How Can I Afford A Home With 85k Annual Income

Use this calculator to calculate how expensive of a home you can afford if you have $85k in annual income. Make sure to consider property taxes, home insurance, and your other debt payments. What is the monthly payment of the mortgage loan?

How much would the mortgage payment be on a $85K house? Assuming you have a 20% down payment , your total mortgage on a $85,000 home would be $68,000. For a 30-year fixed mortgage with a 3.5% interest rate, you would be looking at a $305 monthly payment.

How To Calculate 10

To calculate a 10-year interest-only mortgage, you need to make use of an Interest-only Mortgage Calculator. To use the Calculator effectively, you will need to feed in detail about the Mortgage amount, loan term, and interest rate while setting the interest-only period to 10 years on the Calculator.

Can You Afford A 8500000 Mortgage

Is the big question, can your finances cover the cost of a £85,000.00 Mortgage? Are you sure you have considered all the costs? If you are increasingly answering ‘yes’ then it’s worth doing the final financial checks, review your monthly household budget (so you are ready to answer all the questions the mortgage advisor will ask and check that you have the deposit covered. See how much it will cost you to move home when buying a property worth £85,000.00

Do you need to calculate how much deposit you will need for a £85,000.00 Mortgage? Try our new Mortgage Deposit Calculator or quick on a deposit percentage below to see an illustration that you can tweak to suit your circumstances

Did you know that we review the UK’s leading mortgage providers each month and produce a comparative guide to the best mortgage deals? By collating the latest mortgage deals from each provider, we save you the time and effort of looking for and finding the best mortgage deals. We also provide regular mortgage updates, guides and mortgage news so you can make the right financial decision when choosing a mortgage.

Using an Independent Mortgage Advisor will saves you time and stress and affordability calculations and mortgage comparison can be completed centrally on your behalf. Use a mortgage broker which doesn’t charge you fees, so you get the best mortgage deals without the hassle.

Read Also: What Are The Chances Of Getting A Mortgage

Can You Still Get An Interest

Interest-only mortgages were popular in the early 2000s, along with other types of creative financing. Unfortunately, they were frequently marketed in ways that made them risky, such as requiring little to no down payment or marketing them to borrowers who were ill-prepared to handle principle payments once the interest-only phase ended. This caused many to get into financial difficulty when home values fell and they had no cushion of equity to fall back on.

But interest-only mortgages have been around for a long time, and can be a sensible option for borrowers who are prepared for the end of the interest-only phase. And there are more safeguards in place these days to ensure that borrowers are qualified for an interest-only loan.

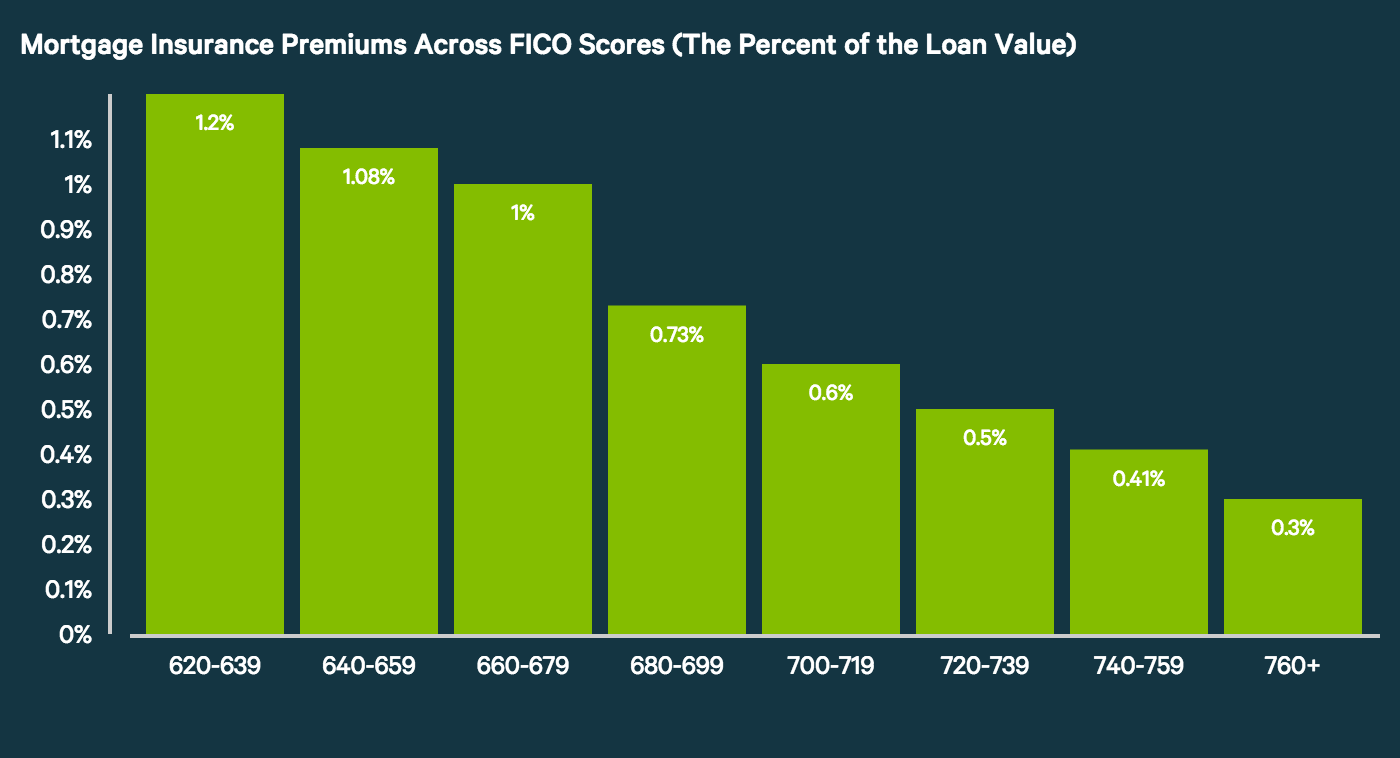

These days, most lenders require a down payment of 20-30 percent on for an interest-only mortgage, so there’s an equity cushion if home values fall. You’ll also need a decent , about 660 or higher, in most cases. Most lenders will also want to ensure that you’ll have adequate income to cover the principle payments when that time comes.

Getting Your First Mortgage

The traditional period for amortization of a mortgage is 25 years. But this is done in periods of five years at a time, though it is possible to pay the mortgage down in a shorter period, just not longer. The longer the amortization period, the smaller the monthly payments will be, but the more the loan will cost in total.

Most mortgages have a five year term, though shorter terms are possible. The five-year mortgage term is the amount of time a mortgage contract is in effect. At the end of each term, the mortgage must be renewed for another term, at which point there is an opportunity to consider making any changes. Possible changes include renegotiating the rate as well as other details of the contract for the next term. The agreed-upon interest rate remains in effect for the term.

It is possible to choose between an open mortgage, which provides a person the flexibility of being able to repay all or part of a mortgage at any time without a prepayment charge, or a closed mortgage, which limits prepayment options. The latter usually has a lower interest rate.

Traditionally, mortgage payments are made every month. It is possible to arrange biweekly payments which permit faster repayment and a lower loan cost. A biweekly payment means making a payment of one-half of the monthly payment every two weeks. This results in 26 payments a year instead of 24.

There are also options for flexible or skipped payments.

Read Also: Can Your Mortgage Go Up

Next: See How Much You Can Borrow

You’ve estimated your affordability, now get pre-qualified by a lender to find out just how much you can borrow.

-

What will your new home cost? Estimate your monthly mortgage payment with our easy-to-use mortgage calculator.

- Award Ribbon

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you’re in the right range.

- Pig Refinance calculator

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

How Much Mortgage Can I Qualify For

Lenders have apre-qualification processthat takes your finances into account to determine how much they are willing to lend you. Once the lender has completed a preliminary review, they generally provide a pre-qualification letter that states how much mortgage you qualify for. Get pre-qualified by a lender toconfirm your affordability.

Also Check: What Is Tip In Mortgage

Can You Buy A House On 50k A Year

Its definitely possible to buy a house on $50K a year. For many, low-down-payment loans and down payment assistance programs are making home ownership more accessible than ever. But everyones home buying budget is different. The amount you can afford doesnt just depend on your salary, but on your mortgage rate, down payment, and more.

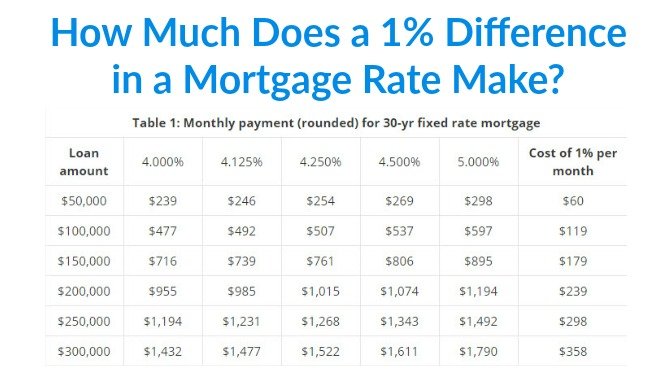

How much is mortgage payment on a $85K house? For a $85,000, 30-year mortgage with a 4.5% interest rate, youd pay around $554.64 per month. But the exact costs of your mortgage will depend on its length and the rate you get.

How To Use The Mortgage Affordability Calculator

To use our mortgage affordability calculator, simply enter you and your partners income , as well as your living costs and debt payments. The calculator can estimate your living expenses if you dont know them.

With these numbers, youll be able to calculate how much you can afford to borrow. You can change your amortization period and mortgage rate, to see how that would affect your mortgage affordability and your monthly payments.

Read Also: What Day Of The Week Are Mortgage Rates Lowest

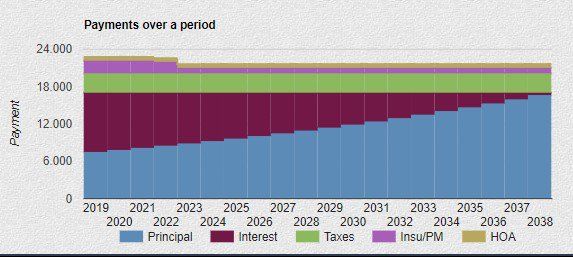

When Does Your Mortgage Balance Start To Fall

Dont be surprised if you check your mortgage balance early in your loan term and find it hasnt dropped much. That is natural. This shifts midway through your loan term, with the principal taking the majority of the mortgage payments later in the term. Remember: The longer you pay your mortgage, the faster your mortgage balance will fall.

Fixed & Variable Rates

The standard variable rate is the basic interest rate lenders use for mortgages. Each lender sets their default SVR. Its the default rate mortgages revert to after the introductory period of a loan, which is usually 2 to 5 years. SVR mortgages usually have higher interest rates than other mortgage options.

Standard variable rates move based on fluctuations in the Bank of England base rate. When rates reset higher, borrowers must be prepared to make higher monthly payments. To avoid reverting to the SVR, borrowers would remortgage to a new deal with a favourable rate.

In recent years, standard variable rates have been on the rise. Because of this, many consumers find fixed-rate mortgage options more attractive. According to the Bank of England, since 2016, fixed-rate options are more preferred by borrowers, especially first-time homebuyers.

In the third quarter of 2020, 91.2% of all mortgages used fixed-rate loans. The average fixed-rate mortgage was priced at 1.91%. In contrast, the average variable rate mortgage was priced at 1.85%, bringing the overall market average to 1.91%.

What is a Fixed Rate?

The UK government provides subsidy programs in Help to Buy and Help to Buy London. These government schemes offer mortgage deposit assistance. However, few lenders in the UK provide loans which have fixed rates extending beyond 5 years.

Which Loans Structures Do Most Buyers Prefer?

Only 1 in 50 mortgages come with a fixed rate longer than 5 years.

Also Check: Is A Mortgage A Line Of Credit

What Is The Total Amount Repayable

When you take out a mortgage, you agree to pay the principal and interest over the life of the loan. Your interest rate is applied to your balance, and as you pay down your balance, the amount you pay in interest changes.

This means that at the beginning of your loan, a big percentage of your payment is applied to interest. With each subsequent payment, you pay more toward your balance.

Estimate your monthly loan repayments on an £850,000 mortgage at a 4% fixed interest with our total amount repayable schedule over 15 and 30 years.

Most Affordable Markets For Homebuyers

According to 2020 data fromZillow Research, record low mortgage rates have helped to boost affordability for potential homeowners. The table below shows the top 10 most affordable markets to live in for December 2020 and is based on a typical home value of no more than $300,000 . The market and share of income spent on a mortgage may fluctuate based on the current mortgage rate, the typical local homeowner’s income and the typical local home value.

Recommended Reading: Is The Property Tax Included In Mortgage Payments

How Much Deposit Do I Need For A 85000 Mortgage

A 85000 mortgage will mean you have at least between 5% 20% for a mortgage deposit.

This means if you want a 85000 mortgage you already have between £4,250 and £17,000 for your mortgage deposit.

This will be the first basis of your affordability of a 85000 mortgage.

You can improve your mortgage affordability by using one of the governments first-time buyer schemes.

This will mean you can put down a smaller mortgage deposit or be eligible for a reduction in the property price.

I Make $85000 A Year How Much Home Can I Afford

The home affordability calculator will give you a rough estimation of how much home can I afford if I make $85,000 a year. As a general rule, to find out how much house you can afford, multiply your annual gross income by a factor of 2.5 – 4. If you make $85,000 per year, you can afford a house anywhere from $212,500 to $340,000.

You May Like: Is Fha Mortgage Insurance For The Life Of The Loan

How To Use The Interest

Here’s how it works:

When you click Calculate, you will see what your monthly payments will be during the initial, interest-only phase of the loan. Then, click View Report to see how your repayment plan will look throughout the duration of your mortgage. This will include the projected increase during the amortization phase of the mortgage, as you begin paying down the loan principal.

Why Is The Total Interest Higher Than That Of A Standard Mortgage

The total interest paid is higher on interest-only mortgages because during the first phase of the loan, you’re not reducing the loan principle . And if you’re not paying down the principle, you’re still paying interest on the full amount of the loan each month. So 4% of $250,000 is the same in the first year of the term as it is in the fifth, unless you make prepayments.

Don’t Miss: Can I Refinance My Mortgage Within A Year

Total Interest Paid On A $450000 Mortgage

The exact amount of interest youll pay on a $450,000 loan will depend on your rate and your loans term . A shorter term will typically offer fewer interest costs than a loan with a longer term.

Example:

A 15-year mortgage with the same terms would come with $109,371.13 in interest costs around $123,000 less.

Credible can be a big help when trying to find a great interest rate. You can easily compare our partner lenders and see prequalified rates in as little as three minutes all without leaving our platform.

Credible makes getting a mortgage easy

- Instant streamlined pre-approval: It only takes 3 minutes to see if you qualify for an instant streamlined pre-approval letter, without affecting your credit.

- We keep your data private: Compare rates from multiple lenders without your data being sold or getting spammed.

- A modern approach to mortgages: Complete your mortgage online with bank integrations and automatic updates. Talk to a loan officer only if you want to.

Checking rates wont affect your credit score.

Estimate My Monthly Mortgage Payment

The loan amount, the interest rate, and the term of the mortgage can have a dramatic effect on the total amount you will eventually pay for the property. Further, mortgage payments typically will include monthly allocations of property taxes, hazard insurance, and private mortgage insurance . Use our mortgage calculator to see the impact of these variables along with an amortization schedule. Accurately calculating your mortgage can be a critical first step when determining your budget.

How Much Can I Afford to Pay for a House?

How much does a home cost? Before you get too comfortable with the asking price in the real estate ad, you should be aware of all the expenses you will be expected to pay.

First, there is the price of the home itself. The seller offers his or her house for sale at the asking price. This price may be negotiable depending upon the condition of the home and other factors. After the negotiations are done, the agreed-upon price becomes the cost of the home. To secure this cost, the buyer is expected to make a non-refundable payment to the seller. This is called earnest money. This amount will be deducted from the amounts paid when the sale is completed.

Finding Suitable Homes in Your Price Range

Mortgages contain two distinct parts:

- Principal. The amount you need to borrow to pay for your home and closing costs.

- Interest. What you pay the financial institution for the use of its money.

Am I Ready to Purchase a Home?

You May Like: How To Get A Mortgage Loan After A Foreclosure

How To Get A $450000 Mortgage

If youve considered the costs and think youre ready to proceed with your $450,000 loan, the process is pretty simple.

Just follow these nine steps, and youll be a proud homeowner in no time:

What Is Mortgage Affordability

Mortgage affordability refers to how much youre able to borrow, based on your current income, debt, and living expenses. Its essentially your purchasing power when buying a home. The higher your mortgage affordability, the more expensive a home you can afford to purchase.

The term affordability is also used to describe overall housing affordability, which has more to do with the cost of living in a particular city. If the cost of housing relative to the average income in a city is high, it will be seen as a less affordable place to live. The two terms are related, but its important to understand the difference.

There are many factors that will affect the maximum mortgage you can afford to borrowincluding the household income of the applicants purchasing the home, the personal monthly expenses of those applicants , and the expenses associated with owning a home .

You May Like: How Big A Mortgage Can I Get With My Salary