What Is An Equity Sharing Agreement

Home equity sharing allows an investment company to buy a slice of your home for a lump sum payment plus a share of the future change in your home equity. These agreements work very much like a company selling stock to investors, according to Thomas Sponholtz, CEO of home co-investing company Unison.

The investor buys an amount of stock in the hopes that the value of the stock will increase over time. When it comes time to sell, the investor recovers their original investment plus any gains in the value of the stock. If the stock loses value, the investor loses as well.

Having the option of using equity in a different way and turning it into liquidity without incurring new debt broadens the flexibility of choice the homeowner has, Sponholtz says.

A big part of the attraction of co-investing is that you wont have to make monthly payments or pay interest on the amount you receive. Instead, youre delaying the repayment until the end of the equity sharing agreements term or when you sell your home, whichever takes place first. Think of an equity sharing agreement as a type of balloon payment loan.

What Are The Advantages Of Shared Equity

- Buy your first home sooner It can take years to save up a full deposit, which can leave you in limbo. The scheme can help you make this crucial step much earlier.

- Take out the loan interest-free In many cases, the amount you pay back is based on the property value, so it doesnt accrue interest as such. When interest is payable, its usually not owed for the first few years , giving you some breathing space.

- Only pay back when you sell Lots of the schemes only require you to pay back the loan when you sell, so you dont need to factor in additional monthly spend on repayments.

What You Need To Know

- The main benefit of a shared equity mortgage is that buyers get help owning a home they might not otherwise be able to afford

- With a shared equity mortgage , the co-investor pays off a portion or the total amount of the down payment and/or closing costs

- For the most part, shared equity mortgage programs are designed to assist low-to-moderate income home buyers or buyers who meet other qualifications

Don’t Miss: How To Find Mortgage Note

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

The Home Equity Sharing Manual

A 187 page book providing the most thorough and comprehensive explanation of shared equity financing available. Chapter topics include: Maximizing Tax Benefits, Calculating Ownership Percentages, Making Equity Sharing Happen: A Home Buyers Guide, A Seller-Investors Guide, and A Real Estate Agents Guide.

Don’t Miss: How To Lock Interest Rates Mortgage

Does My Credit Score Impact The Amount Of Cash I Receive

The short answer, yes.

The amount of cash you receive is determined by several factors. These factors include your homes current appraised value, any pre-existing housing debt, your creditworthiness, and how you use the property.

Remember, though, most equity sharing companies have low minimum credit score requirements, so homeowners with poor credit are eligible. So, while your credit can impact the amount of cash you receive, that doesnt mean you wont still be able to receive a large cash investment.

Should You Get A Shared Equity Mortgage

If youâre planning on buying a home with the assistance of loans from shared equity mortgages, answer the following questions:

- Are you buying a home for the first time?

- Do you lack the down payment for closing costs for the home?

- Have you considered the long-term costs associated with it?

- Do you fit the criteria for the financial assistance program?

- Are you willing to let go of a certain percentage of future appreciation?

If the answer to those is yes, then getting the loan may be a sound idea. There are workarounds to the cons and it can benefit communities altogether.

Recommended Reading: How Much Should You Pay For Mortgage

Benefits Of A Shared Equity Mortgage For Homebuyers

If youâre a homebuyer, shared equity helps you break into an inflated housing market.

Avoid mortgage insurance:If you canât secure a 20% down payment, banks might still lend to you with a 5% or 10% down payment. However, youâll have to pay mortgage insurance â a comforting cushion for lenders, yet a hundreds-of-dollars-per-month burden for homeowners. Shared equity helps you reach a 20% down payment to avoid mortgage insurance.

Lower monthly payments: More down payment equals less in monthly payments. Step 1? Securing a 20% down payment. Anything more is gravy and highly beneficial if you have the capital.

More property options: A budget is limiting, but if you add a few percentage points to your down payment, you might be able to purchase the home of your dreams instead of settling.

Risk management: We know the property market is hot in the GTA, but housing markets cool every so often, resulting in lower demand and property prices. If your home value goes down over 10 years , youâll share the brunt of it with your shared equity investor.

Qualifying For A Shared Equity Mortgage

The exact process of applying and qualifying for a shared equity mortgage will depend on the program or individual lender you choose.

Private shared equity lenders may have more flexible requirements, allowing borrowers of all incomes to receive down payment assistance in exchange for a share of the propertys future appreciation.

However, many shared equity mortgages are loans offered by city or regional governments. These loans are designed to make homeownership affordable for lower- and median-income earners. This means that many shared equity mortgages are limited to middle- or lower-income borrowers who meet certain need-based standards.

For example, San Franciscos Downpayment Loan Assistance Program is only available to first-time homebuyers meaning that they havent owned a home anywhere in the last three years. Borrowers must also meet household income requirements based on size: For a one-person household, the maximum income is $163,200, while a six-person household could make up to $326,400.

The San Francisco DALP is also lottery-based. Even if you qualify, applications are processed according to lottery order, which may not guarantee that youll receive funds in a specific period of time.

When applying for a shared equity mortgage loan, you should expect to provide a combination of the following:

- Proof of income

- Recent bank statements

- Verification of other assets

- Various forms of identification

You May Like: How To Pay Off 100 000 Mortgage In 5 Years

How Repayment Of The Equity Investment Works

Each shared equity investor calculates the outcomes a bit differently. However, in general, these are the possible scenarios.

-

If the home appreciates, you pay back the companys investment in your home the equity you received plus its stake in the increased value.

-

If the homes value remains the same, youll pay back the equity you drew, and you may also pay back any risk-adjusted discount that the investor took.

-

If the home loses value, you’ll pay back the equity you drew, less an adjustment for the depreciation.

Repayment may occur:

-

Before the agreement ends, if the investor allows for it. Unison permits homeowners to buy out after five years, although the company wont share in any losses if you opt out early. Noah allows you to end the agreement at any time, and itll require another appraisal to determine the amount youll have to pay to buy it out.

-

Before the agreements term ends, perhaps by qualifying for a cash-out refinance with another lender, if the agreement allows refinancing.

-

When you sell the home prior to the agreements completion.

-

When you reach the end of the agreements term. At that point, youll have to sell, refinance or find the money.

How Does The Shared Equity Program Work

In order to qualify, you must fall into a certain income range cannot own another home or have significant assets outside of retirement savings.

State and federal funds provide down payments of 20-30% of the homes market value, so you

a) do not need to save a down paymentb) can take out a lower mortgage than you would need to buy a home on the open market

You must pay the closing costs

When you decide to sell, you sell the home back through the housing trust to another qualified buyer.

- You recoup your equity, i.e. the principal you paid down and the value of any authorized capital improvements you made

- If the homes value increased while you owned it, you get 25 percent of the appreciation.

Read Also: Should I Get 15 Year Mortgage

An Example Of An Equity Sharing Investment

Say your home is appraised at $500,000. The company you choose as a co-investor makes a risk adjustment of 10%, bringing your homes value down to $450,000. If you decide to sell 10% of your homes future equity in exchange for a $50,000 payment, the math would work out as follows:

Original adjusted home value: $450,000 Value at time of repayment: $600,000 Total appreciation: $150,000

You would have to repay $65,000 .

On the other hand, if your home depreciated by $100,000 at the time of repayment, you would owe less money:

Original adjusted home value: $450,000 Value at time of repayment: $350,000 Total depreciation: $100,000

You would owe $40,000 .

Are There Any Restrictions

- Homes cannot be rented or sold on the open market and must be owner occupied

- Homeowners are responsible for the maintenance and upkeep of their home and property

- Single family homes require a ground lease that gives ownership of the land to Champlain Housing Trust but allows full use of the property by the homeowner

- There is no time commitment to living in a shared equity home but you must agree to sell the home through CHT to another qualified buyer

Also Check: What Would The Mortgage Be On A 250 000 House

Alternatives To A Shared Equity Mortgage

If you decide that a shared equity loan isnt the best fit, or simply want to see what other options are available to you that still keep homeownership affordable, here are some alternatives to consider.

Low down payment loans: Conventional mortgages allow borrowers to take on a mortgage with as little as 3% down. Additionally, USDA and VA loans offer 0% down payment options to qualified buyers.

These loans will require larger monthly payments, but buyers get to keep 100% of the value of their homes appreciation when they sell. If you can afford the monthly payment, a low down payment loan is a great way to get into a house fast.

Community land trusts: Community land trusts combine permanent affordable housing with the subjective benefits of homeownership. People who buy a home through a community land trust buy the house at a significant financial discount. When it comes time to sell the house, the owner gets to keep some of the appreciation while the remainder gets reinvested in the house to keep the cost of ownership low for the next buyer.

Community land trusts are a permanent, affordable housing strategy not a wealth-building strategy, explained Selina Mack, executive director of Durham Community Land Trustees. Still, most people who buy into a community land trust ultimately gain enough equity, so they can put a down payment on their next home.

How A Home Equity Sharing Agreement Works

-

You want to tap the equity in your home.

-

If you qualify, a home equity sharing company advances you that money.

-

Instead of borrowing at a particular interest rate, you agree to give the investment company a percentage of the future appreciation of your home.

-

You make no monthly payments to the company.

-

The company has no occupancy rights, but there is a lien against your property, just as with a typical loan.

-

You pay back the equity value the company gave you, plus its share of the homes appreciation when you sell the house, or at the end of the term of the agreement, often 10 years. Unisons agreements are for 30 years.

-

Typically, you also have the option to pay back earlier.

For all practical purposes, a home equity sharing agreement is a lot like a balloon-payment loan. The end of the term looms large. Youre facing a deadline to pay back the entire investment and a percentage of your homes appreciation. That is no small consideration. For that reason, these agreements are not for the risk-averse or the faint of heart.

Recommended Reading: What Is A Nmls Mortgage License

Equity Loan Versus Debt With A Government Guarantee

An important question is how the demand for ELs differs from the demand for other products that benefit from government down payment assistance, such as the provision of government debt insurance, which is widely used in the United States by borrowers participating in the Federal Housing Administration market. The insurance protects lenders against losses in case of default, and it allows borrowers with small down payments, including FTBs, to access mortgage finance at LTVs and interest rates that would not be accessible to them in the absence of the government guarantees. Our sample of EL takers has a high prevalence of FTBs.

Mortgage payments with equity loan compared to mortgage guarantee

The figure shows the distribution of mortgage payments relative to income for EL borrowers compared to two scenarios. In the first, we assume that, instead of using the EL, borrowers take a standard mortgage for the whole amount, and pay the interest rate that corresponds to a 95% LTV mortgage. . In the second scenario, we assume that instead of using the EL borrowers take a mortgage for the whole amount, that is, the LTV is 95%, but this mortgage benefits from a government guarantee for LTV above 75%. Therefore, when calculating the mortgage payments, we use the loan amount corresponding to the 95% LTV but the interest rate on a 75% LTV mortgage. In both scenarios, we assume that the mortgage maturity is the same as in the base case with the EL.

What Is Shared Equity Homeownership

Why a shared equity program?

The two biggest obstacles to buying a home are saving for a down payment and the high prices of homes. Our shared equity program addresses both problems.

Advantages to shared equity homeownership:

- Helps low to moderate income earners become homeowners

- Lower home prices for buyers

- Owner builds personal wealth from equity in their home

- Strengthens communities by protecting long term affordability and property values

Recommended Reading: Can I Buy Another House If I Have A Mortgage

Do Shared Equity Mortgages Affect Housing Affordability In Canada

At first glance, it would seem as though a shared equity mortgage program would help to make buying a home more affordable. Thats true to a certain extent, but theyre not necessarily able to alleviate the entire housing affordability issue in more expensive real estate markets. More specifically, these programs wont be able to resolve inventory issues in pricey markets.

For many Canadians who struggle financially, saving a couple of hundred dollars every month on mortgage payments can really help. The lower loan amount can also help deal with the more stringent mortgage qualification criteria stemming from the recently introduced mortgage stress test, which requires borrowers to qualify for a home loan at a rate 200 basis points higher than the interest rate they are quoted.

But the issue of housing supply which has a direct impact on housing prices still needs to be addressed, especially in centres like Toronto and Vancouver, where inventory seems to be perpetually tight. At the end of the day, the most effective way to deal with housing affordability is to boost inventory.

Should I Get A Home Equity Loan

Home equity loans offer some attractive features. Most notably, a home equity loan is a great option if you want to know exactly how much money you wish to borrow on Day 1, and you want a fixed interest rate, Giles says.

Moreover, having a fixed interest rate can be a big benefit when youre in an economic environment where rates are rising like they are today, Kapfidze points out.

Making timely payments on a home equity loan will also improve your credit score, McBride adds.

Nonetheless, make sure you understand how a home equity loan is going to affect your overall financial picture, and figure out a plan for how youre going to pay back the money before you get one, Kapfidze advises.

You May Like: How To Find A Reputable Mortgage Lender

How Does A Shared Equity Mortgage Work

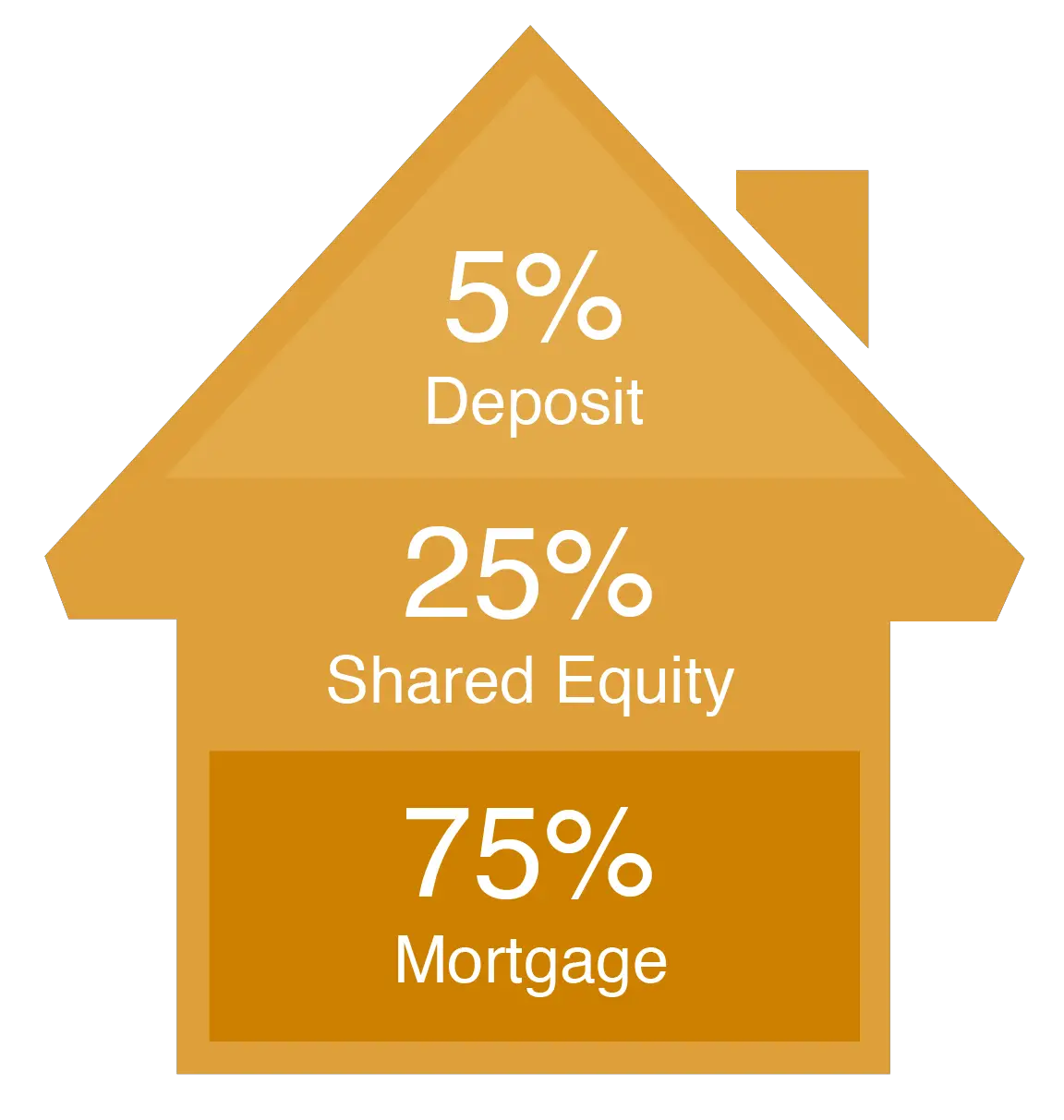

To help you understand how a shared equity mortgage works, lets assume youre buying a home for $650,000 with a 20% down payment .

You take out a 25-year fixed-rate mortgage with a 5-year term and a rate of 3% to finance the purchase. Then, compare that to a shared equity mortgage scenario whereby the lender has a 10% share of the equity . The following chart compares your mortgage amount and monthly payments:

| Mortgage Amount | |

| $455,000 | $$2,153 |

With a shared equity mortgage, youll be saving around $308 per month in mortgage payments, and your loan amount will be about $65,000 less than it would be with a traditional mortgage.

Whos Eligible For Shared Equity Mortgages

To take advantage of this program, you must meet certain criteria:

- Be a first-time homebuyer

- Make at least a 5% down payment on your own

- Have a household income of no more than $120,000

- The home cannot be worth any more than 4 times your income. Meaning you cant buy a home thats more than $480,000 . This amount may vary slightly for more expensive cities like Vancouver and Toronto.

You can access a shared equity loan for up to 10% of the purchase price of a home, and the loan must be paid back when you sell the home, or after 25 years.

Additional Reading

You May Like: How Much Is Mortgage Origination Fee