How To Prepare For Higher Rates Ahead

Itâs safe to say interest rates will rise, eventually. Now that you have a better idea of how higher interest rates may affect you, what can you do to prepare for the inevitable pinch to your pocketbook?

- Pay down your loans as much as possible, while interest rates are still low. Remember, whether itâs a mortgage or another type of loan, a lower interest rate means more of your payment goes toward paying down principal.

- If youâre carrying multiple debts, consider paying down the higher-interest ones first, since those debts are more expensive to carry.

- If youâll be shopping for a home, get pre-approved for a mortgage. Not only does this give you a good idea of how much you can spend, doing this also locks in the current rate for a period, often 90 or 120 days. And getting pre-approved costs you nothing.

- If you have a variable-rate mortgage, discuss your options with your lender or financial adviser, and consider locking it in for a fixed term at the current lower rate.

Of course, itâs always wise to discuss the details of your financial situation and goals with an accredited financial adviser. And speaking of professional help, work with an experienced real estate agent to navigate the Canadian real estate market and find your dream home.

Latest On Mortgage Rates Fixed Rates Start To Fall Despite Another Bank Of England Base Rate Rise

The cost of fixed-rate mortgage deals has started to fall, despite the Bank of England’s base rate rise last week, as the volatility caused by the Government’s mini-budget in September looks to have eased. Variable-rate mortgages are rising, though here’s what you need to know if you’re looking to get a new deal.

Mortgage rates rocketed as a result of uncertainty caused by the Government’s mini-budget in September. However, after Chancellor Jeremy Hunt reversed many of the policies which shook the markets, including cancelling tax cuts and other spending plans, the factors that influence fixed mortgage rates have now stabilised. As a result, some brokers are predicting that the cheapest rates could soon fall below 5%.

Theres Much More Going On Than Home Price Increases

The relationship between real estate sales and rent prices isnt so clear either.

For almost a year now, sales of affordably priced homes have sunk substantially. September stats showed another month of lower sales.

As inflation rose, hopeful buyers discovered there are fewer homes they can qualify to purchase. And more buyers are left to bid on the fewer affordable homes which would then raise the selling price. Yet sales arent happening so those buyers must stay in the rental market or look for a rental house or apartment.

Also Check: What’s A 5 1 Arm Mortgage

Fed Fixes Messaging Problem

The Fed strives to be understood, but investors don’t always catch the central bank’s meaning. When investors hear what they want to hear, the chairman may have to set them straight, as he did in August.

The latest misunderstanding began when the central bank increased the federal funds rate by an aggressive 0.75 percentage point in its July 27 meeting. In the opening statement at his news conference immediately after that meeting, Chair Jerome Powell noted that growth in consumer spending had softened, and that the housing market had weakened. Mortgage rates dropped in the following days, apparently because investors and pundits believed that the Fed was preparing to slow the pace of its rate increases.

But the central bank expects to keep raising short-term interest rates in bigger-than-usual increments. Powell reiterated this point in an Aug. 26 speech, in which he said “another unusually large increase could be appropriate at our next meeting.”

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Read Also: What Is Needed To Refinance A Mortgage

A House Price Slump Is Coming Rising Unemployment Could Make It Much Worse

Last year, Aucklands largest real estate company couldnt sell properties quickly enough to meet demand in New Zealands biggest city.

Houses were flying out the door, said Grant Sykes, a manager at real estate agency Barfoot & Thompson. There were chin-dropping moments when agents stand around the room and are gobsmacked at the prices being achieved, he told CNN Business.

In one example, a property sold for 1 million New Zealanddollars above the asking price in an auction that lasted all of eight minutes.

That was in May 2021, when salesattracted thousands of bidders who drove prices ever higher. Since then, Barfoot & Thompsons clearance rate at auction has plummeted, according to Sykes, prolonging sales times and sending prices lower.

The time it takes to sell a property in New Zealand has increased by around 10 days on average since October 2021, according to the Real Estate Institute of New Zealand. Sales have plunged nearly 35% and median house prices are down 7.5% over the past year.

New Zealand is at the sharp end of a global housing market squeeze that has grim ramifications for the world economy.

The pandemic boom, which sent pricesinto the stratosphere, is running out of steam and house prices now are falling from Canada to China, setting the stage for the broadest housing market slowdown since the global financial crisis.

Are Mortgage Interest Rates Going Up

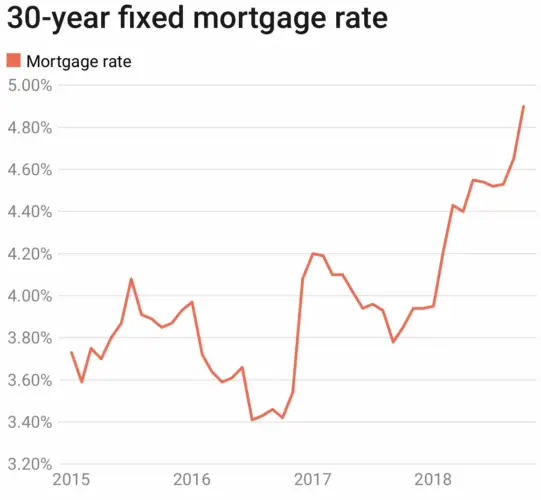

Interest rates declined throughout 2019 and when January 2020 rolled around, the average rate for a 30-year fixed was about 3.7%. Furthermore, when COVID-19 hit the United States, the Federal Reserve responded by dropping the federal funds rate to between 0% â 0.25%.

In 2021, mortgage interest rates were 2.98% on January 21 and by October 21, Freddie Mac reported an average mortgage rate of 3.09% for 30-year mortgages. Though mortgage rate forecasts predict a continual increase in mortgage rates, these interest rates will be lower than historical mortgage rates, according to Freddie Mac.

Don’t Miss: How Much Of Your Salary Should Your Mortgage Be

How The Bank Of England Base Rate Is Set

The MPC is the nine-person committee, within the BOE, that determines the BOE base rate. Usually, every six weeks the Bank announces the MPC’s interest-rate decision. You can find a full schedule of decision dates on the Bank of England website. Whenever a decision is announced the MPC meeting minutes are also published. These minutes are scrutinised by investors for any hints of when rates might go up or down in the future. For example, they would see how many of the nine-person committee voted for interest rates to go up, down or stay the same.

The forecasting of the Bank of England base rate has been transformed in recent years. The former Governor of the Bank of England , Mark Carney, originally created a notional link between the UK unemployment rate and the BOE base rate before replacing this with 18 economic indicators which still inform the BOE’s interest rate decision making today, under current Governor, Andrew Bailey.

How Does The Prime Rate Affect Mortgage Rates In Canada

In Canada, there are two main types of mortgages, fixed rate and variable rate. With a fixed mortgage you will pay the same rate over the entire course of your mortgage term and it will not be affected by the market. So if the prime rate goes up, your fixed rate will stay the same. A fixed rate mortgage is a good option if you like to know exactly how much your mortgage payments will be until you need to renew. A fixed rate is also good in a rising rate environment since you lock in your rate regardless of what happens in the market.

Variable mortgage rates usually dont have a set rate, but rather a spread to the prime rate . When the prime rate in Canada goes up, so will your mortgage rate by the same amount and vice versa. Most lenders will let you convert your variable rate mortgage to a fixed rate mortgage at any time, you will have to pay the fixed rate once you decide to switch.

Its worth noting that banks offer a variable rate or adjustable rate mortgage and you should be aware of the differences. When prime rates move, a variable rate mortgage payment will stay the same , but your amortization will adjust to shift more/less or your mortgage payment towards paying interest. With an adjustable rate mortgage, your amortization will remain the same and your mortgage payment will change as prime rates move.

Recommended Reading: How Do Interest Rates Work On A Mortgage

What Credit Score Do Mortgage Lenders Use

Most mortgage lenders use your FICO score a credit score created by the Fair Isaac Corporation to determine your loan eligibility.

Lenders will request a merged credit report that combines information from all three of the major credit reporting bureaus Experian, Transunion and Equifax. This report will also contain your FICO score as reported by each credit agency.

Each credit bureau will have a different FICO score and your lender will typically use the middle score when evaluating your creditworthiness. If you are applying for a mortgage with a partner, the lender can base their decision on the average credit score of both borrowers.

Lenders may also use a more thorough residential mortgage credit report that includes more detailed information that wont appear in your standard reports, such as employment history and current salary.

Repayment Or Credit Risk

The most important risk for the lender is that you wont repay the loan. A high credit score can help lessen this concern, as it shows the lender youve been good at repaying your debts. So, you may pay a lower interest rate than those who have a lower score.

If your mortgage is worth more than 80 percent of the value of the home, youll have to buy mortgage default insurance. But since insurance protects the lender from the risk of default, you may get a lower interest rate than if you go for an uninsured mortgage with a bigger down payment.

Read Also: Who Has To Pay Mortgage Insurance

Chart : Shelter Cost As A % Of Average After

Forecast

Shelter-cost-to-income ratio at mortgage loan origination, estimated with the average MLS® price and average household disposable income, assuming: minimum down payment and maximum amortization period for insured mortgages, 5-yr fixed discounted interest rate.

| 2024 Q4 | 52.6% |

|---|

From its historical peak of $770,812 in Q1 2022, the national average MLS® price should decline 14.3% by Q2 2023. On an average annual basis, we now predict this price to grow 2.6% in 2022 compared to 21.3% in 2021 and decline by 6.2% in 2023 . Canadas house prices will resume their upward trend in the second half of 2023 as demand rises with the recovery in economic and income conditions and mortgage rates begin normalizing. This house price is predicted to grow by 2.1% in 2024.

When Is The Next Bank Of Canada Rate Increase And What Can I Expect

The current market overnight interest rate forecast for the next 12 months is:

- A 0.50% increase December 7th, 2022

- No change January 25th, 2023

- A 0.25% increase March 8, 2023

- No change April 12, 2023

- A 0.25% increase June 7, 2023

- No change July 12, 2023

- No change September 6, 2023

- No change October 25, 2023

Recommended Reading: Where Are Mortgage Interest Rates Going

Expert Mortgage Rate Predictions For September

Paul Buege, chief executive officer and president at Inlanta Mortgage

Prediction: Rates will rise

I think were going to be range-bound and well see rates stay at this level, maybe a little bit higher. The market is responding to the Feds two significant rate increases and the economy is cooling. What youre seeing right now is the initial response: a recession and people arent buying as much.

But always lurking in the background is going to be some economic news showing that things havent cooled to the level that you might think. Thats why I think youre gonna have these little rate bumps up and down. If you wanted to work with a really broad range, probably 6% would be the high and 5% might be the low. Thats what were using as we manage our book of business as a company.

Danielle Hale, chief economist at Realtor.com

Prediction: Rates will moderate

There isnt a Fed meeting but there is the annual economic policy symposium in Jackson Hole that a lot of the Fed decision makers participate in. Investors will look to that symposium to get an updated sense of how the Fed is thinking about monetary policy and we may see mortgage rates react to whatever is discussed.

Selma Hepp, deputy chief economist at Corelogic

Prediction: Rates will moderate

Odeta Kushi, deputy chief economist at First American

Prediction: Rates will moderate

Jessica Lautz, VP of demographics and behavioral insights at National Association of Realtors

Prediction: Rates will moderate

What Causes Mortgage Rates To Rise Or Fall

Mortgage rates are determined by a complex interaction of macroeconomic and industry factors, such as the level and direction of the bond market, including 10-year Treasury yields the Federal Reserve’s current monetary policy, especially as it relates to funding government-backed mortgages and competition between lenders and across loan types. Because fluctuations can be caused by any number of these at once, it’s generally difficult to attribute the change to any one factor.

Macroeconomic factors have kept the mortgage market relatively low for much of this year. In particular, the Federal Reserve has been buying billions of dollars of bonds in response to the pandemic’s economic pressures, and it continues to do so. This bond-buying policy is a major influencer on mortgage rates.

Since June, the Fed has been reducing its balance sheet. Identical sizable reductions occurred monthly through the summer and are being accelerated in September. This is on top of its plan to reduce new bond purchases by an increment every month, the so-called taper, which began in November.

The Fed’s rate and policy committee, called the Federal Open Market Committee , meets every six to eight weeks. Their next scheduled meeting takes place November 1-2.

Don’t Miss: What Caused The Subprime Mortgage Crisis

Mortgage Rates For The Remainder Of 2022

In the week ending April 7, 2022, mortgage rates rose again, inching closer to 5%. Thatâs the highest since December 2018. The last time mortgage rates increased 1.5% points in 3 months was back in 1994. Itâs important to note that even if rates push past 5%, itâs still on par or better than rates available in the last couple decades.

What Are Points On A Mortgage

Discount points are a way for borrowers to reduce the interest rate they will pay on a mortgage. By buying points, youre basically prepaying some of the interest the bank charges on the loan. In return for prepaying, you get a lower interest rate which can lead to a lower monthly payment and savings on the overall cost of the loan over its full term.

A mortgage discount point normally costs 1% of your loan amount and could shave up to 0.25 percentage points off your interest rate. The exact reduction varies by lender. Always check with the lender to see how much of a reduction each point will make.

Discount points only pay off if you keep the home long enough. Selling the home or refinancing the mortgage before you break even would short circuit the discount point strategy.

In some cases, it makes more sense to put extra cash toward your down payment instead of discount points if a larger down payment could help you avoid paying PMI premiums, for example.

Read Also: How Much Does A Loan Officer Make On A Mortgage

Mortgage Interest Rates Forecast: Will Rates Go Down

Mortgage rates have risen since the start of 2022, reflecting investors’ concerns that the economy is heating up and that the Fed will cool it down and reign in inflation. U.S. Treasury bond rates, which mortgage rates follow, encountered two tough patches this year: in late February, when Russia invaded Ukraine, and in mid-May when investors worried about poor consumer spending. Bond yields and mortgage rates declined throughout these times.

Most mortgage-market analysts predict rates will be choppy over the next few months but will settle above where they are nowwith the 30-year fixed-rate mortgage just around 5 percentfor the next year or two. The Fed raised interest rates by 75 points in June the biggest increase since 1994.

Then it enacted its second consecutive 0.75 percentage point interest rate increase in July, taking its benchmark rate to a range of 2.25%-2.5%. Now, it is set for another 75-basis-point rate hike in the coming weeks due to the hot U.S. consumer price inflation data released for August. Before the data, the majority of economists anticipated that the Fed would slow the pace of rate hikes in November to a half-point increase, but now a 0.75-point increase is predicted.

< < < Also Read: How To Invest in Mortgage Estate Notes?> > >