Where Do You Want To Live

}, }

! Your browser does not support geolocation. Consider using another browser.

How much mortgage can I afford?

The first step in searching for your home is understanding how large of a mortgage you can afford. With a few inputs, you can determine how much mortgage you may be comfortable with and the potential price range of your future home. Knowing your total household income, how much youâve saved for a down payment, and your monthly expenses , plus new expenses youâd take on , you can get a reasonable estimate. Learn more about factors that can affect your mortgage affordability.

How to estimate affordability

To estimate mortgage affordability, lenders will use two standard debt service ratios: Gross Debt Service and Total Debt Service . According to the Canadian Mortgage and Housing Corporation¹Note 1:

-

– GDS is the percentage of your monthly household income that covers your housing costs . It should be at or under 35% of your pre-tax household income.

-

– TDS is the percentage of your monthly household income that covers your housing costs and any other debts . It should be at or under 42% of your pre-tax income.

How your down payment affects affordability

The amount you have saved for a down payment is also another important piece of information to help determine affordability. Depending on the purchase price of a home, there are minimum amounts required for your down payment²Note 2:

Step 2 of 6

The Bottom Line: Deciding How Much House You Can Afford

Ultimately, how much home you can afford depends on your financial situation and preferences. It requires a more comprehensive decision than just how much money you want to spend on mortgage payments each month.

Evaluate your full financial situation, your ability to pay off a mortgage and where you need to save for other things. Once youve done all that, its time to go after that perfect home.

A vital step in figuring out how much youre able to spend on a home is seeking out mortgage approval. Get approved with Rocket Mortgage today.

Get approved to buy a home.

Rocket Mortgage® lets you get to house hunting sooner.

Should I Speak To A Mortgage Broker

Mortgage brokers remove a lot of the paperwork and hassle of getting a mortgage, as well as helping you access exclusive products and rates that arent available to the public. Mortgage brokers are regulated by the Financial Conduct Authority and are required to pass specific qualifications before they can give you advice.

Call or request a callback

Mortgage Advice Bureau offers fee free mortgage advice for Moneyfacts visitors that call on 0808 149 9177. If you contact Mortgage Advice Bureau outside of these channels you may incur a fee of up to 1%. Lines are open Monday to Friday 8am to 8pm and Saturday 9am to 1pm excluding bank holidays. Calls may be recorded.

Your home may be repossessed if you do not keep up repayments on your mortgage.

Read Also: What Is Apr Vs Mortgage Rate

Major Factors That Influence Mortgage Eligibility

When qualifying for a mortgage, lenders rely on standard indicators that determine whether a borrower can repay a loan. These financial factors also influence how much they are willing to lend borrowers. Lenders will thoroughly evaluate your income and assets, credit score, and debt-to-income ratio.

Let’s Start With The Basics

Gross annual household income is the total income, before deductions, for all people who live at the same address and are co-borrowers on a mortgage. Enter an income between $1,000 and $1,500,000.

A down payment is the amount of money, including deposit, you put towards the purchase price of a property.

Minimum down payment amounts:

- For homes that cost up to $500,000, the minimum down payment is 5%

- For homes that cost between $500,000 and $1,000,000, the minimum down payment is 5% of the first $500,000 plus 10% of the remaining balance

- For homes that cost over $1,000,000, the minimum down payment is 20% or more depending on property location

For down payments of less than 20%, home buyers are required to purchase mortgage default insurance.

A down payment is the amount of money, including deposit, you put towards the purchase price of a property.

Minimum down payment amounts:

- For homes that cost up to $500,000, the minimum down payment is 5%

- For homes that cost between $500,000 and $1,000,000, the minimum down payment is 5% of the first $500,000 plus 10% of the remaining balance

- For homes that cost over $1,000,000, the minimum down payment is 20% or more depending on property location

For down payments of less than 20%, home buyers are required to purchase mortgage default insurance.

Selecting your province or territory helps us personalize your mortgage results.

Enter your total monthly payments towards any car loans, student loans or personal loans.

Also Check: What Are Basis Points In Mortgage

What Is Mortgage Affordability

Mortgage affordability refers to how much youâre able to borrow based on your current income, debt and living expenses. Itâs essentially your purchasing power when buying a home. The higher your mortgage affordability, the more expensive a home you can afford to purchase.

The term âaffordabilityâ is also used to describe overall housing affordability, which has more to do with the cost of living in a particular city. If the cost of housing relative to the average income in a city is high, it will be seen as a less affordable place to live. The two terms are related, but itâs important to understand the difference.

There are many factors that will affect the maximum mortgage you can afford to borrow, including the household income of the applicants purchasing the home, the personal monthly expenses of those applicants and the expenses associated with owning a home .

Where Are Mortgage Rates Headed

Mortgage rates plunged early in the pandemic and scraped record lows below 3 percent at the start of 2021. The days of sub-3 percent mortgage interest on the 30-year fixed are behind us, and rates rose past 5 percent in 2022.

Low interest rates were the medicine for economic recovery following the financial crisis, but it was a slow recovery so rates never went up very far, says Greg McBride, CFA, Bankrate chief financial analyst. The rebound in the economy, and especially inflation, in the late pandemic stages has been very pronounced, and we now have a backdrop of mortgage rates rising at the fastest pace in decades.

Recommended Reading: What Is The Mortgage On A 280 000 Home

How Much House Can I Afford Calculator

Maximum Mortgage Payment

How Much House You Can AffordBased on a interest rate on a -year fixed mortgage.

Now that you know what you can afford, get your mortgage here or try our full mortgage calculator.

As you can see from our calculator, how much house you can afford really depends on the relationship between your income and mortgage.

To figure out how much mortgage you can afford with your income, different lenders use different guidelinesbut most lenders dish out mortgages that are way too expensive and keep borrowers in debt for decades!

We want to help you buy a home thats a blessing, not a burden. And the only way to do that is to calculate your home-buying budget the smart wayand stick to it!

Thats what our calculator does for you. How does it work? Well show youget ready for some math!

Recommended Reading: Can You Do A Reverse Mortgage On A Mobile Home

Its Not What You Can Borrow Its What You Can Afford

In some respects, the mortgage lending industry is working against your best interest. If you are deemed a qualified borrower, a lender is prone to approve you for the maximum it believes you can afford. But in some cases, that amount may be too generous.

Buying a home always means dealing with big numbers. And the impact to your budget may seem to be a stretch, particularly in the beginning. The challenge is buying a home that meets your current and future needs, without feeling like all of your money is in your home leaving you without the financial freedom to travel, save for other priorities and have a cash flow cushion.

Now that the NerdWallet How much can I borrow calculator has given you an idea of your buying power, you may want to gut-check the number by:

-

Run affordability scenarios. You can get another view of your home-buying budget by running some what-ifs through the NerdWallet home affordability calculator.

-

Talk to more than one lender. You are more likely to get a better interest rate by comparing terms offered by multiple lenders, and it might be illuminating to see the loan amounts different lenders will qualify you for.

-

Consider all homeownership expenses. Its not just whats built into your monthly payment such as insurance, taxes and the rest but the other having-a-home expenses, like structural upkeep, new furniture, maybe even yard maintenance equipment.

Don’t Miss: How Long Does It Take To Get A Mortgage Commitment

Demystify The Mortgage Process With Our Easy

Once youve found a home youre interested in and learned about pre-approvals, its time to shop for a mortgage. The overall cost of your mortgage and how much youll pay each month will depend on your credit, your down payment, and the interest rate you get.

Youll want to put as much money down as possible in order to lower the overall cost of your mortgage. The less you have to borrow, the less youll pay in interest over the life of the loan. Its also important to shop around for the best mortgage rates, which can change depending on market trends and your location.

In this section of our Homebuying Guide, youll calculate your monthly mortgage payment, compare up-to-the-minute rates, and see how your down payment impacts the overall cost of your loan.

To get started, choose an article below.

When you take out a mortgage, whether youre buying a house or refinancing an existing

Recommended Reading: How Much Is Mortgage On A 1 Million Dollar House

Understanding Your Mortgage Payment

Monthly mortgage payment = Principal + Interest + Escrow Account Payment

Escrow account = Homeowners Insurance + Property Taxes + PMI

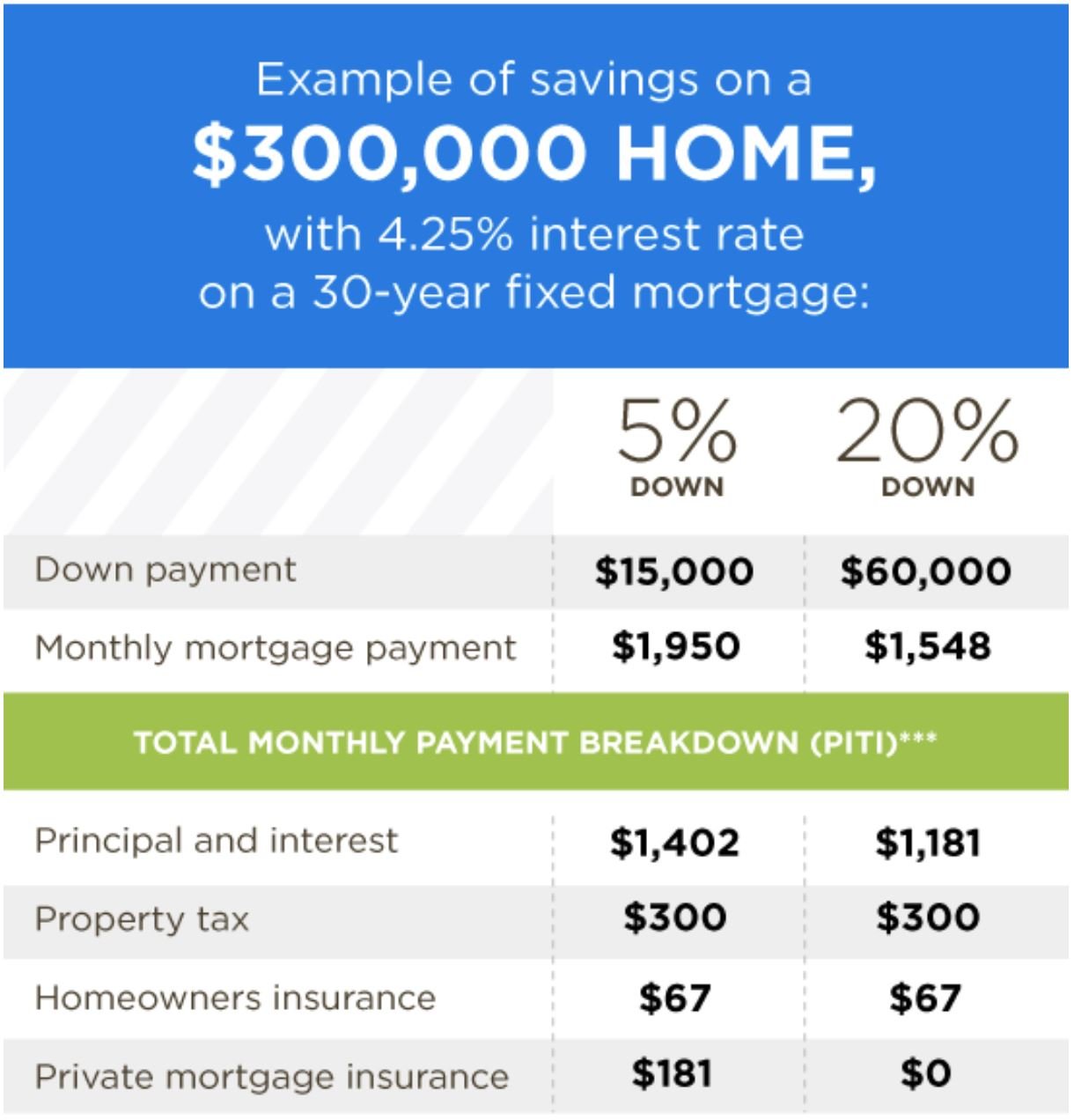

The lump sum due each month to your mortgage lender breaks down into several different items. Most homebuyers have an escrow account, which is the account your lender uses to pay your property tax bill and homeowners insurance. That means the bill you receive each month for your mortgage includes not only the principal and interest payment , but also property taxes, home insurance and, in some cases, private mortgage insurance.

Read Also: Is A Mortgage A Line Of Credit

Costs Associated With Home Ownership And Mortgages

Monthly mortgage payments usually comprise the bulk of the financial costs associated with owning a house, but there are other substantial costs to keep in mind. These costs are separated into two categories, recurring and non-recurring.

Recurring Costs

Most recurring costs persist throughout and beyond the life of a mortgage. They are a significant financial factor. Property taxes, home insurance, HOA fees, and other costs increase with time as a byproduct of inflation. In the calculator, the recurring costs are under the “Include Options Below” checkbox. There are also optional inputs within the calculator for annual percentage increases under “More Options.” Using these can result in more accurate calculations.

Non-Recurring Costs

These costs aren’t addressed by the calculator, but they are still important to keep in mind.

How Much Personal Loan Can I Get

When thinking about taking out a loan the first question in your mind is How much loan can I get? Other than the key question of maximum personal loan, it is also a matter of clearing all the required eligibility criteria.

The eligibility criteria differ for salaried as well as self-employed individuals. The eligibility criteria for applying for a personal loan is as follows:

- The applicant must be an employee of a private or a public enterprise with a basic minimum turnover as per the company policy.

- The applicants age must range between 21 to 60 years.

- The income should be at least Rs. 25,000 in Mumbai and Delhi and Rs. 20,000 in other parts of India.

- A self-employed person can avail of a loan calculated on the profit after tax based on the industry and should be in business for a minimum of 5 years.

- The applicant should have a minimum of 1-year experience and 6 months in the present company.

Read Also: Which Bank Is Best For Mortgage

Recommended Reading: Can I Get A Mortgage With Credit Card Debt

How Does The Type Of Home Loan Impact Affordability

While it’s true that a bigger down payment can make you a more attractive buyer and borrower, you might be able to get into a new home with a lot less than the typical 20 percent down. Some programs make mortgages available with as little as 3 percent or 3.5 percent down, and some VA loans are even available with no money down at all.

How much house can I afford with an FHA loan?

Federal Housing Agency mortgages are available to homebuyers with credit scores of 500 or more and can help you get into a home with less money down. If your credit score is below 580, you’ll need to put down 10 percent of the purchase price. If your score is 580 or higher, you could put down as little as 3.5 percent. There are limits on FHA loans, though. In most areas in 2022, an FHA loan cannot exceed $420,680 for a single-family home. In higher-priced areas, the number can go as high as $970,800. Youll also need to factor in how mortgage insurance premiums required on all FHA loans will impact your payments.

How much house can I afford with a VA loan?

How much house can I afford with a USDA loan?

USDA loans require no down payment, and there is no limit on the purchase price. However, these loans are geared toward buyers who fit the low- or moderate-income classification, so you will need to put a big emphasis on understanding how mortgage payments will impact your overall monthly budget.

What Factors Impact The Amount You Can Borrow

Lenders consider several factors in determining the amount you qualify for, including:

-

Your debt-to-income ratio. Our How much can I borrow calculator? depends on an accurate input of your income and recurring debt. Youll want to really hone those figures down to a fine point, because lenders will be using them too.

-

Your loan-to-value ratio. This ratio is a function of the amount of money you put down. If you want to drill down on this calculation, use NerdWallets loan-to-value calculator.

-

Your credit score. This number impacts the pricing of your loan, more than how much youll qualify for. But thats really important. If you dont know your score, get it here.

Don’t Miss: Can You Get A Second Mortgage With Bad Credit

How Much Would A 100000 Mortgage Cost Per Month

This would depend on the term of the mortgage and the interest rate youre paying, but if we take a typical 25-year mortgage at a rate of 2.5%, your monthly repayment on a £100,000 mortgage would be £448.62. You can find more repayment scenarios by heading to our mortgage repayment calculator.

Cookies

The Advantages Of Paying 20% Down

- Improves your chances of loan approval: Paying 20% down lowers risk for lenders. A larger down payment also makes you look like a more financially responsible consumer. This gives you better chances of qualifying for a mortgage.

- Helps lower your interest rate: Paying 20% down decreases your loan-to-value ratio to 80%. LTV is an indicator which measures your loan amount against the value of the secured property. With a lower LTV ratio, you can obtain a lower interest rate for your mortgage. This will help you gain interest savings over the life of your loan.

- Reduces your monthly payment: A large down payment also significantly decreases your monthly mortgage payments. Though you spend more now, having lower monthly payments will make your budget more manageable. This gives you room to save extra money for emergency funds, retirement savings, or other worthwhile investments.

- Helps build home equity faster: Paying 20% down means paying off a larger portion of your loan. This allows you to pay off your mortgage sooner. If you plan to make extra payments on your mortgage, having 20% equity will help speed up this process, allowing you to cut a few years off your loan term.

- Eliminates private mortgage insurance : As mentioned earlier, PMI is an added cost on a conventional loan if you pay less than 20% on your mortgage. Consider paying 20% down to avoid this extra fee.

Know the Closing Costs

Read Also: What Credit Score Do You Need For A Mortgage Loan

There Are A Number Of Factors To Consider

A Tea Reader: Living Life One Cup at a Time

Purchasing real estate with a mortgage is often the most extensive personal investment most people make. How much you can afford to borrow depends on several factors, not just what a bank is willing to lend you. You need to evaluate not only your finances but also your preferences and priorities.

Here is everything you need to consider to determine how much you can afford.

How To Get More House For Your Money

There are a couple of ways to reduce parts of your mortgage payment and get more house for your money.

PMI is generally required when your down payment is less than 20 percent of the home value. You can avoid a PMIand reduce your mortgage paymentby saving more for a down payment before signing on the dotted line.

Another factor in your payment is your Higher scores can often mean lower interest ratesimproving your credit score before you get a mortgage can significantly reduce the amount you pay over time.

Don’t Miss: How Much Is A Fixed Rate Mortgage