Difference Between Ltv And Cltv

LTV and CLTV are both used for the same reason, i.e., to assess the risk involved with a mortgage. LTV just considers the current mortgage value for risk evaluation. Whereas, CLTV or combined loan to value ratio undertakes all the mortgages previously taken by the applicant to figure out his ability to afford another mortgage. The difference in LTV and CLTV arises during their calculation process, as the former just takes the current amount into consideration while the latter takes all of the amounts. CLTV is mostly used by financial institutes when a mortgagee has taken loans previously.

How To Determine Your Home’s Value

Both standard equity and CLTV depend on a home appraisal. Youll likely need to get a new, professional appraisal when using your house as security for a loan, like a home equity loan. Usually, a professional comes to your home and looks at the exterior. If there are any unique features or concerns, lenders will usually work with you to find a time for an interior inspection as well.

Some of the factors that determine your homes value include the size of your home, its location and your neighborhood, the assessed taxes you pay each year, comparable homes in your area, upgrades you have made to the home, the curb appeal, and the construction quality of the home.

Some lenders use data to determine your homes value. One standard model thats used is called the automated value model , which estimates value based on comparable data, like the most recent listings and sale prices of similar homes in your area.

A Discover Home Loan home equity loan for home improvement can also potentially improve your homes overall value.

While home equity loans are a common way to use your homes equity to receive financing, equity is also a consideration for home equity lines of credit

Common Uses For Helocs

The most popular uses for a HELOC, tend to be purchases like home repairs, annual education costs, a large expense, and debt consolidation.

| Type of Use | |

|---|---|

| 11% | 9% |

For the annual costs, like a yearly tuition, a HELOC can be a smart move, offering you enough credit to cover the bill every year, and then time to pay some of it back to restore your credit line. Likewise, for the home repairs these can be bills that are spread out over time, but need immediate attention to keep your projects rolling, so a HELOC can make a smart move to get it done.

Though a lot of consumers may look to a HELOC as a way to consolidate debt, it may be wise to look more specifically at how it compares in cost and risk to a home equity loan or a cash-out refinance.

Don’t Miss: How Much Percent Of Income Should Mortgage Be

Va Loan: Up To 100% Ltv Allowed

VA loans are guaranteed by the U.S. Department of Veterans Affairs.

VA loan guidelines allow for 100% LTV, which means that no down payment is required for a VA loan.

The catch is, VA mortgages are only available to certain home buyers, including:

- Active-duty military service persons

- Members of the Selected Reserve or National Guard

- Cadets in the U.S. Military

- Air Force or Coast Guard Academy members

- Midshipman in the U.S. Naval Academy

- World War II merchant seamen

- U.S. Public Health Service officers

- National Oceanic & Atmospheric Administration officers

Learn more about the benefits of 100% LTV VA financing here.

Home Equity Lines Of Credit

Home equity lines of credit are similar to home equity loans, but instead of receiving the loan as a lump sum, you will be given a withdrawal limit that you can pull from during the withdrawal period. HELOCs may include annual fees and transaction costs when you make withdrawals, in addition to closing costs when the withdrawal period ends. Discover does not offer HELOCs.

You May Like: What Is Mortgage Insurance On A Home Loan

How Do You Calculate Saas Cltv

The Advanced Method to Calculate Customer Lifetime Value

What Is Ltv Why Loan

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The loan-to-value ratio is one of the key elements lenders consider when you apply for a mortgage, mortgage refinance or home equity loan or line of credit. Generally, a lower LTV will mean less risk for the lender and a lower monthly payment.

Recommended Reading: What Is The Shortest Mortgage Term Available

Why Is Cltv Important In The Mortgage Process

The CLTV gives lenders the big picture. If you have a large second mortgage, such as ahome equity line of credit, you could be a riskier borrower if youre trying to refinance your first mortgage. Some people even use a second mortgage to buy a property. Its called a piggyback loan.

Lets say you were eligible for a HELOC when yourebuying a home. You withdraw from the HELOC to make the down payment on the home. This means you now have a CLTV because you have two loans out on the home.

The down payment lowers the LTV on your first mortgage, but the CLTV tells the big picture. You didnt put money down from your own pocket you borrowed it from the homes value. This helps lenders determine your level of risk and if you might default on the mortgage.

> > More: Find Out How to Refinance Your Mortgage

The Cltv And Loan Approval

A lender’s primary concern with any loan is earning a profit. So the lender imposes controls to make it more likely that a borrower will be able to comply with the terms of a loan. Controls are risk-reducing measures, such as a CLTV cap, which limits the risk that a mortgage refinance poses to the lender.

Each lender sets risk acceptance criteria for every business transaction, including a mortgage refinance. These criteria define some aspects of the overall risk level of a defined business activity for a period, such as a quarter of a financial calendar.

In the case of the CLTV, a lender sets a criteria that defines the maximum acceptable combined loan-to-value ratio of any property that’s subject to a mortgage refinance. The criteria are a reflection of the fact that a lender assumes risk with each loan it makes. In most cases, a lender sets a maximum CLTV as a baseline approval criteria for any prospective borrower. Should the applicant’s CLTV be above that value, the person becomes ineligible for a mortgage refinance.

The CLTV ratio for your mortgage will always be equal to or greater than the LTV ratio, resulting in mortgage lenders having higher maximum limits for the CLTV compared to the LTV ratio.

References

Recommended Reading: Can I Get A 30 Year Mortgage

Why Ltv Is Important In Real Estate

LTV is important when you buy a home or refinance because it determines how risky your loan is.

The more you borrow compared to your homes value, the riskier it is for lenders. Thats because if you default on the loan for some reason, they have more money on the line.

Thats why all mortgages have a maximum LTV to qualify. The maximum loan-to-value can also be thought of as a minimum down payment.

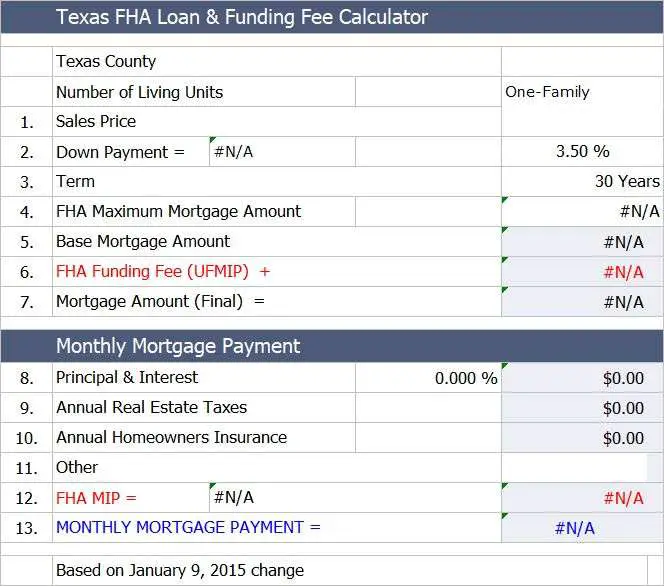

For example, the popular FHA loan program allows a down payment of just 3.5%. Thats the same as saying the program has a max LTV of 96.5% because if you make a 3.5% down payment, the most you can borrow is 96.5% of the home price.

When Paying A Discount Point What Can It Be Used For

Points, also known as discount points, lower your interest rate in exchange paying for an upfront fee. Lender credits lower your closing costs in exchange for accepting a higher interest rate. These terms can sometimes be used to mean other things. Points is a term that mortgage lenders have used for many years.

Read Also: Do 15 Year Mortgages Have Lower Interest Rates

Combined Loan To Value Calculation

The combined loan to value measures two mortgages combined against the appraised property value.

For instance, lets assume that you already have a mortgage but have decided to apply for another.

The lender will evaluate the combined LTV , which factors in the following:

If the current outstanding loan balance is $240,000 on a recently appraised home at $500,000, but now you want to borrow an additional $20,000 in a home equity loan for backyard renovations, the CLTV formula is as follows.

- Combined Loan To Value = / $500,000

How To Calculate A Cltv

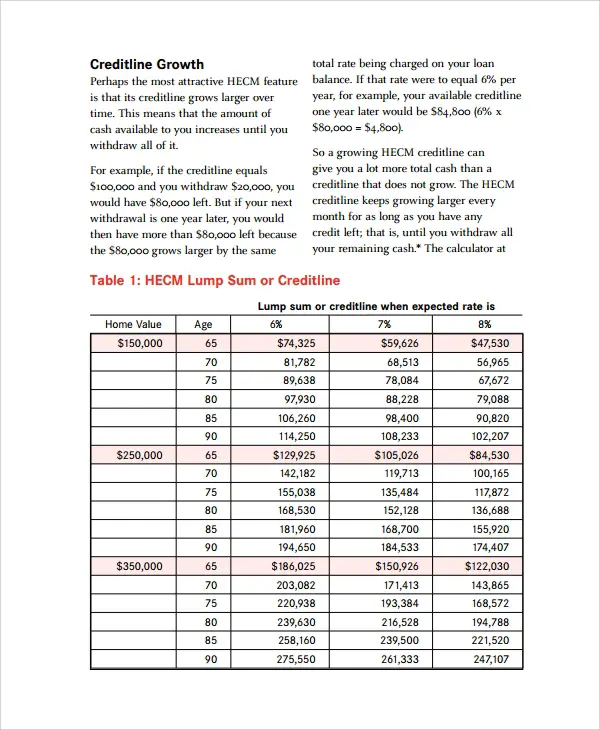

The year 2020 saw a wave of homeowners attempting to ease their cash flow with a mortgage refinance. In fact, according to a Forbes Advisor article, about $2.149 trillion in mortgage refinancing occurred in 2020.

But while mortgage lenders continue to pitch mortgage refinance options with relatively low interest rates, not every homeowner qualifies for a mortgage refinance, let alone one with a staggering low interest rate. The problem being that a wide range of factors goes into the individual mortgage rate a lender offers a borrower. One such factor is the combined loan-to-value ratio .

You May Like: How To Choose Between Mortgage Lenders

What Does The Cltv Ratio Show

The mortgage and lending professionals use the combined loan to value ratio to decide the total percentage of a homeowners property that is stalled due to debt obligations.

Along with a few other calculations, like the debt to income ratio and the standard loan to value ratio the lenders use the CLTV ratio, to gauge the risk of giving a loan to a borrower.

Among various other factors, many economists feel that a relaxed CLTV standard led to the foreclosure crisis in the United States during the late 2000s.

Homebuyers frequently took out second mortgages at the time of purchase in lieu of making down payments at the beginning of the 1990s and the early and mid-2000s.

Greed lenders unwilling to lose these customers business to competitors agreed to such terms and the risks increased leading to the housing crisis.

The standard practice before the real estate bubble that filled the period from the late 1990s to the mid-2000s, was for homebuyers to make down payments adding up to at least 20% of the purchase price.

Most customers were kept within these parameters by the lender who capped LTV at 80%.

When the bubble began flaring up, many of these companies took action to allow customers to get around putting 20% down.

The LTV caps were raised by some lenders and offered mortgages with 5% down payments or less, while others kept LTV requirements in place but raised CLTV caps, to 100%. This action lets customers take out second mortgages and finance their 20% down payments.

What Is A Good Ltv Ratio For A Mortgage

Generally, a good LTV to aim for is around 80% or lower. Managing to maintain these numbers can not only help improve the odds that youll be extended a preferred loan option that comes with better rates attached. It can also boost your chances of being able to avoid paying mortgage insurance and potentially being able to save thousands of dollars in mortgage payments.

In other words, should your LTV come in higher than 80%, youll likely have to pay extra for mortgage insurance. Mortgage insurance basically serves as a form of risk mitigation for lenders that helps protect them in case you default on the loan and helps provide them with needed reassurance if they opt to take on the risk of lending to you.

However, be advised that an acceptable LTV ratio can differ based on the type of mortgage that youre getting. This is true in the case of FHA loans and VA loans as well.

Read Also: How Much Home Can I Afford Rocket Mortgage

What Is Cltv Tltv

Your TLTV, also know as combined loan-to-value or CLTV, adds your first mortgage and second mortgage LTVs together. Using the same example as before, a second mortgage worth $15,000 with an LTV of 80 would raise your TLTV to 95. Even though your second mortgage may be small your lender will take both into account.

How To Reduce Ltv Ratio: Credit Risk Mitigation Methods

In reality, there is no quick-and-easy method to reduce the LTV ratio, as the process can be time-consuming and require some patience.

One option is to spend more on the down payment before taking out the loan however, not every homebuyer has this option.

For those who cannot increase the down payment, the best course of action could be to consider waiting to grow your savings and purchase a more affordable home or car with a lower price tag.

While not ideal, the compromise can pay off in the long run so when the time comes, you can make a larger down payment and own more equity in the property.

Generally, the lower your LTV, the better off youll be over the long-term in terms of interest rates and lending terms.

Another consideration is to get your property re-appraised, especially if there is reason to believe that the property value might have risen over the years .

If so, refinancing or taking out a home equity loan can become easier.

- Refinancing can be negotiated at a lower interest rate since LTV is based on the appraised value rather than the original purchase price.

- Home equity loans are borrowings against the equity on the property, which is beneficial for the borrower if the homes value has been re-valued at a higher value.

Master Real Estate Financial Modeling

This program breaks down everything you need to build and interpret real estate finance models. Used at the world’s leading real estate private equity firms and academic institutions.

Don’t Miss: When To Get Prequalified For A Mortgage

How To Calculate Your Available Home Equity

To see how much home equity you currently have, first look online to understand your current home’s estimated value or hire an appraiser to get an official estimation of your home’s value. Keep in mind, if you decide to apply for a home equity loan, your lender may need to order another appraisal and may not be able to use one that you paid for yourself.

Once you have an estimate of your homes value, add up any outstanding mortgage debt on your home .

Your available home equity can be calculated by subtracting what you owe on your home from the current estimated value of your home.

For example, if your home is currently valued at $300,000 and you owe $120,000 on your mortgage, you have $180,000 available in your home’s equity.

What Is Combined Loan To Value

Combined Loan to Value is the total of all mortgage loans on a property expressed as a percentage of the property value. CLTV reflects the proportion of property that is financed by debt.

The purpose of CLTV is to assess the availability of collateral to meet loan repayment. The primary source of repayment is the borrowers income from which the borrower makes monthly payment. In the event the borrower losses the income, the lender falls back on the secondary source of repayment which is the liquidation of the real estate .

CLTV is calculated by dividing the outstanding balance for all the loans against the property by the property value. At the time of purchase, property value is the lower of appraised value and the purchase price. At any other time property value is the fair market value such as the appraised value. Appraised value is the valuation of the property provided by a licensed appraiser. Purchase price is the amount that the buyer is paying to the seller at an arms-length transaction.

Also Check: Why Do I Pay Escrow On My Mortgage

What About Combined Ltv

If you already have a mortgage and want to apply for a second one, your lender will evaluate the combined LTV ratio, which factors in all of the loan balances on the property the outstanding balance on the first mortgage, and now the second mortgage.

Lets say you have an outstanding balance of $250,000 on a home that is appraised at $500,000, and you want to borrow $30,000 in a home equity line of credit to pay for a kitchen renovation. Heres a simple breakdown of the combined LTV ratio:

$280,000 / $500,000 = 56 percent CLTV

If you have a HELOC and want to apply for another loan, your lender may look at a similar formula called the home equity combined LTV ratio. This figure represents the total amount of the HELOC against the value of your home, not just what youve drawn from the line of credit.

How Is A Loan

LTV ratio is one risk assessment that lenders rely on when evaluating you for a loan. Lenders typically assign better interest rates to loans with lower LTV ratios. If youre buying a home, making a bigger down payment could get you a better interest rate on your mortgage.

LTV ratio isnt the only factor that lenders look at when evaluating your application for a loan, however. They also look at your credit score, debt-to-income ratio, payment history and income to assess your risk as a borrower.

What Debt-to-Income Ratio Do You Need for a Mortgage?

What Debt-to-Income Ratio Do You Need for a Mortgage?

Along with your credit score, your DTI is a primary factor for determining whether you qualify for a home loan, and at what interest rate.

If youre going into the homebuying process, taking time to improve your credit and reduce your debt-to-income ratio may help you secure better rates.

Don’t Miss: What Is The Current Home Mortgage Interest Rate