What Is A Fha Loan With No Down Payment

The FHA Zero Down program gives you the option to buy without a down payment. It removes this common roadblock for lots of first-time homebuyers and repeat buyers. You can start the journey to homeownership without waiting to save.

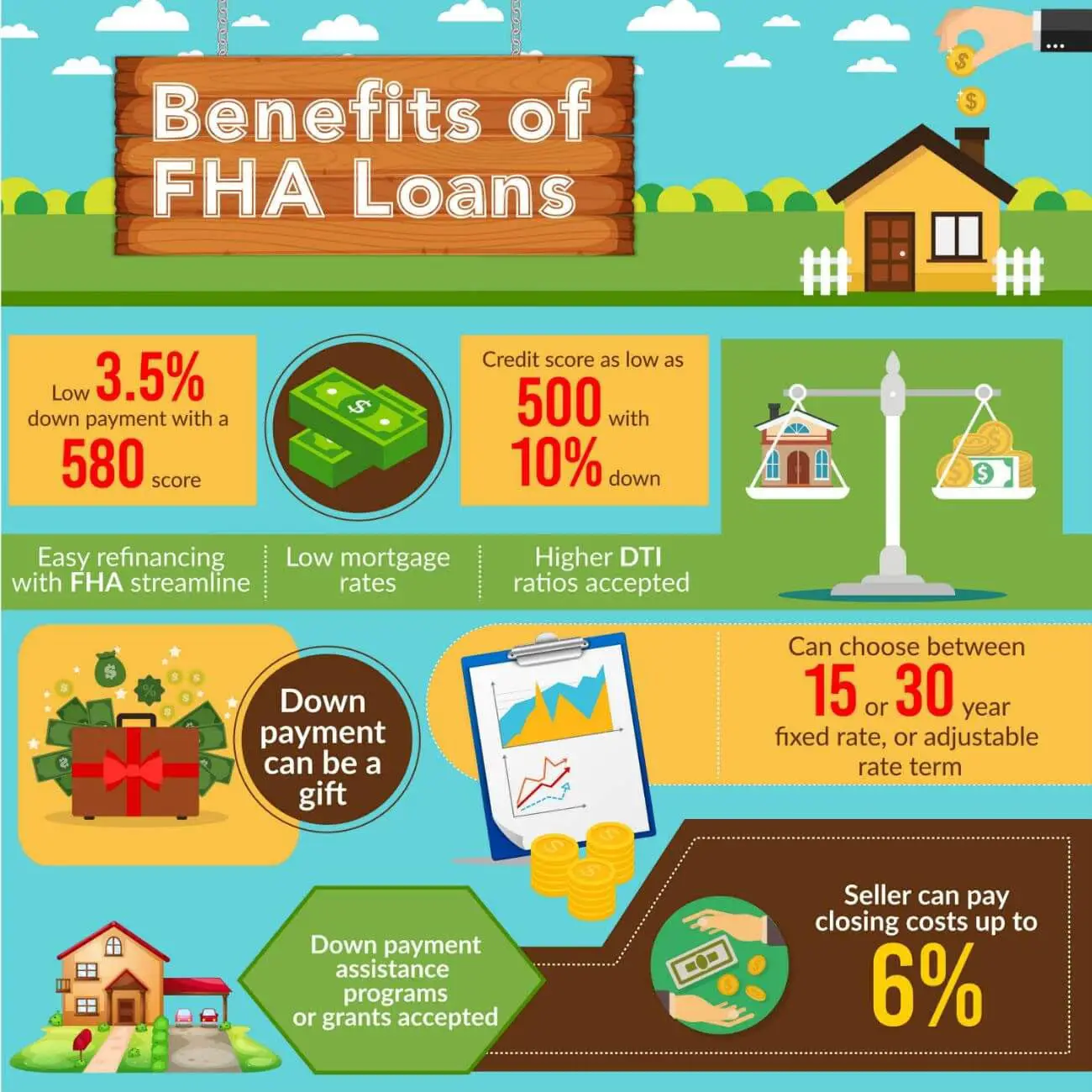

FHA loans are insured by the Federal Housing Administration and issued by an FHA approved lender. These loans offer options to homebuyers with less than perfect credit scores and low to moderate income. Theyre one of the easiest mortgages to qualify for because they provide more flexible credit score requirements.

Our FHA Zero Down program offers an FHA insured first mortgage up to 96.5% of the total purchase price, with second mortgage options for the remainder to be used towards down payment and closing costs. The second mortgage options provide down payment assistance of 3.5-5% of the purchase price as forgivable financing or repayable lien. Your loan officer can provide guidance on the best option for your situation.

You can come to the closing table without a down payment and get into a home you can afford.

What Is A Piggyback Mortgage

A piggyback loan also called an 80/10/10 loan uses two separate loans to finance one home purchase. The first loan is a conventional mortgage that typically covers 80% of the home price. The other loan is a second mortgage that covers 10 percent. The remaining 10% will be covered by your down payment.

Why would someone use two loans to buy one home? Because the piggyback mortgage simulates a 20% down payment with only 10% out of pocket. So you get to enjoy lower rates and no PMI without saving extra cash.

In this article

Financing Your Second Home With Fha

While financing a second home with an FHA loan is not common, it is still possible. When you purchase the second home as your primary residence, it gives you a second investment home that can add to your overall net worth.

However, at Hero Home Programs, we understand how confusing the home buying process can be. We can help you navigate the FHA home buying process and help ensure you meet the qualifications for a new FHA loan when needed. To learn more about Hero Home Programs and how we can help, contact us online today.

Also Check: Do You Pay Interest On A Mortgage

How Long Do You Have To Be Debt Free To Get A Mortgage

Debt-free means having no debts and no outstanding payments on your mortgage. This includes both your credit card and student loan debt. The key to getting there is being mindful of your monthly bills and making sure you are doing everything you can to reduce your spending.

It may take some time, but with a little effort, you can achieve debt-free living.

Fha Mortgage Rates Are Generally The Lowest Available

One of the biggest draws of FHA loans is the low mortgage rates. They happen to be some of the most competitive around, though you do have to consider the fact that youll have to pay mortgage insurance. That will obviously increase your overall housing payment.

In general, you might find that a 30-year fixed FHA mortgage rate is priced about 0.25% to 0.50% below a comparable conforming loan .

So if the non-FHA loan mortgage rate is 3.75%, the FHA mortgage rate could be as low as 3.25%. Of course, it depends on the lender. The difference could be as little as an .125% or a .25% as well.

This interest rate advantage makes FHA loans competitive, even if you have to pay both upfront and monthly mortgage insurance .

The low rate also makes it easier to qualify for an FHA loan, as any reduction in monthly payment could be just enough to get your DTI to where it needs to be.

But if you compare the APR of an FHA loan to a conforming loan, you might find that its higher. This explains why many individuals refinance out of the FHA once they have sufficient equity to do so.

You May Like: What Credit Do I Need For A Mortgage

Should I Get A Second Mortgage

Before you take out a second mortgage, consider the risks to make sure this type of financing will work well for your situation. The best reason to get a second mortgage is to use the money to increase the value of your home.

Using the money from a second mortgage to improve your homes value can maintain the equity you have in your home. Plus, if you use a second mortgage to buy, build or substantially improve the home you use to secure the loan, the interest may be tax-deductible.

If youre thinking about getting a second mortgage to buy a car, pay for a vacation or purchase other luxuries, be cautious. The equity in your home is one of your most important assets think twice before using it for these types of expenses.

Complete Guide To Fha Mortgage Loans

FHA home loans are one of the most popular types of mortgages in the United States. With low down payments and lenient credit requirements, they’re often a good choice for first-time homebuyers and others with modest financial resources.

FHA mortgage guidelines allow down payments of as little as 3.5 percent, so you don’t need a big pile of cash to successfully apply for a loan. Credit requirements are less strict than for conventional mortgages, putting these government home loans in reach of borrowers with short credit histories or flawed credit. And FHA mortgage rates are very competitive.

You can use an FHA mortgage to buy a home, refinance an existing mortgage or get funds for repairs or improvements as part of your home purchase loan. If you already have an FHA home loan, there’s a streamline refinance option that speeds qualifying and makes it easier to get approved.

There’s also an FHA reverse mortgage that allows senior citizens to borrow against their home equity but not have to repay the loan as long as they remain in the home.

This guide is broken down into sections to make it easy to find the information you’re most interested in. At certain points, you’ll also find links to further information or indications where you can scroll down for additional details.

Don’t Miss: How To Get Help With Mortgage

Tips For Applying For A Second Fha Loan

- Check your credit history to make sure you know where you are financially.

- Pay bills and debts on time. Even small infractions will build up and reflect on your credit score, making it harder for you to make bigger financial decisions like becoming a borrower in the future.

- As a borrower, before taking out one or multiple loans, remember your debt-to-income ratio must be able to support both your mortgage payments. This will also be checked by lenders and is a huge factor in qualifying for a loan.

- Be organized about your paperwork. File documents properly in both soft and hard copies in case anything happens to either one.

- Dont give up if youre rejected at first. Ask why you were rejected and correct whats needed before seeing the next lender.

- Do your research! Theres a wide range of lenders besides the FHA, all with varying requirements. You can check out rate comparison sites to see which lenders best suit your situation as a borrower.

Can I Use A Home Equity Loan To Buy Another House

Yes, you can use a home equity loan to buy another house. Using a home equity loan to purchase another home can eliminate or reduce a homeowners out-of-pocket expenses. However, taking equity out of your home to buy another house comes with risks. Learn more about using a home equity loan for a second home.

Also Check: What Happens To Second Mortgage After Foreclosure On The First

Is The Irs Suspending Collections In 2022

The IRS is suspending its collections in 2022, according to a recent report. This means that people who owe taxes may not get their money back until after the year. The report says that this decision was made due to budgetary reasons.

It is not clear yet if the IRS will continue this policy or if it will change it.

Remove Mortgage Insurance Premium On Fha Loans

Unlike private mortgage insurance, mortgage insurance premium is charged exclusively on FHA loans.

MIP payments are split up. First, you pay an initial upfront premium at closing. The remaining premium is amortized monthly over the life of your loan, says Stockwell.

Note that on FHA loans with LTV ratios between 70% and 90%, MIP is required to be paid for 11 years.

But with LTVs at 90.01% or more, the MIP must be paid for the entire loan term. So if you have an LTV of, say 91%, and you have a 30-year FHA loan, youll pay MIP for 360 payments, says Stockwell.

This is true unless you refinance or pay off your mortgage early.

If you have an FHA loan, and build more than 30% equity in your home before the required 11-year MIP period is up, a refinance could help you ditch the insurance costs early.

Recommended Reading: What Is The Fha Monthly Mortgage Insurance Premium

How Can I Qualify For Multiple Fha Loans

Understandably, your mortgage lender will want to know that you can afford to repay more than one home loan at a time.

Like you did for your first FHA loan, youll need to meet the minimum credit score, debt-to-income ratio, and down payment requirements to qualify. On top of that, your lender will check your income and assets to make sure youve got the funds to back the buy. Youll also need to be clear of any foreclosures for at least three years to qualify for another FHA loan.

Depending on your credit score, you could put down as little as 3.5%. Keep in mind, youll need to pay mortgage insurance throughout the life of each of your FHA loans. Unlike other loans, which offer the ability to remove mortgage insurance after meeting certain requirements, FHA MIP stays with you for the life of the loan unless you refinance into something like a Conventional loan.

If the reason for your second FHA loan is to accommodate your growing family, youll need to provide evidence that your current home doesnt meet your needs anymore. In this case, youll need to have at least 25% equity in your current home to be eligible for a second FHA loan. If not, youll either have to pay the principal balance down further, or use other loan financing.

Example : A Rapid Rate Of Home Price Appreciation

The example below is based on the same mortgages as above. However, the following home price appreciation estimates are used.

In this example, we only show a single table of monthly payments for the two options . Notice that PMI is dropped in this case in month 13 because of the rapid home price appreciation, which quickly lowers the LTV to 78%.

With rapid home price appreciation, PMI can be eliminated relatively quickly.

The combined mortgages only have a payment advantage of $85 for 12 months. This equals a total savings of $1,020. Starting in month 13, the stand-alone mortgage has a payment advantage of $35. If we divide $1,020 by 35, we can determine that it would take about 29 months to make up the initial savings of the combined first and second mortgages.

In other words, starting in month 41, the borrower would be financially better off by choosing the stand-alone first mortgage with PMI.

Don’t Miss: Will Mortgage Rates Stay Low

Reasons You May Qualify For An Fha Loan On A Second Property

Generally, FHA loans are only for borrowers who will use the home as their primary residence. But FHA guidelines allow for some exceptions.

For example, you might be thinking, I have an FHA loan and want to buy another house.

You could use a conventional loan, but heres when you could qualify for an FHA loan as a second-time homebuyer:

You Relocated Because Of Your Job

If a person moved for work and didnt want to sell their current residence, she/he may be eligible for an FHA loan as a second-time homebuyer. The FHA 100 Mile Rule requires that a persons new house needs to be 100 miles or more from the old one thats the case whether a person lives in a single-family home or an apartment.

You May Like: Does Goldman Sachs Do Mortgages

How To Choose A Right Fha Lender

When you already have an FHA loan and are considering a second property, you may still use one in certain circumstances. We will help you on your journey to get you a second-time FHA loan.

We are a dedicated and experienced group of professionals. Were committed to assisting you in obtaining the financing you need to purchase a property. Get in touch with us right away!

The first step in obtaining an FHA loan is to figure out which one is the best for you. The decision of which FHA lender to select is perhaps the most crucial choice youll make. Choosing the incorrect mortgage broker or a lender may cost you losing your ideal property or thousands of dollars in extra interest over the course of your mortgage.

Fha Standard Refinance Loans

The standard FHA refinance loan is the 203 loan, mentioned above. FHA refinance rates and other guidelines are similar to those on a home purchase, although you can qualify with only 3.25 percent home equity, just under the 3.5 percent down payment required on a purchase.

This can be a good option for borrowers with a non-FHA mortgage who are having difficulty refinancing due to a low credit score or lack of home equity, as FHA refinance guidelines are less stringent than for conventional refinancing.

You can use this type of refinancing to get a lower mortgage rate, to shorten the term of your current mortgage to pay it off more quickly, to convert an ARM to a fixed-rate mortgage or vice versa, or to extend your current mortgage term in order to lower your monthly payments.Your lender may allow you to roll your closing costs into the loan with a standard FHA refinance, or may waive them in return for charging a somewhat higher mortgage rate.You do not need to refinance with your current lender, nor do you need to currently have an FHA loan to refinance into an FHA mortgage.

Recommended Reading: What Is The Best Refinance Mortgage Company

Do Mortgage Lenders Look At Irs Debt

Mortgage lenders may look at IRS debt when making a decision to refinance a home loan. IRS debt is a form of debt that the government owes. This debt can be from any type of purchase, such as a car or home. Loan officers may want to take into account IRS debt when determining an offer price for a refinancing project.

Types Of Piggyback Loans

There are two ways a piggyback loan can be structured. The first an 80/10/10 loan, which we just looked at is the most popular. But a 75/15/10 loan is also an option. With this variation, the primary mortgage finances only 75% of the home price instead of 80 percent.

80/10/10 piggyback structure:

- 80% of the purchase price is financed by the primary mortgage

- 10% comes from a second mortgage, often a HELOC

- 10% still comes from the buyers cash down payment

75/15/10 piggyback structure:

- 75% of the purchase price is financed by the primary mortgage

- 15% comes from a second mortgage, often a HELOC

- 10% still comes from the buyers cash down payment

Some home buyers use the 75/15/10 structure to avoid getting a jumbo mortgage or to finance a home that requires a higher down payment .

Don’t Miss: How A Mortgage Refinance Works

How You Can Get An Fha Loan For A Second Home

You can get a second loan from the Federal Housing Administration if you’re:

| ð Relocating for a new job thatâs more than 100 miles from your primary residence |

| ðª Adding legal dependents and need a bigger home |

| ð Leaving a home you owned with others and now looking for your own home |

| ð A coborrower on someone else’s loan but now looking for your own home |

How To Apply For An Fha Loan

The FHA doesn’t issue mortgages itself. The Federal Housing Association is a federal agency that insures privately issued mortgages that meet FHA guidelines. It essentially acts as a buffer for lenders by reducing their risk in issuing home loans. This makes it easier for borrowers to obtain those loans as well, and at lower interest rates.

You can apply for an FHA loan at any bank or other financial institution that is an FHA-approved lender. Most mortgage lenders are.

More information: FHA loans: Four mistakes to avoid

Don’t Miss: Who Offers Interest Only Mortgage Loans

Types Of Second Mortgages

Borrowers who wish to take out second mortgages can choose between home equity loans or home equity lines of credit. Heres a look at each of these financing options.

- Home equity loan: A home equity loan comes with a fixed monthly payment. You receive all of the money upfront and pay it back, with interest, over time. To see if it makes sense for you, use Bankrates home equity loan calculator.

- Home equity line of credit : A HELOC also lets you access the equity in your home, but youre charged interest only on the amount that you borrow. This can be a great option if youre not sure exactly how much of your equity youre looking to borrow. Use our HELOC payoff calculator to see if this option makes sense for you.