Discover: Best Home Equity Loan For Low Rates

Overview: Discover is well known for its rewards credit cards, but this national bank also offers a full lineup of banking services, such as checking and savings accounts, personal loans and student loans. We chose this bank as the best for low rates because of its national reach and low rates.

Why Discover is the best home equity loan for low rates: Its APRs start at 6.99 percent.

Perks: Discovers home equity loans allow you to borrow up to $300,000 against your home equity. You can choose a loan term of 10, 15, 20 or 30 years. Plus, borrowers wont pay origination fees, application fees, home valuation fees or cash at closing. Its a solid option thats available to most borrowers across the country.

What to watch out for: The best rates go to customers with excellent credit, so if your credit score needs work, you may want to look elsewhere. Also, borrowers who pay their loans off within 36 months may have to repay closing costs covered by Discover .

- LENDER:

What Are The Minimum Requirements

Many lenders have fixed LTV ratio requirements for their home equity loans, meaning youll need to have a certain amount of equity in your home to qualify. Lenders will also factor in your credit score and income when determining your rate and eligibility.

Minimum requirements generally include a credit score of 620 or higher, a maximum loan-to-value ratio of 80 percent or 85 percent and a documented source of income.

Compare Our Top Lenders

Bestmoney is a dba of Natural Intelligence Technologies Inc.

Natural Intelligence Technologies Inc. NMLS # 2084135

CT: Mortgage Broker only, not a mortgage lender or mortgage correspondent lender.

- Advertising Disclosure

This site is a free online resource that strives to offer helpful content and comparison features to our visitors. We accept advertising compensation from companies that appear on the site, which impacts the location and order in which brands are presented, and also impacts the score that is assigned to it. Company listings on this page DO NOT imply endorsement. We do not feature all providers on the market. Except as expressly set forth in our Terms of Use, all representations and warranties regarding the information presented on this page are disclaimed. The information, including pricing, which appears on this site is subject to change at any time.

Close

You May Like: How Long For A Mortgage Pre Approval

Maintenance Utilities And Repairs

Just like your first house, theres no getting away from these things on your second one. When researching the location of your second home and associated expenses, remember to take into consideration things like landscaping and potential weatherproofing. For example, if youre purchasing somewhere that has a lush garden, that garden will need to be maintained even when youre not there. The same holds for things like swimming pools, where they may need to be closed during the winter and reopened in the spring. Perhaps your second home is in an area that could be threatened by weather systems, such as tropical storms or hurricanes. Youll need to make sure youre adequately prepared and have people in place who can access the home and take appropriate measures if necessary.

Theres also the cost of utilities and repairs as they come up. If you choose a property manager, they can take care of most of these things in your absence. They would also be the contact for renting out the property if you wanted to do so when not staying there yourself. When the microwave goes out though, or the plumbing backs up, youll want to ensure that youre in a comfortable enough position financially to be able to tackle these things without frustration.

What Is A Second Mortgage And How Does It Work

A second mortgage enables you to put your home’s equity to good use, but there are factors to consider when taking on more debt.

Ellen Chang

Ellen Chang is a freelance journalist based in Houston. She has covered personal finance, energy and cybersecurity topics for TheStreet, Forbes Advisor and U.S. News & World Report as well as CBS News, Yahoo Finance, MSN Money, USA Today and Fox Business.

A second mortgage is a loan made in addition to the homeowner’s original mortgage, which is still being repaid. For a homeowner who has seen the value of their property increase over the past two years in the wake of the coronavirus pandemic, taking on a second mortgage is an option that allows them to tap into their home equity and use it to fund such major expenses as home renovations, pay down debt, or pay for their child’s college expenses.

Don’t Miss: How Do You Figure Out Mortgage Interest

Discover Best For New Homeowners With Little Equity

If you dont have a ton of equity in your home, youre in luck. Discover offers loan amounts from $35,000 to $200,000 with fixed-term interest rates as low as 3.99%. Loan terms can be from 10 years to 30 years. And, homeowners dont have to worry about closing costs, appraisal fees, application fees or loan origination fees. In fact, you dont have to bring any cash at all for closing.

The downside is that if you pay your loan balance off in full within three years after your loan closes, you are on the hook to reimburse Discover for a portion of the closing costs originally paid on your behalf, up to $500.

Our Recommended Lenders For 15

AmeriSave Mortgage Corporation is a full-service mortgage lender operating in 49 states and DC. Established in Atlanta in 2002, it has funded 220,000+ homes for a total value of more than $55 billion. AmeriSave is known for offering streamlined online applications with the option of contacting customer support any time you need assistance.

- Apply and submit forms directly online

- No SSN needed to get pre-approved rates

- Recommended for refinancing

AmeriSave MortgageView Rates

Quicken Loans is one of the most reputable mortgage lenders. It offers a large range of mortgage options including refinance loans, FHA, USDA, VA loans, jumbo loans and more.

- Fast application process

- A bevy of educational resources

- Award winning customer service

Quicken LoansView Rates

You can get pre-approved for a mortgage in minutes with Better mortgage. There are no origination or lender fees, no commission, and no prepayment penalties. Better allows you to lock in your rate and connects you with a single loan officer once you’ve finished the pre-approval process.

- No origination or lender fees

- Various fixed and variable rate options

- Fast approval process

BetterView Rates

Recommended Reading: What Was The Mortgage Interest Rate In 2017

How Much Can I Borrow

The amount you can borrow depends on how much equity you have in your home, and how much money you owe on your mortgage. In Canada, the maximum amount you can borrow for a second mortgage is up to 80% of your homes appraised value, minus your mortgage balance.

For example, if your home is valued at $500,000, 80% of that amount is $400,000. If you have $250,000 left on your mortgage, you may be eligible to borrow up to $150,000.

When you take out a second mortgage in the form of a home equity loan, youll receive the funds as a one-time lump sum deposit. Just like your primary mortgage, youll be required to make repayments on a schedule set out in your second mortgage contract.

Bocs Macklem Reiterates That Rates Need To Rise Further But By How Much

For the second time this month, Bank of Canada Governor Tiff Macklem said that interest rates need to rise further.

He made the comment on Wednesday while speaking before the finance committee in Ottawa.

In the face of still-high inflation and an economy that continues to be in excess demand, Macklem said the Bank of Canada is trying to balance the risks of under- and over-tightening.

If we dont do enough, Canadians will continue to endure the hardship of high inflation. And they will come to expect persistently high inflation, which will require much higher interest rates and, potentially, a severe recession to control inflation, he said, repeating comments he made earlier in the month.

If we do too much, we could slow the economy more than needed. And we know that has harmful consequences for peoples ability to service their debts, for their jobs and for their businesses.

Macklem acknowledged that the impact of higher rates is starting to weigh on growth, particularly the parts that are most sensitive to interest rates, such as housing and spending on big-ticket items.

But, the effects of higher rates will take time to spread through the economy, he added. The Banks current forecast is for economic growth to stall to close to zero over the next few quarters.

The Bank has so far raised its overnight target rate by 350 basis points this year, taking it from a low of 0.25% to 3.75% today.

We are getting closer, but we are not there yet, he said.

Don’t Miss: What Is The Payment On A 160 000 Mortgage

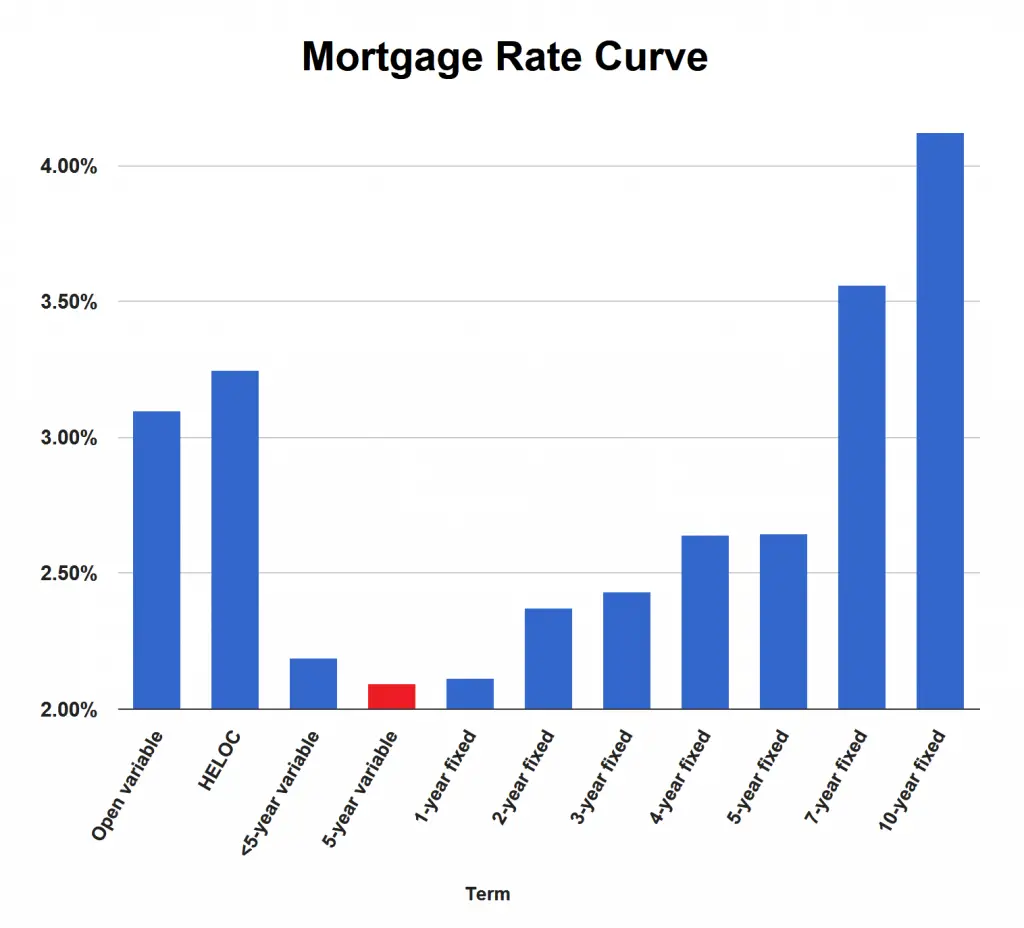

What Kind Of Rate Can You Get With A Second Mortgage

Like most loans that have collateral, interest rates tend to be lower than that of a credit card or unsecured line of credit, for example. However, its important to note that a second mortgage always has a higher interest rate than a first mortgage. This is because the lender assumes more risk on a second mortgage than the first. If a borrower defaults on the loan or fails to pay it back, the first lender always gets paid out first. The second lender takes more risk than the first lender because the chance of being paid out on time is lower than for the first lender or mortgage.

Fixed and Variable Rates

When deciding on a rate with your lender, you will often have the choice of either a fixed rate or a variable rate. Fixed rates are constant rates that do not change for an agreed-upon period of time. For example, a lender might offer you a fixed rate of 2.8% for 5 years. A variable-rate changes with the market. This means that you could start with a more competitive rate, lets say 1.8%, but it also means that the rate can skyrocket with the market.

Also Check: Does Rocket Mortgage Sell Their Loans

Fairway Independent Mortgage Corporation: Best For First

With more than 700 branches, Fairway Independent Mortgage Corporation can offer an in-person experience to both first-time and repeat homebuyers across the U.S.

Strengths: TIf youve never taken out a mortgage before, Fairway has an extensive glossary of mortgage terms you can read up on, several mortgage calculators and a homebuyer guide with a checklist, dos and donts and more. The lender also offers first-time homebuyer-friendly loans, including FHA loans, and a mobile app, FairwayNow, where you can send direct messages and track your loan status.

Weaknesses: Youll have to talk to a loan officer to find out rates and fees these arent available readily on Fairways website.

You May Like: What Is The Mortgage On A 1.5 Million Dollar House

How To Get Started

You can apply for a Discover home equity loan online or by calling 855-361-3435. To get started, youll need to provide information about yourself, your finances and your property. Youll also share how much you want to borrow and the purpose of the loan, and provide your date of birth and Social Security number to verify your identity.

Once you submit your application, you may get prequalified for multiple loan options within a few minutes. After that, you can upload documents, provide additional information and electronically sign documents online.

If youre applying online and have questions, you can call and speak with a personal banker who can help.

Before you accept a loan with Discover, however, shop around and compare loan terms with other lenders to ensure that you get the best deal available.

How Do Second Home Mortgage Rates Differ From Rates For A Primary Residence

Mortgage rates are somewhat higher on second home mortgages by as much as 0.5 percent, 0.75 percent or 1 percent more. This is in part to compensate for the risk of a second home, which youre much more likely to walk away from if you werent able to make payments compared to your primary residence.

You May Like: What To Look For When Applying For A Mortgage

How Do I Figure Out How Much I Can Borrow

- Main

-

Everyone’s financial situation differs it is important to recognize what you can comfortably afford to borrow. In general, the loan amount you can afford depends on four factors:

- Your debt-to-income ratio, which is your total monthly payments as a percentage of your gross monthly income

- The amount of cash you have available for a down payment and closing costs

- Your credit history

- The value of the property you are purchasing

For a better understanding of how much you can afford to borrow, use Discovers Affordability Calculator.

You are leaving Discover.com and entering a website operated by a third party. We are providing the link to this website for your convenience, or because we have a relationship with the third party. Discover Bank does not provide the products and services on the website. Please review the applicable privacy and security policies and terms and conditions for the website you are visiting. Discover Bank does not guarantee the accuracy of any financial tools that may be available on the website or their applicability to your circumstances. For personal advice regarding your financial situation, please consult with a financial advisor.

Pros Of A Second Mortgage

- Second mortgages can mean high loan amounts. Some lenders allow you to take up to 90% of your homes equity in a second mortgage. This means that you can borrow more money with a second mortgage than with other types of loans, especially if youve been making payments on your loan for a long time.

- Second mortgages have lower interest rates than credit cards. Second mortgages are considered secured debt, which means that they have collateral behind them . Lenders offer lower rates on second mortgages than credit cards because theres less of a risk that the lender will lose money.

- There are no limits on fund usage. There are no laws or rules that dictate how you can use the money you take from your second mortgage. From planning a wedding to paying off college debt, the skys the limit.

You May Like: Is A Mortgage Pre Approval A Soft Inquiry

Are Second Mortgage Rates Higher

Second charge mortgage rates are usually higher than the interest rate you were offered on your first charge mortgage. The main reason for this is because having the first charge means you have more debt and are therefore a greater lending risk. It will be harder to satisfy affordability tests with bigger existing debt.

However, the second charge interest rate will be determined by personal circumstances and your credit score, which may have improved since taking out your first charge mortgage.

You Could Enjoy A Low Variable Introductory Rate On A Home Equity Line Of Credit

Now:

Special Introductory variable APR for 6 months

Later:

Variable APR after the introductory period

This rate includes discounts of } for automatic payment and } for a $60,000 initial withdrawalVariable APR Disclosures

Home equity assumptions based on a $100,000 line of credit

We’re unable to display rates at this time. We apologize for any inconvenience. Our experienced lending specialists are ready to help you with your financing needs:

866.290.4674

Don’t Miss: What Is A Non Qm Mortgage

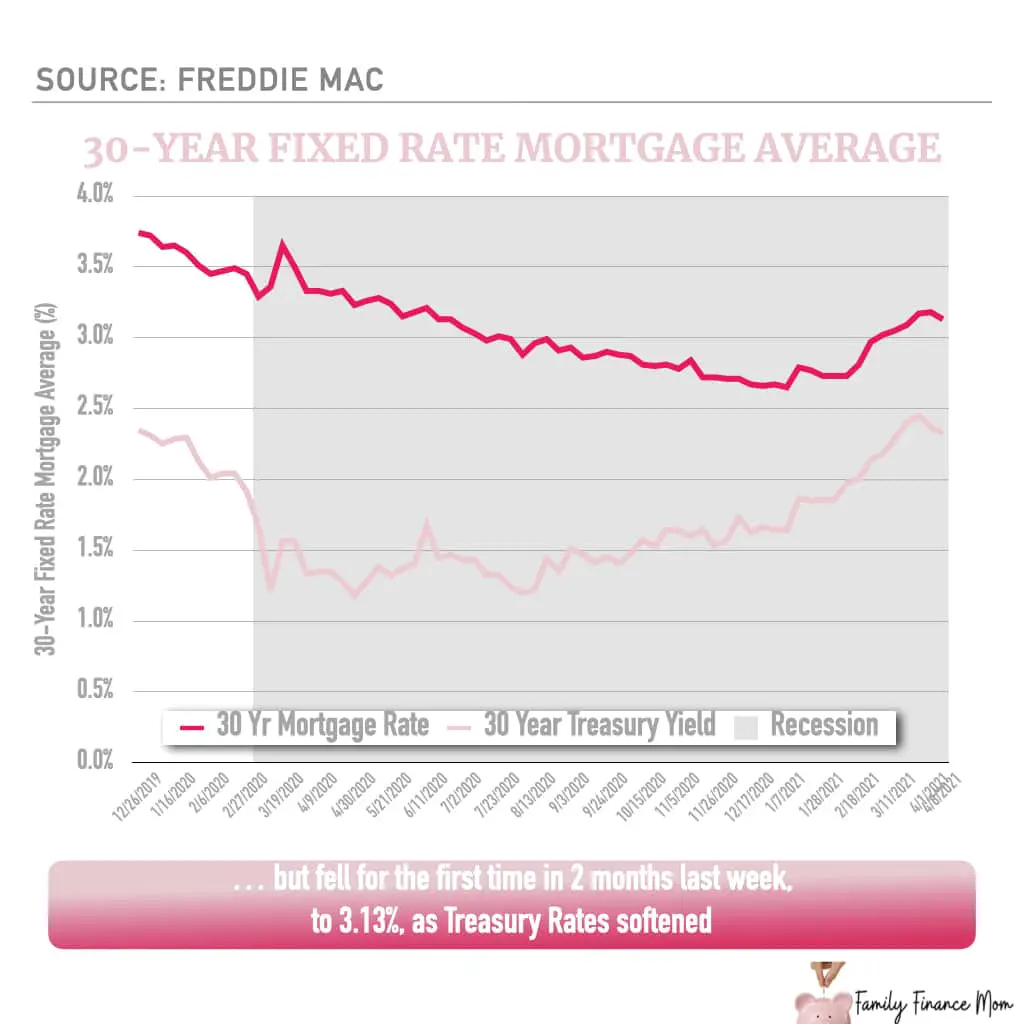

How Long Can You Lock In A Mortgage Rate

Locks are usually in place for at least a month to give the lender enough time to process the loan. If the lender doesnt process the loan before the rate lock expires, youll need to negotiate a lock extension or accept the current market rate at the time.

Even if you have a lock in place, your interest rate could change because of factors related to your application such as:

- A new down payment amount

- The home appraisal came in different from the estimated value in your application

- There was a sudden decrease in your credit score because you are delinquent on payments or took out an unrelated loan after you applied for a mortgage

- Theres income on your application that cant be verified

Talk with your lender about what timelines they offer to lock in a rate as some will have varying deadlines. An interest rate lock agreement will include: the rate, the type of loan , the date the lock will expire and any points you might be paying toward the loan. The lender might tell you these terms over the phone, but its wise to get it in writing as well.

Our Specialized Savings Account Options

- POWERFLEX MONEY MARKET ACCOUNT

- VACATION AND HOLIDAY CLUB SAVINGS

Our tiered PowerFlex Money Market Account provides higher balance savers with higher than regular savings account rates, free in-person withdrawals, and greater liquidity than a CD.

| Product | |

|---|---|

| PowerFlex Money Market $0.01 – $9,999.99 | $1,000 |

| PowerFlex Money Market $10,000.00 – $24,999.99 | $1,000 |

| PowerFlex Money Market $25,000.00 or more | $1,000 |

Rates are effective as of 11/14/2022

*Annual Percentage Yield

Fees charged on some accounts may reduce your earnings.

Rates and terms are subject to change without notice.

One of the best ways to save is to make it a regular process. On a set schedule an amount you specify is automatically withdrawn from your Ridgewood Checking Account and deposited into your Vacation and Holiday Club Savings Account. Club Savings Accounts are a great way to save for vacations, special events, or the holidays.

| Product | |

|---|---|

| Vacation and Holiday Club Account | $1.00 |

Rates are effective as of 11/14/2022

*Annual Percentage Yield

A new or existing checking account is required.

Fees charged on some accounts may reduce your earnings.

Rates and terms are subject to change without notice.

Recommended Reading: How Much Income For 500k Mortgage