Should I Choose A Long Or Short Loan Term

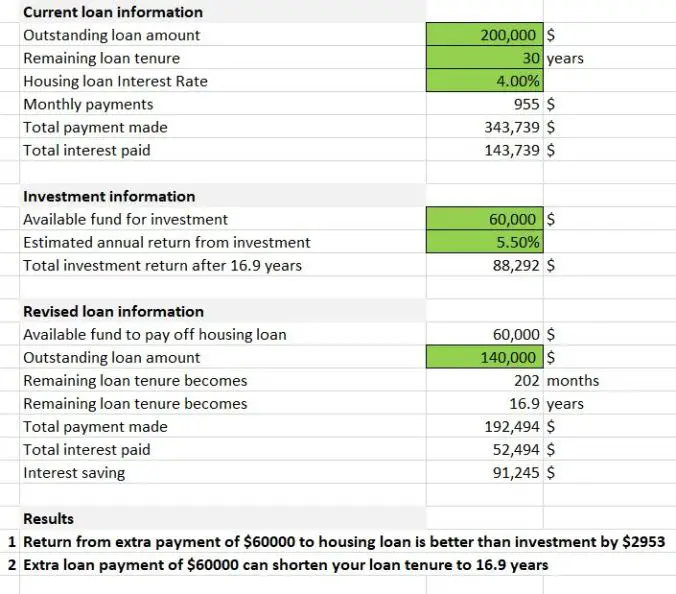

It depends on your budget and goals. A shorter term will allow you to pay off the loan quicker, pay less interest and build equity faster, but youll have a higher monthly payment. A longer term will have a lower monthly payment because youll pay off the loan over a longer period of time. However, youll pay more in interest.

Where To Get A $150000 Mortgage

Traditionally, getting a mortgage loan would mean researching lenders, applying at three to five, and then completing the loan applications for each one. Youd then receive loan estimates from each that breaks down your expected interest rate, loan costs, origination fees, any mortgage points, and closing costs. From there, you could then choose your best offer and move forward with the loan process.

Fortunately, with Credible, theres a more streamlined way to shop for a mortgage. Simply fill out a short form, and you can compare loan offers from all of our partners in the table below at once.

Other Calculators & Tools

Handy calculators to help you work out how you could fund your new home, and market research of property values in the suburbs where youre looking to buy.

Whether its your first or next home, or an investment property, we can help.

There are lots of settings you can adjust using this home loan repayment calculator. Each one will affect your home loan repayments, the overall amount of interest you pay over the loan term, and more.

Make your loan term longer and your mortgage repayments will go down. If you make extra repayments on your loan, youll see that the overall interest you pay over the loan term reduces, and that you could pay your home loan off faster. Toggle between paying Principal & Interest, or Interest Only mortgage repayments, and notice how that affects your repayment amount and total interest charged.

You May Like: What Are 15 Year Mortgage Interest Rates

Dont Overextend Your Budget

Banks and real estate agents make more money when you buy a more expensive home. Most of the time, banks will pre-approve you for the most that you can possibly afford. Right out of the gate, before you start touring homes, your budget will be stretched to the max.

Its important to make sure that you are comfortable with your monthly payment and the amount of money youll have left in your bank account after you buy your home.

How A Broker Can Help You Reduce Repayments On A 60000 Mortgage

The ideal scenario would be one in which your £60,000 mortgage costs you the minimum amount. That means securing a low interest rate and a longer term time but you may not necessarily want to drag repayments out over 25 years. This is where a broker specialising in mortgages of this size can make all the difference.

Knowledgeable in exactly what lenders of this range are looking for and the deals they typically offer, an expert can:

- Quickly advise on which lenders currently offer the best combination of rates and terms, saving you time, money and possible rejections

- Advise on a term that strikes the balance of getting you a mortgage that suits your budget but one that doesnt go on for too long

- Verify any calculations and confirm what repayments are realistic for you today and are likely to be throughout the next decade or so

Don’t Miss: Can I Get More Than One Mortgage Pre Approval

Monthly Payment: Whats Behind The Numbers Used In Our Mortgage Payment Calculator

The NerdWallet mortgage payment calculator cooks in all the costs that are wrapped into your monthly payment, including principal and interest, taxes and insurance. Youll just need to plug in the numbers. The more info youre able to provide, the more accurate your total monthly payment estimate will be.

For example, you may have homeowners association dues built into your monthly payment. Or mortgage insurance, if you put down less than 20%. And then theres property taxes and homeowners insurance. It helps to gather all of these additional expenses that are included in your monthly payment, because they can really add up. If you dont consider them all, you may budget for one payment, only to find out that its much larger than you expected.

For you home gamers, heres how we calculate your monthly mortgage payments on a fixed-rate loan:

M = P /

The variables are:

-

M = monthly mortgage payment

-

P = the principal, or the initial amount you borrowed.

-

i = your monthly interest rate. Your lender likely lists interest rates as an annual figure, so youll need to divide by 12, for each month of the year. So, if your rate is 5%, then the monthly rate will look like this: 0.05/12 = 0.004167.

-

n = the number of payments over the life of the loan. If you take out a 30-year fixed rate mortgage, this means: n = 30 years x 12 months per year, or 360 payments.

What Are The Types Of Mortgages

In addition to there being multiple mortgage terms, there are several common types of mortgages. These include conventional loans and jumbo mortgages, which are issued by private lenders but have more stringent qualifications because they exceed the maximum loan amounts established by the Federal Housing Finance Administration .

Prospective homebuyers also can access mortgages insured by the federal government, including Federal Housing Administration , U.S. Department of Agriculture , U.S. Department of Veterans Affairs and 203 loans. Minimum qualifications for these mortgages vary, but they are all intended for low- to mid-income buyers as well as first-time buyers.

Don’t Miss: Why Are 15 Year Mortgage Rates Lower Than 30 Year

How Much Is A $60k Loan

The monthly payments for a $60K loan are $353.96 and $67,427.24 in total interest payments on a 30 year term with a 5.85% interest rate. There might be other costs such as taxes and insurance.Following is a table that shows the monthly mortgage payments for $60,000 over 30 years and 15 years with different interest rates.

How Much You Need To Earn To Get A 60000 Mortgage

It depends on your personal circumstances and the lender you approach, but in general most lenders would be prepared to offer a mortgage of this size to someone with an income as low as £15,000 or even £10,000 per year.

Most mortgage lenders base their calculations on a multiple of 4 or 4.5 times your annual salary, so for a £60,000 mortgage youd need an income of £13,000 to £15,000. But some will go up to five or even six times your annual salary. The table below illustrates how this works.

| Income multiple | |

| 6x | £10000 |

Of course, it isnt quite as simple as that a lender will look primarily at both your annual income and outgoings before deciding how much you can borrow. In terms of what interest rates you may be offered, this will be determined by a number of factors including your credit score, employment status, and whether youre paying off credit cards or any other debts.

If youd like to find out how much you may be able to borrow, based on your own annual income, take a look at our affordability calculator below.

You May Like: What Would Be The Mortgage Payment On 250 000

The Mortgage Type You Opt For

A fixed or tracker interest rate? Interest-only or capital repayment? These are choices that will impact what you pay back each month. A fixed rate would be higher but more consistent whereas a tracker rate will change in line with market activity, and, as a result, so will your repayments.

An interest-only mortgage would significantly reduce repayments but you would need a viable repayment vehicle to cover the £60,000 loan at the end of the term. Alternatively, capital repayment allows you to pay off a portion of the loan alongside the interest each month so that it is fully repaid by the term. This does however mean more costly repayments throughout.

Talking to a broker would help to demystify some of these models and identify which might be right for you.

How A Broker Can Help With This Size Mortgage

When it comes to taking out a mortgage, using a broker can be really helpful. A broker will have access to a wide range of deals from different lenders, and theyll be able to match you with the one thats right for your circumstances. Theyll also be able to help you compare different deals and negotiate with lenders on your behalf.

If you get in touch we can arrange for a broker we work with to contact you straight away and discuss your requirements in more detail.

Don’t Miss: How To Take Out A 2nd Mortgage

The Term Of The Mortgage

The longer the term, the lower your monthly repayments will be. However, youll pay more interest overall than you would on a mortgage with a shorter term.

Here is a simple table showing how the length of your mortgage term could affect your monthly repayments.

| Mortgage term | |

| 20 | £332.76 |

These figures are estimates only, using an interest rate of 3%. The actual repayments on a £60k mortgage will differ across lenders and depending on your personal circumstances.

Can I Lower My Monthly Payment

There are a few ways to lower your monthly payment. Our mortgage payment calculator can help you understand if one of them will work for you:

-

Increase the term of the loan. The longer you take to pay off the loan, the smaller each monthly mortgage payment will be. The downside is that youll pay more interest over the life of the loan.

-

Get to the point where you can cancel your mortgage insurance. Many lenders require you to carry mortgage insurance if you put less than 20% down. This is another charge that gets added to your monthly mortgage payment. You can usually cancel mortgage insurance when your remaining balance is less than 80% of your homes value. However, FHA loans can require mortgage insurance for the life of a loan.

Look for a lower interest rate. You can think about refinancing or shop around for other loan offers to make sure youre getting the lowest interest rate possible.

Read Also: What Is The Maximum Reverse Mortgage Amount

How Can We Help You

The Independent review organisation Reviews.co.uk report that 100% of reviewers recommend Lending Expert

Lending Experts

Were mortgage experts. This means we know our stuff when it comes to all types of mortgages. We know where the best rates are and have access to exclusive deals just for Lending Expert customers.

Huge Market Comparison

Were not tied to one lender which means we can search the wider market to find you the cheapest mortgages from across the UK.

Lending Expert is an FCA regulated credit broker which means you can be assured you are dealing with a legitimate and reputable finance company.

Flexible Lending

If you have bad credit or have previously been refused a mortgage we can consider your application. Whatever your circumstances please get in touch and we’ll do our best to help find you the perfect mortgage deal.

I Make $60000 A Year How Much House Can I Afford

You can afford a $150,397.13 house with a monthly payment of $1,200.00.

| $1,300.00 | $0.00 |

Estimate how much house you can afford if you make $60,000 a year with our home affordability calculator. Generate an amortization schedule that will give you a breakdown of each monthly payment, and a summary of the total interest, principal paid, and payments at payoff. You have the options to include property tax, insurance, and HOA fees into your calculation.

Read Also: What Is The Recommended Mortgage To Income Ratio

Why 800k Aussies Choose Westpac Home Loans

One point of contact

Even when you apply online, you’ll have a dedicated home loan expert to help guide you and manage your application, all the way to settlement.

Track your application

Submit your application online, then follow your progress. You’ll get notifications, know what’s coming next and can even sign your loan offer online.

We want you to get ahead

Pay down your loan sooner thanks to unlimited extra repayments on variable loans, our offset option, and extra repayments of up to $30k for fixed rate loans^^.

More than a great rate

Come for the compelling interest rates. Stay for the helpful home loan features, like repayment holidays3, $0 redraw fee, split loans and a full offset account.

We’re there for you

Help is at the heart of everything we do, from managing your home loan through our app, to supporting customers through tough times.

A sustainable Australia

Climate change is impacting Australia’s way of life. So we’re supporting existing thermal coal customers, with a commitment to reduce our exposure to zero by 2030.

Estimating How Much House You Can Afford

How much house you can afford depends on several factors, including your monthly income, existing debt service and how much you have saved for a down payment. When determining whether to approve you for a certain mortgage amount, lenders pay close attention to your debt-to-income ratio .

Your DTI compares your total monthly debt payments to your monthly pre-tax income. In general, you shouldnt pay more than 28% of your income to a house payment, though you may be approved with a higher percentage.

Keep in mind, however, that just because you can afford a house on paper doesnt mean your budget can actually handle the payments. Beyond the factors your bank considers when pre-approving you for a mortgage amount, consider how much money youll have on-hand after you make the down payment. Its best to have at least three months of payments in savings in case you experience financial hardship.

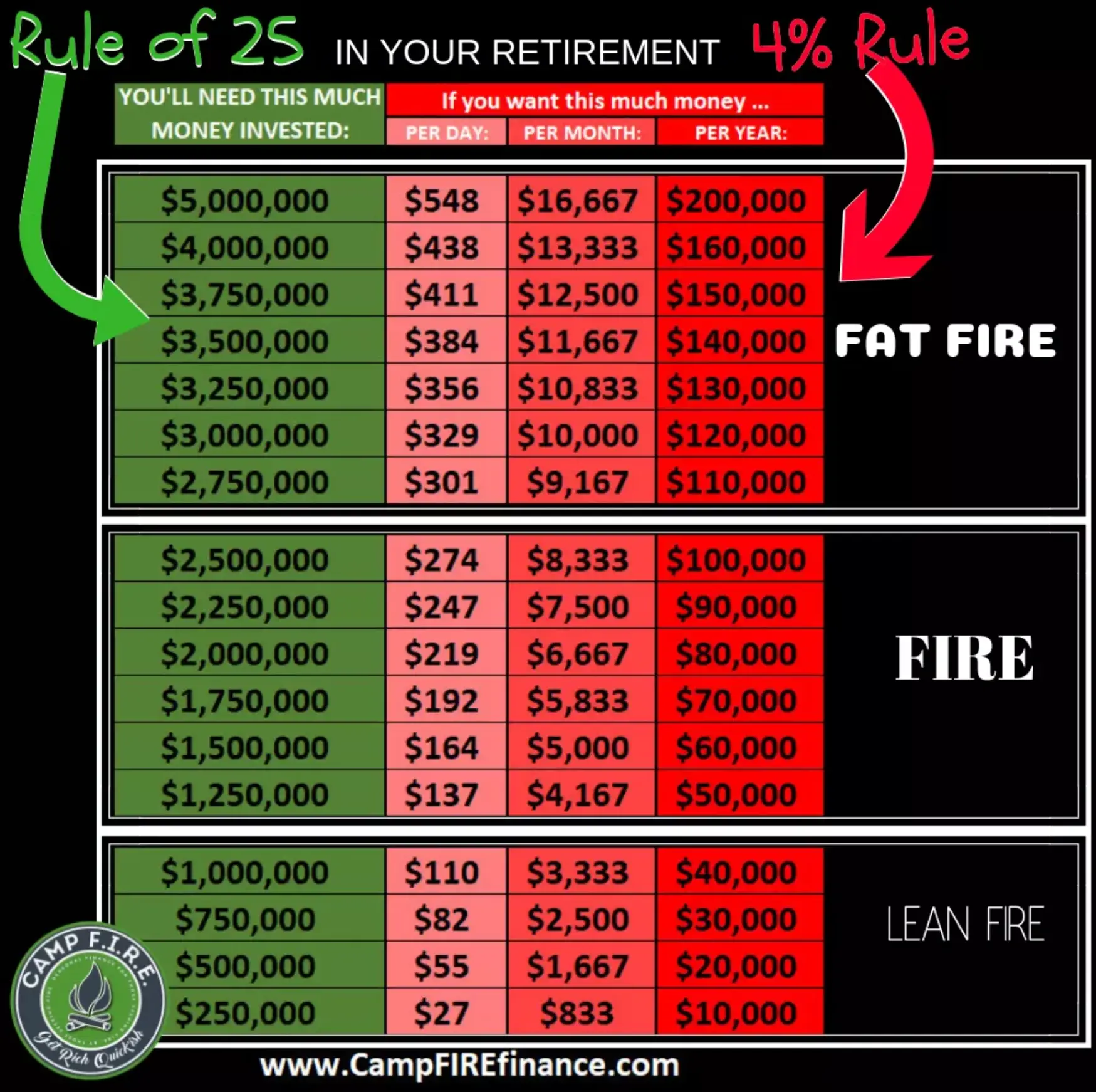

Along with calculating how much you expect to pay in maintenance and other house-related expenses each month, you should also consider your other financial goals. For example, if youre planning to retire early, determine how much money you need to save or invest each month and then calculate how much youll have leftover to dedicate to a mortgage payment.

Ultimately, the house you can afford depends on what youre comfortable withjust because a bank pre-approves you for a mortgage doesnt mean you should maximize your borrowing power.

You May Like: How Long For Mortgage Pre Approval

What Are My Monthly Payments

Use the Mortgage Calculator to get an idea of what your monthly payments could be. This calculator can help you estimate monthly payments with different loan types and terms. You may be able to afford more depending on factors including your down payment and/or the purchase price. The calculator will estimate your monthly principal and interest payment, which represents only a part of your total monthly home expenses. Additional monthly costs may include: real estate taxes, insurance, condo or homeowners association fees and dues, plus home maintenance services and utility bills.

Recommended Savings

Add All Fixed Costs and Variables to Get Your Monthly Amount

Calculator Disclaimer

Can I Get A Mortgage For 60000

Yes, it may be possible for you to get a £60,000 mortgage. If youve saved up a significant deposit and youre looking for a smaller mortgage to purchase a property, lenders will look on you favourably and you may secure a better interest rate.

If you already have an existing mortgage and wish to take out another mortgage to purchase a more expensive home or a second property, mortgage lenders will tend to have stricter requirements.

For more information, speak to an expert for an initial free consultation.

Don’t Miss: How Much Does Mortgage Go Up Per 10000

How Much You Can Expect To Repay Monthly

As the table below suggests, monthly repayments for a £60,000 mortgage could range from anywhere between £330 to just under £1,100 per month. But this could vary further depending on the term you choose and the interest rate offer from the lender.

Your disposable income is one of the most important factors when it comes to getting a mortgage, so its worth doing some research and finding out what kind of monthly repayments you can realistically afford before you start looking at properties.

When it comes to working out how much youll need to repay each month, there are a few things that need to be taken into account. These include:

What Are My Monthly Costs For Owning A Home

There are five key components in play when you calculate mortgage payments

-

Principal: The amount of money you borrowed for a loan. If you borrow $200,000 for a loan, your principal is $200,000.

-

Interest: The cost of borrowing money from a lender. Interest rates are expressed as a yearly percentage. Your loan payment is primarily interest in the early years of your mortgage.

-

Property taxes: The yearly tax assessed by the city or municipality on a home that is paid by the owner. Property taxes are considered part of the cost of owning a home and should be factored in when calculating monthly mortgage payments. However, lenders dont control this cost and so it shouldnt be a major factor when choosing a lender.

-

Mortgage insurance: An additional cost of taking out a mortgage, if your down payment is less than 20% of the home purchase price. This protects the lender in case a borrower defaults on a mortgage. Once the equity in your property increases to 20%, you can stop paying mortgage insurance, unless you have an FHA loan.

-

Homeowners association fee: This cost is common for condo owners and some single-family neighborhoods. Its money that must be paid by owners to an organization that assists with upkeep, property improvements and shared amenities.

Don’t Miss: How Much Per Thousand On A Mortgage