Why Take Out An Fha Mortgage Loan

From a home buyers perspective, the main reasons to apply for an FHA home loan are:

- If youve been rejected by traditional lenders

- If you dont have sufficient money for a 20% down payment

FHA home loans provide borrowers suffering from a poor credit rating with a path to homeownership for a down payment of 10% or less. Active and former members of the Military, National Guard, and Reserves who suffer from poor credit or a lack of funds can apply for a VA loan. For anyone else who cant get approved for a conventional mortgage, an FHA mortgage loan is usually the best type of loan for getting into the housing market. FHA loans are especially popular with first-time homebuyers, with 82% of first-time borrowers using an FHA loan in 2017.

Factors Your Lender Will Consider

When youre being considered for a mortgage loan, your lender will look at your overall financial standing, not just your income. There are a few other factors that will influence how much you can actually afford to borrow.

Your credit score will have a big influence over whether you are approved for a loan and what kind of interest rates youll have access to.

A high credit score indicates that youre used to borrowing money and you pay your bills on time. If you have a low score, lenders may charge you high interest for borrowing even small amounts to compensate for the perceived risk.

Unsure of how you rate? You can find your credit score through for free.

Debt-to-income ratio

This ratio examines how all your monthly debt payments compare to your gross monthly income. Think of your auto loan, student loan and credit cards.

Comparing these figures gives lenders an idea of how likely you are to keep up with all your debts, including a monthly mortgage payment.

When you input your debts into the calculator, make sure theyre accurate. Dont underestimate or lowball your estimates, because lenders will see the full picture and base their numbers on that anyway.

Loan-to-value ratio

This ratio compares the amount you hope to borrow with how much the property is worth. The more you put toward a down payment, the lower your LTV ratio will be.

What Does Borrowing Power Mean

Borrowing power or borrowing capacity refers to the estimated amount that you may be able to borrow for a home loan, calculated generally as your net income minus your expenses. Your expenses include all your daily living costs and regular financial commitments like bills, groceries and petrol, as well as any other debts you hold such as a credit card, car loan or personal loan.

Once you have a ballpark figure for your borrowing power youll be able to house hunt with a price range in mind. See our tips for what to consider when working out how much to borrow.

Don’t Miss: Can A Locked Mortgage Rate Be Changed

What Is The Minimum Mortgage Loan Amount You Can Borrow

When it comes to mortgage types, each lender offers different products. Researching the market will show you theres a lot of variation in interest rates, closing costs and requirements to qualify.

But finding a lender that offers small mortgages can present a special challenge. When it comes to loan amounts, most lenders dont disclose their minimums. Generally speaking, you may have trouble finding a mortgage below about $60,000, unless youre searching for a specific, unconventional loan type .

While mortgage minimums vary, qualification requirements are relatively consistent across lenders. As you search for and prepare to apply for the right loan, keep these common requirements in mind:

You May Like: 10 Year Treasury Yield And Mortgage Rates

Today’s Current Mortgage Interest Rates

While mortgage lenders requirements have grown significantly stricter in recent years, the COVID-19 pandemic has led to extremely low-interest rates on mortgages. Even a fraction of a percentage point can lead to thousands or tens of thousands of dollars in savings over the term of a mortgage.

Mortgage rates can vary widely depending on various criteria, such as your credit history and the value of your new home, along with market conditions.

You May Like: How Much Of Your Income Should You Spend On Mortgage

What Is Gross Monthly Income

Your gross monthly income is the sum of everything you earn in one month, before taxes or deductions. This includes your base monthly income and any additional commissions, bonuses, tips and investment income that you earn each month. To calculate your gross monthly income, take your total annual income and divide it by 12. If you’re hourly, you can multiply your hourly wage by how many hours a week you work, then multiply that number by 52 to get your annual salary. Divide your annual salary by 12 to get your gross monthly income.

How To Use The Mortgage Affordability Calculator

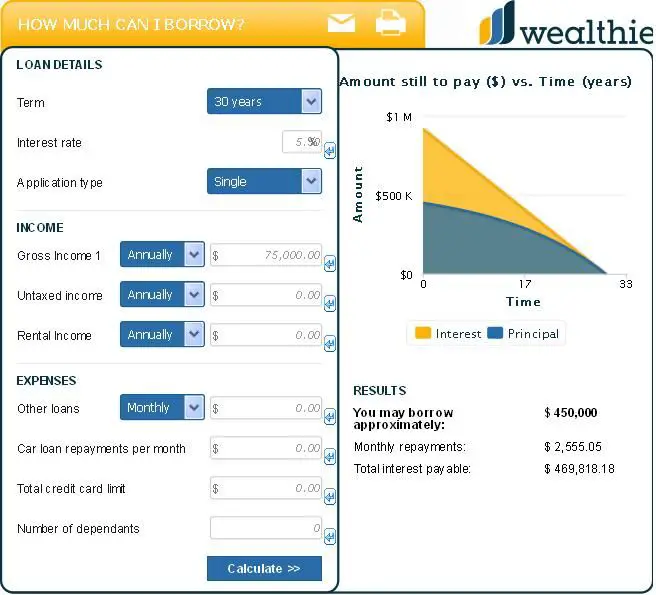

To use our mortgage affordability calculator, simply enter you and your partnerâs income , as well as your living costs and debt payments. The calculator can estimate your living expenses if you donât know them.

With these numbers, youâll be able to calculate how much you can afford to borrow. You can change your amortization period and mortgage rate, to see how that would affect your mortgage affordability and your monthly payments.

Read Also: Is My Homeowners Insurance Included In My Mortgage

What Are The Upfront Costs Of Buying A Home

In addition to your down payment, you will have to pay a range of closing costs when you buy a home, which include an appraisal, title insurance, an origination fee for the mortgage, real estate attorney fees and more. The total will vary depending on what your lender charges, whether youll pay real estate transfer taxes and if the seller agrees to cover a portion of the fees. As youre budgeting for a home purchase, its wise to plan for between 2 percent and 5 percent of the homes purchase price. So, if youre buying a $400,000 home, your closing costs might range between $8,000 and $20,000. Some lenders might give you the option to roll those costs into the loan to avoid paying for them out-of-pocket. Keep in mind, though, that youll pay interest on them if you choose that option.

Your Mortgage Application Doesnt Have To Be Perfect

Sure, youll have the biggest home buying budget if you have no other debts and a large salary.

But those things arent required. As a home buyer, its all about starting where you are now.

Figure out what makes sense for you based on your own salary and needs, rather than aiming for a budget based on a rule of thumb.

Many people find that when they approach it this way, home buying is more attainable than they ever thought possible.

Recommended Reading: Does Ally Bank Offer Mortgages

How To Use A How Much Can I Borrow Mortgage Calculator

With this calculator, you can run some what-if scenarios. For example, you may consider:

-

How long will I live in this home? That can greatly impact your decision on whether to choose a 30-year fixed rate loan or a shorter term. The longer term will provide a more affordable monthly payment, but youll pay a lot more interest over the long term. A 15-year fixed-rate mortgage will cost you way less interest over the life of the loan, but your monthly payment will be considerably more.

-

Is an adjustable-rate mortgage a better option for me? If you plan on being in this home for just a few years, a 5/1 ARM could be a good option. Youll enjoy a lower initial interest rate thats fixed for five years, but the rate changes annually after that.

-

Am I trying to buy too much house? Sure, lenders may be more than happy to put your name on a big loan, but how do you feel about it? Are you comfortable with how it may impact your monthly budget, or are you feeling a bit stretched? Consider how your new home costs may impact your other spending goals, such as travel and savings.

-

How much of a down payment should I make? Its always the big question. Are you putting down as little as possible and having to make up for it with larger monthly payments and possibly having to pay mortgage insurance?

The ‘how Much House Can I Afford’borrowing Power Calculator

One of the first questions that our Loan Officers are commonly asked is: ‘how much house can I afford’? Half the fun in buying a home is exploring the real estate market in your area to see what’s available. To help you zero in on a housing price range, we’ve built a ‘How Much House Can I Afford’ calculator to help you start exploring the possibilities.

Mortgage Questions? We can help.

Getting started is easy. Schedule a call back or email us and well help you take the first step.

You May Like: What Mortgage Could I Get

Factors That Impact Affordability

When it comes to calculating affordability, your income, debts and down payment are primary factors. How much house you can afford is also dependent on the interest rate you get, because alower interest ratecould significantly lower your monthly mortgage payment. While your personal savings goals or spending habits can impact your affordability,getting pre-qualified for a home loancan help you determine a sensible housing budget.

How Many Times My Salary Should I Borrow For A Mortgage

A common financial rule of thumb for how much house payment you can afford based on your income is to multiply your monthly gross income by 28%. As an example, if you earn $10,000 every month pre-tax, multiply $10,000 by 0.28, a $2,800 mortgage is what you are suppose to be able to afford based on your salary. This means that a $2,800 monthly mortgage payment should be the most you can afford regardless of whether you get a 15-year or 30-year mortgage.

Read Also: What Is The Highest Interest Rate On Mortgage

How Do Lenders Decide How Much I Can Borrow

Your salary will have a big impact on the amount you can borrow for a mortgage.

Usually, banks and building societies will offer up to four-and-a-half times the annual income of you and anyone you are buying with. This means if you’re buying alone and earn £30,000 a year, you could be offered up to £135,000.

There are exceptions to this, however. Some banks offer bigger home loans to borrowers who have higher earnings, bigger deposits, or work in specific professions. If you qualify, you may be able to borrow up to five-and-a-half times your income.

How Do Lenders Determine Mortgage Loan Amounts

While each mortgage lender maintains its own criteria for affordability, your ability to purchase a home will always depend mainly on the following factors.

Many different factors go into the mortgage lenders decision on homebuyer affordability, but they boil down to income, debt, assets, and liabilities. A lender wants to know how much income an applicant makes, how many demands there are on that income, and the potential for both in the futurein short, anything that could jeopardize its ability to get paid back.

Income, down payment, and monthly expenses are generally base qualifiers for financing, while and score determine the rate of interest on the financing itself.

You May Like: How To Calculate House Mortgage Payment

How Much House Can I Afford On My Salary

Lets say you earn $70,000 each year. By using the 28 percent rule, your mortgage payments should add up to no more than $19,600 for the year, which equals a monthly payment of $1,633. With that magic number in mind, you can afford a $305,000 home at a 5.35 percent interest rate over 30 years. But youd need to make a down payment of 20 percent.

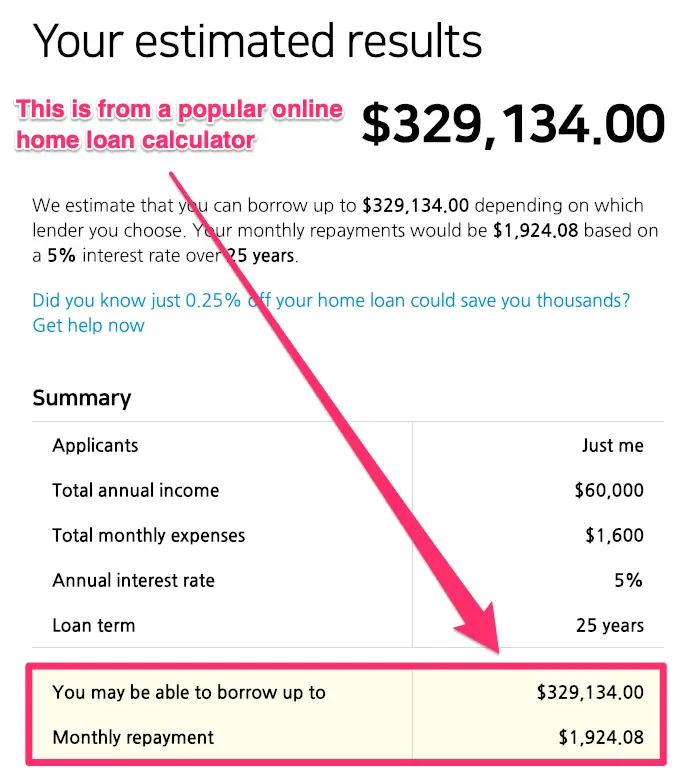

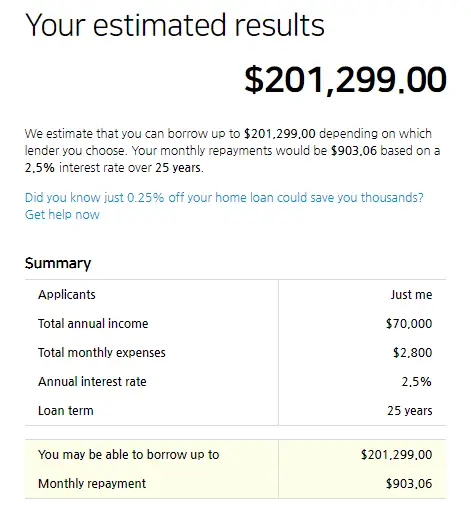

If Each Lender Is Different How Should I Use This Mortgage Calculator

Our mortgage calculator can give you a pretty accurate estimation of what will be available to you and will show you 3 outcomes which represent a lower, medium and higher chance of success.

Many of our customers regularly achieve the highest loan amounts available so dont be put off if you think you need to max out your possible mortgage size.

Don’t Miss: What Is The Veterans Mortgage Relief Program

If You Need Private Mortgage Insurance

Private mortgage insurance or PMI, is insurance that can be required by the mortgage lender when your down payment is less than 20% of the homes purchase price. PMI is the insurance that you pay for that protects the bank against the losses it would suffer if you defaulted on your mortgage payment and it went into foreclosure.

Percentage Of Gross Monthly Income

Ideally your monthly mortgage payment should never exceed 28% of your gross monthly income. With that said, every borrowers daily living expenses are different, and most mainstream conforming loan programs as well as FHA and VA programs allow you to exceed that threshold.

This will ensure that you are not stretched too far with your mortgage payments, and you will be more likely to be able to pay them off. Remember, your gross monthly income is the total amount of money that you have been paid before deductions from social security, taxes, savings plans, child support, etc. Note, when factoring in your income, you usually have to have a stable job or proof of income for at least two years in a row for most lenders.

You May Like: How To Find Out Who Owns My Mortgage

Two Types Of Conventional Loans

- Conforming Conventional Loans: Conventional mortgages follow assigned loan limits established by the Federal Housing Finance Agency . In 2022, the maximum conforming limit for a single-unit home in the U.S. continental baseline is $647,200. If this is the maximum conforming limit in your area, and your loan is worth $600,000, your mortgage can be sold into the secondary market as a conventional loan. We publish maximum conforming limits by county across the country.

- Non-conforming Conventional Loans: Also called jumbo loans, non-conforming conventional mortgages exceed the assigned conforming loan limits set by the FHFA. These loans are used by high-income buyers to purchase expensive property in high-cost locations. The conforming loan limit for high-cost areas are 50% higher than the baseline limit, which is $970,800 for single-unit homes as of 2021. Jumbo mortgages have stricter qualifying standards than conventional loans because larger loans exact higher risk for lenders.

PMI on Conventional Loans

Private mortgage insurance or PMI is required for conventional mortgages when your down payment is less than 20% of the homes value. This is an added fee that protects your lender if you fail to pay back your loan. PMI is typically rolled into your monthly payments, which costs 0.5% to 1% of your loan per year. Its only required for a limited time, which is canceled as soon as your mortgage balance reaches 78%.

How To Use The Maximum Mortgage Calculator

Not sure where to start? Let us help you:

Recommended Reading: Does Pre Approval Mean You Get The Mortgage

How To Choose A Mortgage Lender

You have many options when it comes to choosing a mortgage lender. Banks, credit unions and online lenders all offer mortgages directly, while mortgage brokers and online search tools help you compare options from different lenders.

Its important to make sure you feel comfortable with the broker or company youre working with because youll need to communicate with them frequently during the application processand in some cases, after the loan closes.

You may want to start with the banks or other institutions where you already have accounts, if you like their service. Also, ask your network of friends and family, and any real estate professionals youre working with, for referrals.

How Do You Apply For A Mortgage

Mortgages are available through traditional banks and credit unions as well as a number of online lenders. To apply for a mortgage, start by reviewing your credit profile and improving your credit score so youll qualify for a lower interest rate. Then, calculate how much home you can afford, including how much of a down payment you can make.

Don’t Miss: Where Is Rocket Mortgage Golf Tournament

Next: See How Much You Can Borrow

You’ve estimated your affordability, now get pre-qualified by a lender to find out just how much you can borrow.

-

What will your new home cost? Estimate your monthly mortgage payment with our easy-to-use mortgage calculator.

- Award Ribbon

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you’re in the right range.

- Pig Refinance calculator

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.