Bruce Ailion Realtor And Real Estate Attorney In Atlanta

2023 mortgage rate forecast: 7.1% , 6.8%

What will drive mortgage rates in 2023?

Uncertainty about the future, particularly inflation, is driving the current 20-year highs for interest rates, says Ailion. However, rates can only increase so much before there is a collapse of the mortgage market and housing market. Significantly higher rates will predicate a far worse recession than the Federal Reserve would find acceptable.

Although we will have a recession in 2023, if we are not already in one, I expect that interest rates will remain high throughout most of the year. But as inflation moderates and the economy slows, interest rates should begin to decline.

Advice for home buyers and homeowners

Home buyers who plan to live in a home for several years can still purchase today with the plan to refinance when interest rates drop. Todays buyer has the advantage of more homes on the market now than in the recent past and more negotiable sellers. The likely offsets some of the recent increases in interest rates.

How Much Equity Do You Need To Refinance

Equity requirements differ by loan program and property type. Generally, rate-and-term refinances have fewer restrictions on equity requirements, cash-out refinances have tighter equity restrictions. VA loans accept zero equity on a refinance. However, if you’re refinancing to cancel PMI,expect a minimum requirement of equityin your property .

The Caveat Of Mortgage Interest Rates Forecasting

Mortgage rate forecasting is not a sure thing. It’s a good idea to treat these forecasts as a guide rather than a hard-and-fast rule. Mortgage rates have taken some unexpected turns over the past 2 years, and experts have certainly been wrong before. However, these predictions may help you plan your home purchases in the future.

Each quarter, Freddie Mac publishes a quarterly report with its mortgage rate predictions. Using the economic outlook at past and current rates, Freddie Macs Economic & Housing Research Group forecasts what we can expect from rates in the coming months. You may want to keep tabs on this report to see what’s coming down the pike.

Read Also: How Much To Buy Mortgage Points

What Is The Average Cost Of A Refinance

Generally, youll encounter costs $5,000 on average, according to Freddie Mac when refinancing your mortgage.

Your exact refinancing costs will depend on multiple factors, including the size of your loan and where you live. Typical refinancing costs include:

- The cost of recording your new mortgage

- Lender fees, such as origination or underwriting

- Title service fees

- Mortgage points

- Prepaid interest charges

Keep in mind theres no such thing as a truly no-cost refinance. Lenders who market “no-cost loans” typically charge a higher interest rate and roll the costs into the loan which means youll pay more interest over the life of the loan.

Have a finance-related question, but don’t know who to ask? Email The Credible Money Expert at and your question might be answered by Credible in our Money Expert column.

As a Credible authority on mortgages and personal finance, Chris Jennings has covered topics that include mortgage loans, mortgage refinancing, and more. Hes been an editor and editorial assistant in the online personal finance space for four years. His work has been featured by MSN, AOL, Yahoo Finance, and more.

What Is The Difference Between Apr And Interest Rate

The interest rate is the cost of borrowing the money, and it is advertised as a percentage of the loan. , and it includes the interest rate plus other fees associated with the mortgage. So the APR will provide you with a better idea of the total cost of financing the loan. You may find lenders offering the same interest rate and monthly payments, but if one is charging higher upfront fees, then the APR will be higher.

The Federal Truth in Lending Act requires lenders to disclose the APR, but the fees can vary. When comparing APRs between lenders, ask which fees are not included for better comparison.

You May Like: How Can I Remove Pmi From My Fha Mortgage

How Quickly The Tables Have Turned: A Drop In Mortgage Rates Has Homebuyers So Cocky Theyre Asking Sellers For Cash

After a string of steady increases, mortgage rates fell this past week a mixed blessing for the fragile U.S. economy.

The lower rate on a 30-year fixed mortgage is a relief for home shoppers who have been watching rates climb, but its also a sign that a recession could very well be around the corner as the market slows.

Rates tend to mirror 10-year Treasury yields, which have fallen as investors seek safer, more stable assets in the face of higher inflation and slower economic growth.

Rising prices are eating into consumers paychecks, leaving many Americans with less money for discretionary spending, says George Ratiu, senior economist with Realtor.com.

In addition, with inflation outpacing pay raises, most workers are seeing their income fall behind, further straining the finances of buyers who are also facing higher borrowing costs.

Should You Refinance Your Mortgage When Interest Rates Drop

Determining whether it’s the right time to refinance your home loan or not involves a number of factors. Most experts agree you should consider a mortgage refinance if your current mortgage rate exceeds today’s mortgage rates by 0.75 percentage points. Some say a refi can make sense if you can reduce your mortgage rate by as little as 0.5 percentage points . It doesn’t make sense to refinance every time rates decline a little bit because mortgage fees would cut into your savings.

Many of the best mortgage refinance lenders can give you free rate quotes to help you decide whether the money you’d save in interest justifies the cost of a new loan. Try to get a quote with a soft credit check which won’t hurt your credit score.

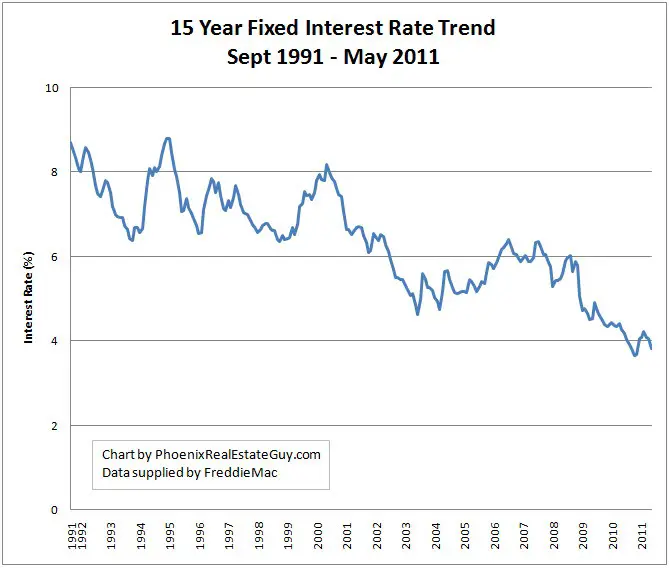

You could increase interest savings by going with a shorter loan term such as a 15-year mortgage. Your payments will be higher, but you could save on interest charges over time, and you’d pay off your house sooner.

How much does the interest rate affect mortgage payments?

In general, the lower the interest rate the lower your monthly payments will be. For example:

- If you have a $300,000 fixed-rate 30-year mortgage at 4% interest, your monthly payment will be $1,432 . You’ll pay a total of $215,608 in interest over the full loan term.

- The same-sized loan at 3% interest will have a monthly payment of $1,264. You will pay a total of $155,040 in interest a savings of over $60,000.

You May Like: Can You Add A Person To A Mortgage

How To Shop For The Best Mortgage Rate

Getting an optimal rate on a home loan can save you a significant amount of money over time. Here are some tips that can help you get the best rate possible for your situation:

- Keep your eye on rates. Mortgage rates are constantly changing. Keeping a close watch will make it easier to find and lock in a better rate.

- Check your credit. When you apply for a mortgage, the lender will review your credit to determine your creditworthiness as well as your interest rate. In general, the higher your , the better your rate will be. To get an idea of where you stand, check your credit before you apply and dispute any errors with the appropriate credit bureau to potentially boost your score.

- Shop around and compare lenders. Consider options from as many mortgage lenders as possible to find the best deal for you. Prospective buyers have saved more than $1,500 over a loans term by getting two quotes from lenders, and saved roughly $3,000 when they sought five quotes, according to Freddie Mac.

Mortgage Interest Rates Forecast For 2022

Are you planning to purchase a home this year? If you’re like many potential home buyers who are looking for information about what will happen with interest rates, it’s worth considering the 2022 mortgage interest rates forecast.

But the big question is, are interest rates going up? More specifically, are mortgage rates going up?

According to 2022 housing market predictions, mortgage rates are likely to continue to rise going into the rest of this year. Let’s go over factors that affect mortgage rates and more information about their movement in 2022.

Read Also: Can You Refinance A New Mortgage

How Do I Find Personalized Mortgage Rates

Finding personalized mortgage interest rates is as easy as talking to your local mortgage broker or searching online. While most factors that impact mortgage interest rates are out of your control, rates still vary from person to person. Lenders charge higher home mortgage rates to borrowers they deem riskier. So having a high credit score will get you the best interest rates. Lenders also look at how much you are borrowing compared to the homes value this is known as loan-to-value, or LTV.

Youll get a better rate when the LTV is below 80%. So if your future home has a value of $200,000, youll get the best rates if the loan is for $160,000 or less.

When shopping around for the best rates, consider a variety of lenders, like local banks, national banks, credit unions, or online lenders. Be sure to compare interest rates, fees, and other terms of the mortgage. Also, mortgage rates are constantly changing, so getting rate quotes from multiple lenders in a short time period makes it easier to get an accurate comparison. If thats too much legwork, you could work with a mortgage broker. Mortgage brokers dont directly issue loans. Instead, they work with lenders to find you the best deal. But their services arent free. They work on commission, which is usually paid by the lender.

What Are Mortgage Rates

Mortgage rates are the costs associated with taking out a loan to finance a home purchase. Because properties cost so much, most people cant pay for them with cash, so they opt to stretch the payments over long periods of time, often as much as 30 years, to make the regular monthly payments more affordable.

When interest rates rise, reflecting changes in the economy and financial markets, so too do mortgage ratesand vice versa.

Recommended Reading: How Much Are Second Mortgage Rates

Mortgage Rates For The Remainder Of 2022

With mortgage rates over 5% and even 6% for the first time since December 2018, many potential home buyers have found themselves wondering if rates are going to drop any time soon. Unfortunately for those seeking the historically low rates of the year prior, rates are expected to continue steadily increasing in 2022.

While mortgage rates arent expected to decrease in the near future, its also important to note that rates are still on par or better than rates available in the last couple decades.

What Prospective Buyers Should Consider

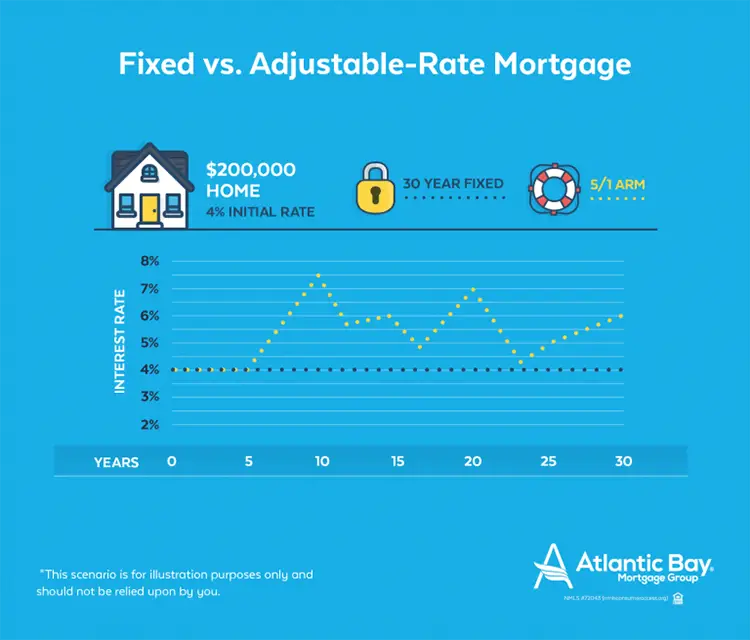

Many consumers have turned to an adjustable-rate mortgage instead of fixed mortgages as borrowing costs have swelled.

Adjustable-rate loans accounted for more than 12% of mortgage applications in both June and July this year the largest share since 2007 and double the percentage from January this year, according to Zillow data.

These loans are riskier than fixed rate mortgages. Consumers generally pay a fixed rate for five or seven years, after which it resets consumers may then owe larger monthly payments depending on prevailing market conditions.

You could chase better numbers for years on end in some cases if things don’t go your way.Kevin Mahoneyfounder and CEO of Illumint

Kevin Mahoney, a certified financial planner based in Washington, D.C., favors fixed-rate loans due to the certainty they provide consumers. Homebuyers with a fixed mortgage can potentially refinance and lower their monthly payments when and if interest rates decline in the future.

More broadly, consumers should largely avoid using mortgage estimates like Fannie Mae’s as a guide for their buying decisions, he added. Personal circumstances and desires should be the primary driver for financial choices further, such predictions can prove to be wildly inaccurate, he said.

“You could chase better numbers for years on end in some cases if things don’t go your way,” said Mahoney, founder and CEO of millennial-focused financial planning firm Illumint.

Also Check: What Is The Mortgage Payment On 240k

Why Is My Mortgage Rate Higher Than Average

Not all applicants will receive the very best rates when taking out a new mortgage or refinancing. Credit scores, loan terms, interest rate types , down payment size, home location and loan size will all affect mortgage rates offered to individual home shoppers.

Rates also vary between mortgage lenders. It’s estimated that about half of all buyers only look at one lender, primarily because they tend to trust referrals from their real estate agent. Yet this means that they may miss out on a lower rate elsewhere.

Freddie Mac estimates that buyers who got offers from five different lenders averaged 0.17 percentage points lower on their interest rate than those who didn’t get multiple quotes. If you want to find the best rate and term for your loan, it makes sense to shop around first.

Mortgage Rates Drop Below Five Percent

MCLEAN, Va., Aug. 04, 2022 — Freddie Mac today released the results of its Primary Mortgage Market Survey® , showing that the 30-year fixed-rate mortgage averaged 4.99 percent.

Mortgage rates remained volatile due to the tug of war between inflationary pressures and a clear slowdown in economic growth, said Sam Khater, Freddie Macs Chief Economist. The high uncertainty surrounding inflation and other factors will likely cause rates to remain variable, especially as the Federal Reserve attempts to navigate the current economic environment.

News Facts

- 30-year fixed-rate mortgage averaged 4.99 percent with an average 0.8 point as of August 4, 2022, down from last week when it averaged 5.30 percent. A year ago at this time, the 30-year FRM averaged 2.77 percent.

- 15-year fixed-rate mortgage averaged 4.26 percent with an average 0.6 point, down from last week when it averaged 4.58 percent. A year ago at this time, the 15-year FRM averaged 2.10 percent.

- 5-year Treasury-indexed hybrid adjustable-rate mortgage averaged 4.25 percent with an average 0.3 point, down from last week when it averaged 4.29 percent. A year ago at this time, the 5-year ARM averaged 2.40 percent.

MEDIA CONTACT:

Recommended Reading: What Is Aag Reverse Mortgage

Today’s Mortgage Rates For Dec 21 202: Rates Recede

Today a couple of important mortgage rates sank, though rates remain high compared to earlier this year. If you’re in the market for a home loan, see how your payments might be affected by inflation.

A variety of notable mortgage rates dropped today. The average interest rates for both 15-year fixed and 30-year fixed mortgages were slashed. For variable rates, the 5/1 adjustable-rate mortgage also fell.

Mortgage rates have increased fairly consistently since the start of 2022, following in the wake of a series of interest rate hikes by the Federal Reserve. Interest rates are dynamic and unpredictable — at least on a daily or weekly basis — and they respond to a wide variety of economic factors. But the Fed’s actions, designed to mitigate the high rate of inflation, are having an unmistakable impact on mortgage rates.

If you’re looking to buy a home, trying to time the market may not play to your favor. If inflation continues to increase and rates continue to climb, it will likely translate to higher interest rates — and steeper monthly mortgage payments. As such, you may have better luck locking in a lower mortgage interest rate sooner rather than later. No matter when you decide to shop for a home, it’s always a good idea to seek out multiple lenders to compare rates and fees to find the best mortgage for your specific situation.

Today’s National Mortgage Rate Averages

After recently rising more than a third of a percentage point, the 30-year average gave up a bold 21 basis points Wednesday, dropping back to 6.54%. Averages on 30-year loans have bounced around between 6.40% and 6.75% since the start of December, after notching a 20-year high of 7.58% in October.

Rates on 15-year loans declined as well Wednesday, but by only six basis points to 5.92%. That leaves the average 1.11% cheaper than its 7.03% fall peak, which was its highest reading since 2007.

Jumbo 30-year rate movement split the difference, dropping a moderate 13 basis points Wednesday. Now back down to 5.77%, the current Jumbo 30-year average is half of a point below the average’s October high of 6.27%, a level not previously breached in over 12 years.

Wednesday’s refinancing rates for 30-year mortgages sank even more dramatically than new purchase rates, with the 30-year refi average plunging 33 basis points. The 15-year average meanwhile declined ten points and Jumbo 30-year refi rates, 12 points. The cost to refinance for 30 years is now 43 basis points more expensive than a new purchase 30-year loan.

The rates you see here generally wont compare directly with teaser rates you see advertised online, since those rates are cherry-picked as the most attractive. They may involve paying points in advance, or they may be selected based on a hypothetical borrower with an ultra-high credit score or taking a smaller-than-typical loan given the value of the home.

Don’t Miss: What Is A Future Advance Mortgage

What Are Closing Costs

Youll likely owe more when you close on the house than just the down payment on the mortgage. There are other expenses that have to be paid to make this big transaction go through. Closing costs often entail taxes and fees associated with the purchase that arent included in the sale price.

Expect closing costs to total around 3% to 6% of the purchase price, so youre looking at between $8,250 and $16,500. They might include fees charged by the lender like loan origination fees, points paid to get a lower mortgage rate, fees associated with the property such as an appraisal or inspection, or prepaid costs such as property taxes or homeowners association dues.