qualify for a pre-approval, youll have the ability to discover out why and create a plan to enhance your funds.

Recommended Reading: Is Closing Cost Part Of Mortgage

Recommended Reading: Does It Matter What Mortgage Lender You Use

How Long Does A Pre

Most mortgage pre-approvals will last up to 90 days, but some are valid for as little as 30 days. This is because your finances including credit scores, bank statements and salary can change rapidly and lenders will want to be sure that their investment in your home is protected. After about three months, theyll want to reassess your financial reports for any changes that might impact the amount you can borrow.

Monitor Your Credit While Shopping For A Home

While getting prequalified for a mortgage might not affect your credit scores, you want to make sure other negative marks donât hurt your credit right before you apply for such a large loan. A credit monitoring service could quickly alert you to changes in your credit reports. Experian offers free monitoring of your Experian credit report.

You may want to monitor your other two credit reports as well, because mortgage lenders may use all three of your reports and credit scores based on each report. The Experian IdentityWorksSM Premium program has a free 30-day trial and comes with three-bureau monitoring and multiple FICO® Scores for each report, including the FICO® Score version commonly used for home loans.

Recommended Reading: How To Get A Physician Mortgage

Gather The Appropriate Documents

Lenders will want to verify your identity, credit history, employment history, income and financial assets to issue a preapproval. Theyll likely ask you to fill out a uniform residential loan application .

The 1003 application asks for your personal information, financial information and loan information, including

- Bank accounts, retirement and other accounts

- Any other assets you have

- Property you own

- Employer contact information

- Debts you owe or other liabilities

Your lender will also likely do a hard credit check, and may require additional documents based on your individual situation, such as pay stubs, tax returns or bank statements.

Getting Prequalified Can Reduce Unpleasant Surprises

When used properly, prequalification is a helpful tool that can reduce your chances of being surprised by a credit card rejection or help you determine the odds of being approved for a loan.

Not only does a prequalification letter give you the information you need to decide whether youd like to proceed with a formal application for a loan or credit card, but it can also be submitted with a real estate offer to show buyers youre more likely to get the necessary funding to close on the property.

Obtaining prequalification is usually quick and painless, and most importantly, it wont affect your credit score.

Need help improving your credit score but not sure where to start? !

Recommended Reading: What Do I Need To Become A Mortgage Broker

Don’t Miss: When To Refinance Home Mortgage

What The Experts Say

While Lindsay is anxious to buy a larger condo, financial planner Heather Franklin doesnt feel Lindsay is in the position to take on a bigger mortgage. She really needs to bring down her personal debtboth on her line of credit and bank loanbefore she considers signing up for a bigger mortgage and all the extra associated costs of a move, says Franklin.

Rob McLister, owner of RateSpy isnt surprised that Lindsay was offered a larger mortgage loan amount by a competing bank but says Lindsays willingness to close down her untapped $29,000 line of credit could have something to do with it. If Lindsay was paying out her line of credit with the new mortgage, the underwriter might have wanted to mitigate risk by asking for the credit line to be closed, says McLister. Some lenders require account closure as a matter of policy on debt consolidations, says McLister.

In general, a strong credit profile and reasonable debt ratio are equally important if you want the best mortgage rates and terms. The best mortgage options go to those with a credit score about 700. If you score dips below 680, it gets harder to qualify for the best rates and returns.

In most cases, cancelling cards isnt a great idea. It reduces the average age of your accounts, and the credit bureaus prefer to see long-established accounts. If you have no debt, then credit utilization is not something Id worry about.

Whats The Difference Between A Hard And A Soft Credit Inquiry

A hard inquiry is when a lender checks your credit because you applied for a loan. A soft inquiry occurs without a loan application, like when companies send you promotional offers.

Soft inquiries dont affect credit scores. Hard inquiries will decrease your and are only affected for a few months.

Soft credit inquiry: Soft inquiries dont impact your credit score. An example of a soft inquiry is an employer conducting a financial background check on a potential new employee candidate.

These inquiries dont submit a new credit application, as they are just looking at your overall credit score. You can perform a soft inquiry and look up your credit score.

Hard credit inquiry: When an individual pursues an application for a new loan or line of credit, the lender performs a more in-depth assessment. This assessment looks at the buyers credit score and credit report to determine if theyre suitable for the credit or loan request.

This comprehensive assessment looks at an individuals credit history reported by the three main credit bureaus,Equifax, TransUnion, and Experian.

Get pre-approved for a mortgage today.

You May Like: How Much Do Points Cost On Mortgage

Minimizing The Impact On Your Credit Score

Different lenders will use different credit scoring models when going through the pre-approval process. These scoring models determine the window of time when multiple credit inquiries count as a single inquiry, thereby minimizing the impact on your score.

The two main credit scoring models are FICO and VantageScore:

- FICO offers homebuyers a 45-day window for rate shopping.

- VantageScore has a narrower period of only 14 days.

Make sure to ask your lender about which scoring model they use to ensure the credit inquiries stay in the same window of time. Past this timeframe, the inquiries stand alone and have a more significant, lasting impact on your score.

Applying For A Mortgage Follow These Three Steps If You Want To Avoid Lowering Your Credit Score

Your is one of the most important indicators of your financial health, which is why lenders use it to determine your creditworthiness whenever you submit an application to borrow money. It’s inevitable that your over time as you take on, apply for and pay off more debt, and it sometimes takes a little time for it to recover from bigger dips.

If you think you’ll be applying for a mortgage anytime soon, you might want to take some extra steps to ensure your credit score doesn’t take too much of a hit throughout the homebuying process.

Note that you should avoid applying for other new lines of credit at the same time you’re shopping for a mortgage. Opening too many new lines of credit simultaneously can cause your credit score to decrease and when you’re applying for a mortgage, you’ll want it to be as high as you can get it since your credit score is what will determine the interest rate you’ll get locked into for 15 or more years.

Paying down existing debt can also help to improve your credit score before you start reaching out to lenders. Depending on what your credit score currently is, an increase by even just a few points could potentially be good enough to push you into a better credit score range, which can land you better terms on your mortgage.

Our best selections in your inbox. Shopping recommendations that help upgrade your life, delivered weekly. Sign-up here.

You May Like: How To Qualify For The Lowest Mortgage Rate

Submit Your Applications Within 45 Days

Generally, every time you apply for a new line of credit, a lender runs a hard inquiry and your credit score may temporarily be lowered. Because of this, submitting too many applications for new credit can damage your credit score since youâll be seen as a riskier borrower.

When it comes to mortgages, however, lenders expect you to shop around and you can do so as much as you need to within 45 days of getting your first hard inquiry without harming your credit score further.

This is where it can be handy to go in with the knowledge gained from already being pre-qualified and aware of which lenders will most likely fit your financial needs. That way, you wonât have to waste valuable time during the 45-day window doing too much additional research for new lenders.

Catch up on Selectâs in-depth coverage of personal finance, tech and tools, wellness and more, and follow us on , and to stay up to date.

Read Also: Do Different Banks Offer Different Mortgage Rates

Should I Negotiate The Final Mortgage Rate

If a lender agrees to loan you a mortgage, you are allowed to negotiate the terms and conditions which include the interest rate along with the amount and the term. You are more likely to be able to negotiate the rate if you have an excellent application that consists of a great credit score, a biggerdown-payment, lower monthly debt, or other things that may appeal to the lender. Many mortgage brokers are willing to buy-down the rate that they get from their lenders, giving you a discount on your interest rate. We suggest that you take the time to shop for rates offered by different lenders and decide what is best for you. Remember, the interest rate isn’t everything the other terms and conditions in a mortgage can make a big difference as well.

Don’t Miss: Is A Timeshare Considered A Mortgage

What To Do If Your Prequalification Application Is Denied

There are some steps you can take to improve your situation if your prequalification application is denied. Equifax recommends obtaining a copy of your credit report and reviewing it for errors and areas where you can improve. Perhaps you need to start making extra payments to reduce your debt, or find a cosigner for a small loan or retail card to develop your credit history. Youll also want to ask the lender the reason for the denial. If the lender requires two years of employment history, for example, and you only have a year and a half, youll know to look for another lender or wait six more months before applying again.

Is Prequalifying The Same As Getting Approved

While a person may prequalify for a loan, that doesnt mean they will be approved. Prequalification is given strictly based on what the person reports.

During the approval process, a potential borrowers application is examined in greater detail. Employment status, income and debt are verified during the approval process. Credit reports are also checked for things like a history of late payments or bankruptcies. If there are any discrepancies, or the lender comes across information they dont like, a loan can be denied. This is true even if prequalification was previously granted.

Recommended Reading: How To Calculate Mortgage Amount Qualification

Whats A Soft Credit Check

When a lender does a soft credit check they contact one of the three credit bureaus to see your credit score based on previous credit inquiries. It doesnt impact your credit score or leave a public trace on your credit history. However, if you request a copy of your credit report, you will be able to see what companies have done a soft credit check on you. If you receive a promotional letter from a bank that says youve been pre-approved for a new credit card, you can be sure that bank ran a soft credit check on you.

A Better Mortgage pre-approval takes as little as 3 minutes and uses a soft credit check to give you a good idea of how much you can borrow without impacting your credit score.

Whats a hard credit check?

When a lender conducts a hard credit check , they review your current credit situation with 13 of the credit bureaus to see if you qualify for new credit. A hard credit check can be seen on your credit report by other lenders and typically reduces your credit score by 5 points. Given that credit scores range between 300 and 850, on balance, 5 points makes less than 2% difference.

Credit reporting companies recognize that many people shop around for a mortgage, so even if a lender uses a hard credit check for your pre-approval, there wont be any further impact to your credit score if you complete multiple mortgage pre-approvals within 45 days. After 2 years, a hard credit check will drop off your credit report entirely.

Does Applying For A Mortgage Hurt Your Credit Score

Similar to a mortgage pre-approval, applying for a mortgage involves a hard inquiry on your credit report, which could lower your credit score by a few points. If you fill out multiple mortgage applications within the 14 to 45-day shopping window, then it will only count as a single inquiry.

The mortgage shopping window only applies to credit checks from mortgage lenders or brokers credit cards, according to the Consumer Financial Protection Bureau, and other inquiries will show separately on your credit report.

After you close on a new mortgage, your credit score may go down again temporarily. Because of this, it may be difficult to get other loans or with the terms you prefer. You may have to wait several months before applying for a larger loan.

On the other hand, a mortgage can also help build your credit over the long run if you make timely payments.

You May Like: Can I Get A Mortgage Without A Tax Return

Read Also: How To Calculate Self Employed Income For Mortgage

Should I Tell My Real Estate Agent How Much I Am Pre

To help tailor your home search,your real estate agentwill ask for your price range and may even ask to see your pre-approval letter. You can let your real estate agent know the maximum amount that you have been approved for, but it is more important to let your agent know the maximum home price that you’re willing to look at. Just because you have been pre-approved for a large number doesn’t mean that you need to purchase a home for that amount. While your agent might want to know your price range, you also do not need to let them know your income or how much money you have.

What Is Mortgage Prequalification

A mortgage prequalification is an estimate of how much a borrower can be approved for based on income and other basic factors. The prequalification process is simpler than the preapproval process, and can typically be done through a phone call or online form that provides some financial information to a lender.

Because a prequalification simply indicates what you might be able to afford and doesnt require official documentation, it doesnt expire. As long as your credit and finances stay about the same , the prequalification should still hold as a general idea of what you can afford.

Read Also: How Much Can You Save By Paying Extra On Mortgage