Can I Get A 500k Mortgage And How Much Will The Repayments Be

If you are looking to buy a property that requires a mortgage of £500,000 or more, there are a number of factors to consider when assessing how likely you are to be accepted for the loan. Top of this list will be whether you can afford a mortgage of this size and whether you are likely to pass the strict affordability assessments that are now part of the mortgage application process.

In this article we explore everything that’s involved in getting a £500,000 mortgage – including how much it is likely to cost – and explain how to find the best deal for you.

Whats A Homeowners Insurance Premium

A homeowners insurance premium is the cost you pay to carry homeowners insurance a policy that protects your home, personal belongings and finances. The homeowners insurance premium is the yearly amount you pay for the insurance. Many home buyers pay for this as part of their monthly mortgage payment.

Lenders typically require you to purchase homeowners insurance when you have a mortgage. The coverage youre required to purchase may vary by location. For example, if you live in a flood zone or a state thats regularly impacted by hurricanes, you may be required to buy additional coverage that protects your home in the event of a flood. If you live near a forest area, additional hazard insurance may be required to protect against wildfires.

Compare Lenders To Find Competitive Rates And Terms That Fit Your Businesss Budget

A $500,000 business loan average is slightly lower than your average business loan around $660,000, according to the Federal Reserve. That means your business has lots of options when it comes to comparing lenders. Look into a few providers to make sure youre getting the most competitive rates and terms before you apply.

Recommended Reading: How Much Does Mortgage Go Up Per 10000

Check Your Credit Score

Its important that you request your credit report before you start the application process and find out your credit score.

Your is a three-digit summary of your creditworthiness. Borrowers with high credit scores will typically be offered the lowest interest rates, while those with low scores will be offered the most expensive rates.

You can get a free once per year from each of the three major . You may also access your credit report for free under certain conditions, for example, if youre the victim of identity theft.

Additionally, thanks to the CARE Act, you can now access free weekly reports from the three major credit bureaus, at least until April 2022.

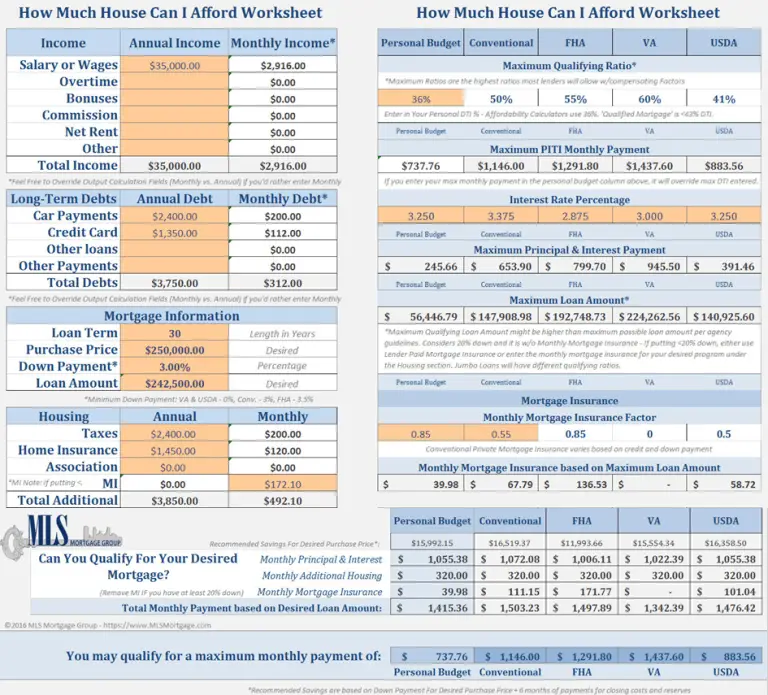

How To Determine How Much Home You Can Afford

Buying a house is exciting, especially as you tour new places and eventually fall in love with a home. But how do you determine your price range? To set realistic expectations, consider your personal finances, borrowing options, and the total costs of buying.

Heres what well cover:

Read Also: What Is A 30 Year Fixed Jumbo Mortgage Rate

Don’t Miss: How Do I Shop For Mortgage Rates

Dont Overextend Your Budget

Banks and real estate agents make more money when you buy a more expensive home. Most of the time, banks will pre-approve you for the most that you can possibly afford. Right out of the gate, before you start touring homes, your budget will be stretched to the max.

Its important to make sure that you are comfortable with your monthly payment and the amount of money youll have left in your bank account after you buy your home.

Additional Mortgage Costs To Consider

There are a few other costs to factor into your total payment calculations when taking out a £500,000 mortgage:

Most mortgages come with fees to pay when setting it up and larger mortgages such as this could result in higher fees. This can include a booking fee, an arrangement fee, and a valuation fee. If you lump these costs onto your mortgage, it can mean nothing to pay upfront, but it will increase how much you pay each month.

Its worth thinking about the additional costs of any insurance you may need for your payments. This can include life insurance to cover the mortgage if you die, income protection if youre unable to work, or critical illness cover to help with costs if you get diagnosed with a serious condition.

Depending on the value of the home and if its your first home, youll have to pay a level of stamp duty. For first-time buyers, at the time of writing, theres nothing to pay on the first £300,000. And then 5% on the next portion up to £500,000. Otherwise, its 0% up to £125,00, 2% from £125,001 to £250,000, and then 5% on the last level from £250,001 to £500,000. These figures may be higher if you already own another property.

These charges will often be paid during the process. So, it wont affect the monthly payments for your £500k mortgage, but it is an extra cost to factor into your calculations.

Read Also: What Are Bank Mortgage Rates

How Much Can I Afford To Borrow

Knowing how much you may be able to borrow is one thing, but knowing how much you can comfortably afford and being confident in your ability to keep up with your repayments is another. This is why youll need to carefully go through your outgoings, making sure to use a mortgage repayment calculator so you get an idea of what your repayments could be and whether you could absorb them in your current salary.

Bear in mind that if youre moving to a bigger property there could be additional expenses to pay, and if youre moving from rented accommodation into homeownership, your outgoings could change again, and thats before we even get to the additional costs of moving . This means its vital to go through everything in advance to make sure youre prepared for the impact on your finances.

Once youve tallied everything up, you can make a decision about the kind of mortgage you can comfortably afford. Though make sure to be realistic its generally recommended that no more than 28% of your household income should go on housing expenses, so if your final total is above this level, it may be worth reconsidering.

How Much Will A 500k Mortgage Cost

A £500,000 mortgage is a sizeable debt to take on and working out what the monthly repayment is going to be, both during the initial offer period and over the long term, is vital in helping you assess whether it is going to be affordable for you. The cost of your repayments will be determined by two factors:

Don’t Miss: How Much Mortgage Can I Afford With 100k Salary

Monthly Principal & Interest

The principal is the amount of money borrowed on a loan. The interest is the charge paid for borrowing money. Principal and interest account for the majority of your mortgage payment, which may also include escrow payments for property taxes, homeowners insurance, mortgage insurance and any other costs that are paid monthly, or fees that may come due.

How Much Do I Need To Earn For A 100000 250000 Or 500000 Mortgage

Our calculator shows that for a £100,000 mortgage you will need to earn at least £22,500 as a single applicant or between you if youre applying for a joint mortgage. Bear in mind that a £100,000 mortgage can result in different LTVs and therefore different rates, depending on the amount of deposit you have and the overall value of the property.

For a £250,000 mortgage you will need to earn at least £56,000 as a single applicant or between you if applying as a couple, while for a £500,000 mortgage you will need a earn at least £111,500 as a single applicant or as joint income for a shared mortgage.

Recommended Reading: What Is Mortgage Payment On 350 000

What Monthly Repayments Can I Expect On A 500000 Mortgage

How much is a mortgage for a £500,000 home?

Unfortunately theres no simple answer to this question. When it comes to home loans, how much a mortgage is on a £500k house is dependant on a number of different variables.

All lenders have their own requirements and eligibility criteria which determine what interest rates they offer, and therefore how much a £500,000 mortgage costs you in repayments.

Best Mortgage Lenders For A 500k Loan

When you want to buy a house with a mortgage of 500k, its a huge deal, so its wise to find the best mortgage lender to help you do that. We recommend shopping for offers from at least three different lenders to find the best rate.

You can compare mortgage rates and other loan terms and choose the best fit for you. Taking the time to do your research can really pay off big, Im talking about thousands of dollars over the life of the loan.

To help you choose the best mortgage lender, Smarts has picked the best mortgage lenders that weve found that offer an online easy application to help you get a home loan with the best terms.

Don’t Miss: Does Chase Allow Mortgage Recast

Required Income Calculator For A Home Purchase Or A Refinance

Have you found a home that you want to buy? Or plan on refinancing? Or youre looking at homes around a certain price point. Can you get a loan to buy it? Need to see how much you can qualify for on a refinance?

This mortgage income calculator can give you the answer. This calculator not only takes into account the loan amount and interest rate, but also looks at a whole range of other factors that affect the affordability of a home and your ability to get a mortgage, including your other debts and liabilities that have to be paid each month, as well as costs like taxes and homeowners insurance that are part of the monthly mortgage payment.

It also makes it easy to see how changes in the mortgage rate or the loan amount affect the income required for a loan, by using the sliding adjusters below to change your results. Just start filling out the fields indicated below. Or scroll down the page for a detailed explanation of how to use the Mortgage Required Income Calculator.

- FAQ: Great tool to use as loan amount estimates change as you shop for a new home. Or for a refinance when the appraised value forces a change in loan amounts because of loan to value .

Dont Miss: Whats The Mortgage Rate

Average Price Of Homes

The average price of homes varies based on several factors, such as the age of the house, location, square footage, and several other characteristics. Regardless of all these, the consensus is that the price of homes is on the rise. Zillow claims the typical value of homes in the US is $337,560 as of March 2022. St Louis Fed claims the median sale price of houses is $428,700 in the first quarter of 2022. This shows just how expensive homes have become in the US and the fact that 500k homes are now more common than ever.

There are several places in the US where its hard to find homes in a good neighborhood for 500k. Cities such as New York City, San Francisco, Los Angeles, San Diego, and several others have become or are close to becoming million-dollar cities due to the average price of homes in those cities being over a million or close to that.

Also Check: Who Do I Pay My Mortgage To

What Income Do You Need For A $400k

Start here to compare mortgage rates

Coverage and rates tailored to fit your needs

Lower rates

Compare multiple quotes and choose the most economical one

Reputable providers

We work in a network of trusted providers

Owning a home is a dream for many. However, purchasing one is a complex process. From making an offer to negotiating closing costs, the financial aspects of home-buying can be frustrating for even the savviest shopper.

What We’ll Cover

However, one thing that shouldn’t feel challenging should be figuring out the income you need to qualify for a mortgage. If youre looking for a jumbo loan between $400K and $500K, read on to learn more.

How Down Payment Size Impacts Home Equity

| Percentage | |

|---|---|

| $250,000 | $0 |

The rule of thumb still stands: 20% of the home value is the ideal amount of money for a down payment. This amount buys you equity in the home, which helps secure the loan. When you donât have a least 20% to put down, you have to find alternate means to secure the mortgage.

This can mean private mortgage insurance , which is an added monthly charge to secure your loan. If you donât have enough money for a down payment, many lenders will require that you have mortgage insurance. Youâll have to pay your monthly mortgage as well as a monthly insurance payment, so itâs not the best option if your budget is tight.

Youâll stop paying PMI when your mortgage reaches about 78% of the homeâs value. While certain homebuyers can qualify for little or no down payment, through VA loans or other 0% down payment programs, most homeowners who donât have a large enough down payment will have to pay the extra expense for PMI.

Recommended Reading: What Is A Good Tip On A Mortgage

Factors That Impact The Monthly Cost

Here are some critical areas that will help determine the monthly cost of your £500,000 mortgage:

How long you take your mortgage out for will make a noticeable difference to the payments. A longer term often means smaller payments, but youre likely to end up paying more over the life of the loan. So, to use the example given above, a 30 year term with the same interest rate would reduce your payments from £2,371 per month to £2,108.

This will be crucial to your final monthly payment figure. A higher rate of interest will mean more expensive monthly repayments. Even a small difference can really add up on a mortgage this size. So, again using the example above, an interest rate of 2.5% over the same term would see your payments reduce to £2,243 per month.

When setting up the mortgage, some of the options you can look at are a fixed rate vs tracker mortgage. A tracker mortgage can be a bit cheaper, but your payments could rise in line with interest rates. Fixed rate gives you more stability, but likely a higher monthly cost. You might also be able to get an interest-only mortgage, which would be the cheapest in terms of monthly payments, but harder to secure for a residential property.

What Are The Income Requirements For Refinancing A Mortgage

Mortgage refinancing options are reserved for qualified borrowers, just like new mortgages. As an existing homeowner, youll need to prove your steady income, have good credit, and be able to prove at least 20 percent equity in your home.

Just like borrowers must prove creditworthiness to initially qualify for a mortgage loan approval, borrowers have to do the same for mortgage refinancing.

Don’t Miss: What Is Cash Out On A Mortgage

Income Is A Significant Part Of Deciding How Much You Could Borrow

Income is crucial for determining how big a mortgage you can have. Traditionally, mortgage lenders applied a multiple of your income to decide how much you could borrow. So, if you earn £30,000 per year and the lender will lend four times this, they may be willing to lend £120,000.

When it comes to households with two incomes, some lenders offer a choice:

The option to add the second income on top of the multiple, so if the main breadwinner earns £30,000 and the second person’s income is £15,000 a lender might offer 4x the first income, plus the second income or

A slightly lower multiple for two incomes than for one. So £30,000 + £15,000 = £45,000. Then £45,000 x 3 = £135,000

Many lenders now only use income multiples as an overall maximum that they will lend, conducting a detailed affordability assessment to decide how much they are willing to lend. This is something that has become particularly strict following mortgage regulations introduced in 2014.

If part of your income is comprised of a bonus or overtime, you may not be able to use this, or if you can, you may only be able to use 50% of the money towards what the lender deems as your income. All income you declare in your mortgage application will need to be proven usually through you providing your latest pay slips, pensions and benefits statements.

Can I Include Overtime Payments When Calculating How Much I Can Borrow For A Mortgage

This depends on both how regular your overtime is and the attitude of the lender concerned. Some lenders will not consider any additional income you may receive through overtime, while others may accept all or 50% of this income. Any earnings from overtime to be included as part of your mortgage application will need to be regular or guaranteed and be evidenced.

If however overtime is something you only get occasionally then the lender may not take it into account at all. This is where a mortgage broker can help they will know which lenders are more likely to accept overtime as part of their income calculations.

You May Like: Is A Mortgage A Line Of Credit

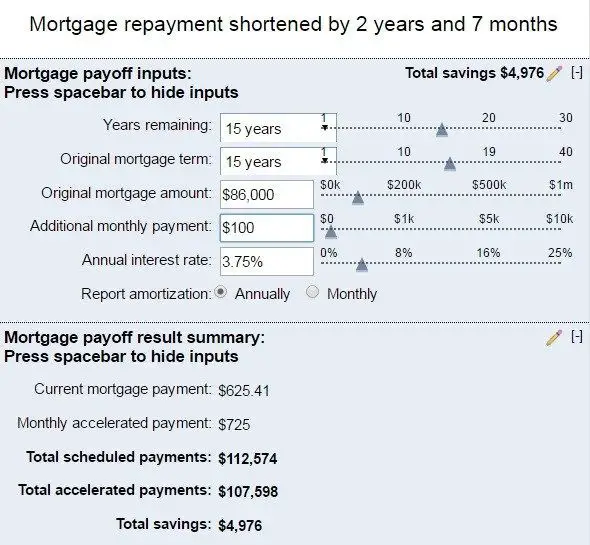

Early Repayment And Extra Payments

In many situations, mortgage borrowers may want to pay off mortgages earlier rather than later, either in whole or in part, for reasons including but not limited to interest savings, wanting to sell their home, or refinancing. Our calculator can factor in monthly, annual, or one-time extra payments. However, borrowers need to understand the advantages and disadvantages of paying ahead on the mortgage.

Early Repayment Strategies

Aside from paying off the mortgage loan entirely, typically, there are three main strategies that can be used to repay a mortgage loan earlier. Borrowers mainly adopt these strategies to save on interest. These methods can be used in combination or individually.

Reasons for early repayment

Making extra payments offers the following advantages:

Drawbacks of early repayment